Get IRS W-9 Form

For individuals and businesses navigating financial transactions with one another, understanding the IRS W-9 form is a critical step in ensuring compliance with U.S. tax law. This form, integral to correctly reporting income and avoiding backup withholding, acts as a tool for collecting essential information such as taxpayer identification numbers (TINs), including Social Security numbers or employer identification numbers. Freelancers, contractors, and others who offer services might find themselves requested to fill one out by their clients, ensuring the payer has the details required for end-of-year tax documents like the 1099-MISC. Navigating the specifics can often be daunting, but an awareness of the form's essential functions and requirements can simplify many aspects of the financial dealings between parties. The versatility of the W-9, coupled with its significance in the landscape of tax documentation, underscores its pivotal role in smooth financial operations and tax reporting processes.

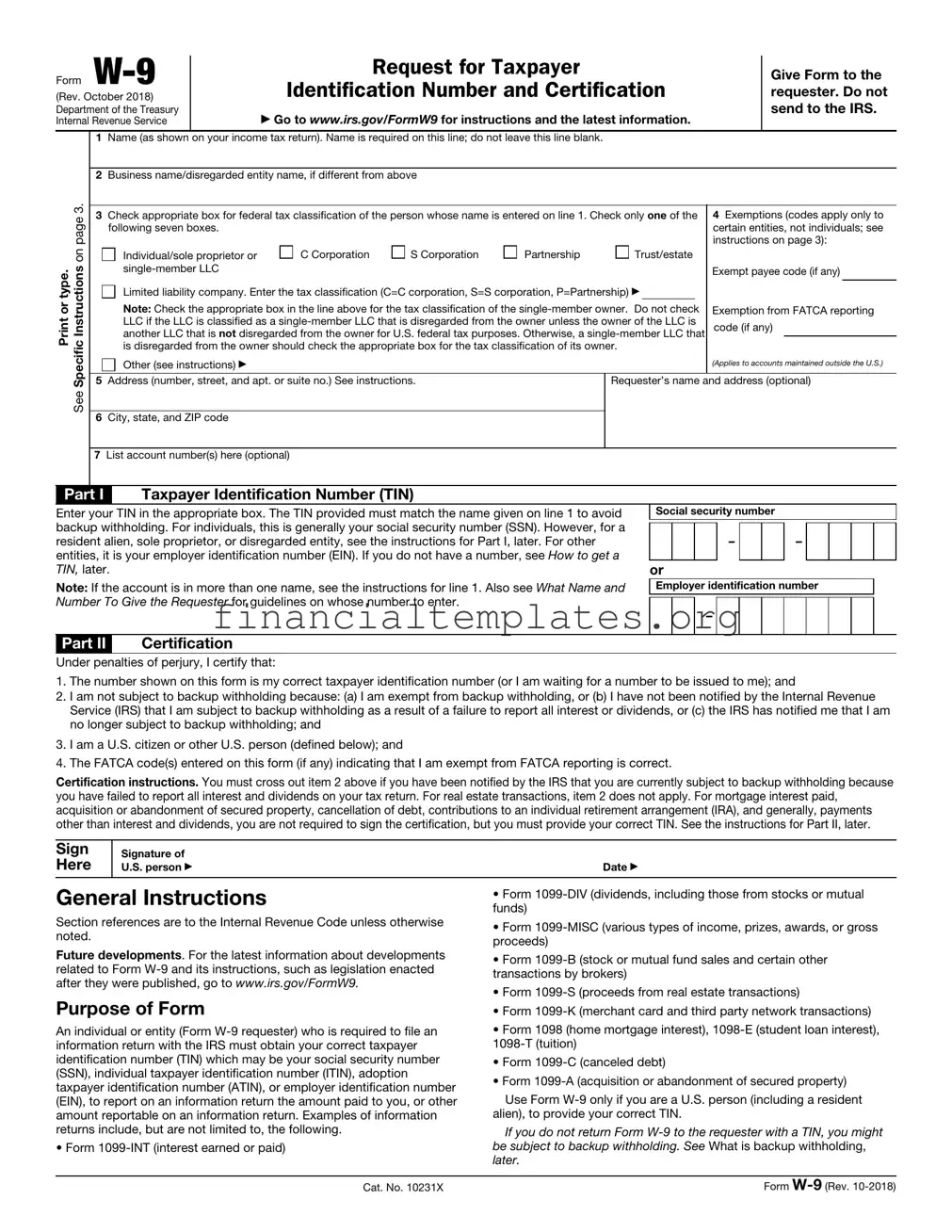

IRS W-9 Example

Form |

Request for Taxpayer |

Give Form to the |

(Rev. October 2018) |

Identification Number and Certification |

requester. Do not |

Department of the Treasury |

▶ Go to www.irs.gov/FormW9 for instructions and the latest information. |

send to the IRS. |

Internal Revenue Service |

|

1Name (as shown on your income tax return). Name is required on this line; do not leave this line blank.

2Business name/disregarded entity name, if different from above

3. |

|

|

|

|

|

|

|

|

3 Check appropriate box for federal tax classification of the person whose name is entered on line 1. Check only one of the |

4 Exemptions (codes apply only to |

|||||||

page |

||||||||

following seven boxes. |

|

|

|

|

certain entities, not individuals; see |

|||

|

|

|

|

|

instructions on page 3): |

|||

on |

Individual/sole proprietor or |

C Corporation |

S Corporation |

Partnership |

Trust/estate |

|

|

|

Printor type. InstructionsSpecific |

|

|

|

|

Exempt payee code (if any) |

|||

5 Address (number, street, and apt. or suite no.) See instructions. |

|

Requester’s name |

|

|

||||

|

and address (optional) |

|||||||

|

Limited liability company. Enter the tax classification (C=C corporation, S=S corporation, P=Partnership) ▶ |

|

|

|||||

|

Note: Check the appropriate box in the line above for the tax classification of the |

Exemption from FATCA reporting |

||||||

|

LLC if the LLC is classified as a |

code (if any) |

||||||

|

another LLC that is not disregarded from the owner for U.S. federal tax purposes. Otherwise, a |

|

|

|||||

|

is disregarded from the owner should check the appropriate box for the tax classification of its owner. |

|

|

|||||

|

Other (see instructions) ▶ |

|

|

|

|

(Applies to accounts maintained outside the U.S.) |

||

See |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

6 City, state, and ZIP code |

|

|

|

|

|

|

|

7List account number(s) here (optional)

Part I Taxpayer Identification Number (TIN)

Enter your TIN in the appropriate box. The TIN provided must match the name given on line 1 to avoid backup withholding. For individuals, this is generally your social security number (SSN). However, for a resident alien, sole proprietor, or disregarded entity, see the instructions for Part I, later. For other entities, it is your employer identification number (EIN). If you do not have a number, see How to get a TIN, later.

Note: If the account is in more than one name, see the instructions for line 1. Also see What Name and Number To Give the Requester for guidelines on whose number to enter.

Part II Certification

Social security number

– |

|

|

– |

|

|

|

|

or

Employer identification number

–

Under penalties of perjury, I certify that:

1.The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); and

2.I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and

3.I am a U.S. citizen or other U.S. person (defined below); and

4.The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct.

Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN. See the instructions for Part II, later.

Sign |

Signature of |

|

Here |

U.S. person ▶ |

Date ▶ |

General Instructions |

• Form |

|

|

||

Section references are to the Internal Revenue Code unless otherwise |

funds) |

|

• Form |

||

noted. |

||

proceeds) |

||

Future developments. For the latest information about developments |

||

• Form |

||

related to Form |

||

transactions by brokers) |

||

after they were published, go to www.irs.gov/FormW9. |

||

• Form |

||

Purpose of Form |

||

• Form |

||

An individual or entity (Form |

• Form 1098 (home mortgage interest), |

|

information return with the IRS must obtain your correct taxpayer |

||

identification number (TIN) which may be your social security number |

• Form |

|

(SSN), individual taxpayer identification number (ITIN), adoption |

• Form |

|

taxpayer identification number (ATIN), or employer identification number |

||

Use Form |

||

(EIN), to report on an information return the amount paid to you, or other |

||

amount reportable on an information return. Examples of information |

alien), to provide your correct TIN. |

|

returns include, but are not limited to, the following. |

If you do not return Form |

|

• Form |

be subject to backup withholding. See What is backup withholding, |

|

|

later. |

Cat. No. 10231X |

Form |

Form |

Page 2 |

By signing the

1.Certify that the TIN you are giving is correct (or you are waiting for a number to be issued),

2.Certify that you are not subject to backup withholding, or

3.Claim exemption from backup withholding if you are a U.S. exempt payee. If applicable, you are also certifying that as a U.S. person, your allocable share of any partnership income from a U.S. trade or business is not subject to the withholding tax on foreign partners' share of effectively connected income, and

4.Certify that FATCA code(s) entered on this form (if any) indicating that you are exempt from the FATCA reporting, is correct. See What is FATCA reporting, later, for further information.

Note: If you are a U.S. person and a requester gives you a form other than Form

Definition of a U.S. person. For federal tax purposes, you are considered a U.S. person if you are:

•An individual who is a U.S. citizen or U.S. resident alien;

•A partnership, corporation, company, or association created or organized in the United States or under the laws of the United States;

•An estate (other than a foreign estate); or

•A domestic trust (as defined in Regulations section

Special rules for partnerships. Partnerships that conduct a trade or business in the United States are generally required to pay a withholding tax under section 1446 on any foreign partners’ share of effectively connected taxable income from such business. Further, in certain cases where a Form

In the cases below, the following person must give Form

•In the case of a disregarded entity with a U.S. owner, the U.S. owner of the disregarded entity and not the entity;

•In the case of a grantor trust with a U.S. grantor or other U.S. owner, generally, the U.S. grantor or other U.S. owner of the grantor trust and not the trust; and

•In the case of a U.S. trust (other than a grantor trust), the U.S. trust (other than a grantor trust) and not the beneficiaries of the trust.

Foreign person. If you are a foreign person or the U.S. branch of a foreign bank that has elected to be treated as a U.S. person, do not use Form

Nonresident alien who becomes a resident alien. Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce or eliminate U.S. tax on certain types of income. However, most tax treaties contain a provision known as a “saving clause.” Exceptions specified in the saving clause may permit an exemption from tax to continue for certain types of income even after the payee has otherwise become a U.S. resident alien for tax purposes.

If you are a U.S. resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from U.S. tax on certain types of income, you must attach a statement to Form

1.The treaty country. Generally, this must be the same treaty under which you claimed exemption from tax as a nonresident alien.

2.The treaty article addressing the income.

3.The article number (or location) in the tax treaty that contains the saving clause and its exceptions.

4.The type and amount of income that qualifies for the exemption from tax.

5.Sufficient facts to justify the exemption from tax under the terms of the treaty article.

Example. Article 20 of the

If you are a nonresident alien or a foreign entity, give the requester the appropriate completed Form

Backup Withholding

What is backup withholding? Persons making certain payments to you must under certain conditions withhold and pay to the IRS 24% of such payments. This is called “backup withholding.” Payments that may be subject to backup withholding include interest,

You will not be subject to backup withholding on payments you receive if you give the requester your correct TIN, make the proper certifications, and report all your taxable interest and dividends on your tax return.

Payments you receive will be subject to backup withholding if:

1.You do not furnish your TIN to the requester,

2.You do not certify your TIN when required (see the instructions for Part II for details),

3.The IRS tells the requester that you furnished an incorrect TIN,

4.The IRS tells you that you are subject to backup withholding

because you did not report all your interest and dividends on your tax return (for reportable interest and dividends only), or

5.You do not certify to the requester that you are not subject to backup withholding under 4 above (for reportable interest and dividend accounts opened after 1983 only).

Certain payees and payments are exempt from backup withholding. See Exempt payee code, later, and the separate Instructions for the Requester of Form

Also see Special rules for partnerships, earlier.

What is FATCA Reporting?

The Foreign Account Tax Compliance Act (FATCA) requires a participating foreign financial institution to report all United States account holders that are specified United States persons. Certain payees are exempt from FATCA reporting. See Exemption from FATCA reporting code, later, and the Instructions for the Requester of Form

Updating Your Information

You must provide updated information to any person to whom you claimed to be an exempt payee if you are no longer an exempt payee and anticipate receiving reportable payments in the future from this person. For example, you may need to provide updated information if you are a C corporation that elects to be an S corporation, or if you no longer are tax exempt. In addition, you must furnish a new Form

Penalties

Failure to furnish TIN. If you fail to furnish your correct TIN to a requester, you are subject to a penalty of $50 for each such failure unless your failure is due to reasonable cause and not to willful neglect.

Civil penalty for false information with respect to withholding. If you make a false statement with no reasonable basis that results in no backup withholding, you are subject to a $500 penalty.

Form |

Page 3 |

Criminal penalty for falsifying information. Willfully falsifying certifications or affirmations may subject you to criminal penalties including fines and/or imprisonment.

Misuse of TINs. If the requester discloses or uses TINs in violation of federal law, the requester may be subject to civil and criminal penalties.

Specific Instructions

Line 1

You must enter one of the following on this line; do not leave this line blank. The name should match the name on your tax return.

If this Form

a.Individual. Generally, enter the name shown on your tax return. If you have changed your last name without informing the Social Security Administration (SSA) of the name change, enter your first name, the last name as shown on your social security card, and your new last name.

Note: ITIN applicant: Enter your individual name as it was entered on your Form

b.Sole proprietor or

c.Partnership, LLC that is not a

d.Other entities. Enter your name as shown on required U.S. federal tax documents on line 1. This name should match the name shown on the charter or other legal document creating the entity. You may enter any business, trade, or DBA name on line 2.

e.Disregarded entity. For U.S. federal tax purposes, an entity that is disregarded as an entity separate from its owner is treated as a “disregarded entity.” See Regulations section

Line 2

If you have a business name, trade name, DBA name, or disregarded entity name, you may enter it on line 2.

Line 3

Check the appropriate box on line 3 for the U.S. federal tax classification of the person whose name is entered on line 1. Check only one box on line 3.

IF the entity/person on line 1 is |

THEN check the box for . . . |

|

a(n) . . . |

|

|

|

|

|

• |

Corporation |

Corporation |

• |

Individual |

Individual/sole proprietor or single- |

• |

Sole proprietorship, or |

member LLC |

• |

|

|

company (LLC) owned by an |

|

|

individual and disregarded for U.S. |

|

|

federal tax purposes. |

|

|

|

|

|

• |

LLC treated as a partnership for |

Limited liability company and enter |

U.S. federal tax purposes, |

the appropriate tax classification. |

|

• |

LLC that has filed Form 8832 or |

(P= Partnership; C= C corporation; |

2553 to be taxed as a corporation, |

or S= S corporation) |

|

or |

|

|

• |

LLC that is disregarded as an |

|

entity separate from its owner but |

|

|

the owner is another LLC that is |

|

|

not disregarded for U.S. federal tax |

|

|

purposes. |

|

|

|

|

|

• |

Partnership |

Partnership |

|

|

|

• |

Trust/estate |

Trust/estate |

|

|

|

Line 4, Exemptions

If you are exempt from backup withholding and/or FATCA reporting, enter in the appropriate space on line 4 any code(s) that may apply to you.

Exempt payee code.

•Generally, individuals (including sole proprietors) are not exempt from backup withholding.

•Except as provided below, corporations are exempt from backup withholding for certain payments, including interest and dividends.

•Corporations are not exempt from backup withholding for payments made in settlement of payment card or third party network transactions.

•Corporations are not exempt from backup withholding with respect to attorneys’ fees or gross proceeds paid to attorneys, and corporations that provide medical or health care services are not exempt with respect to payments reportable on Form

The following codes identify payees that are exempt from backup withholding. Enter the appropriate code in the space in line 4.

Form |

Page 4 |

The following chart shows types of payments that may be exempt from backup withholding. The chart applies to the exempt payees listed above, 1 through 13.

IF the payment is for . . . |

THEN the payment is exempt |

|

for . . . |

|

|

Interest and dividend payments |

All exempt payees except |

|

for 7 |

|

|

Broker transactions |

Exempt payees 1 through 4 and 6 |

|

through 11 and all C corporations. |

|

S corporations must not enter an |

|

exempt payee code because they |

|

are exempt only for sales of |

|

noncovered securities acquired |

|

prior to 2012. |

|

|

Barter exchange transactions and |

Exempt payees 1 through 4 |

patronage dividends |

|

|

|

Payments over $600 required to be |

Generally, exempt payees |

reported and direct sales over |

1 through 52 |

$5,0001 |

|

|

|

Payments made in settlement of |

Exempt payees 1 through 4 |

payment card or third party network |

|

transactions |

|

|

|

1See Form

2However, the following payments made to a corporation and reportable on Form

Exemption from FATCA reporting code. The following codes identify payees that are exempt from reporting under FATCA. These codes apply to persons submitting this form for accounts maintained outside of the United States by certain foreign financial institutions. Therefore, if you are only submitting this form for an account you hold in the United States, you may leave this field blank. Consult with the person requesting this form if you are uncertain if the financial institution is subject to these requirements. A requester may indicate that a code is not required by providing you with a Form

Note: You may wish to consult with the financial institution requesting this form to determine whether the FATCA code and/or exempt payee code should be completed.

Line 5

Enter your address (number, street, and apartment or suite number). This is where the requester of this Form

Line 6

Enter your city, state, and ZIP code.

Part I. Taxpayer Identification Number (TIN)

Enter your TIN in the appropriate box. If you are a resident alien and you do not have and are not eligible to get an SSN, your TIN is your IRS individual taxpayer identification number (ITIN). Enter it in the social security number box. If you do not have an ITIN, see How to get a TIN below.

If you are a sole proprietor and you have an EIN, you may enter either your SSN or EIN.

If you are a

Note: See What Name and Number To Give the Requester, later, for further clarification of name and TIN combinations.

How to get a TIN. If you do not have a TIN, apply for one immediately. To apply for an SSN, get Form

If you are asked to complete Form

Note: Entering “Applied For” means that you have already applied for a TIN or that you intend to apply for one soon.

Caution: A disregarded U.S. entity that has a foreign owner must use the appropriate Form

Part II. Certification

To establish to the withholding agent that you are a U.S. person, or resident alien, sign Form

For a joint account, only the person whose TIN is shown in Part I should sign (when required). In the case of a disregarded entity, the person identified on line 1 must sign. Exempt payees, see Exempt payee code, earlier.

Signature requirements. Complete the certification as indicated in items 1 through 5 below.

Form |

Page 5 |

1.Interest, dividend, and barter exchange accounts opened before 1984 and broker accounts considered active during 1983. You must give your correct TIN, but you do not have to sign the certification.

2.Interest, dividend, broker, and barter exchange accounts opened after 1983 and broker accounts considered inactive during 1983. You must sign the certification or backup withholding will apply. If you are subject to backup withholding and you are merely providing your correct TIN to the requester, you must cross out item 2 in the certification before signing the form.

3.Real estate transactions. You must sign the certification. You may cross out item 2 of the certification.

4.Other payments. You must give your correct TIN, but you do not have to sign the certification unless you have been notified that you have previously given an incorrect TIN. “Other payments” include payments made in the course of the requester’s trade or business for rents, royalties, goods (other than bills for merchandise), medical and health care services (including payments to corporations), payments to a nonemployee for services, payments made in settlement of payment card and third party network transactions, payments to certain fishing boat crew members and fishermen, and gross proceeds paid to attorneys (including payments to corporations).

5.Mortgage interest paid by you, acquisition or abandonment of secured property, cancellation of debt, qualified tuition program payments (under section 529), ABLE accounts (under section 529A), IRA, Coverdell ESA, Archer MSA or HSA contributions or distributions, and pension distributions. You must give your correct TIN, but you do not have to sign the certification.

What Name and Number To Give the Requester

|

For this type of account: |

Give name and SSN of: |

|

|

|

1. |

Individual |

The individual |

2. |

Two or more individuals (joint |

The actual owner of the account or, if |

|

account) other than an account |

combined funds, the first individual on |

|

maintained by an FFI |

the account1 |

3. |

Two or more U.S. persons |

Each holder of the account |

|

(joint account maintained by an FFI) |

|

4. |

Custodial account of a minor |

The minor2 |

|

(Uniform Gift to Minors Act) |

|

5. a. The usual revocable savings trust |

The |

|

|

(grantor is also trustee) |

The actual owner1 |

|

b. |

|

|

a legal or valid trust under state law |

|

6. |

Sole proprietorship or disregarded |

The owner3 |

|

entity owned by an individual |

|

7. |

Grantor trust filing under Optional |

The grantor* |

|

Form 1099 Filing Method 1 (see |

|

|

Regulations section |

|

|

(A)) |

|

|

|

|

|

For this type of account: |

Give name and EIN of: |

|

|

|

8. |

Disregarded entity not owned by an |

The owner |

|

individual |

|

9. |

A valid trust, estate, or pension trust |

Legal entity4 |

10. |

Corporation or LLC electing |

The corporation |

|

corporate status on Form 8832 or |

|

|

Form 2553 |

|

11. |

Association, club, religious, |

The organization |

|

charitable, educational, or other tax- |

|

|

exempt organization |

|

12. |

Partnership or |

The partnership |

13. |

A broker or registered nominee |

The broker or nominee |

|

|

|

For this type of account: |

Give name and EIN of: |

|

|

14. Account with the Department of |

The public entity |

Agriculture in the name of a public |

|

entity (such as a state or local |

|

government, school district, or |

|

prison) that receives agricultural |

|

program payments |

|

15. Grantor trust filing under the Form |

The trust |

1041 Filing Method or the Optional |

|

Form 1099 Filing Method 2 (see |

|

Regulations section |

|

|

|

1List first and circle the name of the person whose number you furnish. If only one person on a joint account has an SSN, that person’s number must be furnished.

2Circle the minor’s name and furnish the minor’s SSN.

3You must show your individual name and you may also enter your business or DBA name on the “Business name/disregarded entity” name line. You may use either your SSN or EIN (if you have one), but the IRS encourages you to use your SSN.

4List first and circle the name of the trust, estate, or pension trust. (Do not furnish the TIN of the personal representative or trustee unless the legal entity itself is not designated in the account title.) Also see Special rules for partnerships, earlier.

*Note: The grantor also must provide a Form

Note: If no name is circled when more than one name is listed, the number will be considered to be that of the first name listed.

Secure Your Tax Records From Identity Theft

Identity theft occurs when someone uses your personal information such as your name, SSN, or other identifying information, without your permission, to commit fraud or other crimes. An identity thief may use your SSN to get a job or may file a tax return using your SSN to receive a refund.

To reduce your risk:

•Protect your SSN,

•Ensure your employer is protecting your SSN, and

•Be careful when choosing a tax preparer.

If your tax records are affected by identity theft and you receive a notice from the IRS, respond right away to the name and phone number printed on the IRS notice or letter.

If your tax records are not currently affected by identity theft but you think you are at risk due to a lost or stolen purse or wallet, questionable credit card activity or credit report, contact the IRS Identity Theft Hotline at

For more information, see Pub. 5027, Identity Theft Information for Taxpayers.

Victims of identity theft who are experiencing economic harm or a systemic problem, or are seeking help in resolving tax problems that have not been resolved through normal channels, may be eligible for Taxpayer Advocate Service (TAS) assistance. You can reach TAS by calling the TAS

Protect yourself from suspicious emails or phishing schemes. Phishing is the creation and use of email and websites designed to mimic legitimate business emails and websites. The most common act is sending an email to a user falsely claiming to be an established legitimate enterprise in an attempt to scam the user into surrendering private information that will be used for identity theft.

Form |

Page 6 |

The IRS does not initiate contacts with taxpayers via emails. Also, the IRS does not request personal detailed information through email or ask taxpayers for the PIN numbers, passwords, or similar secret access information for their credit card, bank, or other financial accounts.

If you receive an unsolicited email claiming to be from the IRS, forward this message to phishing@irs.gov. You may also report misuse of the IRS name, logo, or other IRS property to the Treasury Inspector General for Tax Administration (TIGTA) at

Visit www.irs.gov/IdentityTheft to learn more about identity theft and how to reduce your risk.

Privacy Act Notice

Section 6109 of the Internal Revenue Code requires you to provide your correct TIN to persons (including federal agencies) who are required to file information returns with the IRS to report interest, dividends, or certain other income paid to you; mortgage interest you paid; the acquisition or abandonment of secured property; the cancellation of debt; or contributions you made to an IRA, Archer MSA, or HSA. The person collecting this form uses the information on the form to file information returns with the IRS, reporting the above information. Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their laws. The information also may be disclosed to other countries under a treaty, to federal and state agencies to enforce civil and criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism. You must provide your TIN whether or not you are required to file a tax return. Under section 3406, payers must generally withhold a percentage of taxable interest, dividend, and certain other payments to a payee who does not give a TIN to the payer. Certain penalties may also apply for providing false or fraudulent information.

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The IRS W-9 form is officially titled "Request for Taxpayer Identification Number and Certification". |

| 2 | It is primarily used by individuals and entities to provide their Taxpayer Identification Number (TIN) to entities that will pay them income during the tax year. |

| 3 | Businesses usually require a completed W-9 form from freelancers or independent contractors before they can issue payments. |

| 4 | The form serves to help organizations avoid Backup Withholding, as they may be required to withhold taxes on payments if a W-9 is not provided. |

| 5 | Individuals and entities fill out their name, business name (if different), TIN type (SSN, EIN, ITIN), and certification on the form. |

| 6 | Submitting a false or fraudulent W-9 form can lead to penalties under perjury. |

| 7 | The IRS does not require the W-9 to be submitted directly to them by the payer. Instead, it should be retained by the requester and used to complete information returns (like 1099s) and for withholding purposes. |

| 8 | There is no official IRS requirement for the W-9 form to be updated annually. However, requesters may require a new form to ensure their records are up to date. |

| 9 | While the W-9 is a federal form, some states have similar requirements or forms for state tax purposes. |

| 10 | The form is available for download from the IRS website and can be filled out electronically or by hand. |

Guide to Writing IRS W-9

Completing the IRS W-9 form is a straightforward process if you understand the necessary steps. The W-9 form is essential for freelancers, independent contractors, and other non-employees to provide their taxpayer identification number (TIN) to the entity that pays them. This form helps businesses correctly report income paid to you to the Internal Revenue Service (IRS). Below, you'll find clear, step-by-step instructions to fill out the form accurately and avoid common mistakes. Please review each section carefully to ensure the information you provide is correct and complete.

- Enter your full name as it appears on your income tax return.

- List your business name or disregarded entity name if different from your personal name. If you're a sole proprietor, you might not have a separate business name.

- Choose the appropriate federal tax classification for yourself or your entity. Check only one box. Options include individual/sole proprietor or single-member LLC, C Corporation, S Corporation, Partnership, Trust/Estate.

- Exemptions: If applicable, enter codes for exemption from FATCA reporting and/or federal backup withholding. Most individuals and domestic businesses leave this blank.

- Provide your address, including the city, state, and ZIP code. This should match the address where you receive your tax documents.

- List your TIN, which can be either your Social Security Number (SSN) or Employer Identification Number (EIN), depending on your tax situation.

- Sign and date the form certifying that the information provided is accurate to the best of your knowledge. Remember, providing false information can result in penalties.

After completing the form, review it to ensure all information is correct and legible. Depending on your arrangement, you might need to return the completed form to the requester electronically or by mail. Keeping a copy for your records is recommended. Accurately filling out and returning your W-9 allows the payment process to proceed smoothly and helps ensure that your tax reporting obligations are met.

Understanding IRS W-9

-

What is an IRS W-9 Form?

The IRS W-9 form, officially titled "Request for Taxpayer Identification Number and Certification," is a crucial document primarily used in the United States. This form is requested by businesses or individuals who are required to file information returns with the IRS to report certain types of payments. These payments can include interest, dividends, and non-employee compensation. When you complete a W-9, you are providing your taxpayer identification number (TIN)—such as your Social Security number (SSN) or employer identification number (EIN)—to the person who is required to file an information return with the IRS to report, for example, the income paid to you or real estate transactions. The form serves as a way to confirm your tax ID number and, often, to certify that you are not subject to backup withholding tax.

-

Who Needs to Fill Out a W-9 Form?

Generally, the W-9 form must be completed by individuals or entities who receive payment for services as independent contractors, freelancers, or other non-employees. Furthermore, the form is used when a business relationship is established, necessitating the need for accurate reporting to the IRS of interest, dividends, or real estate transactions. In addition, financial institutions may require a W-9 for certain transactions to report possible taxable events. If you are asked to fill out a W-9 form, it's because the requestor needs your taxpayer information to report to the IRS for tax purposes.

-

How Do You Fill Out and Submit a W-9 Form?

Filling out a W-9 form is straightforward. You need to provide your name as shown on your tax return, your business name if different, your federal tax classification (such as individual/sole proprietor, corporation, etc.), and your TIN (SSN, EIN, ITIN). Additionally, you must certify the information by signing and dating the form. Submitting the completed form is generally done through safe means as requested by the party who asked for it. This could be via mail, a secure electronic submission, or in-person delivery, ensuring the protection of your sensitive information. It's important to verify the requester's legitimacy before submission to guard against identity theft.

-

Is My Personal Information Safe When I Submit a W-9 Form?

The safety of your personal information when submitting a W-9 form hinges on the security measures adopted by the requester and your method of submission. Always verify the identity of the requester to prevent potential fraud. If submitting electronically, ensure it's through a secure platform. If by mail, consider using a traceable form of delivery. Remember, the information on your W-9, such as your TIN, is sensitive and should be protected to prevent identity theft. Be cautious and seek to submit your information in the most secure manner possible.

-

What Happens if You Don't Fill Out a W-9 Form?

Not filling out a W-9 form when requested can have several consequences. The most immediate is the potential application of backup withholding. Backup withholding requires the person or entity paying you to withhold income tax from your payment at the current rate and send it to the IRS. This means you may receive less money upfront. Additionally, failure to furnish a W-9 when required might lead to delays in payment and potential penalties. If you're concerned or unsure about completing the form, it may be helpful to seek professional advice to ensure compliance with IRS requirements.

Common mistakes

Filling out the IRS W-9 form seems straightforward, but it's easy to make mistakes that can lead to headaches down the road. Whether you're an independent contractor, freelancer, or someone who is receiving certain types of income, getting your W-9 right is crucial. Here are six common mistakes people make on this form:

-

Not using the correct form version. The IRS occasionally updates the W-9 form. Always make sure you’re using the latest version available on the IRS website.

-

Entering incorrect information. Mistyping your Social Security Number (SSN) or Employer Identification Number (EIN) is a frequent mistake. Double-check these numbers for accuracy, as errors can cause significant delays or issues with your tax reporting.

-

Using a nickname instead of your legal name. It’s important to use your full legal name as it appears on your Social Security card or EIN documentation. Nicknames or abbreviations can lead to processing delays or misfiled taxes.

-

Not checking the appropriate tax classification. Whether you’re filing as an individual, partnership, corporation, etc., make sure you check the correct box that applies to your situation. Misclassification can have significant tax implications.

-

Forgetting to sign and date the form. An unsigned W-9 form is not valid. Always remember to sign and date the form before you submit it. Your signature confirms that the information you provided is accurate.

-

Sending the form to the wrong place. Typically, you give your completed W-9 directly to the person or company that requested it, not to the IRS. Make sure you’re sending your form to the right recipient.

Avoiding these common errors can help ensure your tax information is accurate and processed correctly. If you’re ever unsure about how to fill out the form correctly, don’t hesitate to ask a tax professional or refer to the instructions provided by the IRS specific to the W-9 form.

Documents used along the form

When it comes to handling financial and tax-related matters, the IRS W-9 form is a critical document used to collect information about contractors, freelancers, and vendors for tax reporting purposes. However, the W-9 form seldom travels alone, especially in the intricate world of US tax and financial documentation. Understanding the companions of the W-9 form can provide a comprehensive picture of the information exchange required for compliance and efficient business operations. Let's explore some of these essential forms and documents that are often used in conjunction with the IRS W-9 form.

- Form 1099-MISC: This document is paramount for reporting payments made in the course of a business to a person who's not an employee or to an unincorporated business. It works hand-in-hand with the information collected on the W-9 for accurate tax reporting on miscellaneous income.

- Form 1099-NEC: Superseding the Form 1099-MISC for reporting non-employee compensation as of 2020, this form is essential for businesses that pay freelancers or independent contractors $600 or more in a tax year. The details provided on the W-9 enable the correct filing of Form 1099-NEC.

- Form W-4: Although this form is used by employees to set their tax withholdings and is not directly related to the W-9, organizations often handle both forms. They cater to different categories of workers—W-4 for employees and W-9 for contractors—and help delineate tax responsibilities accordingly.

- Form W-8BEN: This form is vital for foreign individuals working with US businesses, acting as a counterpart to the W-9 for international contractors or freelancers. It ascertains their tax withholding status in relation to the US tax system.

- Form 1099-INT: Pertinent to individuals receiving interest income, this form intersects with the W-9 for collecting payer information and TIN to accurately report interest payments to the IRS.

- Form 1099-DIV: Similar to 1099-INT but for dividends and distributions, it's another context where the payer uses details from the W-9 for reporting to the IRS on investments that yield dividends or distribution income.

- Form 8300: Relevant for reporting cash payments over $10,000, this form requires detailed information about the payer that often aligns with the data provided on a W-9. It's key in curbing money laundering and ensuring financial transparency.

The landscape of US tax and financial documentation is vast, and navigating it requires familiarity not just with individual forms but also with how they connect to each other. Each document plays a role in the broader financial narrative of an entity or individual. With documents like the IRS W-9 form and its frequent associates, businesses and consultants can ensure compliance, accuracy, and efficiency in their financial operations and tax reporting duties.

Similar forms

The IRS W-9 form is akin to the W-4 form in several ways. Both are used by the IRS to collect taxpayer information. While the W-9 is mainly used by independent contractors to provide their Social Security number or taxpayer identification number to entities they work for, the W-4 is used by employees to indicate their tax withholdings to their employer. Both forms serve as critical tools for tax identification and reporting purposes.

Similar to the W-9, the 1099 form is used in the context of reporting income. However, the 1099 is the form that businesses use to report payments made to independent contractors. In essence, while the W-9 is filled out by the contractor at the beginning of their engagement, the 1099-MISC or 1099-NEC forms are the end result, detailing the income they've received throughout the year, which is used for their tax returns.

The W-8BEN form parallels the W-9 in its purpose of collecting taxpayer information, but its use is specific to foreign persons. While the W-9 is for U.S. persons to declare their tax ID numbers, the W-8BEN is utilized by non-U.S. individuals to certify their foreign status and claim any applicable benefits under the tax treaty between their country and the U.S. This distinction is crucial for international tax compliance.

Another document similar to the W-9 form is the I-9 form. Despite being used for different purposes, both forms are essential for employment in the United States. The W-9 is for tax reporting purposes, while the I-9 is used by employers to verify the employment eligibility and identity of new hires. Each form plays a vital role in ensuring legal employment practices and tax compliance.

The W-2 form also shares similarities with the W-9, primarily in the reporting of income and tax withholding. However, the W-2 is specifically for employees to report wages earned and taxes withheld by their employer. Unlike the W-9, which is used by independent contractors to provide their tax ID information, the W-2 is an annual summary sent by employers to employees and the IRS.

The Schedule C form is akin to the W-9 in the sense that it is used by self-employed individuals, including freelancers and independent contractors. While the W-9 is used to provide taxpayer information to clients, Schedule C is used to report profits or losses from a business operated as a sole proprietorship. This makes both documents integral to the taxation of self-employed persons.

Similar to the W-9, the 1040 form is a staple in U.S. tax filing, albeit serving a broader purpose. The Form 1040 is used by U.S. taxpayers to file their annual income tax returns, encompassing income from various sources, including wages, dividends, and independent contractor work. Therefore, while the W-9 helps entities gather taxpayer information for payments made, the information ultimately contributes to what is reported on an individual's 1040.

The SS-4 form is related to the W-9 in that it involves tax identification numbers. However, the SS-4 is used to apply for an Employer Identification Number (EIN) by businesses. The EIN is crucial for businesses to report taxes and employee information. Though the W-9 is for individuals to provide their taxpayer identification, both forms highlight the importance of tax IDs in the U.S. tax system.

Lastly, the W-7 form shares a purpose with the W-9 by dealing with tax identification. The W-7 is used by individuals who are not eligible for a Social Security number to apply for an Individual Taxpayer Identification Number (ITIN). Like the W-9 collects taxpayer information for U.S. citizens and resident aliens, the W-7 facilitates tax filing and reporting for those not eligible for a Social Security number, reflecting the inclusivity of the tax system.

Dos and Don'ts

Completing the IRS W-9 form accurately is essential for tax reporting purposes. This form is often used when you're starting a new job, working as a freelancer, or when you're doing business with a new entity. To ensure accuracy and compliance, here are 10 dos and don'ts to keep in mind.

Dos:- Verify your name matches the one on your Social Security card to avoid mismatches in IRS records.

- Provide your correct Taxpayer Identification Number (TIN), which could be your Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN).

- Fill out and return the W-9 form promptly to avoid delaying payment.

- Use the most current W-9 form version to ensure compliance with the latest IRS guidelines.

- Directly contact the requester if you have questions or concerns about the information required on the form.

- Review the form for accuracy before submitting it.

- Use black ink or type when filling out the form to ensure legibility.

- Sign and date the form to validate its accuracy and authenticity.

- Securely store a copy of the completed W-9 form for your records.

- Be aware of the form's privacy and do not share your TIN or SSN unnecessarily.

- Don't leave any required fields blank; complete all sections of the form that apply to you.

- Don't use a TIN or SSN that is not yours, as this can lead to serious legal consequences.

- Don't disregard errors; correct any mistakes as soon as you notice them.

- Don't underestimate the importance of using the correct form version; outdated forms might not be accepted.

- Don't send the form to the IRS; the W-9 is provided directly to the requester.

- Don't forget to update your W-9 information if your circumstances change, such as your name or TIN.

- Don't hesitate to consult a professional if you're unsure about how to complete the form.

- Don't ignore requests for a W-9 form; failing to provide it can result in backup withholding.

- Don't fill out the form in a rush; take your time to ensure all information is correct and legible.

- Don't use digital software that doesn't protect your privacy when filling out or sending the form.

Misconceptions

The IRS W-9 form is essential for various business dealings, especially when it pertains to tax reporting for payments made to freelancers, contractors, and vendors. However, several misconceptions surround its use and importance. Clarifying these misunderstandings ensures compliance with tax laws and smoothens business operations.

- Misconception 1: Only Employees Need to Fill Out the W-9

One common mistake is assuming that W-9 forms are only for employees. In reality, this form is specifically designed for freelancers, independent contractors, and other non-employees to provide their taxpayer identification number (TIN) to the entities that pay them. Employers use a different form, the W-4, for hiring employees.

- Misconception 2: A New W-9 Form Must Be Filed Every Year

Many believe that a new W-9 needs to be submitted annually. However, this form only needs to be updated if the contractor’s information changes, such as a change in name, address, or tax ID number. Otherwise, the initial form provided continues to be valid for all future years.

- Misconception 3: The Information on a W-9 is Not Sensitive

Some people underestimate the sensitivity of the information on a W-9. This form contains important personal details, including one's Social Security Number (SSN) or Employer Identification Number (EIN). It's crucial to protect this form from unauthorized access to prevent identity theft and fraud.

- Misconception 4: W-9 Forms are Optional for Freelancers

A final misconception is that filling out a W-9 is optional for freelancers and independent contractors. In fact, clients need this form to accurately report payments to the IRS via Form 1099-NEC. Without a W-9, clients may withhold a higher rate of taxes, affecting the contractor’s earnings.

Key takeaways

When it comes to handling taxes, particularly for businesses or independent contractors, the IRS W-9 form is a critical document. Its primary purpose is to provide information to businesses about their contractors for reporting purposes. Understanding its importance, completing it correctly, and knowing when to use it can save a lot of trouble down the line. Here are five key takeaways about filling out and using the IRS W-9 form:

- Accurate Information is Crucial: The W-9 form requires your legal name, address, and taxpayer identification number (TIN) – for most individuals, this is your Social Security Number (SSN). Ensure the information is accurate to avoid any reporting issues or backup withholding.

- Understand When to Provide a W-9: Typically, this form is requested by companies that pay you for services when you are not their employee. This helps them report payments made to you to the IRS by using the information you provide.

- Privacy Measures Should Be Observed: Given it contains sensitive information, be cautious about who you give your completed W-9 to. Only provide it to entities or individuals who have a legitimate reason to request it (e.g., your employer or a financial institution).

- No Direct Submission to the IRS: Unlike many tax forms, the W-9 is not submitted directly to the IRS. Instead, you give it to the person or entity who requests it from you. They use it to inform the IRS of the payments they've made to you through the form 1099.

- Changes in Information Require a New W-9: If your legal name, address, or TIN changes, you must complete a new W-9 form. Keeping this information current helps avoid potential issues with tax documentation or payments.

Staying informed and diligent about your tax obligations is key. The W-9 form might seem simple, but it plays a crucial role in the tax reporting process, making understanding its purpose and requirements important for anyone in the workforce, especially those working as freelancers or contractors.

Popular PDF Documents

Oklahoma Tax Permit - All vendors responsible for collecting Oklahoma sales tax are required to file this report by the specified due date.

943 - It represents a critical piece of documentation for the agricultural sector in the broader context of federal tax compliance.

What Is Form 4562 - Inputs on Form 4562 directly influence the reduction of taxable income through depreciation and amortization deductions.