Get IRS W-9S Form

Navigating the world of taxes and educational expenses can seem daunting at first glance, yet it's an essential part of ensuring that students and educational institutions communicate effectively with the Internal Revenue Service (IRS). Among the various documents that facilitate this interaction, the IRS W-9S form plays a pivotal role. This form is specifically designed to collect correct taxpayer identification numbers (TINs) from individuals who are receiving payments from education-related activities, including but not limited to, scholarships, grants, and other forms of financial aid. It's not just students who find this form relevant; educational institutions also rely on it for reporting purposes, ensuring that they are in compliance with tax laws. Moreover, the IRS W-9S form assists in accurately processing tax return documents, making it easier for students and their families to claim education credits and deductions. Understanding the major aspects of this form—its purpose, who it affects, and its role in the broader context of educational tax benefits—provides a solid foundation for a comprehensive exploration of tax obligations and entitlements within the academic sector.

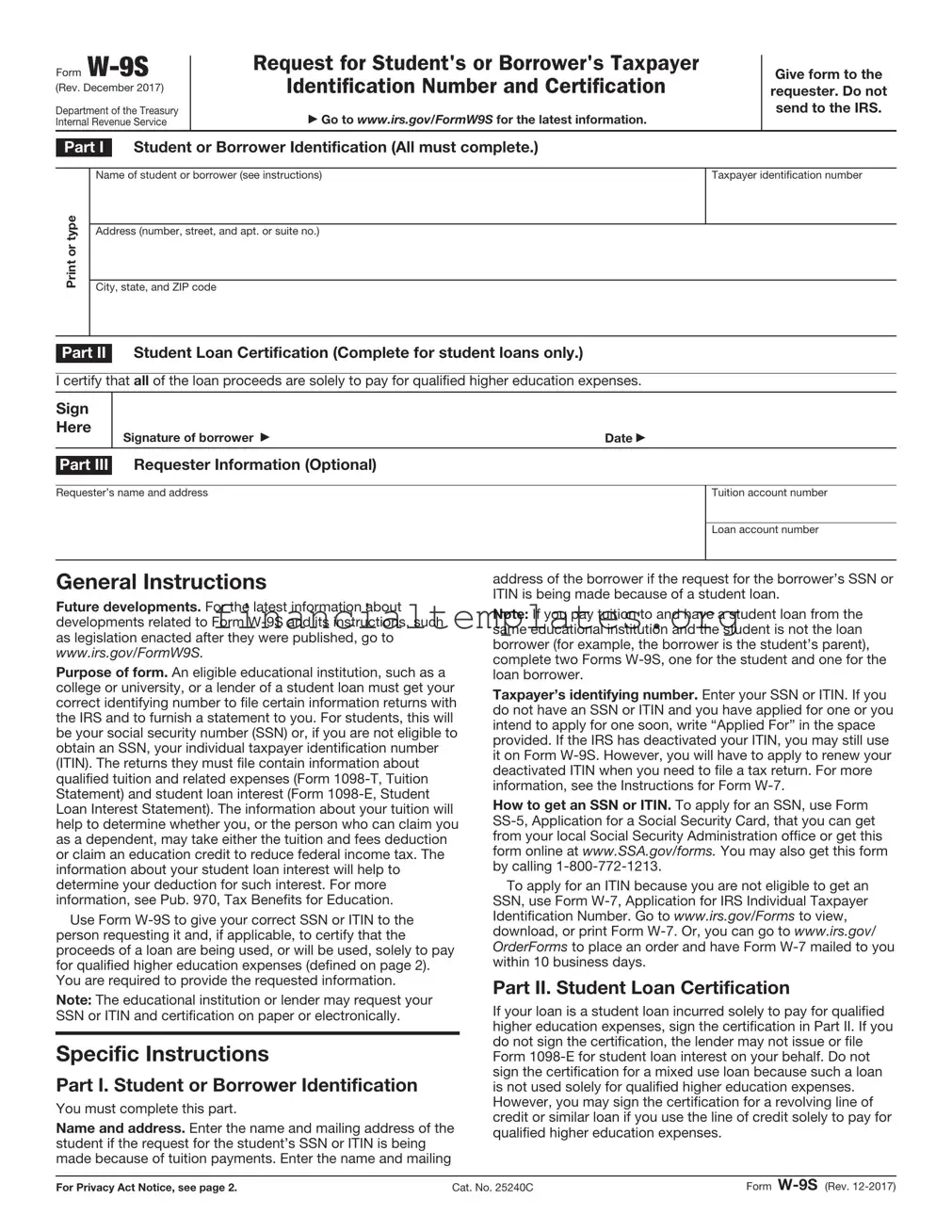

IRS W-9S Example

Form

Department of the Treasury Internal Revenue Service

Request for Student's or Borrower's Taxpayer

Identification Number and Certification

Go to www.irs.gov/FormW9S for the latest information.

Give form to the requester. Do not send to the IRS.

Part I Student or Borrower Identification (All must complete.)

Print or type

Name of student or borrower (see instructions)

Address (number, street, and apt. or suite no.)

City, state, and ZIP code

Taxpayer identification number

Part II Student Loan Certification (Complete for student loans only.)

I certify that all of the loan proceeds are solely to pay for qualified higher education expenses.

Sign

Here

Signature of borrower |

Date |

Part III Requester Information (Optional)

Requester’s name and address

Tuition account number

Loan account number

General Instructions

Future developments. For the latest information about developments related to Form

Purpose of form. An eligible educational institution, such as a college or university, or a lender of a student loan must get your correct identifying number to file certain information returns with the IRS and to furnish a statement to you. For students, this will be your social security number (SSN) or, if you are not eligible to obtain an SSN, your individual taxpayer identification number (ITIN). The returns they must file contain information about qualified tuition and related expenses (Form

Use Form

Note: The educational institution or lender may request your SSN or ITIN and certification on paper or electronically.

Specific Instructions

Part I. Student or Borrower Identification

You must complete this part.

Name and address. Enter the name and mailing address of the student if the request for the student’s SSN or ITIN is being made because of tuition payments. Enter the name and mailing

address of the borrower if the request for the borrower’s SSN or ITIN is being made because of a student loan.

Note: If you pay tuition to and have a student loan from the same educational institution and the student is not the loan borrower (for example, the borrower is the student’s parent), complete two Forms

Taxpayer’s identifying number. Enter your SSN or ITIN. If you do not have an SSN or ITIN and you have applied for one or you intend to apply for one soon, write “Applied For” in the space provided. If the IRS has deactivated your ITIN, you may still use it on Form

How to get an SSN or ITIN. To apply for an SSN, use Form

To apply for an ITIN because you are not eligible to get an SSN, use Form

Part II. Student Loan Certification

If your loan is a student loan incurred solely to pay for qualified higher education expenses, sign the certification in Part II. If you do not sign the certification, the lender may not issue or file Form

For Privacy Act Notice, see page 2. |

Cat. No. 25240C |

Form |

Form |

Page 2 |

Qualified higher education expenses. These expenses are the costs of attending an eligible educational institution, including graduate school, on at least a

Part III. Requester Information

This part is not required to be completed. It is provided for the convenience of the requester to help identify the account to which this Form

Note: For information about electronic submission of Forms

Penalties

Failure to furnish correct SSN or ITIN. If you fail to furnish your correct SSN or ITIN to the requester, you are subject to a penalty of $50 unless your failure is due to reasonable cause and not to willful neglect.

Misuse of SSN or ITIN. If the requester discloses or uses your SSN or ITIN in violation of federal law, the requester may be subject to civil and criminal penalties.

Secure Your Tax Records From Identity Theft

Identity theft occurs when someone uses your personal information such as your name, taxpayer identification number (TIN), or other identifying information, without your permission, to commit fraud or other crimes. An identity thief may use your SSN to get a job or may file a tax return using your TIN to receive a refund.

To reduce your risk:

•Protect your TIN,

•Ensure the requester is protecting your TIN, and

•Be careful when choosing a tax preparer.

If your SSN has been lost or stolen or you suspect you are a victim of

Victims of identity theft who are experiencing economic harm or a system problem, or are seeking help in resolving tax problems that have not been resolved through normal channels, may be eligible for Taxpayer Advocate Service (TAS) assistance. You can reach TAS by calling the TAS

Protect yourself from suspicious emails or phishing schemes. Phishing is the creation and use of email and websites designed to mimic legitimate business emails and websites. The most common act is sending an email to a user falsely claiming to be an established legitimate enterprise in an attempt to scam the user into surrendering private information that will be used for identity theft.

The IRS does not initiate contacts with taxpayers via emails. Also, the IRS does not request personal detailed information through email or ask taxpayers for the PIN numbers, passwords, or similar secret access information for their credit card, bank, or other financial accounts.

If you receive an unsolicited email claiming to be from the IRS, forward this message to phishing@irs.gov. You may also report misuse of the IRS name, logo, or other IRS personal property to the Treasury Inspector General for Tax Administration at

Visit www.irs.gov/IdentityTheft to learn more about identity theft and how to reduce your risk.

Privacy Act Notice

Section 6109 of the Internal Revenue Code requires you to give your correct SSN or ITIN to persons who must file information returns with the IRS to report certain information. The IRS uses the numbers for identification purposes and to help verify the accuracy of your tax return. The IRS may also provide this information to the Department of Justice for civil and criminal litigation and to cities, states, the District of Columbia, and U.S. possessions to carry out their tax laws. We may also disclose this information to other countries under a tax treaty, or to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS Form W-9S is specifically designed for students to provide their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to the educational institution they are enrolled in. |

| 2 | It is primarily used by educational institutions to request the student’s taxpayer identification number in order to file information returns to the IRS for certain grants, scholarships, and aids received by the student. |

| 3 | The form serves the purpose of preventing backup withholding from being applied to the payments made to students for grants or scholarships not used for qualified education expenses. |

| 4 | Backup withholding is a form of tax withholding on income for those taxpayers who have not provided their tax identification number to the payer. |

| 5 | While the W-9S form is a federal form issued by the Internal Revenue Service, there are no state-specific versions of this form as it pertains to federal tax reporting requirements. |

| 6 | By completing and submitting Form W-9S, students allow their educational institution to submit information to the IRS without needing to impose backup withholding taxes on the student’s financial aid. |

| 7 | The information provided by students on the W-9S can also be used by educational institutions to issue a Form 1098-T, which reports qualified tuition and related expenses, enhancing the student's eligibility for education-related tax credits and deductions. |

| 8 | Failure to submit a Form W-9S when requested by an educational institution may result in the institution being unable to report tuition payments correctly, possibly affecting the student’s eligibility for certain tax benefits. |

Guide to Writing IRS W-9S

After submitting the IRS W-9S form, the next steps involve the institution or lender processing the information to report tuition payments or interest paid on student loans to the Internal Revenue Service (IRS). This form primarily serves individuals who are required to report these payments for tax deduction or credit purposes. Once the form has been correctly filled out and submitted, it is crucial for individuals to keep a copy of the form for their records and prepare for any possible inquiries from the IRS or to facilitate tax return preparation.

- Start by entering your full name as it appears on your income tax return in the space provided at the top of the form.

- Fill in your permanent address, including the street number and name, apartment or suite number if applicable, city, state, and ZIP code in the corresponding fields.

- Proceed to enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the designated area. If you are representing an entity, provide its Employer Identification Number (EIN).

- If the form is being filled out in connection with a request for student loan interest deduction, check the box next to “Student loan interest statement.” For requests related to an education credit, check “Tuition statement.” If the form is for both, check both boxes.

- Next, enter the name and address of the educational institution or lender where indicated. This information is critical as it directs where the form needs to be sent after completion.

- Sign and date the form in the designated area at the bottom, confirming that the information provided is accurate and truthful. This also authorizes the institution or lender to use this form for IRS reporting purposes.

- Finally, submit the completed W-9S form to the requesting institution or lender, either through mail or electronically, as directed by them.

Understanding IRS W-9S

-

What is an IRS W-9S form?

The IRS W-9S form, also known as “Request for Student's or Borrower's Taxpayer Identification Number and Certification”, is a document used by educational institutions or lenders to request the social security number (SSN) or the individual taxpayer identification number (ITIN) from students or borrowers. This form is crucial for preparing information returns to report qualified tuition and related expenses, student loan interest, or other educational benefits to the IRS and to the taxpayer.

-

Who needs to fill out the W-9S form?

Typically, students or borrowers who have received educational benefits, such as scholarships, grants, or loans, need to fill out the W-9S form. This form is requested by the educational institution or the lender to ensure they have the correct taxpayer identification number (TIN) for tax reporting purposes.

-

What information is required on the W-9S form?

The W-9S form requires the student or borrower to provide their name, address, TIN (which can be an SSN or ITIN), and the educational institution's or lender's information if known. It also asks the person filling out the form to certify that the TIN provided is correct and that they are not subject to backup withholding due to failure to report interest and dividends.

-

How is the W-9S form submitted?

The W-9S form can be submitted to the requesting educational institution or lender through various means, depending on their preferences. This may include mail, in-person delivery, or, in some cases, electronic submission. It is important to follow the specific submission instructions provided by the requester to ensure the information is processed correctly.

-

Is there a deadline for submitting the W-9S form?

While the IRS does not set a specific deadline for the W-9S form, the educational institution or lender that requests it may have a deadline. This is typically tied to when they need to report your information to the IRS, generally by the end of January for the previous year's payments and expenses. Therefore, it is best to submit the form promptly when requested.

-

What happens if I don't fill out the W-9S form?

If you don't fill out the W-9S form, the educational institution or lender may be unable to report your educational benefits accurately to the IRS. As a result, you may not receive the full tax benefits available for educational expenses, or you could be subject to backup withholding. Backup withholding is a way for the IRS to ensure they collect taxes on income, including non-wage income, that might otherwise go unreported.

-

Can I claim educational tax benefits without the W-9S form?

You may still be eligible to claim educational tax benefits even if you haven't filled out a W-9S form, as long as you have other documentation to support your claim, such as financial records or statements from your educational institution. However, completing the W-9S form when requested helps ensure that you and the IRS receive accurate information about your eligible educational expenses.

-

Is my information safe when submitted on a W-9S form?

The educational institution or lender requesting the W-9S form should have measures in place to protect your personal information, including your TIN. It is important to submit your W-9S form through secure means, as recommended by the requester, to further protect your information. If you have concerns about the security of your information, it’s a good idea to ask the requester about their privacy and security policies.

-

Can the W-9S form be e-signed?

Whether a W-9S form can be e-signed depends on the policies of the requesting educational institution or lender. The IRS does accept electronic signatures on forms it directly manages, but it's up to the requester of the W-9S form to determine if they accept electronic signatures. Always check with the requester to see if they accept e-signatures before submitting your form electronically.

-

What should I do if my personal information changes after submitting the W-9S form?

If your personal information changes after you have submitted a W-9S form (for example, if you change your name or your TIN), it is important to inform the educational institution or lender that requested the form. They may require you to fill out a new W-9S form with your updated information to ensure accurate tax reporting.

Common mistakes

Filling out the IRS W-9S form, which is primarily concerned with requesting a taxpayer identification number (TIN) and certification for educational purposes, frequently includes several common errors. These mistakes can lead to processing delays, incorrect tax reporting, and potential fines. Understanding and avoiding these pitfalls is crucial for ensuring the accuracy and timeliness of one's tax obligations.

Not providing the correct TIN: Often individuals mistakenly provide an incorrect Social Security number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN). Ensuring this number is accurate is vital for tax reporting purposes.

Failure to fully complete the form: It's common for sections of the form to be left blank, particularly the requester’s name and address. This omission can cause significant delays in processing.

Omitting the signature and date: A signed and dated form is mandatory for it to be considered valid. Unsigned or undated forms are not processed, leading to unnecessary complications.

Using an outdated form: The IRS occasionally updates its forms. Using the most current version ensures compliance with the most recent tax laws and regulations.

Incorrectly indicating the account number(s): When the form is used to inform payers of the correct TIN to use when reporting income to the IRS, failing to accurately list account numbers can lead to misreported earnings.

Failure to check the appropriate certification box: This error can question the accuracy of an individual’s tax status, affecting potential withholding and reporting requirements.

Providing inaccurate or outdated personal information: Changes in personal information such as name (after marriage or legal name change) are often not reflected on the form, causing discrepancies with other tax documents.

By paying close attention to these details, individuals can ensure their IRS W-9S forms are filled out correctly, facilitating accurate and timely tax reporting. Given the importance of this document in the financial and educational sectors, maintaining diligence in its completion is of paramount importance.

Documents used along the form

The IRS W-9S form is commonly utilized by students or borrowers to provide their educational institutions or lenders with their correct taxpayer identification number (TIN) for the purpose of reporting interests, dividends, and certain amounts paid. While this form serves an essential function in ensuring compliance with tax reporting requirements, several other documents often accompany or are used in conjunction with the W-9S form to complete financial and tax-related processes for individuals in educational settings. Understanding these documents can offer deeper insights into the broader landscape of tax compliance and financial management in educational contexts.

- IRS Form 1098-T: This form is issued by educational institutions to report amounts billed for qualified tuition and related expenses. It is essential for students or their families who wish to claim education credits such as the American Opportunity Credit or Lifetime Learning Credit on their federal income tax returns.

- IRS Form 1098-E: Used to report interest payments from student loans during the tax year. Borrowers can potentially deduct a portion of the interest paid on qualified student loans, making this form a critical piece of documenting tax deductions.

- IRS Form 1040: The primary U.S. individual income tax return form where taxpayers report their annual income. Information from Forms 1098-T and 1098-E often feeds into this form to adjust taxable income based on education credits or interest deductions.

- IRS Form 8863: Specifically designed for claiming education credits such as the American Opportunity and Lifetime Learning Credits mentioned above. It requires information from Form 1098-T to determine the eligible credit amount.

- IRS Form 8917: This form is used for claiming the tuition and fees deduction, which allows taxpayers to reduce their taxable income by up to $4,000 for qualified education expenses.

- IRS W-4: While not directly related to educational tax reporting, this form is often used by student employees at educational institutions to determine the amount of federal income tax withholding from their paychecks.

- IRS Form 4506-T: This form is used to request tax return transcripts, tax account information, W-2 information, and 1099 information. This can be particularly useful for students applying for financial aid or scholarships that require proof of income or tax filing status.

- IRS Form 8233: For non-resident alien students and scholars receiving compensation for services, this form exempts certain payments from U.S. tax withholding under the terms of a tax treaty.

- FAFSA (Free Application for Federal Student Aid): Although not an IRS form, the FAFSA is crucial for students seeking federal financial aid, including loans and grants. Financial data from tax returns often directly influences the determination of aid eligibility and amounts.

In navigating the complexities of tax compliance and financial management in the context of education, these forms and documents play pivotal roles. They facilitate not only the proper reporting and deduction of education-related expenses but also the reception of financial aid and the leveraging of tax benefits. For students, parents, and educators alike, understanding these documents contributes to making informed decisions about financing education and optimizing tax outcomes.

Similar forms

The IRS W-9 form is closely related to the W-9S, primarily serving to collect taxpayer identification numbers (TINs) and certification from individuals. The W-9 form is used by individuals who are working as freelancers, independent contractors, or any situation requiring the submission of their taxpayer information to an entity from which they receive income. Like the W-9S, the W-9 is a crucial document for tax reporting purposes to ensure accurate reporting to the IRS by payers.

The 1098-T form, issued by educational institutions, is akin to the W-9S form in its focus on educational transactions. This form reports tuition expenses and related fees paid by or on behalf of a student. Its similarity to the W-9S lies in the context of education and the financial transactions associated with it, providing necessary information for tax credits and deductions related to education expenses.

The 1099-MISC form, used for reporting miscellaneous income, aligns with the W-9S through its role in reporting specific financial information to the IRS. Independent contractors, freelancers, and others receive the 1099-MISC from entities that pay them $600 or more in a tax year. The relation to the W-9S is in its function to collect and report tax-relevant information, although the 1099-MISC focuses on income earned outside of traditional employment.

The W-4 form is utilized by employees to indicate their tax withholding preferences to employers, which is different in purpose from the W-9S but still focuses on tax-related documentation. The linkage between the two forms is in their shared goal of providing tax-related information to ensure appropriate tax withholding and reporting, even though the W-4 is for employee-employer relationships and the W-9S is for students and educational institutions.

The W-8BEN form is designed for foreign individuals to document their non-resident alien status and claim any applicable benefits under tax treaty agreements with the United States. Its connection to the W-9S form lies in its goal of collecting tax-related information from individuals, though the W-8BEN specifically addresses the circumstances of foreign entities or individuals receiving income from U.S. sources.

The 1040 form, the U.S. individual income tax return, is a cornerstone document similar to the W-9S in the broad scope of tax documentation. It is where individuals report their annual income, expenses, and available deductions to the IRS. While serving different functions, both forms are integral to the tax reporting and filing process, ensuring individuals comply with U.S. tax laws and regulations.

The SS-4 form, used to apply for an Employer Identification Number (EIN), shares a connection to the W-9S in its role in the collection of tax identification numbers. Businesses and entities use the SS-4 to obtain their EIN, necessary for tax reporting purposes, echoing the W-9S’s function of ensuring tax compliance through proper identification.

Dos and Don'ts

Filling out the IRS W-9S form, which is required for certain tax-reporting purposes primarily related to education expenses and scholarships, demands attentiveness to detail. To assist in this process, it's critical to be aware of both the actions you should take and those you should avoid. This guidance aims to ensure that the form is completed both accurately and efficiently.

What You Should Do

- Ensure that your name and social security number (SSN) or employer identification number (EIN) on the form match the details on your tax return.

- Accurately report your Taxpayer Identification Number (TIN), as this is crucial for tax reporting purposes.

- Include your correct address to ensure that any correspondence or documentation can reach you without delays.

- Sign and date the form to certify that the information provided is accurate and truthful.

- Keep a copy of the completed form for your records to reference if needed in the future or if any issues arise.

What You Shouldn't Do

- Do not leave any required fields blank. Incomplete forms can result in processing delays or issues with tax reporting.

- Avoid using an incorrect TIN, as this could lead to potential fines or penalties.

- Do not forget to sign and date the form, as an unsigned or undated form is not valid.

- Resist the urge to over-disclose personal information not requested on the form to protect your privacy.

- Do not ignore IRS instructions or guidance related to the W-9S form. These directions are designed to help you complete the form correctly.

By following these guidelines, you can complete the IRS W-9S form confidently, ensuring compliance with tax reporting requirements and contributing to a smoother tax process.

Misconceptions

Many people have misconceptions about the IRS W-9S form, which can lead to errors or misunderstandings when submitting information for educational benefits or transactions. Here are some of the most common misconceptions:

It's optional to complete a W-9S form: In reality, this form is necessary for students or borrowers who are receiving certain types of educational benefits, such as tuition statement deductions, to provide their Social Security Number (SSN) or Taxpayer Identification Number (TIN) to the institution paying these benefits.

Anyone can fill out the W-9S form: This form should be completed by individuals who are directly receiving education benefits. It is not intended for use by educational institutions or by parents, unless they are claiming the student as a dependent and are directly receiving the benefits.

The W-9S form is used for employment verification: Contrary to some beliefs, the W-9S form is specifically for reporting information related to educational expenses and benefits, such as scholarships or tuition adjustments. Employment verification typically requires a different form, such as the W-9 or I-9.

The form must be submitted annually: This misconception isn't always the case. The necessity to submit a new W-9S form depends on the institution's requirements or if the student's or borrower's information changes.

All educational institutions require a W-9S form: While many do, it's not universal. Whether a W-9S is required depends on the policies of the institution and the types of educational benefits being provided.

The information provided on the W-9S form can lead to identity theft: While it's essential to keep personal information safe, the educational institutions and financial entities that request this form are required to protect your information under various privacy laws and regulations.

Submitting the W-9S form is the same as filing your taxes: Submitting a W-9S form to an educational institution or lender is not related to filing an annual tax return. It is specifically used to ensure correct information reporting to the IRS regarding educational benefits.

Electronic signatures are not allowed on the W-9S form: This is not necessarily true. Depending on the institution's policies and procedures, electronic signatures may be accepted for the W-9S form. It's important to check with the specific institution for their requirements.

Clearing up these misconceptions is crucial for accurately navigating the procedures related to educational benefits and ensuring compliance with IRS requirements. Always consult the educational institution or a professional advisor if there's uncertainty about completing the W-9S form.

Key takeaways

Filling out and using the IRS W-9S form is an important task for students and borrowers who are receiving certain types of educational benefits, such as tuition credits or student loan interest deductions. Here are four key takeaways to help navigate this process smoothly:

- Personal Information is Critical: Provide accurate personal information, including your name, address, and taxpayer identification number (TIN), usually your Social Security Number (SSN). The IRS uses this information to match your form with your tax records, so it's important to ensure every detail is correct.

- Purpose of the W-9S Form: Understand why you're filling it out. The W-9S form is specifically used by educational institutions or lenders to request your SSN or TIN. This is often for reporting tuition payments, scholarship amounts, or student loan interest to the IRS. Knowing its purpose can help you fill it out properly and understand its role in your tax documentation.

- Protect Your Information: Given that this form includes sensitive information, make sure to send it through secure means. Whether you're mailing it or submitting it electronically, check that you're using a safe method to protect your personal information.

- Keep Copies for Your Records: After submitting the W-9S form, keep a copy for your records. It's always good practice to have your own documentation in case there are any future questions or issues with your tax situation related to your education benefits.

Popular PDF Documents

Write the Lists Which Should Accompany the Statement of Affairs, in Case of a Winding Up by Court? - Outlines the necessity for listing any legal actions, garnishments, or attachments involving the debtor's property within one year before filing for bankruptcy.

Pensco Trust Company - Designed for user-friendliness, the form allows for streamlined submission of payment requests to PENSCO, complete with comprehensive fields for accurate, hassle-free processing of expense payments.