Get IRS W-10 Form

Navigating tax season involves keeping track of numerous forms, and among them, the W-10 form plays a crucial role for individuals who pay for child and dependent care. This document is essential for taxpayers who intend to claim the Child and Dependent Care Credit, a significant tax break that can lower their tax bill by allowing them to deduct eligible expenses related to the care of dependents. The form serves as a means to officially identify the provider of these services, requiring the caregiver's name, address, and taxpayer identification number (TIN), which can be a Social Security number for individuals, or an Employer Identification Number for daycare centers. By completing the W-10, taxpayers lay the groundwork to prove to the Internal Revenue Service (IRS) that their claimed expenses are legitimate, helping to streamline the process and ensure compliance with tax laws. With the financial relief that the Child and Dependent Care Credit offers, understanding and accurately completing the W-10 form is a vital step for eligible taxpayers.

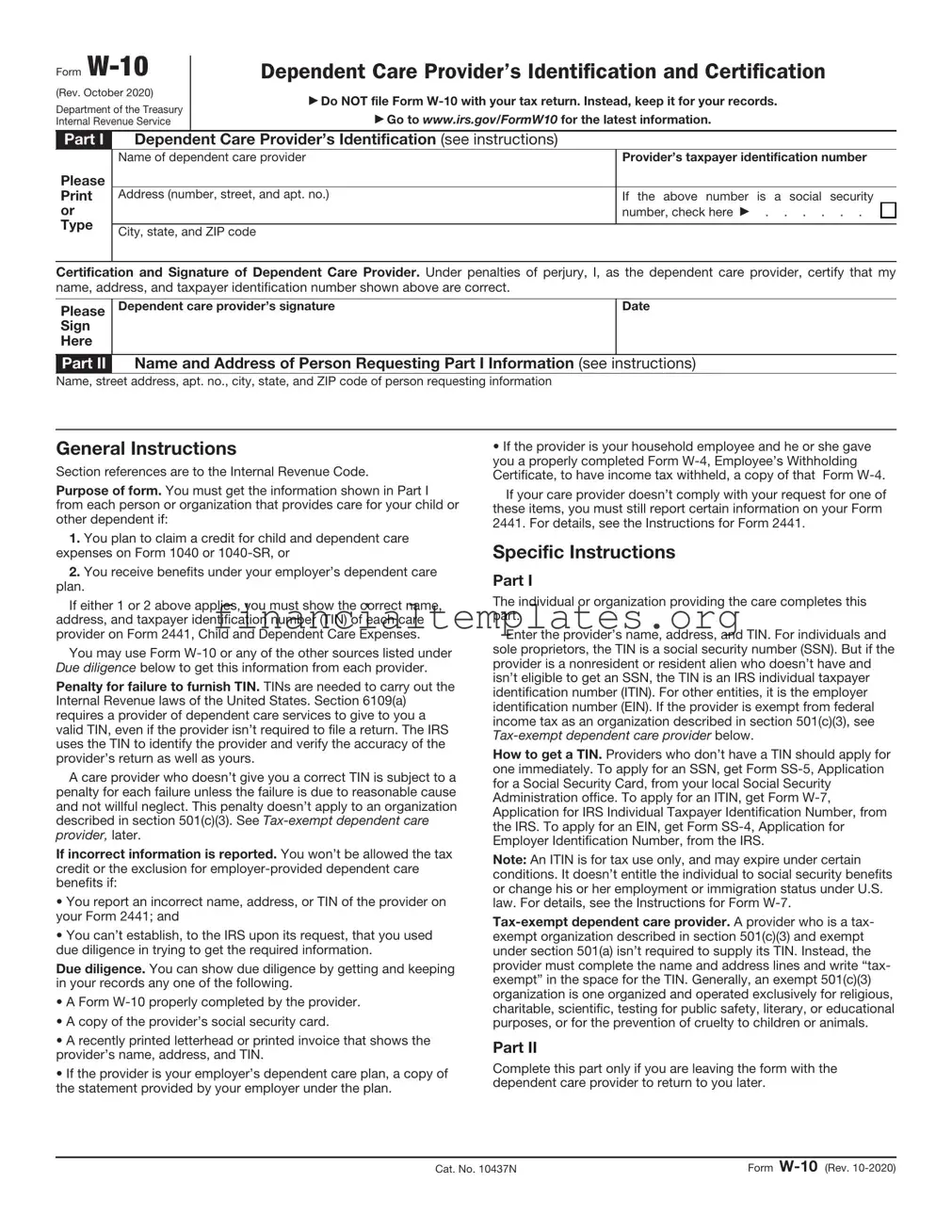

IRS W-10 Example

Form

(Rev. October 2020)

Department of the Treasury Internal Revenue Service

Dependent Care Provider’s Identification and Certification

Do NOT file Form

Go to www.irs.gov/FormW10 for the latest information.

Part I Dependent Care Provider’s Identification (see instructions)

Please

Print or Type

Name of dependent care provider |

Provider’s taxpayer identification number |

||

|

|

|

|

Address (number, street, and apt. no.) |

If the above number is a social security |

||

|

number, check here |

. . . . . . |

|

|

|

|

|

City, state, and ZIP code |

|

|

|

|

|

|

|

Certification and Signature of Dependent Care Provider. Under penalties of perjury, I, as the dependent care provider, certify that my name, address, and taxpayer identification number shown above are correct.

Please

Sign

Here

Dependent care provider’s signature

Date

Part II Name and Address of Person Requesting Part I Information (see instructions)

Name, street address, apt. no., city, state, and ZIP code of person requesting information

General Instructions

Section references are to the Internal Revenue Code.

Purpose of form. You must get the information shown in Part I from each person or organization that provides care for your child or other dependent if:

1.You plan to claim a credit for child and dependent care expenses on Form 1040 or

2.You receive benefits under your employer’s dependent care plan.

If either 1 or 2 above applies, you must show the correct name, address, and taxpayer identification number (TIN) of each care provider on Form 2441, Child and Dependent Care Expenses.

You may use Form

Penalty for failure to furnish TIN. TINs are needed to carry out the Internal Revenue laws of the United States. Section 6109(a) requires a provider of dependent care services to give to you a valid TIN, even if the provider isn’t required to file a return. The IRS uses the TIN to identify the provider and verify the accuracy of the provider’s return as well as yours.

A care provider who doesn’t give you a correct TIN is subject to a penalty for each failure unless the failure is due to reasonable cause and not willful neglect. This penalty doesn’t apply to an organization described in section 501(c)(3). See

If incorrect information is reported. You won’t be allowed the tax credit or the exclusion for

•You report an incorrect name, address, or TIN of the provider on your Form 2441; and

•You can’t establish, to the IRS upon its request, that you used due diligence in trying to get the required information.

Due diligence. You can show due diligence by getting and keeping in your records any one of the following.

•A Form

•A copy of the provider’s social security card.

•A recently printed letterhead or printed invoice that shows the provider’s name, address, and TIN.

•If the provider is your employer’s dependent care plan, a copy of the statement provided by your employer under the plan.

•If the provider is your household employee and he or she gave you a properly completed Form

If your care provider doesn’t comply with your request for one of these items, you must still report certain information on your Form 2441. For details, see the Instructions for Form 2441.

Specific Instructions

Part I

The individual or organization providing the care completes this part.

Enter the provider’s name, address, and TIN. For individuals and sole proprietors, the TIN is a social security number (SSN). But if the provider is a nonresident or resident alien who doesn’t have and isn’t eligible to get an SSN, the TIN is an IRS individual taxpayer identification number (ITIN). For other entities, it is the employer identification number (EIN). If the provider is exempt from federal income tax as an organization described in section 501(c)(3), see

How to get a TIN. Providers who don’t have a TIN should apply for one immediately. To apply for an SSN, get Form

Note: An ITIN is for tax use only, and may expire under certain conditions. It doesn’t entitle the individual to social security benefits or change his or her employment or immigration status under U.S. law. For details, see the Instructions for Form

Part II

Complete this part only if you are leaving the form with the dependent care provider to return to you later.

Cat. No. 10437N |

Form |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS W-10 form is used by taxpayers to provide information about child and dependent care expenses. This helps in qualifying for a tax credit. |

| Who Must File | Anyone claiming the Child and Dependent Care Tax Credit for expenses related to the care of a qualifying individual must complete the form. |

| Required Information | Taxpayers must provide the care provider's name, address, and taxpayer identification number (TIN) on the form. |

| State-Specific Forms | While the W-10 is a federal form, certain states may require additional documentation or have specific laws regarding dependent care credits. Taxpayers should check their state's Department of Revenue for more details. |

Guide to Writing IRS W-10

Filing out the IRS W-10 form is an essential step for taxpayers who want to claim childcare expenses on their tax returns. This form serves as a means to provide the necessary information about the childcare provider to the Internal Revenue Service (IRS). Completing it accurately ensures that you're in a good position when claiming child or dependent care expenses. Following a straightforward, step-by-step guide can help simplify this process.

- Begin by entering the name of the childcare provider in the space provided. This should be the full legal name of the individual or the name of the organization providing the service.

- Add the address of the childcare provider, including the street address, city, state, and ZIP code to ensure there's no confusion about the location of the service.

- Proceed to fill in the taxpayer identification number (TIN) of the childcare provider. This could be a Social Security Number (SSN) if the provider is an individual, or an Employer Identification Number (EIN) if the provider is a business entity.

- Next, input the amount paid to the childcare provider. Providing an accurate figure is crucial as it directly affects the amount of credit you can claim.

- If you're claiming the credit for two or more children, list the name of the child (or children) for whom the childcare services were provided. This is essential to clarify which expenses correspond to which child.

- Sign and date the form to certify that all the information provided is accurate to the best of your knowledge. If you're filing jointly, both spouses need to sign.

Once the form is filled out, review all the information for accuracy. Remember, submitting incorrect information can lead to delays or issues with your tax return. After reviewing, attach the W-10 form to your tax return if required or keep it with your records in case the IRS has further questions. Completing this form correctly is a vital step in utilizing childcare expenses to your advantage when tax season comes around.

Understanding IRS W-10

-

What is an IRS W-10 form?

The IRS W-10 form is a document used to provide information required for certain tax benefits or credits like the Child and Dependent Care Credit. By completing this form, you give your name, the provider’s identification number (either a Social Security Number or Employer Identification Number), and the care provider’s address. It's a way for taxpayers to verify the identity of their child or dependent care provider when filing their tax returns.

-

Who needs to fill out an IRS W-10 form?

Parents or guardians who pay for child or dependent care services and plan to claim the Child and Dependent Care Credit on their tax return should obtain a completed W-10 form from their provider. This form is critical for those claiming this credit, as the IRS may request it to verify the eligibility and identity of the care provider.

-

How do I obtain an IRS W-10 form?

You can download the IRS W-10 form directly from the Internal Revenue Service’s website. Alternatively, care providers may also have copies available, but it's the taxpayer's responsibility to ensure the form is fully and accurately completed. The form does not need to be submitted with your tax return but should be kept for your records and provided if requested by the IRS.

-

What information do I need to provide on the W-10 form?

- Your name and address as the taxpayer.

- The care provider's name, address, and taxpayer identification number (TIN), which could be an Employer Identification Number (EIN) or Social Security Number (SSN).

- Details about the service provided.

This information is crucial for verifying the care expenses claimed on your tax return. Make sure all details are accurate to avoid processing delays or disqualification from the credit.

-

What if my care provider refuses to complete the W-10 form?

If a care provider refuses to provide the information required on the W-10 form or to fill out the form itself, the IRS advises that you still claim your child and dependent care credit. However, you should provide all the information you have regarding the care provider, including name, address, and why the provider's information is not available. It's essential to document your attempt to obtain the information, as this shows due diligence on your part in following tax laws and requirements.

Common mistakes

Filing taxes can be a complex process, and the IRS W-10 form is no exception. This document, essential for certain tax credits, is often filled out incorrectly by many. Understanding the common mistakes can help ensure accuracy and avoid delays or issues with tax returns.

Not using the official form - Many individuals mistakenly use a non-official document or an outdated version of the IRS W-10 form.

Incorrect taxpayer identification number - A common error is entering an incorrect Social Security Number (SSN) or Employer Identification Number (EIN), which can lead to processing delays.

Failing to complete all required fields - Skipping required information can result in the rejection of the form.

Misunderstanding the provider's information section - Individuals often enter their own information instead of the childcare provider's details.

Omitting the provider’s address - The complete address of the childcare provider is mandatory, yet frequently overlooked.

Not signing the form - The form is considered invalid without the taxpayer's signature, a simple but frequent oversight.

Using inappropriate writing tools - Forms filled out in pencil may be rejected; it is advised to use black or blue ink.

Incorrect date format - Dates must be entered in the MM/DD/YYYY format, yet mistakes here are common.

Not updating information - Failing to report changes in childcare providers or their payment information can lead to inaccuracies on the tax return.

Overlooking the need for multiple forms - If services are provided by more than one individual or entity, a separate W-10 form for each is necessary.

Avoiding these mistakes requires attention to detail and adherence to the instructions provided by the IRS. Careful completion of the IRS W-10 form is crucial for accurately claiming tax credits related to childcare expenses. By steering clear of these errors, taxpayers can help ensure their tax filings are accurate and processed without unnecessary delay.

Documents used along the form

The IRS W-10 form is essential for taxpayers to obtain information from care providers for income tax credit purposes. Alongside the W-10, various other forms and documents often come into play during tax preparation, each serving a unique role in ensuring that taxpayers fulfill their obligations accurately and benefit from available credits and deductions. This list highlights some of these important documents, providing a brief overview of their purpose and how they intertwine with the filing process.

- Form W-9: Request for Taxpayer Identification Number and Certification. This form is used to provide the correct taxpayer identification number (TIN) to the person who is required to file an information return with the IRS, ensuring accurate reporting.

- Form 1040: U.S. Individual Income Tax Return. The main tax form used by individuals to file their annual income tax returns, which may require information from the W-10 for specific deductions or credits related to dependent care expenses.

- Schedule C (Form 1040): Profit or Loss from Business (Sole Proprietorship). For individuals who operate a business, this schedule is essential for reporting profits or losses, potentially including payments made to child or dependent care providers.

- Schedule 2 (Form 1040): Additional Taxes. This includes taxes that aren't directly related to income tax but may be related to other tax responsibilities of the filer.

- Form 2441: Child and Dependent Care Expenses. Directly tied to the W-10, this form is used to calculate the credit for child and dependent care expenses and requires information provided by the W-10.

- Form 8863: Education Credits (American Opportunity and Lifetime Learning Credits). For taxpayers claiming education credits, this form calculates the allowable amount of education credits.

- Form 1099-MISC: Miscellaneous Income. Used to report payments made to independent contractors, including day care providers, which may require the W-10 for verification.

- Form W-2: Wage and Tax Statement. Employers issue this form to employees, showing annual wages and the amount of taxes withheld from their paycheck, crucial for accurately completing Form 1040.

- Form 8962: Premium Tax Credit. For individuals who purchase health insurance through the marketplace, this form reconciles the credit received with the amount that the taxpayer is eligible for.

- Form 1095-A: Health Insurance Marketplace Statement. Provides information needed to complete Form 8962, such as the premium amounts paid and advance payments of the premium tax credit.

In the maze of tax filing, understanding the purpose and connection between these forms and the W-10 is crucial. Each document plays a role in ensuring that taxpayers can accurately report their income, claim the appropriate deductions and credits, and, ultimately, comply with tax laws while maximizing their returns. As overwhelming as the list may seem, each form brings the taxpayer a step closer to fulfilling their obligations and securing their entitled benefits.

Similar forms

The IRS W-10 form shares similarities with the Form W-9, specifically in its purpose of collecting taxpayer identification numbers and certification. Just like the W-10, the W-9 form is used to provide crucial tax information to entities that pay you, ensuring that all payments are properly documented for tax purposes. Both forms act as a means of prevention against tax evasion by making sure individuals and entities accurately report their income and taxation details to the Internal Revenue Service (IRS).

Another document akin to the IRS W-10 is the Form 1099-MISC. This comparison stems from their use in reporting payment information to the IRS. While the W-10 is utilized by childcare providers to supply their tax identification information, the 1099-MISC form is used by businesses to report payments made to independent contractors and others for services rendered. Both forms are integral in ensuring that the IRS receives accurate information about payments that may affect an individual’s or entity’s tax liabilities and income reporting.

The Child and Dependent Care Information Form closely echoes the function of the IRS W-10 form in that it is utilized by individuals to report child or dependent care expenses on their tax returns. The key similarity lies in the necessity of obtaining the caregiver's tax identification number, something the W-10 form also requires. This commonality underscores the importance of accurate record-keeping in qualifying for potential tax credits related to child and dependent care expenses.

Similar to the IRS W-10, the Form W-4 is used by individuals to relay important tax information, specifically about their employment. While the W-10 form is used by childcare providers to give their tax identification information to parents, the W-4 is filled out by employees to inform their employers of their income tax withholding preferences. Both documents are crucial in ensuring that the correct amount of tax is either withheld or reported, thereby aiding in the accurate settlement of annual tax liabilities.

The Scholarship and Fellowship Grant Information Form is also parallel to the IRS W-10 in its focus on accurate tax reporting and documentation. While the W-10 assists in the accurate reporting of payments for child care services by obtaining provider tax identification numbers, this form is used by educational institutions to report scholarship or fellowship amounts granted to students. Both are vital in helping the IRS track income that may not be traditionally earned but is nonetheless subject to specific tax treatment and reporting requirements.

Dos and Don'ts

Filling out the IRS W-10 form is an important step for taxpayers who want to claim a credit for child and dependent care expenses. It's critical to complete this form accurately to ensure you can take full advantage of possible tax benefits. Here are some do's and don'ts to keep in mind:

Do:- Provide accurate information: Ensure the provider's name, address, and taxpayer identification number (SSN or EIN) are correct.

- Ask your care provider to complete the form: It's often easier and more accurate to have your care provider fill out their part of the form.

- Keep a copy for your records: After the form is filled out, keep a copy for your personal records in case the IRS has any questions.

- Update the form as needed: If your care provider changes during the year, fill out a new W-10 form with the new provider's information.

- Review for mistakes: Go over the form carefully to catch and correct any potential errors before submitting.

- Leave fields blank: Incomplete information can delay processing and affect your credit. If a field doesn’t apply, consider entering “N/A” instead of leaving it empty.

- Guess information: If you're unsure about specific details, verify them with your care provider rather than guessing. Incorrect information can lead to processing delays or inaccuracies in your credit.

By following these guidelines, taxpayers can ensure that their IRS W-10 form is filled out correctly and accurately, helping them receive the appropriate child and dependent care credits without unnecessary delay.

Misconceptions

When it comes to the IRS and tax forms, it's easy for misunderstandings to occur. The W-10 form is no exception. Below, we'll tackle some common misconceptions about this document, aiming to provide clearer insights for taxpayers.

All caregivers and childcare providers must fill out a W-10 form. This is a misunderstanding. The W-10 form is actually for the taxpayer's records and is used by individuals to collect information about their childcare provider for tax credit purposes. The provider does not fill out the form; rather, they provide the necessary information to the taxpayer.

The W-10 form must be submitted with your tax return. This isn't accurate. Taxpayers should keep the completed W-10 form for their records and not send it to the IRS with their tax return. However, the information collected on the form is used to complete other tax forms, such as the Form 2441 for Child and Dependent Care Expenses.

Digital signatures are not acceptable on the W-10 form. In today's digital age, this has changed. The IRS now accepts digital signatures on tax documents, including the W-10, as long as they adhere to the IRS standards for digital signatures.

Only licensed childcare providers can be listed on the W-10 form. In fact, taxpayers can list any individual who provides childcare, assuming they meet other IRS requirements for the tax credit. This can include relatives (excluding dependents and spouses) and unlicensed babysitters.

If you lose your W-10 form, you can't claim the childcare tax credit. This isn't the case. If you lose the form, you should attempt to gather the necessary information again from your childcare provider. The critical part is having the accurate information, not the form itself, to claim the credit.

You need a new W-10 form for each child. This is a common mistake. You actually only need one form per childcare provider, regardless of how many children that provider cares for.

The W-10 form is only for children under 5. This is not correct. The child and dependent care credit applies to children under the age of 13, or any age if they are disabled and incapable of self-care.

A Social Security number is the only acceptable identifying number for childcare providers on the W-10 form. In fact, taxpayers can provide an Employer Identification Number (EIN) if the childcare provider is a qualified organization, or the provider's Social Security Number (SSN) if they are an individual. Both are acceptable.

You can't claim the childcare tax credit without a completed W-10 form. The truth is, the critical component of claiming the credit is having the necessary provider information, such as name, address, and taxpayer identification number (SSN or EIN). While the W-10 form helps organize this information, what's most important to the IRS is that your tax return includes accurate and verifiable information about your childcare expenses.

Clearing up these misconceptions can help ensure that taxpayers effectively utilize the Child and Dependent Care Tax Credit and understand the role of the W-10 form in their tax preparation process.

Key takeaways

The IRS W-10 form is essential for anyone hiring a care provider for a dependent and planning to claim related credits or deductions on their taxes. Understanding the proper way to fill out and use this form can help ensure compliance with tax laws while maximizing potential benefits. Below are ten key takeaways to be aware of:

- The primary purpose of the IRS W-10 form is to provide necessary information about the care provider. This includes their name, address, and taxpayer identification number (TIN) or social security number (SSN), which is crucial for tax reporting purposes.

- To claim the Child and Dependent Care Credit or the Dependent Care Benefits, taxpayers must complete the IRS W-10 form. Failure to do so can result in the inability to take advantage of these tax benefits.

- It is the taxpayer's responsibility to ensure the accuracy of the information provided on the W-10 form. Incorrect or incomplete information can lead to delays or issues with tax filings.

- The form requires the care provider’s signature, validating the accuracy of the information provided. This helps protect against fraudulent claims.

- Not all care providers have a TIN or SSN. In such cases, taxpayers should document the attempt to obtain this information and be prepared to provide additional documentation if required by the IRS.

- The W-10 form does not need to be submitted with the taxpayer's annual tax returns. However, it should be kept on file for at least three years as the IRS may request it to verify the credit or deduction claims.

- If a care provider refuses to provide the necessary information, taxpayers can still claim the credit or deduction by including a statement with their tax return explaining the attempt to obtain the information.

- Accuracy is paramount when filling out the W-10 form. Double-check all entries, particularly the care provider’s TIN or SSN, to ensure they match the provider’s records.

- The IRS provides detailed instructions for completing the W-10 form, including who qualifies as a care provider and what information needs to be reported. These instructions can be found on the IRS website and are a valuable resource.

- In addition to the W-10 form, taxpayers should also retain receipts, invoices, or other proof of payment made to the care provider. This documentation can be important if the IRS has questions about the claims made on the tax return.

By keeping these key points in mind, taxpayers can more confidently navigate the process of claiming tax benefits related to dependent care expenses, ensuring that they comply with tax laws while making the most of available credits and deductions.

Popular PDF Documents

433a Instructions - It gathers all necessary financial information in one place, simplifying the IRS's task of evaluating an Offer in Compromise.

U.S. Corporation Income Tax Return - Tax professionals often assist in the preparation and filing of Form 1120 to ensure compliance with complex tax rules.