Get IRS W-4P Form

Imagine you're about to embark on a journey into retirement, or you're already there, enjoying your well-earned rest. Suddenly, you're faced with the reality of taxes on your pension or annuity payments. It can feel overwhelming, but there's a beacon of light in the form of the IRS W-4P form. This crucial document is designed to help you navigate the waters of federal income tax withholding from these payments. Whether you're receiving payments from a pension, an annuity, a profit-sharing plan, or any other deferred compensation plan, understanding how to properly fill out and submit the IRS W-4P can make a significant difference in your financial health. By indicating how much federal income tax you wish withheld from your payments, you can avoid unexpected tax bills and penalties for underpayment. This form offers a way to tailor your withholding to match your tax liability, which can vary greatly depending on your overall income and deductions. It stands as an essential tool for managing your retirement income effectively, ensuring that you can focus on enjoying your retirement years with one less thing to worry about.

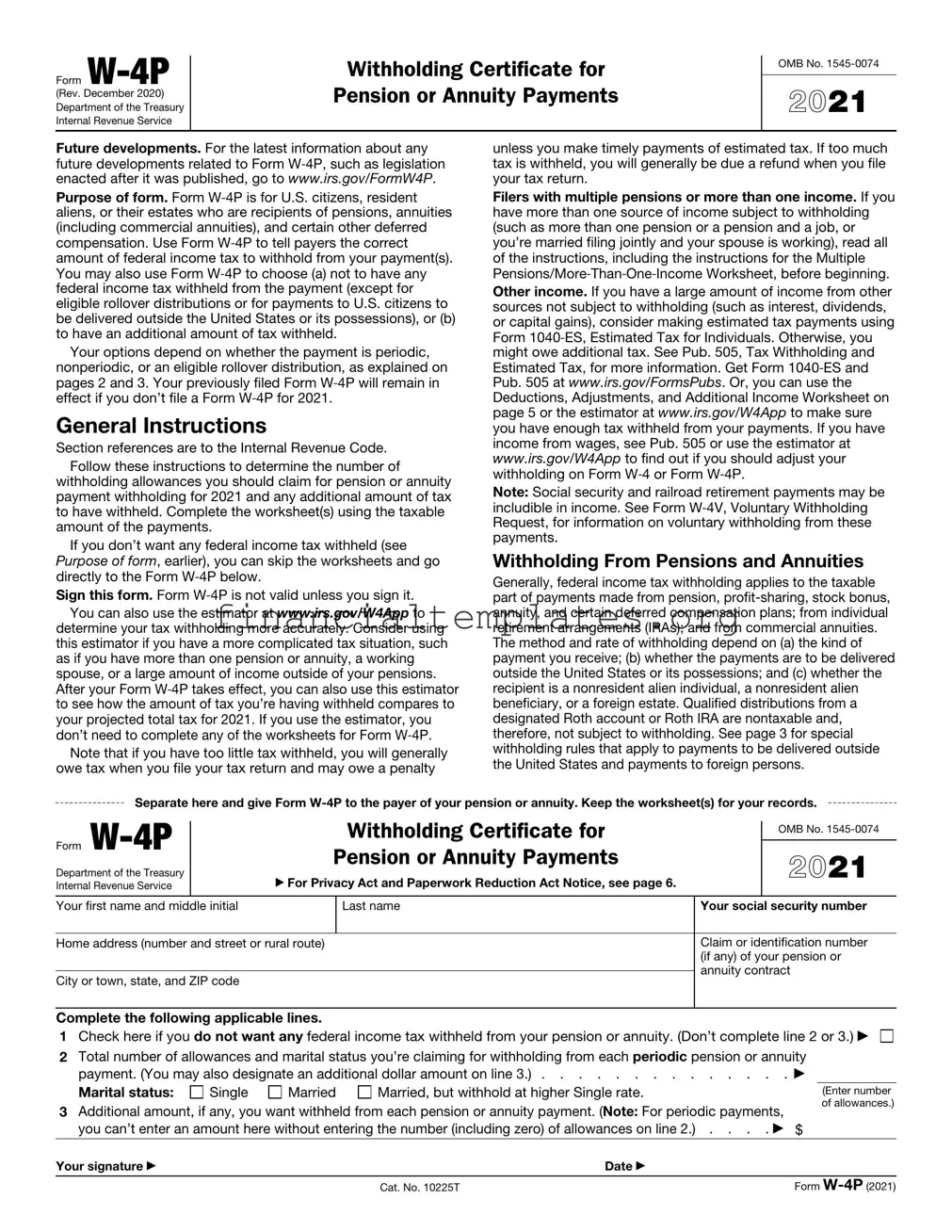

IRS W-4P Example

Form |

Withholding Certificate |

|

OMB No. |

|||

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

for Periodic Pension or Annuity Payments |

|

|

|

Department of the Treasury |

|

|

2022 |

|||

|

▶ Give Form |

|

||||

Internal Revenue Service |

|

|

|

|

|

|

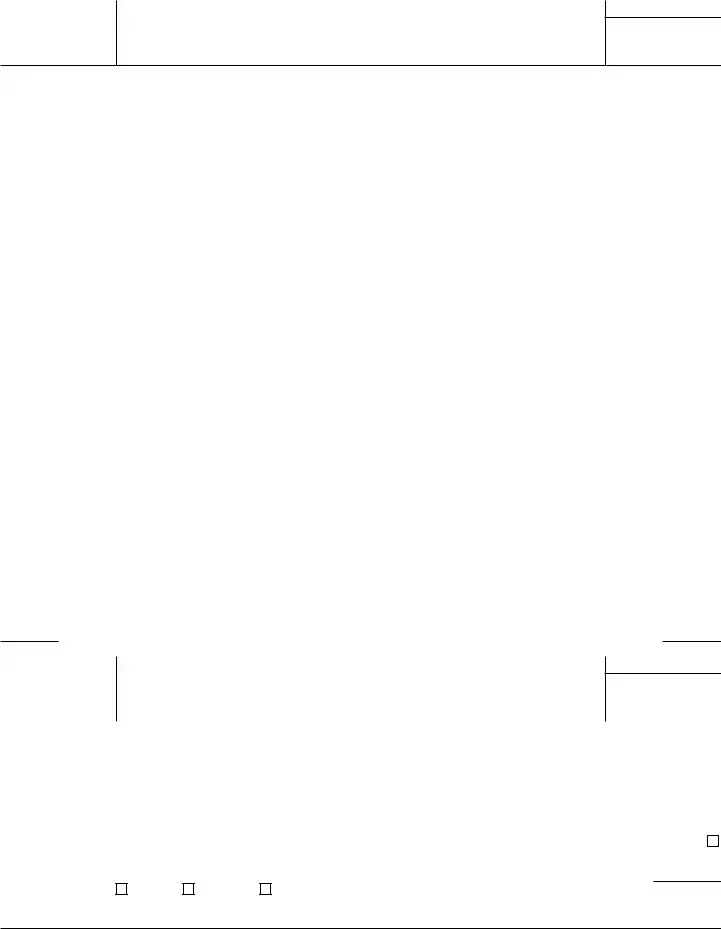

Step 1: |

(a) |

First name and middle initial |

Last name |

(b) Social security number |

||

|

|

|

|

|

|

|

Enter |

|

|

|

|

|

|

Address |

|

|

|

|

||

Personal |

|

|

|

|

||

|

|

|

|

|

|

|

Information |

|

|

|

|

||

City or town, state, and ZIP code |

|

|

|

|||

|

|

|

|

|

|

|

|

(c) |

Single or Married filing separately |

|

|

|

|

|

|

|

Married filing jointly or Qualifying widow(er) |

|

|

|

|

|

|

Head of household (Check only if you’re unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) |

|||

|

|

|

|

|

|

|

Complete Steps

Step 2: |

Complete this step if you (1) have income from a job or more than one pension/annuity, or (2) are married filing |

|||

Income |

jointly and your spouse receives income from a job or a pension/annuity. See page 2 for examples on how to |

|||

From a Job |

complete Step 2. |

|

|

|

Do only one of the following. |

|

|

||

and/or |

|

|

||

Multiple |

(a) Reserved for future use. |

|

|

|

Pensions/ |

(b) Complete the items below. |

|

|

|

Annuities |

|

|

||

(i) If you (and/or your spouse) have one or more jobs, then enter the total taxable annual pay |

||||

(Including a |

||||

Spouse’s |

from all jobs, plus any income entered on Form |

|||

Job/ |

deductions entered on Form |

▶ $ |

||

|

|

|

||

Pension/ |

(ii) If you (and/or your spouse) have any other pensions/annuities that pay less annually than |

|||

Annuity) |

this one, then enter the total annual taxable payments from all |

|||

|

annuities. Otherwise, enter |

▶ $ |

||

|

(iii) Add the amounts from items (i) and (ii) and enter the total here |

|

|

|

|

▶ $ |

|||

|

|

|

||

|

TIP: To be accurate, submit a 2022 Form |

|||

|

job(s) if you have not updated your withholding since 2019. If you have |

|||

If (b)(i) is blank and this pension/annuity pays the most annually, complete Steps

Otherwise, do not complete Steps

Step 3: |

If your total income will be $200,000 or less ($400,000 or less if married filing jointly): |

|

|

|

||

Claim |

Multiply the number of qualifying children under age 17 by $2,000 ▶ |

$ |

|

|

|

|

Dependent |

|

|

|

|

|

|

Multiply the number of other dependents by $500 . . . . . ▶ |

$ |

|

|

|

||

and Other |

|

|

|

|||

|

|

|

|

|

|

|

Credits |

Add other credits, such as foreign tax credit and education tax credits ▶ |

|

$ |

|

|

|

|

Add the amounts for qualifying children, other dependents, and other credits and enter the |

|

|

|

||

|

total here |

. . . . . . . |

|

3 |

$ |

|

Step 4 |

(a) Other income (not from jobs or pension/annuity payments). If you want tax withheld |

|

|

|

||

(optional): |

on other income you expect this year that won’t have withholding, enter the amount of |

|

4(a) |

|

||

Other |

other income here. This may include interest, taxable social security, and dividends . |

|

$ |

|||

|

|

|

|

|

|

|

Adjustments |

(b) Deductions. If you expect to claim deductions other than the basic standard deduction |

|

|

|

||

|

|

|

|

|||

|

and want to reduce your withholding, use the Deductions Worksheet on page 3 and |

|

|

|

||

|

enter the result here |

. . . . . . . |

|

4(b) |

$ |

|

|

(c) Extra withholding. Enter any additional tax you want withheld from each payment . |

|

4(c) |

$ |

||

Step 5:

Sign

Here

▲

Your signature (This form is not valid unless you sign it.)

▲

Date

For Privacy Act and Paperwork Reduction Act Notice, see page 3. |

Cat. No. 10225T |

Form |

Form |

Page 2 |

General Instructions

Section references are to the Internal Revenue Code.

Future developments. For the latest information about any future developments related to Form

Purpose of form. Complete Form

Choosing not to have income tax withheld. You can choose not to have federal income tax withheld from your payments by writing “No Withholding” on Form

Caution: If you have too little tax withheld, you will generally owe tax when you file your tax return and may owe a penalty unless you make timely payments of estimated tax. If too much tax is withheld, you will generally be due a refund when you file your tax return. If your tax situation changes, or you chose not to have federal income tax withheld and you now want withholding, you should submit a new Form

Payments to nonresident aliens and foreign estates. Do not use Form

Tax relief for victims of terrorist attacks. If your disability payments for injuries incurred as a direct result of a terrorist attack are not taxable, write “No Withholding” in the space below Step 4(c). See Pub. 3920, Tax Relief for Victims of Terrorist Attacks, for more details.

Specific Instructions

Step 1(c). Check your anticipated filing status. This will determine the standard deduction and tax rates used to compute your withholding.

Step 2. Use this step if you have at least one of the following: income from a job, income from more than one pension/annuity, and/or a spouse (if married filing jointly) that receives income from a job/pension/annuity. The following examples will assist you in completing Step 2.

Example 1. Bob, a single filer, is completing Form

If Bob also has $1,000 of interest income, which he entered on Form

Example 2. Carol, a single filer, is completing Form

If Carol also has $1,000 of interest income, then she will enter $1,000 in Step 4(a) of this Form

Example 3. Don, a single filer, is completing Form

If Don also has $1,000 of interest income, he won’t enter that amount on this Form

Example 4. Ann, a single filer, is completing Form

Ann will enter $25,000 in Step 2(b)(i), $20,000 in Step 2(b)(ii), and $45,000 in Step 2(b)(iii).

If Ann also has $1,000 of interest income, which she entered on Form

If you are married filing jointly, the entries described above do not change if your spouse is the one who has the job or the other pension/annuity instead of you.

▲! Multiple sources of pensions/annuities or jobs. If you (or if married filing jointly, you and/or your spouse) have a

CAUTION job(s), do NOT complete Steps 3 through 4(b)

on Form

Step 3. This step provides instructions for determining the amount of the child tax credit and the credit for other dependents that you may be able to claim when you file your tax return. To qualify for the child tax credit, the child must be under age 17 as of December 31, must be your dependent who generally lives with you for more than half the year, and must have the required social security number. You may be able to claim a credit for other dependents for whom a child tax credit can’t be claimed, such as an older child or a qualifying relative. For additional eligibility requirements for these credits, see Pub. 501, Dependents, Standard Deduction, and Filing Information. You can also include other tax credits for which you are eligible in this step, such as the foreign tax credit and the education tax credits. Including these credits will increase your payments and reduce the amount of any refund you may receive when you file your tax return.

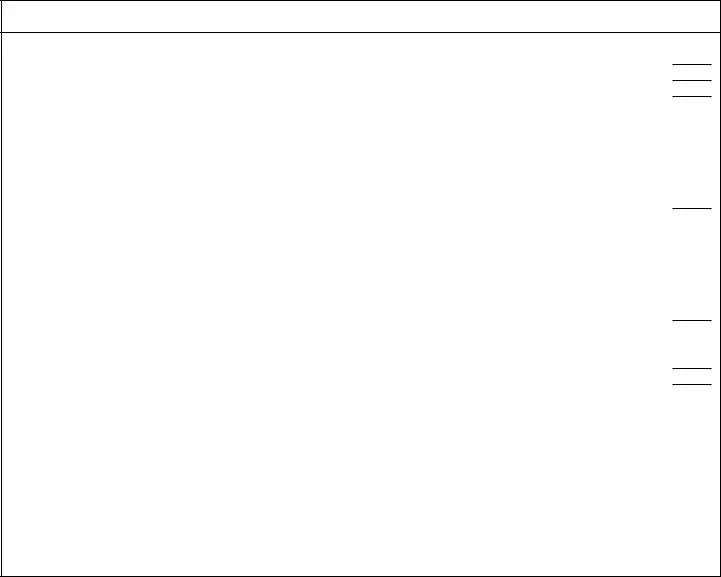

Form |

Page 3 |

Specific Instructions (continued)

Step 4 (optional).

Step 4(a). Enter in this step the total of your other estimated income for the year, if any. You shouldn’t include amounts from any job(s) or pension/annuity payments. If you complete Step 4(a), you likely won’t have to make estimated tax payments for that income. If you prefer to pay estimated tax rather than having tax on other income withheld from your pension, see Form

Step 4(b). Enter in this step the amount from the Deductions Worksheet, line 6, if you expect to claim deductions other than the basic standard deduction on your 2022 tax return and want to reduce your withholding to account for these deductions.

This includes itemized deductions, the additional standard

deduction for those 65 and over, and other deductions such as for student loan interest and IRAs.

Step 4(c). Enter in this step any additional tax you want withheld from each payment. Entering an amount here will reduce your payments and will either increase your refund or reduce any amount of tax that you owe.

Note: If you don’t give Form

Step

1Enter an estimate of your 2022 itemized deductions (from Schedule A (Form 1040)). Such deductions may include qualifying home mortgage interest, charitable contributions, state and local taxes (up to

$10,000), and medical expenses in excess of 7.5% of your income . . |

. . . . . . . . . . |

1 |

$ |

|||

|

{ |

• $25,900 if you’re married filing jointly or qualifying widow(er) |

} |

|

|

|

2 Enter: |

• $19,400 if you’re head of household |

. . . . . . . . |

2 |

$ |

||

|

• $12,950 if you’re single or married filing separately |

|

|

|

||

3If line 1 is greater than line 2, subtract line 2 from line 1 and enter the result here. If line 2 is greater

than line 1, enter |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

3 |

$ |

4 If line 3 equals zero, and you (or your spouse) are 65 or older, enter: |

|

|

• $14,700 if you’re single or head of household. |

|

|

• $27,300 if you’re married and one of you is under age 65. |

|

|

• $28,700 if you’re married and both of you are age 65 or older. |

|

|

Otherwise, enter |

4 |

$ |

5Enter an estimate of your student loan interest, deductible IRA contributions, and certain other

adjustments (from Part II of Schedule 1 (Form 1040)). See Pub. 505 for more information . . . . |

5 |

$ |

6 Add lines 3 through 5. Enter the result here and in Step 4(b) on Form |

6 |

$ |

|

|

|

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to provide this information only if you want to (a) request federal income tax withholding from pension or annuity payments based on your filing status and adjustments; (b) request additional federal income tax withholding from your pension or annuity payments; (c) choose not to have federal income tax withheld, when permitted; or (d) change a previous Form

Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may

also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The average time and expenses required to complete and file this form will vary depending on individual circumstances. For estimated averages, see the instructions for your income tax return.

If you have suggestions for making this form simpler, we would be happy to hear from you. See the instructions for your income tax return.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form W-4P | This form is used by U.S. citizens and resident aliens who receive pensions, annuities, and certain other deferred compensation to tell payers the correct amount of federal income tax to withhold from their payments. |

| Who Needs to File | Individuals receiving pensions, annuities, and other deferred compensation plans, including IRAs, are required to complete the form if they want any federal income tax withheld. |

| Where to Submit the Form | The completed form should be submitted to the payer of the pension or annuity, not to the IRS. |

| Withholding Options | Recipients can choose to have no federal income tax withheld or elect to have it withheld using the rates and tables provided by the IRS. |

| Effect of Not Filing | If a recipient does not submit a Form W-4P, or if it is not correctly completed, the payer must withhold federal income tax at the rate designated for a married individual filing jointly with three allowances. |

| State-Specific Versions | Some states have their own version of Form W-4P for state income tax withholding. The applicability and requirements are governed by each state's tax laws. |

| Annual Submission | While it's not always required to submit a new form each year, any changes to a recipient's personal or financial situation warrant a review and possible update to their withholding preferences. |

Guide to Writing IRS W-4P

Filling out the IRS W-4P form is a critical step for recipients of pensions, annuities, and certain other deferred compensation plans who want to control the amount of federal income tax withheld from their payments. The process ensures taxes are accurately withheld from your distributions, avoiding surprises during tax season. Understanding and completing this form correctly will help maintain your financial health and compliance with IRS requirements.

- Begin by downloading the most current IRS W-4P form from the official IRS website.

- Enter your full name, social security number, and address in the designated sections at the top of the form.

- If your address has changed since your last filing, mark the box indicating this near your address.

- Specify your tax filing status by ticking the appropriate box. Your options include Single or Married, but filing separately; Married filing jointly or Qualifying widow(er); and Head of household as defined in the tax code.

- If you want tax to be withheld at a higher single rate, check the corresponding box.

- To claim exemption from withholding, if you meet certain IRS criteria for exemption, you may enter “Exempt” in the designated space. Note that there are specific requirements to qualify for this exemption, including having had no tax liability in the previous year and expecting none in the current year.

- If exemption is not applicable, proceed to the Multiple Jobs Worksheet if you have more than one source of income, or your spouse works, to more accurately compute withholding amounts. Complete this worksheet according to its instructions and enter the result on the form.

- Alternatively, or in addition to the worksheet, you can indicate an additional amount you want withheld from each payment in the respective field.

- Sign and date the form in the designated area to certify that the information is accurate and complete. Note that failure to sign the form will render it invalid.

- Finally, submit the completed form to the payer of your pension, annuity, or other deferred compensation. This could be your pension fund administrator, insurance company, or another entity responsible for making these payments to you.

After submitting the form, monitor your subsequent payments to ensure the correct amount of tax is being withheld. It's advisable to review and possibly update your W-4P form annually or after any major life changes, such as marriage or the birth of a child, which could affect your tax liability. If you're unsure about any part of the process, consider consulting a tax adviser to assist with filling out the form accurately.

Understanding IRS W-4P

What is the IRS W-4P Form?

The IRS W-4P Form, officially titled "Withholding Certificate for Pension or Annuity Payments," is a document that recipients of pensions, annuities, and certain other deferred compensation use to tell payers the correct amount of federal income tax to withhold from their payments. Individuals use this form to adjust their withholding based on their personal financial situation, similar to how employees use the W-4 form for employment income.

Who needs to fill out the W-4P Form?

Anyone receiving pension, annuity payments, or certain other deferred compensation, who wants federal income tax withheld from these payments, should complete the W-4P Form. This includes retirees, individuals who have inherited pension rights, and beneficiaries of deceased employees. The ultimate goal is to help individuals manage their tax obligations throughout the year.

When should the W-4P Form be updated?

Updating the W-4P Form is advised whenever one's personal or financial situation changes in a way that could affect their tax liability. Such changes may include marital status, the birth of a child, or a change in the total income. Reviewing and, if necessary, updating the form annually is also a good practice to ensure that the withholding amounts accurately reflect one's current tax situation.

What happens if I don't submit a W-4P Form?

If a W-4P Form is not submitted, payers are required by the IRS to withhold federal income tax at the rate applicable for a married individual filing separately, with no other adjustments. This default withholding may not accurately reflect your tax liability, potentially leading to an unexpected tax bill or a larger refund than anticipated at year-end.

Where can I find a W-4P Form?

The W-4P Form is available on the IRS website. It can be downloaded for free. Additionally, pension plan administrators and other payers of annuities often provide this form to recipients or offer assistance in completing it.

What information do I need to complete the W-4P Form?

To complete the W-4P Form, you'll need your personal information, such as your full name, Social Security Number, and address. You'll also need to decide your desired withholding amount. This decision might require some calculations based on your expected tax liability, exemptions, deductions, and credits for the year. Referring to the IRS withholding calculator or consulting with a tax professional can help ensure the accuracy of the form.

Can the W-4P Withholding amount be changed during the year?

Yes, recipients can submit a new W-4P Form at any time during the year to adjust their withholding. This flexibility allows individuals to respond to changes in their financial situation and avoid under- or over-withholding.

How does marital status affect the withholding amount?

Marital status significantly influences the amount of tax withholding, as it alters the standard deduction and tax brackets applicable to an individual. Married individuals filing jointly usually benefit from lower tax rates on a per-person basis compared to single filers. Indicating your accurate marital status on the W-4P Form helps ensure the correct amount of tax is withheld from your pension or annuity payments.

Are there penalties for not paying enough tax through withholding?

If too little tax is withheld from pension or annuity payments, individuals could face penalties for underpayment of taxes. The IRS might charge interest on the amount owed. To avoid these penalties, individuals should aim for accuracy in their withholdings. This may involve estimating yearly income and taxes accurately or making quarterly estimated tax payments in addition to the withholding on their pension or annuity income.

Common mistakes

Completing the IRS W-4P form often seems straightforward, but errors can occur. Understanding these mistakes is crucial to ensure accuracy and avoid unnecessary taxes or penalties. Here’s a breakdown of common pitfalls:

-

Not updating the form after major life changes. Life events like marriage, divorce, or the death of a spouse significantly alter tax obligations. Failing to update the W-4P form to reflect these changes can lead to incorrect withholding.

-

Overlooking the need for adjustments when you have multiple sources of income. If you receive income from more than one source, you need to adjust your withholdings on the W-4P to prevent underpayment of taxes.

-

Entering incorrect Social Security Number (SSN) or Taxpayer Identification Number (TIN). An incorrect SSN or TIN can cause delays in processing and may affect your tax liabilities.

-

Choosing the wrong tax withholding amount. Whether it's too little leading to a large tax bill and possible penalties, or too much, causing an unnecessary strain on your monthly budget, incorrect withholding amounts pose problems.

-

Missing signatures or dates. An unsigned or undated W-4P form is not valid, which can delay processing and lead to underwithholding or overwithholding.

-

Ignoring the Multiple Pensions/More-Than-One-Income Worksheet. Individuals with multiple pensions or other income sources need to fill out this section to ensure accurate withholding.

-

Not seeking professional advice when needed. The W-4P form can be complex, and specific situations may warrant the help of a tax professional to avoid errors.

-

Incorrectly claiming exemption from withholding. Claiming exemption unjustly can lead to a significant tax bill and penalties at the end of the tax year.

Steering clear of these missteps will help ensure that the taxes on your pension or annuity are correctly calculated, keeping you compliant with tax laws and securing your financial peace of mind.

Documents used along the form

When dealing with the IRS W-4P form, which is primarily used for withholding tax from pensions or annuities, individuals often find themselves needing various other forms and documents to manage their tax responsibilities accurately. These documents are essential for ensuring correct tax withholding, beneficial tax treatment, and compliance with federal tax laws. Here's a look at ten other forms and documents frequently used alongside the IRS W-4P form.

- Form W-4: This form is used by employees to determine the amount of federal income tax to withhold from their paychecks. It's relevant for individuals who have multiple sources of income, including a job in addition to receiving a pension or annuity.

- Form 1099-R: This document reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc. It's essential for accurately reporting retirement income on tax returns.

- Form 1040: The U.S. Individual Income Tax Return form is where all income, including pensions and annuity distributions reported on Form 1099-R, is declared to calculate the individual's tax liability.

- Schedule A (Form 1040): This schedule is used for itemizing deductions, allowing taxpayers to deduct qualified medical expenses, state and local taxes, and various other items, potentially reducing taxable income.

- Schedule B (Form 1040): Required for reporting interest and ordinary dividend income, this schedule is pertinent for individuals who receive these types of incomes in addition to their pension or annuity.

- Form 8606: This form is used to report contributions to and distributions from nondeductible IRAs and Roth IRAs, essential for taxpayers who have made nondeductible contributions to their retirement plans.

- Form 5329: Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts form must be filed if there are subject distributions that incur additional taxes, such as early distributions or excess contributions.

- Form 8880: For those who qualify, this form is used to claim the Credit for Qualified Retirement Savings Contributions, which could lower the tax bill for eligible low- and moderate-income individuals saving for retirement.

- Form 8960: Net Investment Income Tax Individuals, Estates, and Trusts form is used to calculate the 3.8% tax on net investment income, which can include distributions from certain types of pensions and annuities for those above a certain income threshold.

- Power of Attorney and Declaration of Representative (Form 2848): This authorization allows an individual to appoint another person to represent them before the IRS, useful in intricate tax situations or for those unable to handle their tax matters.

The coordination and completion of these forms and documents can be intricate but are fundamental in navigating the complexities of tax planning and compliance for individuals receiving pension or annuity distributions. Close attention to the interaction between these forms ensures individuals can optimize their tax outcomes and fulfill their obligations under U.S. tax law.

Similar forms

The IRS W-4 form shares similarities with the W-4P form as both pertain to tax withholdings. While the W-4 is used by employees to determine the amount of federal income tax to be withheld from their paychecks, the W-4P is specifically designed for pension or annuity payments. Both forms allow individuals to adjust their tax withholdings by accounting for personal allowances, aiming to match the tax owed to the IRS as closely as possible.

The W-9 form, like the W-4P, is involved in tax reporting but serves a different purpose. It is typically requested by businesses or financial institutions to obtain taxpayer identification numbers from contractors, freelancers, or any entity they are making payments to that are not employees. This ensures correct reporting to the IRS of interest, dividends, and other income types. However, they are similar in that both are crucial for accurate tax reporting and compliance.

Form 1099-R bears similarities to the W-4P as they both involve retirement or pension plans. The 1099-R is issued by plan providers to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts. The W-4P, in contrast, is used by the recipients of these funds to specify the amount of tax to be withheld. Together, these forms ensure proper tax withholding and reporting of retirement income.

The SSA-1099 form, used by the Social Security Administration to report the amount of social security benefits paid to a beneficiary, is similar to the W-4P in its focus on fixed income types. However, the SSA-1099 highlights benefits received, while the W-4P allows recipients of pension or annuity payments to determine their tax withholding level. Both forms are integral to managing tax obligations related to income from government or retirement sources.

The W-4V, Voluntary Withholding Request, is akin to the W-4P, as it specifically enables beneficiaries of certain government payments, such as unemployment compensation and social security benefits, to ask for federal tax to be withheld. Like the W-4P, it gives recipients control over their tax withholdings to avoid owing taxes at year-end, though the W-4V applies to a broader range of government payments beyond pensions and annuities.

Lastly, the 1040-ES, Estimated Tax for Individuals form, parallels the W-4P in the context of managing tax payments. This form is used by individuals to estimate and pay their taxes quarterly on income that is not subject to withholding, like earnings from self-employment, interest, dividends, and rents. Both the 1040-ES and the W-4P aim to align the amount of taxes paid throughout the year with the taxpayer’s total tax liability, albeit through different mechanisms.

Dos and Don'ts

Filing your IRS W-4P form, a task essential for managing how taxes are withheld from your pensions, annuities, and other deferred compensation, requires attention to detail and an understanding of your current financial situation. There are several do's and don'ts you should keep in mind to ensure the process goes smoothly and accurately.

Do:

- Review your entire financial situation before deciding on the number of allowances. Remember, more allowances mean less tax withheld, but also the risk of owing more at year-end.

- Consult with a tax advisor if you have multiple sources of income. This can help you determine the correct amount of tax to withhold to avoid surprises during tax season.

- Consider using the IRS Tax Withholding Estimator tool available on the IRS website. This tool can help you figure out how much tax should be withheld from your pension based on your complete tax situation.

- Update your W-4P form promptly after any major life changes, such as marriage, divorce, or the death of a spouse, which may impact your tax situation.

- Keep a copy of the completed W-4P form for your records. This can serve as proof of your withholdings and help you make modifications in the future if necessary.

Don't:

- Ignore tax law changes. Federal and state tax codes can change from year to year, potentially affecting how you should fill out your W-4P form.

- Forget to specify whether you want no taxes withheld. If that's your choice, you must affirmatively indicate so on your W-4P.

- Assume that the withholdings that worked for you last year will still work this year. Always re-evaluate your tax situation annually or after any significant financial changes.

In addition to these guidelines, always ensure your form is filled out completely and correctly, and submit it according to your payer's instructions. Avoid making estimations or guesses when providing information on your W-4P; instead, rely on accurate and current financial data. This strategic approach will help you manage your withholdings efficiently and avoid potential tax liabilities or penalties at the end of the tax year.

Misconceptions

The IRS W-4P form, officially titled "Withholding Certificate for Pension or Annuity Payments," is a vital document for U.S. taxpayers who receive retirement or annuity income. It's used to determine the amount of federal income tax to be withheld from those payments. Despite its importance, there are several misconceptions about this form. Let's clarify six common ones:

- It's the same as the W-4 form: A common misunderstanding is that the W-4P serves the same purpose as the W-4. While both forms deal with tax withholding, the W-4 is used by employers for withholding from wages or salaries. The W-4P is specifically for pension or annuity payments.

- Once filled out, it doesn't need to be updated: Many believe that once you submit a W-4P form, it's set for life. However, your financial situation can change over time, necessitating updates to ensure the correct amount of tax is withheld. Changes in income, marital status, or tax laws are good reasons to review and possibly update your W-4P.

- Filling out the form is mandatory: While it's wise to complete a W-4P to avoid owing a large amount of tax at year's end, it's not legally mandatory. If you choose not to fill one out, or if you don't designate the number of allowances, the default withholding will be at the rate of a married individual claiming three allowances.

- Only pensions are covered: Despite its name, the W-4P form is not exclusive to traditional pension plans. It also applies to any annuity plans, profit-sharing plans, and other deferred compensation plans. The misunderstanding that it's solely for pension income might cause those with other forms of retirement income to overlook the need to submit this form.

- Tax withholding is the same as for wages: Another mistake is thinking the withholding rules and rates that apply to wages or salary income apply in the same way to pensions or annuities. The withholding tables and calculations are different, reflecting the distinct nature of retirement income versus wage income.

- It only affects federal taxes: While the W-4P is a federal form, the amount of federal tax withheld can influence your state tax liability, especially in states that tax retirement income. Failing to appropriately plan for federal withholdings might lead to surprises when it comes to state taxes, depending on your state’s rules and regulations.

Addressing these misconceptions can lead to better tax planning and financial management for those receiving pension or annuity income. Remember, staying informed and consulting with a tax professional if you have questions or concerns about the W-4P form or its implications is always a good approach.

Key takeaways

When dealing with the IRS W-4P form, which is used for withholding tax from pensions and annuities, it’s crucial to have a clear understanding of the process and its implications. Below are key takeaways that will guide you through filling out and utilizing this form effectively:

Understand the Purpose: The IRS W-4P form is designed for individuals receiving pensions, annuities, and other deferred compensation plans to determine the amount of federal income tax to be withheld from their payments.

Accuracy is Key: Providing accurate information on the form is critical to ensure the correct amount of tax is withheld. This can prevent owing a large amount of tax at year's end or over-withholding throughout the year.

Personal Allowances: Remember that the more allowances you claim, the less tax will be withheld. If your financial situation changes, such as through marriage or dependents, it's important to update this form.

Multiple Sources of Income: If you have multiple sources of retirement income, consider the total picture to decide on the correct amount of withholding. You may need to allocate different withholding amounts on forms for each source.

Periodic Review and Update: Review and, if necessary, update your W-4P form annually or after major life events to ensure withholdings remain accurate. Tax laws and personal circumstances change, affecting your withholding needs.

Marital Status: Your marital status impacts the rate at which you're taxed, so it's important to reflect any changes on the W-4P form. This ensures withholdings are correctly adjusted in line with your current marital status.

Consult a Professional: If you find the process confusing or if your tax situation is complex, seeking assistance from a tax professional can prevent mistakes and ensure you're withholding the right amount.

Properly filled out, the IRS W-4P form helps manage your tax liabilities efficiently, ensuring that you are neither under nor overpaying through the year. By staying informed and consulting with professionals when needed, retirees and others on deferred compensation plans can navigate their tax obligations more effectively.

Popular PDF Documents

Irs Online Transcript - Facilitates a thorough review of taxable and non-taxable components of income.

Tax Affidavit Form - Part of a broader system of checks and balances within the real estate industry to promote fairness and integrity.