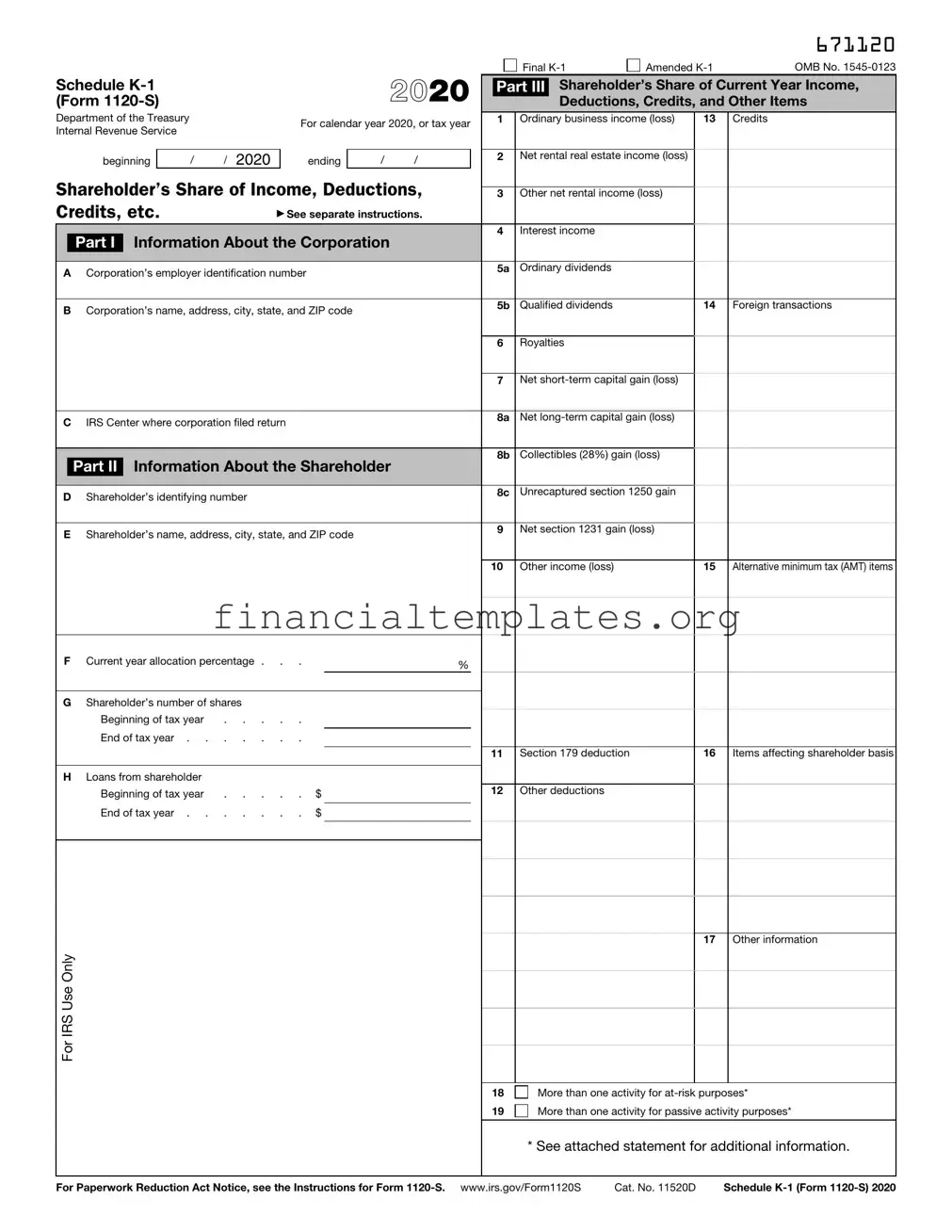

Get IRS Schedule K-1 1120-S Form

Navigating the complexities of tax forms can often feel like a daunting task, especially when it comes to ensuring compliance and maximizing benefits for small businesses and shareholders. Among the myriad of forms the IRS requires, the Schedule K-1 (Form 1120-S) stands out for its critical role in the tax reporting process for S corporations. This form is a vehicle through which S corporations pass along their income, deductions, and credits to their shareholders. Each shareholder receives a Schedule K-1 that details their share of the corporation's financial activity, which must then be reported on their individual tax returns. The significance of this form lies in its ability to provide a transparent mechanism for reporting each shareholder's earnings and losses, thereby avoiding double taxation—once at the corporate level and again on the individual's return. Understanding the key aspects of this form is imperative for shareholders and the corporation itself to ensure accuracy in reporting and to take advantage of potential tax benefits, all while remaining compliant with IRS regulations.

IRS Schedule K-1 1120-S Example

Schedule |

|

|

|

|

2021 |

|

(Form |

|

|

|

|

||

Department of the Treasury |

|

|

For calendar year 2021, or tax year |

|||

Internal Revenue Service |

|

|

||||

|

|

|

|

|

||

|

|

|

|

|

|

|

beginning |

|

/ |

/ 2021 |

ending |

/ |

/ |

Shareholder’s Share of Income, Deductions, Credits, etc.

Part I Information About the Corporation

ACorporation’s employer identification number

BCorporation’s name, address, city, state, and ZIP code

CIRS Center where corporation filed return

DCorporation’s total number of shares

Beginning of tax year . . . . .

End of tax year . . . . . . .

Part II Information About the Shareholder

EShareholder’s identifying number

FShareholder’s name, address, city, state, and ZIP code

G Current year allocation percentage . . . |

% |

|

HShareholder’s number of shares

Beginning of tax year |

. . . . . |

|

|

|

End of tax year |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

I Loans from shareholder |

|

|

|

|

Beginning of tax year |

. . . . . |

$ |

|

|

End of tax year . . |

. . . . . |

$ |

|

|

|

|

|||

|

|

|

|

|

For IRS Use Only

|

|

671121 |

Final |

Amended |

OMB No. |

Part III Shareholder’s Share of Current Year Income,

Deductions, Credits, and Other Items

1 Ordinary business income (loss) |

13 Credits |

2Net rental real estate income (loss)

3Other net rental income (loss)

4Interest income

5a |

Ordinary dividends |

|

|

5b |

Qualified dividends |

14 |

Schedule |

|

|

|

checked . . . . ▶ |

6 |

Royalties |

15 |

Alternative minimum tax (AMT) items |

7Net

8a |

Net |

|

8b |

Collectibles (28%) gain (loss) |

|

|

||

8c |

Unrecaptured section 1250 gain |

|

|

||

9 |

Net section 1231 gain (loss) |

16 Items affecting shareholder basis |

10Other income (loss)

17 Other information

11Section 179 deduction

12Other deductions

18 More than one activity for

19 More than one activity for passive activity purposes*

* See attached statement for additional information.

For Paperwork Reduction Act Notice, see the Instructions for Form |

Cat. No. 11520D |

Schedule |

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS Schedule K-1 (1120-S) form is used by shareholders of an S corporation to report their share of the corporation's income, deductions, credits, etc., on their personal tax returns. |

| 2 | Schedule K-1 (1120-S) forms are essential for S corporations, as they allow income and losses to be passed through to shareholders, who then report this information on their individual tax returns. |

| 3 | The form helps ensure that all income from the S corporation is accounted for and taxed only once, directly on the shareholders' personal tax returns, avoiding double taxation. |

| 4 | Each shareholder's tax liability from the S corporation is determined based on their share percentage of ownership or stock in the corporation. |

| 5 | Schedule K-1 (1120-S) must be filed with the IRS along with the S corporation's 1120-S tax return. |

| 6 | Shareholders use the information provided on Schedule K-1 (1120-S) to complete Schedule E (Form 1040), Supplemental Income and Loss. |

| 7 | It is crucial for shareholders to receive their Schedule K-1 forms in a timely manner to meet their own tax filing deadlines and obligations. |

| 8 | The form details the type of income, such as ordinary business income, real estate income, dividends, royalties, and capital gains, that shareholders need to report. |

| 9 | If applicable, the Schedule K-1 (1120-S) form may also report deductions and credits that pass through to shareholders, affecting their overall tax liability. |

| 10 | While the IRS requires the Schedule K-1 (1120-S) form for federal tax purposes, state-specific requirements and forms may vary, depending on the state's governing laws. |

Guide to Writing IRS Schedule K-1 1120-S

Filling out the IRS Schedule K-1 1120-S form is necessary for reporting an individual shareholder's share of income, deductions, credits, etc., from a corporation that operates as an S corporation. It might seem daunting at first, but breaking it down into steps can make the process clearer and more manageable. Once you've gathered the necessary information about the corporation's earnings, deductions, and the shareholder's personal details, you're ready to start.

- Locate and download the most recent version of the IRS Schedule K-1 (1120-S) form from the official IRS website to ensure you're using the correct document.

- Begin by filling out the top section of the form, where you need to provide the S corporation's name, Employer Identification Number (EIN), address, and the state of incorporation.

- Proceed to fill in the shareholder's information, including their name, address, and tax identification number, which could be a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Enter the shareholder's stock percentage owned at the beginning and end of the tax year in the designated fields. This information determines the shareholder's portion of the corporation's income and losses.

- Fill out the income section of the form with the shareholder's share of the corporation's ordinary business income (or loss). This figure should be derived from the corporation's total earnings, as proportionate to the shareholder's percentage of ownership.

- Report any other income, deductions, and credits applicable to the shareholder based on their share of the S corporation's operations. This could include real estate income, dividend income, royalties, and more, each designated in its specific line on the form.

- If the shareholder has received any distributions from the corporation, these should be noted in the appropriate section. These are typically cash or property distributions.

- Review all information for accuracy to ensure all required sections are correctly filled out and reflect the shareholder's share of the S corporation's financial activities accurately. Mistakes can lead to processing delays or inquiries from the IRS.

- Sign and date the form if required. Check the form's instructions to see if a signature is needed. Generally, an authorized officer of the corporation signs the form.

- Submit the completed Schedule K-1 (1120-S) to the IRS along with the S corporation's 1120-S tax return. Provide a copy to the shareholder for their records and use in completing their individual tax return.

Successfully completing and submitting IRS Schedule K-1 (1120-S) is a crucial step in ensuring compliance with IRS regulations and properly reporting income, deductions, and credits related to an S corporation's activities. By carefully following each step, you help safeguard against potential errors and ensure both the corporation and its shareholders meet their tax reporting obligations effectively.

Understanding IRS Schedule K-1 1120-S

-

What is an IRS Schedule K-1 (1120-S) form?

The IRS Schedule K-1 (1120-S) form is a document used by S corporations to report each shareholder's share of the corporation's income, deductions, credits, etc. It serves to inform shareholders about their share of the business's financial activity, which they must report on their individual tax returns. Unlike a traditional corporation (C corp), an S corporation's income is passed through to its shareholders, and taxes are paid at the individual level.

-

Who needs to file an IRS Schedule K-1 (1120-S) form?

S corporations are required to file the Schedule K-1 (1120-S) and provide a copy to each shareholder. It's essential for shareholders as they use this form to fill out parts of their own tax returns. This information helps them report their share of profit, loss, and other financial activities from the S corporation.

-

What information is included on the Schedule K-1 (1120-S) form?

The Schedule K-1 (1120-S) form includes various pieces of financial information, notably:

- The shareholder's pro-rata share of the corporation's income or loss

- Dividends and special deductions

- Information on credits and deductions

- Details of the shareholder's stock and debt in the corporation

This information is vital for accurately reporting taxes and understanding the financial standing in relation to the S corporation.

-

When is the Schedule K-1 (1120-S) form due?

The IRS Schedule K-1 (1120-S) form is due to the IRS and to the shareholders by the 15th day of the 3rd month following the end of the corporation's tax year. For corporations that follow a calendar year, this means the forms should be sent by March 15th. If this date falls on a weekend or holiday, the deadline is the next business day.

-

What happens if a shareholder receives their Schedule K-1 (1120-S) form late?

Receiving a Schedule K-1 (1120-S) form late can delay a shareholder's ability to file their personal tax return. However, shareholders should still file their tax returns by the deadline, even if they estimate their share of the corporation's income and deductions. Once they receive the actual Schedule K-1, they may need to amend their tax return if there are discrepancies between their estimates and the actual figures. It's advisable to consult with a tax professional in these situations to ensure compliance and to understand the potential implications of filing an amended return.

Common mistakes

Filling out IRS Schedule K-1 (1120-S) is a critical task for shareholders of an S corporation. Mistakes made during this process can lead to delays, audits, and penalties. Below, we've compiled a list of common mistakes to avoid to ensure the form is completed accurately and efficiently.

Incorrect Shareholder Information: Failing to provide accurate and current information for each shareholder, such as names, addresses, and Social Security numbers or Tax Identification numbers. This information is vital for the IRS to identify and contact shareholders regarding the S corporation's tax filings.

Incorrect Allocation of Income, Deductions, and Credits: Not accurately reporting each shareholder's pro rata share of the corporation's items. These include income, losses, deductions, and credits based on their ownership percentage. Accurate allocation is essential for proper tax treatment.

Omitting State Tax Information: Overlooking to report relevant state income, adjustments, and taxes if the S corporation operates in states that require state tax information on Schedule K-1. Different states may have unique filing requirements that need to be adhered to.

Not Reporting Foreign Transactions: Neglecting to disclose foreign transactions, including income from foreign operations or transactions with foreign partners. This oversight can lead to significant penalties under U.S. tax law which requires reporting of international dealings.

Failing to Accurately Report Capital Accounts: Incorrectly reporting a shareholder’s capital account can lead to miscalculations in their income or loss allocations. It’s critical to accurately track contributions, distributions, and share of profits or losses.

Mismatching IRS Records: Making errors that result in information on Schedule K-1 not matching the corporation’s 1120-S form or the shareholders’ individual returns. Consistency across all documents submitted to the IRS is imperative to avoid unnecessary scrutiny.

Late Filing: Missing the filing deadline can result in penalties and interest charges. It’s important to note the deadlines and either file on time or request an extension if more time is needed to prepare accurate and complete documents.

Avoiding these common mistakes can help ensure that Schedule K-1 (1120-S) submissions are accurate and compliant with IRS requirements, thus minimizing the risk of errors and potential penalties.

Documents used along the form

When dealing with taxes, especially in contexts involving S corporations, understanding the complementary documents that accompany the IRS Schedule K-1 1120-S form can significantly streamline the process and ensure compliance. The Schedule K-1 form itself is a critical component used by S corporations to report each shareholder's proportionate share of net income, deductions, and credits. However, several other forms often go hand in hand with Schedule K-1, enhancing the detail and clarity of an individual's tax situation. Let's explore a few of these documents to better understand their roles.

- Form 1120S: This is the U.S. Income Tax Return for an S Corporation form. It is foundational, as it reports the income, gains, losses, deductions, credits, etc., of the S corporation. The data from Form 1120S are used to fill out the Schedule K-1s for the shareholders, making it a prerequisite document for understanding the allocations reported on the K-1.

- Form 1040: The U.S. Individual Income Tax Return form is where individual taxpayers report their annual income, expenses, and credits to the IRS. Shareholders in an S corporation must report the income and deductions from Schedule K-1 on their personal Form 1040. This ensures the flow-through taxation principle of S corporations is upheld, with income taxed at the individual level rather than the corporate level.

- Form 4562: Depreciation and Amortization (Including Information on Listed Properties) form is used to report the depreciation and amortization of property. Shareholders of an S corporation who have such deductions passed through to them will often need this form to accurately report these aspects on their personal tax returns, in conjunction with the information received on their Schedule K-1.

- Form 8825: Rental Real Estate Income and Expenses of a Partnership or an S Corporation is used if the S corporation has rental income. This form is akin to the Schedule E form used for individual taxpayers but is specifically designed for pass-through entities. It documents income, expenses, and depreciation of rental real estate activity, which then affects the shareholder's income reported on Schedule K-1.

In the complex landscape of tax preparation and compliance, understanding each document's role and how they interconnect is vital for shareholders and S corporations. From the overarching view provided by Form 1120S to the specific deductions detailed in Form 4562, each form plays a part in painting the complete financial picture for tax purposes. By familiarizing oneself with these documents, individuals can navigate their tax responsibilities more confidently and accurately.

Similar forms

The IRS Schedule K-1 (Form 1065) serves a purpose akin to the IRS Schedule K-1 1120-S form, but it is specifically used by partnerships. Both documents are essential for reporting each partner's share of the business's income, deductions, credits, etc. While the Schedule K-1 1120-S is for S corporations, providing the shareholders with necessary information for their tax returns, the Form 1065 variant does the same for partners in a partnership. This ensures that all income is reported accurately by each individual on their personal tax returns.

Form 1041 (Schedule K-1) is another document that shares similarities with the IRS Schedule K-1 1120-S form, with its primary use being for estates and trusts. This version of Schedule K-1 conveys the beneficiary's share of the estate or trust's income, deductions, and credits. Even though the entities differ—trusts and estates versus S corporations—the underlying purpose remains consistent: to provide beneficiaries or shareholders with the specific financial information needed for their personal tax filings.

The IRS Form 1120 is akin to the Schedule K-1 1120-S in that it is used by corporations to report their income, gains, losses, deductions, credits, and to figure out their income tax liability. However, Form 1120 is used by C corporations, which are taxed separately from their owners, contrasting with S corporations that pass through their income to shareholders. This distinction highlights how both forms serve to ensure that businesses report their income accurately, albeit under different taxation frameworks.

Form 1099-DIV, Dividends and Distributions, shares a common goal with the IRS Schedule K-1 1120-S form: reporting income. While Schedule K-1 1120-S is for shareholders of an S corporation to report profit, losses, and dividends on their personal tax returns, Form 1099-DIV applies to investors receiving dividends from stocks or mutual funds. The similarity lies in their purpose to inform the recipient about income that must be reported on their tax return, ensuring proper taxation of income from different sources.

Form 8865 (Schedule K-1) also parallels the IRS Schedule K-1 1120-S, yet it specifically caters to U.S. persons who are partners in foreign partnerships. Like its domestic counterparts, this form reports the partner's share of income, deductions, and credits from the foreign partnership. The information provided helps U.S. taxpayers to accurately report foreign income on their tax returns, thereby fulfilling similar reporting obligations as those with domestic partnerships and S corporations to prevent underreporting of income and tax evasion.

The W-2 form, though used for different purposes, shares an essential reporting function similar to the IRS Schedule K-1 1120-S form. The W-2 is given to employees to report wages, tips, and other compensation received, along with taxes withheld during the year. While the W-2 is employment-related and Schedule K-1 1120-S pertains to investment in S corporations, both are crucial for individuals to accurately report income and taxes paid to the IRS on their personal tax returns.

Finally, the Schedule D (Form 1040) is used by taxpayers to report capital gains and losses from the sale or exchange of capital assets. Similar to the IRS Schedule K-1 1120-S, the primary connection is the reporting of financial transactions that affect an individual's tax obligations. Although Schedule D deals specifically with capital assets and Schedule K-1 1120-S deals with income from S corporations, both forms contribute essential details that influence an individual's total tax liability, demonstrating the broader ecosystem of tax documentation aimed at capturing all sources of income.

Dos and Don'ts

The IRS Schedule K-1 (1120-S) form is a document used by shareholders of an S corporation to report their share of the corporation's income, deductions, credits, etc. Properly filling out this form is crucial for accurate tax reporting. Below are 10 do's and don'ts to keep in mind.

Do's

-

Ensure all information is accurate before submitting the form to avoid any discrepancies.

-

Report all income, deductions, and credits proportionate to your share in the S corporation.

-

Double-check the corporation's Employer Identification Number (EIN) and your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

-

Use the correct tax year's form to ensure compliance with current tax laws and rates.

-

Keep a copy of the completed Schedule K-1 (1120-S) for your personal records.

Don'ts

-

Don't estimate or guess amounts. Use actual figures from the corporation's financial documents.

-

Don't leave any required fields blank. If a section does not apply, enter "0" or "N/A" .

-

Don't use pencil or erasable ink pen when filling out the form to prevent alterations.

-

Don't forget to sign and date the form if required. An unsigned form can lead to processing delays.

-

Don't file the Schedule K-1 (1120-S) with your personal tax return. It's for informational purposes and should be used to complete your return.

Misconceptions

When it comes to understanding tax forms, particularly the IRS Schedule K-1 (1120-S) associated with S corporations, several misconceptions can lead taxpayers astray. It's essential to dispel these myths to ensure compliance and optimize tax outcomes. Here are nine common misunderstandings about the Schedule K-1 (1120-S) form:

- It's only for large corporations. The Schedule K-1 (1120-S) is actually a form used by S corporations regardless of their size. Even small businesses formed as S corporations must use this form to report each shareholder's share of the corporation's income, deductions, and credits.

- Income reported is immediately taxable. While the income reported on Schedule K-1 (1120-S) does affect the shareholder's personal income tax, it’s not always immediately taxable. The characterization of income, whether it's active or passive, can influence how it's taxed.

- Shareholders can't take losses beyond their investment. In fact, shareholders can sometimes take losses beyond their initial investment, subject to certain limitations like basis and at-risk rules. These losses may be carried forward to offset future profits.

- Schedule K-1 (1120-S) is filed with the shareholder’s personal tax returns. Although the information on K-1 impacts the shareholder's personal income taxes, the form itself is not filed with their personal tax return. Instead, it’s the responsibility of the S corporation to file it and furnish copies to each shareholder, who then use the information to complete their individual returns.

- The form is only about income. Besides income, the Schedule K-1 (1120-S) also reports deductions, credits, and the shareholder's share of corporate debt, which can affect tax liability and investment decisions.

- It's due when individual tax returns are due. The due date for the S corporation to file Schedule K-1 (1120-S) forms is the same as the S corporation tax return due date, generally the 15th day of the third month following the end of the corporation's fiscal year, not the individual tax return due date in April.

- If no income, no need to file. Even if the S corporation does not generate income, it still must file the Schedule K-1 (1120-S) forms to report this to shareholders and the IRS. All financial activity, regardless of its profitability, needs to be reported.

- All shareholders receive identical K-1 forms. Each shareholder's K-1 form can differ based on their share of stock, period of ownership during the fiscal year, and any additional agreements that affect how profits and losses are allocated.

- Errors on the K-1 are the corporation’s problem. While the corporation is responsible for issuing K-1 forms, shareholders need to review their own forms for accuracy. Mistakes can impact their personal tax liabilities, so it's crucial for shareholders to report any discrepancies to the corporation for correction.

Understanding these intricacies of the IRS Schedule K-1 (1120-S) is crucial for shareholders and businesses alike to navigate the complexities of tax reporting accurately and effectively.

Key takeaways

Filling out the IRS Schedule K-1 1120-S form is a crucial step for shareholders of an S corporation. It details each shareholder’s share of income, deductions, and credits. Given its importance, here are six key takeaways to ensure accuracy and compliance:

- Accuracy is crucial: When completing the Schedule K-1 1120-S, it's vital to provide accurate information. This form directly impacts each shareholder's income tax return, influencing their tax obligations.

- Understand the deadlines: The IRS requires S corporations to file the Schedule K-1 1120-S form by March 15, following the end of the tax year. If the 15th falls on a weekend or holiday, the deadline will be the next business day. It's imperative to adhere to these deadlines to avoid penalties.

- Each shareholder needs one: Every shareholder should receive their Schedule K-1 1120-S form. Even if a shareholder is no longer with the corporation by the year's end, they're still entitled to a K-1 for the part of the year they were a shareholder.

- Be prepared for state implications: While the Schedule K-1 1120-S is a federal form, it's important to remember that many states require their version or have additional reporting requirements. Shareholders must use their K-1 to comply with state income tax filings as well.

- Documentation is key: Keep detailed records and documentation to support the information provided on the Schedule K-1 1120-S. This can include earnings reports, dividend receipts, and expense records. These documents are essential in the event of an IRS audit.

- Professional advice can help: Given the complexity of tax laws and the potential for significant impact on personal taxes, seeking advice from a tax professional or accountant is wise. They can provide guidance tailored to the specific situation, ensuring compliance and optimizing tax outcomes.

By keeping these key takeaways in mind, shareholders and S corporations can navigate the Schedule K-1 1120-S form more confidently and effectively, ensuring compliance and potentially optimizing their tax situation.

Popular PDF Documents

Wisconsin Department of Revenue Forms - Users must complete specific sections to outline the authority levels and limitations on the representative’s actions.

Philadelphia Wage Tax Refund - Use this document to claim a refund if you are a non-salaried employee who believes wage tax was overwithheld in 2017.

Senior Property Tax Exemption - Applicants must describe the religious activities conducted on the property.