Get Is 8948 Sent To Irs Form

The Form 8948, officially named the Preparer Explanation for Not Filing Electronically, plays an essential role for tax return preparers who opt for paper filing over the now predominantly preferred electronic submission method to the Internal Revenue Service (IRS). Introduced to streamline and clarify the exceptions to the e-filing mandate, this form assists specified tax return preparers in documenting legitimate reasons for paper filing. Attached to a variety of tax returns including the Form 1040 series and Form 1041, Form 8948 necessitates detailed information such as the taxpayer's and preparer's identification details along with the tax year in focus. Its creation was spurred by the growing emphasis on electronic filing, aimed at enhancing the efficiency, accuracy, and security of tax return processing. However, recognizing that certain scenarios may impede electronic filing, the IRS allows for exclusions such as taxpayer choice, preparer's e-file exemption, or technological constraints, all of which must be meticulously reported on Form 8948. As an integral part of the compliance process, this form underscores the IRS's commitment to accommodating various filing circumstances while steering towards a more digitalized future in tax administration.

Is 8948 Sent To Irs Example

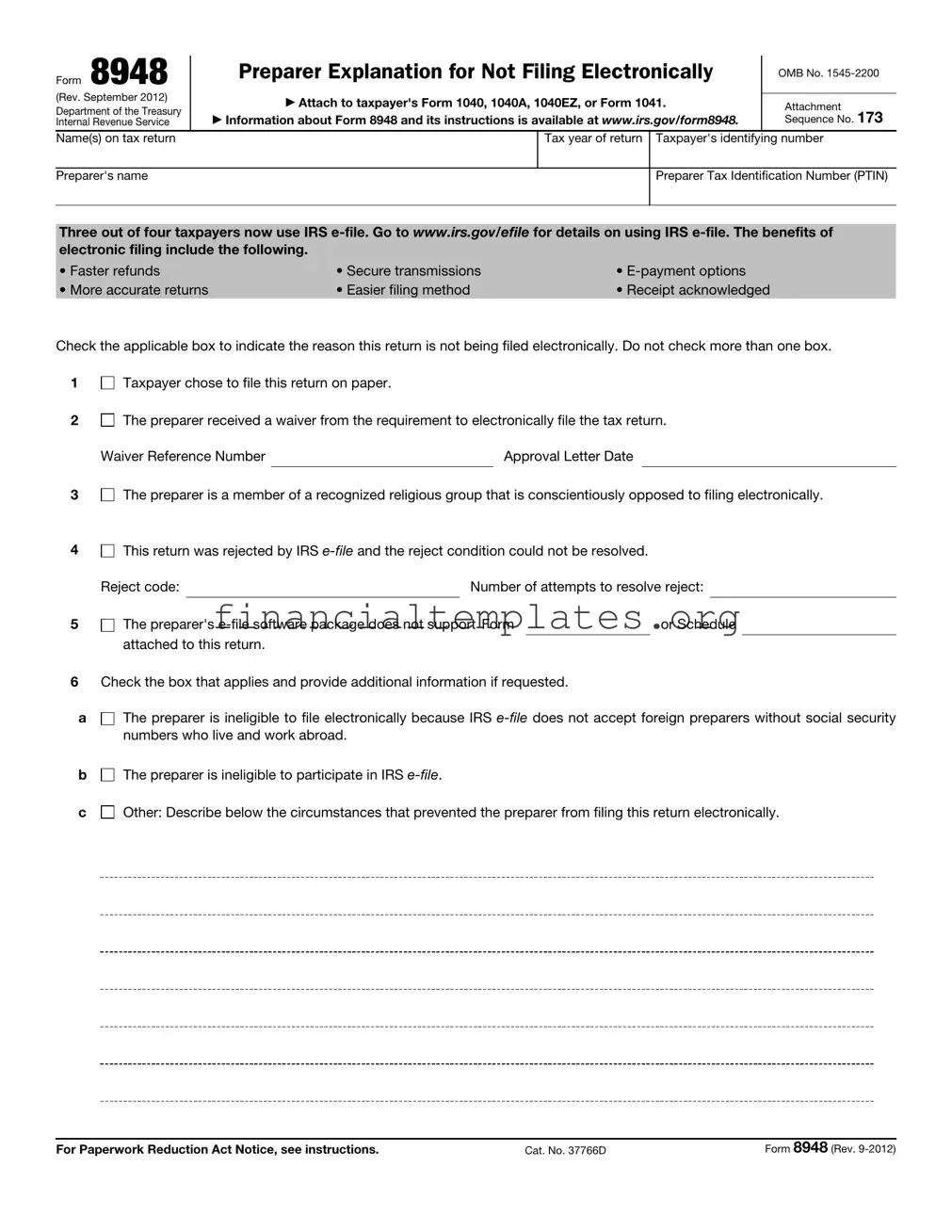

Form 8948 |

Preparer Explanation for Not Filing Electronically |

OMB No. |

||

|

|

|

||

(Rev. September 2012) |

▶ Attach to taxpayer's Form 1040, 1040A, 1040EZ, or Form 1041. |

|

||

Attachment |

||||

Department of the Treasury |

||||

▶ Information about Form 8948 and its instructions is available at www.irs.gov/form8948. |

Sequence No. 173 |

|||

Internal Revenue Service |

||||

Name(s) on tax return |

|

Tax year of return Taxpayer's identifying number |

||

|

|

|

|

|

Preparer's name

Preparer Tax Identification Number (PTIN)

Three out of four taxpayers now use IRS

• Faster refunds |

• Secure transmissions |

• |

• More accurate returns |

• Easier filing method |

• Receipt acknowledged |

Check the applicable box to indicate the reason this return is not being filed electronically. Do not check more than one box.

1

Taxpayer chose to file this return on paper.

Taxpayer chose to file this return on paper.

2

The preparer received a waiver from the requirement to electronically file the tax return.

The preparer received a waiver from the requirement to electronically file the tax return.

Waiver Reference Number |

|

Approval Letter Date |

|

|

|

3

The preparer is a member of a recognized religious group that is conscientiously opposed to filing electronically.

The preparer is a member of a recognized religious group that is conscientiously opposed to filing electronically.

4

This return was rejected by IRS

This return was rejected by IRS

|

Reject code: |

Number of attempts to resolve reject: |

|||||

|

|

|

|

|

|

|

|

5 |

The preparer's |

|

or Schedule |

||||

|

attached to this return. |

|

|

|

|

|

|

|

|

|

|

|

|

||

6Check the box that applies and provide additional information if requested.

a

The preparer is ineligible to file electronically because IRS

b

The preparer is ineligible to participate in IRS

c

Other: Describe below the circumstances that prevented the preparer from filing this return electronically.

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 37766D |

Form 8948 (Rev. |

Form 8948 (Rev. |

Page 2 |

|

|

General Instructions

Section and subtitle A references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about developments related to Form 8948 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8948.

What's New

The tax year of the tax return associated with Form 8948 must be entered. The name and preparer tax identification number (PTIN) of the preparer must also be entered on the form.

Purpose of Form

Form 8948 is used only by specified tax return preparers (defined below) to explain why a particular return is being filed on paper. A specified tax return preparer may be required by law to electronically file

When To File

Attach this form to the paper tax return you prepare and furnish to the taxpayer for the taxpayer's signature. File Form 8948 with the tax return that is filed on paper.

Form 8944 and Form 8948. Specified tax return preparers who submitted Form 8944, Preparer

▲The taxpayer choice statement, which is described in Regulations !

CAUTION the preparer's records. Do not attach the taxpayer choice statement to the tax return or otherwise send it to the IRS.

Specified Tax Return Preparer

A specified tax return preparer is a tax return preparer, as identified in section 7701(a)(36) and Regulations section

Aggregate filing of returns. For the

When a return is considered filed by a preparer. For the

Covered Returns

Covered returns include any return of tax imposed by subtitle A on individuals, estates, or trusts. This includes any return of income tax in the Form 1040 series such as Form 1040, U.S. Individual Income Tax Return; Form 1040A, U.S. Individual Income Tax Return; and Form 1040EZ, U.S. Income Tax Return for Single and Joint Filers with No Dependents. It also includes Form 1041, U.S. Income Tax Return for Estates and Trusts.

Covered returns that cannot be filed electronically. Some covered returns are not currently capable of being accepted electronically by the IRS. In certain instances, the IRS has instructed taxpayers not to file some covered returns electronically. Additionally, certain covered returns cannot be

Specific Instructions

Names on Tax Return, Tax Year of Return, and Taxpayer's Identifying Number. Enter the taxpayer's name(s), the tax year, and identifying number (SSN or EIN) that appear on the tax return with which Form 8948 will be filed. If the return is an individual tax return using the Married Filing Joint filing status, enter the first SSN listed on the tax return.

Name and PTIN of Preparer. Enter the preparer's name and PTIN. Enter all the numbers of the PTIN.

Line 1. Check this box if the taxpayer has chosen to file on paper and the return is prepared by the preparer, but will be submitted by mail by the taxpayer. See Revenue Procedure

Line 2. Check this box if the preparer applied for and received an approved undue hardship waiver for the calendar year in which the return is being filed. Enter the waiver reference number and date of the approval letter. Do not submit the approval letter with this form.

Line 3. Check this box if the preparer is a member of a recognized religious group that is conscientiously opposed to its members using electronic technology, including the filing of income tax returns electronically, and the group has existed continuously since December 31, 1950.

Line 4. Check this box if the preparer attempted to

Line 5. Check this box if the preparer attempted to

▲Do not check this box if the reason you could not

CAUTION attached to this return.

Line 6a. Check this box if the preparer is a foreign person without a social security number who cannot enroll in

Line 6b. Check this box if the preparer is ineligible to

Line 6c. Check the box if the preparer is unable to

Paperwork Reduction Act Notice. We ask for the information on these forms to carry out the Internal Revenue laws of the United States. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103.

The time needed to provide this information would vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

. . . |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

57 |

min. |

|

Learning about the law |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

or the form |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

30 |

min. |

||

Preparing and sending |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

the form |

. . . . . |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

32 |

min. |

|

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:M:S, 1111 Constitution Ave. NW,

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Purpose | Form 8948 is designed for tax preparers to justify why a return is filed on paper instead of electronically. |

| Relevant Tax Forms | It is attached to tax returns such as Form 1040, 1040A, 1040EZ, or Form 1041. |

| Specified Tax Return Preparer | A tax preparer expecting to file 11 or more covered returns in a calendar year and prepares covered returns. |

| Covered Returns | Covers returns of tax imposed by subtitle A on individuals, estates, or trusts including the Form 1040 series and Form 1041. |

| Electronic Filing Benefits | Benefits include faster refunds, secure transmissions, E-payment options, more accurate returns, easier filing method, and acknowledged receipt. |

| Reasons for Paper Filing | Reasons may include taxpayer's choice, preparer received a waiver, membership in a religious group opposed to electronic filing, e-file rejection issues, software limitations, and other exceptional circumstances. |

Guide to Writing Is 8948 Sent To Irs

Filing a tax return can sometimes involve additional steps, especially when certain conditions prevent you from submitting it electronically. For specified tax return preparers who encounter such scenarios, Form 8948 serves as a critical tool. This form is attached to the client's paper tax return, explaining the reason behind the necessity to file in a traditional paper format. Whether it's due to technological limitations, specific waivers, or other unique circumstances, completing this form ensures compliance with IRS requirements. Let's break down the step-by-step process to properly fill out Form 8948, ensuring that you and your client's submissions are correctly processed.

- Heading Information:

- At the top, enter the Name(s) on tax return exactly as it appears on the paper tax return you're filing.

- Fill in the Tax year of return to specify for which year the return is being filed.

- Provide the Taxpayer's identifying number, which could be a Social Security Number (SSN) or Employer Identification Number (EIN), depending on the return type.

- Preparer Information:

- Enter the Preparer's name as it should appear in tax preparation documents.

- Fill in the Preparer Tax Identification Number (PTIN), ensuring all numbers are accurate.

- Reason for Paper Filing: Choose only one box that best explains why you're not filing the return electronically. Provide additional details such as waiver reference numbers, reject codes, or software limitations as prompted by your selection.

- If you check box 1, no additional information is needed.

- For box 2, provide the Waiver Reference Number and Approval Letter Date.

- Box 4 requires the Reject code and the Number of attempts to resolve the reject.

- If selecting box 5 or any of the 6 options (a, b, or c), specify the forms, schedules not supported, or describe the specific circumstances preventing e-filing.

- After completing all relevant sections, attach Form 8948 to the front of the taxpayer's paper return.

- Ensure the entire tax return package, including Form 8948, is mailed to the IRS according to the instructions provided for the specific form you're filing (e.g., Form 1040, 1040A, 1040EZ, or Form 1041).

Once Form 8948 is properly filled out and attached, your next step is to mail the entire tax return package to the designated IRS address for paper returns. This process allows you to communicate effectively with the IRS, ensuring that they understand the reason behind the paper filing. It's essential for maintaining transparency and compliance with tax filing requirements, especially in an era where electronic filing is the norm.

Understanding Is 8948 Sent To Irs

Frequently Asked Questions about Form 8948

What is Form 8948?

Form 8948, "Preparer Explanation for Not Filing Electronically," is a document used by tax preparers to explain why a particular return is being filed on paper instead of electronically. It must be attached to the taxpayer's paper return forms such as Form 1040, 1040A, 1040EZ, or Form 1041.

When should Form 8948 be filed?

This form should be filed alongside the paper tax return prepared for the taxpayer and upon which the preparer has signed. It is essential whenever a tax return prepared is not submitted electronically, under circumstances that require justification.

Who is considered a specified tax return preparer?

A specified tax return preparer is a professional who prepares and is expected to file 11 or more covered returns in a calendar year. This determination also considers the aggregate expected filings by a firm, if the preparer is a member.

What are covered returns?

Covered returns refer to any tax returns imposed by subtitle A on individuals, estates, or trusts, including those in the Form 1040 series and Form 1041. There are specific exclusions, particularly for situations where electronic filing cannot accommodate certain forms, schedules, or documents.

Can all tax returns be filed electronically?

No, not all tax returns can be filed electronically. Some returns or attached documents cannot be accepted electronically by the IRS. In such cases, Form 8948 serves as an explanation for the paper filing without needing any additional justification.

How does a tax preparer qualify for a waiver from electronic filing?

A preparer may receive a waiver for undue hardship, recognizing circumstances that prevent electronic filing. This requires submitting Form 8944 and, upon approval, including the waiver reference number and approval date on Form 8948.

What should be included if the tax preparer is a member of a religious group opposed to electronic filing?

The preparer should indicate their membership in a recognized religious group that opposes electronic technology use, provided the group has existed continuously since December 31, 1950.

What if the return prepared could not be filed electronically due to technical issues or software limitations?

Specific boxes on Form 8948 allow preparers to indicate if a return was rejected by e-file systems, if the software used did not support an attached form or schedule, or if other verifiable and documented technological difficulties occurred. The relevant details, including attempts to resolve such issues or the unsupported forms, should be described as required.

What happens if a preparer files paper returns without submitting Form 8948?

Failing to provide a valid explanation for not filing electronically when required may result in penalties or other consequences for the tax preparer, emphasizing the importance of correctly completing and submitting Form 8948 when applicable.

For more detailed information or further clarification, preparers and taxpayers are encouraged to visit the official IRS website or consult with a tax professional.

Common mistakes

When filling out the IRS Form 8948, "Preparer Explanation for Not Filing Electronically," individuals and tax preparers can encounter several mistakes. These errors can delay processing and potentially affect the taxpayer's obligations. Below are five common mistakes frequently made:

Incorrect or Incomplete Information: Ensuring that all fields are accurately completed, including the taxpayer's name(s), tax year, and identifying number, along with the preparer's name and Preparer Tax Identification Number (PTIN), is crucial. Each piece of information serves a distinct purpose and aids the IRS in processing the form efficiently.

Checking Multiple Boxes: The form requires the filer to check only one box to indicate the reason the return is not being filed electronically. Sometimes, filers check more than one box, which can lead to confusion and delays since the IRS needs to understand the specific reason for paper filing.

Failing to Attach to the Taxpayer's Return: Form 8948 should be attached to the taxpayer's return (Form 1040, 1040A, 1040EZ, or Form 1041) before submission. Neglecting to attach the form can lead to processing delays because the IRS won't have the necessary explanation for the paper filing.

Omission of Additional Required Information: For some boxes checked, additional information might be required, such as the waiver reference number and date of the approval letter (if applicable). Not providing this necessary information can result in incomplete documentation and potential follow-up requests from the IRS.

Misunderstanding Eligibility and Requirements: A common mistake is selecting reasons for paper filing that do not accurately reflect the filer's situation. For example, choosing the option for technological difficulties when the real issue is an unsupported form or schedule by the e-file software might mislead the IRS about the preparer's circumstances.

To facilitate a smoother process with the IRS, individuals and tax preparers should review Form 8948 carefully, ensuring that all information is accurate, complete, and correctly documents the reason for paper filing. Avoiding these mistakes can help in adhering to tax filing regulations and in achieving a more efficient filing process.

Documents used along the form

When filing a tax return using Form 8948, "Preparer Explanation for Not Filing Electronically," tax professionals and taxpayers often incorporate several additional forms and documents to ensure compliance and thoroughness in their submission. The effective management of these documents is essential for a clear and complete tax filing process.

- Form 8453, "U.S. Individual Income Tax Transmittal for an IRS e-file Return" - This form is used to submit any required documents or supporting material that cannot be electronically filed with the tax return. It serves as a cover sheet to transmit these documents after the return has been e-filed, ensuring the IRS receives all necessary information.

- Form 8944, "Preparer e-file Hardship Waiver Request" - Necessary for tax preparers who face technological or other legitimate hardships that prevent them from filing returns electronically. If approved, this waiver allows them to file paper returns without penalties, complementing the information provided in Form 8948.

- Form 2848, "Power of Attorney and Declaration of Representative" - Often used when a taxpayer needs to authorize a tax professional to communicate with the IRS on their behalf. This form details the extent of the representative's authority, including filing returns, addressing penalties, and discussing confidential tax information.

- Form 4868, "Application for Automatic Extension of Time To File U.S. Individual Income Tax Return" - When a taxpayer cannot file their income tax return by the due date, this form requests an additional six months to file. While it extends the filing deadline, any taxes owed are still due by the original deadline to avoid penalties and interest.

- Form 1040 - While not an accompanying form, various versions of Form 1040, such as the 1040A and 1040EZ, are directly referenced in Form 8948. These individual income tax return forms are fundamental to the tax filing process, outlining taxable income, deductions, and credits to determine the taxpayer's liability or refund.

Understanding and effectively utilizing these forms ensures that taxpayers and their preparers can navigate the complexities of tax filing, address specific situations such as filing extensions or hardships preventing electronic filing, and properly authorize representative actions on the taxpayer's behalf. They play vital roles in the broader context of managing and complying with tax responsibilities in the United States.

Similar forms

The Form 8944, Preparer e-file Hardship Waiver Request, shares a significant purpose with Form 8948. Both forms accommodate special circumstances that prevent tax returns from being filed electronically. Tax professionals use Form 8944 to request an exemption from the e-filing mandate due to hardship. If approved, they then attach Form 8948 to the paper tax return to document the granted waiver. This relationship emphasizes the IRS’s flexibility in accommodating tax preparers facing genuine difficulties with electronic filing, ensuring that even in exceptional cases, there is a procedural pathway to compliance.

Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return, is akin to Form 8948 in that it serves as a bridge between paper documentation and electronic filing. While Form 8948 is used to justify a paper filing when e-filing is otherwise mandated, Form 8453 is used when parts of an e-filed return must be submitted in paper format. This could include certain forms or documents that the IRS does not accept electronically. Both forms ensure that exceptions to the IRS's general rules for submission are accounted for and properly documented, thereby facilitating a hybrid approach to tax return submission when needed.

Form 8453-F, U.S. Estate or Trust Income Tax Declaration and Signature for Electronic Filing, parallels Form 8948 in its role for estates and trusts. Just as Form 8948 explains why a tax return does not comply with the e-filing requirement, Form 8453-F allows estates and trusts to submit certain documentation in paper format alongside an electronically filed return. This similarity underscores the IRS's comprehensive approach to electronic filing across different taxpayer categories, recognizing and making provisions for instances where paper submissions remain necessary.

Notice 2011-26, although not a form, is closely related to the content and purpose of Form 8948 in regulatory guidance. This notice provides details on the IRS's e-file mandate, including exceptions and procedures for when electronic filing is not feasible or required. By clarifying situations that warrant the use of Form 8948, Notice 2011-26 helps tax preparers understand the legal context and compliance requirements surrounding the electronic filing of tax returns, aligning closely with the practical applications of Form 8948.

Dos and Don'ts

When it comes to filling out the IRS Form 8948, "Preparer Explanation for Not Filing Electronically," there are certain practices you should follow to make sure everything is done correctly. Here are five dos and don'ts that can help guide you through this process:

-

Do:

- Double-check the taxpayer's identifying number, the tax year of the return, and the preparer's PTIN to ensure all information is accurate and matches the associated tax return.

- Review the reason codes carefully and select the correct reason for not filing the return electronically. Only one box should be checked.

- Attach Form 8948 to the taxpayer's paper return before it's mailed.

- Keep a copy of the form and any relevant documentation for your records, in case the IRS has questions in the future.

- Follow the instructions for specific situations, like if the preparer received a waiver or if filing on behalf of a taxpayer who chose to file on paper.

-

Don't:

- Check more than one reason for not filing electronically. It's important to select the single most applicable reason.

- Forget to provide additional information if the option you select requests it, such as the reject code or the number of attempts made to file electronically.

- Attach documents that aren't required, such as the approval letter for a hardship waiver. Just enter the waiver reference number and approval date on the form.

- Ignore the form's requirements if you're filing on behalf of a recognized religious group with specific exemptions from electronic filing.

- Assume all parts of the return can't be filed electronically without checking if certain forms or schedules are the issue and can be sent separately using Form 8453 or Form 8453-F.

By following these guidelines, you can ensure the process goes smoothly and that you're in compliance with IRS rules for when electronic filing isn't an option.

Misconceptions

Here are nine common misconceptions regarding Form 8948, "Preparer Explanation for Not Filing Electronically," and the facts that correct these misunderstandings:

- Misconception 1: Form 8948 is required for all paper-filed returns. Fact: This form is only necessary when a specified tax return preparer who typically is required to file electronically opts to file a paper return under certain exceptions.

- Misconception 2: Taxpayers filing their own returns on paper must attach Form 8948. Fact: Form 8948 is to be used by specified tax return preparers, not by taxpayers filing on their own behalf.

- Misconception 3: This form can be sent separately from the tax return. Fact: Form 8948 should be attached to the taxpayer's paper-filed tax return when submitted to the IRS.

- Misconception 4: Electronic filing waivers are automatically granted to all preparers who request one. Fact: A waiver from the e-file requirement (cited in box 2 of the form) must be specifically applied for and approved by the IRS.

- Misconception 5: A rejected electronic filing attempt means you no longer have to attempt e-filing in the future. Fact: Form 8948 includes a section for detailing rejected e-file attempts; however, it does not exempt the preparer from future e-filing requirements.

- Misconception 6: All foreign preparers are exempt from the e-file requirement. Fact: The exemption applies only to foreign preparers without Social Security numbers and under specific conditions, as outlined in box 6a.

- Misconception 7: The preparer can choose any reason for paper filing. Fact: The reason for not filing electronically must fit within the specific options provided on the form.

- Misconception 8: Form 8948 is a substitute for a taxpayer choice statement. Fact: This form does not replace the taxpayer choice statement described in regulations, which preparers must keep in their records.

- Misconception 9: There are no consequences for not attaching Form 8948 when required.Fact: Not following proper IRS procedure, including the omission of required forms, can result in penalties and processing delays.

Understanding the specific role and requirements of Form 8948 helps tax preparers comply with IRS regulations and avoid common filing mistakes.

Key takeaways

Filling out and submitting the Form 8948 to the IRS is a task that requires attention to detail and a clear understanding of its purposes and instructions. Here are five key points to keep in mind:

- The purpose of Form 8948 is specifically for preparers who are explaining why a tax return is being filed on paper instead of electronically. It's important for tax professionals to recognize when this form is necessary, especially since the IRS encourages e-filing for its speed and accuracy.

- This form must be attached to the taxpayer's paper return, such as Forms 1040, 1040A, 1040EZ, or Form 1041, before mailing. This step ensures the IRS understands the reason behind the choice or necessity of paper filing.

- The form provides several check-box options to indicate the specific reason a return isn't filed electronically, including taxpayer's choice, issues with e-file software, and more. It's critical to select the correct box and provide additional details if required, to avoid any confusion or delays with the IRS.

- Specific data entries are essential on this form, including the taxpayer's name(s), tax year, identifying number (either SSN or EIN), and the preparer's name and Preparer Tax Identification Number (PTIN). Accurate and complete information prevents processing errors and potential follow-up issues.

- For those returns that cannot be filed electronically due to limitations within the IRS's systems or the unavailability of certain forms for e-filing, Form 8948 serves as a critical document to explain these exceptions. However, if the return or its attachments are eligible for e-filing at a later date, such options should be reconsidered to comply with IRS preferences for electronic submissions.

Understanding the role of Form 8948 in paper submissions to the IRS helps tax preparers ensure compliance with filing requirements while accommodating specific scenarios that necessitate traditional paper returns. Keeping abreast of updates to this form and related IRS instructions is also essential for maintaining effective tax practice standards.

Popular PDF Documents

Wa B&o Tax Rate - Professional services, such as legal or medical, are informed on how to report under the service and other activity section.

IRS 8822 - Ensures your address is current in the IRS system, preventing misdirected mail.