Get IRS W-8BEN Form

In the world of international finance and tax compliance, navigating the complexities of cross-border transactions includes understanding the roles and requirements of certain tax forms. Among these, the IRS W-8BEN form stands out as a crucial document for non-U.S. residents who receive income from U.S. sources. This form is essentially a certificate of foreign status of beneficial ownership for United States tax withholding and reporting. It is designed for use by individuals, not entities, which distinguishes it from its counterparts that serve businesses and other types of organizations. The primary purpose of the W-8BEN is to inform U.S. withholding agents and tax-reporting entities that the individual is exempt from certain U.S. tax withholding obligations or eligible for a reduced rate under an applicable income tax treaty. Furthermore, it establishes the non-U.S. resident's claim that they are the beneficial owner of the income for which the form is being provided. By correctly completing and submitting this document, individuals can ensure proper compliance with U.S. tax laws while potentially reducing the amount of tax withheld from their U.S.-source income, making it a vital tool for international financial planning and operations.

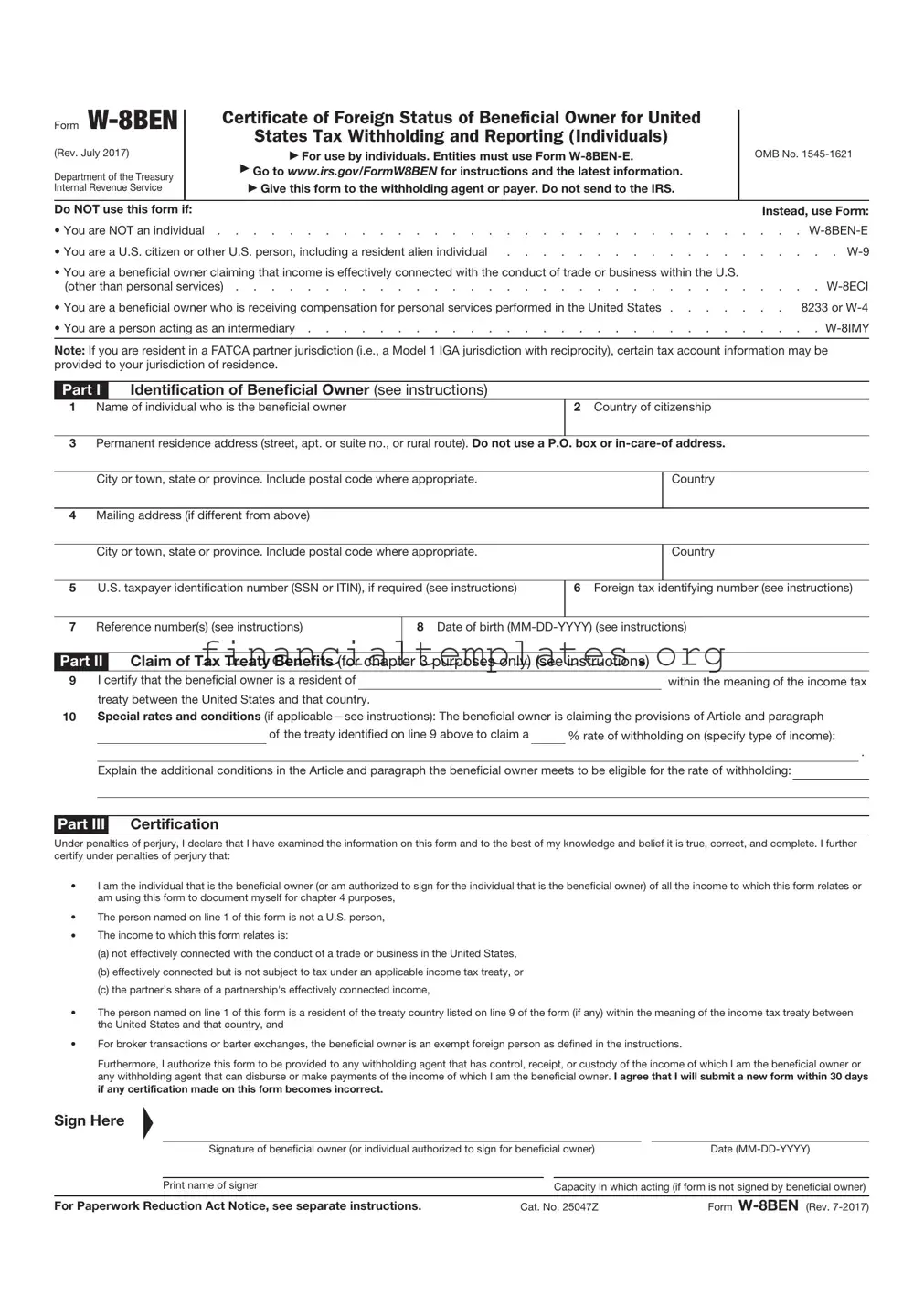

IRS W-8BEN Example

Form |

|

|

Certificate of Foreign Status of Beneficial Owner for United |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

States Tax Withholding and Reporting (Individuals) |

|

|

|

|

|

|

(Rev. October 2021) |

|

|

▶ For use by individuals. Entities must use Form |

|

|

OMB No. |

|||

Department of the Treasury |

|

|

▶ Go to www.irs.gov/FormW8BEN for instructions and the latest information. |

|

|

|

|

|

|

Internal Revenue Service |

|

|

▶ Give this form to the withholding agent or payer. Do not send to the IRS. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Do NOT use this form if: |

|

|

|

Instead, use Form: |

|||||

• You are NOT an individual |

. |

. |

. . |

. |

|||||

• You are a U.S. citizen or other U.S. person, including a resident alien individual |

. |

. |

. . |

. |

. |

. |

|||

• You are a beneficial owner claiming that income is effectively connected with the conduct of trade or business within the United States |

|

|

|

||||||

(other than personal services) |

. |

. |

. . |

. |

. |

||||

• You are a beneficial owner who is receiving compensation for personal services performed in the United States . . . |

. |

. |

. . |

|

8233 or |

||||

• You are a person acting as an intermediary |

. |

. |

. . |

. |

. |

||||

Note: If you are resident in a FATCA partner jurisdiction (that is, a Model 1 IGA jurisdiction with reciprocity), certain tax account information may be provided to your jurisdiction of residence.

Part I Identification of Beneficial Owner (see instructions)

1Name of individual who is the beneficial owner

2Country of citizenship

3Permanent residence address (street, apt. or suite no., or rural route). Do not use a P.O. box or

City or town, state or province. Include postal code where appropriate.

Country

4Mailing address (if different from above)

City or town, state or province. Include postal code where appropriate.

Country

5U.S. taxpayer identification number (SSN or ITIN), if required (see instructions)

6a Foreign tax identifying number (see instructions) |

6b Check if FTIN not legally required |

|

|

7 Reference number(s) (see instructions) |

8 Date of birth |

Part II Claim of Tax Treaty Benefits (for chapter 3 purposes only) (see instructions)

9 I certify that the beneficial owner is a resident of treaty between the United States and that country.

10Special rates and conditions (if

of the treaty identified on line 9 above to claim a |

% rate of withholding on (specify type of income): |

.

Explain the additional conditions in the Article and paragraph the beneficial owner meets to be eligible for the rate of withholding:

Part III Certification

Under penalties of perjury, I declare that I have examined the information on this form and to the best of my knowledge and belief it is true, correct, and complete. I further certify under penalties of perjury that:

•I am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to which this form relates or am using this form to document myself for chapter 4 purposes;

•The person named on line 1 of this form is not a U.S. person;

•This form relates to:

(a)income not effectively connected with the conduct of a trade or business in the United States;

(b)income effectively connected with the conduct of a trade or business in the United States but is not subject to tax under an applicable income tax treaty;

(c)the partner’s share of a partnership’s effectively connected taxable income; or

(d)the partner’s amount realized from the transfer of a partnership interest subject to withholding under section 1446(f);

•The person named on line 1 of this form is a resident of the treaty country listed on line 9 of the form (if any) within the meaning of the income tax treaty between the United States and that country; and

•For broker transactions or barter exchanges, the beneficial owner is an exempt foreign person as defined in the instructions.

Furthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the income of which I am the beneficial owner or any withholding agent that can disburse or make payments of the income of which I am the beneficial owner. I agree that I will submit a new form within 30 days if any certification made on this form becomes incorrect.

Sign Here

▲

I certify that I have the capacity to sign for the person identified on line 1 of this form.

|

Signature of beneficial owner (or individual authorized to sign for beneficial owner) |

|

Date |

|

|

|

|

|

|

|

Print name of signer |

|

|

|

|

|

|

|

|

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 25047Z |

|

Form |

|

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form W-8BEN | It is used by foreign individuals to certify their non-U.S. status and claim any applicable benefits of a tax treaty, effectively reducing the amount of U.S. tax on income from U.S. sources. |

| Applicable Individuals | This form is specifically intended for use by non-U.S. residents. U.S. citizens or entities should use other forms, such as Form W-9. |

| Tax Treaty Benefits | Foreign individuals can use Form W-8BEN to claim lower withholding tax rates or exemptions, available under tax treaties between the United States and their country of residence. |

| Validity Period | The form is valid for the year in which it is signed and for the next three calendar years, unless a change in circumstances makes any information on the form incorrect. |

| Governing Law | Form W-8BEN is governed by U.S. federal tax law, as the Internal Revenue Service (IRS) is a federal agency. There are no state-specific versions of this form. |

Guide to Writing IRS W-8BEN

Filling out the IRS W-8BEN form is a necessary step for foreign individuals receiving income from U.S. sources, aiming to claim tax treaty benefits and confirm their non-U.S. status. Although the process can seem daunting at first glance, following a step-by-step guide can make it manageable and straightforward. The correct completion of this form ensures that the individual is subject to the appropriate tax withholding rates, potentially resulting in significant savings.

- Locate the latest version of the form on the Internal Revenue Service (IRS) website to ensure that all the information provided is up-to-date and accurate.

- Enter your full name as listed on your income tax return in Part I, line 1.

- If you have a U.S. taxpayer identification number (TIN), such as an SSN or ITIN, enter it on line 6. If not, proceed to the next step.

- For line 8, provide your date of birth in the format MM-DD-YYYY.

- In Part II, line 9, enter the country of citizenship. This should be the same country whose tax treaty benefits you wish to claim.

- Complete line 10, only if applicable, to claim tax treaty benefits. You must reference the specific article of the tax treaty between your country and the U.S. that you are claiming benefits under, and why you meet the treaty terms.

- In Part III, certify that the information given is correct by signing and dating the form. Note that electronic signatures are not accepted; the form must be printed, signed, and dated in ink.

- Once completed and signed, submit the form to the withholding agent or payer and not to the IRS. It’s the responsibility of the withholding agent or payer to determine the appropriate rate of withholding—or exemption based on the information provided.

By accurately completing the IRS W-8BEN form, individuals can navigate the complexities of tax obligations with confidence, ensuring they meet their U.S. tax responsibilities while maximizing potential treaty benefits. It’s a critical document that serves as a declaration of foreign status, thereby setting the stage for proper tax treatment of international income. Always consult with a tax professional if unsure about any steps in this process to avoid mistakes that could lead to unnecessary withholding or other tax compliance issues.

Understanding IRS W-8BEN

-

What is the purpose of the IRS W-8BEN form?

The W-8BEN form, issued by the Internal Revenue Service (IRS), serves a crucial role for foreign individuals conducting financial activities in the United States. It is specifically designed to establish an individual's status as a foreign person, exempting them from certain U.S. tax withholdings. Primarily, it ensures that the correct amount of taxes is applied to interest, dividends, and other types of income that non-U.S. residents earn from U.S. sources, possibly benefiting from tax treaties between their country of residence and the United States.

-

Who needs to fill out the W-8BEN form?

The W-8BEN form must be completed by individuals who are not U.S. citizens or resident aliens. This includes foreign individuals receiving US source income that is subject to withholding, foreign individuals claiming tax treaty benefits, or those participating in certain financial transactions that require the form. Essentially, if you are a non-U.S. individual earning income from U.S. sources, you likely need to fill out this form to potentially reduce or exempt your income from U.S. taxation, in alignment with tax treaties.

-

How often does the W-8BEN form need to be updated or renewed?

The validity of the W-8BEN form generally extends from the date of signature until the end of the third succeeding calendar year, meaning it lasts for three years. For instance, a form signed on January 15, 2023, will be valid until December 31, 2026. It is imperative to submit a new W-8BEN form if there are any changes to your circumstances that affect your tax status or to renew the form once it expires to continue receiving the appropriate tax treatment on your U.S. source income.

-

Where can one obtain and submit the W-8BEN form?

- The W-8BEN form can be downloaded directly from the IRS website or obtained from the financial institution or entity requesting it from you.

- Submission processes vary depending on the requester's specific instructions. Typically, you may return the completed form to the financial institution, such as a bank or brokerage, or to the entity that pays you the income.

- It's important to complete the form with accurate information and consult with a tax advisor or the requester if you have any questions about filling it out or where to submit it.

Common mistakes

Filling out the IRS W-8BEN form is a task that demands attention to detail. This form, crucial for non-U.S. residents, helps ensure the correct amount of taxes are withheld from income earned within the United States. Unfortunately, mistakes can happen, and here are six common ones to watch out for:

-

Not Updating Personal Information: One of the first stumbling blocks comes from individuals not updating their personal information whenever it changes. This includes changes in address, immigration status, or even their name. Keeping the IRS informed of your current situation is crucial for ensuring correct processing of your tax obligations.

-

Using the Wrong Form Version: The IRS periodically updates its forms, including the W-8BEN, to reflect current tax laws and guidelines. Using an outdated form can lead to processing delays or requests for additional information, complicating what should be a straightforward filing.

-

Misunderstanding Tax Treaty Benefits: A common pitfall is incorrectly claiming tax treaty benefits without fully understanding the eligibility requirements. Each tax treaty the U.S. has with other countries specifies particular conditions under which residents of those countries may be entitled to reduced rates or exemptions. It's essential to research and verify your eligibility before claiming such benefits.

-

Omission of Required Information: The form requires specific information that individuals sometimes overlook. This includes the taxpayer identification number (TIN) of the country of residence, the U.S. TIN (if applicable), and other significant details. Omitting required information can lead to the form being rejected or improperly processed.

-

Failing to Sign and Date the Form: It might seem minor, but the absence of a signature and date invalidates the form. This oversight is surprisingly common and can delay the processing of your documentation, potentially affecting tax withholding rates and resulting in unnecessary withholding.

-

Inaccurate or Incomplete Form Fields: Lastly, individuals sometimes enter information in the wrong fields or leave sections incomplete. Given the importance of each question in determining your tax status, every field should be filled out with accurate and complete information to avoid confusion or errors in processing.

By carefully avoiding these mistakes, you can ensure the smooth processing of your IRS W-8BEN form, helping to secure your financial interests in the United States.

Documents used along the form

The IRS W-8BEN form plays a crucial role for non-U.S. persons in certifying their foreign status and eligibility for reduced withholding tax rates under tax treaties. However, the journey to compliance doesn't stop with this form. Various documents often accompany the W-8BEN, each serving its unique purpose in the broader context of international finance and taxation. Understanding these documents can pave the way for a smoother engagement with U.S. tax obligations.

- Form W-8BEN-E: Designed for entities rather than individuals, this form is utilized by foreign entities to claim foreign status or, when applicable, to assert eligibility for benefits under an income tax treaty.

- Form 1042-S: This document reports amounts paid to foreign persons, including non-resident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts that are subject to income tax withholding. It is closely associated with the information provided on W-8 forms.

- Form 8833: Treaty-Based Return Position Disclosure under Section 6114 or 7701(b). This form is used by taxpayers to disclose positions taken on a tax return that treat a U.S. income tax treaty's provisions in a way that overrules or modifies the Internal Revenue Code.

- Form W-9: Request for Taxpayer Identification Number and Certification. For individuals and entities residing and operating within the U.S., this form is the counterpart to the W-8BEN, used to provide a Social Security Number (SSN) or Employer Identification Number (EIN) to entities that will pay them income.

- Form 1099: There are various forms within the 1099 series, used to report various types of income other than wages, salaries, and tips. It serves as the domestic parallel to the international income reporting done with the 1042-S form.

- Form 8233: Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual. This form allows non-resident aliens performing independent personal services in the U.S. to claim an exemption from withholding on the basis of a tax treaty.

Each document offers a piece of the puzzle when navigating the complexities of U.S. tax law for non-U.S. persons. Together with the IRS W-8BEN form, these documents facilitate compliance, enable entitlement to treaty benefits, and ensure accurate withholding and reporting of payments to foreign individuals and entities. Given the intricate nature of these forms and their implications, individuals and organizations are encouraged to consult with tax professionals to ensure accuracy and compliance.

Similar forms

The IRS W-8BEN form is closely related to the W-8BEN-E form, specifically designed for entities rather than individuals. Where the W-8BEN is used by individuals to certify their foreign status and claim exemptions from certain U.S. tax withholdings, the W-8BEN-E serves the same purpose for foreign entities. Both forms play a crucial role in ensuring compliance with U.S. tax reporting regulations and help in claiming benefits under tax treaties, but cater to different types of beneficiaries.

Similarly, the W-9 form shares a connection with the W-8BEN, albeit serving a contrasting purpose. While the W-8BEN is for foreign individuals to assert their non-U.S. status, the W-9 is used by U.S. persons, including citizens and resident aliens, to provide their taxpayer identification numbers to entities that pay them income. This contrast highlights the IRS's efforts to distinguish between U.S. and non-U.S. persons for tax purposes.

The Form 1042-S is another document similar to the W-8BEN, as it relates to reporting income paid to non-U.S. persons. Where individuals use W-8BEN to assert their eligibility for reduced tax withholdings, the form 1042-S is the document that payers must use to report amounts paid to foreign persons, including those claimed exemptions. This connection underlines the form’s role in the documentation and reporting chain for payments to foreign individuals.

The Form 8233 is akin to the W-8BEN as it involves claims for exemptions from withholding on compensation for personal services of a non-resident alien individual. Both forms are used by individuals to claim a tax treaty benefit; however, the Form 8233 is specifically for individuals receiving compensation for personal services performed in the U.S. This specialized focus contrasts with the broader applicability of the W-8BEN, which can be used by individuals receiving various types of income.

The Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding (W-8ECI) is similar to the W-8BEN in that it is also designed for foreign individuals or entities. However, the W-8ECI is specifically used to claim that income is effectively connected with the conduct of a trade or business within the U.S., thereby subjecting it to different tax treatment. This distinction is crucial for individuals or entities that have U.S. business operations and need to be taxed accordingly.

The SS-4 Form bears a resemblance to the W-8BEN in the aspect of tax identification. The SS-4 is the application for an Employer Identification Number (EIN), which is needed by entities for tax filing and reporting purposes. Although used by entities rather than individuals and serving a different fundamental purpose, the need to identify one's tax status clearly links the SS-4 with the W-8BEN, underlining the importance of proper documentation for tax purposes.

Last but not least, the W-8IMY form is used by intermediaries and flow-through entities, not unlike the W-8BEN, which is used by individuals. Both forms partake in the complex ecosystem of tax documentation required by the IRS for foreign persons and entities engaging in financial activities within the U.S. While the W-8BEN helps individual account holders and investors to claim tax treaty benefits, the W-8IMY is utilized by entities acting between the payer and the beneficial owner to certify their status for withholding purposes.

Dos and Don'ts

The IRS W-8BEN form, formally known as the "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding," is a document that foreign individuals use to report their tax status to entities that they are doing business with in the United States. When completing this form accurately, individuals can ensure they are taxed appropriately on income earned within the U.S. Here are some essential do's and don'ts:

Do's:- Do ensure your name and the country of citizenship are exactly as they appear on your passport. This helps in verifying your identity and tax obligations accurately.

- Do provide your complete foreign address to indicate your country of residence for tax purposes. This is crucial for determining if income is effectively connected with a United States trade or business.

- Do include your U.S. Individual Taxpayer Identification Number (ITIN) if you have one, especially if you're claiming a tax treaty benefit. This number is essential for processing the benefits applicable to you.

- Do specify the type of income that you are receiving from U.S. sources. Accurately categorizing your income is necessary for applying the correct withholding tax rate.

- Do claim tax treaty benefits if you're eligible. If a tax treaty between your country and the U.S. exists, it may reduce the amount of tax you owe. Be sure to know the treaty's provisions that apply to your situation.

- Do sign and date the form. An unsigned form is not valid. Always check that you have filled out everything correctly before signing.

- Don't use the W-8BEN form if you are a U.S. citizen or a resident alien. This form is specifically designed for foreign individuals.

- Don't leave fields blank that are relevant to your financial situation. Incomplete forms may result in incorrect withholding and could lead to penalties.

- Don't provide a U.S. address as your home address. This can lead to confusion about your tax residency status.

- Don't forget to update your W-8BEN form if your personal or tax situation changes. Keeping your form up-to-date is crucial for maintaining the correct taxation level on your U.S. source income.

- Don't guess on how to fill out the form. If you're not sure about a question, it's better to seek advice from a tax professional than to make an incorrect entry.

- Don't submit your form without reviewing it for errors. Mistakes on your W-8BEN form can delay payments and affect your taxation.

Misconceptions

The IRS W-8BEN form is an important document for foreign entities and individuals that receive income from U.S. sources. Despite its significance, there are several misconceptions surrounding its use and purpose. Clarifying these misunderstandings ensures accurate compliance with U.S. tax laws and helps avoid potential legal issues.

Only applicable for individuals: A common misconception is that the W-8BEN form is exclusively for individuals. In reality, the form is designed for both individuals and entities through two distinct versions: the W-8BEN for individuals and the W-8BEN-E for entities. Each form caters to the specific reporting needs and tax statuses of the different types of beneficial owners.

Replacement for W-9 for all foreign persons: Another misunderstanding is that the W-8BEN serves as a replacement for the W-9 form for all foreign persons. The W-9 form is used by U.S. citizens, green card holders, and resident aliens to provide their taxpayer identification number (TIN). The W-8BEN is used by non-resident aliens to certify their foreign status and claim any applicable tax treaty benefits, not to replace the W-9 for all foreign persons.

Only necessary for employment income: Some believe the W-8BEN form is needed solely for employment income. This is incorrect, as the W-8BEN is required for a variety of types of income from U.S. sources, including, but not limited to, dividends, interest, rents, royalties, and certain annuities. The form helps determine the correct withholding tax rate and eligibility for tax treaty benefits across these diverse income types.

Solely reduces tax liabilities: While it's true that the W-8BEN form can help reduce withholding tax rate under applicable U.S. tax treaties, thinking of it merely as a tool for reducing tax liability is a simplification. It primarily serves as a documentation requirement for foreign persons to establish their non-U.S. status and their eligibility for treaty benefits, which may or may not reduce their tax liabilities depending on their circumstances and the specifics of the applicable tax treaty.

Key takeaways

When navigating the complexities of U.S. tax laws, foreign individuals and entities often encounter the Internal Revenue Service (IRS) W-8BEN form. This document plays a crucial role in managing tax obligations for non-U.S. persons. Here are some key takeaways about filling out and using the IRS W-8BEN form, designed to make the process less daunting:

Identify the Proper Use: The IRS W-8BEN form is intended for use by non-U.S. individuals (foreign persons or entities) to certify their foreign status and claim exemptions from certain U.S. tax withholdings on income. This form is crucial for individuals receiving income from U.S. sources.

Claim Tax Treaty Benefits: Many non-U.S. individuals are eligible for reduced rates of tax withholding due to treaties between their home country and the United States. Completing a W-8BEN form allows individuals to claim these benefits.

Different Forms for Entities: It's essential to recognize that the W-8BEN form is specifically for individuals. Entities, such as corporations or partnerships, must use the W-8BEN-E form to claim tax treaty benefits or assert their foreign status.

Validity Period: Once signed, the W-8BEN form is valid for the year in which it's signed and the next three full calendar years, unless a change in circumstances makes any information on the form incorrect.

Provide Required Information: Completing the W-8BEN form requires providing your name, country of citizenship, permanent address, and the country in which you claim tax residency under a treaty, if applicable.

Special Rules for Certain Incomes: Specific types of income, such as income from employment or operating a business, have different tax rules and may not be covered under the W-8BEN form.

No SSN or ITIN Needed in Some Cases: An individual doesn't always need a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN) to complete the W-8BEN form, unless claiming a tax treaty benefit that requires one.

Avoid Common Mistakes: Common errors include using the wrong form (W-8BEN-E instead of W-8BEN or vice versa), failing to claim a tax treaty benefit correctly, and not updating the form when circumstances change.

Direct Submission to the Requester: The W-8BEN form is submitted directly to the financial institution or paying entity, not to the IRS, unlike many other tax forms.

Consult with a Professional: Given the complexities of tax treaties and withholdings, consulting with a tax professional can be incredibly helpful to ensure that the form is filled out accurately and effectively.

Understanding the IRS W-8BEN form's nuances can significantly impact non-U.S. persons dealing with U.S. source income. Whether it's ensuring compliance with U.S. tax laws, claiming treaty benefits, or navigating the various forms and requirements, a careful approach to this task can provide significant benefits and mitigate potential issues.

Popular PDF Documents

It-201 Resident Income Tax Return - IT-201-X helps correct errors in reporting state and local bond interest, government pensions, and other specific deductions.

IRS 8822 - Guards against the risk of misplaced or undelivered IRS correspondences.

What Is Form 3921 - In summary, Form 3921 is indispensable for accurate tax reporting and financial planning concerning incentive stock options.