Get It 201X Tax Form

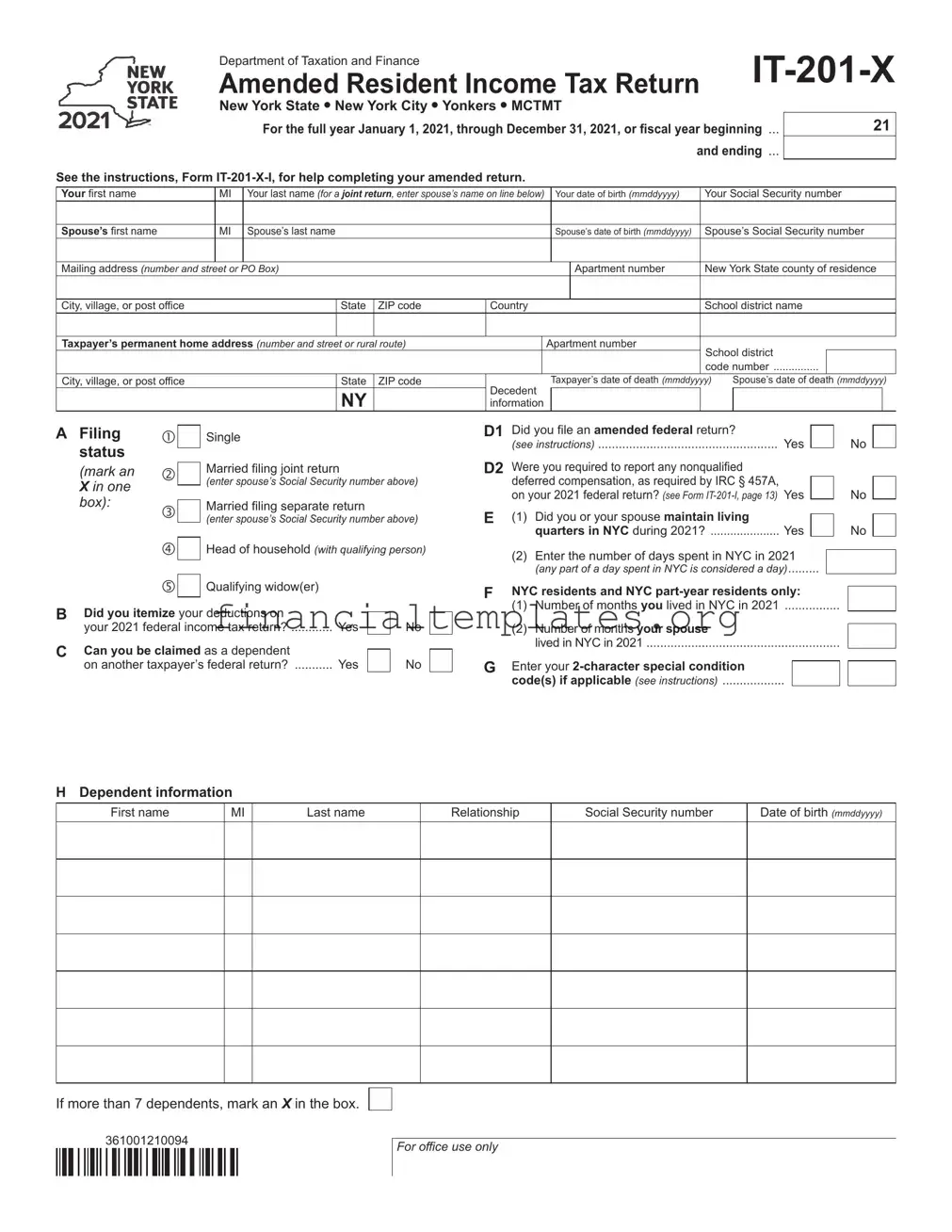

Navigating the complexities of amending a New York State resident income tax return requires attention to detail and a thorough understanding of the IT-201-X form. Designed for full-year residents who need to alter any aspect of their previously filed New York State, New York City, or Yonkers tax returns within the specified tax year - in this instance, from January 1, 2021, to December 31, 2021 - this document serves as a critical tool. Whether changes stem from an amended federal return, alterations in reported income, or corrections to credits and deductions initially claimed, the IT-201-X ensures taxpayers can update their information accurately. Beyond personal and spouse information, it meticulously breaks down income types, adjustments, deductions, and credits, offering a comprehensive framework for individuals to recalibrate their financial disclosure to the state accurately. Moreover, it caters to various filing statuses and accounts for city-specific taxes and credits, reflecting the nuanced tax obligations residents may face. With additional sections for calculating the standard or itemized deductions, dependent exemptions, and even the minutiae of New York additions and subtractions, taxpayers are equipped to refine their reports in pursuit of fairness and compliance. All this, coupled with detailed instructions for understanding and executing the form's requirements, makes the IT-201-X an essential resource for ensuring one's tax responsibilities are thoroughly and accurately met.

It 201X Tax Example

Department of Taxation and Finance |

|

|

|

Amended Resident Income Tax Return |

|

New York State • New York City • Yonkers • MCTMT

For the full year January 1, 2021, through December 31, 2021, or fiscal year beginning ...

and ending ...

See the instructions, Form

21

Your first name |

MI |

Your last name (for a joint return, enter spouse’s name on line below) |

|

Your date of birth (mmddyyyy) |

Your Social Security number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Spouse’s first name |

MI |

Spouse’s last name |

|

|

|

|

Spouse’s date of birth (mmddyyyy) |

Spouse’s Social Security number |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address (number and street or PO Box) |

|

|

|

|

|

Apartment number |

New York State county of residence |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, village, or post office |

|

|

State |

ZIP code |

Country |

|

|

|

School district name |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer’s permanent home address (number and street or rural route) |

|

|

Apartment number |

School district |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

code number |

|

||

City, village, or post office |

|

|

State |

ZIP code |

Decedent |

|

Taxpayer’s date of death (mmddyyyy) |

|

Spouse’s date of death (mmddyyyy) |

||||

|

|

|

NY |

|

|

|

|

|

|

|

|

||

|

|

|

|

information |

|

|

|

|

|

|

|

||

A Filing |

|

status |

|

(mark an |

|

X in one |

|

box): |

|

|

|

|

|

Single

Married filing joint return

(enter spouse’s Social Security number above)

Married filing separate return

(enter spouse’s Social Security number above)

Head of household (with qualifying person)

D1 |

Did you file an amended federal return? |

Yes |

|

|

(see instructions) |

||

D2 |

Were you required to report any nonqualified |

|

|

|

deferred compensation, as required by IRC § 457A, |

|

|

|

on your 2021 federal return? (see Form |

Yes |

|

E |

(1) |

Did you or your spouse maintain living |

Yes |

|

|

quarters in NYC during 2021? |

|

|

(2) |

Enter the number of days spent in NYC in 2021 |

|

|

|

(any part of a day spent in NYC is considered a day) |

|

No

No

No

|

|

|

Qualifying widow(er) |

|

B |

Did you itemize your deductions on |

Yes |

||

|

your 2021 federal income tax return? |

|||

C |

Can you be claimed as a dependent |

Yes |

||

|

on another taxpayer’s federal return? |

|||

No

No

FNYC residents and NYC

(1)Number of months you lived in NYC in 2021 ................

(2)Number of months your spouse

lived in NYC in 2021 ........................................................

GEnter your

H Dependent information

First name

MI

Last name

Relationship

Social Security number

Date of birth (mmddyyyy)

If more than 7 dependents, mark an X in the box.

361001210094

For office use only

Page 2 of 6

Your Social Security number

Federal income and adjustments

|

|

|

|

|

|

|

|

|

|

|

Whole dollars only |

|

Wages, salaries, tips, etc |

|

|

|

|

|

|

|

|

||

1 |

|

|

|

|

|

1 |

.00 |

||||

2 |

...............................................................................................................Taxable interest income |

|

|

|

|

|

2 |

.00 |

|||

3 |

......................................................................................................................Ordinary dividends |

|

|

|

|

|

3 |

.00 |

|||

4 |

...........Taxable refunds, credits, or offsets of state and local income taxes (also enter on line 25) |

|

4 |

.00 |

|||||||

5 |

.........................................................................................................................Alimony received |

|

|

|

|

|

5 |

.00 |

|||

6 |

......................................Business income or loss (submit a copy of federal Schedule C, Form 1040) |

|

6 |

.00 |

|||||||

7 |

..............................Capital gain or loss (if required, submit a copy of federal Schedule D, Form 1040) |

|

7 |

.00 |

|||||||

8 |

.............................................................Other gains or losses (submit a copy of federal Form 4797) |

|

|

|

|

|

8 |

.00 |

|||

|

|

|

|

|

|

|

|||||

9 |

...Taxable amount of IRA distributions. If received as a beneficiary, mark an X in the box |

|

|

|

9 |

.00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

10 |

Taxable amount of pensions and annuities. If received as a beneficiary, mark an X in the box |

|

|

|

10 |

.00 |

|||||

|

Rental real estate, royalties, partnerships, S corporations, trusts, etc. (submit copy of federal Schedule E, Form 1040) |

|

|

||||||||

11 |

11 |

.00 |

|||||||||

|

Rental real estate included in line 11 |

|

|

|

|

|

|

|

|

||

12 |

|

12 |

|

|

.00 |

|

|

||||

13 |

Farm income or loss (submit a copy of federal Schedule F, Form 1040) |

|

13 |

.00 |

|||||||

14 |

.....................................................................................................Unemployment compensation |

|

|

|

|

|

14 |

.00 |

|||

15 |

.................................................Taxable amount of Social Security benefits (also enter on line 27) |

|

15 |

.00 |

|||||||

16 |

Other income |

Identify: |

|

|

|

|

|

|

16 |

.00 |

|

17 |

................................................................................Add lines 1 through 11 and 13 through 16 |

|

|

|

|

|

17 |

.00 |

|||

18 |

Total federal adjustments to income |

Identify: |

|

|

|

|

|

|

18 |

.00 |

|

19 |

Federal adjusted gross income (subtract line 18 from line 17) |

|

........................................................ |

|

|

|

|

19 |

.00 |

||

19a |

Recomputed federal adjusted gross income (see Form |

.... |

|

19a |

.00 |

||||||

New York additions |

|

|

|

|

|

|

|

|

|||

|

Interest income on state and local bonds and obligations (but not those of NYS or its local governments) |

|

|

||||||||

20 |

20 |

.00 |

|||||||||

21 |

...............Public employee 414(h) retirement contributions from your wage and tax statements |

|

21 |

.00 |

|||||||

22 |

...............................................................New York’s 529 college savings program distributions |

|

|

|

|

|

22 |

.00 |

|||

23 |

Other (Form |

|

|

|

|

|

23 |

.00 |

|||

24 |

............................................................................................................Add lines 19a through 23 |

|

|

|

|

|

24 |

.00 |

|||

New York subtractions |

|

|

|

|

|

|

|

|

|||

|

Taxable refunds, credits, or offsets of state and local income taxes (from line 4) |

|

|

|

|

|

|

||||

25 |

|

25 |

|

|

.00 |

|

|

||||

26 |

Pensions of NYS and local governments and the federal government |

|

26 |

|

|

.00 |

|

|

|||

27 |

.......Taxable amount of Social Security benefits (from line 15) |

|

27 |

|

|

.00 |

|

|

|||

28 |

......................Interest income on U.S. government bonds |

|

28 |

|

|

.00 |

|

|

|||

29 |

.............................Pension and annuity income exclusion |

|

29 |

|

|

.00 |

|

|

|||

30 |

New York’s 529 college savings program deduction/earnings |

|

30 |

|

|

.00 |

|

|

|||

31 |

Other (Form |

31 |

|

|

.00 |

|

|

||||

32 |

Add lines 25 through 31 |

|

|

|

|

|

|

32 |

.00 |

||

|

|

|

|

|

|||||||

33 |

New York adjusted gross income (subtract line 32 from line 24) |

|

33 |

.00 |

|||||||

361002210094

Name(s) as shown on page 1 |

Your Social Security number |

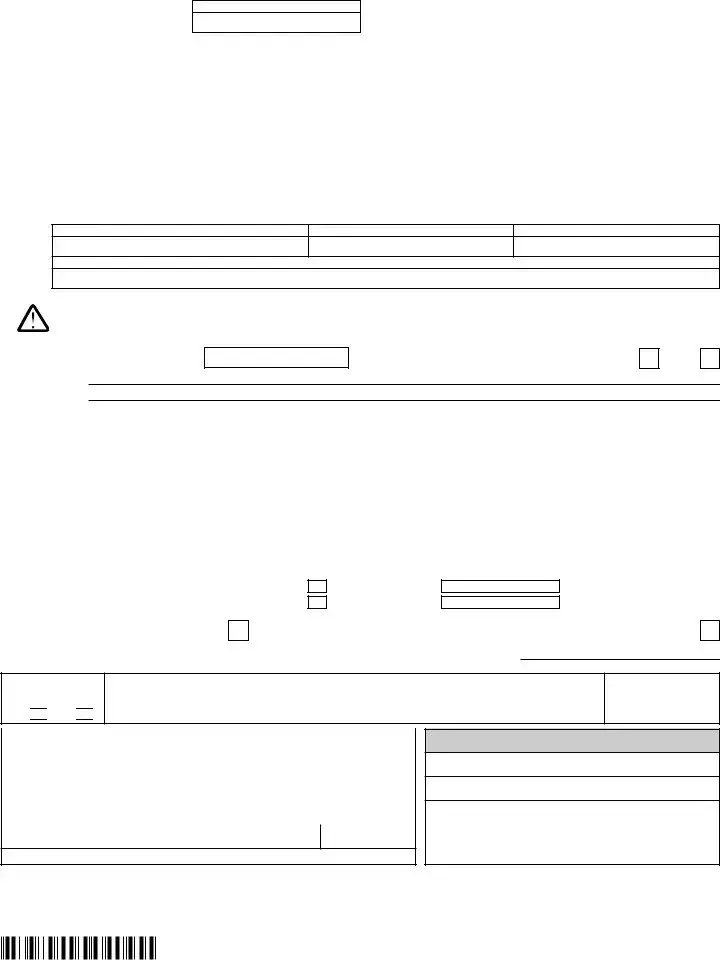

Standard deduction or itemized deduction

34 Enter your standard deduction (from table below) or your itemized deduction (from Form

Mark an X in the appropriate box: |

|

Standard |

- or - |

|

Itemized |

35Subtract line 34 from line 33 (if line 34 is more than line 33, leave blank)

36Dependent exemptions (enter the number of dependents listed in item H)

37Taxable income (subtract line 36 from line 35) ..................................................................................................................................................................

34 |

.00 |

35 |

.00 |

36 |

000.00 |

37 |

.00 |

New York State

standard deduction table

Filing status |

Standard deduction |

|

(from the front page) |

(enter on line 34 above) |

|

|

|

|

Single and you |

|

|

marked item C Yes |

$ 3,100 |

|

Single and you |

|

|

marked item C No |

8,000 |

|

Married filing joint return |

16,050 |

|

Married filing separate

return |

8,000 |

Head of household |

|

(with qualifying person) |

11,200 |

Qualifying widow(er) |

16,050 |

(continued on page 4)

361003210094

Page 4 of 6 |

|

|

|

|

|

|

|||||

|

Your Social Security number |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Tax computation, credits, and other taxes |

|

|

|

|

|||||||

38 |

Taxable income (from line 37 on page 3) |

|

|

|

|

||||||

|

|

|

38 |

||||||||

39 |

NYS tax on line 38 amount |

|

|

|

|

|

39 |

||||

40 |

NYS household credit |

........................................................ |

|

|

|

|

40 |

|

.00 |

|

|

41 |

Resident credit |

|

|

|

|

41 |

|

.00 |

|

||

42 |

Other NYS nonrefundable credits (Form |

42 |

|

.00 |

|

||||||

43 |

..............................................................................................................Add lines 40, 41, and 42 |

|

|

|

|

|

43 |

||||

44 |

..........................................Subtract line 43 from line 39 (if line 43 is more than line 39, leave blank) |

44 |

|||||||||

45 |

Net other NYS taxes (Form |

|

|

|

45 |

||||||

46 |

Total New York State taxes (add lines 44 and 45) |

|

|

|

46 |

||||||

New York City and Yonkers taxes, credits, and surcharges and MCTMT |

|

|

|||||||||

|

NYC taxable income |

|

|

|

|

|

|

|

|

|

|

47 |

........................................................ |

|

|

|

|

47 |

|

.00 |

|

||

47a |

................................NYC resident tax on line 47 amount |

47a |

|

.00 |

|

||||||

48 |

......................................................NYC household credit |

|

|

48 |

|

.00 |

|

||||

49 |

Subtract line 48 from line 47a (if line 48 is more than |

|

|

|

|

||||||

|

line 47a, leave blank) |

........................................................ |

|

|

|

|

49 |

|

.00 |

|

|

50 |

50 |

|

.00 |

|

|||||||

51 |

........................Other NYC taxes (Form |

51 |

|

.00 |

|

||||||

52 |

..................................................Add lines 49, 50, and 51 |

|

|

52 |

|

.00 |

|

||||

53 |

........NYC nonrefundable credits (Form |

53 |

|

.00 |

|

||||||

54 |

Subtract line 53 from line 52 (if line 53 is more than |

|

|

|

|

||||||

|

line 52, leave blank) |

|

|

|

|

54 |

|

.00 |

|

||

54a |

MCTMT net |

|

|

|

|

|

|

|

|

|

|

|

earnings base .... |

|

54a |

|

.00 |

|

|

|

|

|

|

54b |

MCTMT |

|

|

|

|

54b |

|

.00 |

|

||

55 |

...........................Yonkers resident income tax surcharge |

|

55 |

|

.00 |

|

|||||

56 |

................Yonkers nonresident earnings tax (Form |

|

56 |

|

.00 |

|

|||||

57 |

|

57 |

|

.00 |

|

||||||

58 |

Total New York City and Yonkers taxes / surcharges and MCTMT (add lines 54 and 54b through 57) |

58 |

|||||||||

59 |

Sales or use tax as reported on your original return (see instructions. Do not leave line 59 blank.) |

|

|||||||||

59 |

|||||||||||

60 |

Voluntary contributions as reported on your original return (or as adjusted by the |

|

|

||||||||

|

................................................................................................Tax Department; see instructions) |

|

|

|

60 |

||||||

61 |

Total New York State, New York City, Yonkers, and sales or use taxes, MCTMT, and |

|

|

||||||||

|

..............................................................voluntary contributions (add lines 46, 58, 59, and 60) |

|

|

|

61 |

||||||

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

361004210094

Name(s) as shown on page 1

Your Social Security number

62 Enter amount from line 61 ...........................................................................................................

Payments and refundable credits

62

.00

63 |

Empire State child credit |

63 |

.00 |

|

64 |

NYS/NYC child and dependent care credit |

64 |

.00 |

|

65 |

NYS earned income credit (EIC) |

|

65 |

.00 |

66 |

NYS noncustodial parent EIC |

66 |

.00 |

|

67 |

Real property tax credit |

67 |

.00 |

|

68 |

College tuition credit |

68 |

.00 |

|

69 |

NYC school tax credit (fixed amount) (also complete F on page 1) |

69 |

.00 |

|

|

NYC school tax credit (rate reduction amount) |

|

|

|

69a |

69a |

.00 |

||

70 |

NYC earned income credit |

|

70 |

.00 |

70a |

This line intentionally left blank |

70a |

|

|

71 |

Other refundable credits (Form |

71 |

.00 |

|

72 |

Total New York State tax withheld |

72 |

.00 |

|

73 |

Total New York City tax withheld |

73 |

.00 |

|

74 |

Total Yonkers tax withheld |

74 |

.00 |

|

75 |

Total estimated tax payments / Amount paid with Form |

75 |

.00 |

|

76Amount paid with original return, plus additional tax paid

after your original return was filed (see instructions) |

76 |

.00 |

77 Total payments (add lines 63 through 76) .....................................................................................

You must submit all required forms. Failure to

do so will result in an adjustment to your return.

See Important information in the instructions.

77 |

.00 |

78Overpayment, if any, as shown on original return or previously adjusted by NY State (see instr.) ... 78

78a Amount from original Form |

78a |

.00 |

.00

79 Subtract line 78 from line 77 |

79 |

Your refund

80If line 79 is more than line 62, subtract line 62 from line 79 and indicate how you want your refund

|

direct |

(fill in lines 82 |

|

paper |

|

Mark one refund choice: |

deposit |

through 82c) |

- or - |

check |

80 |

Amount you owe

.00

.00

...............................81 If line 79 is less than line 62, subtract line 79 from line 62 (see instructions) |

81 |

|

.00 |

||

To pay by electronic funds withdrawal, mark an X in the box |

|

and fill in lines 82 through 82d. If you pay by check or money |

|

||

|

|

||||

order you must complete Form |

return. |

|

|

|

|

Account information |

|

|

|

|

|

82Account information for direct deposit or electronic funds withdrawal (see instructions)

If the funds for your payment (or refund) would come from (or go to) an account outside the U.S.,

mark an X in this box (see instructions) ..............................................................................................................................

82a |

Account type: |

|

|

Personal checking - or - |

|

Personal savings - or - |

|

|

||

82b |

Routing number |

|

|

|

|

|

82c Account number |

|||

|

|

|

|

|

||||||

|

|

|

|

|

|

|||||

82d |

Electronic funds withdrawal (see instructions) |

Date |

|

|

|

|||||

Business checking - or - |

|

Business savings |

||

|

|

|

||

|

|

|

|

|

|

|

|

||

Amount |

|

.00 |

||

361005210094

Page 6 of 6

Your Social Security number

83Reason(s) for amending your return (mark an X in all applicable boxes; see instructions)

83a |

Federal audit change (complete lines |

84 through 91 below) |

|

|

|

|

83b |

..............Worthless stock/securities |

|

|||||||||||||

|

|

|

|

|

|

|||||||||||||||||

83c |

Claim of right |

|

|

|

83d |

...........................................Wages |

|

|

|

|

|

83e |

.............................................Military |

|

||||||||

83f |

Court ruling |

|

|

|

83g |

Workers’ compensation |

|

83h |

Treaties/visa |

|

||||||||||||

|

|

|

|

|

||||||||||||||||||

83i |

Tax shelter transaction |

|

|

|

83j |

Credit claim |

|

|

|

|

|

|

83k |

Protective claim (see instructions) |

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||||||||

83l |

Net operating loss (see instructions). Mark an X in the box |

|

and enter the year of the loss |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

||||||||||||||||

83m |

Report Social Security number (SSN) |

|

|

Prior identification number |

|

|

|

|

|

Date SSN was issued |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

83n |

Other. Mark an X in the box ... |

|

and explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

83o |

To report adjustments to partnership or S corporation income, |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

gain, loss or deduction, provide the following information: |

Partnership |

|

|

S corporation |

|

|

|

||||||||||||||

Name of partnership or S corporation

Identifying number

Principal business activity

Address of partnership or S corporation

If you marked an X in box 83a above, you must complete lines 84 through 91 below. All others may skip lines 84 through 91 and go directly to the

84Enter the date (mmddyyyy) of the

final federal determination

85Do you concede the federal audit

changes (If No, explain below.) |

Yes |

No

|

(Explain) |

|

|

|

|

|

|

86 |

List federal changes |

|

|

|

|

|

|

|

86a |

|

|

|

|

|

|

|

86b |

|

|

|

|

|

|

|

86c |

|

|

|

|

|

|

|

86d |

|

|

|

|

|

|

|

86e |

|

|

|

|

|

|

87 |

Net federal changes (increase or decrease) |

|

|

|

|

||

88 |

Federal taxable income (mark an X in one box) |

Per return |

|

Previously adjusted |

|

|

|

|

|

|

|||||

89 |

............................................................................................Corrected federal taxable income |

|

|

|

|

||

86a |

.00 |

86b |

.00 |

86c |

.00 |

86d |

.00 |

86e |

.00 |

|

|

87 |

.00 |

88 |

.00 |

89 |

.00 |

90 Federal credits disallowed |

Earned income credit |

|

Child care credit |

Amount disallowed Amount disallowed

91 Federal penalties assessed

91a Fraud .............................................

91b Negligence |

|

..........................91c Other (explain below) |

|

Yes

No

No

Print designee’s name |

Designee’s phone number |

|

|

( |

) |

Email:

Personal identification

number (PIN)

▼ Paid preparer must complete ▼ |

Preparer’s NYTPRIN |

NYTPRIN |

||||

(see instructions) |

|

|

|

excl. code |

|

|

Preparer’s signature |

|

Preparer’s printed name |

|

|

|

|

|

|

|

|

|

|

|

Firm’s name (or yours, if |

|

|

Preparer’s PTIN or SSN |

|||

|

|

|

|

|

|

|

Address |

|

|

Employer identification number |

|||

|

|

|

|

|

|

|

Date

Email:

▼ Taxpayer(s) must sign here ▼ Your signature

Your occupation

Spouse’s signature and occupation (if joint return)

Date |

(Daytime)phone number |

Email: |

|

See instructions for where to mail your return.

361006210094

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title | IT-201-X Amended Resident Income Tax Return |

| Applicable Locations | New York State, New York City, Yonkers, and MCTMT |

| Reporting Period | Full year from January 1, 2021, through December 31, 2021, or applicable fiscal year |

| Instructions Form | Form IT-201-X-I |

| Filing Status Options | Single, Married filing jointly, Married filing separately, Head of household, Qualifying widow(er) |

| Itemized Deductions | Option to itemize deductions if done so on 2021 federal income tax return |

| Dependent Information | Includes first name, MI, last name, relationship, Social Security number, and date of birth |

| Amendment Indicators | Questions regarding amended federal return and nonqualified deferred compensation |

| New York Specific Adjustments | Additions and subtractions specific to New York State taxation regulations |

| Governing Law(s) | New York State Tax Law |

Guide to Writing It 201X Tax

Filing an amended tax return can be necessary when you need to correct or include information that was not reported on your original tax return. The IT-201-X form is designed for residents of New York State, New York City, or Yonkers who need to amend their income tax returns. The following steps will guide you through the process of accurately completing the IT-201-X form.

- Enter your first and middle initials, last name, and date of birth in the designated areas at the top of the form. If you're filing a joint return, include your spouse's name, date of birth, and Social Security number in the spaces provided.

- Fill in your mailing address, including the apartment number if applicable, your city, state, ZIP code, and the county of residence in New York State.

- Provide your taxpayer identification numbers (Social Security numbers) for both you and your spouse, if applicable.

- Indicate your filing status by marking the appropriate box for single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- If applicable, answer the questions in sections D1 and D2 about filing amended federal returns and nonqualified deferred compensation.

- In section E, answer questions regarding residence or days spent in New York City in the tax year.

- For New York City and part-year residents, enter the number of months lived in NYC in 2021.

- If applicable, enter your 2-character special condition code(s).

- Complete the dependent information section H, listing dependents' first names, middle initials, last names, relationship to you, their Social Security numbers, and dates of birth.

- Report your federal income and adjustments to income, including wages, interest, dividends, and any other relevant income items, in dollars only.

- Calculate and enter your New York add-backs, such as interest income from non-New York State bonds, and subtractions, including pensions, Social Security benefits, and other applicable subtractions to arrive at your New York adjusted gross income.

- Choose between the standard deduction or itemized deductions and subtract this from your New York adjusted gross income to determine your taxable income.

- Refer to the New York State standard deduction table to determine your standard deduction based on your filing status.

- Compute the tax by applying the New York State tax rates to your taxable income and enter the amount of tax due.

- Enter credits, including the New York State household credit and any adjustments for New York City or Yonkers taxes if applicable.

- Calculate and enter payments and refundable credits, including New York State tax withheld, estimated tax payments, and any credit amounts.

- If this results in an overpayment from your original return, indicate how you prefer to receive your refund or if you owe additional tax, calculate the amount you owe.

- Provide your bank account information for direct deposit of your refund or electronic withdrawal of any amount due.

- Double-check all entries for accuracy, sign and date the form, and attach any required documentation before submission.

Remember to include all the necessary schedules and documentation, such as a copy of your amended federal return if applicable. Once completed, review your form for accuracy to ensure all required information is provided and accurate. Submitting an accurate and complete amended return helps avoid processing delays.

Understanding It 201X Tax

What is the IT-201-X form used for?

The IT-201-X form is used by residents of New York State, including those living in New York City and Yonkers, who need to amend their original state income tax return. If, after filing your original tax return, you discover an error or your federal return was amended and affects your state return, you will use this form to make any necessary corrections.

Who needs to file the IT-201-X form?

Any New York State resident who has already filed their state income tax return but needs to correct it must file the IT-201-X form. This includes those who filed jointly, separately, as head of household, or qualifying widow(er) and discovered that their previously filed state return was either inaccurate or incomplete.

Do I need to file an amended return if I filed an amended federal return?

Yes, if you filed an amended federal tax return, you might also have to file an amended New York State tax return using the IT-201-X form. It's important to review your state return after making changes to your federal return to ensure all information remains accurate.

Can the IT-201-X form be used for making changes to my personal information?

Yes, if there's an error or change needed in your personal information such as name, address, or Social Security number after the initial filing, you can use the IT-201-X form to update this information. However, it's primarily meant for making changes to your income, deductions, credits, or tax liability.

What years does the IT-201-X cover?

The IT-201-X form applies to the tax year stated on the form itself. Each amended form is specific to a tax year, so ensure you're using the correct version for the year you need to amend. The example provided discusses amending the 2021 tax year.

What if I made a mistake on my original tax return?

If you made a mistake on your original tax return, such as reporting incorrect income, forgetting to claim a deduction or credit, or needing to change your filing status, you should file Form IT-201-X to correct these errors. This ensures your tax liability is accurate according to New York State tax laws.

How do I know if I need to amend my New York State return if I amended my federal return?

Generally, if changes to your federal return affect your taxable income, deductions, or credits that are also reported on your New York State return, you will need to amend your state return. Review the changes made to your federal return carefully to determine if they also impact your state tax liability.

What are the steps for filing an IT-201-X?

- Review your original state return and federal amendment, if applicable, to understand the changes needed.

- Gather documentation supporting your amendments, such as W-2s, 1099s, federal Schedule A, and so on.

- Complete the IT-201-X form accurately, double-checking all changes against your documentation.

- Submit the form following the New York State Department of Taxation and Finance instructions, usually either by mail or electronically.

Remeber, it's important to include any required documentation or schedules to avoid processing delays.

Common mistakes

When filling out the IT-201-X Amended Resident Income Tax Return, many individuals unintentionally make errors that could affect their tax calculations and refunds. Here are seven common mistakes to be cautious of:

- Incorrect Social Security Numbers: Many people mistakenly enter incorrect Social Security numbers for themselves, their spouse, or dependents. This can delay processing and impact tax credits and deductions.

- Filing Status Confusion: Selecting the wrong filing status can lead to incorrect tax obligations or benefits. It's critical to choose the status that best fits your marital and household situation as of December 31 of the tax year.

- Reporting Income Incorrectly: Not accurately reporting all sources of income, such as wages, dividends, or business income, can result in an incorrect tax calculation.

- Overlooking Deductions and Credits: Taxpayers often miss out on itemized deductions or credits for which they are eligible, such as the Empire State child credit, which can decrease their tax liability.

- Address Errors: A wrong or incomplete mailing address can delay any refunds or correspondence from the Department of Taxation and Finance.

- Miscalculating New York Additions or Subtractions: It's common to incorrectly calculate adjustments to the federal adjusted gross income for specific New York State items, leading to inaccurate New York State adjusted gross income.

- Incorrect Payment Information: When opting for a direct deposit refund or electronic payment, entering incorrect account information can delay or misdirect funds.

By avoiding these errors, taxpayers can ensure a smoother process when filing their IT-201-X and potentially maximize their refund or minimize their tax liability. It's always advisable to double-check the return before submission or consult with a tax professional for assistance.

Documents used along the form

Filing an amended tax return with the IT-201-X form, such as an Amended Resident Income Tax Return in New York State, usually involves including additional forms and documents to support the changes being reported. These additional documents ensure that the amendment is processed correctly and reflect the individual's financial situation accurately.

- W-2 Forms: These are wage and tax statements provided by employers. They summarize an employee's annual earnings and taxes withheld.

- 1099 Forms: A series of documents reporting various types of income from non-employment sources, such as independent contractor work (1099-NEC), interest and dividends (1099-INT and 1099-DIV), and government payments like tax refunds (1099-G).

- Schedule C: A form used by sole proprietors to report income or loss from a business they operated or a profession they practiced as a sole proprietor.

- Schedule D: This document is used to report capital gains and losses from transactions of capital assets.

- Form 4797: Used to report the sale or exchange of business property, including capital assets and depreciable property.

- Schedule E: For reporting income and losses from rental real estate, royalties, partnerships, S corporations, estates, and trusts.

- Schedule F: Used by farmers to report income and expenses related to farming.

- Form 8863: For reporting education credits, such as the American Opportunity Credit and the Lifetime Learning Credit.

- Form 1098: Mortgage interest statement, used to report interest and related expenses from a mortgage, to possibly deduct mortgage interest on the tax return.

- Form 2441: For child and dependent care expenses. It's used to report the expenses for child care which could qualify for a tax credit.

Completing the IT-201-X form often requires careful documentation to navigate the complexities of tax adjustments and ensure that taxpayers correctly report their financial changes. These additional forms and documents assist in painting a complete picture of one’s financial changes during the tax year, making sure that all necessary information is accounted for in the amended tax filing process.

Similar forms

The Federal 1040 Tax Form is quite similar to the IT-201-X Tax Form in that it serves as the standard federal income tax form used by residents in the United States. Both documents are used to report an individual’s yearly income to respective tax authorities and determine the amount of taxes owed or refundable. The 1040 form, like the IT-201-X, also accommodates various income sources, deductions, and credits, thereby influencing the calculation of taxable income and tax liability.

The 1040X Amended U.S. Individual Income Tax Return mirrors the IT-201-X in its fundamental purpose: to correct or amend a previously filed income tax return. Taxpayers might need to correct their income, change their filing status, or amend previously claimed deductions or credits. Both forms require detailed information on the original return and a clear explanation of the changes being made, ensuring that tax records are accurate and up to date.

Form W-2, Wage and Tax Statement, shares a connection with the IT-201-X form as it provides essential information needed to complete income tax returns. This document outlines the amount of money earned by an employee and the taxes withheld by the employer over the year. While the W-2 form itself is not a tax return, the information it contains directly influences the income information reported on both federal and state tax forms like the IT-201-X.

Form 1099, particularly various sub-forms like 1099-INT for interest income and 1099-DIV for dividends, are akin to information required on the IT-201-X form. These forms report different types of income other than wages, salaries, and tips. The IT-201-X, much like the federal tax return, requires this income information to accurately assess an individual’s total taxable income for the year, underscoring their importance in the tax filing process.

Form W-4, Employee's Withholding Certificate, while not a tax return form, significantly impacts the information reported on the IT-201-X. The W-4 form dictates how much federal income tax is withheld from an employee’s paycheck, affecting the ultimate tax liability or refund depicted on annual tax returns. Adjustments made on the W-4 during the year can lead to changes that might necessitate the filing of an amended return using IT-201-X or its federal counterpart.

Schedule A (Form 1040), Itemized Deductions, is akin to parts of the IT-201-X that deal with deductions. For taxpayers who choose to itemize deductions rather than take the standard deduction, Schedule A outlines various deductible expenses that can lower taxable income. These might include medical expenses, state and local taxes, and charitable contributions, all of which are considered in determining the amount of tax owed or refunded on the IT-201-X form.

Schedule C (Form 1040), Profit or Loss from Business, parallels the sections of the IT-201-X for reporting income or losses from a business operated as a sole proprietorship. Self-employed individuals use Schedule C to detail their business income and expenses, affecting the total taxable income reported. This information feeds into the total income assessment on the IT-201-X for New York State residents.

Schedule D (Form 1040), Capital Gains and Losses, is connected to the IT-201-X by its focus on reporting gains or losses from the sale of capital assets. Both forms require taxpayers to report these transactions due to their impact on tax obligations. The calculation of capital gains or losses plays a critical role in the overall income tax equation, influencing the tax liability or refund due to the taxpayer.

Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, relates to the IT-201-X as it provides taxpayers additional time to file their income tax returns without penalty. While Form 4868 does not extend the time to pay taxes owed, it prevents late filing penalties, potentially reducing the corrections or amendments needed on a hastily filed return that may later be corrected with an IT-201-X form.

Form 8822, Change of Address, while administratively different, plays a crucial role in the accurate processing and correspondence regarding the IT-201-X form. Ensuring that tax authorities have the correct address is vital for receiving notices, refunds, or any documentation related to an amended return. Timely updates with Form 8822 support the smooth resolution of matters related to the IT-201-X form, highlighting the interconnectedness of various tax documents.

Dos and Don'ts

When it comes to amending your tax return using the New York State Form IT-201-X, there are specific actions that can streamline the process and others that could potentially create unnecessary hindrances. Below are critical dos and don'ts to consider:

Do:

- Review the instructions thoroughly. The IT-201-X form comes with comprehensive instructions that are crucial for accurately amending your tax return. Take the time to read these guidelines carefully to ensure you understand the requirements and procedures.

- Include all relevant documentation. If you’re reporting changes in your income, deductions, credits, or any other aspects of your tax return, make sure to attach all necessary documents. This often includes updated W-2 forms, schedules, or any other supporting paperwork.

- Double-check your calculations. Errors in arithmetic can lead to further delays in processing your amendment. Before submitting the form, re-examine your math and consider using tax software or consulting with a professional to verify the accuracy of your calculations.

- Report changes made to your federal tax return. If you also amended your federal tax return with an IRS Form 1040-X, ensure that any relevant changes are reflected in your IT-201-X form. Discrepancies between federal and state amendments can lead to questions or additional review time.

Don't:

- Omit your signature. A common oversight is forgetting to sign the amended return. An unsigned form is considered incomplete and cannot be processed, leading to delays.

- Include incomplete or inaccurate information. Failing to provide the correct details for sections such as your Social Security Number, income amounts, and deductions can result in processing delays or an incorrect amendment. Take the time to verify each entry for completeness and accuracy.

- Miss the deadline for amendments. Be aware of the timeframe you have to amend a return, typically within three years after the date you filed your original return or within two years after the date you paid the tax, whichever is later. Filing after the deadline could prevent you from receiving any potential refund.

- Forget to adjust your state and city taxes, if applicable. When amending your New York State tax return, also revisit any pertinent New York City or Yonkers taxes. Neglecting adjustments to these can result in inaccuracies on your amended return.

Adhering to these guidelines can help ensure that your IT-201-X Amended Resident Income Tax Return is completed accurately and processed efficiently.

Misconceptions

- Amended returns are only for errors. A common misconception is that the IT-201-X form should only be used if an error was made on the original tax return. In reality, it can also be used to report changes to your income, deductions, or credits that may have occurred after you filed your original return.

- Filing an amended return will trigger an audit. Another concern is the belief that filing an amended return will automatically lead to an audit. However, submitting an amended return does not increase your chances of being audited. The IRS and state tax departments routinely process these forms to correct or update return information.

- The IT-201-X can be filed at any time. It's often thought that there's no deadline for filing an amended return. Yet, there are deadlines for when you can submit an amended return to claim a refund or credit. Typically, this is within three years from the date you filed your original return or within two years from the date you paid the tax, whichever is later.

- You can e-file the IT-201-X. Currently, many people assume that all tax forms, including amended returns, can be filed electronically. However, certain states and specific forms might require that amendments be filed in paper format, so it's important to check the latest filing requirements.

- Amending one part of your return doesn't affect the rest. Some believe that if they amend one section of their return, the rest of the return remains untouched. In truth, amending any part of your tax return can affect your overall tax liability, possibly changing the amount owed or the refund due.

- If you amend your federal return, you don't need to amend your state return. There's a misconception that amending your federal return doesn't impact your state return. Most of the time, changes to your federal return will also affect your state return, as state taxation often bases calculations on federal adjusted gross income or taxable income.

Key takeaways

Filling out and using the IT-201-X Tax Form correctly is crucial for New York residents needing to amend their tax returns. Here are key takeaways to ensure the process is hassle-free:

- Ensure all personal information is accurate, including Social Security numbers for you and your spouse, if applicable.

- Mark the correct filing status and double-check that you've entered the right numbers in sections addressing income, adjustments, deductions, and credits.

- Itemizing deductions? Be certain to use Form IT-196. This is especially important if your itemized deductions on your federal return.

- If you've maintained living quarters in NYC or spent any part of a day in NYC, you need to report the number of days to accurately calculate your tax obligations.

- Remember to include information on dependents. If there are more than seven, mark the box indicating this to ensure you receive the appropriate exemptions and credits.

- For the overall accuracy of your amended return, meticulously cross-verify the entries related to your income, deductions, and tax liability. Also, highlight any changes or corrections from your original submission.

Submitting Form IT-201-X requires meticulous attention to detail. With careful review and proper completion, taxpayers can efficiently update their state income tax returns. Always consult the instructional guide for Form IT-201-X-I to avoid common errors, and remember to include all necessary documentation and schedules to support your amended return. Timely addressing these aspects ensures your amended tax return is processed smoothly.

Popular PDF Documents

Form W-8eci - Understanding when and how to use the W-8EXP form can save foreign entities from tax headaches.

Nj St-50 - Its focus on online functionality meets the modern business environment's needs for efficiency and accessibility in tax reporting.

5305 Vs 5305a - Makes it possible for employers to contribute towards a retirement plan, benefiting from tax incentives in the process.