Get IRS Schedule K-1 1065 Form

The intricacies of tax filing for partnerships in the United States demand a meticulous approach, particularly when it comes to ensuring that profits, losses, and other financial activities are accurately reported. At the heart of this process lies the IRS Schedule K-1 (Form 1065), a crucial document designed to detail the share of income, deductions, credits, etc., that each partner in a partnership must report on their individual tax returns. This form plays a pivotal role not only in maintaining transparency between the partnership and the IRS but also in facilitating an accurate assessment of tax liabilities for each partner based on their proportional share of the partnership's finances. Understanding the importance of this form, its components, and how it fits into the larger picture of partnership taxation can significantly streamline the tax filing process, ensuring compliance and preventing common pitfalls that may arise from inaccuracies or omission of vital information.

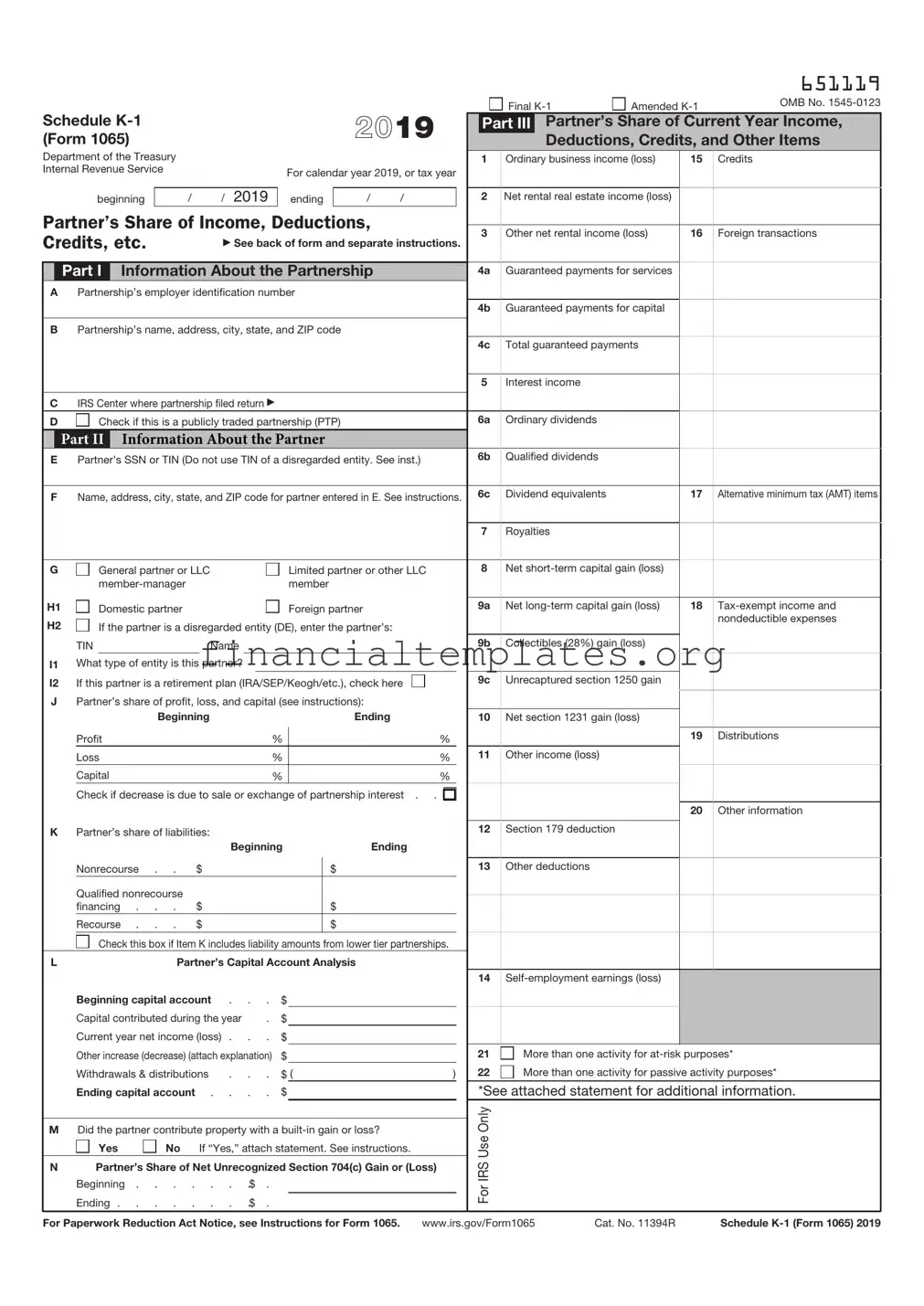

IRS Schedule K-1 1065 Example

Schedule |

|

|

|

2020 |

||

(Form 1065) |

|

|

|

|||

Department of the Treasury |

|

|

|

|

|

|

Internal Revenue Service |

|

|

For calendar year 2020, or tax year |

|||

|

|

|

|

|||

|

|

|

ending |

|

|

|

beginning |

|

/ |

/ 2020 |

/ |

/ |

|

Partner’s Share of Income, Deductions, Credits, etc.

Part I Information About the Partnership

APartnership’s employer identification number

BPartnership’s name, address, city, state, and ZIP code

CIRS Center where partnership filed return ▶

D |

Check if this is a publicly traded partnership (PTP) |

Part II Information About the Partner

EPartner’s SSN or TIN (Do not use TIN of a disregarded entity. See instructions.)

FName, address, city, state, and ZIP code for partner entered in E. See instructions.

G |

General partner or LLC |

Limited partner or other LLC |

|

member |

|

H1 |

Domestic partner |

Foreign partner |

H2 |

If the partner is a disregarded entity (DE), enter the partner’s: |

|

|

TIN |

|

Name |

|

|

I1 |

What type of entity is this partner? |

|

|||

I2 |

If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here |

||||

JPartner’s share of profit, loss, and capital (see instructions):

Beginning |

|

Ending |

|

Profit |

% |

|

% |

|

|||

Loss |

% |

|

% |

Capital |

% |

|

% |

Check if decrease is due to sale or exchange of partnership interest . . |

|

||

KPartner’s share of liabilities:

|

|

|

Beginning |

Ending |

|

|||

|

Nonrecourse . . |

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

||

|

Qualified nonrecourse |

|

|

|

|

|

|

|

|

financing . . . |

$ |

|

|

|

$ |

|

|

|

Recourse . . . |

$ |

|

|

|

$ |

|

|

|

Check this box if Item K includes liability amounts from lower tier partnerships. |

|

||||||

L |

Partner’s Capital Account Analysis |

|

|

|||||

|

Beginning capital account . . . |

$ |

|

|

|

|

||

|

Capital contributed during the year . . |

$ |

|

|

|

|

||

|

Current year net income (loss) . . . |

$ |

|

|

|

|

||

|

Other increase (decrease) (attach explanation) |

$ |

|

|

|

|

||

|

Withdrawals & distributions |

. . . |

$ ( |

|

) |

|

||

|

Ending capital account . . . . |

$ |

|

|

|

|

||

MDid the partner contribute property with a

Yes |

No If “Yes,” attach statement. See instructions. |

NPartner’s Share of Net Unrecognized Section 704(c) Gain or (Loss) Beginning . . . . . . . . $

Ending . . . . . . . . . $

651119

Final |

Amended |

OMB No. |

||

|

||||

Part III |

Partner’s Share of Current Year Income, |

|||

|

Deductions, Credits, and Other Items |

|||

1 Ordinary business income (loss) |

15 Credits |

|

||

2Net rental real estate income (loss)

3 |

Other net rental income (loss) |

16 Foreign transactions |

4a |

Guaranteed payments for services |

|

|

||

4b |

Guaranteed payments for capital |

|

|

||

4c |

Total guaranteed payments |

|

|

5Interest income

6a |

Ordinary dividends |

|

6b |

Qualified dividends |

|

|

||

6c |

Dividend equivalents |

17 Alternative minimum tax (AMT) items |

7Royalties

8Net

9a |

Net |

18 |

|

|

|

|

nondeductible expenses |

9b |

Collectibles (28%) gain (loss) |

|

|

9c |

Unrecaptured section 1250 gain |

|

|

|

|

||

10 |

Net section 1231 gain (loss) |

|

|

|

|

||

|

|

|

|

|

|

19 |

Distributions |

11Other income (loss)

20 Other information

12Section 179 deduction

13Other deductions

14

21 More than one activity for

22 More than one activity for passive activity purposes*

*See attached statement for additional information.

For IRS Use Only

For Paperwork Reduction Act Notice, see Instructions for Form 1065. |

www.irs.gov/Form1065 |

Cat. No. 11394R |

Schedule |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form | The IRS Schedule K-1 1065 form is used to report the income, deductions, and credits of partners in a partnership. |

| Filing Requirement | This form must be filed with the IRS as part of the partnership's tax return (Form 1065) and issued to each partner for their individual tax filings. |

| Who Needs to File | Any partnership operating in the United States that generates income, gains, losses, deductions, or credits. |

| Sections of the Form | The form includes sections for the partnership's information, the partner's share of current year income, deductions, credits, etc. |

| Timing for Filing | The form is typically due on the same date as the partnership tax return, usually March 15 for calendar year partnerships. |

| Implications of Late Filing | Late filing can result in penalties for the partnership and inaccuracies in the individual tax filings of partners. |

| State-specific Versions | Some states require a state-specific version of Schedule K-1 for state tax filing purposes, governed by the respective state tax laws. |

| Utilization in Personal Tax Returns | Partners must use the information on Schedule K-1 to complete their own tax returns, affecting their taxable income and tax liability. |

Guide to Writing IRS Schedule K-1 1065

Filling out the IRS Schedule K-1 (Form 1065) is essential for partners in a partnership or members of an LLC taxed as a partnership. This document is used to report each partner's share of the partnership's income, deductions, credits, etc. It is important for partners to accurately complete and file this form to ensure correct reporting of their income tax obligations. The process involves gathering financial information about the partnership and allocating the income or loss according to the partnership agreement.

- Gather all necessary documents, including the partnership's income statement, balance sheet, and any other relevant financial documents.

- Identify the partnership's total income, deductions, and credits for the year. This information is typically found in the partnership's tax return, Form 1065.

- Review the partnership agreement to understand how income, losses, deductions, and credits are allocated among partners.

- Fill in the basic information about the partnership at the top of Schedule K-1 (Form 1065), including the partnership's name, address, and Employer Identification Number (EIN).

- Enter the partner's information in the designated area on the form, including the partner's name, address, and tax identification number (SSN, ITIN, or EIN).

- Allocate the partnership's income, deductions, credits, and other items to the partners according to the terms of the partnership agreement. Enter these amounts in the respective sections of Schedule K-1.

- Complete any applicable items in Sections L, M, and N, which include the partner's capital account analysis, partner's share of liabilities, and other information based on the partnership's and partner's circumstances.

- Review the completed Schedule K-1 forms for accuracy. Make any necessary adjustments to ensure that all information is correct and complies with the tax laws and regulations.

- Distribute a copy of the completed Schedule K-1 (Form 1065) to each partner by the tax filing deadline, and retain a copy for the partnership's records.

- File the partnership's tax return, including all completed Schedule K-1 forms, with the IRS by the filing deadline.

Accurately completing and filing Schedule K-1 (Form 1065) is critical for both the partnership and the individual partners. It ensures that each partner pays the correct amount of tax on their share of the partnership's income. Partners should also use the information from Schedule K-1 to complete their own individual tax returns, ensuring they report their income and pay their taxes accurately. If a partner is unsure about any aspect of completing Schedule K-1, consulting a tax professional is advisable.

Understanding IRS Schedule K-1 1065

-

What is the IRS Schedule K-1 1065 form?

The IRS Schedule K-1 1065 form is a document used by partnerships to report each partner's share of the partnership's earnings, losses, deductions, and credits. It serves as a way for partners to understand how the partnership's business activities affect their individual tax situations.

-

Who needs to file the IRS Schedule K-1 1065 form?

Any partnership that operates in the United States and earns income, incurs losses, or participates in certain transactions must file a Form 1065. From this, the Schedule K-1 1065 forms are prepared—one for each partner—detailing their share of the partnership’s financial activity.

-

When is the IRS Schedule K-1 1065 form due?

The Schedule K-1 1065 form, as part of the Form 1065, is generally due on the 15th day of the third month following the end of the partnership's tax year. For most partnerships operating on a calendar year, this due date falls on March 15th. If this date falls on a weekend or holiday, the deadline is moved to the next business day.

-

What information is included on the Schedule K-1 1065 form?

This form includes detailed information about the partner's share of the partnership's income, losses, capital gains, deductions, and credits. It also reports on distributions, foreign transactions, tax-exempt income, and non-deductible expenses. This information helps partners figure out their tax liability and filing requirements.

-

How does the IRS Schedule K-1 1065 affect my taxes?

Information from the Schedule K-1 1065 form directly impacts your personal tax filings. It must be reported on your tax return, affecting your taxable income, tax credits, and deductions. Because of this, it's essential to include the schedules accurately to calculate your tax liability correctly.

-

Can I file my Schedule K-1 1065 form electronically?

Yes, the IRS does allow for electronic filing of the Schedule K-1 1065 form as part of the e-filing process for Form 1065. Electronic filing is encouraged as it is faster and tends to be more secure than paper filing.

-

What should I do if I receive my Schedule K-1 1065 form late?

If you receive your Schedule K-1 1065 form after the deadline for your personal tax return, you may need to file an amended tax return to accurately report this information. It's important to communicate with the partnership for a timeline on when to expect the K-1 to avoid penalties and to keep your financial records up to date.

Common mistakes

Filling out IRS forms can be daunting, especially when it's the Schedule K-1 (Form 1065) that partners use to report their share of a partnership's income, deductions, credits, etc. Mistakes are common, but awareness is the first step towards avoidance. Let's explore five common errors people often make with this form:

Not Reporting All Income: A frequent oversight occurs when individuals do not report all types of income. Schedule K-1 is thorough, covering various income types from real estate to dividends. Missing any can lead to discrepancies and potentially trigger an audit.

Mixing Up Business and Personal Expenses: It’s easy to blur the lines between personal and business expenses, especially in partnerships where personal and business dealings might overlap. Remember, only legitimate business expenses should be reported on the Schedule K-1.

Misunderstanding Partnership Distributions: People often confuse distributions with partner income. Distributions are typically not considered taxable income on your personal return, but the income attributed to you through the K-1 must be reported, regardless of whether it was distributed or not.

Incorrectly Reporting International Transactions: If the partnership engages in international transactions, these must be reported accurately. Special rules can apply, and overlooking these details can lead to problems with the IRS.

Failure to Meet Deadlines: With everything else going on, deadlines can sneak up on partners. Late or incorrect filings can result in penalties. Keep a strict calendar for IRS deadlines to avoid these issues.

While the above points cover common mistakes, they also underscore the complexity of tax reporting for partnerships. Accuracy, diligence, and sometimes professional guidance are critical in navigating through the potentially murky waters of tax preparation and filing. Let this serve as a beacon, guiding you towards a compliant and stress-free tax season.

Documents used along the form

When preparing and filing taxes, particularly for those involved in partnerships, the IRS Schedule K-1 (Form 1065) is a crucial document that reports each partner's share of the partnership's earnings, losses, deductions, and credits. However, it's rarely filed in isolation. Several other forms and documents are typically used alongside it to ensure accurate and complete tax reporting. Understanding these additional forms can drastically smooth the filing process and ensure compliance with IRS requirements.

- Form 1065, U.S. Return of Partnership Income: This is the main tax return form for a partnership. It includes the partnership's total income, deductions, and gains or losses. The Schedule K-1 is a part of this form, detailing individual partners' distributive shares.

- Form 4562, Depreciation and Amortization: Often filed along with Form 1065 if the partnership has assets that depreciate or amortize. This form helps calculate the depreciation and amortization deductions that affect the partnership's income and, consequently, the amounts reported on Schedule K-1.

- Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships: Required for partners in a foreign partnership. Similar to the Schedule K-1 in its purpose, it reports the U.S. person's share of the foreign partnership's income, losses, credits, etc.

- Form 8949, Sales and Other Dispositions of Capital Assets: This form is used if the partnership has capital asset transactions like sales or exchanges. It helps calculate capital gains and losses, which affect the partnership's income and the information provided on Schedule K-1.

- Form 8308, Report of a Sale or Exchange of Certain Partnership Interests: If there's a sale or exchange of partnership interests, this form must be filed. It reports any gains or losses from these transactions, which are essential for accurate income reporting on Form 1065 and for the partners' Schedule K-1s.

In conclusion, while the Schedule K-1 (Form 1065) is vital for partners in a partnership to report their shares of the business's financial activities, navigating the complexities of partnership taxation often requires several other forms. Each plays a significant role in the accurate and comprehensive reporting of a partnership's financial activities. Partnerships must gather, complete, and file these forms meticulously to stay compliant and avoid possible penalties. Understanding these requirements and how each document interrelates can provide clarity and confidence throughout the tax filing process.

Similar forms

The IRS Form 1040 is akin to the Schedule K-1 1065, as both are crucial for reporting individual income tax. While the Form 1040 is the standard federal income tax form for individuals, detailing income, deductions, and credits to determine their tax liability, the Schedule K-1 1065 form provides each partner of a partnership with their share of the business's income, losses, deductions, and credits to be reported on their personal Form 1040. This direct link in reporting personal share from business operations ties these two forms closely together.

Similarly, the IRS Form 1120S, used by S corporations, parallels the Schedule K-1 1065. Both forms facilitate the pass-through of income, losses, deductions, and credits from the entity to the individual taxpayers. However, the Form 1120S serves this role for S corporations and their shareholders, while the Schedule K-1 1065 is for partnerships and their partners. Each shareholder of an S corporation receives a Schedule K-1 (Form 1120S) reporting their share of the corporation's financial activity, akin to how partners receive their financial information.

The IRS Form 1065, U.S. Return of Partnership Income, is directly connected to the Schedule K-1 1065. Form 1065 is used by partnerships to report the income, gains, losses, deductions, credits, etc., of the business. From this form, the information is then distributed to the partners via Schedule K-1 1065, detailing each partner's share of the business’s financial activity for the year. This partnership form sets the foundation for the individual reporting provided by the Schedule K-1 1065.

The IRS Schedule K-1 1041 form, used by estates and trusts, bears similarity to the Schedule K-1 1065 in its purpose to pass through entity information to individual beneficiaries or trustees for their tax filings. Just as the Schedule K-1 1065 provides each partner with their share of income and losses from the partnership, the Schedule K-1 1041 serves beneficiaries of estates and trusts by detailing their portion of income, deductions, and credits to report on their personal tax returns.

IRS Form 8865 (Return of U.S. Persons With Respect to Certain Foreign Partnerships) shares functions similar to the Schedule K-1 1065, as it deals with the reporting requirements for U.S. persons who have an interest in a foreign partnership. The form includes a Schedule K-1 that reports the partner’s share of income, deductions, and credits, akin to the domestic partnership scenario, underscoring the global applicability of the K-1 reporting mechanism.

The IRS Form 8283 (Noncash Charitable Contributions) parallels the purpose of Schedule K-1 1065 in itemizing specific types of deductions. While Schedule K-1 1065 includes deductions for partners within a partnership, Form 8283 is used by individual taxpayers to report information on noncash contributions over a certain value. Both forms complement the taxpayer's main tax filing by providing additional detail on specific financial activities.

IRS Form 8858 (Information Return of U.S. Persons With Respect To Foreign Disregarded Entities) is in line with the concepts of the Schedule K-1 1065, providing disclosure of financial details for Americans with interests in foreign entities disregarded as separate from the owner for tax purposes. While the Form 8858 focuses on international transparency, the Schedule K-1 1065 ensures domestic transparency of partnership dealings to the IRS, with both enhancing fair tax administration.

Form 5471 (Information Return of U.S. Persons With Respect to Certain Foreign Corporations) shares similarities with Schedule K-1 1065, since they both involve international reporting by U.S. taxpayers. Form 5471 is used by certain U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations, mirroring the K-1’s role in informing the IRS about international partnerships via the Form 8865 Schedule K-1, albeit focused on corporations.

The Schedule E (Form 1040), used to report income from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs, shares connectivity with the Schedule K-1 1065. Partnerships’ income and loss reported on Schedule K-1 1065 often make their way to the individual's Schedule E, showcasing the flow-through nature of partnership earnings and their impact on the individual partner's tax obligations.

Lastly, IRS Form 7202, Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals, although more focused on specific credits rather than overall income reporting, parallels the Schedule K-1 1065 in providing a mechanism for individuals to claim due benefits on their tax returns. It complements personal tax filings by offering targeted financial relief, similar to how Schedule K-1 1065 reports personal shares of broader financial activities from partnerships.

Dos and Don'ts

When it comes to the IRS Schedule K-1 Form 1065, precision and accuracy are key in providing comprehensive details about the income, deductions, and credits of a partnership. This document plays a crucial role in the tax filing process, ensuring that partners report their share of the partnership’s financial activities correctly. Here are several dos and don'ts to consider:

- Do ensure you have all necessary financial statements and records on hand before starting. These documents provide crucial information required for accurate reporting on the Schedule K-1.

- Do double-check the partnership's information, including the Employer Identification Number (EIN), to ensure it matches the details the IRS has on file. Inaccuracies can lead to processing delays or audits.

- Do accurately report each partner's share of income, deductions, and credits based on the partnership agreement. The allocation should match the agreed-upon percentages or the specific terms outlined in the partnership agreement.

- Do consider using tax preparation software or consulting with a tax professional if the partnership's finances are complex. This can help prevent mistakes that could result in penalties or interest charges.

- Do file the Schedule K-1 by the IRS deadline, typically March 15, unless an extension has been filed. Late filing can result in penalties and interest on any taxes due.

- Don't overlook the importance of reporting foreign transactions or financial interests. Failure to report these accurately can result in significant penalties.

- Don't guess or estimate amounts. Use actual figures from the partnership’s financial records to ensure accuracy. Estimations can lead to discrepancies and may trigger an audit.

- Don't forget to distribute copies of the Schedule K-1 to all partners in the partnership. Each partner needs this information to correctly file their individual tax returns.

- Don't ignore notices from the IRS. If there are questions or discrepancies with the filed form, respond promptly to avoid further penalties or interest.

Adhering to these dos and don'ts can greatly smooth the process of completing and filing the IRS Schedule K-1 1065 form. Paying attention to detail, verifying the accuracy of the information provided, and seeking professional advice when necessary can help avoid common pitfalls and ensure compliance with IRS regulations.

Misconceptions

The IRS Schedule K-1 (Form 1065) plays a critical role in the reporting of income, losses, and dividends from partnership investments. However, there are several misconceptions about this form that can create confusion. Here’s a list aimed at clarifying some of these misunderstandings.

- It's only for large partnerships: Some people believe that the Schedule K-1 is only for large or complex partnerships. However, the form is required for partnerships of all sizes, from small family-owned businesses to larger entities.

- It's a one-page form: Contrary to what some might think, the Schedule K-1 can be more than a single page. The length of the form can vary depending on the amount and types of income and deductions the partnership reports.

- It reports the partnership’s total income only: While the Schedule K-1 does include the partnership's total income, it also reports the partner's share of the income, which can include dividends, interest, and gains from sales, among other categories.

- It’s filed with your personal tax return: This is a misunderstanding. The Schedule K-1 itself is not filed with the recipient's personal income tax return. Instead, the information from the K-1 is used to complete parts of the personal tax return.

- All partners receive the same form: Each partner receives a Schedule K-1 that reflects their specific share of the partnership's profits, losses, and other items. Thus, while forms may look similar, the information can differ significantly from one partner to another.

- It determines how much tax you owe: The Schedule K-1 provides the details needed to figure out your tax liability, but it doesn't directly tell you how much tax you owe. It's the information within the form that gets incorporated into your overall tax return that affects your tax bill.

- It’s due when personal tax returns are due: The partnership is required to issue Schedule K-1s to the partners by March 15th, which is before the typical April 15th deadline for individual tax returns. This allows partners time to include this information in their personal tax returns.

- No action is needed if losses are reported: Receiving a K-1 with losses does not mean you can ignore it. Reporting these losses on your personal tax return could have implications for your overall tax situation, sometimes in beneficial ways.

- It's only concerned with American income: For partners in an American partnership, the Schedule K-1 will report all income from both domestic and foreign sources, requiring partners to report this on their income tax returns.

- Electronic distribution isn’t allowed: Partnerships are allowed to distribute Schedule K-1s electronically, provided they obtain the consent from the recipient to do so. This is a convenient option that can expedite the process.

Understanding these aspects of the Schedule K-1 (Form 1065) can help partners in a partnership navigate their tax obligations more effectively and with less confusion.

Key takeaways

The IRS Schedule K-1 1065 form is a document used to report an individual's share of income, deductions, and credits from a partnership. Understanding the key elements of this form can significantly streamline the process of completing and utilizing it for tax filing purposes. Here are six essential takeaways:

Partnership's Information is Crucial: At the top of the form, it's important to accurately fill in the partnership's name, address, and the Employer Identification Number (EIN). This ensures the IRS can correctly associate the income or loss reported with the right entity.

Understand Your Share: The form details your share of the partnership's income, gains, losses, deductions, and credits. It's vital to understand how these figures are derived, as they directly affect your personal tax liability.

Report Income on Your Tax Return: The information provided on Schedule K-1 must be reported on your personal tax return. For example, ordinary business income is typically reported on Schedule E of your 1040 form. Not properly reporting income or deductions can lead to audits or penalties.

Report Foreign Transactions: If the partnership is involved in foreign transactions, or holds overseas assets, these must be reported. The Schedule K-1 includes sections to detail foreign transactions, which can have significant tax implications.

Timeliness Matters: Even if the partnership extends its filing deadline, it's essential to provide K-1 forms to the partners as quickly as possible. This ensures that individuals have the necessary information to file their personal tax returns by the deadline.

Keep for Records: It is crucial for both the partnership and the individual partners to keep copies of the Schedule K-1 for their records. This document may be needed for future reference, especially if the IRS queries a return or when calculating basis in the partnership.

Completing and utilizing the IRS Schedule K-1 1065 form accurately plays a significant role in the proper management of partnership taxation matters. Being attentive to the details and understanding the implications of the data reported can help avoid common pitfalls and ensure compliance with tax obligations.

Popular PDF Documents

Irs 1040A - It outlines the process for direct deposit of refunds into a taxpayer's bank account.

Irs Form 4506 - State Form 45016 is designed to streamline the certification process for aspiring real estate appraisers with its precise instructions.

Estimate Taxes Due - It is used to determine penalty amounts for taxpayers who did not pay enough taxes throughout the year.