Get IRS SS-8 Form

Understanding one’s employment status can often be a complex and nuanced matter, especially when it comes to distinguishing between being an independent contractor and an employee. This distinction is crucial, as it affects taxation, benefits, and legal rights. Here is where the Internal Revenue Service (IRS) Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, steps in as an invaluable resource. By providing a formal mechanism for workers or firms to seek the IRS’s assistance in clarifying a worker’s employment status, the form plays a pivotal role in ensuring the proper classification is applied. This not only safeguards workers' rights but also ensures that employers fulfill their legal obligations. Given the significant implications for Social Security, Medicare taxes, and unemployment insurance, correctly determining a worker’s status through the SS-8 process is of paramount importance for both parties involved.

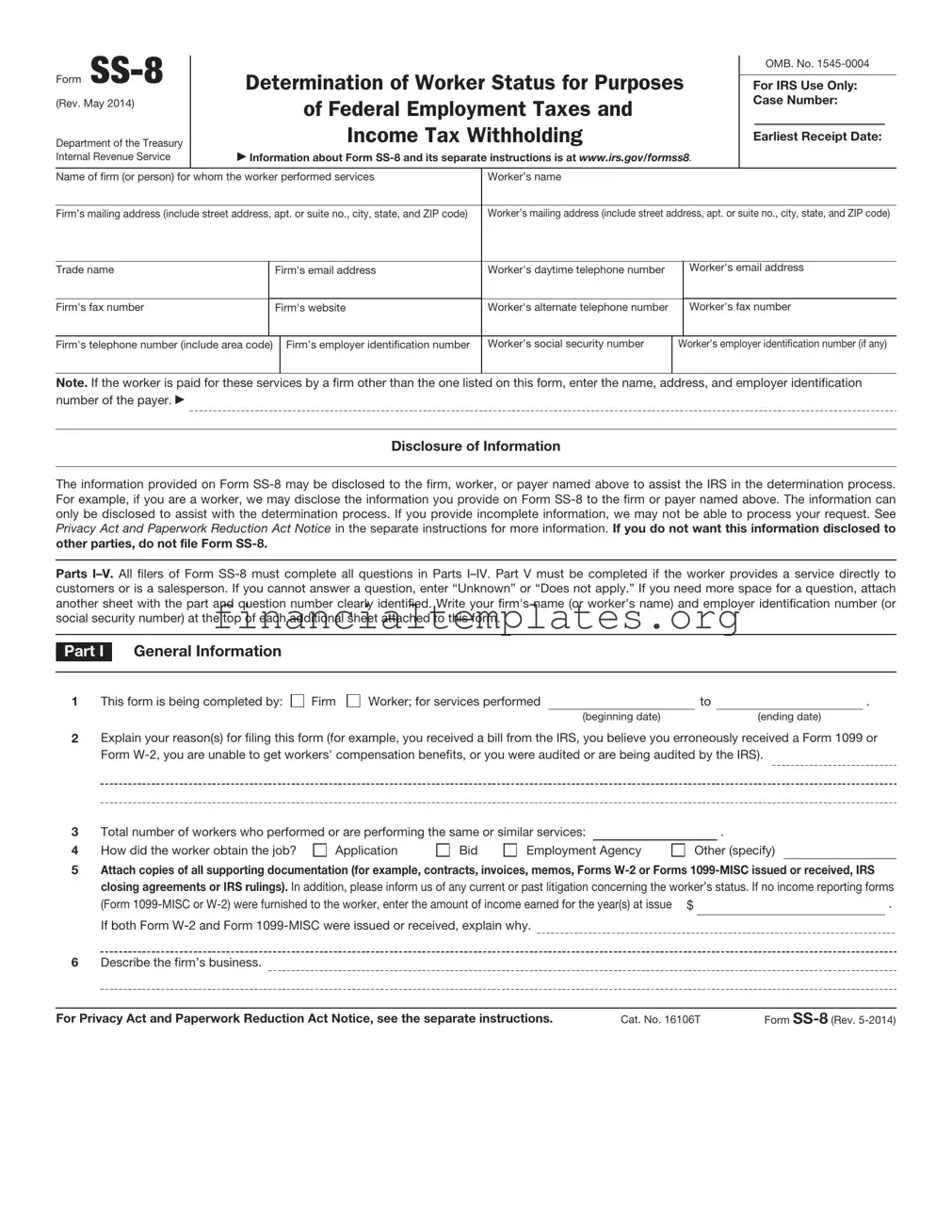

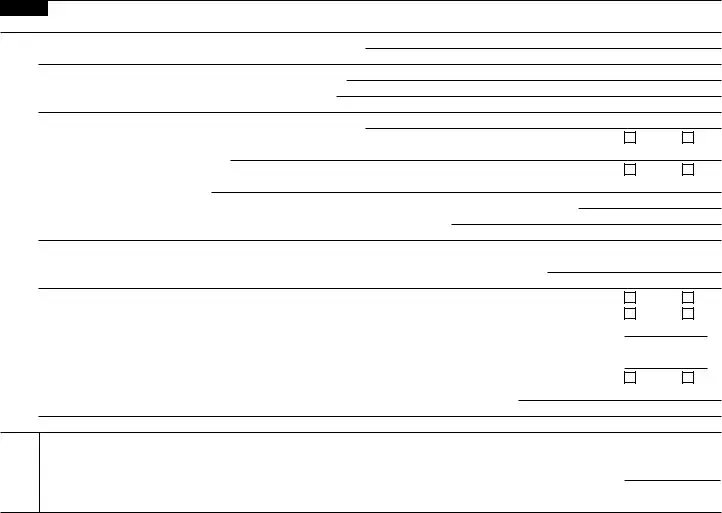

IRS SS-8 Example

Form |

Determination of Worker Status for Purposes |

|

OMB. No. |

|

|

|

|

||||

For IRS Use Only: |

|

||||

(Rev. May 2014) |

of Federal Employment Taxes and |

Case Number: |

|

||

|

|

|

|

||

|

Income Tax Withholding |

|

|

|

|

Department of the Treasury |

Earliest Receipt Date: |

|

|||

Internal Revenue Service |

Information about Form |

|

|

|

|

|

|

|

|

|

|

Name of firm (or person) for whom the worker performed services |

Worker’s name |

|

|

|

|

Firm’s mailing address (include street address, apt. or suite no., city, state, and ZIP code)

Worker’s mailing address (include street address, apt. or suite no., city, state, and ZIP code)

Trade name

Firm's email address

Worker's daytime telephone number

Worker's email address

Firm's fax number

Firm's website

Worker's alternate telephone number

Worker's fax number

Firm's telephone number (include area code)

Firm’s employer identification number

Worker’s social security number

Worker’s employer identification number (if any)

Note. If the worker is paid for these services by a firm other than the one listed on this form, enter the name, address, and employer identification number of the payer.

Disclosure of Information

The information provided on Form

Parts

Part I General Information

1This form is being completed by:

Firm

Worker; for services performed |

|

to |

|

. |

|

(beginning date) |

|

(ending date) |

|

2Explain your reason(s) for filing this form (for example, you received a bill from the IRS, you believe you erroneously received a Form 1099 or Form

3 |

Total number of workers who performed or are performing the same or similar services: |

|

|

. |

|||

4 |

How did the worker obtain the job? |

Application |

Bid |

Employment Agency |

Other (specify) |

||

5Attach copies of all supporting documentation (for example, contracts, invoices, memos, Forms

|

(Form |

. |

|

|

If both Form |

|

|

6 |

Describe the firm’s business. |

|

|

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. |

Cat. No. 16106T |

Form |

Form |

Page 2 |

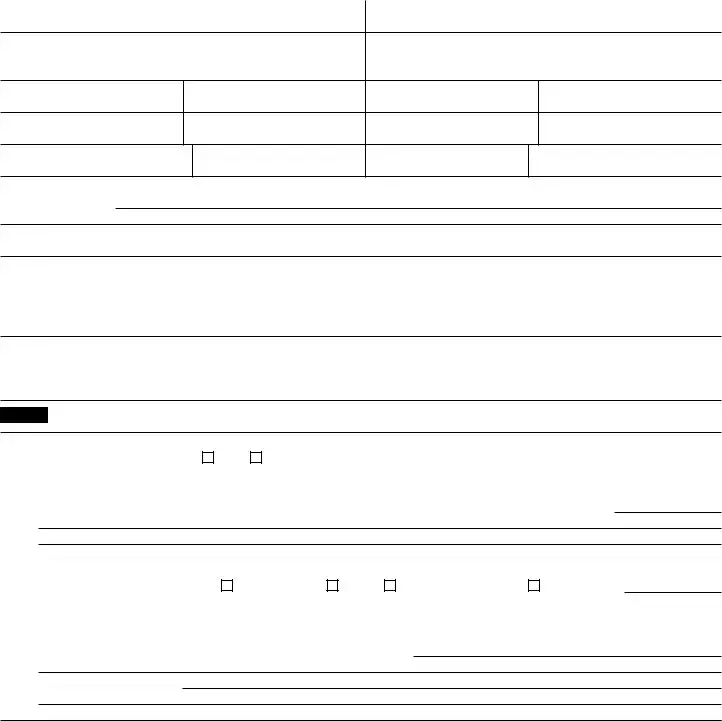

Part I General Information (continued)

7If the worker received pay from more than one entity because of an event such as the sale, merger, acquisition, or reorganization of the firm for whom the services are performed, provide the following: Name of the firm's previous owner:

Previous owner's taxpayer identification number: |

Change was a: |

Sale |

Merger |

Acquisition |

Reorganization |

Other (specify) |

|

|

|

|

|

Description of above change: |

|

|

|

|

|

Date of change (MM/DD/YY):

8Describe the work done by the worker and provide the worker’s job title.

9Explain why you believe the worker is an employee or an independent contractor.

10Did the worker perform services for the firm in any capacity before providing the services that are the subject of this determination request?

Yes

No

N/A

If “Yes,” what were the dates of the prior service?

If “Yes,” explain the differences, if any, between the current and prior service.

11If the work is done under a written agreement between the firm and the worker, attach a copy (preferably signed by both parties). Describe the terms and conditions of the work arrangement.

Part II Behavioral Control (Provide names and titles of specific individuals, if applicable.)

1What specific training and/or instruction is the worker given by the firm?

2How does the worker receive work assignments?

3Who determines the methods by which the assignments are performed?

4Who is the worker required to contact if problems or complaints arise and who is responsible for their resolution?

5What types of reports are required from the worker? Attach examples.

6Describe the worker’s daily routine such as his or her schedule or hours.

7At what location(s) does the worker perform services (for example, firm’s premises, own shop or office, home, customer’s location)? Indicate the appropriate percentage of time the worker spends in each location, if more than one.

8Describe any meetings the worker is required to attend and any penalties for not attending (for example, sales meetings, monthly meetings, staff meetings).

9 |

Is the worker required to provide the services personally? |

Yes |

No |

10If substitutes or helpers are needed, who hires them?

11 |

If the worker hires the substitutes or helpers, is approval required? |

Yes |

No |

|

If “Yes,” by whom? |

|

|

12Who pays the substitutes or helpers?

13 |

Is the worker reimbursed if the worker pays the substitutes or helpers? |

Yes |

No |

|

If “Yes,” by whom? |

|

|

Form

Form |

Page 3 |

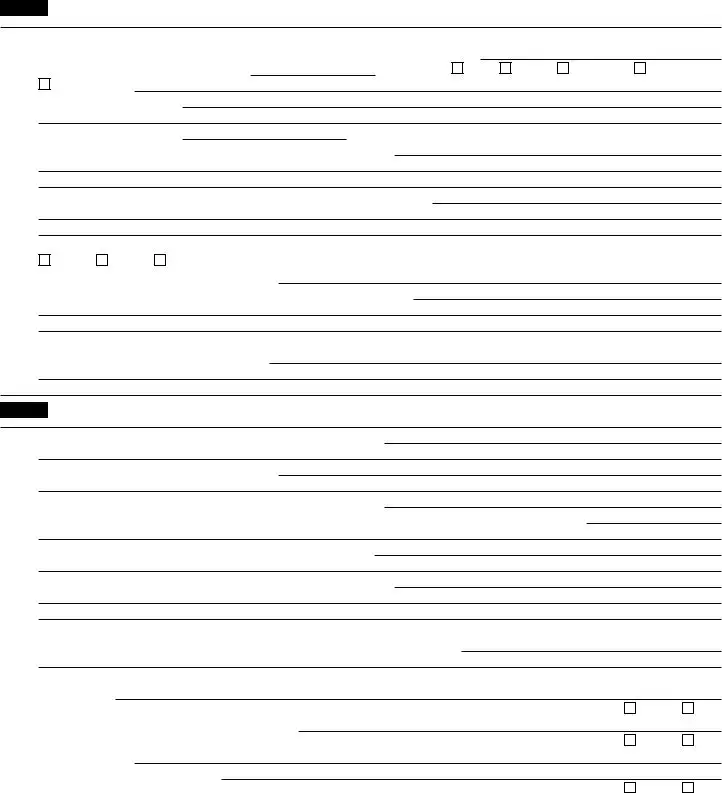

Part III Financial Control (Provide names and titles of specific individuals, if applicable.)

1List the supplies, equipment, materials, and property provided by each party: The firm:

The worker:

Other party:

2 Does the worker lease equipment, space, or a facility? . . . . . . . . . . . . . . . . . . . .

If “Yes,” what are the terms of the lease? (Attach a copy or explanatory statement.)

Yes

No

3What expenses are incurred by the worker in the performance of services for the firm?

4Specify which, if any, expenses are reimbursed by: The firm:

|

Other party: |

|

|

|

|

|

|

|

5 |

Type of pay the worker receives: |

Salary |

Commission |

Hourly Wage |

Piece Work |

|

||

|

Lump Sum |

Other (specify) |

|

|

|

|

|

|

|

If type of pay is commission, and the firm guarantees a minimum amount of pay, specify amount. $ |

|

|

|

||||

6 |

Is the worker allowed a drawing account for advances? |

Yes |

No |

|||||

|

If “Yes,” how often? |

|

|

|

|

|

|

|

|

Specify any restrictions. |

|

|

|

|

|

|

|

7 |

Whom does the customer pay? |

. . . . . . |

Firm |

|

|

If worker, does the worker pay the total amount to the firm? |

Yes |

No If |

“No,” explain. |

Worker

8 |

Does the firm carry workers' compensation insurance on the worker? |

Yes |

No |

9What economic loss or financial risk, if any, can the worker incur beyond the normal loss of salary (for example, loss or damage of equipment, material)?

10 |

Does the worker establish the level of payment for the services provided or the products sold? |

|

If “No,” who does? |

Yes

No

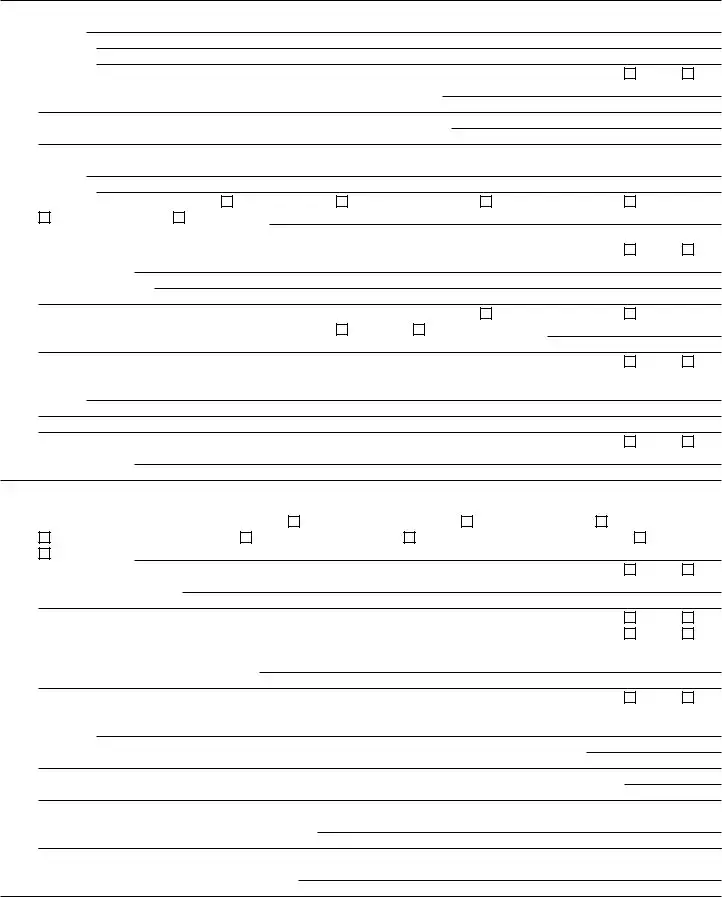

Part IV |

Relationship of the Worker and Firm |

|

|

|

|

||

|

|

|

|

|

|

|

|

1 |

Please check the benefits available to the worker: |

Paid vacations |

Sick pay |

Paid holidays |

|

||

|

|

Personal days |

Pensions |

|

Insurance benefits |

Bonuses |

|

|

|

Other (specify) |

|

|

|

|

|

2 |

Can the relationship be terminated by either party without incurring liability or penalty? |

Yes |

No |

||||

|

If “No,” explain your answer. |

|

|

|

|

|

|

3 |

Did the worker perform similar services for others during the time period entered in Part I, line 1? |

Yes |

No |

||||

|

If “Yes,” is the worker required to get approval from the firm? |

Yes |

No |

||||

4Describe any agreements prohibiting competition between the worker and the firm while the worker is performing services or during any later period. Attach any available documentation.

5 Is the worker a member of a union? |

Yes |

6What type of advertising, if any, does the worker do (for example, a business listing in a directory or business cards)? Provide copies, if applicable.

7If the worker assembles or processes a product at home, who provides the materials and instructions or pattern?

No

8What does the worker do with the finished product (for example, return it to the firm, provide it to another party, or sell it)?

9How does the firm represent the worker to its customers (for example, employee, partner, representative, or contractor), and under whose business name does the worker perform these services?

10If the worker no longer performs services for the firm, how did the relationship end (for example, worker quit or was fired, job completed, contract ended, firm or worker went out of business)?

Form

Form |

Page 4 |

Part V For Service Providers or Salespersons. Complete this part if the worker provided a service directly to customers or is a salesperson.

1What are the worker’s responsibilities in soliciting new customers?

2Who provides the worker with leads to prospective customers?

3Describe any reporting requirements pertaining to the leads.

4What terms and conditions of sale, if any, are required by the firm?

5 Are orders submitted to and subject to approval by the firm? . . . . . . . . . . . . . . . . . .

6Who determines the worker’s territory?

7 |

Did the worker pay for the privilege of serving customers on the route or in the territory? |

|

If “Yes,” whom did the worker pay? |

|

If “Yes,” how much did the worker pay? . . . . . . . . . . . . . . . . . . . . . $ |

8Where does the worker sell the product (for example, in a home, retail establishment)?

Yes

Yes

No

No

9List the product and/or services distributed by the worker (for example, meat, vegetables, fruit, bakery products, beverages, or laundry or dry cleaning services). If more than one type of product and/or service is distributed, specify the principal one.

10 |

Does the worker sell life insurance full time? |

11 |

Does the worker sell other types of insurance for the firm? |

|

If “Yes,” enter the percentage of the worker’s total working time spent in selling other types of insurance |

12If the worker solicits orders from wholesalers, retailers, contractors, or operators of hotels, restaurants, or other similar

establishments, enter the percentage of the worker’s time spent in the solicitation . . . . . . . . . . . .

13Is the merchandise purchased by the customers for resale or use in their business operations? . . . . . . . .

Describe the merchandise and state whether it is equipment installed on the customers’ premises.

Yes Yes

Yes

No No

%

%

No

Sign Here

Under penalties of perjury, I declare that I have examined this request, including accompanying documents, and to the best of my knowledge and belief, the facts presented are true, correct, and complete.

F |

|

Title |

|

Date |

|

|

|

||

|

|

|

|

|

|

Type or print name below signature. |

|

|

|

Form

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of SS-8 | This form is used to determine the classification of workers as employees or independent contractors. |

| Who Can File | Either workers or firms can submit Form SS-8 to inquire about the correct classification of a worker. |

| Importance of Classification | Correct classification is crucial because it impacts taxes, benefits, and obligations to workers. |

| IRS Response Time | The IRS typically takes at least six months to respond to an SS-8 filing. |

| Confidentiality | The IRS handles Form SS-8 with confidentiality, but information may be shared within the agency to enforce tax laws. |

| Voluntary Compliance | Filing Form SS-8 does not ensure compliance with the IRS’s determination, but it can help avoid penalties for incorrect classification. |

| Governing Laws | The federal tax code and IRS regulations guide the classification process, not state-specific laws. |

Guide to Writing IRS SS-8

Filling out the IRS SS-8 form is crucial for those seeking clarification on the employment status of a worker in relation to tax responsibilities. It determines if a worker should be classified as an employee or an independent contractor. Properly completing this form not only ensures compliance with tax laws but also helps in securing the necessary protections and benefits for workers. Below, you will find the necessary steps to fill out the form accurately.

- Begin by downloading the latest version of the IRS SS-8 form from the official IRS website to ensure you have the most current form.

- Read all instructions provided by the IRS carefully before filling out the form. This will help avoid common mistakes and ensure accurate completion.

- Enter the full name of the firm or worker in question in the designated section. Be sure to include any "doing business as" (DBA) names if applicable.

- Provide the complete address of the firm or worker, including city, state, and ZIP code, in the space provided.

- Insert your contact information, including your phone number and email address, in case the IRS needs to reach out for further clarification or additional information.

- Answer all questions on the form to the best of your ability. Each question is designed to help the IRS determine the correct employment status. Ensure your answers are clear and concise.

- If you need to provide additional information or documents to support your case, attach them to the form. Make sure any attachments are clearly labeled and refer to the specific part of the form they support.

- Review the form and attached documents to ensure all information is accurate and complete. Double-check for any errors or omitted information.

- Sign and date the form in the designated area. Your signature confirms that all information provided is true and accurate to the best of your knowledge.

- Mail the completed form and any attachments to the IRS at the address provided in the form instructions. Keep a copy of everything for your records.

Completing the IRS SS-8 form with attention to detail and accuracy is essential. Once submitted, the IRS will review the information and make a determination on the worker’s employment status. This decision will impact tax obligations and can clarify the nature of the working relationship for both parties. Patience is necessary, as the review process can take time. It’s advised to monitor the status of your request and be prepared to provide additional information if called upon. Following these steps will ensure your inquiry is handled efficiently and effectively.

Understanding IRS SS-8

-

What is an IRS SS-8 Form?

The IRS SS-8 form is used by employers and workers to determine the status of a worker as an employee or an independent contractor. This distinction is crucial, as it affects federal employment taxes and income tax withholdings. The form requests detailed information regarding the nature of the working relationship and the degree of control and independence present.

-

Why would someone file an SS-8 Form?

Filing an SS-8 form can be motivated by several reasons, both for workers and employers. Workers might file it if they believe their classification as an independent contractor is incorrect, potentially denying them employment benefits and protections. Employers, on the other hand, may file it to clarify tax obligations and ensure compliance with tax laws, avoiding penalties associated with misclassifying employees as independent contractors.

-

How can one obtain an SS-8 Form?

An SS-8 form can be easily obtained by downloading it directly from the IRS website. It’s available in a PDF format that can be printed out. Alternatively, individuals can request a physical copy from the IRS by calling them directly or by visiting a local IRS office.

-

What information do I need to provide in the SS-8 Form?

To complete the SS-8 form accurately, you will need to provide detailed information about the nature of the work performed, the business relationship between the worker and the firm, and the degree of control the firm has over the worker. This includes details of how work is assigned, evaluated, and how payment is determined, along with any contracts or agreements that define the relationship.

-

How do I submit the SS-8 Form to the IRS?

Once the SS-8 form is filled out, it can be submitted to the IRS through mail. The mailing address is provided in the instructions that accompany the form. It’s important to keep a copy of the form for your records. The IRS does not currently accept electronic submissions of the SS-8 Form.

-

What happens after I submit the SS-8 Form?

After submitting the SS-8 form, the IRS will review the information and may contact both the worker and the employer for further details. This process can take at least six months, sometimes longer. Once a determination is made, both parties will receive a determination letter indicating the worker’s status as an employee or independent contractor.

-

Can a determination made by the IRS be appealed?

Yes, both workers and employers have the right to appeal the IRS determination if they disagree with it. The process and requirements for appealing will be detailed in the determination letter. It’s important to note that there is a deadline for filing an appeal, typically 30 days from the date of the determination letter.

-

Is filing an SS-8 Form confidential?

Information provided in the SS-8 form is used solely for determining the worker's status and is confidential. However, the IRS may contact the employer for their side of the story, so the employer will know that an SS-8 form has been filed. Despite this, the IRS is prohibited from sharing the identity of the worker who filed the form if the worker requests confidentiality.

Common mistakes

When it comes to the IRS SS-8 form, which is used to determine worker status for purposes of federal employment taxes and income tax withholding, careful and accurate completion is crucial. Unfortunately, some errors are commonly made, which can lead to delays or incorrect determinations by the IRS. Here are six mistakes to avoid:

Not providing detailed information: It's essential to give comprehensive details about the work relationship and conditions. Short or vague answers may not give the IRS enough context to make an accurate determination.

Overlooking state regulations: Although the SS-8 form is for federal purposes, some state labor laws may influence how you should describe the work relationship. Ignoring these can lead to inconsistencies.

Misunderstanding the worker's role: Accurately portraying the worker's role and degree of independence is key. Misrepresentation, even if unintended, may cause the IRS to make a wrong classification.

Failing to consider industry specifics: Every industry has its norms and standards concerning independent contractors and employees. Not taking these into account can be a significant oversight.

Skipping relevant details about the work relationship: Any unique or specific aspects of the work agreement should be included. Missing this information can lead to a lack of clarity and a possible misjudgment.

Assuming the decision will automatically favor one status over another: Some people fill out the form with a bias towards wanting an independent contractor or employee classification. The IRS, however, assesses each case on its merits without preference.

To ensure the best possible outcome when submitting an SS-8 form, take the time to provide thorough, accurate, and clear information. Avoiding these common mistakes can streamline the process and help achieve an accurate determination of worker status.

Documents used along the form

When dealing with employment tax issues, filling out the IRS SS-8 form can be a critical step for determining a worker’s status as an employee or independent contractor. However, this form doesn't stand alone. A range of other documents and forms often accompany the IRS SS-8 to provide a comprehensive view of the worker’s employment situation and ensure compliance with tax laws. Here is a selection of relevant forms and documents that are frequently used alongside the IRS SS-8 form.

- W-9, Request for Taxpayer Identification Number and Certification: This form is essential for collecting the correct taxpayer identification number (TIN) of U.S. persons (including residents and citizens) or entities. It’s crucial for reporting income paid to the IRS and helps avoid backup withholding.

- W-2, Wage and Tax Statement: Employers use this form to report an employee’s annual wages and the amount of taxes withheld from their paycheck. It’s necessary for determining if the appropriate amount of tax was withheld given the employee’s status.

- 1099-MISC, Miscellaneous Income: This document is used by businesses to report payments made to independent contractors. It’s important for determining if the worker is being paid in a way that aligns with their employment status.

- 1099-NEC, Nonemployee Compensation: Introduced in tax year 2020, this form specifically reports non-employee compensation, making it particularly relevant in cases where SS-8 determination may be uncertain.

- I-9, Employment Eligibility Verification: Required by U.S. Citizenship and Immigration Services, this form verifies the identity and employment authorization of newly hired employees. It ensures that employees are legally allowed to work in the U.S.

- Form 941, Employer's Quarterly Federal Tax Return: This form is used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks.

- Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return: Employers file this form to report annual Federal Unemployment Tax Act (FUTA) tax. The FUTA tax funds state workforce agencies and must be paid by the employer.

- State Tax Withholding Forms: These vary by state but generally are required for reporting state income tax withholding from employees’ paychecks. They are essential for ensuring compliance with state tax laws.

- Worker’s Compensation Insurance Forms: Although the specific form varies by state, these documents are necessary for proving that a business carries worker’s compensation insurance, which is required in most states if the business has employees.

Together, these forms create a framework to properly assess and document the tax and employment status of a worker. By clarifying the relationship between workers and employers, they ensure accurate tax reporting and compliance with employment laws. Properly completing and filing these documents, along with the SS-8 when applicable, provides protection and clarity for both parties in the workforce.

Similar forms

The IRS Form W-9 requests taxpayer identification number and certification, sharing similarities with the IRS SS-8 form by collecting identification details from individuals for tax purposes. Both forms are integral to clarifying tax-related information, although the W-9 is primarily utilized by independent contractors and freelancers to provide their taxpayer identification number to entities paying them. This facilitates proper reporting of payments to the IRS, akin to how the SS-8 helps determine worker status for tax liability reasons.

Form W-4, Employee's Withholding Certificate, like the SS-8, interacts with tax status determination, though from a different approach. The W-4 allows employees to outline their tax withholding preferences to their employers, which contrasts with the SS-8's role in defining the worker's status as an employee or independent contractor. The core similarity lies in their contribution to accurate tax reporting and withholding, ensuring that individuals and employers comply with tax laws effectively.

The 1099-MISC form is used for reporting miscellaneous income, resembling the IRS SS-8 form in its function of facilitating correct tax reporting. Where the SS-8 determines if income should be subject to employment taxes, the 1099-MISC captures information about payments made to non-employees, including independent contractors. Both documents are pivotal in delineating the nature of payments or compensation for IRS scrutiny, helping clarify tax obligations.

The IRS Form I-9, Employment Eligibility Verification, shares its goal of worker classification with the SS-8 form, albeit focusing on verifying an employee's legal right to work in the United States. The SS-8 helps classify workers for tax purposes, while the I-9 assists employers in confirming their employees' work eligibility based on immigration status. Each form ensures compliance with federal regulations, be they tax or immigration laws, underscoring the importance of proper documentation in employment contexts.

The State Unemployment Tax Act (SUTA) forms, applicable within individual states, have a parallel with the IRS SS-8 form in the realm of employment tax obligations. SUTA forms determine businesses' unemployment insurance tax rates, a calculation contingent upon the number and status of employees. Similarly, the SS-8's role in classifying workers can influence a company's tax and financial responsibilities, highlighting their shared significance in the broader spectrum of employment taxation.

Form 940, the Employer's Annual Federal Unemployment (FUTA) Tax Return, aligns with the SS-8 form by both addressing aspects of employment taxes. The 940 form is specific to unemployment tax reporting on a federal level, requiring information on the workforce that impacts tax calculation. This connection emphasizes their mutual involvement in delineating employer tax duties based on accurate worker classification and employment status, reinforcing the theme of compliance and proper tax administration.

The Occupational Safety and Health Administration (OSHA) forms, which document workplace injuries and illnesses, indirectly relate to the IRS SS-8 by focusing on employment conditions. Although primarily concerned with safety rather than tax issues, these forms necessitate an understanding of who is considered an employee under the law, affecting their implementation. This echoes the SS-8’s objective of defining the worker-employer relationship, underpinning the importance of accurate classification in various regulatory frameworks.

Dos and Don'ts

Filling out the IRS SS-8 form, which determines a worker's employment status, is a crucial task that must be approached with care. Here are essential do's and don'ts to consider:

Do's:Provide detailed explanations where necessary. If a question requires specifics about the work relationship, offering thorough details can be instrumental in helping the IRS make an accurate determination.

Double-check for accuracy. Before submitting the form, review all answers to ensure they are accurate and complete. Mistakes or omissions can delay the decision process.

Include supporting documentation. Attach any relevant contracts, agreements, or other documents that can clarify the nature of the working relationship.

Consult with an expert if needed. If you're unsure about how to answer certain questions, consulting with a tax professional or lawyer can provide clarity and help avoid errors.

Use the latest version of the form. Always download the most recent version of the SS-8 form from the IRS website to ensure compliance with current regulations.

Don't guess on answers. If you're unsure about a response, seek clarification rather than making guesses. Incorrect information can lead to wrongful determinations.

Don't leave sections blank. If a question doesn't apply, write "N/A" (not applicable) instead of leaving the space empty. This shows you didn't overlook the question.

Don't provide misleading information. Honesty is crucial when filling out government documents. Providing false information can result in severe consequences.

Don't rush through the form. Take your time to read and understand each question before answering, ensuring that the information provided reflects the true nature of the work relationship.

Don't forget to sign and date the form. An unsigned form is considered incomplete and will not be processed by the IRS.

Misconceptions

The Internal Revenue Service (IRS) Form SS-8, titled "Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding," often leads to confusion and misconceptions. Understanding this form is crucial because it affects how businesses and workers classify employment status and, subsequently, their taxes. Below are ten common misconceptions about the IRS SS-8 form, explained to provide clarity on its purpose and use.

Misconception #1: The form is only for employees to dispute their status.

Although employees can use the SS-8 form to request a determination of their employment status, employers can also file the form to ensure they correctly classify workers.

Misconception #2: Filing an SS-8 form immediately changes a worker's tax status.

Filing the SS-8 form starts a review process by the IRS; it does not instantly alter a worker's tax status. The determination can take time, during which current tax obligations continue based on the existing classification.

Misconception #3: The SS-8 determination applies retroactively.

The IRS's determination might influence future tax periods but generally does not apply retroactively to change past tax filings.

Misconception #4: The IRS SS-8 form determination is mandatory for all employers.

Not all employers need to file an SS-8 form. This form is for those who need clarification about the classification of one or more workers.

Misconception #5: An SS-8 determination is final and cannot be appealed.

Both workers and employers have the right to appeal the IRS's determination if they disagree with it, through specific IRS procedures.

Misconception #6: The SS-8 form should be used for all independent contractors.

The SS-8 form is not necessary for clear-cut cases of independent contractors. It's designed for ambiguous situations where worker status is uncertain.

Misconception #7: Filing an SS-8 will lead to an immediate audit.

Filing the form does not automatically trigger an IRS audit, though it may lead to a review of the worker classification in question.

Misconception #8: The form is complicated and requires legal assistance to complete.

While the SS-8 form can be detailed, following the instructions carefully can allow individuals and businesses to complete it without necessarily needing legal assistance.

Misconception #9: Only large businesses need to worry about the SS-8 form.

Businesses of all sizes might need to clarify worker status through the SS-8 form, especially if they work with freelancers or independent contractors.

Misconception #10: The IRS will provide a quick determination.

The process for the IRS to make a determination based on the SS-8 form can be lengthy, sometimes taking several months, depending on the complexity of the case and IRS workload.

Key takeaways

The IRS SS-8 form plays a crucial role in determining the classification of workers for tax purposes, identifying whether an individual should be regarded as an employee or an independent contractor. Here are key takeaways for completing and utilizing the IRS SS-8 form:

- Understanding the Purpose: The form is designed to clarify the status of a worker when there’s uncertainty about whether they're an employee or an independent contractor. This distinction affects how workers and employers fulfill their tax obligations.

- Who Can File: The SS-8 form can be filed by either the worker or the firm. This flexibility supports fairness and compliance from both perspectives.

- Information Required: Filling out the form demands detailed information about the nature of the work, the relationship between the worker and the firm, and the agreement under which the work is performed.

- Impact on Taxes: The determination made as a result of the SS-8 form influences how taxes are reported and paid, affecting Social Security, Medicare, and unemployment taxes.

- Timeframe for Determination: The IRS takes its time in reviewing each submission, with determinations often taking at least six months. Patience is essential throughout this process.

- Confidentiality: The IRS keeps the identity of the worker confidential, especially if the inquiry might risk their employment situation.

- Voluntary Compliance Program: Employers who have misclassified workers can use the information from the SS-8 determination to correct mistakes under the IRS Voluntary Classification Settlement Program (VCSP).

- Legally Binding: The determination issued by the IRS is specific to the requester and the facts submitted. It's important to accurately represent the work situation to receive a valid decision.

- No Appeal: The decision made by the IRS regarding the classification through the SS-8 form is final and cannot be appealed. However, new facts can be submitted if circumstances change.

- Effect on Future Tax Years: Generally, a determination applies only to the specific tax year for which the form is filed. If working conditions remain unchanged, the classification may carry over to future years.

- Importance of Keeping Records: After submitting the SS-8 form, it’s crucial to maintain copies of the form and any correspondence received from the IRS, as these documents serve as records of classification.

Popular PDF Documents

Wage and Tax Statement - Scholarships or grant income for non-degree candidates is sometimes reported on a W-2, depending on the circumstances.

Md Sales and Use Tax Form 202 - Form 202 is an important document for Maryland business owners to officially declare the cessation of their business to the Comptroller of Maryland.