Get It 201 Att Tax Form

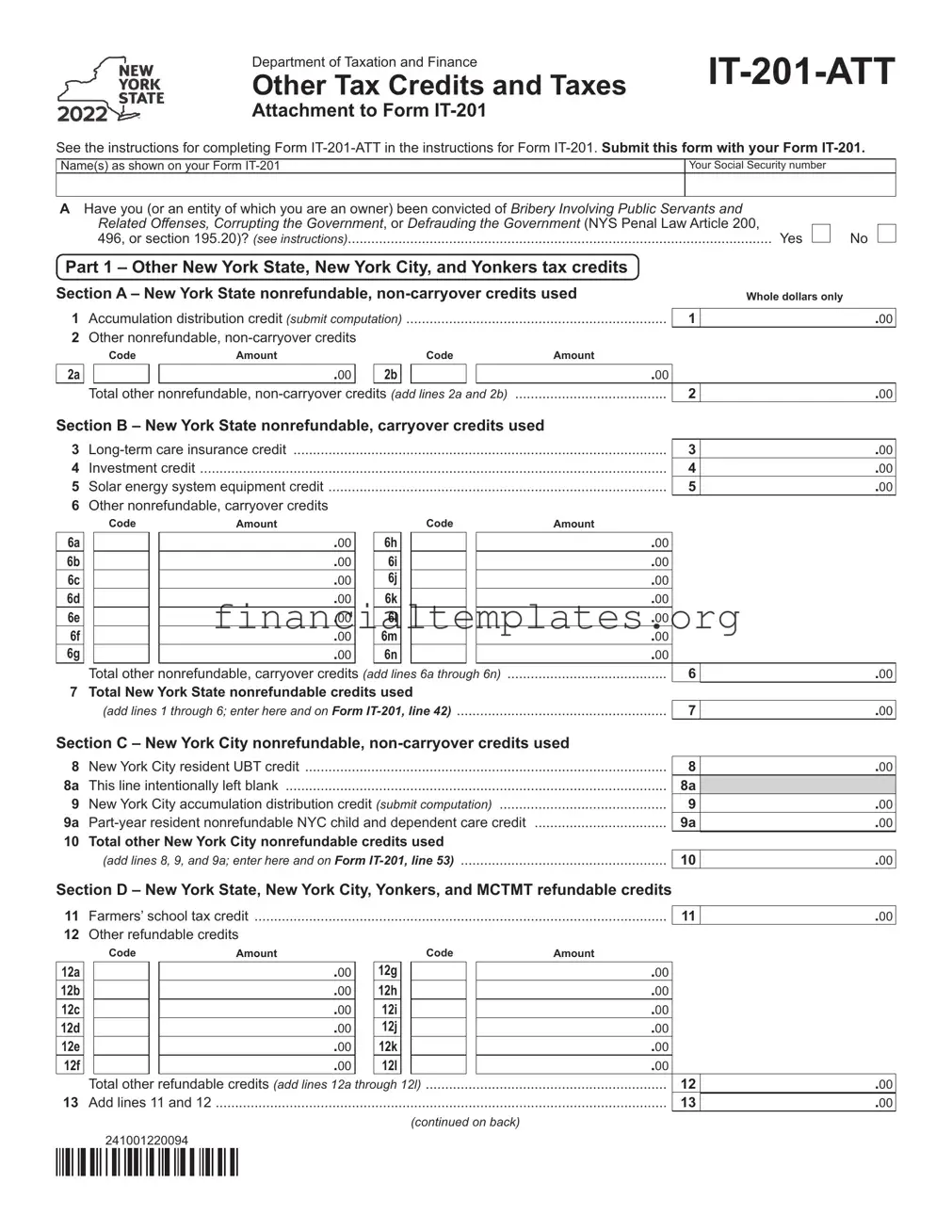

Filing taxes can often appear daunting, especially when dealing with specific forms like the IT-201-ATT, known as the Other Tax Credits and Taxes Attachment to Form IT-201. This crucial document, provided by the Department of Taxation and Finance, plays a significant role for taxpayers in New York, facilitating the declaration of various tax credits and additional taxes that might not be covered in the main IT-201 form. It asks for detailed information on nonrefundable, carryover, and refundable credits spanning New York State, New York City, and Yonkers, and it addresses different tax scenarios, including capital gains or lump-sum distributions. The sections are meticulously designed to ensure taxpayers don’t overlook potential credits such as those for long-term care insurance, solar energy systems, or even unique situations like the claim of right credits across different jurisdictions. Additionally, it inquires about other state taxes and encapsulates categories for New York City taxes, ensuring a thorough accounting of one's fiscal responsibilities. Completing this attachment with accuracy is vital as it directly impacts the calculation on the main IT-201 form, highlighting its importance in the broader scope of state tax compliance.

It 201 Att Tax Example

Department of Taxation and Finance

Other Tax Credits and Taxes

Attachment to Form

See the instructions for completing Form

Name(s) as shown on your Form

Your Social Security number

AHave you (or an entity of which you are an owner) been convicted of Bribery Involving Public Servants and

Related Offenses, Corrupting the Government, or Defrauding the Government (NYS Penal Law Article 200,

496, or section 195.20)? (see instructions) |

Yes |

No

Part 1 – Other New York State, New York City, and Yonkers tax credits

Section A – New York State nonrefundable,

1 |

Accumulation distribution credit (submit computation) |

................................................................... |

||

2 |

Other nonrefundable, |

|

|

|

|

Code |

Amount |

Code |

Amount |

1

Whole dollars only

.00

2a |

|

|

|

.00 |

|

2b |

|

|

|

|

.00 |

|

|

Total other nonrefundable, |

2 |

||||||||||

Section B – New York State nonrefundable, carryover credits used |

|

|

||||||||||

3 |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

3 |

||||||

4 |

Investment credit |

|

|

|

|

|

|

4 |

||||

5 |

Solar energy system equipment credit |

|

|

|

|

|

|

5 |

||||

6Other nonrefundable, carryover credits

|

|

Code |

Amount |

|

|

|

|

Code |

Amount |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6a |

|

|

|

|

.00 |

|

6h |

|

|

|

|

.00 |

|

6b |

|

|

|

|

.00 |

|

6i |

|

|

|

|

.00 |

|

6c |

|

|

|

|

.00 |

|

6j |

|

|

|

|

.00 |

|

6d |

|

|

|

|

.00 |

|

6k |

|

|

|

|

.00 |

|

6e |

|

|

|

|

.00 |

|

6l |

|

|

|

|

.00 |

|

6f |

|

|

|

|

.00 |

|

6m |

|

|

|

|

.00 |

|

6g |

|

|

|

|

.00 |

|

6n |

|

|

|

|

.00 |

|

|

Total other nonrefundable, carryover credits (add lines 6a through 6n) |

......................................... |

6 |

||||||||||

7 Total New York State nonrefundable credits used |

|

|

|||||||||||

|

|

......................................................(add lines 1 through 6; enter here and on FORM |

7 |

||||||||||

.00

.00

.00

.00

.00

.00

Section C – New York City nonrefundable,

8 |

New York City resident UBT credit |

8 |

8a |

This line intentionally left blank |

8a |

9 |

New York City accumulation distribution credit (submit computation) |

9 |

9a |

9a |

|

10 |

Total other New York City nonrefundable credits used |

|

|

(add lines 8, 9, and 9a; enter here and on FORM |

10 |

Section D – New York State, New York City, Yonkers, and MCTMT refundable credits |

|

|

11 |

Farmers’ school tax credit |

11 |

12Other refundable credits

|

|

Code |

Amount |

|

|

|

|

Code |

Amount |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a |

|

|

|

|

.00 |

|

12g |

|

|

|

|

.00 |

|

12b |

|

|

|

|

.00 |

|

12h |

|

|

|

|

.00 |

|

12c |

|

|

|

|

.00 |

|

12i |

|

|

|

|

.00 |

|

12d |

|

|

|

|

.00 |

|

12j |

|

|

|

|

.00 |

|

12e |

|

|

|

|

.00 |

|

12k |

|

|

|

|

.00 |

|

12f |

|

|

|

|

.00 |

|

12l |

|

|

|

|

.00 |

|

|

Total other refundable credits (add lines 12a through 12l) |

.............................................................. |

|

|

12 |

||||||||

13 Add lines 11 and 12 |

.................................................................................................................... |

|

|

|

|

|

|

|

13 |

||||

(continued on back)

241001220094

.00

.00

.00

.00

.00

.00

.00

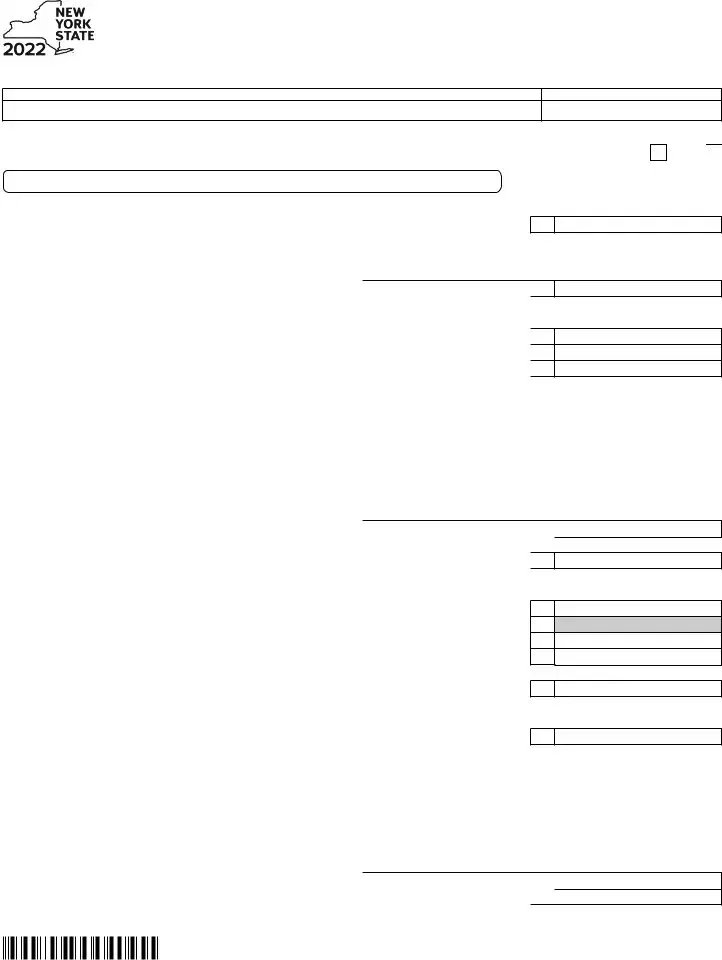

Part 1, Section D – New York State, New York City, Yonkers, and MCTMT refundable credits (continued)

Your Social Security number

14 |

Enter amount from line 13 on the front page |

14 |

.00 |

|

|

|

|

15 |

New York State claim of right credit |

15 |

.00 |

16 |

New York City claim of right credit |

16 |

.00 |

17 |

Yonkers claim of right credit |

17 |

.00 |

17a |

MCTMT (metropolitan commuter transportation mobility tax) claim of right credit |

17a |

.00 |

18 |

Total New York State, New York City, Yonkers, and MCTMT other refundable credits |

|

|

|

(add lines 14 through 17a; enter here and on FORM |

18 |

.00 |

Part 2 – Other New York State taxes (submit all applicable forms)

If you are subject to other New York State taxes, complete Part 2.

19 |

...................New York State tax on capital gain portion of |

19 |

|||||||||||||

20 |

Other New York State taxes |

|

|

|

|

|

|

|

|

|

|||||

|

|

Code |

Amount |

|

|

Code |

Amount |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20a |

|

|

|

|

.00 |

|

20g |

|

|

|

|

|

.00 |

|

|

20b |

|

|

|

|

.00 |

|

20h |

|

|

|

|

|

.00 |

|

|

20c |

|

|

|

|

.00 |

|

20i |

|

|

|

|

|

.00 |

|

|

20d |

|

|

|

|

.00 |

|

20j |

|

|

|

|

|

.00 |

|

|

20e |

|

|

|

|

.00 |

|

20k |

|

|

|

|

|

.00 |

|

|

20f |

|

|

|

|

.00 |

|

20l |

|

|

|

|

|

.00 |

|

|

|

Total other New York State taxes (add lines 20a through 20l) |

|

20 |

||||||||||||

21 |

Add lines 19 and 20 |

|

|

|

|

|

|

|

|

|

|

||||

................................................................................................................... |

|

|

|

|

|

|

|

|

|

21 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

See instructions for line 22 |

|

|

|

22 |

|

|

.00 |

|

||||||

23 |

Enter amount from Form |

|

|

|

23 |

|

|

.00 |

|

||||||

24 |

Subtract line 23 from line 22 (if line 23 is more than line 22, leave blank) |

......................................... |

24 |

||||||||||||

25 |

Subtract line 24 from line 21 (if line 24 is more than line 21, leave blank) |

......................................... |

25 |

||||||||||||

26New York State separate tax on

(Form |

26 |

.00 |

27Resident credit against separate tax on

|

distributions |

27 |

.00 |

|

|

28 |

Subtract line 27 from line 26 |

|

|

28 |

|

|

|

|

|||

29 |

This line intentionally left blank |

|

|

29 |

|

|

|

|

|||

30 |

Net other New York State taxes |

|

|

|

|

|

(add lines 25 and 28; enter here and on FORM |

........................................................ |

|

30 |

|

Part 3 – Other New York City taxes (submit all applicable forms)

31 |

This line intentionally left blank |

31 |

32 |

New York City resident separate tax on |

32 |

33 |

New York City tax on capital gain portion of |

33 |

34 |

Total other New York City taxes |

|

|

(add lines 32 and 33; enter here and on FORM |

34 |

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

241002220094

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IT-201-ATT form is an attachment to Form IT-201 used for reporting Other Tax Credits and Taxes. |

| Sections | It includes sections for New York State, New York City, and Yonkers tax credits, along with specific sections for other New York State and New York City taxes. |

| Conviction Disclosure | Requires disclosure of convictions relating to bribery, corrupting the government, or defrauding the government under specified NYS Penal Law articles. |

| Governing Law | The form is governed by various New York State, New York City, and Yonkers tax laws, depending upon the specific credits and taxes being reported. |

Guide to Writing It 201 Att Tax

Filing the IT-201-ATT form is an essential step for taxpayers who need to attach additional information regarding other tax credits and taxes when submitting the Form IT-201. This attachment is crucial for claiming various credits and reporting additional taxes, ensuring compliance and potentially benefiting your tax situation overall. Below are step-by-step instructions to guide you through filling out this form accurately.

- Begin by providing your name(s) and Social Security number as they appear on your Form IT-201.

- Answer the question regarding any convictions for bribery, corrupting the government, or defrauding the government by checking the appropriate box for "Yes" or "No".

- Part 1 - Other New York State, New York City, and Yonkers tax credits:

- Section A: List any New York State nonrefundable, non-carryover credits. Include specific codes and amounts, and add these to get the total for line 2.

- Section B: Detail New York State nonrefundable, carryover credits used. Provide codes and amounts for each credit, summing them up for line 6.

- Enter the total New York State nonrefundable credits used on line 7.

- Section C: For New York City nonrefundable, non-carryover credits, detail the required credits, their amounts, and sum them for line 10.

- Section D deals with refundable credits. List each, provide amounts, and calculate the total to add lines 11 and 12 for the sum on line 13. Continue on the back for more refundable credits, and enter the total amount from line 13 at the front page on line 14. Sum up for the total on line 18.

- Part 2 - Other New York State taxes:

- If subject to other New York State taxes, complete the appropriate sections by listing types, providing codes, and amounts for each, and sum them up for line 20.

- Add lines 19 and 20 for the total on line 21.

- Follow the instructions for lines 22 through 26 to calculate any additional New York State taxes payable.

- Sum the relevant lines to find your net other New York State taxes and enter this on line 30.

- Part 3 - Other New York City taxes: If applicable, fill in the required information regarding New York City taxes, specifically focusing on lump-sum distributions and capital gain portions for both residents and the city tax. Sum these for the total on line 34.

After completing all relevant sections, review the form to ensure accuracy. Attach this form to your IT-201 when submitting. Addressing each part thoroughly is crucial for an accurate tax return and to take advantage of all potential credits and deductions available to you.

Understanding It 201 Att Tax

What is Form IT-201-ATT used for?

Form IT-201-ATT, titled "Other Tax Credits and Taxes Attachment to Form IT-201," is utilized by taxpayers to report additional tax credits and taxes for both New York State and New York City. It serves as a supplement to Form IT-201, which is the primary income tax return form for New York State residents.

Do I need to file Form IT-201-ATT?

If you are claiming other New York State, New York City, or Yonkers tax credits not listed on Form IT-201 or if you are subject to additional taxes, you must complete and submit Form IT-201-ATT along with your Form IT-201.

What types of credits can I report on Form IT-201-ATT?

On Form IT-201-ATT, you can report various types of credits, including:

- New York State nonrefundable, non-carryover credits.

- New York State nonrefundable, carryover credits.

- New York City nonrefundable, non-carryover credits.

- New York State, New York City, and Yonkers refundable credits.

What additional taxes can be reported on Form IT-201-ATT?

Form IT-201-ATT allows taxpayers to report additional New York State taxes, such as the New York State tax on capital gain portion of lump-sum distributions. If applicable, various codes and amounts for other New York State taxes are also reported in part 2 of the form.

How does the form affect my tax return?

Submitting Form IT-201-ATT with your Form IT-201 can affect your tax return by either increasing your refund due to the tax credits claimed or increasing the amount of tax owed because of additional taxes reported.

Where do I submit Form IT-201-ATT?

Form IT-201-ATT should be submitted together with your Form IT-201. The submission address can vary based on whether you are receiving a refund or owe additional tax. It's important to refer to the instructions for Form IT-201 for the specific address.

Can I file Form IT-201-ATT electronically?

Yes, Form IT-201-ATT can be filed electronically along with Form IT-201. Many taxpayers find electronic filing to be a convenient and efficient way to submit their tax returns and attachments.

What should I do if I make a mistake on Form IT-201-ATT?

If you realize you have made a mistake on Form IT-201-ATT after submitting it, you should file an amended return using Form IT-201-X, which allows you to correct information previously reported. Attach a corrected IT-201-ATT form if necessary.

Where can I find instructions for completing Form IT-201-ATT?

Instructions for completing Form IT-201-ATT can be found in the instructions for Form IT-201. These detailed instructions provide guidance on how to accurately report additional credits and taxes.

Common mistakes

When filling out the IT-201-ATT Tax form, individuals often make mistakes that can lead to errors in their tax returns. Here are ten common mistakes to avoid:

Not submitting the form with the main Form IT-201. The IT-201-ATT is an attachment and needs to be filed together with your main tax return.

Entering incorrect Social Security numbers. Double-check the numbers to ensure they match what's on your Social Security card.

Failing to answer the question about convictions under specific New York State Penal Law articles. This information is crucial for accurate processing.

Incorrectly totaling the nonrefundable, non-carryover and carryover credits. Use a calculator to avoid simple math errors.

Omitting code amounts for other nonrefundable, non-carryover, and carryover credits. Each credit must be correctly coded and calculated.

Overlooking New York City and Yonkers tax credits if applicable. Residents of these areas have specific credits available to them.

Misunderstanding the refundable credits section. Ensure all eligible credits are claimed.

Leaving sections blank that should have calculations or vice versa. Review the instructions for each section carefully.

Calculating the New York State, New York City, and Yonkers taxes incorrectly in Parts 2 and 3. Follow the guidelines closely to determine what you owe.

Forgetting to add the total taxes and credits to the main Form IT-201. The sums from the IT-201-ATT form must be transferred to the corresponding lines on the main return.

Avoiding these mistakes can help ensure that your tax return process is smoother and free of common errors. It's always a good idea to double-check your work or seek professional guidance if you're unsure about how to correctly fill out the form.

Documents used along the form

When preparing and filing your taxes, it's crucial to have all the necessary forms and documents at your fingertips. This ensures the process is smooth and that you're taking advantage of every tax credit and deduction available to you. If you're filing the IT-201 form, which is used by New York State residents, there are several other forms and documents you might need to include. Here's an overview of some of these forms and what they pertain to.

- Form IT-230: This form covers the New York State tax on the capital gain portion of lump-sum distributions. It's specifically designed for those who've received a large sum of money at once and need to calculate applicable taxes.

- Form W-2: The Wage and Tax Statement is issued by employers and outlines the salary paid to an employee and the taxes withheld throughout the year. It's fundamental for accurately reporting your income.

- Form 1099-INT: This document reports interest income. Banks and other financial institutions issue it to individuals who have earned more than a certain threshold in interest during the tax year.

- Form 1099-DIV: Dividend income is reported via the 1099-DIV form. It's needed by individuals who have received dividends from investments during the tax year.

- Form 1099-MISC: For individuals who have received miscellaneous income that does not fit typical salary or investment categories, the 1099-MISC form is used. This can include rental income, prize money, or payments for freelance work.

- Form 1098: Homeowners who are paying a mortgage might receive Form 1098 from their lender. It reports the amount of interest and related expenses paid on a mortgage, which could be deductible.

- Schedule C (Form 1040): Entrepreneurs or freelancers operating a sole proprietorship use this form to report profits or losses from their business operations.

- Schedule E (Form 1040):b> This form is relevant for reporting income or losses from rental properties, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

- Form 4868: Should you need an extension to file your taxes, Form 4868 is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. It provides an additional six months to file.

- Form IT-215: For claiming the Earned Income Credit, which supports low- to moderate-income working individuals and families, especially those with children, the IT-215 form is necessary.

Handling your tax documents can be overwhelming, but understanding each form's purpose can simplify the process considerably. Whether it's income from a full-time job, interest earnings, business profits, or more unique financial situations, being organized and knowledgeable about these forms aids in a complete and accurate tax filing. Remember, when it comes to tax paperwork, it's better to have it and not need it than need it and not have it.

Similar forms

The IT-201 form, or the main New York State Income Tax Return, closely parallels the IT-201-ATT in its function and audience. Both are crucial for New York State taxpayers who need to file their annual income taxes. The IT-201 form serves as the primary document collecting general income information, while the IT-201-ATT attachment specifically gathers details about various credits and additional taxes owed. Together, they ensure a comprehensive accounting of a taxpayer's financial responsibility to the state.

The Schedule 1 form, an attachment for the federal 1040 tax return, is akin to the IT-201-ATT in its purpose of providing extra detail. Schedule 1 is used to report additional income or adjustments to income that cannot be captured on the main 1040 form. Similar to how the IT-201-ATT offers space for other tax credits and taxes for New York State filers, Schedule 1 expands the federal tax filing to ensure all financial information is accounted for comprehensively.

Form IT-215, Claim for Earned Income Credit, shares similarities with parts of the IT-201-ATT that deal with refundable credits. Specifically, both forms allow New York State residents to claim credits that could result in a tax refund. The IT-215 focuses on the earned income credit, providing a way for lower-income residents to decrease their tax liability, similar to how the IT-201-ATT includes sections for claiming various refundable and nonrefundable tax credits.

Form IT-216, Claim for Child and Dependent Care Credit, is similar to IT-201-ATT as it details specific tax credits New York taxpayers may be eligible for. While the IT-201-ATT encompasses a broad range of credits, the IT-216 zeroes in on one particular area, offering tax relief to those who incur child and dependent care expenses. Both forms serve the purpose of reducing taxable income through credits, although they focus on different aspects of taxpayers' financial obligations.

The IT-225 form, New York State Modifications, is similar to the IT-201-ATT in its additive nature to the main tax return form. It provides a structured way for taxpayers to report modifications that affect their New York State tax calculation. Like the IT-201-ATT, the IT-225 is necessary for a more accurate reflection of one's tax liability, targeting adjustments outside the scope of standard income reporting.

Form IT-2, Summary of W-2 Statements, although more directly connected to income reporting, shares the IT-201-ATT's role in aggregating necessary details for filing. The IT-2 form consolidates information from an individual's W-2 forms, which is akin to how IT-201-ATT accumulates various tax credit information. Both are essential for providing a complete picture of an individual's tax situation.

Form DTF-635, Claim for Clean Heating Fuel Credit, parallels the IT-201-ATT in focusing on specific tax reliefs within New York State’s tax code. Similar to sections of the IT-201-ATT that handle particular tax credits, the DTF-635 form allows taxpayers to claim credits for using certain clean heating fuels, highlighting the state’s incentivization of environmentally-friendly choices.

The Form IT-203, Nonresident and Part-Year Resident Income Tax Return, while a separate kind of tax form, shares its essence with the IT-201-ATT by targeting specific taxpayer groups with tailored information. The IT-203 caters to nonresidents and part-year residents much like the IT-201-ATT caters to various credits and additional taxes for those fully residing in New York, reflecting the state's tax structure’s diverse applicability.

Form IT-601, Claim for EZ Wage Tax Credit, mirrors elements of the IT-201-ATT by offering a way to claim specific tax incentives. Focused on employers in designated Economic Zones, IT-601 is akin to IT-201-ATT's sections on various credits, showcasing how New York State’s tax forms cater to a wide array of situational tax benefits to stimulate economic activities.

Last, Form IT-658, New York State Historic Homeownership Rehabilitation Credit, is analogous to the IT-201-ATT in its specialized focus. This form allows homeowners who rehabilitate historic properties to claim a tax credit, much like the IT-201-ATT compiles various tax credits and additional taxes for a broad spectrum of taxpayers. Both forms reflect New York State's commitment to rewarding certain behaviors and circumstances through the tax code.

Dos and Don'ts

Filling out tax forms can be daunting, especially when you're dealing with the IT-201-ATT Tax form, which is a crucial attachment for New York State tax filers. To ensure the process is as smooth as possible, here are some essential do's and don'ts. Following these guidelines not only helps in avoiding common mistakes but also in utilizing potential tax credits to your advantage.

Do's:

- Read the instructions carefully before you start. The instructions for Form IT-201 contain valuable information on completing the IT-201-ATT.

- Ensure all information is accurate and complete, including your name and Social Security number, as they appear on your Form IT-201.

- Report all applicable credits in Section A and B for New York State nonrefundable, non-carryover credits, and carryover credits used.

- Use whole dollar amounts only. Round cents to the nearest whole dollar to avoid calculation errors.

- For any credits related to New York City or Yonkers, make sure to fill out the relevant sections accurately.

- If you're claiming any refundable credits, carefully fill out Part 1, Section D, including any farmers' school tax credit or other refundable credits.

- Attach all necessary computations and forms for credits like the accumulation distribution credit or New York City resident UBT credit.

- Double-check your calculations to ensure the total amounts for each section are correctly tallied and entered onto the main Form IT-201.

- For parts regarding Other New York State taxes and Other New York City taxes, ensure to attach all required forms if you are subject to any additional taxes.

- Review your form one last time before submission to catch any missed entries or errors.

Don'ts:

- Don't leave any relevant sections blank if they apply to your tax situation. Incomplete forms can lead to processing delays or missed credit opportunities.

- Avoid guessing when it comes to filling out the sections. If unsure, recheck the instructions or seek clarification.

- Don't omit your Social Security number on the IT-201-ATT form; it's crucial for processing.

- Don't round up or down improperly when converting cents to dollars. Always round to the nearest whole dollar.

- Avoid making alterations or use correction fluid on the form. If a mistake is made, it's better to start with a new form.

- Don't forget to sign the form if a signature is required. An unsigned tax form can be considered invalid.

- Don't submit without attaching the necessary documentation for any claimed credits, as this can lead to discrepancies.

- Avoid procrastinating. Giving yourself ample time before the deadline can prevent errors and stress.

- Don't overlook the impact of New York City and Yonkers sections if you're a resident or part-year resident.

- Resist the urge to skip the final review. A thorough check can prevent common mistakes from slipping through.

Navigating tax forms can be complex, but understanding the do's and don'ts for the IT-201-ATT can significantly ease the process. Remember, accuracy, completeness, and adherence to instructions are key to a successful tax filing experience.

Misconceptions

When it comes to filing taxes in New York, the IT-201-ATT form often comes into play. However, there are several misconceptions about this form that can confuse taxpayers. Let's clear up some of those misunderstandings.

It's just for businesses or the wealthy. A common myth is that the IT-201-ATT form is only relevant for businesses or individuals with high income. In reality, this form is designed for a variety of taxpayers who need to claim various New York State, New York City, and Yonkers tax credits or declare other specific taxes. Whether you’re an individual or part of an entity, it’s the nature of the credits or taxes applicable to you that dictates the use of this form, not necessarily your income level or business ownership.

It’s too complicated for the average person to complete. While tax forms can indeed be daunting, the New York State Department of Taxation and Finance provides detailed instructions for Form IT-201-ATT. With these guidelines, most taxpayers with a bit of patience can successfully navigate and complete this attachment. It’s also a good idea to consult with a tax professional if you’re uncertain.

You must submit this form every year. Not everyone needs to submit the IT-201-ATT form annually. This form is only necessary if you’re claiming certain credits or need to report specific taxes for the tax year in question. If your financial situation or applicable credits and taxes do not change from one year to the next, you might not need to fill out this form every year.

Filing this form guarantees tax benefits. Simply submitting the IT-201-ATT form doesn’t guarantee you’ll receive additional refunds or owe less in taxes. This form is a vehicle to claim various credits and report certain taxes. Whether these claims result in tax benefits depends on the broader context of your full tax return and your financial situation.

Only full-time New York residents need to fill it out. This misconception can lead to missed opportunities for tax credits or incorrect tax filings. Part-year residents and individuals subject to specific New York City or Yonkers taxes may also need to complete the IT-201-ATT, depending on the credits they are eligible for or the taxes they need to report. Always check the current tax year instructions to accurately determine your filing obligations.

Understanding the IT-201-ATT form is crucial for accurately filing your New York State taxes. By demystifying these common misconceptions, taxpayers can ensure they're completing their tax obligations correctly, possibly benefit from available credits, and avoid potential issues with their returns.

Key takeaways

Filling out and using the IT-201-ATT form, an attachment to Form IT-201 for New York State residents, involves several key considerations. This guide highlights the most crucial aspects to ensure accurate completion and submission.

Understand the Purpose: The IT-201-ATT form is designed to report various New York State, New York City, and Yonkers tax credits, along with calculating certain additional taxes. It's essential for individuals seeking to claim these credits or report specific taxes.

Review Tax Credits Carefully: The form is divided into sections that cover nonrefundable, non-carryover credits; nonrefundable, carryover credits; and refundable credits. Taxpayers must review each credit carefully to determine eligibility before claiming.

Complete All Relevant Sections: Not all sections may apply to every taxpayer. However, it's crucial to review every section and complete those that apply to your tax situation, including any related to New York City or Yonkers if applicable.

Accurate Information is Key: Ensure that all information, including your Social Security number and the amount of credits claimed or taxes reported, is accurate. Errors can delay processing or result in an incorrect tax assessment.

Submission Instructions: The IT-201-ATT must be submitted along with your Form IT-201. Failure to include this form with your tax return when required can lead to processing delays and possible denial of claimed credits.

It's always recommended to consult the instructions for Form IT-201 when completing the IT-201-ATT to ensure compliance with all tax laws and guidelines. These documents provide detailed guidance on eligibility requirements, how to calculate credits, and proper form submission procedures.

Popular PDF Documents

Pay Sales Tax Colorado - Don't let incomplete paperwork delay your business plans. The Denver Sales and Use Tax Application form encourages thorough completion for a faster processing time.

8832 Election - Entities considering international operations may use Form 8832 to establish a clear and beneficial tax treatment for foreign activities under U.S. law.