Get IRS W-7 Form

In the intricate world of United States tax law, the IRS W-7 form emerges as a pivotal document for a specific group of taxpayers. This form is the gateway for individuals who are not eligible to obtain a Social Security Number (SSN) to acquire an Individual Taxpayer Identification Number (ITIN). The ITIN then enables these individuals to comply with U.S. tax laws, and, under certain conditions, allows them to file federal tax returns, claim treaty benefits, and receive refunds. The W-7 form's importance is underscored by its role in the tax system, ensuring everyone contributes their fair share, regardless of their citizenship or residency status. Furthermore, it assists in providing these individuals access to banking and other financial services that require taxpayer identification. Navigating the specifics of the W-7 form reveals the complexities of tax law compliance, evidencing the careful balance between regulatory requirements and the facilitation of inclusive financial participation.

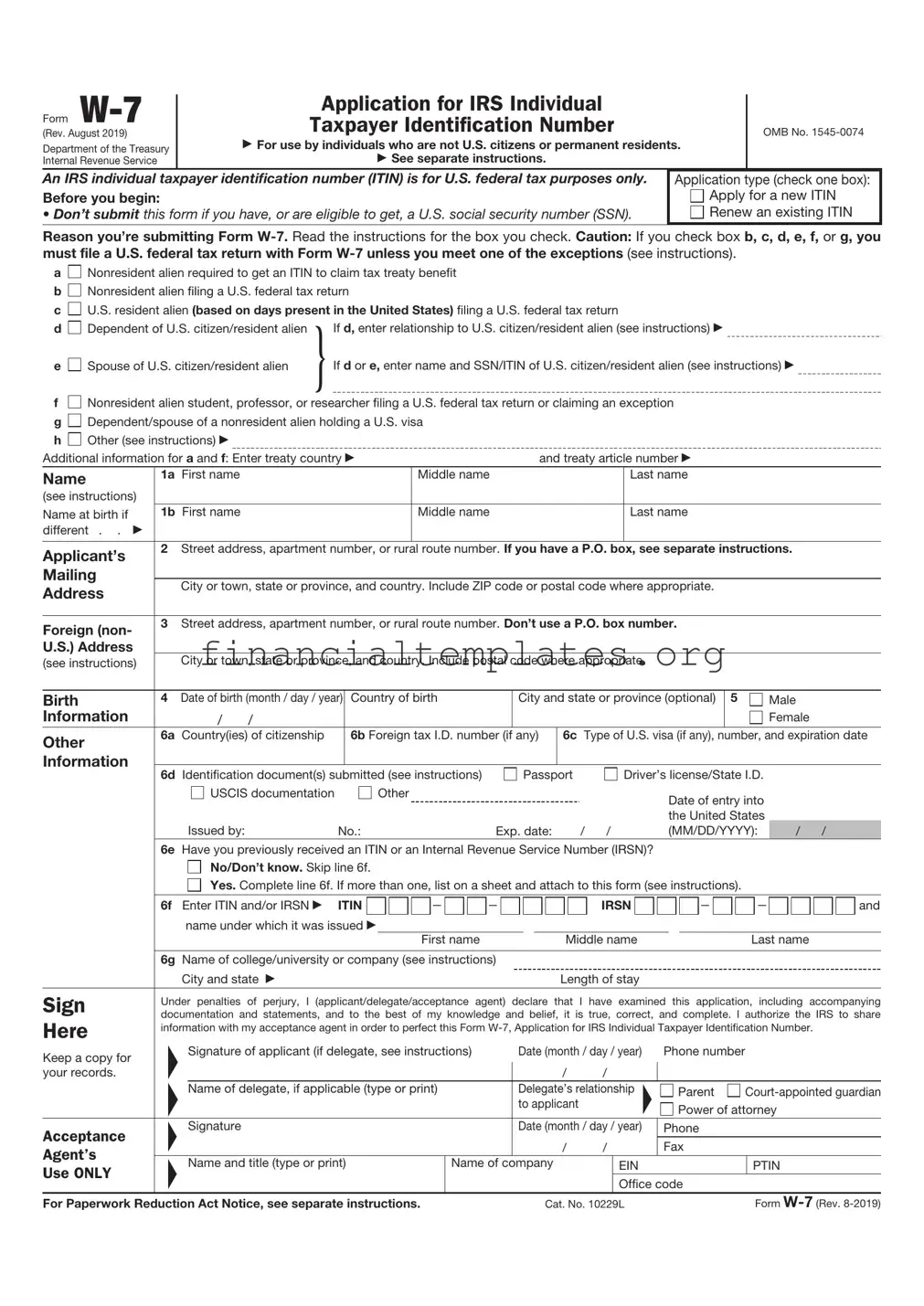

IRS W-7 Example

Form

(Rev. August 2019)

Department of the Treasury

Internal Revenue Service

Application for IRS Individual

Taxpayer Identification Number

For use by individuals who are not U.S. citizens or permanent residents.

See separate instructions.

OMB No.

An IRS individual taxpayer identification number (ITIN) is for U.S. federal tax purposes only.

Before you begin:

•Don’t submit this form if you have, or are eligible to get, a U.S. social security number (SSN).

Application type (check one box):

Apply for a new ITIN Renew an existing ITIN

Reason you’re submitting Form

a b c d

e

Nonresident alien required to get an ITIN to claim tax treaty benefit

Nonresident alien filing a U.S. federal tax return

U.S. resident alien (based on days present in the United States) filing a U.S. federal tax return

Dependent of U.S. citizen/resident alien }If d, enter relationship to U.S. citizen/resident alien (see instructions)

If d or e, enter name and SSN/ITIN of U.S. citizen/resident alien (see instructions)

f |

Nonresident alien student, professor, or researcher filing a U.S. federal tax return or claiming an exception |

g |

Dependent/spouse of a nonresident alien holding a U.S. visa |

h |

Other (see instructions) |

Additional information for a and f: Enter treaty country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and treaty article number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

Name |

1a First name |

|

|

|

|

|

|

|

|

Middle name |

|

|

|

|

|

|

|

|

|

|

|

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

(see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name at birth if |

1b First name |

|

|

|

|

|

|

|

|

Middle name |

|

|

|

|

|

|

|

|

|

|

|

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

different . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Applicant’s |

2 Street address, apartment number, or rural route number. If you have a P.O. box, see separate instructions. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or town, state or province, and country. Include ZIP code or postal code where appropriate. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Foreign (non- |

3 Street address, apartment number, or rural route number. Don’t use a P.O. box number. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S.) Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(see instructions) |

|

City or town, state or province, and country. Include postal code where appropriate. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Birth |

4 Date of birth (month / day / year) |

Country of birth |

|

|

City and state or province (optional) |

5 |

|

|

Male |

||||||||||||||||||||||||||||||||||||||||||||

Information |

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Female |

|||||||||

Other |

6a Country(ies) of citizenship |

|

6b Foreign tax I.D. number (if |

any) |

6c Type of U.S. visa (if any), number, and expiration date |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6d Identification document(s) submitted (see instructions) |

|

|

|

|

Passport |

|

|

Driver’s license/State I.D. |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

USCIS documentation |

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of entry into |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the United States |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Issued by: |

|

No.: |

|

|

|

|

|

|

|

|

|

Exp. date: |

/ |

/ |

|

|

|

|

|

(MM/DD/YYYY): |

/ / |

|

|

|

|

|||||||||||||||||||||||||

|

6e Have you previously received an ITIN or an Internal Revenue Service Number (IRSN)? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

No/Don’t know. Skip line 6f. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Yes. Complete line 6f. If more than one, list on a sheet and attach to this form (see instructions). |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

6f Enter ITIN and/or IRSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IRSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

ITIN |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

|

|

and |

|||||||||

|

|

name under which it was issued |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

First name |

|

|

|

|

|

|

|

|

|

Middle name |

|

|

|

|

|

|

|

|

|

|

|

Last name |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

6g Name of college/university or company (see instructions) ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

City and state |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Length of stay ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Sign |

Under penalties of perjury, I (applicant/delegate/acceptance agent) declare that I have examined this application, including accompanying |

||||||||||||||||||||||||||||||||||||||||||||||||||||

documentation and statements, and to the best of my knowledge and belief, it is true, correct, and complete. I authorize the IRS to share |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

Here |

information with my acceptance agent in order to perfect this Form |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

Keep a copy for |

FF |

|

Signature of applicant (if delegate, see instructions) |

|

|

Date (month / day / year) |

F |

|

Phone number |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of delegate, if applicable (type or print) |

|

|

Delegate’s relationship |

|

|

|

|

Parent |

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to applicant |

|

|

|

|

|

|

|

|

Power of attorney |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Acceptance |

F |

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date (month / day / year) |

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

|

|

|

|

Fax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Agent’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

F |

|

Name and title (type or print) |

|

|

|

|

|

|

Name of company |

|

|

|

|

EIN |

|

|

|

|

|

|

|

|

|

|

|

PTIN |

|||||||||||||||||||||||||||

Use ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 10229L |

Form |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of W-7 Form | Used to apply for an IRS Individual Taxpayer Identification Number (ITIN). |

| Applicants | Individuals who are not eligible to obtain a Social Security Number (SSN) but need a tax identification number for federal tax purposes. |

| When to File | Filed with a federal tax return when an ITIN is required to fulfill a tax obligation in the United States. |

| Documentation Required | Applicants must provide original documentation or certified copies from the issuing agency to prove foreign/alien status and identity. |

| Processing Time | Typically, it takes about 7 weeks to receive an ITIN if the application is complete and all required documentation is provided. |

| Validity Period | ITINs may expire if not used on a federal income tax return for any year during a period of 5 consecutive years. |

| Governing Law | Federal law governs the application and issuance of ITINs through the W-7 form, not state-specific laws. |

Guide to Writing IRS W-7

Filling out the IRS W-7 form is an important step for individuals who need to apply for an Individual Taxpayer Identification Number (ITIN). The process can seem daunting, but by following a clear set of steps, applicants can navigate through it with confidence. After completing the form, it will be submitted along with the required documentation to the IRS. Upon review, if everything is in order, the IRS will issue an ITIN. This number is crucial for those who are not eligible for a Social Security Number (SSN) but still need to comply with U.S. tax laws.

- Gather necessary documents. Before beginning the form, make sure you have identification documents ready. These include a passport or two or more documents that prove foreign status and identity.

- Download the latest version of the IRS W-7 form from the IRS website to ensure you're using the most current form.

- Start by entering your name and mailing address. Ensure this information is consistent with your identification documents.

- Fill in your foreign status and identity information. This includes your date of birth, country of citizenship, and foreign tax ID number, if applicable.

- Specify the reason you're applying for an ITIN by checking the appropriate box that matches your situation. If you're submitting the form because of a tax return, attach the return to your application.

- Enter your U.S. nonresident alien status information, if it applies. This involves noting your visa type, number, and expiration date.

- Sign and date the form. Make sure you read the declarations carefully before signing. If you're using a paid preparer, they must also fill in their section and sign.

- Attach the required identification documents or certified copies from the issuing agency to your form. Photocopies are not acceptable unless they are certified.

- Review your application thoroughly. Check for any mistakes or missing information to avoid processing delays.

- Send your completed W-7 form along with the tax return (if applicable) and identification documents to the IRS address listed in the form's instructions. You can also apply in person at designated IRS taxpayer assistance centers or via an acceptance agent.

Once the form is submitted, the waiting process begins. It usually takes about 6 to 10 weeks for the IRS to process your application and mail your ITIN. During peak periods, processing times may be longer. If additional information is required, the IRS will contact you. Receiving your ITIN paves the way to fulfilling your tax obligations effectively, even without a Social Security Number.

Understanding IRS W-7

Welcome to the frequently asked questions section about the IRS W-7 form. Here, you will find detailed answers to some common queries about this important document.

What is IRS Form W-7?

The IRS Form W-7, also known as the Application for IRS Individual Taxpayer Identification Number (ITIN), is designed for individuals who are required to have a U.S. taxpayer identification number but do not have, and are not eligible to obtain, a Social Security Number (SSN).

Who needs to fill out a W-7 form?

This form is necessary for individuals who are not eligible for a Social Security Number but still need to file a U.S. federal tax return or claim a refund. This group might include non-resident aliens required to file a U.S. tax return, U.S. resident aliens filing a U.S. tax return based on days present in the United States, and dependents or spouses of U.S. citizens or resident aliens.

What documents are needed to apply for an ITIN using Form W-7?

Applicants must submit original documentation or certified copies from the issuing agency to prove their identity and foreign status. This includes a passport, which is the only document that can stand alone, or a combination of documents, such as a birth certificate, driver's license, or other government-issued ID.

How do I submit Form W-7?

Form W-7 can be submitted to the IRS either by mail, in person through an IRS-authorized Acceptance Agent, or at an IRS Taxpayer Assistance Center. Accompanying tax returns should be attached if they apply to your situation.

Can I apply for an ITIN for my dependents?

Yes, you can apply for an ITIN for your dependents when filing your tax return if they require a U.S. taxpayer identification number and do not qualify for a Social Security Number. This is commonly needed for dependents in the United States who need to be claimed on a tax return.

Is it possible to renew an ITIN?

Yes, ITINs must be renewed if they have not been included on a U.S. federal tax return at least once in the last three consecutive tax years or if the ITIN has expired. The IRS periodically updates its rules regarding which ITINs need to be renewed, so it's important to stay informed on the current requirements.

How long does it take to receive an ITIN after submitting Form W-7?

The processing time for an ITIN application can vary but generally takes about 7 weeks. If you haven’t received any correspondence from the IRS after 7 weeks, you may contact the IRS ITIN office to inquire about the status of your application.

Can Form W-7 be filed electronically?

As of now, Form W-7 cannot be filed electronically. The form must be submitted through the mail, or in person via an IRS-authorized Acceptance Agent or at an IRS Taxpayer Assistance Center.

What happens if my ITIN application is denied?

If your ITIN application is denied, the IRS will send you a letter explaining the reason for denial. You have the option to reapply and include any additional documentation that might clarify your eligibility. It's also recommended to seek assistance from an IRS-authorized Acceptance Agent for guidance.

Are there any fees associated with applying for an ITIN?

The IRS does not charge a fee to apply for an ITIN. However, if you choose to use the services of an Acceptance Agent, they may charge a fee for their services.

Understanding and complying with the requirements for Form W-7 can be crucial for individuals who need to navigate the U.S. tax system without a Social Security Number. It's always recommended to review the latest IRS guidelines or seek advice from a tax professional when applying for or renewing an ITIN.

Common mistakes

Filling out the IRS W-7 form, necessary for applying for an Individual Taxpayer Identification Number (ITIN), is a critical step for those who are not eligible for a Social Security Number (SSN) but still need to comply with U.S. tax laws. Despite its importance, applicants often encounter pitfalls that can lead to delays or rejection. Here are the top 10 mistakes made during this process:

- Not checking the appropriate reason box for applying on the form. It's vital to select the reason that exactly matches your situation.

- Using an outdated form version is a common mistake. Always ensure you're filling out the latest version available on the IRS website.

- Failing to include the required supporting documentation, such as identity and foreign status proof, can result in processing delays.

- Providing incorrect information, like names or dates, that doesn't match the details on your supporting documents.

- Applicants often miss signing the form, an oversight that renders the submission invalid.

- Another frequent error is not using the official IRS address for submission, leading to documents being sent to the wrong place.

- Forgetting to include a U.S. federal tax return when required. Some applicants must attach a tax return, depending on their reason for applying.

- Making calculational errors on attached tax returns, if applicable, can also cause delays or the need for corrections.

- Some individuals document their mailing address incorrectly, complicating communications with the IRS.

- Last but not least, choosing an expired identification document for verification purposes can lead to automatic rejection.

By diligently avoiding these errors, applicants can smooth the process of obtaining an ITIN. Attentiveness to detail and thoroughness are key to a successful application.

Documents used along the form

The IRS W-7 form is a crucial document used to apply for an Individual Taxpayer Identification Number (ITIN). Along with it, numerous documents are typically required to ensure compliance and complete various financial and legal processes. The following list outlines some of the key documents often used in conjunction with the IRS W-7 form.

- Passport: The most commonly accepted standalone document which proves foreign status and identity.

- U.S. Federal Tax Return: Required to show the necessity for an ITIN for tax reporting purposes.

- Birth Certificate: Helps establish the age and identity of the applicant, especially necessary for dependents.

- U.S. Visa: If issued, it can serve as identification and proves the applicant's legal entry into the U.S.

- Foreign Driver’s License: Can be used as proof of identity if the applicant doesn't have a U.S. driver's license.

- U.S. State Identification Card: An alternative identification for those who don’t have a U.S. driver's license.

- School Records: For dependents and students, these records help prove identity and foreign status.

- Medical Records: Essential for dependents under 14 years (under 18 if a student) to establish identity.

- Bank Statements: Might be necessary to provide additional information or clarify details about financial status.

- Lease Agreements: Could be required to establish residency or physical presence in the United States.

Collecting these documents in preparation for the ITIN application is a detailed process that requires attention to the specific requirements of each case. Proper documentation supports the application, ensuring a smoother process for obtaining an ITIN.

Similar forms

The IRS 1040 form shares similarities with the W-7 form because both are essential when dealing with personal income tax matters. While the W-7 form is used to apply for an IRS Individual Taxpayer Identification Number (ITIN), the 1040 form is the standard federal income tax form used to report an individual’s annual income. Both forms are crucial for the IRS to determine the taxpayer's tax liabilities and ensure the correct amount of tax is paid or refunded.

The Form SS-4, Application for Employer Identification Number (EIN), is akin to the W-7 in that both involve obtaining identification numbers from the IRS. However, while an individual uses the W-7 to obtain an ITIN, the SS-4 is used by entities to obtain an EIN. These numbers are foundational for the IRS's ability to identify and track taxpayers and their tax liabilities.

Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding, is somewhat parallel to the W-7 form. While the W-7 allows individuals who are not eligible for a Social Security Number to file taxes, W-8BEN is used by foreign individuals to claim tax treaty benefits and exemptions from certain U.S. tax withholdings. Both forms address the tax responsibilities of individuals without U.S. citizenship but with U.S. tax reporting requirements.

Form W-9, Request for Taxpayer Identification Number and Certification, is used by U.S. persons to provide their taxpayer identification number to entities that pay them income. Like the W-7, the W-9 helps maintain accurate tax records. However, the W-7 is specifically for obtaining an ITIN, while the W-9 is for confirming an existing Taxpayer Identification Number (TIN), whether it’s a Social Security Number or an ITIN, to other parties.

Form 8822, Change of Address, though primarily for notifying the IRS of a change in address, shares a fundamental similarity with the W-7 as both involve updating personal information with the IRS to facilitate accurate tax administration. The W-7 updates a taxpayer’s identification records, while Form 8822 ensures the IRS has the correct address on file.

The Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, known as Form 4868, is similar to the W-7 in its purpose of facilitating compliance with tax obligations. While the W-7 is about obtaining the necessary identification to file taxes, Form 4868 is used to request more time to file the actual tax returns, showing that both forms are instrumental in managing tax filing duties.

Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit, is related to the W-7 in the operational aspect of tax filing and benefits. Form 8850 is used by employers to pre-screen and certify that an employee is eligible for the work opportunity tax credit. Like the W-7, which facilitates an individual’s ability to fulfill their tax responsibilities, Form 8850 is a step in the process to claim specific tax benefits.

Form 8962, Premium Tax Credit, is used to calculate the amount of premium tax credit an individual is eligible for and reconcile it with any advance payments of the credit. It correlates with the W-7 in that both are involved in the computation and reconciliation of taxes, ensuring that taxpayers either pay the correct amount or receive the appropriate refunds or credits due to them.

The Child Tax Credit Update Portal, while not a form in the traditional sense, functions in a related capacity to the W-7 by allowing individuals to update their tax information for specific credits. Similar to how the W-7 updates the IRS with necessary identification information, the portal enables taxpayers to update their status to accurately receive the Child Tax Credit, showing both tools are designed to aid in accurate tax administration.

Dos and Don'ts

When filling out the IRS W-7 form, which is used to apply for an Individual Taxpayer Identification Number (ITIN), there are specific guidelines you should follow. Adherence to these guidelines ensures that your application is processed smoothly and without unnecessary delays. Below are lists of things you should do and shouldn't do when completing this form.

What You Should Do:

- Ensure you're eligible for an ITIN by reviewing the IRS criteria before completing the form.

- Use blue or black ink when filling out the form to ensure that the information is legible and can be scanned correctly.

- Provide your complete and accurate mailing address to receive correspondence from the IRS.

- Include your original identification documents or certified copies from the issuing agency to prove your identity and foreign status.

- Attach a federal income tax return to your W-7 form unless you meet an exception, in which case you should include the exception documentation.

- Enter your name exactly as it appears on your passport or other identification documents to avoid discrepancies.

- Sign and date the form to certify that the information provided is accurate.

- If applicable, fill out the section concerning a third-party designee who is authorized to discuss the application with the IRS.

- Review the completed form for any errors or missing information before submission.

- Keep a copy of the completed W-7 form and all submitted documentation for your records.

What You Shouldn't Do:

- Don't leave any required fields blank. If a particular section does not apply, indicate with "N/A" (not applicable).

- Don't use pencil or inks in colors other than blue or black, as they may not be readable when scanned.

- Don't submit documents that are expired. The IRS requires current, valid identification.

- Don't send photocopies or notarized copies of identification documents unless they are certified copies from the issuing agency.

- Don't forget to include your daytime phone number in case the IRS needs to contact you for additional information.

- Don't apply for an ITIN if you are eligible to obtain a Social Security Number (SSN).

- Don't overlook the necessity to renew your ITIN if it has expired and you still have tax filing requirements.

- Don't neglect to review the specific instructions for each section; doing so can help avoid common mistakes.

- Don't guess on dates or figures; ensure all information is accurate and based on documented evidence.

- Don't mail the form and documents to the wrong IRS address, as it may delay processing.

Misconceptions

When it comes to understanding the Internal Revenue Service (IRS) and its forms, misconceptions can easily arise. One such form that often gets misunderstood is the IRS W-7 form, which is used to apply for an Individual Taxpayer Identification Number (ITIN). Below are seven common misconceptions about the IRS W-7 form explained to foster a better understanding.

- All non-U.S. citizens must fill out the W-7 form. This is not accurate. The W-7 form is specifically for individuals who are not eligible to obtain a Social Security Number (SSN) but still have a requirement to furnish a taxpayer identification number for federal tax purposes or for another specific reason outlined by the IRS.

- You can only submit the W-7 form during tax season. This misconception is widespread but untrue. While it's common to submit the W-7 form when filing a federal income tax return, the form can actually be submitted at any point in the year if the individual meets the eligibility criteria.

- Submitting a W-7 form will automatically make you liable to pay U.S. taxes. Submitting this form does not create a tax liability by itself. It merely provides an individual with a taxpayer identification number, which is used for tax purposes. Whether someone is liable for U.S. taxes depends on a range of factors including their income, residency status, and specific tax treaty agreements between the U.S. and other countries.

- The IRS W-7 form is only for individuals who earn income in the United States. Although earning income in the U.S. is a common reason for needing an ITIN, there are other reasons one might need to fill out a W-7 form. These can include opening a U.S. bank account or being a dependent or spouse of a U.S. taxpayer.

- You need a lawyer to complete the W-7 form. While legal advice might be helpful in complex situations, many individuals can complete the W-7 form by carefully following the instructions provided by the IRS. The IRS also provides assistance through its acceptance agent program to help applicants navigate the process.

- It costs money to apply for an ITIN using the W-7 form. The IRS does not charge a fee to apply for an ITIN. However, there might be costs associated with obtaining the necessary documentation to support the application or if you decide to use a professional to help fill out the form.

- The ITIN expires as soon as you get a Social Security Number (SSN). While it is true that individuals who later become eligible for a SSN should not continue using the ITIN, the ITIN itself does not automatically expire upon receiving a SSN. It may still be active until its expiration date set by the IRS, and individuals are responsible for rescinding the ITIN and updating their information with the IRS upon obtaining a SSN.

Key takeaways

The IRS W-7 form is used to apply for an IRS Individual Taxpayer Identification Number (ITIN), which is necessary for individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security Number (SSN).

Applicants must complete the W-7 form with accurate information, including their name, mailing address, birth information, and foreign tax ID number, if applicable. Misinformation can lead to the rejection of the application.

Supporting documents are crucial: To successfully apply for an ITIN, you must provide documents that prove your identity and foreign status. Typically, a passport or birth certificate, along with U.S. visa information if applicable, are required.

Tax Return Association: The W-7 form is usually submitted along with a federal income tax return, unless you meet one of the exceptions. It’s important to understand whether you need to file it with your tax return or if your situation allows for a separate submission.

There are specific times of the year when processing times may be longer due to high volume. Planning accordingly by applying as early as possible is advisable, especially if you need the ITIN for a tax deadline.

Renewing an ITIN is necessary if it has not been used on a federal tax return at least once in the last three consecutive years. Also, ITINs with middle digits 88, and those in the series 90 through 99 that were assigned before 2013, expired at the end of a specific year and must be renewed.

Application accuracy is key, but if an error occurs or circumstances change, the IRS can be contacted for guidance on corrections. It’s crucial to address errors promptly to avoid complications with tax return processing.

The W-7 form is available in multiple languages, making it accessible to a broad range of applicants. However, the form must be completed in English to be processed.

Popular PDF Documents

Va Home Loan Checklist - A clear and orderly presentation of a veteran's loan information, facilitating a smoother loan processing journey.

Driver Contract Agreement With Vehicle Owner - Determines lease types and rates based on vehicle age and efficiency, guiding lessees in selecting suitable leasing options.

IRS 941-X - Correcting past tax errors using the 941-X form is a sign of a responsible employer who maintains integrity in business practices.