Get IRS W-4 Form

At the core of employee paycheck management in the United States, the IRS W-4 form plays a pivotal role, shaping how much income tax is withheld from an employee's paycheck. Critical for both employers and employees, this form reflects an individual's tax situation, influencing the accuracy of tax withholding to align closely with the amount owed at year-end. It includes provisions for personal allowances, dependents, and any additional income or deductions, which in turn, can impact take-home pay significantly. Changes in personal or financial status, such as marriage, divorce, the birth of a child, or an increase in income, necessitate a fresh evaluation of the form. Keeping the W-4 up-to-date ensures employees are neither overburdened by excessive withholdings nor caught off guard by a large tax bill during tax season. Given its direct effect on financial planning and payroll operations, understanding and correctly completing the W-4 is essential for optimizing tax outcomes and achieving a balanced financial state throughout the tax year.

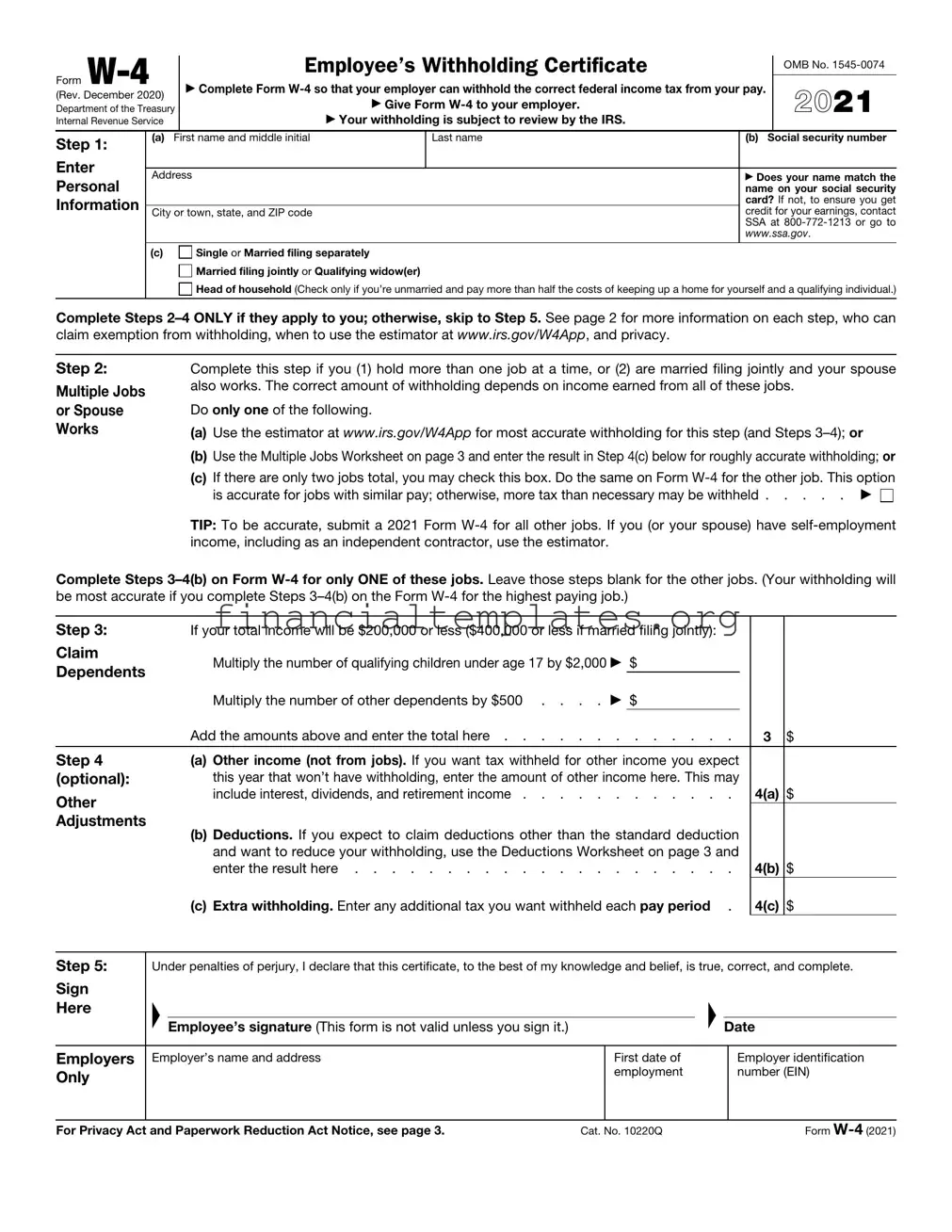

IRS W-4 Example

Form |

|

Employee’s Withholding Certificate |

|

OMB No. |

|||

|

|

||||||

|

|

|

|

|

|||

|

▶ Complete Form |

|

|||||

|

2022 |

||||||

Department of the Treasury |

|

▶ Give Form |

|

||||

|

▶ Your withholding is subject to review by the IRS. |

|

|||||

Internal Revenue Service |

|

|

|

||||

|

|

|

|

|

|

|

|

Step 1: |

(a) |

First name and middle initial |

|

Last name |

(b) Social security number |

||

|

|

|

|

|

|

||

Enter |

|

|

|

|

|

|

|

|

Address |

|

|

▶ Does your name match the |

|||

Personal |

|

|

|||||

|

|

|

|

name on your social security |

|||

Information |

|

|

|

|

|

card? If not, to ensure you get |

|

|

City or town, state, and ZIP code |

|

|

credit for your earnings, contact |

|||

|

|

|

|

|

|

SSA at |

|

|

|

|

|

|

|

www.ssa.gov. |

|

|

|

|

|

|

|

||

|

|

(c) |

Single or Married filing separately |

|

|

||

|

|

|

Married filing jointly or Qualifying widow(er) |

|

|

||

Head of household (Check only if you’re unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.)

Head of household (Check only if you’re unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.)

Complete Steps

Step 2:

Multiple Jobs or Spouse Works

Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. The correct amount of withholding depends on income earned from all of these jobs.

Do only one of the following.

(a)Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps

(b)Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or

(c)If there are only two jobs total, you may check this box. Do the same on Form

TIP: To be accurate, submit a 2022 Form

Complete Steps

Step 3: |

If your total income will be $200,000 or less ($400,000 or less if married filing jointly): |

|

|

|

|

Claim |

Multiply the number of qualifying children under age 17 by $2,000 ▶ $ |

|

|

|

|

Dependents |

|

|

|

|

|

Multiply the number of other dependents by $500 . . . . ▶ $ |

|

|

|

||

|

|

|

|

||

|

|

|

|

3 |

$ |

|

Add the amounts above and enter the total here |

|

|||

Step 4 |

(a) Other income (not from jobs). If you want tax withheld for other income you |

|

|

|

|

(optional): |

expect this year that won’t have withholding, enter the amount of other income here. |

|

4(a) |

|

|

Other |

This may include interest, dividends, and retirement income |

|

$ |

||

|

|

|

|

|

|

Adjustments |

(b) Deductions. If you expect to claim deductions other than the standard deduction and |

|

|

|

|

|

want to reduce your withholding, use the Deductions Worksheet on page 3 and enter |

|

|

|

|

|

the result here |

|

4(b) |

$ |

|

|

(c) Extra withholding. Enter any additional tax you want withheld each pay period . . |

|

4(c) |

$ |

|

Step 5:

Sign

Here

Employers Only

Under penalties of perjury, I declare that this certificate, to the best of my knowledge and belief, is true, correct, and complete.

▲ |

|

|

▲ |

|

Employee’s signature (This form is not valid unless you sign it.) |

|

Date |

||

|

|

|

||

Employer’s name and address |

First date of |

|

Employer identification |

|

|

|

employment |

|

number (EIN) |

For Privacy Act and Paperwork Reduction Act Notice, see page 3. |

Cat. No. 10220Q |

Form |

Form |

Page 2 |

General Instructions

Section references are to the Internal Revenue Code.

Future Developments

For the latest information about developments related to Form

Purpose of Form

Complete Form

Exemption from withholding. You may claim exemption from withholding for 2022 if you meet both of the following conditions: you had no federal income tax liability in 2021 and you expect to have no federal income tax liability in 2022. You had no federal income tax liability in 2021 if (1) your total tax on line 24 on your 2021 Form 1040 or

(2)you were not required to file a return because your income was below the filing threshold for your correct filing status. If you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2022 tax return. To claim exemption from withholding, certify that you meet both of the conditions above by writing “Exempt” on Form

Your privacy. If you prefer to limit information provided in Steps 2 through 4, use the online estimator, which will also increase accuracy.

As an alternative to the estimator: if you have concerns with Step 2(c), you may choose Step 2(b); if you have concerns with Step 4(a), you may enter an additional amount you want withheld per pay period in Step 4(c). If this is the only job in your household, you may instead check the box in Step 2(c), which will increase your withholding and significantly reduce your paycheck (often by thousands of dollars over the year).

When to use the estimator. Consider using the estimator at www.irs.gov/W4App if you:

1.Expect to work only part of the year;

2.Have dividend or capital gain income, or are subject to additional taxes, such as Additional Medicare Tax;

3.Have

4.Prefer the most accurate withholding for multiple job situations.

Nonresident alien. If you’re a nonresident alien, see Notice 1392, Supplemental Form

Specific Instructions

Step 1(c). Check your anticipated filing status. This will determine the standard deduction and tax rates used to compute your withholding.

Step 2. Use this step if you (1) have more than one job at the same time, or (2) are married filing jointly and you and your spouse both work.

Option (a) most accurately calculates the additional tax you need to have withheld, while option (b) does so with a little less accuracy.

If you (and your spouse) have a total of only two jobs, you may instead check the box in option (c). The box must also be checked on the Form

|

Multiple jobs. Complete Steps 3 through 4(b) on only |

! |

|

▲ |

one Form |

CAUTION |

you do this on the Form |

|

Step 3. This step provides instructions for determining the amount of the child tax credit and the credit for other dependents that you may be able to claim when you file your tax return. To qualify for the child tax credit, the child must be under age 17 as of December 31, must be your dependent who generally lives with you for more than half the year, and must have the required social security number. You may be able to claim a credit for other dependents for whom a child tax credit can’t be claimed, such as an older child or a qualifying relative. For additional eligibility requirements for these credits, see Pub. 501, Dependents, Standard Deduction, and Filing Information. You can also include other tax credits for which you are eligible in this step, such as the foreign tax credit and the education tax credits. To do so, add an estimate of the amount for the year to your credits for dependents and enter the total amount in Step 3. Including these credits will increase your paycheck and reduce the amount of any refund you may receive when you file your tax return.

Step 4 (optional).

Step 4(a). Enter in this step the total of your other estimated income for the year, if any. You shouldn’t include income from any jobs or

Step 4(b). Enter in this step the amount from the Deductions Worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2022 tax return and want to reduce your withholding to account for these deductions. This includes both itemized deductions and other deductions such as for student loan interest and IRAs.

Step 4(c). Enter in this step any additional tax you want withheld from your pay each pay period, including any amounts from the Multiple Jobs Worksheet, line 4. Entering an amount here will reduce your paycheck and will either increase your refund or reduce any amount of tax that you owe.

Form |

Page 3 |

Step

If you choose the option in Step 2(b) on Form

Note: If more than one job has annual wages of more than $120,000 or there are more than three jobs, see Pub. 505 for additional tables; or, you can use the online withholding estimator at www.irs.gov/W4App.

1Two jobs. If you have two jobs or you’re married filing jointly and you and your spouse each have one job, find the amount from the appropriate table on page 4. Using the “Higher Paying Job” row and the

“Lower Paying Job” column, find the value at the intersection of the two household salaries and enter |

|

|

that value on line 1. Then, skip to line 3 |

1 |

$ |

2Three jobs. If you and/or your spouse have three jobs at the same time, complete lines 2a, 2b, and 2c below. Otherwise, skip to line 3.

a Find the amount from the appropriate table on page 4 using the annual wages from the highest paying job in the “Higher Paying Job” row and the annual wages for your next highest paying job

in the “Lower Paying Job” column. Find the value at the intersection of the two household salaries |

|

and enter that value on line 2a |

2a $ |

bAdd the annual wages of the two highest paying jobs from line 2a together and use the total as the wages in the “Higher Paying Job” row and use the annual wages for your third job in the “Lower Paying Job” column to find the amount from the appropriate table on page 4 and enter this amount

on line 2b |

2b |

$ |

c Add the amounts from lines 2a and 2b and enter the result on line 2c |

2c |

$ |

3Enter the number of pay periods per year for the highest paying job. For example, if that job pays

weekly, enter 52; if it pays every other week, enter 26; if it pays monthly, enter 12, etc |

3 |

4Divide the annual amount on line 1 or line 2c by the number of pay periods on line 3. Enter this amount here and in Step 4(c) of Form

amount you want withheld) |

4 |

$ |

|

|

|

Step

1Enter an estimate of your 2022 itemized deductions (from Schedule A (Form 1040)). Such deductions

may include qualifying home mortgage interest, charitable contributions, state and local taxes (up to |

|

|

||||

$10,000), and medical expenses in excess of 7.5% of your income . . |

. . . . . . . . . . |

1 |

$ |

|||

|

{ |

• $25,900 if you’re married filing jointly or qualifying widow(er) |

} |

|

|

|

2 Enter: |

• $19,400 if you’re head of household |

. . . . . . . . |

2 |

$ |

||

|

• $12,950 if you’re single or married filing separately |

|

|

|

||

3If line 1 is greater than line 2, subtract line 2 from line 1 and enter the result here. If line 2 is greater

than line 1, enter |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

3 |

$ |

4Enter an estimate of your student loan interest, deductible IRA contributions, and certain other

adjustments (from Part II of Schedule 1 (Form 1040)). See Pub. 505 for more information . . . . |

4 |

$ |

5 Add lines 3 and 4. Enter the result here and in Step 4(b) of Form |

5 |

$ |

|

|

|

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. Internal Revenue Code sections 3402(f)(2) and 6109 and their regulations require you to provide this information; your employer uses it to determine your federal income tax withholding. Failure to provide a properly completed form will result in your being treated as a single person with no other entries on the form; providing fraudulent information may subject you to penalties. Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation; to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws; and to the Department of Health and Human Services for use in the National Directory of New Hires. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103.

The average time and expenses required to complete and file this form will vary depending on individual circumstances. For estimated averages, see the instructions for your income tax return.

If you have suggestions for making this form simpler, we would be happy to hear from you. See the instructions for your income tax return.

Form |

|

|

|

|

|

|

|

|

|

|

|

Page 4 |

||

|

|

|

|

|

Married Filing Jointly or Qualifying Widow(er) |

|

|

|

|

|||||

Higher Paying Job |

|

|

|

Lower Paying Job Annual Taxable Wage & Salary |

|

|

|

|||||||

Annual Taxable |

$0 - |

$10,000 - |

$20,000 - |

$30,000 - |

$40,000 - |

$50,000 - |

$60,000 - |

$70,000 - |

$80,000 - |

$90,000 - |

$100,000 - |

$110,000 - |

||

Wage & Salary |

9,999 |

19,999 |

29,999 |

39,999 |

49,999 |

59,999 |

69,999 |

79,999 |

89,999 |

99,999 |

109,999 |

120,000 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

- |

9,999 |

$0 |

$110 |

$850 |

$860 |

$1,020 |

$1,020 |

$1,020 |

$1,020 |

$1,020 |

$1,020 |

$1,770 |

$1,870 |

$10,000 |

- |

19,999 |

110 |

1,110 |

1,860 |

2,060 |

2,220 |

2,220 |

2,220 |

2,220 |

2,220 |

2,970 |

3,970 |

4,070 |

$20,000 |

- |

29,999 |

850 |

1,860 |

2,800 |

3,000 |

3,160 |

3,160 |

3,160 |

3,160 |

3,910 |

4,910 |

5,910 |

6,010 |

$30,000 |

- |

39,999 |

860 |

2,060 |

3,000 |

3,200 |

3,360 |

3,360 |

3,360 |

4,110 |

5,110 |

6,110 |

7,110 |

7,210 |

$40,000 |

- |

49,999 |

1,020 |

2,220 |

3,160 |

3,360 |

3,520 |

3,520 |

4,270 |

5,270 |

6,270 |

7,270 |

8,270 |

8,370 |

$50,000 |

- |

59,999 |

1,020 |

2,220 |

3,160 |

3,360 |

3,520 |

4,270 |

5,270 |

6,270 |

7,270 |

8,270 |

9,270 |

9,370 |

$60,000 |

- |

69,999 |

1,020 |

2,220 |

3,160 |

3,360 |

4,270 |

5,270 |

6,270 |

7,270 |

8,270 |

9,270 |

10,270 |

10,370 |

$70,000 |

- |

79,999 |

1,020 |

2,220 |

3,160 |

4,110 |

5,270 |

6,270 |

7,270 |

8,270 |

9,270 |

10,270 |

11,270 |

11,370 |

$80,000 |

- |

99,999 |

1,020 |

2,820 |

4,760 |

5,960 |

7,120 |

8,120 |

9,120 |

10,120 |

11,120 |

12,120 |

13,150 |

13,450 |

$100,000 |

- 149,999 |

1,870 |

4,070 |

6,010 |

7,210 |

8,370 |

9,370 |

10,510 |

11,710 |

12,910 |

14,110 |

15,310 |

15,600 |

|

$150,000 |

- 239,999 |

2,040 |

4,440 |

6,580 |

7,980 |

9,340 |

10,540 |

11,740 |

12,940 |

14,140 |

15,340 |

16,540 |

16,830 |

|

$240,000 |

- 259,999 |

2,040 |

4,440 |

6,580 |

7,980 |

9,340 |

10,540 |

11,740 |

12,940 |

14,140 |

15,340 |

16,540 |

17,590 |

|

$260,000 |

- 279,999 |

2,040 |

4,440 |

6,580 |

7,980 |

9,340 |

10,540 |

11,740 |

12,940 |

14,140 |

16,100 |

18,100 |

19,190 |

|

$280,000 |

- 299,999 |

2,040 |

4,440 |

6,580 |

7,980 |

9,340 |

10,540 |

11,740 |

13,700 |

15,700 |

17,700 |

19,700 |

20,790 |

|

$300,000 |

- 319,999 |

2,040 |

4,440 |

6,580 |

7,980 |

9,340 |

11,300 |

13,300 |

15,300 |

17,300 |

19,300 |

21,300 |

22,390 |

|

$320,000 |

- 364,999 |

2,100 |

5,300 |

8,240 |

10,440 |

12,600 |

14,600 |

16,600 |

18,600 |

20,600 |

22,600 |

24,870 |

26,260 |

|

$365,000 |

- 524,999 |

2,970 |

6,470 |

9,710 |

12,210 |

14,670 |

16,970 |

19,270 |

21,570 |

23,870 |

26,170 |

28,470 |

29,870 |

|

$525,000 and over |

3,140 |

6,840 |

10,280 |

12,980 |

15,640 |

18,140 |

20,640 |

23,140 |

25,640 |

28,140 |

30,640 |

32,240 |

||

|

|

|

|

|

|

Single or |

Married |

Filing |

Separately |

|

|

|

|

|

Higher Paying Job |

|

|

|

Lower Paying Job Annual Taxable Wage & Salary |

|

|

|

|||||||

Annual Taxable |

$0 - |

$10,000 - |

$20,000 - |

$30,000 - |

$40,000 - |

$50,000 - |

$60,000 - |

$70,000 - |

$80,000 - |

$90,000 - |

$100,000 - |

$110,000 - |

||

Wage & Salary |

9,999 |

19,999 |

29,999 |

39,999 |

49,999 |

59,999 |

69,999 |

79,999 |

89,999 |

99,999 |

109,999 |

120,000 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

- |

9,999 |

$400 |

$930 |

$1,020 |

$1,020 |

$1,250 |

$1,870 |

$1,870 |

$1,870 |

$1,870 |

$1,970 |

$2,040 |

$2,040 |

$10,000 |

- |

19,999 |

930 |

1,570 |

1,660 |

1,890 |

2,890 |

3,510 |

3,510 |

3,510 |

3,610 |

3,810 |

3,880 |

3,880 |

$20,000 |

- |

29,999 |

1,020 |

1,660 |

1,990 |

2,990 |

3,990 |

4,610 |

4,610 |

4,710 |

4,910 |

5,110 |

5,180 |

5,180 |

$30,000 |

- |

39,999 |

1,020 |

1,890 |

2,990 |

3,990 |

4,990 |

5,610 |

5,710 |

5,910 |

6,110 |

6,310 |

6,380 |

6,380 |

$40,000 |

- |

59,999 |

1,870 |

3,510 |

4,610 |

5,610 |

6,680 |

7,500 |

7,700 |

7,900 |

8,100 |

8,300 |

8,370 |

8,370 |

$60,000 |

- |

79,999 |

1,870 |

3,510 |

4,680 |

5,880 |

7,080 |

7,900 |

8,100 |

8,300 |

8,500 |

8,700 |

8,970 |

9,770 |

$80,000 |

- |

99,999 |

1,940 |

3,780 |

5,080 |

6,280 |

7,480 |

8,300 |

8,500 |

8,700 |

9,100 |

10,100 |

10,970 |

11,770 |

$100,000 |

- 124,999 |

2,040 |

3,880 |

5,180 |

6,380 |

7,580 |

8,400 |

9,140 |

10,140 |

11,140 |

12,140 |

13,040 |

14,140 |

|

$125,000 |

- 149,999 |

2,040 |

3,880 |

5,180 |

6,520 |

8,520 |

10,140 |

11,140 |

12,140 |

13,320 |

14,620 |

15,790 |

16,890 |

|

$150,000 |

- 174,999 |

2,040 |

4,420 |

6,520 |

8,520 |

10,520 |

12,170 |

13,470 |

14,770 |

16,070 |

17,370 |

18,540 |

19,640 |

|

$175,000 |

- 199,999 |

2,720 |

5,360 |

7,460 |

9,630 |

11,930 |

13,860 |

15,160 |

16,460 |

17,760 |

19,060 |

20,230 |

21,330 |

|

$200,000 |

- 249,999 |

2,970 |

5,920 |

8,310 |

10,610 |

12,910 |

14,840 |

16,140 |

17,440 |

18,740 |

20,040 |

21,210 |

22,310 |

|

$250,000 |

- 399,999 |

2,970 |

5,920 |

8,310 |

10,610 |

12,910 |

14,840 |

16,140 |

17,440 |

18,740 |

20,040 |

21,210 |

22,310 |

|

$400,000 |

- 449,999 |

2,970 |

5,920 |

8,310 |

10,610 |

12,910 |

14,840 |

16,140 |

17,440 |

18,740 |

20,040 |

21,210 |

22,470 |

|

$450,000 and over |

3,140 |

6,290 |

8,880 |

11,380 |

13,880 |

16,010 |

17,510 |

19,010 |

20,510 |

22,010 |

23,380 |

24,680 |

||

|

|

|

|

|

|

|

Head of |

Household |

|

|

|

|

|

|

Higher Paying Job |

|

|

|

Lower Paying Job Annual Taxable Wage & Salary |

|

|

|

|||||||

Annual Taxable |

$0 - |

$10,000 - |

$20,000 - |

$30,000 - |

$40,000 - |

$50,000 - |

$60,000 - |

$70,000 - |

$80,000 - |

$90,000 - |

$100,000 - |

$110,000 - |

||

Wage & Salary |

9,999 |

19,999 |

29,999 |

39,999 |

49,999 |

59,999 |

69,999 |

79,999 |

89,999 |

99,999 |

109,999 |

120,000 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

- |

9,999 |

$0 |

$760 |

$910 |

$1,020 |

$1,020 |

$1,020 |

$1,190 |

$1,870 |

$1,870 |

$1,870 |

$2,040 |

$2,040 |

$10,000 |

- |

19,999 |

760 |

1,820 |

2,110 |

2,220 |

2,220 |

2,390 |

3,390 |

4,070 |

4,070 |

4,240 |

4,440 |

4,440 |

$20,000 |

- |

29,999 |

910 |

2,110 |

2,400 |

2,510 |

2,680 |

3,680 |

4,680 |

5,360 |

5,530 |

5,730 |

5,930 |

5,930 |

$30,000 |

- |

39,999 |

1,020 |

2,220 |

2,510 |

2,790 |

3,790 |

4,790 |

5,790 |

6,640 |

6,840 |

7,040 |

7,240 |

7,240 |

$40,000 |

- |

59,999 |

1,020 |

2,240 |

3,530 |

4,640 |

5,640 |

6,780 |

7,980 |

8,860 |

9,060 |

9,260 |

9,460 |

9,460 |

$60,000 |

- |

79,999 |

1,870 |

4,070 |

5,360 |

6,610 |

7,810 |

9,010 |

10,210 |

11,090 |

11,290 |

11,490 |

11,690 |

12,170 |

$80,000 |

- |

99,999 |

1,870 |

4,210 |

5,700 |

7,010 |

8,210 |

9,410 |

10,610 |

11,490 |

11,690 |

12,380 |

13,370 |

14,170 |

$100,000 |

- 124,999 |

2,040 |

4,440 |

5,930 |

7,240 |

8,440 |

9,640 |

10,860 |

12,540 |

13,540 |

14,540 |

15,540 |

16,480 |

|

$125,000 |

- 149,999 |

2,040 |

4,440 |

5,930 |

7,240 |

8,860 |

10,860 |

12,860 |

14,540 |

15,540 |

16,830 |

18,130 |

19,230 |

|

$150,000 |

- 174,999 |

2,040 |

4,460 |

6,750 |

8,860 |

10,860 |

12,860 |

15,000 |

16,980 |

18,280 |

19,580 |

20,880 |

21,980 |

|

$175,000 |

- 199,999 |

2,720 |

5,920 |

8,210 |

10,320 |

12,600 |

14,900 |

17,200 |

19,180 |

20,480 |

21,780 |

23,080 |

24,180 |

|

$200,000 |

- 449,999 |

2,970 |

6,470 |

9,060 |

11,480 |

13,780 |

16,080 |

18,380 |

20,360 |

21,660 |

22,960 |

24,250 |

25,360 |

|

$450,000 and over |

3,140 |

6,840 |

9,630 |

12,250 |

14,750 |

17,250 |

19,750 |

21,930 |

23,430 |

24,930 |

26,420 |

27,730 |

||

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of the W-4 Form | This form is used by employees to indicate their tax situation to their employer. It determines the amount of federal income tax withheld from the employee's paycheck. |

| Annual Update Requirement | Employees may need to fill out a new W-4 form each year or when their personal or financial situation changes. |

| State Variations | Some states have their own version of the W-4 form, and the rules governing these can vary widely. It's important to check the specific requirements for each state. |

| Effect of Inaccuracies | Submitting a W-4 with inaccurate information can result in under or over-withholding of taxes, potentially leading to a balance due or a refund when filing your tax return. |

Guide to Writing IRS W-4

After completing an IRS W-4 form, the next steps involve making sure it is properly processed so that your tax withholdings are accurately adjusted. This crucial financial documentation determines how much federal income tax is withheld from your paycheck. It's important to accurately reflect your current financial situation to avoid owing taxes or receiving a large refund at the end of the fiscal year. Once the form is filled out according to the steps below, submit it to your employer's payroll or human resources department. They will update their payroll system with the new withholding information to ensure the correct amount of tax is deducted from your wages.

- Begin by entering your personal information, including your full name, address, Social Security Number, and tax filing status (single, married filing jointly, etc.).

- If you have multiple jobs or if you and your spouse are both employed, consider the adjustments recommended in the Multiple Jobs Worksheet on page 3 of the W-4.

- Decide if you want to claim any dependents. If so, use the Dependents section to determine the amount of the child tax credit and other dependent credits you can claim.

- Fill out the Other Adjustments section if applicable. This section is for other income (not from jobs), deductions other than the standard deduction, and any extra withholding you'd like to request.

- Review the Extra Withholding section if you want an additional amount withheld from each paycheck. This can be helpful if, for example, you have additional income not subject to withholding or you owe additional taxes for other reasons.

- Sign and date the form. Your signature attests that the information provided is accurate to the best of your knowledge.

Once completed and submitted, it's important to monitor your paychecks to ensure the withholdings are as expected. If your situation changes, such as a change in marital status, the birth of a child, or a change in income, you should fill out a new W-4 form to adjust your withholdings accordingly. Remember, timely updates can help avoid unwanted surprises during tax season.

Understanding IRS W-4

-

What is the IRS W-4 form used for?

The IRS W-4 form, also known as the Employee's Withholding Certificate, is used by employees to inform their employers of their tax situation. This includes marital status, the number of dependents, and any additional income or deductions. The information provided helps employers determine the right amount of federal income tax to withhold from the employee's paycheck. Filling it out correctly ensures that you're not overpaying or underpaying your taxes throughout the year.

-

How often should you update your W-4?

You should update your W-4 whenever you experience a major life change that could affect your tax situation. This includes events like marriage, divorce, the birth of a child, adoption, or a change in your financial situation, such as earning income from a second job or losing income. It's a good idea to review your W-4 annually to ensure your withholdings are accurate for your current situation.

-

Are there penalties for filling out the W-4 incorrectly?

While there are no direct penalties for inaccurately filling out your W-4, doing so can lead to under-withholding, which may result in owing taxes and potential penalties at the end of the year. Conversely, over-withholding means you're giving the government an interest-free loan instead of having access to that money throughout the year. Striving for accuracy helps avoid these scenarios.

-

How can you claim exemption from withholding on the W-4?

To claim exemption from withholding, you need to meet certain criteria, such as not owing any federal income tax in the previous year and expecting to owe none in the current year. If you qualify, you can claim exemption by writing “Exempt” on Form W-4 in the space below Step 4(c). Be sure to submit a new W-4 every year to maintain your exemption status.

-

What should you do if you've had multiple jobs or if both you and your spouse work?

If you have multiple jobs or if both you and your spouse are employed, it's important to adjust your W-4 to avoid owing tax at the end of the year. The IRS provides a Tax Withholding Estimator tool online that can help you determine how to fill out your W-4 in these situations. Alternatively, you can use the Multiple Jobs Worksheet provided with the W-4 form to calculate accurate withholdings.

Common mistakes

Filling out the IRS W-4 form is a critical step for accurately managing your taxes throughout the year. However, it's common for mistakes to be made during this process. These errors can lead to a surprise tax bill or a smaller refund than expected. Here are seven common mistakes:

-

Not updating the form after major life events. Changes such as marriage, divorce, or the birth of a child can significantly affect your tax situation. If these updates are not reflected on the W-4, tax withholdings may not be accurate.

-

Claiming too few allowances. Before 2020, W-4 forms operated on an allowances system. Claiming too few allowances meant more tax was withheld than necessary, potentially leading to a large refund.

-

Claiming too many allowances. Conversely, claiming too many allowances could result in too little tax being withheld, leading to a tax bill during the filing season.

-

Failure to account for all income sources. Those with multiple jobs or households with dual incomes might not account for the combined income, affecting the accuracy of withholdings.

-

Overlooking the deductions worksheet. This section helps individuals adjust withholdings based on expected deductions (beyond the standard deduction), ensuring withholdings more closely match their tax liability.

-

Incorrectly filling out the new W-4 form after 2020 changes. The W-4 form was redesigned to be more straightforward. However, misunderstanding the new form can still lead to inaccurately filled sections.

-

Not consulting a tax professional when unsure. Many individuals attempt to fill out the W-4 on their own without fully understanding their tax situation. This can lead to inaccuracies. Consulting a professional can help clarify any confusion.

In conclusion, careful attention to detail and an updated understanding of your tax situation are critical when filling out the W-4 form. Avoiding these common mistakes can help ensure your withholdings are accurate, preventing unexpected tax outcomes.

Documents used along the form

When employees start a new job or their financial situation changes, the IRS W-4 form becomes crucial in determining the amount of federal income tax to withhold from their wages. However, it’s often not the only document needed during this process. Understanding additional forms and documents can help ensure accuracy and compliance with tax obligations, providing a smoother onboarding experience for both employees and employers.

- I-9 Employment Eligibility Verification: This form is required by the U.S. Citizenship and Immigration Services to verify an employee's identity and eligibility to work in the United States. Both employees and employers must complete their respective sections of the form.

- State Withholding Forms: Depending on the state, an employee may also need to fill out a state-specific tax withholding form. Similar to the W-4, these forms determine the amount of state income tax to withhold from an employee’s paycheck.

- Direct Deposit Authorization Forms: Many employers offer direct deposit. This form is used by employees to authorize the transfer of their paychecks directly into their bank accounts, requiring the provision of bank account details and, often, a voided check.

- Employee’s Withholding Certificate for Local Taxes: In certain localities, employees may also need to complete specific forms to withhold local taxes from their paychecks, further ensuring their tax withholdings are correctly adjusted for their living and working location.

In conclusion, while the IRS W-4 form is a key document for new hires, it is just one part of a larger ecosystem of employment-related documentation. Familiarity with these additional forms not only helps employees manage their tax withholdings more effectively but also supports employers in maintaining compliance with various regulatory requirements. Ensuring these documents are accurately completed and processed is essential for the smooth operation of payroll and tax reporting processes.

Similar forms

The IRS W-4 form, critical for determining the amount of taxes withheld from an employee's paycheck, shares similarities with the IRS W-9 form. Businesses use the W-9 form to collect taxpayer identification numbers from contractors or freelancers to report income paid to the IRS. Both forms serve the essential function of reporting income data to the IRS but are tailored to different types of income earners — W-4 for employees and W-9 for independent contractors.

Another document resembling the W-4 in purpose is the 1099-NEC form, used for reporting non-employee compensation. This form is pivotal for freelancers and independent contractors as it documents income received from clients or companies during the tax year. Similar to the W-4, the 1099-NEC contributes to accurate tax withholding and reporting though it is from the viewpoint of the payer, maintaining the IRS’s objective of capturing all taxable income.

The W-2 form also shares a functional similarity with the W-4 form. Employers issue the W-2 form to employees annually to report wages paid and taxes withheld throughout the year. While the W-4 dictates the amount of federal income tax withheld from an employee’s paycheck, the W-2 provides a year-end summary of these withholdings. In essence, the W-2 form reflects the outcome of the information employees provide on their W-4 forms.

Comparable to the W-4 in its focus on tax withholdings is the state counterpart form that various U.S. states utilize for state tax withholdings from paychecks. Although these forms vary by state, their purpose mirrors that of the W-4 – to inform employers about how much state income tax to withhold from an employee's earnings. Both serve to align tax withholdings with the employee's tax liabilities, but on different jurisdictional levels (federal vs. state).

Lastly, the IRS Form 1040, the U.S. individual income tax return, while more comprehensive, intersects with the W-4 form's objective. Form 1040 is where taxpayers ultimately report their annual income, deductions, and credits to calculate their tax due or refund. The accurate completion of a W-4 form plays a crucial role in ensuring that the amount withheld from each paycheck aligns with the taxpayer's overall liability, as reported on Form 1040. It highlights the continuum from income earning, through withholding, to final reporting and tax reconciliation.

Dos and Don'ts

When filling out the IRS W-4 form, it's important to approach the task with care and attention to detail. The form determines how much federal income tax is withheld from your paycheck, influencing whether you'll owe money or receive a refund at the end of the tax year. Here are some essential do's and don'ts to guide you through the process:

- Do review your W-4 form annually or after major life events, such as marriage, divorce, or the birth of a child, to ensure the information remains accurate.

- Do use the IRS Tax Withholding Estimator tool if you're unsure how to fill out the form. This can provide a clearer idea of your tax obligations and help prevent surprises during tax season.

- Do claim allowances if you are eligible. For instance, having dependents like children can affect the amount of your withholdings.

- Do consult with a tax professional if you have multiple jobs or if your tax situation is complex. Their expertise can help you avoid mistakes and optimize your withholdings.

- Do check the accuracy of your Social Security Number (SSN) and other personal information to prevent processing delays and potential issues.

- Don't underestimate your income if you have freelance work, side gigs, or any other sources of additional income. Underreporting income can lead to underpayment of taxes and penalties.

- Don't forget to consider adjustments if you plan to itemize deductions or have significant non-wage income, like investment earnings, that isn't subject to withholding.

- Don't hesitate to adjust your withholdings if your financial situation changes mid-year. This can help avoid owing a large sum at tax time.

- Don't ignore the W-4 form provided by your employer. Failing to submit a W-4 will result in the highest rate of withholding, which may not be ideal for your financial situation.

Misconceptions

The IRS W-4 form, essential for determining the amount of federal income tax to withhold from an employee's paycheck, is often surrounded by misconceptions. Understanding these misconceptions can help employees ensure they're not overpaying or underpaying their taxes throughout the year. Below are seven common misconceptions about the IRS W-4 form.

- Filling it out once is enough. Many believe that you only need to fill out the W-4 form when you start a new job. However, it's important to update your W-4 form whenever your personal or financial situation changes, such as after getting married, having a child, or experiencing a significant change in income.

- More allowances mean more taken out of your paycheck. Actually, the opposite is true. The more allowances you claim, the less tax is withheld from your paycheck. This is because you’re indicating that you have more deductions or credits that reduce your taxable income.

- Claiming zero allowances maximizes your refund. While claiming zero allowances will increase the amount withheld from your paycheck, potentially leading to a larger refund, it also means less take-home pay throughout the year. Essentially, you’re giving the government an interest-free loan.

- Married couples must file the same number of allowances. Each spouse can claim a different number of allowances based on their individual income, deductions, and credits. This flexibility allows couples to more accurately project their tax liability and adjust withholdings accordingly.

- You can’t make changes to your W-4 during the year. This is false. You can update your W-4 form at any time during the year. In fact, it’s recommended to review your withholdings and consider adjustments after any major life event or change in financial circumstances.

- Only the employee can determine the correct number of allowances. While it’s ultimately the employee's responsibility to accurately complete their W-4, employers and financial advisors can provide guidance. The IRS also offers a Tax Withholding Estimator tool online to help employees make more accurate determinations.

- Submitting a new W-4 for state taxes isn’t necessary. Some states require a separate state withholding form that is similar to the federal W-4. Employees should check with their state's taxation agency or their employer to see if a separate form is needed, as not all states use the federal form for state tax withholdings.

By understanding these misconceptions, employees can take control of their financial situation and avoid surprises during tax season. Regularly reviewing and updating your W-4 form ensures that the right amount of tax is withheld, aligning your expectations with reality when it's time to file your tax return.

Key takeaways

The IRS W-4 form is critical for both employers and employees, guiding how much federal income tax is withheld from a paycheck. Understanding how to fill it out properly and the implications of the information provided is essential. Here are ten key takeaways to help navigate this process:

- Personal Information: At the very beginning, ensure your personal information, including your Social Security Number, is accurate. Mistakes here could lead to processing delays or issues with your tax return.

- Multiple Jobs or Spouse Works: If you have more than one job or if you're married and your spouse also works, special attention is needed. The form provides options to account for this to ensure enough tax is withheld.

- Claim Dependents: If you have dependents, you might qualify for the Child Tax Credit or other credits. Properly claiming dependents can significantly reduce the amount of tax you owe.

- Other Adjustments: Section 4 allows for other adjustments, including other income not from jobs, deductions other than the standard deduction, and any extra withholding you desire. This section tailors withholding to your exact financial situation.

- Exemption Claims: If you meet certain criteria, you might be exempt from withholding. However, this requires understanding the eligibility rules and, if claiming exemption, certifying that you meet them for the current year.

- Tax Withholding Estimator: The IRS provides an online Tax Withholding Estimator tool. This tool can help you calculate the accurate withholding amount based on your personal financial situation.

- Changes in Life Events: Life changes, such as a marriage, divorce, or the birth of a child, can affect your tax situation. Updating your W-4 in response to these events is crucial to avoid under or over-withholding.

- Yearly Review: Even if your situation doesn't change, reviewing your W-4 annually is a good practice. It ensures that the amount being withheld from your paycheck aligns with the overall tax you will owe for the year.

- Privacy: If you're concerned about privacy, particularly regarding disclosing income from multiple jobs to your employer, the form provides options to address this. You can choose a withholding amount that complements your privacy needs.

- Final Check: Before submitting your W-4 to your employer, double-check all the information for accuracy. Incorrect information can lead to incorrect withholding, impacting your tax bill or refund at the year's end.

Completing the W-4 accurately is a step toward financial stability, ensuring you're not caught off-guard by a large tax bill or missing out on money that could be in your pocket throughout the year. If you're uncertain, consulting a tax advisor is a wise choice.

Popular PDF Documents

1040 Irs Form - The IRS website provides the latest updates on Form 1040-ES and instructions for completion.

Oregon Income Tax Form - The form is designed to be printed and mailed, as there is no option for electronic filing.

Irs 501 - Mailing instructions are provided, including the specific PO Box in Columbus, Ohio, designated for IT 501 submissions.