Get It 101V Payment Voucher Form

Navigating through tax documentation is essential for ensuring compliance and accuracy in financial reporting, and the IT-101V Payment Voucher plays a critical role for employers in West Virginia. This form is specifically designed for the remittance of withheld income tax to the West Virginia State Tax Department, demonstrating the importance of precision in filling out and submitting such documents. Located in Charleston, WV, this form requires detailed information including the period ending, due date, number of employees at the end of the period, and the total payment amount, among other crucial details. Employers must meticulously report their account number, name, address, and other identification information to ensure the proper processing of their tax payments. By doing so, this aids the state in efficiently managing and allocating tax revenues, underlining the importance of the IT-101V Payment Voucher not only as a legal obligation but also as a component of the broader fiscal structure. Understanding and correctly using the IT-101V Payment Voucher underscores an employer's commitment to fiscal responsibility and regulatory adherence.

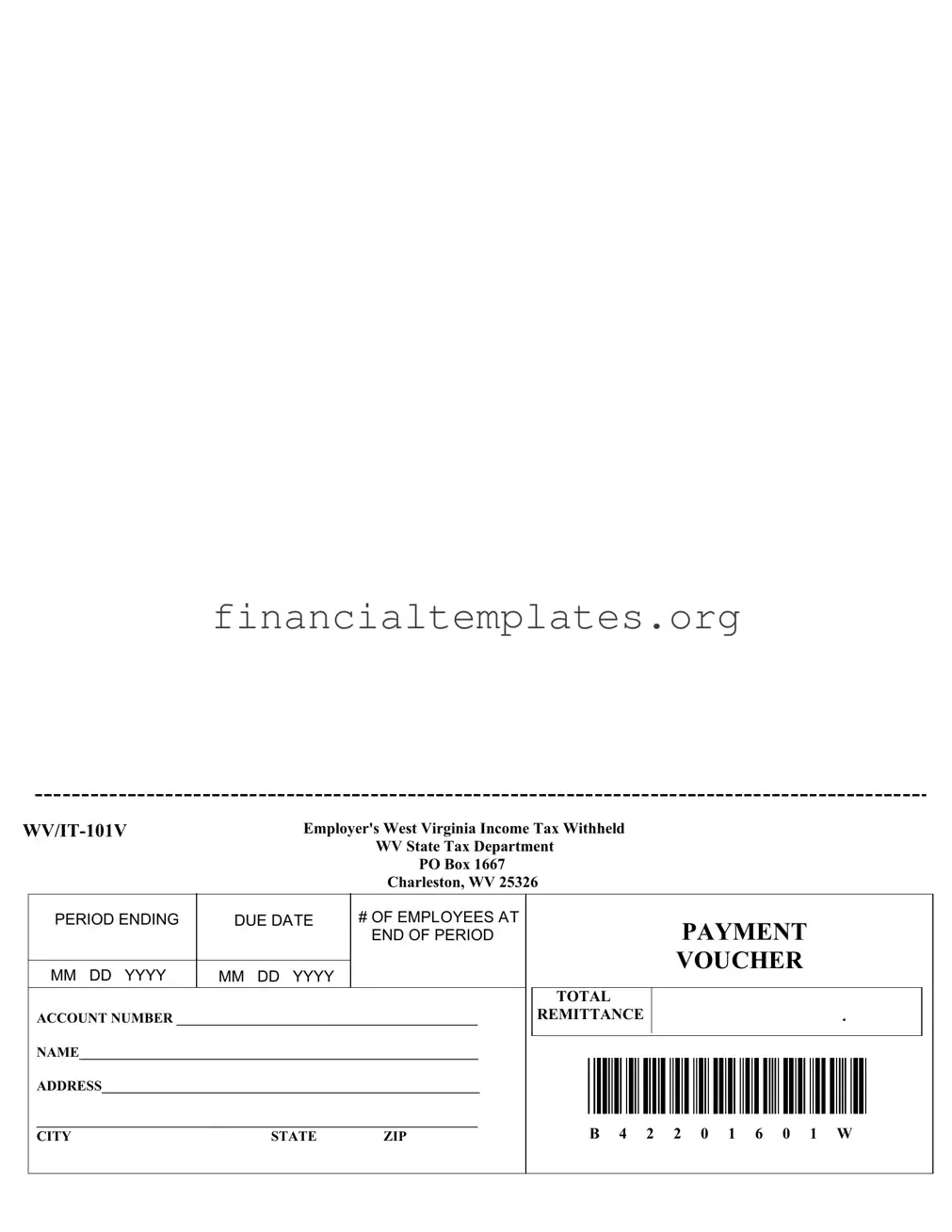

It 101V Payment Voucher Example

Employer's West Virginia Income Tax Withheld |

|

|

WV State Tax Department |

|

PO Box 1667 |

|

Charleston, WV 25326 |

PERIOD ENDING |

DUE DATE |

|

|

MM DD YYYY |

MM DD YYYY |

|

|

#OF EMPLOYEES AT END OF PERIOD

PAYMENT

VOUCHER

TOTAL

ACCOUNT NUMBER ___________________________________________

NAME_________________________________________________________

ADDRESS______________________________________________________

_______________________________________________________________

CITY |

STATE |

ZIP |

REMITTANCE.

B 4 2 2 0 1 6 0 1 W

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The WV/IT-101V Payment Voucher is used for employers in West Virginia to report and pay the state income tax withheld from their employees' wages. |

| Recipient Address | Completed forms are sent to the West Virginia State Tax Department, P.O. Box 1667, Charleston, WV 25326. |

| Key Fields | Important fields include period ending, due date, number of employees at end of period, payment voucher total, account number, employer name, and address. |

| Governing Law | This form is governed by West Virginia state laws relating to income tax withholding requirements for employers. |

Guide to Writing It 101V Payment Voucher

Once you have calculated the amount of West Virginia income tax withheld from employees, the next step is to report and remit this amount to the West Virginia State Tax Department. The IT-101V Payment Voucher is the form used for this purpose. This document ensures that your payment is processed correctly and credited to your account without any delays. Below are the detailed instructions to help you accurately complete the IT-101V Payment Voucher form.

- Start by entering the period ending date in the 'PERIOD ENDING' field using the format MM DD YYYY.

- Next, specify the due date for this payment in the 'DUE DATE' field, also in the format MM DD YYYY.

- In the '#OF EMPLOYEES AT END OF PERIOD' field, enter the total number of employees you had at the end of the reporting period.

- Fill in the 'PAYMENT VOUCHER TOTAL' field with the total amount of West Virginia income tax withheld from your employees.

- Enter your account number in the 'ACCOUNT NUMBER' field. It is critical to ensure this information is accurate for proper processing.

- In the 'NAME' field, write the full legal name of your business as registered.

- Provide your complete mailing address in the 'ADDRESS' lines, including any suite or unit numbers if applicable.

- Finally, fill out the 'CITY STATE ZIP' field with your business’s city, state, and zip code details.

- After completing the form, prepare a check or money order for the amount of remittance made payable to "WV State Tax Department" and include the Payment Voucher (IT-101V).

- Mail the completed IT-101V form along with your payment to: WV State Tax Department, PO Box 1667, Charleston, WV 25326. Ensure that your account number and the period ending date are written on your check or money order.

By following these instructions, you can successfully submit the IT-101V Payment Voucher. Timely and accurate submission of this form and your payment helps maintain compliance with West Virginia State tax laws and avoids potential penalties. Should you have any questions during this process, contacting the West Virginia State Tax Department directly or seeking advice from a tax professional is recommended.

Understanding It 101V Payment Voucher

- What is the IT-101V Payment Voucher form used for?

This form is utilized by employers to submit withheld West Virginia income tax to the state tax department. It's a way for businesses to report the income tax they've deducted from their employees' paychecks for the specified period.

- Where should the IT-101V Payment Voucher be sent?

The completed form should be mailed to the West Virginia State Tax Department at PO Box 1667, Charleston, WV 25326. This ensures your payment is processed timely and correctly.

- How do I fill out the PERIOD ENDING and DUE DATE sections?

For the PERIOD ENDING section, enter the last day of the period for which you're reporting the withheld taxes in a MM DD YYYY format. Similarly, for the DUE DATE section, input the date by which the payment must be received by the state tax department, also in a MM DD YYYY format.

- What does the "# OF EMPLOYEES AT END OF PERIOD" mean?

This section requires you to report the total number of employees you had at the end of the reporting period. It helps the tax department assess the scope of employment and withholding for that period.

- How to determine the TOTAL AMOUNT in the PAYMENT VOUCHER section?

The TOTAL AMOUNT refers to the sum of West Virginia income tax you've withheld from your employees' paychecks during the reporting period. Calculate this total carefully to ensure accurate reporting and payment.

- What should I include in the REMITTANCE section?

In the REMITTANCE section, specify the amount of money you are sending to the West Virginia State Tax Department. This amount should match the TOTAL AMOUNT reported on the voucher.

- Where do I find my ACCOUNT NUMBER?

Your ACCOUNT NUMBER is provided by the West Virginia State Tax Department. It's a unique identifier for your business, ensuring your payments are credited to the correct account. If you're unsure of your number, contact the tax department directly.

- Can I submit the IT-101V Payment Voucher electronically?

Depending on the current policies of the West Virginia State Tax Department, electronic submission may be possible. Check the official tax department website or contact them for up-to-date instructions on electronic filing and payment options.

- What happens if I submit the payment after the DUE DATE?

Submitting your payment after the due date can result in late fees and interest charges. It's crucial to send in the payment voucher and the corresponding payment on time to avoid unnecessary penalties.

- Who can I contact for help with the IT-101V Payment Voucher?

If you need assistance, the West Virginia State Tax Department is available to help. Reach out to them through the contact information provided on their website for guidance on filling out the form, understanding your obligations, or addressing any concerns regarding your payment.

Common mistakes

When filling out the WV/IT-101V Payment Voucher form, individuals frequently make several mistakes that can lead to processing delays or even penalties. To ensure accuracy and compliance, it is essential to be mindful of the following errors:

- Incorrect Period Ending and Due Dates: Mixing up the MM DD YYYY formats for the period's end and the due dates can cause significant confusion. Ensure these dates are accurately reflected as per the specific tax period in question.

- Miscounting the Number of Employees: Reporting the incorrect number of employees at the period end affects the accuracy of the submitted data and, subsequently, the calculated tax amount.

- Erroneous Payment Voucher Amounts: Entering the wrong payment amount on the voucher can lead to underpayments or overpayments. Both situations require additional paperwork and adjustments, delaying the final settlement.

- Failing to Provide the Total Account Number: The Total Account Number is a critical piece of information that ensures the payment is credited to the correct account. Omitting or miswriting this number can misdirect funds.

- Incorrect or Incomplete Name and Address: Failing to provide a full and correct name and address hinders the communication process. This includes not only the street address but also the city, state, and zip code.

- Neglecting to Double-Check Remittance Information: The remittance information, including B 4 2 2 0 1 6 0 1 W, should be verified for accuracy to ensure that the payment is processed without issues.

- Leaving Sections Blank: Every section of the WV/IT-101V is crucial. Leaving any section incomplete can invalidate the form, or at the very least, delay its processing.

- Using Incorrect or Outdated Forms: Submitting information using an outdated version of the form can lead to compliance issues. Always ensure to use the most current form available from the WV State Tax Department.

Attention to detail is paramount when completing the WV/IT-101V Payment Voucher form. Avoiding these common mistakes will facilitate a smoother process for employers, reducing the risk of delays and ensuring that all tax liabilities are correctly reported and paid. Regularly consulting the latest guidelines and requirements from the West Virginia State Tax Department is advisable to remain compliant and avoid potential issues.

Documents used along the form

Filing taxes can be a complex process, especially for employers who must navigate through various forms and documents to ensure compliance with state and federal regulations. One important piece in this intricate puzzle for businesses operating in West Virginia is the WV/IT-101V Payment Voucher. This form is used by employers to submit withheld income taxes to the West Virginia State Tax Department. Alongside this form, there are often other documents that play critical roles in the tax filing process. Understanding each of these documents can help streamline tax season tasks, ensuring accuracy and timeliness.

- WV/IT-103 Withholding Tax Reconciliation Form: This document is essential for employers at the end of the tax year. It reconciles the total income tax withheld from employees' wages with the amounts reported and paid throughout the year using the WV/IT-101V Payment Vouchers. It helps in ensuring that the correct total tax amount has been remitted to the state treasury.

- W-2 Wage and Tax Statement: The W-2 form is a federal requirement that reports an employee's annual wages and the amount of taxes withheld from their paycheck. Employers need to send out W-2 forms to their employees and file them with the IRS, often using information reconciled through forms like the WV/IT-103 and payment vouchers such as WV/IT-101V.

- WV/UC-A-154 Quarterly Contribution Report: For businesses with employees, this quarterly report for the West Virginia Unemployment Compensation Fund is critical. It details the wages paid to employees, which is necessary for calculating unemployment insurance contributions, an aspect that runs parallel to income tax withholdings.

- 1099 Forms: Used to report various types of income other than wages, salaries, and tips (for example, independent contractor income), 1099 forms may need to be filed alongside WV/IT-101V Payment Vouchers for businesses that employ freelancers or contractors.

- WV/IT-104 Employer's Quarterly Return of Income Tax Withheld: This is a quarterly form similar to the WV/IT-101V Payment Voucher but focuses on the total income tax withheld from employees' wages each quarter. It's essential for maintaining precise records and ensuring that income tax withholdings are reported and paid accurately throughout the fiscal year.

Whether you are new to running a business in West Virginia or have been navigating the complexities of tax filings for years, understanding how each of these forms and documents works together can simplify the process. Each form, from the WV/IT-101V Payment Voucher to the associated reconciliation and reporting forms, plays a vital role in ensuring that businesses meet their tax obligations accurately and on time. Managing these documents efficiently can lead to a seamless tax filing process, keeping your business compliant and in good standing with both state and federal tax authorities.

Similar forms

The IT-101V Payment Voucher is similar to the 1040-V Payment Voucher used in federal tax filings. Both forms are designed to accompany payment sent to the tax authorities. They provide essential details like the taxpayer's name, address, and the amount being paid so that the payment can be correctly applied to the taxpayer's account. While the IT-101V is specific to employers' withheld income tax in West Virginia, the 1040-V applies to individual income tax payments on the federal level.

Analogous to the IT-101V, the W-3 Form, or the Transmittal of Wage and Tax Statements, is another document used in the realm of tax reporting. The W-3 summarises the total earnings, Social Security wages, Medicare wages, and withholding for all employees for a given year. Although the W-3 is more about reporting totals rather than making a payment, both forms are crucial for ensuring the accurate accounting and reporting of tax withholdings to the relevant tax authorities.

Similarly, the State Unemployment Tax Act (SUTA) payment vouchers share a resemblance to the IT-101V in both function and purpose. Businesses use SUTA vouchers to report and remit unemployment taxes to their respective state. Like the IT-101V, these vouchers detail the employer's account number, the period for which taxes are being paid, and the total payment amount to ensure proper credit to the employer's account.

The Federal Tax Deposit Coupon, or Form 8109, before its discontinuation for electronic payments, functioned similarly to the IT-101V. It was used by businesses to remit employment taxes, including withheld income, Social Security, and Medicare taxes to the IRS. Both forms facilitated the process of separating payments from returns, ensuring that payments were credited accurately.

Quarterly Federal Excise Tax Return (Form 720) vouchers serve a similar purpose as the IT-101V for businesses responsible for reporting and paying federal excise taxes. Both documents aid in the separate submission of reports and payments, although for different types of taxes, ensuring that entities meet their tax obligations in a structured manner.

The Sales and Use Tax Return forms used by businesses to report and pay state and local sales taxes resemble the IT-101V Payment Voucher for their role in tax compliance. They gather details about the amount of sales tax collected from customers and direct the payment to the correct taxing authority, highlighting the critical function of payment vouchers in tax administration.

Comparable in purpose, Estimated Tax Payment Vouchers for individuals (1040-ES) and corporations (1120-W) offer a parallel to the IT-101V's mechanism for submitting tax payments. These vouchers allow taxpayers to make quarterly estimated tax payments for expected tax liabilities, ensuring that both individuals and corporations can pay their tax dues in increments throughout the year.

The IT-14X Amended Return Payment Voucher, specifically designed for adjustments to previously filed state tax returns, shares similarities with the IT-101V in facilitating tax payments, albeit for amendments. This shows the adaptability of payment vouchers to various tax-related processes, ensuring accurate application of payments to amended filings.

Lastly, the Property Tax Payment Voucher, used by property owners to pay their real estate taxes, echoes the functionalities of the IT-101V. Though one pertains to property taxation and the other to withheld income taxes, both ensure that tax payments are appropriately credited against the payer’s account, underscoring the universal applicability and significance of payment vouchers in tax systems.

Dos and Don'ts

Completing the IT-101V Payment Voucher form is a critical task for reporting your West Virginia Income Tax Withheld. To ensure accuracy and compliance, here are key guidelines to follow and common pitfalls to avoid.

Things You Should Do

- Double-check the Period Ending and Due Date fields for accuracy, ensuring the dates are correctly formatted as MM DD YYYY.

- Accurately report the number of employees at the end of the period in the designated field.

- Fill out the Payment Voucher Total with the exact amount of withheld income tax.

- Ensure your Account Number is correctly entered without errors.

- Provide your complete and accurate Name, Address, City, State, and Zip in the provided fields.

- Verify the REMITTANCE code, B 4 2 2 0 1 6 0 1 W, to confirm it matches the required code for your payment.

Things You Shouldn't Do

- Do not leave any required fields blank. Every section is important for processing your payment correctly.

- Avoid using incorrect or outdated payment codes. Double-check the REMITTANCE code for accuracy.

- Refrain from guessing or estimating figures. Use exact numbers for employees and payment totals.

- Do not ignore the due dates. Late submissions can result in penalties or interest charges.

- Never submit the form without reviewing it for mistakes. Even small errors can cause delays.

- Avoid using informal or incomplete addresses. Ensure your address is complete and matches official records.

Misconceptions

When dealing with the WV/IT-101V Payment Voucher form, there are several misconceptions that need to be clarified to ensure proper understanding and compliance.

- Misconception 1: The WV/IT-101V is only for large employers.

- Misconception 2: Submission is only by mail.

- Misconception 3: The form covers all tax types.

- Misconception 4: It's the only form employers need for tax reporting.

- Misconception 5: Information about the number of employees is optional.

Many people believe that the WV/IT-101V form is exclusively for large businesses with many employees. However, this form is required for all employers that withhold West Virginia income tax from their employees, regardless of the number of employees.

While the form provides a mailing address, implying that it should be sent via mail, employers have multiple submission options, including online filing through the West Virginia State Tax Department's website. This flexibility helps to facilitate timely and efficient filing.

Some might misconstrue the function of the WV/IT-101V and believe it is a universal tax document for all types of tax payments to the state. In reality, it is specifically designed for employers to report and pay withheld income tax. Other tax obligations require different forms and processes.

This misconception can lead to compliance issues. Although the WV/IT-101V is vital for reporting withheld income tax, employers must also complete additional forms, such as annual or quarterly tax reports, to fully meet their reporting responsibilities. The WV/IT-101V is part of a broader set of documentation needed for comprehensive tax compliance.

The requirement to include the number of employees at the end of the period is sometimes overlooked or deemed unimportant. However, this information is crucial for the West Virginia State Tax Department to track employment and economic trends. Thus, accurately reporting the number of employees is not optional but a mandatory field on the form.

Clarifying these misconceptions is essential for proper compliance with West Virginia's state tax laws and ensuring that employers fulfill their reporting and payment obligations correctly and on time.

Key takeaways

Filling out the IT-101V Payment Voucher form accurately and understanding its use are crucial steps for businesses in West Virginia to comply with state tax regulations. Here are eight key takeaways to ensure a smooth process:

- Identification is Essential: Include the total account number prominently at the top of the form to ensure the payment is applied to the correct account.

- Accuracy Matters: Ensure that the name and address of the employer are filled out correctly to prevent any processing delays.

- Specificity Counts: Clearly indicate the period ending and due dates in the format MM DD YYYY to designate the specific tax period for which the payment is intended.

- Employee Count: Include the number of employees at the end of the period to keep the state informed and ensure adherence to any regulations that vary by employer size.

- Payment Details: The payment voucher section must show the exact remittance amount, allowing for accurate accounting and tracking of tax payments.

- Mail with Care: Send the completed form and any payment to the specified address: WV State Tax Department, PO Box 1667, Charleston, WV 25326, to ensure it reaches the intended destination.

- Timeliness is Key: Submit the form and payment by the due date to avoid penalties and interest for late payments.

- Record Keeping: Maintain copies of the completed IT-101V form and any correspondence for your records. This practice assists in future queries or the need to amend a submission.

By closely following these guidelines, businesses can efficiently fulfill their West Virginia income tax withholding requirements, keeping them in good standing with the state tax department.

Popular PDF Documents

IRS 2210 - It provides a detailed calculation method to figure out the underpayment for each payment period and the corresponding penalty.

¥7,200 - It provides a mechanism for employers to financially manage paid sick and family leave wages by claiming advanced credit payments.

Tax Returns - With the 1040-NR, nonresident aliens can provide details on dependents, which may affect their U.S. tax calculation and liability.