Get IRS SS-4 Form

When starting a business, one of the first steps entrepreneurs must take involves navigating through the various forms and legal documents necessary to legally establish their entity. Among these, the IRS SS-4 form plays a critical role as it is the document required to apply for an Employer Identification Number (EIN). This nine-digit number is akin to a social security number for a business, providing a unique identifier for companies in their dealings with the IRS and often needed for opening business bank accounts, hiring employees, and handling company taxes. Completing the SS-4 form correctly is vital for ensuring smooth interactions with tax authorities and avoiding potential issues that could arise from paperwork errors or misunderstandings. Understanding the specific fields and required information on the form can help streamline the process, making it easier for business owners to focus on the growth and operation of their new venture.

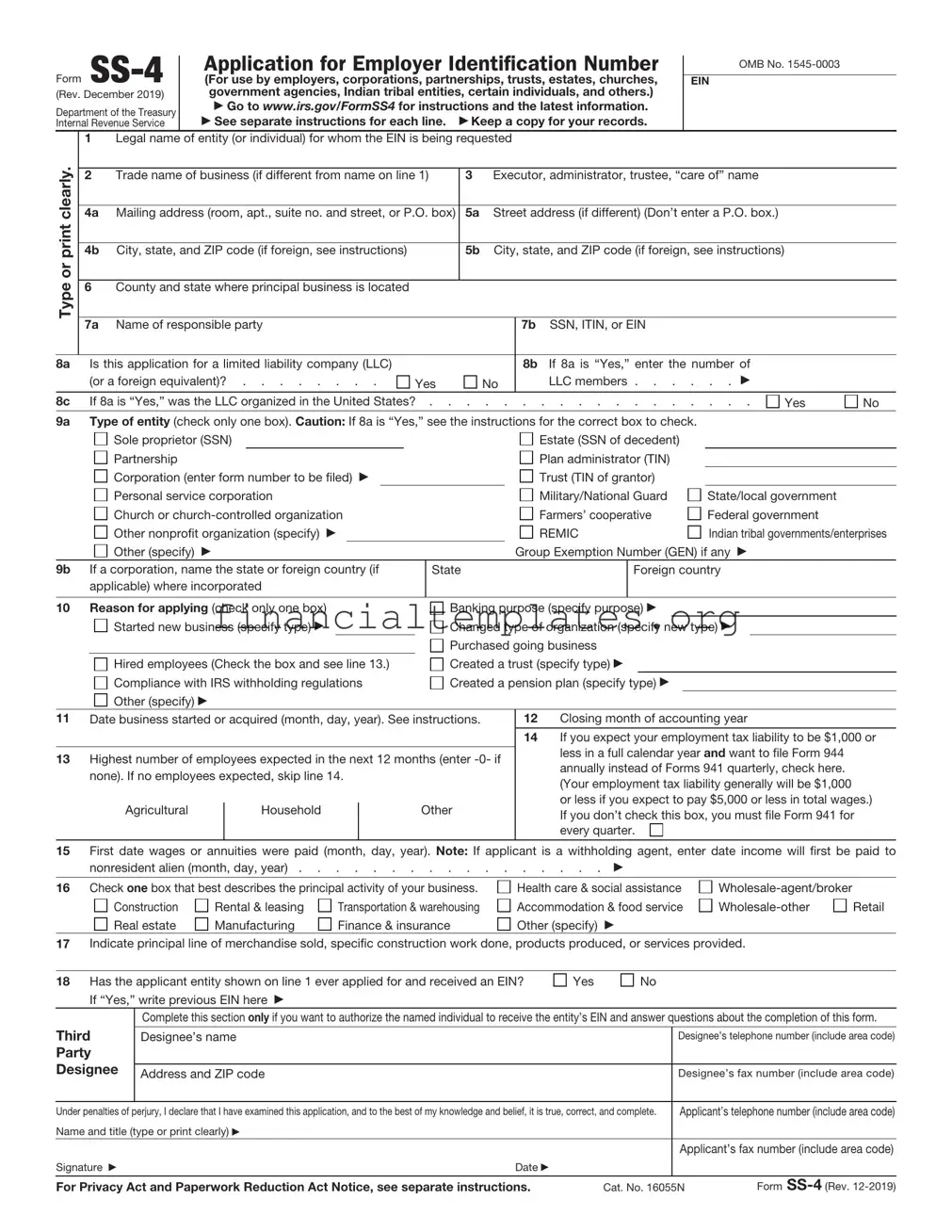

IRS SS-4 Example

Form

Department of the Treasury Internal Revenue Service

Application for Employer Identification Number

(For use by employers, corporations, partnerships, trusts, estates, churches, government agencies, Indian tribal entities, certain individuals, and others.)

Go to www.irs.gov/FormSS4 for instructions and the latest information.

See separate instructions for each line. |

Keep a copy for your records. |

OMB No.

EIN

Type or print clearly.

8a

8c

9a

1Legal name of entity (or individual) for whom the EIN is being requested

2 |

Trade name of business (if different from name on line 1) |

3 Executor, administrator, trustee, “care of” name |

|

|

|

4a Mailing address (room, apt., suite no. and street, or P.O. box) |

5a Street address (if different) (Don’t enter a P.O. box.) |

|

|

|

|

4b City, state, and ZIP code (if foreign, see instructions) |

5b City, state, and ZIP code (if foreign, see instructions) |

|

|

|

|

6County and state where principal business is located

7a Name of responsible party |

|

|

|

|

7b SSN, ITIN, or EIN |

|

|

|

|||

Is this application for a limited liability company (LLC) |

|

|

|

|

8b If 8a is “Yes,” enter the number of |

|

|

||||

(or a foreign equivalent)? |

Yes |

No |

|

|

LLC members |

|

|

||||

If 8a is “Yes,” was the LLC organized in the United States? . . . . |

. . . . . . . . . . . |

. . . |

Yes |

No |

|||||||

Type of entity (check only one box). Caution: If 8a is “Yes,” see the instructions for the correct box to check. |

|

|

|

||||||||

Sole proprietor (SSN) |

|

|

|

|

|

Estate (SSN of decedent) |

|

|

|

||

Partnership |

|

|

|

|

Plan administrator (TIN) |

|

|

|

|||

Corporation (enter form number to be filed) |

|

|

|

|

|

Trust (TIN of grantor) |

|

|

|

||

Personal service corporation |

|

|

|

|

Military/National Guard |

State/local government |

|

||||

Church or |

|

|

|

|

Farmers’ cooperative |

Federal government |

|

||||

Other nonprofit organization (specify) |

|

|

|

|

|

REMIC |

Indian tribal governments/enterprises |

||||

Other (specify) |

|

|

|

|

Group Exemption Number (GEN) if any |

|

|

||||

9b If a corporation, name the state or foreign country (if applicable) where incorporated

State

Foreign country

10 Reason for applying (check only one box)

Started new business (specify type)

Hired employees (Check the box and see line 13.) Compliance with IRS withholding regulations Other (specify)

Banking purpose (specify purpose)

Changed type of organization (specify new type) Purchased going business

Created a trust (specify type) Created a pension plan (specify type)

11Date business started or acquired (month, day, year). See instructions.

13Highest number of employees expected in the next 12 months (enter

Agricultural |

Household |

Other |

|

|

|

12Closing month of accounting year

14If you expect your employment tax liability to be $1,000 or less in a full calendar year and want to file Form 944 annually instead of Forms 941 quarterly, check here. (Your employment tax liability generally will be $1,000

or less if you expect to pay $5,000 or less in total wages.)

If you don’t check this box, you must file Form 941 for every quarter.

15First date wages or annuities were paid (month, day, year). Note: If applicant is a withholding agent, enter date income will first be paid to

nonresident alien (month, day, year) . . . . . . . . . . . . . . . . .

16 Check one box that best describes the principal activity of your business. |

Health care & social assistance |

|

|||

Construction |

Rental & leasing |

Transportation & warehousing |

Accommodation & food service |

Retail |

|

Real estate |

Manufacturing |

Finance & insurance |

Other (specify) |

|

|

17Indicate principal line of merchandise sold, specific construction work done, products produced, or services provided.

18 Has the applicant entity shown on line 1 ever applied for and received an EIN? |

Yes |

No |

If “Yes,” write previous EIN here |

|

|

Complete this section only if you want to authorize the named individual to receive the entity’s EIN and answer questions about the completion of this form.

Third |

Designee’s name |

|

Designee’s telephone number (include area code) |

|

Party |

|

|

|

|

Designee |

|

|

|

|

Address and ZIP code |

|

Designee’s fax number (include area code) |

||

|

|

|||

|

|

|||

Under penalties of perjury, I declare that I have examined this application, and to the best of my knowledge and belief, it is true, correct, and complete. |

Applicant’s telephone number (include area code) |

|||

Name and title (type or print clearly) |

|

|

|

|

|

|

|

Applicant’s fax number (include area code) |

|

Signature |

Date |

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 16055N |

Form |

||

Form

Do I Need an EIN?

File Form

IF the applicant... |

AND... |

THEN... |

|

|

|

started a new business |

doesn’t currently have (nor expect to have) |

complete lines 1, 2, |

|

employees |

9b (if applicable), and |

|

|

|

hired (or will hire) employees, |

doesn’t already have an EIN |

complete lines 1, 2, |

including household employees |

|

|

|

|

|

opened a bank account |

needs an EIN for banking purposes only |

complete lines |

|

|

(if applicable), 9a, 9b (if applicable), 10, and 18. |

|

|

|

changed type of organization |

either the legal character of the organization or its |

complete lines |

|

ownership changed (for example, you incorporate a |

|

|

sole proprietorship or form a partnership)2 |

|

|

|

|

purchased a going business3 |

doesn’t already have an EIN |

complete lines |

created a trust |

the trust is other than a grantor trust or an IRA |

complete lines |

|

trust4 |

|

created a pension plan as a |

needs an EIN for reporting purposes |

complete lines 1, 3, |

plan administrator5 |

|

|

is a foreign person needing an |

needs an EIN to complete a Form |

complete lines |

EIN to comply with IRS |

Form |

8a, |

withholding regulations |

or claim tax treaty benefits6 |

and 18. |

|

|

|

is administering an estate |

needs an EIN to report estate income on Form 1041 |

complete lines |

|

|

and 18. |

|

|

|

is a withholding agent for |

is an agent, broker, fiduciary, manager, tenant, or |

complete lines 1, 2, 3 (if applicable), |

taxes on nonwage income |

spouse who is required to file Form 1042, Annual |

|

paid to an alien (that is, |

Withholding Tax Return for U.S. Source Income of |

|

individual, corporation, or |

Foreign Persons |

|

partnership, etc.) |

|

|

|

|

|

is a state or local agency |

serves as a tax reporting agent for public assistance |

complete lines 1, 2, |

|

recipients under Rev. Proc. |

|

|

|

|

is a |

needs an EIN to file Form 8832, Entity Classification |

complete lines |

similar |

Election, for filing employment tax returns and excise |

|

|

tax returns, or for state reporting purposes8, or is a |

|

|

|

|

|

EIN to file Form 5472, Information Return of a 25% |

|

|

|

|

|

Corporation Engaged in a U.S. Trade or Business |

|

|

|

|

is an S corporation |

needs an EIN to file Form 2553, Election by a Small |

complete lines |

|

Business Corporation9 |

|

1For example, a sole proprietorship or

2However, don’t apply for a new EIN if the existing entity only (a) changed its business name, (b) elected on Form 8832 to change the way it is taxed (or is covered by the default rules), or (c) terminated its partnership status because at least 50% of the total interests in partnership capital and profits were sold or exchanged within a 12- month period. The EIN of the terminated partnership should continue to be used. See Regulations section

3Don’t use the EIN of the prior business unless you became the “owner” of a corporation by acquiring its stock.

4However, grantor trusts that don’t file using Optional Method 1 and IRA trusts that are required to file Form

5A plan administrator is the person or group of persons specified as the administrator by the instrument under which the plan is operated.

6Entities applying to be a Qualified Intermediary (QI) need a

7See also Household employer agent in the instructions. Note: State or local agencies may need an EIN for other reasons, for example, hired employees.

8See Disregarded entities in the instructions for details on completing Form

9An existing corporation that is electing or revoking S corporation status should use its

Document Specifics

| Fact | Description |

|---|---|

| Form Name | IRS Form SS-4 |

| Primary Purpose | Application for Employer Identification Number (EIN) |

| Who Must File | Businesses needing an EIN for tax purposes |

| When to File | Before hiring employees or opening a business bank account |

| Filing Methods | Online, fax, mail |

| Processing Time | Varies; immediate online, up to 4 weeks by mail |

| State-Specific Versions | No, federal form used nationally |

| Governing Law | Federal tax law |

| Validity | Does not expire but must be updated for significant business changes |

Guide to Writing IRS SS-4

Filling out the IRS SS-4 form marks a significant step for entrepreneurs and businesses ready to embark on a journey in the marketplace. This form is designed to apply for an Employer Identification Number (EIN), a necessary identification for businesses dealing with employees, taxes, bank accounts, and more. Going through this process requires attention to detail and an understanding of your business structure and operations. After completion, you'll have taken a critical step towards formalizing your business identity and ensuring compliance with tax obligations. Let's dive into the steps to fill out this form correctly.

- Gather necessary information about your business, such as the legal name, address, type of entity (e.g., sole proprietorship, partnership, corporation), and the reason for applying for an EIN.

- Visit the official IRS website to access the SS-4 form. You have the option to fill it out online or download the form to complete it manually.

- Enter the legal name of the entity or individual for whom the EIN is being requested in the appropriate section of the form.

- Specify the trade name of the business if it differs from the legal name.

- Provide the mailing address where all correspondence related to the EIN should be sent. This includes the street address, city, state, and ZIP code.

- Indicate the county and state where the business is primarily located.

- Provide the name of the responsible party, the individual who owns or controls the entity and is the primary contact for tax matters.

- Enter the responsible party’s Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or EIN, depending on the entity.

- Specify the type of entity by selecting the appropriate box that describes your business structure (e.g., sole proprietor, partnership, corporation).

- Explain the reason for applying, such as starting a new business, hiring employees, banking purposes, or changes in the organizational structure.

- Indicate the date when the business started or acquired, and provide an estimate of the expected number of employees in the next 12 months.

- Complete the section about the principal activity of the business, including products or services provided.

- Read the third-party designee section carefully if you wish to authorize another person to receive and provide information to the IRS on your behalf.

- Review all the information entered for accuracy, complete the signature area at the bottom of the form, and provide the date and your title in the business.

- Submit the completed SS-4 form to the IRS, either online, by fax, or by mail, based on your preference.

After submitting the SS-4 form, you will receive your EIN from the IRS. This number serves as an important identifier for your business in all dealings with the IRS and other government agencies. Safeguard this number and ensure it's used appropriately in your business operations and tax filings. Congratulations, with your EIN secured, you're on your way to building and growing your enterprise in the landscape of the industry.

Understanding IRS SS-4

-

What is an IRS SS-4 form?

The IRS SS-4 form, also known as the Application for Employer Identification Number (EIN), is a form used by businesses to apply for an EIN. This nine-digit number is assigned by the IRS and used to identify a business entity for tax purposes. The EIN is necessary for filing business tax returns, opening a bank account in the name of the business, and for payroll and employment tax purposes.

-

Who needs to file an IRS SS-4 form?

Entities that need to file an IRS SS-4 form include businesses that are just starting, existing businesses that are hiring employees for the first time, trusts, estates, non-profit organizations, and certain individuals, such as sole proprietors who plan to employ workers. Generally, if an entity operates as a separate financial entity, it is required to obtain an EIN by filing an SS-4 form.

-

How can one apply for an EIN using the SS-4 form?

Applicants have several options to apply for an EIN using the SS-4 form. The process can be completed online, which is the fastest method and typically provides an EIN immediately upon completion. Alternatively, the SS-4 form can be faxed or mailed to the IRS, but these methods are slower, taking up to four weeks. For international applicants without a Social Security Number (SSN), the IRS also allows the SS-4 form to be submitted via telephone.

-

Is there a fee to apply for an EIN?

No, the IRS does not charge a fee to apply for an EIN. Regardless of the method chosen for submission (online, fax, mail, or telephone), obtaining an EIN is free of charge. Applicants should be wary of third-party services that charge a fee for obtaining an EIN on their behalf.

-

What information is needed to complete the SS-4 form?

To complete the SS-4 form, applicants need to provide detailed information about their entity. This includes the legal name of the entity, business address, responsible party's name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), the type of entity (such as corporation, partnership, sole proprietorship), reason for applying (such as started a new business, hiring employees), and the date when wages or annuities were first paid.

-

What happens after submitting the SS-4 form?

After the SS-4 form is submitted, the IRS will review the application and, if all information is in order, issue an EIN for the entity. For online applications, the EIN is provided immediately upon completion. Applications submitted by fax typically receive a response within four business days, while mailed applications can take up to four weeks. It's important for the entity to keep a copy of the SS-4 form and the EIN confirmation for its records.

Common mistakes

When applying for an Employer Identification Number (EIN) via Form SS-4 for the IRS, it's crucial to pay attention to detail to avoid common mistakes. The form is a key step for new businesses, allowing them to correctly file taxes, open business bank accounts, and more. However, errors can slow down the process, causing unnecessary delays. Here are seven common mistakes to watch out for:

Not specifying the legal structure of the business correctly. Each business structure has different tax implications, and incorrectly identifying your entity can lead to issues with the IRS.

Entering incorrect Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs). Accuracy is critical, as these numbers are essential for identity verification.

Omitting the responsible party's name. The IRS requires the name of the individual or entity that controls, manages, or directs the applicant entity and the disposition of its funds and assets.

Forgetting to specify the reason for applying. Whether it's starting a new business, hiring employees, or changing the organizational type, the reason aids in the processing of your form.

Misclassifying employees as independent contractors. This mistake can lead to significant tax-related issues and penalties, so it's vital to understand the difference.

Overlooking the need to indicate the expected number of employees. This information helps the IRS determine your tax obligations.

Ignoring the "Third Party Designee" section if you want someone else to speak to the IRS on your behalf. If this section is not filled out, only the responsible party or their legal representative will be able to discuss the application with the IRS.

Here are some additional tips to ensure the process goes smoothly:

Double-check all provided information for accuracy before submitting.

Consider consulting with a tax professional if you're unsure about any section of the form.

Keep a copy of the completed form for your records.

Avoiding these common mistakes can save a lot of time and hassle in the long run, making the process of obtaining your EIN smoother and quicker.

Documents used along the form

When starting a business or managing tax-related matters, the IRS SS-4 form is a key document for obtaining an Employer Identification Number (EIN). However, this form is often just the first step in a series of paperwork that needs to be tackled. Several other forms and documents usually come into play, each serving its unique purpose in the context of business operations and compliance. Let's explore some of these forms to understand their uses better.

- Form W-9, Request for Taxpayer Identification Number and Certification: This document is used to provide the correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS. It's often requested from contractors and freelancers to ensure proper reporting of payments for services.

- Form 941, Employer's Quarterly Federal Tax Return: Employers use this form to report income taxes, social security tax, or Medicare tax withheld from employee's paychecks. It's also used to pay the employer's portion of social security or Medicare tax.

- Form W-2, Wage and Tax Statement: This form is crucial for employers, as it needs to be sent to each employee and the IRS at the end of the year. It reports an employee's annual wages and the amount of taxes withheld from their paycheck.

- Form W-4, Employee's Withholding Certificate: Typically filled out by the employee at the start of a new job or when their personal or financial situations change. It indicates how much federal income tax to withhold from the employee's paycheck.

- Form 1099-NEC, Nonemployee Compensation: This form is used to report any payments of $600 or more to a non-employee. This is essential for businesses that hire freelancers, independent contractors, or other non-employees for services.

Understanding and correctly handling these forms alongside the IRS SS-4 can significantly smooth out the operational and financial aspects of running a business. Each form carries its importance in maintaining compliance with IRS regulations, ensuring accurate tax reporting and withholding. Familiarizing oneself with these documents can help in avoiding common pitfalls and in staying on top of necessary paperwork throughout the year.

Similar forms

The IRS SS-4 form, an application for an Employer Identification Number (EIN), shares similarities with the W-9 form, Request for Taxpayer Identification Number and Certification. Both forms are integral for tax identification purposes. The W-9 form is typically used by freelancers and independent contractors to provide their Taxpayer Identification Number (TIN) to entities that pay them, ensuring accurate tax reporting to the IRS. Like the SS-4, it collects essential taxpayer information, although the W-9 is geared more towards individuals and entities receiving income rather than those employing or paying salaries.

Comparable to the IRS SS-4 is the W-4 form, Employee's Withholding Certificate. The W-4 is used by employers to determine the correct amount of tax withholding from an employee's paycheck. Where the SS-4 form establishes a business's ability to employ and pay individuals through obtaining an EIN, the W-4 ensures the correct tax amount is withheld from employees' earnings. Both documents play crucial roles in the employment and taxation process, directly affecting how businesses and individuals fulfill their tax obligations.

The form 941, Employer’s Quarterly Federal Tax Return, also bears resemblance to the SS-4 form. Form 941 is used by employers to report income taxes, social security tax, or Medicare tax withheld from employee's paychecks, and to pay the employer's portion of social security or Medicare tax. While the SS-4 is concerned with the initial step of obtaining an identification number for tax purposes, the 941 handles ongoing tax reporting and payment obligations. Both are essential for compliance with U.S. tax laws and for operational and financial reporting by businesses.

Lastly, the SS-4 form is similar to the Form 2553, Election by a Small Business Corporation. Form 2553 is filled out by small businesses to elect S corporation status for tax purposes, allowing income, losses, deductions, and credits to be passed through to shareholders directly. The linkage between the SS-4 and the 2553 lies in their mutual goal of defining the tax structure and obligations of a business. While the SS-4 is focused on identifying the entity for tax purposes, the 2553 allows businesses to select a taxation classification that can influence financial and operational strategies significantly.

Dos and Don'ts

Applying for an Employer Identification Number (EIN) through the Internal Revenue Service (IRS) SS-4 form is a critical step for new business entities. This number is essential for tax purposes, employee payroll, and opening a business bank account among other functions. Being thorough and accurate when completing this form is crucial. Below are key dos and don'ts to assist you in the process.

Dos:

- Double-check the IRS guidelines before starting to ensure you understand the form's requirements.

- Provide accurate information about your business, including the legal name, address, and type of entity.

- Specify the reason for applying, whether it's starting a new business, hiring employees, banking purposes, or changing the type of organization.

- Include a responsible party's name and Social Security Number (SSN) or Individual Tax Identification Number (ITIN); this person should have control over, or be entitled to, the entity's funds and assets.

- Clearly indicate the date business started or acquired to help the IRS determine your tax obligations.

- Specify the highest number of employees expected in the next 12 months for accurate tax assessments and obligations.

- Choose the appropriate closing month of your accounting year for proper tax filing purposes.

- Make sure to sign and date the form; an unsigned form is incomplete and will not be processed.

- If you have questions or uncertainties, consult with a tax professional or attorney to avoid mistakes.

- Keep a copy of the completed SS-4 form and the EIN assignment notice for your records.

Don'ts:

- Don't rush through the form without understanding each section fully; mistakes can delay the processing time.

- Don't use pencil; fill out the form in blue or black ink if submitting by fax or mail, and follow instructions carefully if filling out online.

- Don't leave mandatory fields blank; incomplete forms will not be processed.

- Don't guess on specifics like the start date or number of employees; provide the most accurate estimates possible.

- Don't neglect the details of the responsible party; this information is crucial for the IRS.

- Don't submit multiple applications for the same entity; this can cause confusion and delays.

- Don't ignore IRS instructions or legal advice; ensuring compliance with regulations is essential.

- Don't forget to review the entire form before submission to catch any errors or omissions.

- Don't underestimate the importance of the EIN; it's crucial for various business operations and legal requirements.

- Don't hesitate to contact the IRS directly if you encounter issues or have questions during the application process.

Misconceptions

The Internal Revenue Service (IRS) Form SS-4, Application for Employer Identification Number (EIN), often encounters various misconceptions. Understanding these misconceptions is crucial for businesses and individuals to ensure they are complying with IRS rules and regulations properly. Below are five common misunderstandings about the IRS SS-4 form:

Every business needs to file an SS-4 form: This is not always true. While most businesses do require an EIN and must file an SS-4 form to obtain one, some sole proprietors and individual business owners might not need an EIN if they don't have employees, and if they don't meet other criteria requiring an EIN. They can instead use their Social Security Number for business tax filings.

The SS-4 form can only be submitted by mail or fax: While these were the traditional methods, the IRS now offers an online application process that is faster and more convenient. This online application is available for most entities and can immediately provide an EIN upon completion.

It's complicated and requires professional help to complete: While it's essential to ensure accuracy when completing any form for the IRS, the SS-4 form is designed to be straightforward. Most individuals can complete the application without professional help by following the detailed instructions provided by the IRS.

Once obtained, an EIN can be changed or canceled if there are errors: If there's an error in the information provided to the IRS, such as the business name or address, the EIN itself cannot be changed. Corrections to the entity's information are possible, but the EIN assigned to the business remains the same. Similarly, an EIN cannot be canceled. The IRS can close an account associated with an EIN, but the number itself is never reissued or reassigned.

An EIN is only needed for tax purposes: Although a primary use of the EIN is for federal tax reporting, it is also necessary for a variety of other business activities. These activities include opening a business bank account, applying for business licenses, and hiring employees. An EIN is essentially the social security number for a business, providing a unique identifier for various legal and financial transactions.

By dispelling these misconceptions, individuals and businesses can better navigate the process of obtaining and using an EIN, ensuring they comply with IRS requirements and avoid potential complications.

Key takeaways

Filing out and using the IRS SS-4 form, also known as the Application for Employer Identification Number (EIN), is a crucial step for new businesses. This form lays the groundwork for tax identification and compliance. Understanding its significance and correctly completing it can pave the way for a smooth business journey. Here are nine key takeaways that can help guide you through this process:

- Understand the purpose: The SS-4 form is used to apply for an EIN, which is necessary for tax reporting, hiring employees, opening a business bank account, and more. It’s the tax ID number for your business.

- Determine eligibility: Almost every business needs an EIN. This includes corporations, partnerships, and LLCs. Even sole proprietors without employees are often required to obtain one under certain conditions, such as if they have a Keogh plan.

- Gather necessary information: Before filling out the form, you’ll need to have several pieces of information ready, including the legal name of the entity, the responsible party's social security number, the business address, and the reason for applying.

- Decide how to apply: The SS-4 can be submitted online, by fax, or by mail. Online submission is the fastest method, generally providing an EIN immediately. However, international applicants may have specific restrictions and might need to apply via fax or mail.

- Accurately describe your business: When completing the form, it's crucial to accurately describe your business activity. This ensures that the IRS can accurately classify your business for tax purposes.

- Know the responsible party: The form requires the identification of a “responsible party.” This is the person who ultimately owns or controls the entity or who exercises ultimate effective control over the entity. For most small businesses, this will be the owner or a primary officer.

- Review before submitting: Double-check your form for any errors or omissions before submitting. Mistakes can delay the issuance of your EIN or even require the submission of a corrected application.

- Keep your EIN secure: Once issued, treat your EIN with the same security as you would your social security number. It’s critical for filing taxes and sensitive financial transactions.

- Understand your obligations: Obtaining an EIN is just the first step. Be aware of ongoing requirements, such as annual tax filings, maintaining employee records (if you have employees), and other state and federal obligations.

By following these guidelines and ensuring a thorough understanding of the SS-4 form and its implications, business owners can set a solid foundation for managing their tax responsibilities and focusing on growing their business.

Popular PDF Documents

6781 Form - Form 6781 helps in delineating complex trades that might otherwise be challenging to classify for tax purposes.

California Stop Payment - A vital document for maintaining financial integrity and transparency, allowing parties to assert their rights and obligations under the law.