Get IRS W-4V Form

The interplay between individual income and the taxes levied on it by the government forms a complex web, where understanding each thread can be crucial to navigating financial health effectively. Within this intricate spectrum lies a tool designed to offer a semblance of control to those receiving certain government benefits: the IRS W-4V form. This voluntary form is an avenue through which recipients of unemployment compensation, social security benefits, and certain other government payments can request federal tax withholding directly from these payments. It is a proactive step for individuals aiming to manage their tax obligations smoothly throughout the year, thus avoiding unexpected tax bills and potential penalties during the annual tax filing season. Despite its relative obscurity, the significance of the IRS W-4V form in financial planning and tax management cannot be understated, as it embodies an essential mechanism for aligning anticipated tax liabilities with reality, thereby affording peace of mind and financial stability to those it impacts.

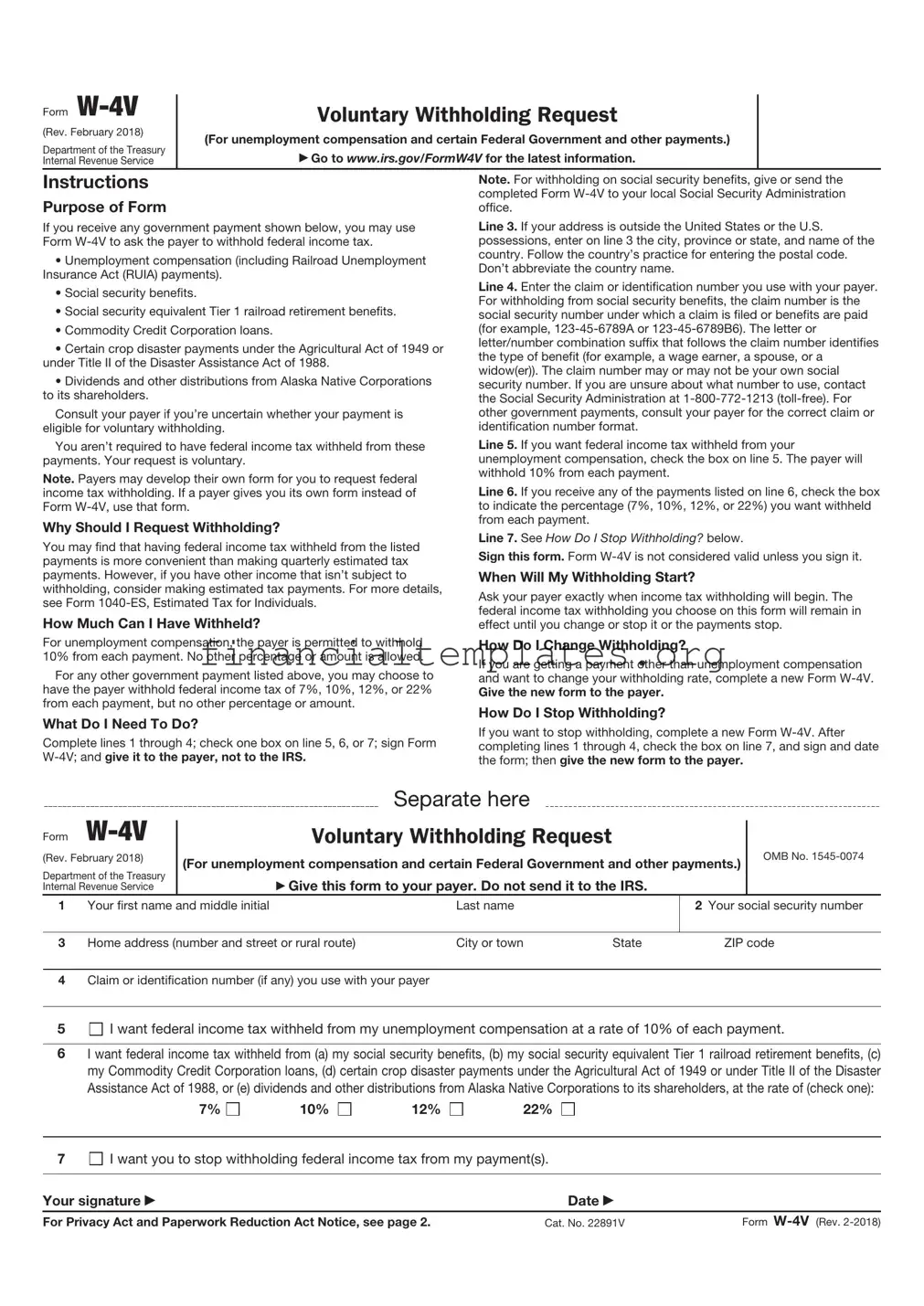

IRS W-4V Example

Form |

|

|

Voluntary Withholding Request |

|

|

|

|||||

|

|

|

|

|

|||||||

(Rev. February 2018) |

|

(For unemployment compensation and certain Federal Government and other payments.) |

|

||||||||

Department of the Treasury |

|

|

|||||||||

|

|

Go to www.irs.gov/FormW4V for the latest information. |

|

|

|

||||||

Internal Revenue Service |

|

|

|

|

|

||||||

Instructions |

|

|

|

Note. For withholding on social security benefits, give or send the |

|||||||

Purpose of Form |

|

|

|

completed Form |

|||||||

|

|

|

office. |

|

|

|

|

|

|||

If you receive any government payment shown below, you may use |

Line 3. If your address is outside the United States or the U.S. |

||||||||||

Form |

possessions, enter on line 3 the city, province or state, and name of the |

||||||||||

• Unemployment compensation (including Railroad Unemployment |

country. Follow the country’s practice for entering the postal code. |

||||||||||

Don’t abbreviate the country name. |

|

|

|

||||||||

Insurance Act (RUIA) payments). |

|

|

|

|

|||||||

|

Line 4. Enter the claim or identification number you use with your payer. |

||||||||||

• Social security benefits. |

|

|

|||||||||

|

|

For withholding from social security benefits, the claim number is the |

|||||||||

• Social security equivalent Tier 1 railroad retirement benefits. |

|||||||||||

social security number under which a claim is filed or benefits are paid |

|||||||||||

• Commodity Credit Corporation loans. |

|

(for example, |

|||||||||

• Certain crop disaster payments under the Agricultural Act of 1949 or |

letter/number combination suffix that follows the claim number identifies |

||||||||||

the type of benefit (for example, a wage earner, a spouse, or a |

|||||||||||

under Title II of the Disaster Assistance Act of 1988. |

|||||||||||

widow(er)). The claim number may or may not be your own social |

|||||||||||

• Dividends and other distributions from Alaska Native Corporations |

|||||||||||

security number. If you are unsure about what number to use, contact |

|||||||||||

to its shareholders. |

|

|

|

the Social Security Administration at |

|||||||

Consult your payer if you’re uncertain whether your payment is |

other government payments, consult your payer for the correct claim or |

||||||||||

eligible for voluntary withholding. |

|

identification number format. |

|

|

|

||||||

You aren’t required to have federal income tax withheld from these |

Line 5. If you want federal income tax withheld from your |

||||||||||

payments. Your request is voluntary. |

|

unemployment compensation, check the box on line 5. The payer will |

|||||||||

Note. Payers may develop their own form for you to request federal |

withhold 10% from each payment. |

|

|

|

|||||||

Line 6. If you receive any of the payments listed on line 6, check the box |

|||||||||||

income tax withholding. If a payer gives you its own form instead of |

|||||||||||

Form |

|

|

to indicate the percentage (7%, 10%, 12%, or 22%) you want withheld |

||||||||

Why Should I Request Withholding? |

|

from each payment. |

|

|

|

|

|

||||

|

Line 7. See How Do I Stop Withholding? below. |

|

|||||||||

You may find that having federal income tax withheld from the listed |

|

||||||||||

Sign this form. Form |

|||||||||||

payments is more convenient than making quarterly estimated tax |

|||||||||||

|

|

|

|

|

|

||||||

payments. However, if you have other income that isn’t subject to |

When Will My Withholding Start? |

|

|

|

|||||||

withholding, consider making estimated tax payments. For more details, |

Ask your payer exactly when income tax withholding will begin. The |

||||||||||

see Form |

|||||||||||

federal income tax withholding you choose on this form will remain in |

|||||||||||

How Much Can I Have Withheld? |

|

||||||||||

|

effect until you change or stop it or the payments stop. |

||||||||||

For unemployment compensation, the payer is permitted to withhold |

How Do I Change Withholding? |

|

|

|

|||||||

10% from each payment. No other percentage or amount is allowed. |

If you are getting a payment other than unemployment compensation |

||||||||||

For any other government payment listed above, you may choose to |

|||||||||||

and want to change your withholding rate, complete a new Form |

|||||||||||

have the payer withhold federal income tax of 7%, 10%, 12%, or 22% |

Give the new form to the payer. |

|

|

|

|||||||

from each payment, but no other percentage or amount. |

How Do I Stop Withholding? |

|

|

|

|||||||

What Do I Need To Do? |

|

|

|

|

|

||||||

|

|

If you want to stop withholding, complete a new Form |

|||||||||

Complete lines 1 through 4; check one box on line 5, 6, or 7; sign Form |

|||||||||||

completing lines 1 through 4, check the box on line 7, and sign and date |

|||||||||||

the form; then give the new form to the payer. |

|

||||||||||

|

|

|

|

Separate here |

|

|

|

|

|

||

Form |

|

|

Voluntary Withholding Request |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||||

(Rev. February 2018) |

(For unemployment compensation and certain Federal Government and other payments.) |

|

OMB No. |

||||||||

Department of the Treasury |

|

|

|||||||||

|

|

Give this form to your payer. Do not send it to the IRS. |

|

|

|

||||||

Internal Revenue Service |

|

|

|

|

|

||||||

1 |

Your first name and middle initial |

|

Last name |

|

|

2 Your social security number |

|||||

|

|

|

|

|

|

||||||

3 |

Home address (number and street or rural route) |

City or town |

State |

ZIP code |

|||||||

4Claim or identification number (if any) you use with your payer

5

I want federal income tax withheld from my unemployment compensation at a rate of 10% of each payment.

6I want federal income tax withheld from (a) my social security benefits, (b) my social security equivalent Tier 1 railroad retirement benefits, (c) my Commodity Credit Corporation loans, (d) certain crop disaster payments under the Agricultural Act of 1949 or under Title II of the Disaster Assistance Act of 1988, or (e) dividends and other distributions from Alaska Native Corporations to its shareholders, at the rate of (check one):

7%

10%

12%

22%

7

I want you to stop withholding federal income tax from my payment(s).

Your signature |

Date |

|

For Privacy Act and Paperwork Reduction Act Notice, see page 2. |

Cat. No. 22891V |

Form |

Form |

Page 2 |

Privacy Act and Paperwork Reduction Act Notice

We ask for the information on Form

Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal

You aren’t required to provide the information requested on a form

that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103.

The average time and expenses required to complete and file this form will vary depending on individual circumstances. For estimated averages, see the instructions for your income tax return.

If you have suggestions for making this form simpler, we would be happy to hear from you. See the instructions for your income tax return.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS W-4V form is used for voluntary withholding of taxes from certain government payments, such as Social Security benefits, unemployment compensation, and other federal payments that the beneficiary might receive. |

| Voluntary Withholding Choice | Recipients of government payments can choose to have a percentage of their payment withheld to cover their expected tax liability. This way, they can avoid owing a large amount of taxes at the end of the year. |

| Submission Process | The completed IRS W-4V form must be submitted to the specific agency that issues the government payment, not directly to the IRS. Each agency has its own submission procedures. |

| State-Specific Forms | While the IRS W-4V form pertains to federal tax withholding, some states may have their own forms and rules for state tax withholding from certain types of government payments. These are governed by individual state tax laws. |

Guide to Writing IRS W-4V

After choosing to make a financial adjustment in life, such as deciding on a voluntary withholding request from certain government payments, it is necessary to navigate through some paperwork; in this case, the IRS W-4V form. This document allows individuals to specify the amount of federal income tax they wish to have withheld from payments like Social Security benefits, unemployment compensation, and other government payments. Filling out this form correctly ensures that the right amount of tax is withheld, aligning with one's financial planning goals and reducing the likelihood of a surprise tax bill at the end of the year. Follow these step-by-step instructions to complete the form accurately.

- Locate the most current version of the IRS W-4V form on the official IRS website. Ensure it's the version for the correct tax year you are dealing with.

- Start by reading through the entire form to familiarize yourself with its requirements and instructions. This preliminary step helps in understanding the purpose of each section.

- Enter your full name and social security number in the designated spaces at the top of the form. It's crucial that these details are accurate for identity verification purposes.

- Choose the type of government payment you are receiving from the options provided. This could include unemployment compensation, Social Security benefits, or other specified government payments.

- Specify the percentage of your payment you want withheld. The IRS provides predetermined percentages that you can select. Each type of government payment may have a different set of available withholding percentages.

- After deciding on the withholding percentage, input the appropriate figure in the field provided. This ensures the government withholds the correct portion of your payments for federal income tax purposes.

- Review the form to ensure all entered information is correct and complete. Errors or omissions could delay processing or impact the accuracy of your withholding.

- Sign and date the form in the designated area at the bottom. Your signature is necessary to validate the request for withholding.

- Lastly, submit the completed form to the appropriate agency handling your government payment. The address or method of submission can often be found in the instructions provided with the form or on the agency’s official website.

Completing the IRS W-4V form is a straightforward process that plays a vital role in personal financial management. By determining the amount of federal income tax to be withheld from certain government payments, individuals can better predict their financial situations and prepare adequately for tax season. It’s an important step for those who prefer to manage their taxes proactively.

Understanding IRS W-4V

What is the purpose of the IRS W-4V Form?

The IRS W-4V form, formally known as the Voluntary Withholding Request, is used by individuals who receive certain government payments to request federal income tax withholding. These payments include Social Security benefits, unemployment compensation, and social security equivalent Tier 1 railroad retirement benefits, among others. Opting for withholding through this form can help individuals manage their tax liabilities and potentially avoid owing taxes when filing their annual tax returns.

How can someone fill out the IRS W-4V Form?

To fill out the IRS W-4V Form, individuals must first obtain a copy, which can be downloaded from the IRS website or picked up from a local IRS office. The form requires basic personal information, the type of government payment, and the desired percentage of withholding. Choices for withholding rates are specific to the type of payment and are listed directly on the form. Once completed, the form should be submitted to the agency that issues the government payment, not directly to the IRS.

Can the withholding rate be changed after submitting the IRS W-4V Form?

Yes, individuals have the flexibility to change their withholding rate after they have submitted a W-4V form. To do this, they must simply fill out a new W-4V form with the updated withholding percentage and submit it to the paying agency. It's important to note that changes will not affect payments retroactively but will apply to future payments.

What are the consequences of not opting for withholding on eligible government payments?

Not choosing to have taxes withheld from government payments, like Social Security benefits, can lead to surprises during tax season. Individuals might find themselves liable for a larger tax bill than expected, as these payments are considered taxable income. In some cases, if the amount owed exceeds certain thresholds, it could also result in underpayment penalties. Opting for withholding through the W-4V form can help spread tax liabilities over the year, making it easier to manage finances.

Is it possible to stop withholding once it has begun?

Yes, individuals can stop the withholding of federal income tax from their government payments at any time. This requires filling out another IRS W-4V form and selecting the option to stop withholding. The form should then be submitted to the appropriate paying agency. As with changing the withholding rate, stopping withholding will only affect future payments and not those already processed.

Common mistakes

Filling out IRS forms can be daunting, and it's easy to make mistakes if you're not paying close attention. The IRS W-4V form, used for voluntary withholding requests, is no exception. Here's a list of common mistakes people make when completing this particular form:

- Not checking the correct withholding amount: It's crucial to select the percentage of your payment that you want to be withheld. People often overlook this, resulting in either too much or too little tax being withheld.

- Forgetting to sign and date the form: An unsigned or undated form is invalid. This simple oversight can lead to unnecessary delays.

- Entering incorrect Social Security or Taxpayer Identification Numbers (TIN): Accuracy here is key. Mistakes can lead to misprocessed forms or even identity verification issues.

- Using outdated forms: Tax forms are updated regularly. Using an old version might mean missing out on recent changes, leading to incorrect filings.

- Misunderstanding the form's purpose and using it for the wrong type of income: The W-4V form is specific about what income it applies to, such as Social Security benefits or unemployment compensation. Some people mistakenly use it for other types of income.

- Selecting the wrong type of payment: The form lists various payment types for which you can request withholding. It's important to accurately identify which one applies to you.

- Incorrectly filling out personal information: Even basic mistakes here can complicate your tax situation. Double-check your name, address, and other personal details.

- Failing to notify the payer: Completing the form is one step, but you must also submit it to the right payer, whether that's the Social Security Administration, the Railroad Retirement Board, or another payer listed on the form.

- Omitting necessary attachments or documentation: While the W-4V form itself is straightforward, some may require additional documentation. Not providing what's needed can delay processing.

To avoid these pitfalls, take the time to review the form carefully before submission. Ensure you have the most current form, double-check your information, and verify you've selected the appropriate options for your situation. When in doubt, consult with a professional who can provide guidance specific to your needs.

Documents used along the form

When managing taxes, especially for those receiving government benefits or other payments subject to federal tax, the IRS W-4V form becomes a tool for volunteers to specify the amount of federal income tax to withhold. This form is often just one component of a larger set of documents necessary for comprehensive financial and tax planning. The following list introduces forms and documents commonly associated with or used in conjunction with the IRS W-4V, each playing a crucial role in ensuring an individual's tax and financial affairs are correctly managed and reported.

- IRS Form W-2: This wage and tax statement is essential for employees, detailing the income they received from their employer and the taxes withheld throughout the tax year.

- IRS Form W-4: Employees use this form to inform employers of the amount of tax to withhold from their paycheck, based on marital status, dependents, and other factors influencing their tax obligations.

- IRS Form 1099-MISC: For freelancers, independent contractors, and others who receive income outside of traditional employment, this document reports earnings that would not typically be subject to withholding, making the W-4V relevant for voluntary withholding purposes.

- IRS Form 1040: As the standard federal income tax form for individuals, Form 1040 is where all sources of income, deductions, and applicable credits are reported annually.

- IRS Schedule C: This form is used by sole proprietors and single-member LLCs to report profits or losses from their business, which can influence the need for and amount of voluntary withholding.

- IRS Form SSA-1099: Recipients of Social Security benefits receive this form to report the amount received throughout the year, which in some cases might be subject to federal tax withholding via Form W-4V.

- IRS Form 1099-G: This document reports unemployment compensation, state or local tax refunds, credits, or offsets that might require adjustment of withholding amounts.

- IRS Form 1099-INT: Individuals who earn interest from banks, savings institutions, or other financial entities receive this form indicating the amount of interest earned in the tax year.

- IRS Form 1099-DIV: This form is for those who receive dividends and distribution from investments, another source of income that might influence an individual's decision to adjust withholding on other payments.

Understanding how each of these documents interacts with the IRS W-4V form can enable individuals to make informed decisions regarding their tax withholding preferences. Whether it's adjusting withholdings on Social Security benefits, pensions, or any other government payment, the nuanced interplay of these forms ensures that taxpayers can manage their financial obligations in a proactive manner. Collectively, they represent a critical toolkit for personal financial management and tax planning.

Similar forms

The IRS W-4V form is similar to the W-4 form in that both are used for tax withholding purposes. The W-4 form is specifically for employees to determine the amount of federal income tax to withhold from their paychecks, while the W-4V is used for voluntary withholding from certain government benefits, like Social Security. Each form plays a key role in managing tax liabilities for individuals, ensuring the correct amount of taxes are collected or withheld during the year.

Another document resembling the IRS W-4V form is the 1099 form. The 1099 form is used to report income from sources other than wages, salaries, and tips. Like the W-4V, it deals with federal tax matters by reporting income that might not be subject to regular withholding. The difference lies in the fact that the W-4V allows for voluntary withholding on such income, potentially simplifying tax payments for the recipient.

The IRS W-2 form also shares similarities with the W-4V form. The W-2 form is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. Both the W-2 and W-4V forms deal with the taxation of income and the withholding of taxes but from different perspectives—W-2 for employment income already withheld and W-4V for voluntary withholding on other government payments.

Similar to the W-4V form, the W-8BEN form is used in the context of taxation but for foreign individuals. The W-8BEN form allows foreign individuals to claim exemptions from certain withholdings on income linked to the United States. Both forms serve to adjust the withholding of taxes, although they cater to different populations and types of income.

The 1040 form is the standard IRS form for individual income tax returns in the United States. Though its purpose differs from that of the W-4V, which is for withholding, both forms are integral to the process of reporting and paying federal taxes. The 1040 form is the culmination of an individual’s tax year, possibly including any adjustments made through forms like the W-4V.

Another document that shares a purpose with the IRS W-4V form is the SSA-1099. This form reports any social security benefits received, part of which may be taxable and thus subject to voluntary withholding as authorized by the W-4V. Both documents are crucial for individuals receiving social security benefits who need to manage their tax obligations effectively.

Similar in function to the IRS W-4V form is the state tax withholding forms that many states use for the purpose of withholding state income taxes. While the W-4V pertains specifically to federal tax withholdings from government payments, state withholding forms concentrate on income from employment and other sources at the state level. Both sets of forms allow individuals to manage the payment of their taxes more smoothly over the course of the year, avoiding large lump-sum payments during tax season.

The IRS 4506-T form, which requests a tax return transcript, also connects with the process of managing one’s taxes, although it serves a different function than the W-4V. The 4506-T form is often used for loan applications and to verify income and tax filing status. It complements the tax withholding and reporting process by providing official documentation of one’s tax filings and income, indirectly affecting how one might fill out a W-4V.

The Estimated Tax Payment form, or 1040-ES, is used by individuals to pay taxes on income that is not subject to withholding. This includes earnings from self-employment, interest, dividends, and other sources. Like the W-4V, it is a tool for managing tax payments, but it is designed for use by those who do not have taxes automatically withheld from their income, making estimated payments necessary throughout the year.

Last but not least, the ITIN Application form (W-7) bears a resemblance to the W-4V in the context of the U.S. tax system. The W-7 form is used by individuals who are required to have a U.S tax identification number but do not have and are not eligible to get a social security number. While serving different purposes—W-7 for obtaining an identification number and W-4V for managing withholding—both are essential in the broader context of fulfilling federal tax obligations for individuals within the United States.

Dos and Don'ts

When managing federal taxes, particularly when dealing with forms such as the IRS W-4V, it's important to approach the task with diligence and accuracy. The IRS W-4V form is used for voluntary withholding requests from certain government payments for individuals who prefer to have federal taxes withheld directly. Here are key recommendations on what to do and what to avoid to ensure the process is smooth and error-free.

Do:Read the instructions provided by the IRS for the W-4V form carefully before starting. These guidelines are designed to help filers understand the purpose of the form and how to accurately complete it.

Verify your personal information, including your Social Security Number (SSN), is accurately entered. A mistake here can lead to processing delays or issues with your tax records.

Choose the correct percentage of federal tax you wish to have withheld. This decision should be based on your overall tax situation, which may require consulting with a tax professional.

Keep a copy of the completed form for your records before submitting it to the appropriate agency. Having a personal copy is crucial for future reference or in case of disputes.

Regularly review and, if necessary, update your W-4V form. Life changes such as marriage or the birth of a child may influence your tax liabilities and necessitate adjustments to withholding.

Rush through filling out the form without understanding each section. This increases the likelihood of errors and could affect your financial situation adversely.

Ignore tax law changes. Tax regulations evolve, and something that was correct last year may not be applicable now. Stay informed to make educated choices about your withholdings.

Forget to submit the form to the correct agency. The IRS W-4V form must be sent to the government agency paying you the benefits, not the IRS directly. Each agency has its own procedure for handling the form.

Misconceptions

Many people have misconceptions about the IRS W-4V form, which can lead to confusion when it comes to managing taxes on certain government payments. Let's clear up some of the most common misunderstandings:

All unemployment benefits are taxed the same way. This is not true. While federal income tax requirements apply uniformly across the U.S., individual states may have different rules for taxing unemployment benefits. The W-4V form is specifically for voluntary withholding requests from certain government payments, including unemployment compensation.

Filling out a W-4V form is mandatory for all government payments. Actually, submitting a W-4V form is completely voluntary. This form is for those who wish to have federal taxes withheld from specific government payments, such as Social Security benefits, to avoid paying a lump sum during the tax season.

The W-4V form allows you to claim exemptions. Unlike the W-4 form used by employees, the W-4V does not provide the option to claim allowances or exemptions. Instead, it is used to request a flat withholding rate for federal taxes from the specified benefits.

You can specify any withholding amount on the W-4V form. This is incorrect. The form allows only for the selection of predetermined percentages for tax withholding. These percentages vary depending on the type of government payment.

Once submitted, you cannot change your withholding on the W-4V. You can actually change your withholding preferences at any time by submitting a new W-4V form. This flexibility helps individuals adapt to changing financial situations or tax laws.

The W-4V is used to request state tax withholding. The IRS W-4V form is exclusively for federal tax withholding requests. For state taxes, you'll need to check with your local state tax agency to see if they have a separate form or process for withholding requests on government payments.

Submitting a W-4V form will impact your Medicare premiums. Medicare calculations are based on your modified adjusted gross income as reported on your IRS tax return, not on your withholding preferences. Therefore, adjusting your withholdings using the W-4V form does not directly affect your Medicare premiums.

It's unnecessary to update the W-4V after personal changes, like marriage or divorce. While it's true the W-4V form itself doesn't factor in marital status in the same way the W-4 does for employment income, significant personal financial changes—including marriage or divorce—can affect your overall tax liability. Reviewing and updating your W-4V withholdings can be a smart move to avoid unexpected tax bills or penalties.

Key takeaways

The IRS W-4V form, known as the Voluntary Withholding Request, is a tool for individuals receiving certain government payments to request federal income tax withholding. Understanding how to fill out and use this form correctly is important for managing your taxes effectively. Here are key takeaways to consider:

- Identify when you need it: The form is for recipients of government payments such as Social Security benefits, unemployment compensation, and social security equivalent Tier 1 railroad retirement benefits, among others, who wish to have federal taxes withheld.

- Understand its purpose: By submitting a completed W-4V form, you can have a set percentage of your payment withheld for federal taxes, helping you manage your tax burden throughout the year and potentially avoiding a large tax bill during tax season.

- Choose your withholding rate carefully: The form allows you to select a withholding rate that suits your financial situation. Options typically include 7%, 10%, 12%, or 22%. Deciding which rate applies to you may require some calculation or consultation with a tax professional.

- Submitting the form: Once you’ve filled out the form, you need to submit it to the agency issuing your benefits. This might be the Social Security Administration, the Railroad Retirement Board, or another federal agency.

- Updating your information: If your financial situation changes, for example, due to a new job or other changes in income, you might need to update your W-4V form to adjust your withholding rate accordingly.

- Each payer requires a separate form: If you receive payments from more than one source and wish to have taxes withheld from each, you'll need to submit a separate W-4V form to each payer.

- It's voluntary: Submitting a W-4V is optional. If you prefer to pay your taxes in one lump sum, or make estimated tax payments throughout the year, you don't need to fill out this form.

- Keep records: Always keep a copy of your completed W-4V form for your records. It can help you track your withholdings and is useful when preparing your annual tax return.

Handling the W-4V form properly ensures that you have greater control over your tax situation, potentially making tax season less stressful. Remember, while the form is straightforward, consulting with a tax preparer can provide personalized advice suited to your specific financial situation.

Popular PDF Documents

1040 Sr - Schedule 2 is a necessary step for those with additional tax liabilities, making the tax filing process thorough and comprehensive.

8879-f - Used by exempt organizations, Form 8879-EO enables authorization for an electronic funds withdrawal if applicable.

W-10 Tax Form - Childcare service providers are obliged to furnish accurate and up-to-date information on W-10 forms to support their clients’ tax-related documentation needs.