Get Jazz Tax Certificate Form

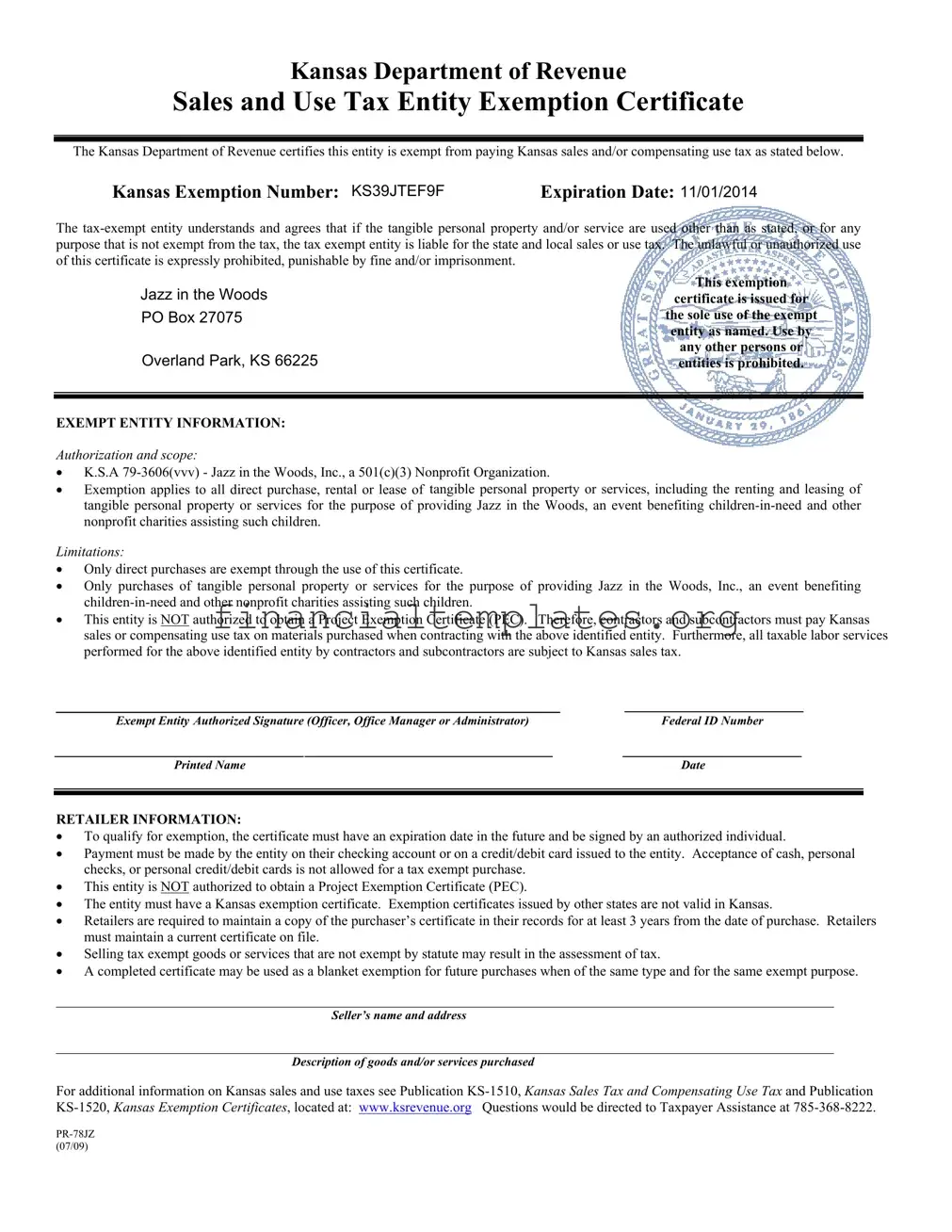

The Kansas Department of Revenue Sales and Use Tax Entity Exemption Certificate serves a critical function for qualifying entities, such as Jazz in the Woods, Inc., by exempting them from Kansas sales and/or compensating use tax under specified circumstances. This exemption, delineated by an exemption number and an expiration date, is exclusively available to entities such as Jazz in the Woods, Inc., which is recognized as a 501(c)(3) Nonprofit Organization focusing on benefiting children in need and other related nonprofit charities through their event. The certificate outlines clear restrictions, emphasizing that it applies solely to direct purchases related to the event and disallows the use for obtaining a Project Exemption Certificate (PEC), affecting transactions with contractors and subcontractors. It is also emphasized that unauthorized use of this certificate is met with legal consequences. Retailers engaging in transactions with the exempt entity are tasked with adhering to specific protocols, such as ensuring that payment methods align with the certificate’s requirements and maintaining records of these tax-exempt transactions for stipulated periods. Additionally, the certificate details the need for a Kansas exemption certificate for validation, highlighting its non-transferrable nature regarding exemption certificates from other states. This document underscores both the rights and responsibilities vested in an exempt entity and the retailers providing goods or services, aiming to streamline the application of tax exemption while preventing misuse.

Jazz Tax Certificate Example

Kansas Department of Revenue

Sales and Use Tax Entity Exemption Certificate

The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales and/or compensating use tax as stated below.

KS39JTEF9F |

11/01/2014 |

Kansas Exemption Number: <KS12345678> |

Expiration Date: <MM/DD/YYYY> |

The

JAZZ<PetitioningIN THE WOODSAuthority>

PO<AddressBOX 27075Line 1>

<Address Line 2>

OVERLAND<City StatePARK,ZipKS>66225

This exemption

certificate is issued for

the sole use of the exempt entity as named. Use by any other persons or entities is prohibited.

EXEMPT ENTITY INFORMATION:

Authorization and scope:

•K.S.A

•Exemption applies to all direct purchase, rental or lease of tangible personal property or services, including the renting and leasing of tangible personal property or services for the purpose of providing Jazz in the Woods, an event benefiting

Limitations:

•Only direct purchases are exempt through the use of this certificate.

•Only purchases of tangible personal property or services for the purpose of providing Jazz in the Woods, Inc., an event benefiting

•This entity is NOT authorized to obtain a Project Exemption Certificate (PEC). Therefore, contractors and subcontractors must pay Kansas sales or compensating use tax on materials purchased when contracting with the above identified entity. Furthermore, all taxable labor services performed for the above identified entity by contractors and subcontractors are subject to Kansas sales tax.

______________________________________________________ |

_______________________ |

Exempt Entity Authorized Signature (Officer, Office Manager or Administrator) |

Federal ID Number |

________________________________________________________________ |

_______________________ |

Printed Name |

Date |

|

|

RETAILER INFORMATION:

•To qualify for exemption, the certificate must have an expiration date in the future and be signed by an authorized individual.

•Payment must be made by the entity on their checking account or on a credit/debit card issued to the entity. Acceptance of cash, personal checks, or personal credit/debit cards is not allowed for a tax exempt purchase.

•This entity is NOT authorized to obtain a Project Exemption Certificate (PEC).

•The entity must have a Kansas exemption certificate. Exemption certificates issued by other states are not valid in Kansas.

•Retailers are required to maintain a copy of the purchaser’s certificate in their records for at least 3 years from the date of purchase. Retailers must maintain a current certificate on file.

•Selling tax exempt goods or services that are not exempt by statute may result in the assessment of tax.

•A completed certificate may be used as a blanket exemption for future purchases when of the same type and for the same exempt purpose.

____________________________________________________________________________________________________

Seller’s name and address

____________________________________________________________________________________________________

Description of goods and/or services purchased

For additional information on Kansas sales and use taxes see Publication

Document Specifics

| Fact Name | Description |

|---|---|

| Governing Law | K.S.A 79-3606(vvv) - This law specifically recognizes Jazz in the Woods, Inc., a 501(c)(3) Nonprofit Organization, as tax-exempt for certain purchases and activities related to its charitable events. |

| Authorized Use | The certificate permits tax-exempt purchases only for direct use in providing Jazz in the Woods events, benefiting children in need and supporting other nonprofit charities assisting such children. |

| Limitations and Prohibitions | The exemption applies strictly to direct purchases. The Jazz Tax Certificate does not allow for obtaining a Project Exemption Certificate (PEC), and contractors or subcontractors must pay sales or use tax on materials and taxable labor when engaged by the exempt entity. |

| Requirements for Retailers | Retailers must verify that the exemption certificate is current, not expired, and properly authorized. They are required to maintain a copy of the certificate for at least 3 years and ensure that all sales meet exemption statutes. |

| Purchaser Obligations and Restrictions | The certificate restricts payments to those made directly from the entity’s accounts. Personal payments or payments through personal accounts are not permitted for tax-exempt purchases. Additionally, misuse of this exemption is punishable by law. |

Guide to Writing Jazz Tax Certificate

Filling out the Jazz Tax Certificate form is an essential step for entities that are qualified for a sales and use tax exemption in Kansas. This document outlines the rights and responsibilities of these entities, ensuring they comply with Kansas tax laws while benefiting from the exemption. Careful and correct completion of the form is crucial to avoid any legal issues or loss of exemption status. Below are step-by-step instructions to guide you through the process, ensuring accuracy and compliance.

- Start with the top section of the form, which is pre-filled with information about the Kansas Department of Revenue and the exemption details. Verify the Kansas Exemption Number KS12345678 and ensure the Expiration Date is in the future.

- In the "EXEMPT ENTITY INFORMATION" section, confirm the specific authorization and scope for which the exemption is granted, ensuring it matches your entity's purpose and operations. This includes the authorization under K.S.A 79-3606(vvv) for Jazz in the Woods, Inc., and its eligibility criteria.

- Review the limitations outlined, noting that direct purchases by the entity for the specified purpose are exempt, but the entity cannot obtain a Project Exemption Certificate (PEC).

- Under the "Exempt Entity Authorized Signature" subsection, the officer, office manager, or administrator of the entity should sign the form to validate it. Ensure that the Federal ID Number is correctly filled in.

- Print the name of the authorized person and enter the date of signing next to the signature.

- In the "RETAILER INFORMATION" area, note that for a purchase to qualify for the exemption, specific criteria need to be met, such as the payment method and the requirement for the certificate to have an expiration date in the future.

- Ensure the retailer understands that the entity is not authorized to obtain a PEC, and the rules regarding maintenance of a copy of the certificate for at least three years.

- At the bottom, the seller is required to fill in their name, address, and a description of goods and/or services purchased. This area may be completed during the transaction with the retailer.

- Refer to the mentioned publications (KS-1510 and KS-1520) available at www.ksrevenue.org for additional information on Kansas sales and use taxes and exemption certificates. For further clarifications, contact Taxpayer Assistance at 785-368-8222.

This form is a crucial document for entities exempt from paying Kansas sales and/or use tax, ensuring that their eligible purchases are conducted in compliance with state regulations. Completing this form accurately helps maintain the entity's exemption status and avoids potential penalties for incorrect use or reporting.

Understanding Jazz Tax Certificate

What is the purpose of the Jazz Tax Certificate form?

The Jazz Tax Certificate form is designed to certify that Jazz in the Woods, Inc., a 501(c)(3) Nonprofit Organization, is exempt from paying Kansas sales and/or compensating use tax on all direct purchases, rentals, or leases of tangible personal property or services. This exemption is specifically for the purpose of providing Jazz in the Woods, an event benefiting children-in-need and other nonprofit charities assisting such children.

Who can use the Jazz Tax Certificate form?

This certificate is issued solely for the use of the exempt entity, Jazz in the Woods, Inc., as named on the certificate. Its use by any other persons or entities is strictly prohibited.

What are the limitations of the Jazz Tax Certificate form?

The form's use is limited to direct purchases of tangible personal property or services intended specifically for supporting Jazz in the Woods events. It does not authorize the entity to obtain a Project Exemption Certificate (PEC), meaning contractors and subcontractors must pay Kansas sales or compensating use tax on materials and taxable labor services purchased or performed when contracting with Jazz in the Woods, Inc.

How can a purchase qualify for a tax exemption using this certificate?

To qualify for exemption, the certificate must have a future expiration date and be signed by an authorized individual of the entity. Payments for exempt purchases must be made from the entity's checking account or on a credit/debit card issued to the entity. Acceptance of cash, personal checks, or personal credit/debit cards for tax-exempt purchases is not allowed.

Is this exemption certificate valid for use outside of Kansas?

No, this exemption certificate is only valid within the state of Kansas. Exemption certificates issued by other states are not recognized or valid in Kansas.

What is required of retailers when accepting this tax exemption certificate?

Retailers must ensure the certificate has a future expiration date and is signed by an authorized representative of the entity. They are required to maintain a copy of the certificate in their records for at least 3 years after the date of purchase and must retain a current certificate on file. Retailers should also ensure that the goods or services sold under this exemption are indeed exempt by statute, to avoid the assessment of tax.

Can this certificate be used as a blanket exemption for future purchases?

Yes, a completed certificate may be utilized as a blanket exemption for future purchases, provided those purchases are of the same type and for the same exempt purpose as originally certified.

Where can additional information regarding Kansas sales and use taxes, as well as exemption certificates, be found?

Additional information about Kansas sales tax and compensating use tax, as well as details about exemption certificates, can be found by visiting the Kansas Department of Revenue website at www.ksrevenue.org. Questions can be directed to Taxpayer Assistance at 785-368-8222.

Common mistakes

Not verifying the expiration date is set in the future can lead to the rejection of the certificate for being outdated.

Failing to sign the form renders it invalid since the signature of an authorized individual is essential for the certificate's authenticity.

Using personal payment methods instead of those issued directly to the entity, like personal checks or personal credit/debit cards, which are strictly prohibited for tax-exempt purchases.

Omitting or inaccurately filling out the Kansas Exemption Number may lead to processing delays or outright denial, as this number is crucial for validation.

Attempting to use the certificate for unauthorized purposes not covered by the exemption can result in liability for the state and local sales or use tax, as the certificate covers only certain types of purchases directly benefiting the Jazz in the Woods event.

Ignoring the limitation on direct purchases only and trying to qualify indirect expenditures or the use for a Project Exemption Certificate (PEC), which the entity is explicitly not authorized to obtain, could lead to tax liabilities.

Incorrectly assuming the certificate can be used outside Kansas, or without possessing a Kansas exemption certificate, even if the entity holds exemption certificates from other states.

Forgetting to maintain and update copies of the exemption certificate with the retailer, which is essential for the retailer's records and compliance with state requirements.

Every tax-exempt purchase must be directly linked to activities benefiting children-in-need and other nonprofit charities as outlined, without any deviations to ensure compliance and maintain tax-exempt status.

Retailers play a critical role and must ensure they follow through by maintaining an updated certificate on file for at least three years from the date of purchase, to avoid penalties.

The entity's responsibility extends to being aware of the exact nature of goods and services covered under their exemption and the limitations imposed on such exemptions.

Documents used along the form

When handling the Jazz Tax Certificate form for tax-exempt status in Kansas, several additional forms and documents may often be required to ensure full compliance and proper record-keeping. These documents serve different purposes, from verifying the entity's tax-exempt status to maintaining accurate financial records. Let’s explore some of these commonly used forms and documents.

- IRS Form 1023: This form is used by non-profit organizations to apply for recognition of tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. It's crucial for organizations seeking exemption from federal income tax.

- IRS Determination Letter: After reviewing Form 1023, the IRS issues this letter to confirm the organization's tax-exempt status. It's important for organizations as proof of their 501(c)(3) status to states and other parties.

- Annual Financial Statements: These documents, which include an income statement and balance sheet, provide a financial overview of the organization. They are often required to maintain transparency and accountability.

- State Annual Report: Many states require tax-exempt organizations to file an annual report with the Secretary of State or similar entity. This report typically outlines the organization’s activities, financial status, and updates on board members.

- W-9 Form: Organizations often need to provide this form, Request for Taxpayer Identification Number and Certification, when opening a bank account or conducting transactions requiring tax reporting.

- Form 990: Most tax-exempt organizations are required to file Form 990 with the IRS annually. This form provides the IRS and the public with financial information about the nonprofit, ensuring accountability and transparency.

Together, these forms and documents support the tax-exempt status of organizations and ensure they meet both federal and state requirements. Accurate and up-to-date records are essential for maintaining exemption and avoiding penalties. Whether for applying, reporting, or conducting daily financial transactions, these documents form a comprehensive framework for managing a tax-exempt organization's compliance and financial integrity.

Similar forms

The Nonprofit Organization Income Tax Exemption Certificate closely resembles the Jazz Tax Certificate form, primarily due to their shared objective of endorsing tax exemptions for nonprofit entities. Both documents validate an organization's exemption from specific tax obligations, centering on purchases related to their exempt activities. The narrative in each certificate ensures that transactions directly supporting the organization's mission benefit from this tax relief, explicitly limiting the use of such exemptions to the organization's direct activities and necessitating compliance with designated conditions.

The Resale Certificate for Sales Tax mirrors the Jazz Tax Certificate in its function to delineate purchases exempt from sales tax, with the primary distinction being the buyer's intent to resell the purchased goods in the course of business. Like the exemption certificates, it mandates that the goods acquired under this certificate must be for resale or for producing resale items. Both documents explicitly necessitate the buyer's qualification under the certificate's criteria and forbid the personal use of purchased items to ensure compliance with tax exemption regulations.

The Streamlined Sales Tax Exemption Certificate, while serving a broader, multi-state purpose, shares similarities with the Jazz Tax Certificate by providing a mechanism for tax-exempt purchases. This certificate particularly caters to businesses that operate across state lines, offering a singular form recognized by multiple states for tax exemption on eligible transactions. The necessity for accurate completion and the potential consequences for misuse are common threads, emphasizing the integrity of tax-exempt transactions.

The Government Purchase Exemption Certificate parallels the Jazz Tax Certificate, simplifying tax-exempt purchases made by government entities. Both certificates exempt the entitled holder from sales tax on qualifying transactions and require the entity to explicitly state the exempt purpose. The stringent conditions applied to these certificates ensure that only qualified purchases benefit from the exemption, highlighting the government's accountability and the nonprofit's commitment to its cause.

The Agricultural Exemption Certificate similarly exempts qualifying purchases from sales tax, aimed at supporting the agricultural sector. Like the Jazz Tax Certificate, it outlines specific conditions under which the exemption is valid, focusing on the purchase of goods and services used in farming. This ensures that both the agricultural industry and nonprofit organizations like Jazz in the Woods can operate more effectively by reducing the financial burden of sales tax on essential purchases.

The Direct Pay Permit operates on a similar principle to the Jazz Tax Certificate but from a different perspective, allowing the permit holder to purchase goods and services tax-free and then self-assess and remit tax directly to the state. This certificate shares the responsibility aspect with the Jazz Tax Certificate, where the entity holding the certificate must ensure compliance with tax laws and correct usage of the exemption. The focus is on allowing businesses more control over their tax liabilities, with strict conditions to prevent misuse.

The Use Tax Exemption Certificate resembles the Jazz Tax Certificate by offering tax exemptions for purchases made outside of the state or online, where sales tax was not collected. Entities eligible for this exemption, similar to those holding a Jazz Tax Certificate, must demonstrate the purpose of the purchase aligns with their exempt status. Both certificates necessitate understanding the tax exemption's scope and proper documentation to validate the tax-exempt purchase, ensuring adherence to legal obligations.

Dos and Don'ts

When filling out the Jazz Tax Certificate form, there are specific dos and don'ts that you need to adhere to. By following these guidelines, you can ensure the process is both smooth and compliant with the Kansas Department of Revenue's requirements.

Do:

- Ensure the Kansas Exemption Number is accurately entered. This number is crucial for identifying the tax-exempt entity.

- Verify the expiration date is still valid. It’s important to check that the certificate has not expired to maintain tax-exempt status.

- Have the form signed by an authorized individual. This could be an officer, office manager, or administrator of the exempt entity.

- Use payment methods issued to the entity, such as checks or credit/debit cards, to qualify for the tax exemption.

- Keep the description of goods and/or services purchased clear and specific. This helps in demonstrating their direct use for exempt purposes.

- Maintain a copy of the completed certificate for at least 3 years from the date of purchase, as required by the Kansas Department of Revenue.

Don't:

- Use this certificate for personal purchases. The certificate is intended solely for the use of the named tax-exempt entity.

- Accept cash, personal checks, or personal credit/debit cards for a tax-exempt purchase. This goes against the stipulations for qualifying for exemption.

- Attempt to obtain a Project Exemption Certificate (PEC) using this form. The form specifically states that the entity is not authorized to do so.

- Use exemption certificates issued by other states. Kansas requires its own certificate for tax exemption.

- Overlook the signature requirement. A completed, unsigned form is not valid for claiming tax exemptions.

- Fail to update the form if there are changes in the entity’s information or if making different types of exempt purchases in the future.

By following these guidelines, you can efficiently navigate the process of completing and using the Jazz Tax Certificate form for eligible tax-exempt purchases in Kansas.

Misconceptions

When it comes to the Jazz Tax Certificate form, numerous misconceptions abound. It's crucial to dispel these myths for correct usage and understanding of the document's purpose and limitations.

It's a universal tax-exempt document: A common misconception is that the Jazz Tax Certificate grants a blanket exemption for all types of taxes. In reality, it specifically exempts the entity from Kansas sales and/or compensating use tax under defined conditions. It does not apply to other types of taxes or in other jurisdictions.

Unlimited use by anyone: Despite what some might think, this exemption certificate is issued only for the use of the named exempt entity. Unauthorized use by other persons or entities is expressly prohibited.

Applicable to all purchases: Another misconception is that the certificate covers all purchases made by the exempt entity. However, it is only applicable to direct purchases, rentals, or leases of tangible personal property or services for the specific purpose of providing Jazz in the Woods, benefiting children-in-need and related nonprofits.

No expiration: Some might assume once acquired, the certificate holds indefinitely. However, it has a specific expiration date, and for ongoing tax-exempt status, it must be renewed accordingly.

Exemption extends to contractors: The belief that contractors or subcontractors working for the exempt entity are also exempt from paying sales or use tax is incorrect. They are required to pay Kansas sales or compensating use tax on materials and taxable labor services.

Payment method flexibility: The assumption that the exempt entity can make tax-exempt purchases through any payment method is false. Qualification for exemption stipulates payment must be made on the entity’s account or a credit/debit card issued to the entity. Cash, personal checks, or personal credit/debit cards are not permitted for tax exempt purchases.

Applicable across states: A major misconception is that the Jazz Tax Certificate is valid in states other than Kansas. This certificate is only valid in Kansas; exemption certificates issued by other states are not recognized.

One-time paperwork: Some believe that after the initial submission, no further action is needed. Retailers are, in fact, required to maintain a current copy of the certificate for at least 3 years from the purchase date, and entities must ensure that their certificate is renewed and up-to-date for continued exemptions.

Understanding the specific conditions and limitations of the Jazz Tax Certificate is essential for its correct application and to maintain compliance with Kansas sales tax laws.

Key takeaways

The Jazz Tax Certificate form is exclusively for entities exempt from paying Kansas sales and/or compensating use tax, as specified by the Kansas Department of Revenue.

Entities must possess a valid Kansas Exemption Number and an unexpired certificate to qualify for tax-exempt purchases.

The certificate strictly limits its use to the specific entity named, prohibiting its use by any individual or entity not expressly named therein.

Eligible purchases include all direct purchases, rentals, or leases of tangible personal property or services intended solely for the benefit of Jazz in the Woods or similar charitable activities.

The certificate does not authorize the entity to obtain a Project Exemption Certificate, affecting contractors and subcontractors who must pay sales or use tax on materials and taxed labor services.

To maintain the exemption, the payment must originate from the exempt entity's official accounts; personal payments do not qualify.

- Retailers accepting the certificate must retain a copy for at least three years from the date of sale and ensure it remains current and valid for future transactions.

- A completed exemption certificate can serve as a blanket exemption for identical future purchases that serve the same tax-exempt purpose.

- Improper use of this certificate, including unauthorized use or for purposes not stated as exempt, may lead to tax liability and penal actions including fines or imprisonment.

For further details on the exemptions and applicable laws, entities and retailers should consult Publication KS-1510 and Publication KS-1520 available on the Kansas Department of Revenue website or contact Taxpayer Assistance directly.

Popular PDF Documents

IRS 8282 - Allows for the proper tracking and reporting of sold donations, aiding in the financial transparency of charities.

California Workers Compensation Forms - Equips employers with a structured format for recording critical information following a workplace injury.