Get IRS W-7 (COA) Form

Many individuals find the process of dealing with tax-related documents daunting, especially when navigating the specifics of requests for unique tax considerations. Among these critical forms is the IRS W-7 (COA) form, a document crucial for individuals who are not eligible for a Social Security Number but require an Individual Taxpayer Identification Number (ITIN) to comply with U.S. tax laws. This form serves as a bridge for those needing to report income, pay taxes, or claim tax returns in situations where a Social Security Number is not applicable. The process of filing this form involves providing detailed personal information and necessary identification documents, which can be complex and requires careful attention to detail. Understanding the major aspects of the IRS W-7 (COA) form is essential for ensuring that those who find themselves in need of an ITIN can navigate their tax obligations smoothly and efficiently, without unnecessary stress or errors. The importance of this form cannot be understated, as it directly impacts an individual's ability to fulfill their tax responsibilities and access certain tax benefits rightfully.

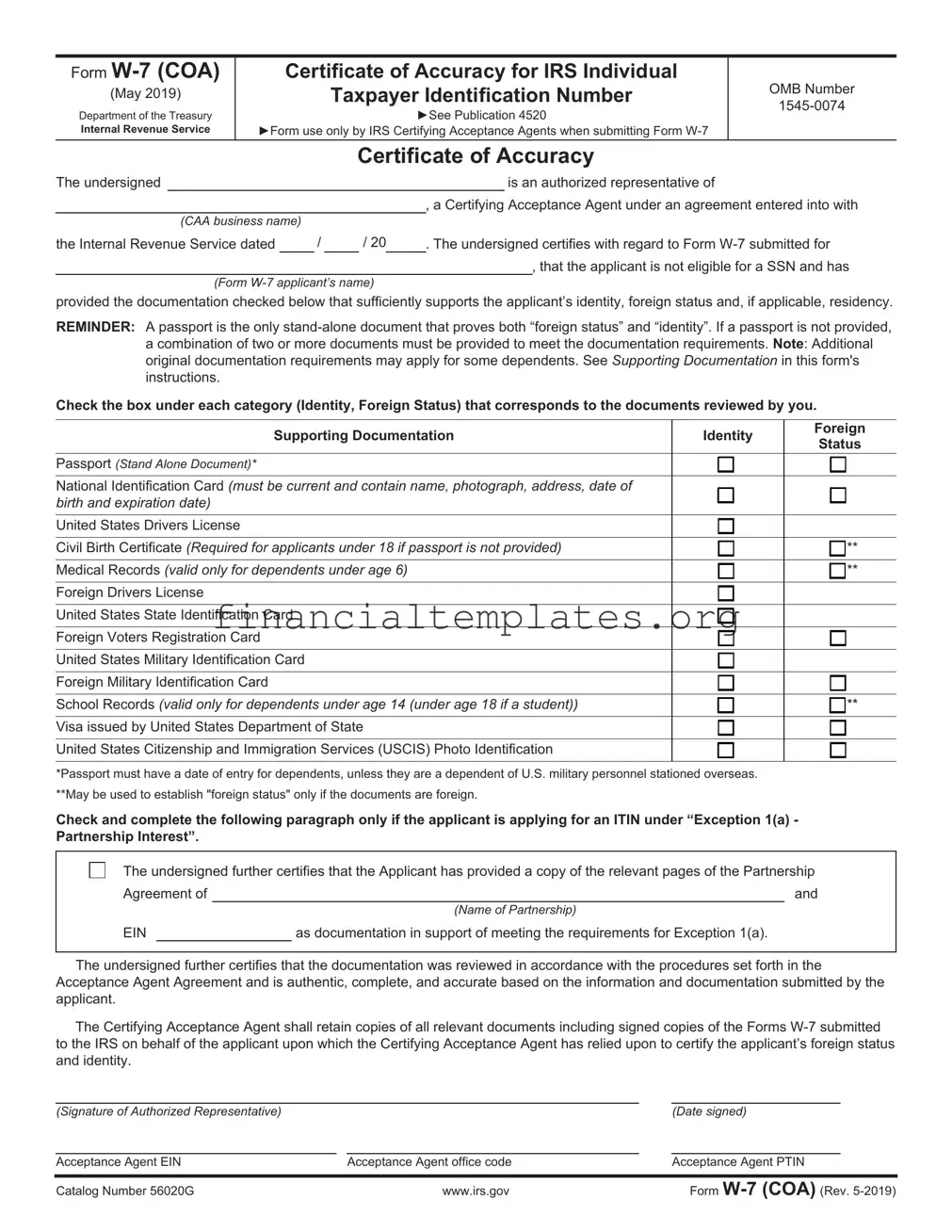

IRS W-7 (COA) Example

Form |

|

Certificate of Accuracy for IRS Individual |

OMB Number |

|||||||||

(May 2019) |

|

|

|

Taxpayer Identification Number |

||||||||

|

|

|

||||||||||

Department of the Treasury |

|

|

|

|

|

|

ŹSee Publication 4520 |

|||||

|

|

|

|

|

|

|

||||||

Internal Revenue Service |

ŹForm use only by IRS Certifying Acceptance Agents when submitting Form |

|

||||||||||

|

|

|

|

|

Certificate of Accuracy |

|

||||||

The undersigned |

|

|

|

|

|

|

|

|

|

is an authorized representative of |

|

|

|

|

|

|

|

|

|

|

, a Certifying Acceptance Agent under an agreement entered into with |

||||

|

(CAA business name) |

|

|

|

|

|

|

|

|

|||

the Internal Revenue Service dated |

/ |

/ 20 |

. The undersigned certifies with regard to Form |

|||||||||

|

|

|

|

|

|

|

|

|

|

, that the applicant is not eligible for a SSN and has |

||

|

(Form |

|

|

|

|

|

||||||

provided the documentation checked below that sufficiently supports the applicant’s identity, foreign status and, if applicable, residency.

REMINDER: A passport is the only

Check the box under each category (Identity, Foreign Status) that corresponds to the documents reviewed by you.

Supporting Documentation |

Identity |

Foreign |

|

Status |

|||

|

|

||

Passport (Stand Alone Document)* |

|

|

|

National Identification Card (must be current and contain name, photograph, address, date of |

|

|

|

birth and expiration date) |

|

|

|

United States Drivers License |

|

|

|

|

|

|

|

Civil Birth Certificate (Required for applicants under 18 if passport is not provided) |

|

** |

|

Medical Records (valid only for dependents under age 6) |

|

** |

|

|

|

|

|

Foreign Drivers License |

|

|

|

|

|

|

|

United States State Identification Card |

|

|

|

|

|

|

|

Foreign Voters Registration Card |

|

|

|

|

|

|

|

United States Military Identification Card |

|

|

|

Foreign Military Identification Card |

|

|

|

|

|

|

|

School Records (valid only for dependents under age 14 (under age 18 if a student)) |

|

** |

|

|

|

|

|

Visa issued by United States Department of State |

|

|

|

|

|

|

|

United States Citizenship and Immigration Services (USCIS) Photo Identification |

|

|

|

|

|

|

*Passport must have a date of entry for dependents, unless they are a dependent of U.S. military personnel stationed overseas.

**May be used to establish "foreign status" only if the documents are foreign.

Check and complete the following paragraph only if the applicant is applying for an ITIN under “Exception 1(a) - Partnership Interest”.

The undersigned further certifies that the Applicant has provided a copy of the relevant pages of the Partnership

Agreement of |

|

and |

||

|

|

|

(Name of Partnership) |

|

EIN |

|

as documentation in support of meeting the requirements for Exception 1(a). |

||

The undersigned further certifies that the documentation was reviewed in accordance with the procedures set forth in the Acceptance Agent Agreement and is authentic, complete, and accurate based on the information and documentation submitted by the applicant.

The Certifying Acceptance Agent shall retain copies of all relevant documents including signed copies of the Forms

(Signature of Authorized Representative) |

|

|

(Date signed) |

|

|

|

|

|

|

|

|

Acceptance Agent EIN |

|

Acceptance Agent office code |

|

Acceptance Agent PTIN |

|

|

|

|

|||

Catalog Number 56020G |

www.irs.gov |

Form |

|||

Instructions for Form

What is Form

Form

•The name of the designated authorized representative of the CAA who is completing the Certificate of Accuracy (COA).

•The legal name of the business.

•The Employers Identification Number (EIN) and office code of the CAA.

•The date that the Acceptance Agent Agreement was approved.

•The name of the ITIN Applicant.

•The type(s) of supporting documentation reviewed by the CAA to prove the ITIN applicant’s “identity” and “foreign status”.

•A statement by the CAA that they have verified to the best of their knowledge, the authenticity, accuracy and completeness of the documentation they reviewed.

•The signature of the individual who has prepared the COA and the date that it was signed.

What is the purpose of Form

The COA is a certification by the CAA that they have reviewed the supporting documentation to prove the ITIN applicant’s “identity” and “foreign status” and to the best of their knowledge the documents are complete, authentic, and accurate. Note: With the exception of documentation to prove Exception 1(a) criteria, the only documents that should be included in the COA are those that were reviewed by you to prove the applicant’s claim of identity and foreign status. All other supplemental documentation supporting “Exception” criteria, (i.e. a copy of a withholding document, a letter from a financial institution, etc,) as well as a denial letter from the Social Security Administration (if applicable) must be attached to Form

Who must submit a COA?

All CAAs are required to complete and submit a separate COA for each Form

Who can sign the Certificate of Accuracy?

Only the designated authorized representative of the business is permitted to sign the COA.

Where can I find Form

Form

Whose PTIN is required?

Only tax practitioners are required to have a PTIN. The approved authorized representative of the business must provide their PTIN on Form

Supporting Documentation

You should check only the boxes that correspond to the documents which you reviewed and certified to support the ITIN applicant’s identity and foreign status. A passport is the only stand alone document for purposes of satisfying both the “identity” and “foreign status” criteria. A passport that doesn't have a date of entry won't be accepted as a

Definitions — The following chart represents definitions for phrases used in Form

Phrase |

Definition |

|

|

The Undersigned |

This is the name of the individual who is preparing and signing the Certificate of Accuracy. This person must be the |

|

the individual who has been designated as the authorized representative of the business. |

|

|

CAA Business Name |

This is the legal name of the business that was entered by you on Form 13551, Application to Participate in the |

|

ITIN Acceptance Agent Program. |

|

|

Agreement approved date |

This is the date that IRS approved your agreement. You can locate this date on your CAA Agreement. |

___ / ___ / 20__ |

|

|

|

Form |

This is the name of the individual for whom you are completing the Form |

|

|

Name of Partnership |

The name of the partnership should be entered on this line only if you are requesting an ITIN under Exception 1 |

|

(a) – Partners in a U.S. or foreign partnership that invests in the U.S. |

|

|

EIN, Office Code and PTIN |

This is the Employer’s Identification Number (EIN) that was assigned to the business by IRS. The office code is a |

|

number assigned by the ITIN Policy Section when the application for AA status is approved. Preparer Tax |

|

Identification Number (PTIN) is required for anyone who prepares or assists in preparing federal tax returns for |

|

compensation. This number should be entered on the line for Acceptance Agent PTIN |

|

|

Date signed |

This is the date that the Certificate of Accuracy is signed by the authorized representative of the Business. |

|

|

For additional information regarding documentation, please refer to Publication 4520 Acceptance Agents Guide for Individual Taxpayer Identification Number (ITIN)

Catalog Number 56020G |

www.irs.gov |

Form |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS W-7 (COA) form is used to apply for an IRS Individual Taxpayer Identification Number (ITIN) for individuals who are not eligible for a Social Security Number (SSN). |

| Eligibility | Individuals who need to file a federal tax return but do not qualify for a SSN, including non-U.S. citizens, their spouses, and dependents, may apply using this form. |

| Documentation Required | Applicants must provide original or certified copies of documentation proving foreign status and identity, such as a passport or birth certificate. |

| Submission | The form, along with the required documentation, can be submitted either in person to an IRS-authorized Acceptance Agent or mailed directly to the IRS. |

| Processing Time | Typically, it takes about 7 to 11 weeks for the IRS to process the W-7 (COA) form and issue an ITIN. |

| Renewal | ITINs may need to be renewed if they have not been used on a federal tax return at least once in the last three consecutive tax years or if it has expired due to IRS policies. |

| Governing Law | This form is regulated by federal tax law, and its use and requirements are determined by the Internal Revenue Service (IRS), a federal agency. |

Guide to Writing IRS W-7 (COA)

Obtaining the correct taxpayer identification number is crucial for a variety of financial and tax-related processes in the United States. For those who are not eligible for a Social Security Number (SSN), the Internal Revenue Service (IRS) provides a means to obtain an Individual Taxpayer Identification Number (ITIN) through the W-7 (COA) form. This form might seem daunting at first glance, but by following a clear set of steps, it can be completed accurately and efficiently. Let's walk through the steps necessary to fill out this important document.

- Gather necessary documentation. Before you start, ensure you have all required identification and foreign status documents at hand. These could include a passport, national identification card, U.S. driver's license, or birth certificate.

- Fill out your basic information. This includes your name, mailing address, and foreign address (if applicable). Ensure the information matches the documentation you're providing.

- Answer the questions regarding your tax status. Specify whether you're completing this form for a nonresident alien tax return, resident alien tax return, or other circumstances. Choose the option that best fits your situation.

- Enter your birth information. Include your date of birth and country of birth as it appears on your birth certificate.

- Indicate your country of citizenship. List all countries where you currently hold citizenship.

- Provide identification numbers. This includes your U.S. visa number, if applicable, and any identification numbers issued to you by your country of residence or citizenship.

- Document review. You'll have to select and attach the documentation that proves your foreign status and identity. Follow the form's instructions carefully to decide which documents to attach.

- Signature and date. Sign and date the form to certify that the information provided is accurate. If you're preparing the form for someone else, there’s a separate space for your signature and the relationship to the applicant.

- Review the form. Double-check all your entries and the accompanying documents to ensure everything is correct and complete.

- Submit the form and documents. Send the completed form and all required documentation to the IRS. The address to which you need to send the form can vary, so refer to the form's instructions for the correct mailing instruction.

After submitting the form, the next steps involve waiting for the IRS to process your application. This may take several weeks. Upon approval, you will receive your ITIN in the mail. It's a critical number that plays a pivotal role in filing your taxes, opening a bank account, or even obtaining employment in some cases. Ensuring the form is filled out correctly the first time can help avoid delays. If there are any issues or the IRS requires additional information, they will contact you directly. Remember, maintaining accurate and up-to-date records with the IRS is essential for all taxpayers, including those necessitating an ITIN.

Understanding IRS W-7 (COA)

-

What is the IRS W-7 (COA) form?

The IRS W-7 (COA) form, also known as the Application for IRS Individual Taxpayer Identification Number Certificate of Accuracy, serves a vital purpose for individuals who are not eligible to obtain a Social Security Number (SSN) but still require a taxpayer identification number to comply with U.S. tax laws. This includes, but is not limited to, filing federal tax returns, claiming treaty benefits, and receiving payments from the IRS.

-

Who needs to complete the IRS W-7 (COA) form?

Individuals who require a U.S. taxpayer identification number but cannot obtain an SSN must complete the IRS W-7 (COA) form. Typically, these are foreign nationals and others who have specific tax situations, such as claiming tax treaty benefits. Dependents or spouses of U.S. citizens or resident aliens, nonresident aliens required to file a U.S. tax return, and others with specific IRS-dictated circumstances may also need to use this form.

-

What documents are required to accompany the IRS W-7 (COA) form?

A variety of documents can accompany the IRS W-7 (COA) form to verify identity and foreign status. These documents must be either originals or certified copies from the issuing agency. Common documents include a passport, U.S. Citizenship and Immigration Services (USCIS) photo identification, visa issued by the U.S. Department of State, and foreign military identification card. Specific situations may require additional documentation.

-

How does one submit the IRS W-7 (COA) form?

The IRS W-7 (COA) form can be submitted in several ways: by mail, through an acceptance agent, or in person at a designated IRS Taxpayer Assistance Center. Mailing addresses and locations for in-person submission can be found on the official IRS website. When using an acceptance agent, individuals can benefit from additional guidance through the application process.

-

What is the processing time for the IRS W-7 (COA) form?

Processing times can vary based on the time of year and the method of submission. Generally, the IRS states that it takes about 7 weeks for a W-7 form to be processed if it's filed with a tax return during the tax filing season and slightly longer if filed separately. However, applicants should be prepared for the possibility of delays and are encouraged to submit their application well in advance of when they need their Taxpayer Identification Number.

-

Is there a fee to apply for an ITIN using the IRS W-7 (COA) form?

No, there is no fee charged by the IRS to apply for an Individual Taxpayer Identification Number (ITIN) using the W-7 (COA) form. However, if an individual decides to use the services of an acceptance agent or a tax professional to help fill out and submit the form, they may charge a fee for their services.

-

What mistakes should be avoided when filling out the IRS W-7 (COA) form?

Common mistakes include not providing the required supporting documentation, submitting photocopies of documents instead of the originals or certified copies, filling out the form inaccurately, and not signing the form. Each of these mistakes can lead to delays in the processing time or outright rejection of the application. Carefully reviewing the IRS instructions for the W-7 form can help avoid these errors.

-

Can the IRS W-7 (COA) form be filled out online?

As of the current guidance, the IRS W-7 (COA) form cannot be completed or submitted online. Applicants must fill out a paper copy of the form and submit it via mail or in person, accompanied by the necessary supporting documentation.

-

How can one check the status of their IRS W-7 (COA) application?

After submitting the W-7 (COA) form, individuals can check the status of their application by calling the IRS hotline dedicated to ITIN issues. The phone number and hours of operation are available on the IRS official website. Applicants should be prepared to provide their name, address, and the date they submitted their W-7 form to receive information about their application status.

Common mistakes

Filling out the IRS W-7 (COA) form, which is used to apply for an IRS Individual Taxpayer Identification Number (ITIN), can be complex and prone to errors. Mistakes can delay processing and affect tax return filings. Below are nine common errors individuals make when completing this form.

- Not checking the appropriate box for the reason the ITIN is needed. Each reason has specific documentation requirements.

- Missing signatures and dates on the form. Every application must be signed and dated by the applicant, or if the applicant is a dependent, by the parent/guardian.

- Incorrect tax year noted. It is crucial to specify the correct tax year for which the ITIN is being applied for to avoid processing delays.

- Using an expired passport without additional documentation when a passport is the sole document for identity and foreign status; if expired, additional documentation is required.

- Failing to provide a complete foreign address. A full, detailed foreign address must be provided unless a U.S. address is the applicant’s permanent residence and the foreign address is not known.

- Forgetting to include supplemental documents. Depending on the reason for applying, additional documentation may be required. Failing to include these can result in a rejected application.

- Incomplete or incorrect National Identification Number, if applicable. Not all countries issue such a number, but if one is available, it must be accurately reported.

- Not using the most current form. The IRS updates forms regularly; using an outdated form can mean automatic rejection.

- Omitting name discrepancies documentation if the name on the application does not match exactly the name on the identification documents, appropriate documentation explaining the discrepancy must be included.

Avoiding these mistakes can greatly improve the processing time and reduce the chances of a rejected application. Individuals are encouraged to read the instructions carefully, consult with a professional if needed, and double-check their application before submission.

Documents used along the form

When individuals file the IRS W-7 (COA) form, typically aiming to obtain or renew an Individual Taxpayer Identification Number (ITIN), they find themselves navigating a labyrinth of associated documentation. This complex process ensures compliance and accuracy in identifying taxpayers who are not eligible for Social Security Numbers. Understanding the array of forms and documents that often accompany the IRS W-7 (COA) form can significantly streamline this procedural pathway, offering clarity and foresight into the necessary preparatory steps.

- Form 1040: The U.S. Individual Income Tax Return is foremost among the documents filed with the IRS W-7 (COA). It outlines the taxpayer's income, deductions, and credits, establishing the foundation for their tax obligations and entitlements.

- Proof of Identity Documents: Applicants must present a passport or a combination of two or more documents, including a driver’s license and birth certificate, to verify their identity.

- U.S. Federal Tax Return Transcript: This transcript is often needed if the applicant previously filed taxes in the United States. It serves as a detailed record of past tax returns and is used to verify income and tax compliance.

- Foreign Status Documents: Documents proving the applicant's foreign status are critical, especially if the tax return pertains to non-U.S. citizen taxpayers.

- Dependent Documentation: For individuals applying for an ITIN for dependents, official records like birth certificates or residency documents are necessary to establish the dependent's eligibility.

- Proof of Residency: Applicants must typically provide documentation, such as rental agreements or utility bills, proving U.S. residency when the tax situation requires it.

- State Identification Card: A state-issued identification card can also serve as part of the identity verification process when applying for an ITIN.

- School Records: For dependents and students, school records provide essential information supporting their claims, including their status and residency.

Navigating the requirements of the IRS W-7 (COA) form and its accompanying documents calls for a meticulous attention to detail. Each document plays a pivotal role in substantiating the applicant's claims, ensuring the IRS can make an informed decision regarding ITIN issuance. Those who approach this process with a comprehensive understanding of the required documentation are better positioned to achieve a favorable outcome. As with all tax-related matters, when in doubt, seeking advice from a tax professional can provide invaluable guidance and peace of mind.

Similar forms

The IRS W-7 form is often compared to the SS-4 form, which is used to apply for an Employer Identification Number (EIN). Both forms serve as critical steps for individuals or entities to properly engage with the U.S. tax system, though they cater to different needs. The W-7 form is primarily for individuals needing an Individual Taxpayer Identification Number (ITIN) when they don't qualify for a Social Security Number (SSN). In contrast, the SS-4 form is necessary for businesses requiring an EIN to operate legally in the United States, illustrating how each form addresses distinct aspects of tax identity and compliance.

Similarly, the W-9 form shares common ground with the W-7 form, as both are integral to tax reporting and withholding processes. The W-9 form is used by individuals or entities to provide their taxpayer identification number (TIN) to the entity from which they are receiving income, ensuring that appropriate taxes are withheld or exempted properly. While the W-7 form is aimed at individuals needing an ITIN, the W-9 serves a broader purpose, enabling U.S. persons and entities to declare their tax ID numbers to others, showcasing the diverse mechanisms through which the IRS collects taxpayer information.

The Form 1040, U.S. Individual Income Tax Return, is another document related to the W-7 form, but from the perspective of tax filing. Once an individual obtains an ITIN through the W-7 form, they often use it to file a Form 1040, fulfilling their annual income tax responsibilities. Although the W-7 is a prerequisite for the ITIN, and Form 1040 is the subsequent step for reporting yearly income, the connection between the two is undeniable. They collectively ensure that individuals, regardless of their eligibility for a Social Security Number, can comply with U.S. tax laws.

Lastly, the W-8BEN form also parallels the W-7 form in its function for non-U.S. residents. While the W-7 form allows these individuals to obtain an ITIN for tax reporting purposes, the W-8BEN form is used to claim tax treaty benefits and to certify that they are not U.S. persons. This distinction highlights the tailored approaches the IRS takes to accommodate foreign individuals' interactions with the U.S. tax system, providing pathways for compliance while recognizing the unique status of non-resident aliens and foreign entities operating within or in relation to the United States.

Dos and Don'ts

Filling out the IRS W-7 (Certificate of Accuracy for IRS Individual Taxpayer Identification Number) form is a crucial step for certain taxpayers who are not eligible for a Social Security Number. To ensure a smooth application process, here are key dos and don’ts to consider:

Do:Review the instructions for the IRS W-7 form carefully to understand the requirements and the necessary documentation.

Ensure that your application includes original documentation or certified copies from the issuing agency to support your foreign status and identity.

Fill out the form completely, providing accurate and current information.

Use the most recent version of the IRS W-7 form from the official IRS website to avoid processing delays.

Sign and date the form. An unsigned form will not be processed.

Keep a copy of the completed form and all documents sent for your records.

Mail the form to the correct IRS address. The address can change, so it's important to verify it on the IRS website or the form's instructions.

Apply for the ITIN in time if you need it for a tax return to avoid delays in your tax refund.

Seek assistance from IRS-authorized acceptance agents or consult a tax professional if you are unsure about the process or your eligibility.

Include your phone number and email address (if available) on your application to facilitate communication.

Don’t send documents without making sure they meet the IRS criteria for identity verification and foreign status.

Don’t fill out the form with outdated or incorrect information; this can result in processing delays or denial of your application.

Don’t use the W-7 form for purposes other than applying for an ITIN or renewing an existing one.

Don’t forget to check the specific instructions for the tax year you are applying for; requirements can differ year over year.

Don’t overlook the need to renew your ITIN if it has expired. ITINs not used on a federal income tax return for the last three consecutive years or those with middle digits 88, 90, 91, 92, 94, 95, 96, 97, 98, or 99 (unless renewed) will expire.

Don’t guess on any part of the form; if you’re unsure, seek out the correct information from a reliable source.

Don’t use white-out or make other alterations on the form; if you need to make a change, it’s best to start over with a new form.

Don’t neglect to include a return address on the envelope when you mail your form and documents.

Don’t mail your original documents without considering other methods of verification first. Certified copies or IRS acceptable alternatives might be safer.

Don’t lose patience. The processing of your ITIN application can take several weeks. Keep a copy of your submission and note the date it was mailed.

Misconceptions

The Internal Revenue Service (IRS) W-7 (COA) form, often surrounded by misconceptions, plays a critical role in the tax filing process for certain individuals. Clarification on these misunderstandings is crucial to ensure proper compliance and understanding of U.S. tax obligations.

- Misconception 1: The form is only for non-U.S. residents.

While it's commonly thought that the IRS W-7 (COA) form is exclusively for non-U.S. residents, it actually serves a broader audience. It is designed for individuals who are not eligible to obtain a Social Security Number (SSN) but who require a Taxpayer Identification Number (TIN) to comply with U.S. tax laws. This group may include certain non-residents, as well as residents and dependents.

- Misconception 2: Filling out the form instantly bestows tax benefits.

A common misunderstanding is that simply completing the W-7 (COA) form will grant the filer access to tax benefits. In reality, the form's purpose is to apply for a TIN, which is necessary for tax filing and reporting but does not in itself confer any tax benefits. Eligibility for tax benefits depends on a variety of factors that are assessed during the filing of the income tax return.

- Misconception 3: The application process is lengthy and complicated.

Many are under the impression that the application process for obtaining a TIN via the W-7 (COA) form is excessively complex and time-consuming. Although the process does require attention to detail and specific documentation, the IRS provides comprehensive guidance to assist applicants. By following the provided instructions carefully, individuals can complete the process efficiently.

- Misconception 4: It's a one-time form with permanent effects.

It is often mistakenly believed that once the W-7 (COA) form is filed and a TIN is issued, no further action is required. However, in some cases, the IRS may require individuals to reapply or renew their TIN, depending on changes in their tax status or other relevant circumstances.

- Misconception 5: Personal attendance at an IRS office is mandatory to submit the form.

This misunderstanding can cause unnecessary concern for individuals who live far from an IRS office or have difficulty traveling. In fact, the IRS allows for the submission of the W-7 (COA) form via mail, and under certain circumstances, through an acceptance agent or by utilizing the services of a certified professional, thereby accommodating individuals in diverse situations.

Key takeaways

The Internal Revenue Service (IRS) Form W-7 (Certificate of Accuracy for IRS Individual Taxpayer Identification Number), is a critical document for those who are not eligible for a Social Security Number (SSN) but require a U.S. taxpayer identification number to comply with U.S. tax laws. Understanding the correct way to fill out and utilize this form can help individuals navigate the complexities of tax regulations more effectively. Here are key takeaways for successfully managing the IRS W-7 (COA) application process:

- Eligibility Criteria: Before initiating the process, individuals should confirm their eligibility for an Individual Taxpayer Identification Number (ITIN). This includes foreign nationals and other individuals who have federal tax reporting or filing requirements and do not qualify for an SSN.

- Accuracy is Crucial: When filling out the IRS W-7 (COA) form, thoroughness and accuracy are paramount. Any discrepancy or mistake can lead to delays in processing or even rejection of the application. It’s important to review the form multiple times and ensure all provided information is correct and current.

- Supporting Documentation: Applicants must attach relevant supporting documentation to validate their identity and foreign status. This includes a passport or a combination of documents such as a U.S. state identification card, foreign driver's license, birth certificate, or other national identification document. These documents must be either originals or copies certified by the issuing agency.

- Understanding Taxpayer Rights: Individuals applying for an ITIN should familiarize themselves with their rights under U.S. tax law. This includes understanding the confidentiality of the information provided to the IRS and knowing that obtaining an ITIN does not change an individual’s immigration status or right to work in the United States.

- Tax Return Attachment Requirement: Generally, the IRS W-7 (COA) form must be submitted alongside a federal tax return, unless the applicant meets an exception. This links the ITIN application directly to the federal tax responsibilities the applicant is trying to fulfill, aligning the process with the individual’s tax obligations.

Utilizing the IRS W-7 (COA) form properly is a significant step for those who are not eligible for a Social Security Number but still have tax responsibilities or reporting requirements in the United States. Ensuring that all information is complete, accurate, and accompanied by the necessary documentation can facilitate a smoother process in obtaining an Individual Taxpayer Identification Number.

Popular PDF Documents

Office Depot Nonprofit Discount - Applicants can mail, fax, or email the completed form along with their tax-exemption certificate to Office Depot.

What Is the Savers Credit - Eligibility requirements for Form 8880 include not being a full-time student and not being claimed as a dependent on someone else’s tax return.

Form 843 Irs - It is instrumental for those pursuing a refund of taxes or abatements that were incorrectly applied to their account.