Get IRS Schedule M-3 1120 Form

The IRS Schedule M-3 1120 form plays a vital role in the corporate financial landscape, providing a detailed view of a company's financial activities throughout the fiscal year. Designed for corporations with total assets of $10 million or more, it demands a thorough reconciliation of financial statements with the income tax return reported to the IRS. This form delves into the nuances between book income and taxable income, helping to ensure transparency and accuracy in reporting. Corporations are required to account for differences in income recognition, expense deductions, and varied tax treatments of certain transactions. With its comprehensive structure, the Schedule M-3 1120 form aids in identifying discrepancies that could lead to audit flags, making it an essential document for corporations navigating the complexities of tax reporting. By filling out this form meticulously, companies can avoid potential penalties while adhering to tax laws, underscoring its importance in the corporate tax preparation process.

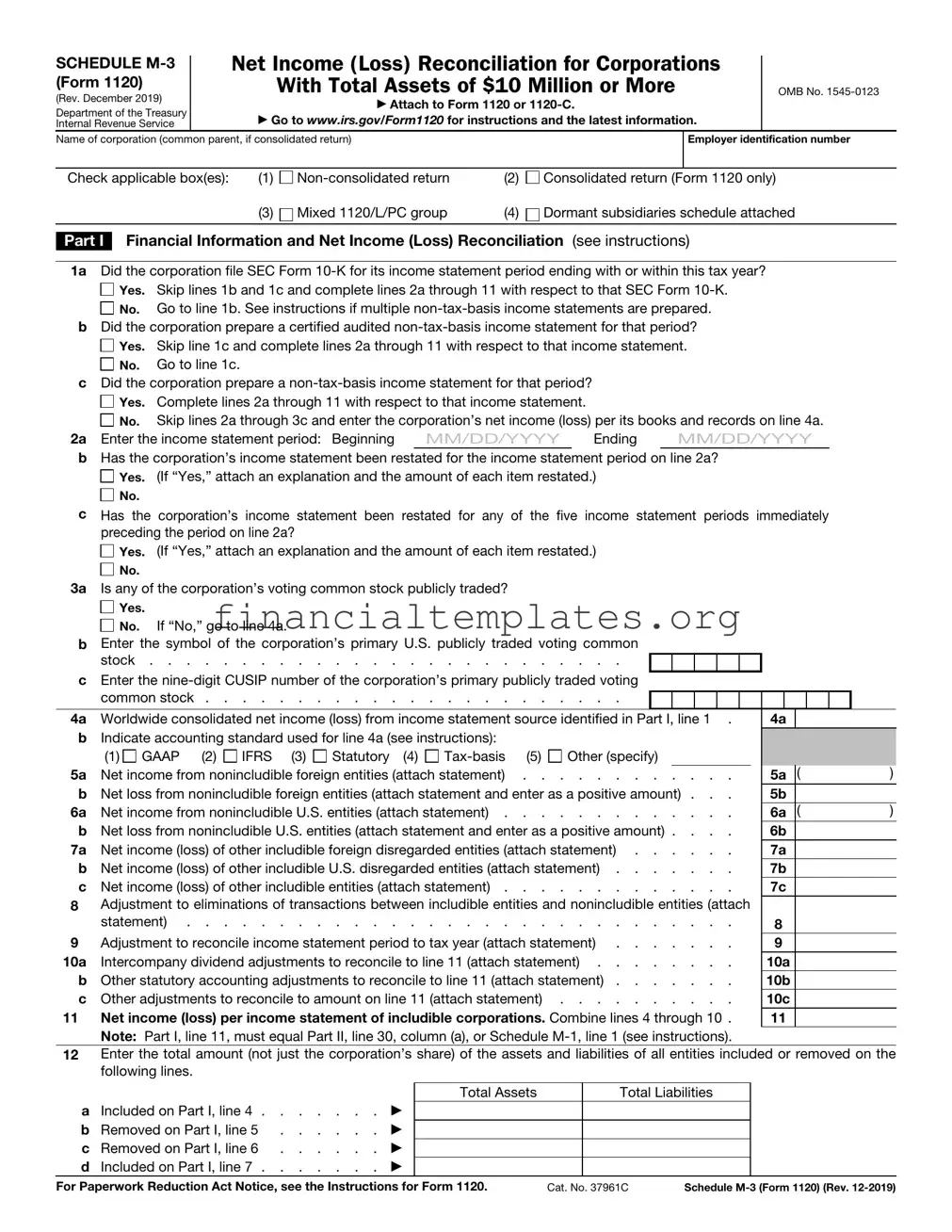

IRS Schedule M-3 1120 Example

SCHEDULE

(Rev. December 2019)

Department of the Treasury

Internal Revenue Service

Net Income (Loss) Reconciliation for Corporations

With Total Assets of $10 Million or More

▶Attach to Form 1120 or

▶Go to www.irs.gov/Form1120 for instructions and the latest information.

OMB No.

Name of corporation (common parent, if consolidated return)

Employer identification number

Check applicable box(es): |

(1) |

(2) |

Consolidated return (Form 1120 only) |

|

|

(3) |

Mixed 1120/L/PC group |

(4) |

Dormant subsidiaries schedule attached |

|

|

|

|

|

Part I Financial Information and Net Income (Loss) Reconciliation (see instructions)

1a Did the corporation file SEC Form

Yes. Skip lines 1b and 1c and complete lines 2a through 11 with respect to that SEC Form

Yes. Skip lines 1b and 1c and complete lines 2a through 11 with respect to that SEC Form

No. Go to line 1b. See instructions if multiple

No. Go to line 1b. See instructions if multiple

bDid the corporation prepare a certified audited

Yes. Skip line 1c and complete lines 2a through 11 with respect to that income statement.

Yes. Skip line 1c and complete lines 2a through 11 with respect to that income statement.

No. Go to line 1c.

No. Go to line 1c.

cDid the corporation prepare a

Yes. Complete lines 2a through 11 with respect to that income statement.

Yes. Complete lines 2a through 11 with respect to that income statement.

No. Skip lines 2a through 3c and enter the corporation’s net income (loss) per its books and records on line 4a.

No. Skip lines 2a through 3c and enter the corporation’s net income (loss) per its books and records on line 4a.

2a Enter the income statement period: Beginning MM/DD/YYYY Ending MM/DD/YYYY

bHas the corporation’s income statement been restated for the income statement period on line 2a?

Yes. (If “Yes,” attach an explanation and the amount of each item restated.)

Yes. (If “Yes,” attach an explanation and the amount of each item restated.)

No.

No.

cHas the corporation’s income statement been restated for any of the five income statement periods immediately preceding the period on line 2a?

Yes. (If “Yes,” attach an explanation and the amount of each item restated.)

Yes. (If “Yes,” attach an explanation and the amount of each item restated.)

No.

No.

3a Is any of the corporation’s voting common stock publicly traded?

Yes.

Yes.

No. If “No,” go to line 4a.

bEnter the symbol of the corporation’s primary U.S. publicly traded voting common

stock . . . . . . . . . . . . . . . . . . . . . . . . . .

cEnter the

common stock . . . . . . . . . . . . . . . . . . . . . . .

4a Worldwide consolidated net income (loss) from income statement source identified in Part I, line 1 .

bIndicate accounting standard used for line 4a (see instructions):

(1) GAAP (2) |

IFRS (3) |

Statutory (4) |

Other (specify) |

5a Net income from nonincludible foreign entities (attach statement) . . . . . . . . . . . .

bNet loss from nonincludible foreign entities (attach statement and enter as a positive amount) . . .

6a Net income from nonincludible U.S. entities (attach statement) . . . . . . . . . . . . .

bNet loss from nonincludible U.S. entities (attach statement and enter as a positive amount) . . . .

7a |

Net income (loss) of other includible foreign disregarded entities (attach statement) |

b |

Net income (loss) of other includible U.S. disregarded entities (attach statement) |

c |

Net income (loss) of other includible entities (attach statement) |

8Adjustment to eliminations of transactions between includible entities and nonincludible entities (attach

|

statement) |

9 |

Adjustment to reconcile income statement period to tax year (attach statement) |

10a |

Intercompany dividend adjustments to reconcile to line 11 (attach statement) |

b |

Other statutory accounting adjustments to reconcile to line 11 (attach statement) |

c |

Other adjustments to reconcile to amount on line 11 (attach statement) |

11 |

Net income (loss) per income statement of includible corporations. Combine lines 4 through 10 . |

4a

|

|

|

5a |

( |

) |

5b |

|

|

6a |

( |

) |

6b |

|

|

7a |

|

|

7b |

|

|

7c |

|

|

8 |

|

|

9 |

|

|

10a |

|

|

10b |

|

|

10c |

|

|

11 |

|

|

Note: Part I, line 11, must equal Part II, line 30, column (a), or Schedule

12Enter the total amount (not just the corporation’s share) of the assets and liabilities of all entities included or removed on the following lines.

a |

Included on Part I, line 4 . |

. |

. . . |

. |

. |

▶ |

b Removed on Part I, line 5 |

. |

. . . |

. |

. |

▶ |

|

c Removed on Part I, line 6 |

. |

. . . |

. |

. |

▶ |

|

d |

Included on Part I, line 7 . |

. |

. . . |

. |

. |

▶ |

Total Assets

Total Liabilities

For Paperwork Reduction Act Notice, see the Instructions for Form 1120. |

Cat. No. 37961C |

Schedule |

Schedule |

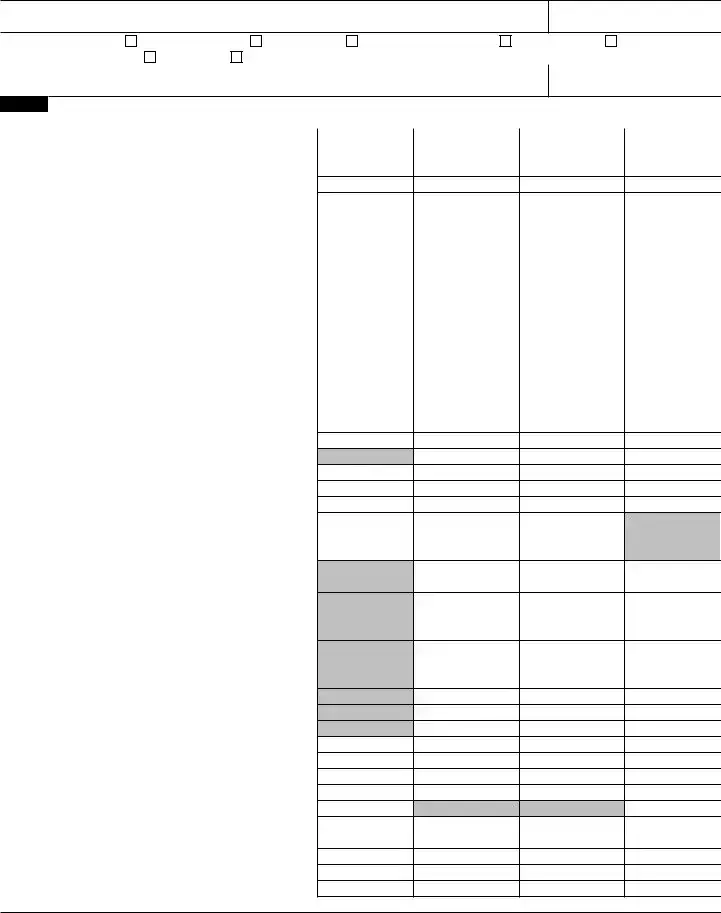

Page 2 |

Name of corporation (common parent, if consolidated return)

Employer identification number

Check applicable box(es): (1) |

Consolidated group |

(2) |

Parent corp |

(3) |

Consolidated eliminations |

(4) |

Subsidiary corp (5) |

Mixed 1120/L/PC group |

Check if a |

1120 group (7) |

1120 eliminations |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of subsidiary (if consolidated return) |

|

|

|

|

|

Employer identification number |

||

Part II Reconciliation of Net Income (Loss) per Income Statement of Includible Corporations With Taxable Income per Return (see instructions)

Income (Loss) Items |

(a) |

(b) |

(c) |

(d) |

Income (Loss) per |

Temporary |

Permanent |

Income (Loss) |

|

(Attach statements for lines 1 through 12) |

Income Statement |

Difference |

Difference |

per Tax Return |

1 Income (loss) from equity method foreign corporations |

|

|

|

|

2Gross foreign dividends not previously taxed . . .

3 |

Subpart F, QEF, and similar income inclusions . . |

|

|

|

|

|

4 |

|

|

|

|

|

|

5 |

Gross foreign distributions previously taxed . . . |

|

|

|

|

|

6 |

Income (loss) from equity method U.S. corporations |

|

|

|

|

|

7 |

U.S. dividends not eliminated in tax consolidation . |

|

|

|

|

|

8 |

Minority interest for includible corporations . . . |

|

|

|

|

|

9 |

Income (loss) from U.S. partnerships |

|

|

|

|

|

10 |

Income (loss) from foreign partnerships . . . . |

|

|

|

|

|

11 |

Income (loss) from other |

|

|

|

|

|

12 |

Items relating to reportable transactions . . . . |

|

|

|

|

|

13 |

Interest income (see instructions) |

|

|

|

|

|

14 |

Total accrual to cash adjustment |

|

|

|

|

|

15 |

Hedging transactions |

|

|

|

|

|

16 |

|

|

|

|

||

17 |

Cost of goods sold (see instructions) . . . . . ( |

) |

( |

) |

||

18Sale versus lease (for sellers and/or lessors) . . .

19 |

Section 481(a) adjustments |

20 |

Unearned/deferred revenue |

21 |

Income recognition from |

22Original issue discount and other imputed interest .

23a Income statement gain/loss on sale, exchange, abandonment, worthlessness, or other disposition of assets other than inventory and

b Gross capital gains from Schedule D, excluding amounts from

c Gross capital losses from Schedule D, excluding amounts from

d Net gain/loss reported on Form 4797, line 17, excluding amounts from

e Abandonment losses . . . . . . . . . .

f Worthless stock losses (attach statement) . . . .

g Other gain/loss on disposition of assets other than inventory

24Capital loss limitation and carryforward used . . .

25Other income (loss) items with differences (attach statement)

26Total income (loss) items. Combine lines 1 through 25

27Total expense/deduction items (from Part III, line 39)

28 Other items with no differences . . . . . . .

29a Mixed groups, see instructions. All others, combine lines 26 through 28 . . . . . . . . . . .

b PC insurance subgroup reconciliation totals . . .

c Life insurance subgroup reconciliation totals . . .

30Reconciliation totals. Combine lines 29a through 29c

Note: Line 30, column (a), must equal Part I, line 11, and column (d) must equal Form 1120, page 1, line 28.

Schedule

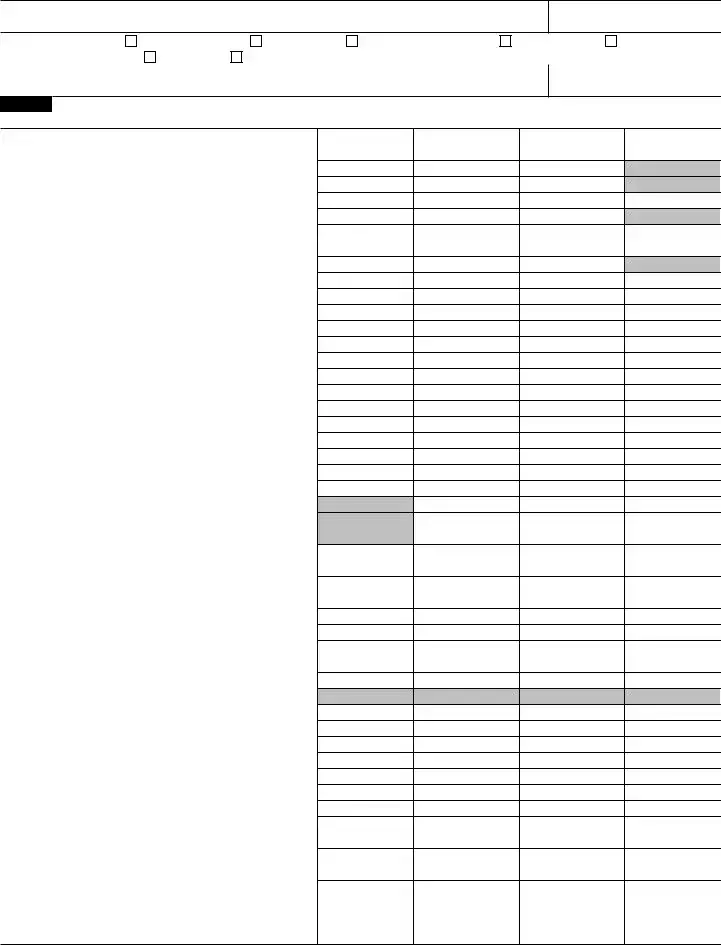

Schedule |

Page 3 |

Name of corporation (common parent, if consolidated return)

Employer identification number

Check applicable box(es): (1) |

Consolidated group |

(2) |

Parent corp |

(3) |

Consolidated eliminations |

(4) |

Subsidiary corp (5) |

Mixed 1120/L/PC group |

Check if a |

1120 group (7) |

1120 eliminations |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of subsidiary (if consolidated return) |

|

|

|

|

|

Employer identification number |

||

Part III Reconciliation of Net Income (Loss) per Income Statement of Includible Corporations With Taxable Income per

|

Expense/Deduction Items |

1 |

U.S. current income tax expense |

2 |

U.S. deferred income tax expense |

3 |

State and local current income tax expense . . . |

4State and local deferred income tax expense . . .

5Foreign current income tax expense (other than

foreign withholding taxes) . . . . . . . . .

6 |

Foreign deferred income tax expense |

7 |

Foreign withholding taxes |

8 |

Interest expense (see instructions) |

9 |

Stock option expense |

10 |

Other |

11 |

Meals and entertainment |

12 |

Fines and penalties |

13 |

Judgments, damages, awards, and similar costs . |

14 |

Parachute payments |

15Compensation with section 162(m) limitation . . .

16Pension and

17 |

Other |

18 |

Deferred compensation |

19Charitable contribution of cash and tangible property

20 |

Charitable contribution of intangible property |

. . |

21 |

Charitable contribution limitation/carryforward . . |

|

22Domestic production activities deduction (see

instructions) . . . . . . . . . . . . . .

23Current year acquisition or reorganization

investment banking fees . . . . . . . . .

24Current year acquisition or reorganization legal and

accounting fees . . . . . . . . . . . .

25Current year acquisition/reorganization other costs .

26 Amortization/impairment of goodwill |

. . . . . |

27Amortization of acquisition, reorganization, and

28 |

Other amortization or impairment |

29 |

Reserved |

30 |

Depletion |

31 |

Depreciation |

32 |

Bad debt expense |

33 |

Corporate owned life insurance premiums . . . |

34 |

Purchase versus lease (for purchasers and/or lessees) . |

35 |

Research and development costs |

36Section 118 exclusion (attach statement) . . . .

37Section

large financial institutions (see instructions) . . .

38Other expense/deduction items with differences

(attach statement) |

. . . . . . . . . . . |

39Total expense/deduction items. Combine lines 1 through 38. Enter here and on Part II, line 27, reporting positive amounts as negative and negative amounts as positive . . . . . . . .

(a)

Expense per

Income Statement

(b)

Temporary Difference

(c) Permanent Difference

(d)

Deduction per

Tax Return

Schedule

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Schedule M-3 for Form 1120 is used by certain corporations to report income and financial information differently from what is reported on their income statement. |

| Who Must File | Corporations with total assets of $10 million or more at the end of the tax year must file Schedule M-3 with their Form 1120. |

| Parts of the Form | The Schedule M-3 consists of three parts: Part I relates to financial statements, Part II reconciles income (loss) per income statement with income (loss) per return, and Part III provides information on intercompany transactions. |

| Main Objectives | The main objectives of filing this form are to improve transparency in reporting and to aid the IRS in understanding the differences between book income and taxable income. |

| Additional Forms | Corporations filing Schedule M-3 may also need to file Schedule L (Balance Sheets per Books), Schedule M-1 (Reconciliation of Income (Loss) per Books With Income per Return), and other accompanying schedules, depending on specific scenarios. |

| Filing Deadline | The filing deadline for Schedule M-3 coincides with the due date of Form 1120, which is generally the 15th day of the 4th month after the end of the corporation's tax year. |

| Governing Law | Schedule M-3 is governed by the Internal Revenue Code (IRC) as enforced by the Internal Revenue Service (IRS), applicable to all states. |

Guide to Writing IRS Schedule M-3 1120

When preparing to complete the IRS Schedule M-3 for Form 1120, it's vital for corporations to ensure their financial transparency and compliance with tax regulations. The Schedule M-3 provides a detailed account of the differences between financial accounting and tax reporting. Individuals responsible for this task must approach it with meticulous attention to detail to accurately reflect the corporation's financial activities and status. Below are the steps necessary to fill out this form efficiently and accurately.

- Collect and review the corporation's financial statements and tax return documents to have a clear understanding of its financial activities within the tax year.

- Access the latest version of IRS Schedule M-3 for Form 1120 from the Internal Revenue Service website to ensure compliance with the current tax laws and regulations.

- Begin by entering the corporation's name and Employer Identification Number (EIN) at the top of the Schedule M-3.

- Proceed to Part I, which focuses on the reconciliation of income (loss) per accounting books with income per tax return. Enter the net income (loss) as per the income statement in line 1.

- Adjust this amount on lines 2 through 11 for differences between book and tax reporting, such as non-deductible expenses, tax-exempt interest, and other income and expenses that are treated differently for tax purposes.

- In Part II, provide an analysis of the corporation's cost of goods sold as required. This includes adjustments from financial statement amounts to tax return amounts.

- Fill out Part III if the corporation is required to report additional information regarding certain entities, transactions, and relationships. This includes transactions with foreign related parties and details about reportable transaction categories.

- Review the form carefully to ensure all necessary information has been included and correct any errors. Pay special attention to parts that require detailed explanations of the adjustments made.

- Attach Schedule M-3 to the corporation's Form 1120 and include any other required schedules or documentation as specified in the instructions for Form 1120.

- Finally, submit the completed Schedule M-3 along with Form 1120 and other necessary documents to the IRS by the filing deadline to avoid any penalties.

The completion of the IRS Schedule M-3 for Form 1120 is a critical step for corporations in detailing the differences between their book accounting and tax reporting. By following these steps diligently, corporations can ensure they meet their tax reporting obligations accurately and efficiently. This process contributes to the overall accountability and transparency that govern corporate financial practices.

Understanding IRS Schedule M-3 1120

-

What is the IRS Schedule M-3 for Form 1120?

The IRS Schedule M-3 for Form 1120 is a document that certain corporations must file in addition to their Form 1120, which is the U.S. Corporation Income Tax Return. Its purpose is to provide a more detailed reconciliation of the company's financial statement income with its taxable income as reported on Form 1120.

-

Who needs to file Schedule M-3 for Form 1120?

Corporations required to file Schedule M-3 are those with at least $10 million in total assets at the end of the tax year. This includes both domestic and foreign corporations, as well as consolidated tax return filers that meet this asset threshold.

-

What are the parts of Schedule M-3?

Schedule M-3 is divided into three parts:

Part I requires information on financial statement net income (loss).

Part II reconciles financial statement net income (loss) to the income (loss) on income tax return basis.

Part III asks for information on certain financial statement items not reported on the tax return.

-

How can I obtain Schedule M-3 for Form 1120?

Schedule M-3 can be downloaded from the Internal Revenue Service (IRS) website. You can also request a physical copy by calling the IRS or visiting a local IRS office.

-

Are there penalties for not filing Schedule M-3 if it's required?

Yes, corporations that are required to file Schedule M-3 but fail to do so may face penalties. These penalties can be for failing to file, filing late, or for filing an incomplete or inaccurate Schedule M-3. The specifics of the penalties will depend on the circumstances.

-

Can the Schedule M-3 affect my tax return?

Yes, since Schedule M-3 provides a detailed reconciliation of income, it can affect your tax return. It gives the IRS a clearer understanding of the discrepancies between book income and taxable income, which can lead to adjustments in taxable income, ultimately affecting the tax liabilities of the corporation.

-

Is there any software that can help in preparing Schedule M-3?

Yes, there are several tax preparation software packages designed for businesses that can assist in preparing Schedule M-3 along with the Form 1120. These software programs can help ensure accuracy and compliance with IRS rules and regulations, thereby simplifying the filing process.

-

Where can I find help if I have questions while filling out Schedule M-3?

If you have questions or need assistance while filling out Schedule M-3, you can seek help from a professional tax advisor, consult the IRS's official publications, or contact the IRS directly through their helpline. Additionally, numerous online resources and forums discuss various aspects of Schedule M-3, where you can find valuable insights and advice.

Common mistakes

Filling out the IRS Schedule M-3 for Form 1120 can be a daunting task even for seasoned taxpayers. It requires a deep understanding of how to reconcile financial accounting net income with tax return income. Mistakes can lead to discrepancies, triggering audits or penalties. Here are some common pitfalls to avoid:

- Failing to provide complete information on the entire form. Taxpayers often overlook parts of the Schedule M-3 that require detailed disclosures. Every section demands careful attention to ensure accurate reporting.

- Incorrectly reporting non-deductible expenses and income exempt from tax. These items must be reconciled properly to avoid misstating the company's taxable income.

- Mixing up book and tax income adjustments. The Schedule M-3 is designed to show differences between the financial accounting income and the tax return income. Confusing these adjustments can significantly skew the results.

- Not utilizing the correct lines for specific adjustments. The form has designated lines for various adjustments, and placing an item on the wrong line can cause confusion or errors in processing.

- Omitting descriptions for “Other” adjustments. Taxpayers often enter amounts in the "other" adjustment columns without providing the necessary explanation, making it difficult for the IRS to understand the nature of these adjustments.

- Overlooking the need to file Schedule M-3 Part II or III. The form consists of three parts, and depending on the situation, Parts II and III may also need to be completed. Ignoring these sections when required can result in incomplete filing.

- Underreporting or overreporting transactions between related entities. Transactions between entities that are related must be disclosed accurately to avoid misstating the economic activity.

- Misinterpreting the instructions regarding foreign operations and partnerships. Schedule M-3 requires specific information about foreign operations and partnerships, which is often reported incorrectly due to misunderstandings of the instructions.

- Not keeping adequate records. Documentation is crucial for substantiating the entries made on Schedule M-3. Inadequate records can lead to difficulties if the IRS requests further information or clarification.

Avoiding these mistakes requires a careful and informed approach to filling out the IRS Schedule M-3. It's always advisable to seek the guidance of a professional if uncertainty arises. Accurate and thorough completion of this form not only complies with tax regulations but also minimizes the risk of audits and penalties.

Documents used along the form

When businesses file their federal tax returns, particularly corporations that use the IRS Schedule M-3 (Form 1120), they often need to submit additional forms and documents. These additional pieces are crucial for providing a comprehensive view of the company's financial situation and tax obligations. Below is a brief description of eight documents commonly submitted alongside the IRS Schedule M-3 (Form 1120).

- Form 1120: The U.S. Corporation Income Tax Return is the primary form that corporations use to report their income, gains, losses, deductions, credits, and to figure out their income tax liability.

- Schedule K-1 (Form 1120): Shareholders use this form to report their share of the corporation’s income, deductions, credits, etc. It’s essential for corporations that have elected to be S corporations.

- Form 4562: Depreciation and Amortization Report is used to claim depreciation on property, amortization on assets, or to report information about the business use of cars and other listed properties.

- Form 4797: Sales of Business Property is necessary for reporting the sale or exchange of property used in the business, including sections 1231 property, and to calculate the gain or loss from the sale.

- Form 8829: Expenses for Business Use of Your Home applies to individuals who are self-employed and use part of their home for business. It helps them calculate the allowable expenses for business use of their home.

- Form 8903: Domestic Production Activities Deduction allows companies to calculate and claim a deduction for certain domestic production activities, encouraging domestic manufacturing and production within the U.S.

- Form 5471: Information Return of U.S. Persons With Respect To Certain Foreign Corporations is required for certain U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations, reporting financial activities and interests.

- Form 8938: Statement of Specified Foreign Financial Assets is necessary for reporting specified foreign financial assets if the total value exceeds the applicable reporting threshold. It's crucial for compliance with the Foreign Account Tax Compliance Act (FATCA).

These documents serve various functions, from reporting and calculating deductions to providing details on foreign financial activities. Together with the IRS Schedule M-3 (Form 1120), they enable corporations to report accurately and comply with U.S. tax laws, potentially optimizing their tax liabilities. It’s important for businesses to understand the specific requirements and how each form relates to their unique situations.

Similar forms

The IRS Schedule M-3 for Form 1120 shares similarities with the IRS Form 1065 Schedule M-3, which is used by partnerships to report their financial adjustments. Both forms serve the purpose of reconciling financial statement net income with the income reported on the tax return. They require detailed disclosures about the differences between book and tax income, ensuring that businesses accurately report their taxable income. While one is for corporations, the other caters to partnerships, but their core function of promoting financial transparency remains the same.

Similar to the IRS Schedule M-3 1120, the IRS Schedule M-1 for Form 1120 also aims to reconcile tax return income with the income reported on financial statements. However, Schedule M-1 is less detailed and is only required for corporations with less than $10 million in assets. This makes Schedule M-1 a simplified version intended for smaller corporations, focusing on the primary differences without the need for extensive detail required in Schedule M-3.

The IRS Schedule L (Form 1120) is another document that, while distinct, shares a connection with the IRS Schedule M-3 1120. Schedule L provides a snapshot of a corporation’s balance sheet, reporting assets, liabilities, and equity. While Schedule M-3 focuses on income reconciliation, Schedule L complements it by offering a clear picture of a corporation’s financial status. Together, these forms provide a comprehensive view of a company's financial health, aligning the balance sheet with income reporting requirements.

IRS Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, although serving a different primary purpose, contains sections that resemble the objectives of the IRS Schedule M-3 1120. It requires detailed financial information from U.S. shareholders of certain foreign corporations, including income and balance sheet data, similar to what is reported on Schedule M-3 for domestic corporations. This comparison highlights the IRS’s consistent approach towards ensuring full disclosure of financial details, whether the entities are domestic or foreign.

Lastly, the IRS Form 8858, Information Return of U.S. Persons With Respect To Foreign Disregarded Entities and Foreign Branches, parallels the IRS Schedule M-3 1120 in its requirement for detailed financial information reporting. Form 8858 is focused on U.S. persons who own foreign disregarded entities or operate foreign branches, demanding a thorough account of their operations and finances similar to the detailed reconciliation of book and tax income on Schedule M-3. Both forms are instrumental in the IRS's efforts to prevent tax evasion and ensure transparency in financial reporting across borders.

Dos and Don'ts

When filling out the IRS Schedule M-3 for Form 1120, accuracy and thoroughness are crucial. This form is used by corporations to report both their financial statement net income and taxable income. Below are essential do's and don'ts to consider:

Do:- Ensure that all the information aligns with the records in your financial statements. Discrepancies could raise red flags with the IRS.

- Utilize the instructions provided by the IRS for Schedule M-3 to understand the requirements for each part of the form. This will help in providing accurate and comprehensive details.

- Report any transaction between the corporation and its shareholders or other related entities accurately. These transactions are often closely scrutinized.

- Consider consulting with a tax professional or accountant. Navigating complex IRS forms can be challenging, and professional advice can be invaluable.

- Double-check the calculations. Errors in arithmetic or transferring amounts can lead to incorrect tax liability assessments.

- Leave any fields that apply to your company blank. If a specific line does not apply, enter -0-, not just a blank space, to indicate that the line was reviewed but not applicable.

- Ignore the additional schedules and attachments that may be required. The information on Schedule M-3 might necessitate further details that need to be provided on other forms.

- Rush through filling out the form. This can lead to mistakes or omissions that could be interpreted as negligence by the IRS.

- Forget to keep a copy of the completed Schedule M-3 and any supporting documents. These could be crucial if your return is selected for a review or audit.

- Use outdated versions of the form. Tax laws and requirements can change from year to year, so it’s important to use the current form for the tax year you’re filing.

Misconceptions

The IRS Schedule M-3 for Form 1120 is a document that corporations use to reconcile their financial statement income with their taxable income. Despite its importance, several misconceptions surround its use and requirements. Let's address some of these misunderstandings.

It's only for large corporations. While it's true that Schedule M-3 is mandatory for corporations with $10 million or more in assets, smaller corporations can also file it voluntarily. This can be a strategic move to provide clearer tax information to the IRS, possibly reducing the risk of an audit.

It replaces Schedule M-1. This is a misunderstanding. Schedule M-3 provides a more detailed reconciliation of income than Schedule M-1, but it doesn't replace it. Smaller corporations not required to file Schedule M-3 will still use Schedule M-1.

Filing it automatically triggers an audit. There's a fear that the detailed reporting required by Schedule M-3 increases audit risks. However, transparency can actually reduce the chances of an audit by clarifying discrepancies between book and taxable income, addressing potential issues proactively.

Only CPAs can prepare it. While it's wise to consult with a CPA or a tax professional when preparing complex tax documents, technically, anyone with a thorough understanding of the corporation's finances and tax law can prepare it. Ensuring accuracy is key, though, due to its complexity.

It's just a more detailed version of the tax return. Schedule M-3 is not a standalone document; it's part of the tax return that requires specific financial details to reconcile book and taxable income. This goes beyond simply providing more details; it requires understanding and applying complex tax regulations.

All parts of Schedule M-3 must be completed. Not all parts of Schedule M-3 are required for every corporation. The form itself and IRS instructions specify which parts need to be filled out based on certain conditions and thresholds.

Schedule M-3's sole purpose is to increase tax. The purpose of Schedule M-3 is not to increase tax liabilities but to provide clarity and transparency in the reconciliation process between book income and taxable income. This can sometimes lead to a lower tax liability if handled correctly.

There are no penalties for incorrect filings. Incorrect or incomplete filings of Schedule M-3 can lead to penalties, just like with other tax forms. Accuracy and thoroughness are critical to avoid potential issues with the IRS.

Once you start filing Schedule M-3, you must always file it. This isn't necessarily true. If a corporation no longer meets the criteria that require filing Schedule M-3 (like having assets under $10 million), they may not need to file it. However, transitions between forms should be handled carefully, with attention to IRS regulations and potential implications.

Understanding the specifics of IRS Schedule M-3 for Form 1120 is crucial for corporate taxpayers. Dispelling these misconceptions can lead to better compliance and potentially smoother interactions with taxation authorities.

Key takeaways

Understanding the IRS Schedule M-3 for Form 1120 can seem daunting, but it's an essential document for certain corporations. This form helps the IRS gain a clearer view of a company's financial situation, especially when there are differences between financial accounting and tax reporting. Here are some key takeaways to ensure you fill out and use the Schedule M-3 effectively:

- The Schedule M-3 is meant for corporations that report total assets at the end of the tax year equal to or exceeding $10 million on Form 1120, U.S. Corporation Income Tax Return.

- Its primary purpose is to reconcile financial accounting income with taxable income reported to the IRS. It ensures transparency in how taxable income is calculated from book income.

- Corporations required to file Schedule M-3 must provide detailed information about the adjustments made between book income and taxable income. This includes both income and expense adjustments.

- Filing the Schedule M-3 is a part of the Form 1120 submission package. It should be prepared in conjunction with the corporate tax return to maintain consistency of information.

- The form is divided into three parts: Part I deals with net income (loss) reconciliation from financial statement income to income per the income tax return. Part II focuses on the reconciliation of liabilities, and Part III is about analyzing the relationships between financial statement and tax return information.

- Understanding the specific instructions for each line item on the Schedule M-3 is crucial. Incorrect entries can lead to misunderstandings about the corporation's financial and tax positions and potentially trigger an audit.

- Record-keeping is vital when using Schedule M-3. Corporations should maintain detailed documentation to support all adjustments made between book income and taxable income to facilitate explanations if queried by the IRS.

- Consider seeking professional assistance when preparing Schedule M-3 for the first time or if your corporation undergoes significant changes in its financial structure. Tax professionals are well-versed in IRS requirements and can provide guidance to ensure compliance and minimize errors.

Filing the IRS Schedule M-3 1120 form is a critical task that contributes to a corporation's compliance with IRS regulations. By meticulously preparing and understanding the relevance of each piece of information required, corporations can effectively communicate their financial and tax positions, reflecting the transparency and integrity of their business practices.

Popular PDF Documents

8655 Form - The form represents a formal agreement for the sharing of tax-related information with approved external parties.

Broward Tax Collector Plantation - Facilitates compliance with Florida Statutes for businesses operating under a Fictitious Name by requiring State Registration documents.

How to Get Power of Attorney in Tennessee - The Tax POA RV-F0103801 form allows individuals to grant authority to someone else to handle their tax matters.