Get IRS Schedule SE 1040 Form

For individuals navigating their own tax preparation, understanding the vast array of forms the Internal Revenue Service (IRS) requires can be a daunting task. One such form, the IRS Schedule SE 1040, plays a crucial role for those who are self-employed or are otherwise required to pay self-employment tax. This form is utilized to calculate how much self-employment tax an individual owes based on the net earnings from self-employment. The importance of Schedule SE lies not just in its function as a tax document but also in how it impacts the calculation of Social Security and Medicare benefits, which are reliant on the self-employment taxes paid over an individual’s working life. With its ties to both current tax liabilities and future benefits, the Schedule SE 1040 form stands as a pivotal piece of paperwork for freelancers, business owners, and other self-employed professionals aiming to comply with tax laws and secure their retirement benefits.

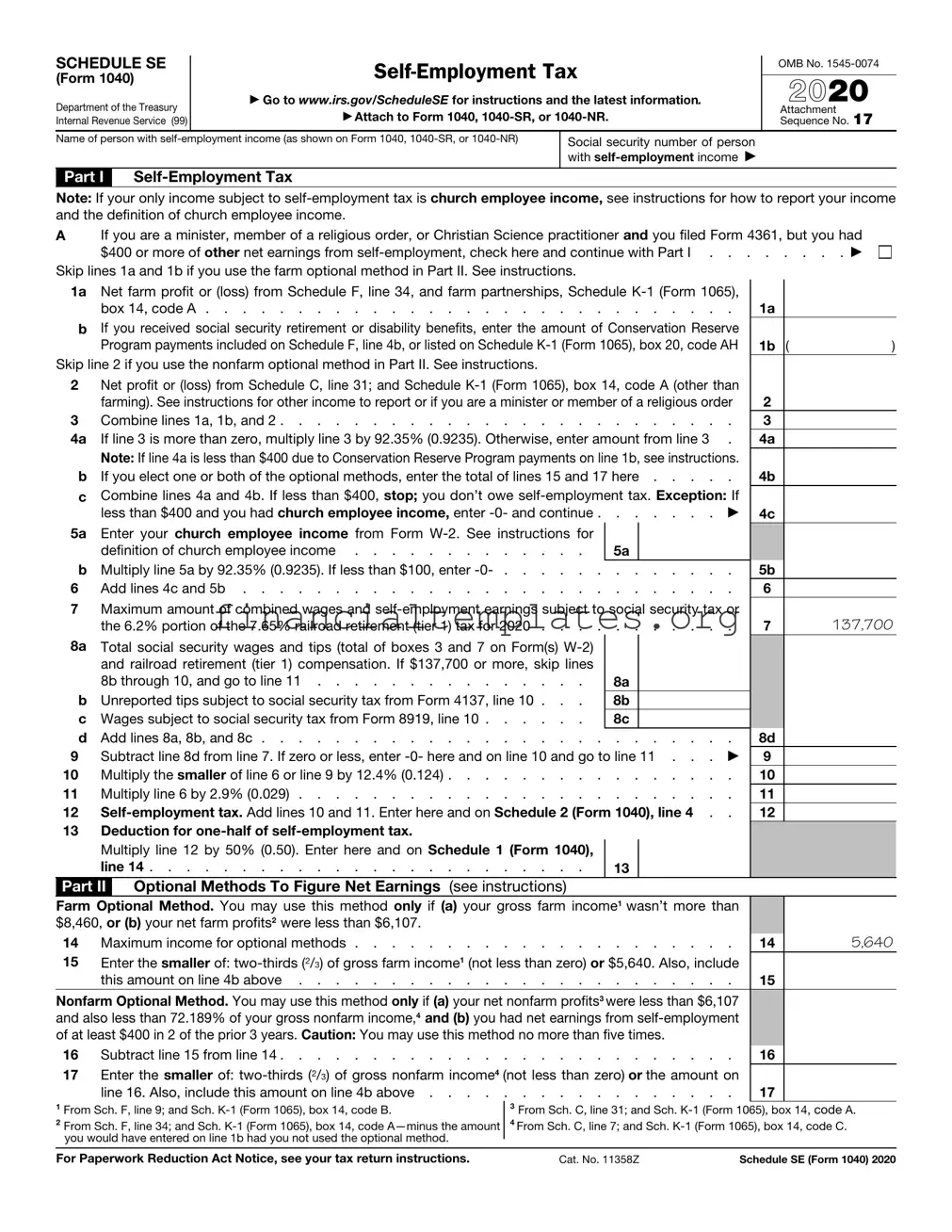

IRS Schedule SE 1040 Example

SCHEDULE SE

(Form 1040)

Department of the Treasury Internal Revenue Service (99)

▶Go to www.irs.gov/ScheduleSE for instructions and the latest information.

▶Attach to Form 1040,

OMB No.

2021

Attachment Sequence No. 17

Name of person with

Part I

Social security number of person with

Note: If your only income subject to

AIf you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had

$400 or more of other net earnings from

1a Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule

bIf you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule

Skip line 2 if you use the nonfarm optional method in Part II. See instructions.

2Net profit or (loss) from Schedule C, line 31; and Schedule

3 |

Combine lines 1a, 1b, and 2 |

4a |

If line 3 is more than zero, multiply line 3 by 92.35% (0.9235). Otherwise, enter amount from line 3 . |

|

Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. |

b |

If you elect one or both of the optional methods, enter the total of lines 15 and 17 here |

cCombine lines 4a and 4b. If less than $400, stop; you don’t owe

5a |

Enter your church employee income from Form |

See instructions for |

|

|

|

definition of church employee income |

. . . . . . . |

5a |

|

b |

Multiply line 5a by 92.35% (0.9235). If less than $100, enter |

|||

6 |

Add lines 4c and 5b |

|||

7Maximum amount of combined wages and

the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2021 . . . . . . . . . . .

8a |

Total social security wages and tips (total of boxes 3 and 7 on Form(s) |

|

|

|

and railroad retirement (tier 1) compensation. If $142,800 or more, skip lines |

|

|

|

8b through 10, and go to line 11 |

8a |

|

b |

Unreported tips subject to social security tax from Form 4137, line 10 . . . |

8b |

|

c |

Wages subject to social security tax from Form 8919, line 10 |

8c |

|

d |

Add lines 8a, 8b, and 8c |

||

9 |

Subtract line 8d from line 7. If zero or less, enter |

||

10 |

Multiply the smaller of line 6 or line 9 by 12.4% (0.124) |

||

11 |

Multiply line 6 by 2.9% (0.029) |

||

12 |

|||

13 |

Deduction for |

|

|

|

Multiply line 12 by 50% (0.50). Enter here and on Schedule 1 (Form 1040), |

|

|

|

line 15 |

13 |

|

Part II Optional Methods To Figure Net Earnings (see instructions)

1a

1b ( |

) |

2

3

4a

4b

4c

5b

6

7142,800

8d

9

10

11

12

Farm Optional Method. You may use this method only if (a) your gross farm income1 wasn’t more than |

|

|

$8,820, or (b) your net farm profits2 were less than $6,367. |

|

|

14 Maximum income for optional methods |

14 |

5,880 |

15Enter the smaller of:

this amount on line 4b above |

15 |

|

Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits3 were less than $6,367 |

|

|

and also less than 72.189% of your gross nonfarm income,4 and (b) you had net earnings from |

|

|

of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than five times. |

|

|

16 Subtract line 15 from line 14 |

16 |

|

17Enter the smaller of:

line 16. Also, include this amount on line 4b above |

17 |

1From Sch. F, line 9; and Sch.

2From Sch. F, line 34; and Sch.

3From Sch. C, line 31; and Sch.

4From Sch. C, line 7; and Sch.

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 11358Z |

Schedule SE (Form 1040) 2021 |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Schedule SE | This form is used to calculate the self-employment tax owed by individuals who have earned income other than salaries and wages. |

| Applicability | It applies to those who operate a business as a sole proprietor, an independent contractor, a partner in a partnership, or are otherwise self-employed. |

| Components of Self-Employment Tax | The tax consists of two parts: Social Security and Medicare contributions. |

| Deduction for Adjusted Gross Income | Filers can deduct half of their self-employment tax from their gross income, reducing the taxable income amount. |

| Earning Thresholds | A threshold amount exists, below which a self-employed individual may not need to file Schedule SE. This amount can change annually. |

| Federal Tax Law | The requirements and details of the Schedule SE form are governed by federal tax law, specifically the Internal Revenue Code. |

Guide to Writing IRS Schedule SE 1040

Once you've determined you need to fill out the IRS Schedule SE for 1040 form, you’re on your way to properly reporting your self-employment taxes. This form is essential for anyone who earns self-employment income to calculate how much they owe in Social Security and Medicare taxes. The process can appear daunting, but breaking it down into structured steps helps to simplify it.

- Gather all necessary documents, including your 1040 form, 1099 forms, and any records of business expenses.

- Access the IRS Schedule SE 1040 form. This can be done through the IRS website or tax preparation software.

- Start by filling in your personal information, including your name and Social Security Number, at the top of the form.

- Determine which version of Schedule SE you need to fill out. If your only income is from church employee income, you will fill out the Short Schedule SE. Otherwise, you will likely use the Long Schedule SE.

- For the Long Schedule SE, calculate your net earnings from self-employment. This involves subtracting your business expenses from your business income.

- Enter your calculated net earnings in Part I, line 2.

- If applicable, fill out Part II for church employee income.

- Calculate your self-employment tax in Part III by following the instructions provided on the form, which will walk you through calculating the Social Security and Medicare tax amounts.

- Report the self-employment tax amount on your Form 1040 and attach Schedule SE to it.

- Review your filled-out form for accuracy, make any necessary corrections, and then sign and date the form.

- Submit your form either electronically through the IRS e-file system or mail it to the IRS, attached to your 1040 form.

Once you’ve submitted your Schedule SE with your tax return, you've completed an essential step in handling your taxes as a self-employed individual. If you have questions or uncertainties about any steps in the process, consider seeking assistance from a tax professional. They can provide personalized advice and ensure that you're meeting all your tax obligations correctly.

Understanding IRS Schedule SE 1040

-

What is the IRS Schedule SE 1040 form used for?

The IRS Schedule SE 1040 form is designed for individuals to calculate and report the self-employment tax due on net earnings from self-employment. This form helps in determining the amount of Social Security and Medicare taxes that self-employed persons must pay. It is directly tied to the income reported on Schedule C, which outlines the profit or loss from a business the taxpayer owned or operated.

-

Who needs to file the Schedule SE 1040 form?

The necessity to file a Schedule SE 1040 form generally applies to individuals who have net earnings from self-employment of $400 or more. This includes those who are sole proprietors, independent contractors, or partners in a partnership. Furthermore, people involved in a trade or business as part of a qualifying joint venture or those who are otherwise required to pay self-employment tax need to file this form.

-

How do I know if I have net earnings from self-employment?

Net earnings from self-employment are calculated by taking the gross income from one’s business and subtracting the allowable business deductions. These earnings include not just the profit made from selling goods or services but also factors in expenses such as rent, utilities, supplies, and other costs associated with running the business. If the resulting figure is $400 or more, it is necessary to file Schedule SE to determine the self-employment tax owed.

-

What are the rates for Social Security and Medicare taxes for the self-employed?

For self-employed individuals, the Social Security tax rate is 12.4% on the first $137,700 of net earnings (as of the last update) and the Medicare tax rate is 2.9% on all net earnings. Importantly, there is no cap on the earnings subject to the Medicare tax. In addition, individuals with earnings exceeding a threshold amount may be subject to an additional 0.9% Medicare tax.

-

Can I deduct any portion of my self-employment tax?

Yes, taxpayers can deduct the employer-equivalent portion of their self-employment tax in calculating their adjusted gross income. This amounts to 50% of the total self-employment tax. This deduction only affects the income tax owed and not the total self-employment tax due.

-

How do I file the Schedule SE 1040 form?

The Schedule SE form is filled out and filed alongside your Form 1040 or Form 1040-SR during the annual tax filing. The form requires you to input your net earnings from self-employment and guides you through the calculation of self-employment tax owed. It is important to thoroughly review and accurately report income and expenses to ensure proper self-employment tax is calculated.

-

Where can I find more assistance or information?

For more detailed guidance, individuals can refer to the official IRS website or consult the instructions for Schedule SE provided by the IRS. Additionally, seeking advice from a tax professional or accountant who understands the nuances of self-employment income can be very helpful, especially for complex situations or for those new to self-employment.

Common mistakes

Filling out IRS forms can sometimes feel like navigating a maze without a map. The IRS Schedule SE 1040 form, which is used to calculate and report the tax owed on earnings from self-employment, is no exception. Here are the top eight mistakes people commonly make when completing this particular form:

Not filing at all because their earnings were below $400. Even if your self-employment income is under this threshold, other factors might still necessitate filing the form.

Overlooking the option to deduct half of the self-employment tax from their gross income. This can reduce the total amount of income tax owed, but it's often missed by filers.

Miscalculating net profit or loss. Accurately reporting earnings and expenses is crucial but can get confusing. Errors can lead to either overpayment or potential penalties for underpayment.

Failing to pay the self-employment tax quarterly. Many are unaware that they can (and should) make these payments throughout the year to avoid a large tax bill and penalties at year's end.

Not separating personal expenses from business expenses. This common mistake can not only skew your reported earnings but also draw unwanted attention from the IRS.

Forgetting to include all sources of self-employment income. If you have multiple streams of income, each must be reported to avoid underreporting.

Ignoring the earned income credit. Those with lower incomes might qualify for this credit, but without proper attention, they could miss out on significant tax savings.

Incorrectly using the optional methods to calculate net earnings. These methods can benefit those with lower income, but using them incorrectly can result in errors in the amount of tax owed.

When filling out the IRS Schedule SE 1040 form, taking care to avoid these mistakes can save you time, money, and potential headaches down the line. If you're ever in doubt, seeking guidance from a tax professional can help ensure that your tax obligations are met accurately and efficiently.

Documents used along the form

When preparing taxes, particularly for individuals with income from self-employment, the IRS Schedule SE (Form 1040) is pivotal for calculating the amount of self-employment tax owed. This form works in tandem with various other documents and forms, which are essential for accurately reporting income, deductions, and credits. The integration of these forms ensures a comprehensive approach to tax filing, reflecting an individual's fiscal activities and obligations over the tax year.

- Form 1040: The U.S. Individual Income Tax Return is the foundational document where you report your annual income, claim tax deductions and credits, and calculate the total tax owed or refund due. Schedule SE is directly related to this form, as it determines the self-employment tax that contributes to your overall tax responsibility.

- Schedule C (Form 1040): Profit or Loss from Business is vital for sole proprietors and single-member LLCs. It details the income and expenses related to your business, providing the net profit or loss figure that Schedule SE requires to compute self-employment tax.

- Schedule F (Form 1040): Profit or Loss From Farming offers a format for farmers to report their farming income and expenses. Similar to Schedule C, the net profit or loss calculated on this form is used in Schedule SE for self-employment tax calculation if applicable.

- Schedule 1 (Form 1040): Additional Income and Adjustments to Income captures various income types not entered directly on Form 1040. It includes self-employed SEP, SIMPLE, and qualified plans, affecting the self-employment tax calculation on Schedule SE.

- Form 8829: Expenses for Business Use of Your Home allows for the deduction of expenses tied to the use of your home for business purposes. The deductible portion can reduce the net profit reported on Schedule C, subsequently affecting the self-employment tax computed on Schedule SE.

- Form 1099-NEC: Nonemployee Compensation is received by freelancers, independent contractors, and others who have earned $600 or more from a client or company. This form helps in reporting the earned income that must be declared on Schedule C and influences the self-employment tax on Schedule SE.

Together, these documents paint a complete financial portrait for the IRS, ensuring that self-employed individuals adequately report their earnings, claim pertinent deductions, and calculate the correct amount of taxes owed. The accuracy of the information provided on these forms is crucial for the fair assessment and payment of taxes, highlighting the interconnectivity between them and their role in the broader tax filing process.

Similar forms

The IRS Schedule SE 1040 form is closely related to the Form 1040, U.S. Individual Income Tax Return. Both forms are essential for individuals to report their annual income to the Internal Revenue Service (IRS). While the Form 1040 provides a comprehensive overview of an individual's income, deductions, and credits, Schedule SE specifically focuses on calculating the self-employment tax owed by individuals who earn income outside of traditional employment. This connection is vital because information from the 1040 form often feeds directly into Schedule SE to determine the self-employment tax due.

Another similar document is the IRS Schedule C (Form 1040), Profit or Loss from Business. This form is used by sole proprietors as well as single-member LLCs to report the income or loss from a business they operated or a profession they practiced as a sole proprietor. The income reported on Schedule C directly impacts the calculations on Schedule SE, as the net profit or loss from business activities on Schedule C is used to determine self-employment tax obligations on Schedule SE.

IRS Form 1099-MISC, Miscellaneous Income, also has similarities to Schedule SE. Form 1099-MISC is used to report payments made in the course of a trade or business to people who aren't employees, such as independent contractors. For individuals receiving a 1099-MISC, this income must be reported on Schedule C, which then influences the self-employment tax calculated on Schedule SE. Thus, 1099-MISC income is a critical component for many individuals completing their Schedule SE.

The IRS Schedule F (Form 1040), Profit or Loss from Farming, is akin to Schedule SE in that it impacts self-employment tax calculations for individuals involved in farming activities. Farmers utilize Schedule F to report farm income and expenses. The net profit or loss from farming operations reported on Schedule F is then used to determine the self-employment tax on Schedule SE, highlighting the direct relationship between profit from farming and self-employment tax obligations.

IRS Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, indirectly relates to Schedule SE. When individuals file Form 4868, they receive an extension on the deadline to file their Form 1040 and, by extension, Schedule SE. This correlation ensures that individuals who may need additional time to accurately report their income and calculate their self-employment tax can do so without penalty.

The IRS Schedule 1 (Form 1040), Additional Income and Adjustments to Income, interacts with Schedule SE by requiring certain types of additional income to be reported, some of which may affect self-employment tax calculations. Specifically, income adjustments reported on Schedule 1 can impact the adjusted gross income figure used in the self-employment tax calculation on Schedule SE, thus connecting the forms in the overall task of income reporting and tax calculation.

IRS Form 8829, Expenses for Business Use of Your Home, is another document related to Schedule SE, especially for self-employed individuals who take a home office deduction. The expenses reported on Form 8829 can lower the net profit reported on Schedule C, consequently affecting the self-employment tax owed, as calculated on Schedule SE. This form demonstrates how business deductions impact self-employment tax liabilities.

The IRS Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., has a connection to Schedule SE for individuals who are partners in partnerships. The income or loss reported on Schedule K-1 affects the partner's individual income tax return, including the net earnings from self-employment that are subject to self-employment tax on Schedule SE. This form is crucial in determining how partnership income contributes to an individual's self-employment tax obligations.

IRS Form 1040-ES, Estimated Tax for Individuals, bears relevance to Schedule SE as it involves the estimated tax payments that self-employed individuals are often required to make. Based on the self-employment tax calculated on Schedule SE, along with other tax liabilities, Form 1040-ES helps individuals determine how much they should pay in estimated taxes quarterly to avoid penalties for underpayment of taxes due throughout the year.

Lastly, the IRS Form W-2, Wage and Tax Statement, while primarily for traditionally employed individuals, connects with Schedule SE for individuals who have both traditional employment and self-employment income. The W-2 reports wages on which Social Security and Medicare tax has already been paid, which can affect the calculation of self-employment tax on Schedule SE, ensuring that individuals do not overpay into Social Security and Medicare.

Dos and Don'ts

Filling out the IRS Schedule SE 1040 form, which calculates the self-employment tax, necessitates attention to detail and adherence to specific rules. Here are essential do's and don'ts to guide individuals through the process:

- Do carefully read the instructions provided by the IRS for the Schedule SE 1040 form to ensure comprehension of the requirements and criteria.

- Do verify your eligibility for using either the Short Schedule SE or the Long Schedule SE, as your net earnings from self-employment influence which schedule you should use.

- Do report all your sources of self-employment income accurately, including all the businesses you own and operate.

- Do deduct allowable expenses that can reduce your self-employment income, thereby affecting your self-employment tax liability.

- Do check the necessity to include any farm income or loss, as this can significantly impact your self-employment earnings calculation.

- Don't forget to include your Social Security number on the form, ensuring your self-employment earnings are properly credited to your social security record.

- Don't neglect to use the correct calculation for your self-employment tax; the rate is typically a combined percentage of Social Security and Medicare taxes.

- Don't overlook the deduction for self-employed health insurance premiums, which can reduce your adjusted gross income if you qualify.

- Don't hesitate to consult a tax professional if you encounter uncertainties or complexities in the tax calculation process.

Misconceptions

When it comes to understanding tax forms, especially those involving self-employment and additional earnings, misconceptions are all too common. The IRS Schedule SE (Form 1040) is designed for filing self-employment taxes, but there are several misunderstandings that often color people's perceptions and handling of this form. Let's clear up some of the common myths.

- The Schedule SE is only for full-time self-employed individuals. This is untrue. The form is required for anyone who has earned $400 or more from self-employment activities, regardless of their employment status elsewhere. Part-time freelancers, gig economy workers, and individuals with side businesses also need to file if they meet the income threshold.

- If you don’t owe income taxes, you don’t have to file Schedule SE. Even if your business did not earn enough to owe income taxes, you might still have to file Schedule SE to pay self-employment Social Security and Medicare taxes. These taxes are due if your net self-employment earnings are $400 or more.

- Filing a Schedule SE means paying more in taxes. While it's true that self-employed individuals are responsible for both the employee and employer portions of Social Security and Medicare taxes, filing Schedule SE also allows for deductions that can lower your taxable income. For example, you can deduct the employer-equivalent portion of your self-employment taxes when calculating your adjusted gross income.

- You can only file Schedule SE with a paper form. This is not the case. You can file Schedule SE electronically along with your Form 1040 through IRS e-file or through various tax software programs. Electronic filing is not only more convenient but it can also reduce errors and speed up processing times.

- I can ignore Schedule SE if I only have a small amount from self-employment. This could be a costly mistake. If you've earned $400 or more through self-employment, ignoring Schedule SE can lead to underreported income, resulting in penalties and interest from the IRS. It's important to report all income, regardless of the amount or the source.

Understanding the facts about the IRS Schedule SE (Form 1040) can save taxpayers time, prevent unnecessary stress, and avoid potential penalties. Proper filing is crucial for all, from the seasoned freelancer to the new gig economy participant.

Key takeaways

Understanding and correctly utilizing the IRS Schedule SE 1040 form is key for those who are self-employed or have earned income other than salaries and wages. Here are ten crucial takeaways to help you navigate through the process seamlessly:

- Know When to Use It: The IRS Schedule SE 1040 form is a must-have for individuals who are self-employed, including those who work as independent contractors, sole proprietors, and others, and have earned $400 or more.

- Self-Employment Tax: This form is used to calculate the self-employment tax owed, which covers the individual's Social Security and Medicare taxes. The necessity of filling out this form stems from the absence of an employer to withhold these taxes from paychecks.

- Two Parts, Two Rates: The form comes in two parts - Short Schedule SE and Long Schedule SE. Your business’s net earnings and the specifics of your self-employed income determine which section you should fill out.

- Deductible Expenses: It allows for the deduction of business expenses, ensuring that taxes are only paid on net earnings. Keeping meticulous records of these expenses is crucial.

- Net Earnings Calculation: Schedule SE helps you calculate net earnings from self-employment by taking into account various deductions including, but not limited to, the deductible portion of self-employment tax, and health insurance costs.

- Deduction on Income Tax Return: Half of the self-employment tax can be deducted from your gross income, lowering the overall taxable income on your tax return.

- Reporting Tips: If you receive tips as part of your self-employed income, these are also subject to self-employment tax and must be reported through Schedule SE.

- Social Security Benefits: The self-employment tax contributes to your Social Security benefits. The earnings reported and the tax paid through Schedule SE affect your benefits upon retirement.

- Joint Filing Considerations: If filing jointly, and both spouses are self-employed, each spouse must fill out a separate Schedule SE to accurately report their earnings and calculate their respective self-employment taxes.

- Electronic Filing: While the form can be downloaded and filled out manually, using tax software or consulting with a tax professional can streamline the process, ensuring accuracy and compliance.

Tackling the IRS Schedule SE 1040 form with these takeaways in mind will demystify the process of calculating and reporting self-employment taxes, ultimately leading to a smoother tax filing experience.

Popular PDF Documents

Pa Real Estate Forms - It's a comprehensive tool for both declaring and calculating the applicable transfer tax, designed to streamline the filing process.

Power of Attorney Irs - A Tax Power of Attorney (POA) form allows someone else to handle your tax matters with the IRS on your behalf.