Get IRS W-2 Form

The IRS W-2 form stands as a critical document in the annual financial and tax reporting landscape for both employers and employees in the United States, encapsulating an array of information pivotal for accurate tax preparation and compliance with federal and state tax laws. It serves dual purposes: providing employees with details on the income they've earned and the taxes withheld from that income over a calendar year, and supplying the Internal Revenue Service (IRS) with a record to verify an individual's tax obligations and refunds. This comprehensive snapshot includes wages, salaries, bonuses, and other forms of compensation, alongside deductions for federal and state taxes, Social Security, Medicare, and any additional withholdings. As the cornerstone for tax reporting, understanding the facets of the W-2 form is essential for both employers, who are tasked with issuing the form to each employee and submitting copies to the SSA (Social Security Administration) and the IRS by specific deadlines, and employees, who rely on the accuracy of these documents to fulfill their tax responsibilities. Its significance is underscored by its role in detecting and preventing fraud, ensuring that the reported income matches the taxes collected by the government, thus maintaining the integrity of the tax system.

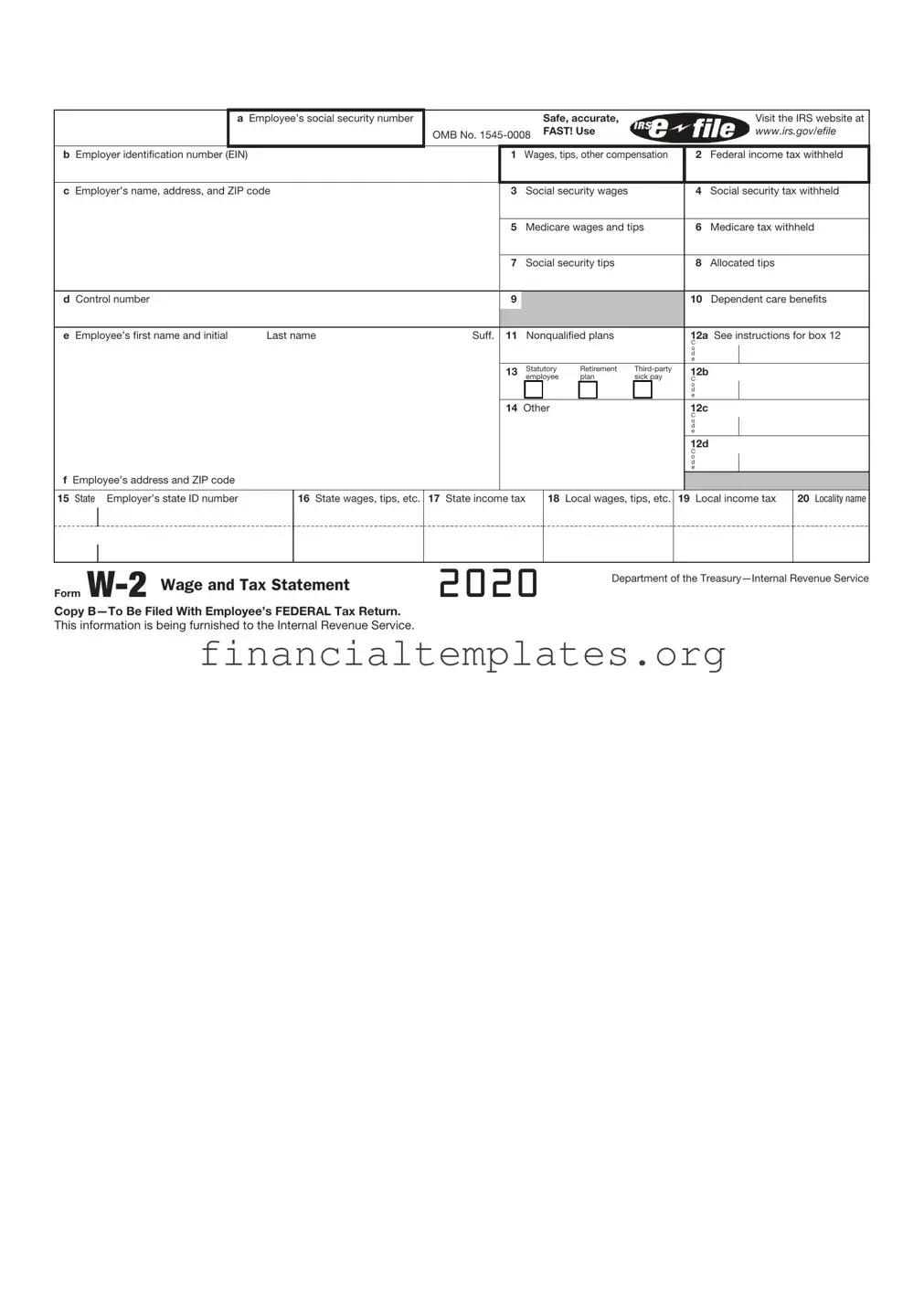

IRS W-2 Example

Attention:

You may file Forms

Note: Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file Copy A downloaded from this website with the SSA; a penalty may be imposed for filing forms that can’t be scanned. See the penalties section in the current General Instructions for Forms

Please note that Copy B and other copies of this form, which appear in black, may be downloaded, filled in, and printed and used to satisfy the requirement to provide the information to the recipient.

To order official IRS information returns such as Forms

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax forms.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22222 |

VOID |

|

|

a |

Employee’s social security number |

For Official Use Only ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

OMB No. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

b Employer identification number (EIN) |

|

|

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

d Control number |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e Employee’s first name and initial |

|

Last name |

|

Suff. |

11 |

Nonqualified plans |

|

|

|

12a See instructions for box 12 |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

15 State Employer’s state ID number |

|

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

|

20 Locality name |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2021 |

|

|

Department of the |

||||||||||||||||||||||

|

|

|

|

|

For Privacy Act and Paperwork Reduction |

||||||||||||||||||||||

|

Copy |

|

|

|

|

|

Act Notice, see the separate instructions. |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Form |

|

|

|

|

|

|

|

|

|

|

Cat. No. 10134D |

|||||||||||||||

Do Not Cut, Fold, or Staple Forms on This Page

22222 |

a Employee’s social security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

OMB No. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

||||

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2021 |

|

|

Department of the |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

Copy

|

|

a |

Employee’s social security number |

|

|

|

Safe, accurate, |

|

|

|

|

|

Visit the IRS website at |

|

|||||

|

|

|

|

|

OMB No. |

FAST! Use |

|

|

|

|

|

www.irs.gov/efile |

|

||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a See instructions for box 12 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

|

|

||||

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2021 |

|

|

Department of the |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Copy

This information is being furnished to the Internal Revenue Service.

Notice to Employee

Do you have to file? Refer to the Instructions for Forms 1040 and

Earned income credit (EIC). You may be able to take the EIC for 2021 if your adjusted gross income (AGI) is less than a certain amount. The amount of the credit is based on income and family size. Workers without children could qualify for a smaller credit. You and any qualifying children must have valid social security numbers (SSNs). You can’t take the EIC if your investment income is more than the specified amount for 2021 or if income is earned for services provided while you were an inmate at a penal institution. For 2021 income limits and more information, visit www.irs.gov/EITC. See also Pub. 596, Earned Income Credit. Any EIC that is more than your tax liability is refunded to you, but only if you file a tax return.

Employee’s social security number (SSN). For your protection, this form may show only the last four digits of your SSN. However, your employer has reported your complete SSN to the IRS and SSA.

Clergy and religious workers. If you aren’t subject to social security and Medicare taxes, see Pub. 517, Social Security and Other Information for Members of the Clergy and Religious Workers.

Corrections. If your name, SSN, or address is incorrect, correct Copies B, C, and 2 and ask your employer to correct your employment record. Be sure to ask the employer to file Form

Cost of

Credit for excess taxes. If you had more than one employer in 2021 and more than $8,853.60 in social security and/or Tier 1 railroad retirement (RRTA) taxes were withheld, you may be able to claim a credit for the excess against your federal income tax. If you had more than one railroad employer and more than $5,203.80 in Tier 2 RRTA tax was withheld, you may also be able to claim a credit. See the Instructions for Forms 1040 and

(See also Instructions for Employee on the back of Copy C.)

aEmployee’s social security number

|

This information is being furnished to the Internal Revenue Service. If you |

|

OMB No. |

are required to file a tax return, a negligence penalty or other sanction |

|

may be imposed on you if this income is taxable and you fail to report it. |

||

|

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a See instructions for box 12 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

||||

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2021 |

|

|

Department of the |

||||||||||||

|

|

|

|

Safe, accurate, |

|

|||||||||||

Copy |

|

|

|

|

|

|

|

FAST! Use |

|

|||||||

(See Notice to Employee on the back of Copy B.)

Instructions for Employee

(See also Notice to Employee on the back of Copy B.)

Box 1. Enter this amount on the wages line of your tax return.

Box 2. Enter this amount on the federal income tax withheld line of your tax return.

Box 5. You may be required to report this amount on Form 8959, Additional Medicare Tax. See the Instructions for Forms 1040 and

Box 6. This amount includes the 1.45% Medicare Tax withheld on all Medicare wages and tips shown in box 5, as well as the 0.9% Additional Medicare Tax on any of those Medicare wages and tips above $200,000.

Box 8. This amount is not included in box 1, 3, 5, or 7. For information on how to report tips on your tax return, see the Instructions for Forms 1040 and

You must file Form 4137, Social Security and Medicare Tax on Unreported Tip Income, with your income tax return to report at least the allocated tip amount unless you can prove with adequate records that you received a smaller amount. If you have records that show the actual amount of tips you received, report that amount even if it is more or less than the allocated tips. Use Form 4137 to figure the social security and Medicare tax owed on tips you didn’t report to your employer. Enter this amount on the wages line of your tax return. By filing Form 4137, your social security tips will be credited to your social security record (used to figure your benefits).

Box 10. This amount includes the total dependent care benefits that your employer paid to you or incurred on your behalf (including amounts from a section 125 (cafeteria) plan). Any amount over $5,000 is also included in box 1. Complete Form 2441, Child and Dependent Care Expenses, to figure any taxable and nontaxable amounts.

Box 11. This amount is (a) reported in box 1 if it is a distribution made to you from a nonqualified deferred compensation or nongovernmental section 457(b) plan, or (b) included in box 3 and/or box 5 if it is a prior year deferral under a nonqualified or section 457(b) plan that became taxable for social security and Medicare taxes this year because there is no longer a substantial risk of forfeiture of your right to the deferred amount. This box shouldn’t be used if you had a deferral and a

distribution in the same calendar year. If you made a deferral and received a distribution in the same calendar year, and you are or will be age 62 by the end of the calendar year, your employer should file Form

Box 12. The following list explains the codes shown in box 12. You may need this information to complete your tax return. Elective deferrals (codes D, E, F, and S) and designated Roth contributions (codes AA, BB, and EE) under all plans are generally limited to a total of $19,500 ($13,500 if you only have SIMPLE plans; $22,500 for section 403(b) plans if you qualify for the

However, if you were at least age 50 in 2021, your employer may have allowed an additional deferral of up to $6,500 ($3,000 for section 401(k)(11) and 408(p) SIMPLE plans). This additional deferral amount is not subject to the overall limit on elective deferrals. For code G, the limit on elective deferrals may be higher for the last 3 years before you reach retirement age. Contact your plan administrator for more information. Amounts in excess of the overall elective deferral limit must be included in income. See the Instructions for Forms 1040 and

Note: If a year follows code D through H, S, Y, AA, BB, or EE, you made a

(continued on back of Copy 2)

|

|

a Employee’s social security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

OMB No. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

||||

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2021 |

|

|

Department of the |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

Copy

Income Tax Return

Instructions for Employee (continued from back of

Copy C)

Box 12 (continued)

Box 13. If the “Retirement plan” box is checked, special limits may apply to the amount of traditional IRA contributions you may deduct. See Pub.

Box 14. Employers may use this box to report information such as state disability insurance taxes withheld, union dues, uniform payments, health insurance premiums deducted, nontaxable income, educational assistance payments, or a member of the clergy’s parsonage allowance and utilities. Railroad employers use this box to report railroad retirement (RRTA) compensation, Tier 1 tax, Tier 2 tax, Medicare tax, and Additional Medicare Tax. Include tips reported by the employee to the employer in railroad retirement (RRTA) compensation.

Note: Keep Copy C of Form

|

VOID |

|

|

a Employee’s social security number |

OMB No. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a See instructions for box 12 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

||||

|

|

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2021 |

|

|

Department of the |

|||||||||||||||

|

|

|

|

For Privacy Act and Paperwork Reduction |

|||||||||||||||

Copy |

|

|

|

|

|

|

|

|

|

|

Act Notice, see separate instructions. |

||||||||

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The IRS W-2 form is officially titled the "Wage and Tax Statement." |

| 2 | It is used by employers to report annual wages and taxes withheld from employees' paychecks to the IRS. |

| 3 | Employers must send out W-2 forms to their employees by January 31st of the year following the reported earnings. |

| 4 | Employees use the information on the W-2 form to prepare their federal and state tax returns. |

| 5 | The form contains information such as the employee's social security number, income, tax withheld, and contributions to retirement plans. |

| 6 | There are multiple copies of the W-2 form: Copy A is sent to the Social Security Administration, Copy B is for filing with the employee’s federal tax returns, and other copies are for state or local tax departments and the employee's records. |

| 7 | Failure to file the W-2 form correctly and on time can result in penalties for employers. |

| 8 | The W-2 form has been around since the introduction of the income tax in 1913. |

| 9 | For state-specific reporting, some states have additional requirements or forms that must be submitted along with the federal W-2. |

| 10 | Electronic filing of W-2 forms is available and encouraged for employers, providing a more efficient and secure way of transmission to federal and state entities. |

Guide to Writing IRS W-2

Filing out the IRS W-2 form is an essential process for employers, as it entails reporting wages, tips, and other compensation paid to an employee during the tax year. This document is critical for both the employer, who needs to comply with federal tax obligations, and the employee, who requires it to file personal income taxes. The procedure can seem daunting at first, but breaking it down into manageable steps simplifies the task, ensuring accuracy and compliance with IRS requirements.

- Gather employee information: Collect all necessary details such as the employee's Social Security Number (SSN), address, and full name. This ensures accuracy in reporting and identification.

- Understand the W-2 form: Familiarize yourself with the different boxes on the W-2 form and what each represents, including wages earned, federal income tax withheld, Social Security wages, and so on.

- Fill out employee's financial details: Enter the total amount of wages, tips, and other compensation paid to the employee in the respective year. Make sure to accurately report all earnings to avoid any discrepancies.

- Calculate and enter withholdings: Calculate the total federal income tax, Social Security tax, and Medicare tax withheld from the employee's earnings throughout the year and input these amounts in the designated boxes.

- Include dependent care benefits and other benefits: If applicable, report any dependent care benefits provided to the employee, along with any other benefits that may need to be disclosed on the W-2 form.

- Verify state and local tax information: If you operate in a state or locality that requires income tax withholding, ensure these amounts are correctly calculated and reported in the respective sections.

- Review the form: Double-check all entries for accuracy. Misreporting or typos can lead to unnecessary complications for both the employee and employer.

- Sign and date the form: The employer must sign and date the W-2 form, validating its accuracy and completeness.

- Distribute copies: Distribute the necessary copies to the employee, the Social Security Administration (SSA), and any state or local tax departments as required. Remember, employees should receive their copies by January 31 of the year following the reported earnings.

- Retain a copy for records: Keep a copy of each W-2 form for your records. This is crucial for future reference and compliance with record-keeping requirements set forth by the IRS.

By diligently following these steps, employers can ensure they fulfill their reporting obligations accurately and efficiently. This not only helps in maintaining compliance with tax regulations but also supports employees in managing their own tax responsibilities. The key is to approach the process methodically, ensuring that each piece of information is double-checked for accuracy. With careful attention to detail and adherence to the guidelines, filling out the IRS W-2 form can be completed successfully.

Understanding IRS W-2

-

What is a W-2 form?

The Internal Revenue Service (IRS) W-2 form is an essential document for employees in the United States. It reports an employee's annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 is used by employees to prepare their annual tax returns.

-

Who needs to file a W-2 form?

Any employer engaged in a trade or business who pays remuneration for services performed by an employee, including non-cash payments, must file a W-2 form for each employee from whom Income, Social Security, or Medicare tax was withheld.

-

When is the W-2 form due?

Employers must send out the W-2 forms to their employees by January 31st of the year following the reporting year. For instance, for the 2022 reporting year, the W-2 forms should reach the employees by January 31, 2023.

-

What should I do if I find an error on my W-2 form?

If you discover an error on your W-2 form, you should immediately contact your employer. Your employer will have to issue a corrected W-2, known as a W-2c, to both you and the IRS to fix any mistakes.

-

How can I get a copy of my W-2 form?

If you need a copy of your W-2 form, start by asking your employer. If you cannot obtain your W-2 from your employer, you can request a copy from the IRS by filing Form 4506-T, but be aware that a fee may be required.

-

What information does the W-2 form include?

The W-2 form includes various pieces of information, such as your wage, salary, and other compensation, tips earned, federal and state taxes withheld, Social Security and Medicare earnings, retirement plan contributions, and other benefits.

-

Can I file my tax return if I haven't received my W-2?

If you have not received your W-2 by the due date, you should contact your employer to request a copy. If you still don't receive it, you can file Form 4852, Substitute for Form W-2, with your tax return, estimating your income and withholding taxes as accurately as possible.

-

What are the penalties for employers who do not issue W-2 forms?

Employers who fail to provide W-2 forms to their employees or file them with the IRS may face penalties. These penalties vary based on how late the W-2 forms are issued or filed and can increase over time, including potential criminal charges for intentional disregard of filing requirements.

Common mistakes

When it comes to filling out the IRS W-2 form, ensuring accuracy is crucial for both employers and employees. Mistakes can lead to a range of issues, from processing delays to audits. Here are six common errors that are often encountered:

Incorrect Social Security Numbers: One of the most frequent mistakes is entering incorrect Social Security numbers. This error can cause significant delays in processing tax returns and might lead to issues with an individual’s Social Security benefits.

Misclassifying Employees: Sometimes, workers are incorrectly classified as independent contractors instead of as employees. This misclassification can affect how taxes are reported and paid, potentially landing a business in hot water with the IRS.

Incorrect Wage or Tax Amounts: Reporting incorrect income or withholding amounts can lead to discrepancies that might trigger an IRS inquiry. This mistake often results from typographical errors or failing to account for all sources of income.

Using the Wrong Year’s Form: The IRS updates forms annually, and using an outdated version can result in processing delays. Always verify that you are using the correct version for the tax year you are reporting.

Failure to Provide Complete Information: Leaving fields blank or not providing complete information can lead to the rejection of the W-2 form. It's important to review your form thoroughly to ensure all necessary information is included.

Omitting State or Local Tax Information: If applicable, state or local tax information must be included. Failing to do so can lead to issues with state or local tax returns.

To avoid these mistakes, double-check all information before submission and consult the IRS website or a tax professional if you're unsure about any details. Remember, correcting these errors promptly can help avoid any potential headaches with the IRS down the line.

Documents used along the form

The IRS W-2 form is crucial for many individuals during tax season as it reports an employee’s annual wages and the amount of taxes withheld from their paycheck. However, this form is often just one piece of the puzzle when filing taxes. Several other documents may be used alongside the W-2 to provide a comprehensive overview of someone's financial situation and fulfill their reporting obligations. Below is a list of up to 10 other forms and documents that are frequently used in conjunction with the IRS W-2 form.

- IRS 1040 Form: This is the standard federal income tax form used to report an individual’s gross income. It is where you summarize your earnings, deductions, and credits to determine how much tax you owe or are refunded.

- IRS 1099 Form: This form reports income from self-employment earnings, interest and dividends, government payments, and more. It's essential for individuals who have income that is not subject to withholding.

- Schedule C: Sole proprietors use this form to report profits or losses from their business. It is filed along with the 1040 to show the IRS the income and expenses of your business.

- Schedule D: This form is used to report capital gains or losses from the sale of assets. It is important for individuals who have invested in stocks, bonds, or real estate.

- Schedule E: Used to report income and losses from rental property, royalties, partnerships, S corporations, estates, and trusts. It's crucial for taxpayers who have income from these sources.

- Schedule SE: This form is used to calculate the self-employment tax owed on income from self-employment. It's necessary for freelancers, independent contractors, and small business owners.

- Form 8863: For those who are eligible, this form is used to claim education credits, including the American Opportunity Credit and the Lifetime Learning Credit, helping to reduce the tax bill by the amount spent on certain educational expenses.

- Form 8962: This form is used to calculate the amount of premium tax credit (PTC) and reconcile it with any advance payments of the PTC. It's essential for individuals who obtained health insurance through the Marketplace.

- State Tax Return Forms: In addition to federal taxes, many individuals are required to file state tax returns. Each state has its own set of forms that are similar to the federal forms but tailored to the specific tax laws of that state.

- W-4 Form: Though not filed with your tax return, the W-4 is closely related to the W-2, as it is used by employees to determine the amount of federal income tax to withhold from their paychecks.

Together, these forms and documents help individuals accurately report their income, calculate taxes owed, and take advantage of any deductions or credits they're eligible for. It is essential to understand the purpose of each document to ensure a complete and correct tax filing process. Keeping organized records and understanding the connections between these documents can significantly streamline the tax preparation process.

Similar forms

The IRS 1099 form bears similarity to the W-2 form in its function of reporting income. However, unlike the W-2, which is used for employees, the 1099 is for freelancers, independent contractors, and other non-employee compensation. This form details the amount of money a person has received from a single entity over the fiscal year, serving much the same purpose as the W-2 but for individuals not traditionally employed.

The W-4 form is another document related to the W-2, focusing instead on an employee's withholding allowances. Employees fill out this form when they start a new job to determine how much federal income tax to withhold from their wages. The vital link between the W-4 and the W-2 is that the information provided on the former directly influences the financial information reported on the latter, ensuring the correct tax amount is withheld from an employee's pay.

Similar to the W-2 form is the IRS Form W-3, which serves as a summary of individual W-2 forms for employers. This document is sent to the Social Security Administration (SSA) alongside copies of the W-2 forms. It compiles the total earnings, Social Security wages, Medicare wages, and withholding for all employees of a company, making it a collective report of what is individually detailed on each W-2 form.

The IRS form 941, Employer's Quarterly Federal Tax Return, also connects closely to the W-2. This form is used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks. Additionally, it reports the employer's portion of Social Security or Medicare tax. The cumulative information reported quarterly on Form 941 helps to verify the accuracy of income and taxes withheld as reported on the yearly W-2 forms.

Another document similar to the W-2 is the state wage and tax statement forms, which vary by state. Like the W-2, these forms report the amount of state and possibly local income tax withheld from an employee's wages. While the W-2 includes this information, some states require a separate form to report and detail the information specifically for state tax purposes, ensuring compliance with state-level tax obligations.

The IRS Form 1040, the U.S. Individual Income Tax Return, while primarily for individuals to file their annual income taxes, is closely related to the information on a W-2. The form includes sections where taxpayers report wages, salaries, and tips, typically from their W-2 forms, along with other income sources. This makes the W-2 a crucial document for accurately completing the 1040, ensuring individuals report their income correctly to the IRS.

Dos and Don'ts

When preparing the IRS W-2 form, individuals and employers are advised to proceed with caution to ensure accuracy and compliance with all applicable tax laws. The following lists detail the do’s and don'ts that should be considered:

Do:

- Review all employee information carefully, including Social Security numbers and addresses, to ensure accuracy.

- Use the official IRS W-2 form that is applicable for the tax year you are reporting.

- Report all wages, tips, and other compensation in the correct boxes and ensure that the totals add up correctly.

- Submit the form to the Social Security Administration by the due date, generally January 31, to avoid penalties.

Don't:

- Leave any fields blank; if a field does not apply, enter "0" or "not applicable" as appropriate.

- Guess or estimate figures. Use actual payroll records to report earnings and withholdings accurately.

- Forget to distribute copies of the W-2 form to your employees by the January 31 deadline.

- Ignore discrepancies between your records and the W-2. Double-check and correct any errors before submission.

Misconceptions

When it comes to the Internal Revenue Service (IRS) W-2 form, many people hold misconceptions that can lead to confusion and errors. Understanding what the W-2 form is and what it's not can help clarify tax responsibilities and streamline the filing process. Here is a list of six common myths about the IRS W-2 form and the facts that dispel them.

- Only full-time employees receive a W-2. This is a misunderstanding. Both full-time and part-time employees should receive a W-2 form from their employer. The key factor is not the hours worked but rather that the person has been employed and has had taxes withheld from their paycheck.

- Independent contractors should expect a W-2. This is incorrect. Independent contractors, freelancers, and self-employed individuals typically do not receive W-2 forms. Instead, they should receive a Form 1099-NEC if they have earned $600 or more from an entity during the tax year. The W-2 form is specifically for employees.

- You don’t have to report W-2 income if you didn’t receive the form. This is untrue. Even if the W-2 form is lost or never received, individuals are still responsible for reporting all income earned to the IRS. In such cases, it's important to contact the employer to request a copy or use the IRS's "Get Transcript" tool as a last resort.

- The W-2 form only reports wage income. While it's true that the W-2 form primarily reports wages, salaries, and tips, it also includes other types of compensation such as bonuses, commissions, and tax-exempt benefits. Additionally, it reports federal and state tax withholdings, social security and Medicare earnings, and contributions to retirement plans.

- If I work in different states, I'll receive multiple W-2 forms. This can be both true and false, depending on how an employer chooses to report. Some employers issue separate W-2 forms for income earned in different states, while others may consolidate earnings and withholdings into a single W-2 form. Always verify the accuracy of state-related information on the W-2 form, especially if you’ve worked in multiple states.

- Filing taxes is not possible without a W-2. While filing taxes is certainly easier with a W-2, it is not impossible without one. If the tax deadline is approaching and an individual still hasn't received their W-2, they should file Form 4852, Substitute for Form W-2, Wage and Tax Statement. This allows them to estimate earnings and withholdings based on their last paystub, ensuring timely filing.

Key takeaways

The IRS W-2 form, a critical document for both employers and employees, plays a vital role in the annual tax filing process. This document reports an employee's annual wages along with the amount of taxes withheld from their paycheck. Understanding its components and ensuring its accuracy is pivotal for the smooth completion of tax responsibilities.

- Every employer engaged in a trade or business, who pays remuneration for services performed by an employee, including noncash payments, must file a W-2 form for each employee from whom:

- Income, Social Security, or Medicare tax was withheld.

- Income tax would have been withheld if the employee had claimed no more than one withholding allowance or had not claimed exemption from withholding on a Form W-4.

- The W-2 form must be filled out by the employer and provided to each employee by January 31 of the year following the reporting year. For example, for the 2022 reporting year, the due date was January 31, 2023.

- It is essential for employees to review their W-2 forms upon receipt to check for any discrepancies in their personal information, such as SSN and address, and in their financial information, including wages and tax withholdings.

- If corrections are required, the employer must issue a corrected W-2 form, known as a W-2c, as soon as possible.

- Employees need the W-2 form to file their federal and state taxes. Without this document, correctly filing taxes can be challenging and potentially delay any tax refunds.

- The W-2 form includes several copies: Copy A to be sent to the Social Security Administration, Copy B and C for the employee (for federal tax return filing and personal records respectively), and Copy D for the employer’s records.

- Employers must also ensure that they submit Copy A of the W-2 form electronically or by mail to the Social Security Administration by the end of January. Late submissions can result in penalties.

- The information on the W-2 form helps employees to understand how much they’ve earned in a year and how much has been withheld for taxes, thereby assisting in financial planning and budgeting.

- For any questions or additional clarifications regarding the W-2 form, employees should not hesitate to contact their HR department or payroll provider. Inaccurate information can lead to tax issues and possibly penalties.

Popular PDF Documents

IRS 1065 - A well-prepared Form 1065 can help partnerships facilitate smooth operations and future planning by accurately reflecting their financial health.

IRS 8863 - Form 8863 provides a way for families to offset the cost of higher education by reducing their tax liability.

Revenue Portal Login - By asking about previous employment and military service, the form aligns with broader efforts to select applicants who demonstrate reliability, responsibility, and a commitment to public service.