Get IRS Schedule K-1 1041 Form

Understanding the IRS Schedule K-1 1041 form is crucial for anyone involved in the financial aspects of trusts or estates. This document is a key piece of the tax filing puzzle, serving to report the income, deductions, and credits of beneficiaries. The form stands out as a connector, linking the entity's financial activities to the individual tax responsibilities of the beneficiaries. It's more than just a form; it's a bridge between the complex financial operations of trusts or estates and the personal tax obligations of those who benefit from them. With its pivotal role, the Schedule K-1 1041 requires careful attention to ensure accuracy and compliance with IRS rules, making it indispensable for trustees and beneficiaries alike. Delving into its parts reveals its importance in making sure that everyone pays their fair share to Uncle Sam, while also ensuring that beneficiaries understand their tax liabilities derived from estates and trusts, aiming for a smooth and transparent process.

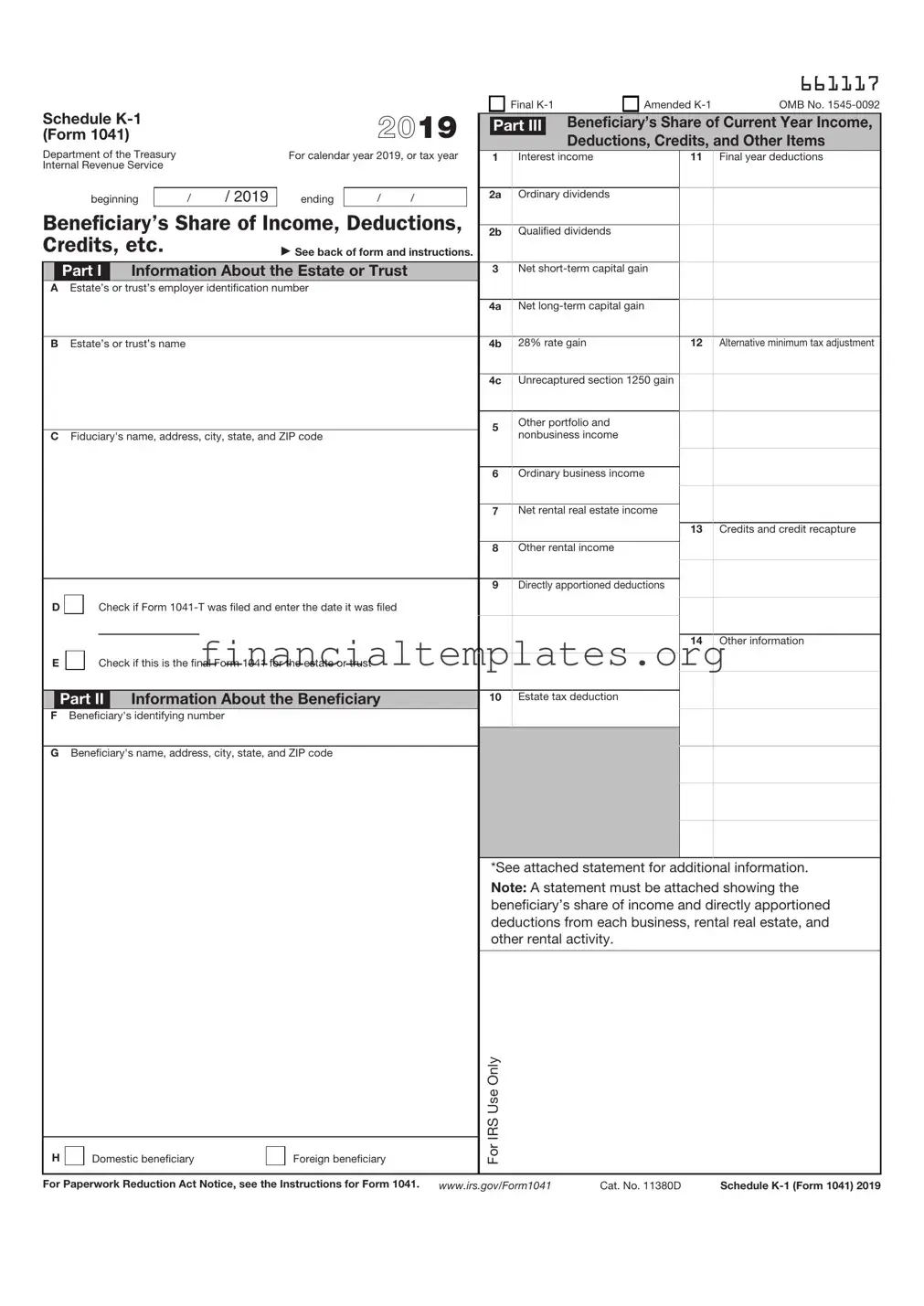

IRS Schedule K-1 1041 Example

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

661117 |

Schedule |

|

|

|

|

2021 |

|

|

|

Final |

|

Amended |

OMB No. |

|||||||||

|

|

|

|

|

|

Part III |

|

Beneficiary’s Share of Current Year Income, |

|||||||||||||

(Form 1041) |

|

|

|

|

|

|

|

|

|

Deductions, Credits, and Other Items |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Department of the Treasury |

|

|

For calendar year 2021, or tax year |

1 |

Interest income |

|

11 |

Final year deductions |

|||||||||||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

beginning |

|

/ |

/ |

ending |

|

/ |

/ |

|

2a |

Ordinary dividends |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Beneficiary’s Share of Income, Deductions, |

|

|

|

|

|

||||||||||||||||

2b |

Qualified dividends |

|

|

|

|||||||||||||||||

Credits, etc. |

|

|

▶ See back of form and instructions. |

|

|

|

|

|

|

|

|

||||||||||

|

|

Part I |

|

Information About the Estate or Trust |

|

|

3 |

Net |

|

|

|||||||||||

A Estate’s or trust’s employer identification number |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4a |

Net |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

B Estate’s or trust’s name |

|

|

|

|

|

|

|

4b |

28% rate gain |

|

12 |

Alternative minimum tax adjustment |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4c |

Unrecaptured section 1250 gain |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Other portfolio and |

|

|

|

|||

C Fiduciary’s name, address, city, state, and ZIP code |

|

|

|

nonbusiness income |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Ordinary business income |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Net rental real estate income |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

Credits and credit recapture |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

Other rental income |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

Directly apportioned deductions |

|

|

||||

D |

|

Check if Form |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

Other information |

|

E |

|

Check if this is the final Form 1041 for the estate or trust |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part II |

|

Information About the Beneficiary |

|

|

10 |

Estate tax deduction |

|

|

|

|||||||||||

F |

Beneficiary’s identifying number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G Beneficiary’s name, address, city, state, and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*See attached statement for additional information.

Note: A statement must be attached showing the beneficiary’s share of income and directly apportioned deductions from each business, rental real estate, and other rental activity.

|

|

|

|

|

For IRS Use Only |

H |

|

Domestic beneficiary |

|

Foreign beneficiary |

|

|

|

For Paperwork Reduction Act Notice, see the Instructions for Form 1041. |

www.irs.gov/Form1041 |

Cat. No. 11380D |

Schedule |

Schedule |

Page 2 |

This list identifies the codes used on Schedule

|

|

Report on |

1. |

Interest income |

Form 1040 or |

2a. Ordinary dividends |

Form 1040 or |

|

2b. Qualified dividends |

Form 1040 or |

|

3. |

Net |

Schedule D, line 5 |

4a. Net |

Schedule D, line 12 |

|

4b. 28% rate gain |

28% Rate Gain Worksheet, line 4 |

|

|

|

(Schedule D Instructions) |

4c. Unrecaptured section 1250 gain |

Unrecaptured Section 1250 Gain |

|

|

|

Worksheet, line 11 (Schedule D |

|

|

Instructions) |

5. Other portfolio and nonbusiness |

Schedule E, line 33, column (f) |

|

|

income |

|

6. |

Ordinary business income |

Schedule E, line 33, column (d) |

|

|

or (f) |

7. |

Net rental real estate income |

Schedule E, line 33, column (d) |

|

|

or (f) |

8. |

Other rental income |

Schedule E, line 33, column (d) |

|

|

or (f) |

9.Directly apportioned deductions Code

13. Credits and credit recapture |

|

Code |

Report on |

A Credit for estimated taxes |

Form 1040 or |

B Credit for backup withholding |

Form 1040 or |

C |

|

D Rehabilitation credit and energy credit |

|

E Other qualifying investment credit |

|

F Work opportunity credit |

|

G Credit for small employer health |

|

insurance premiums |

|

H Biofuel producer credit |

|

ICredit for increasing research activities

JRenewable electricity, refined coal, and Indian coal production credit

K Empowerment zone employment credit} L Indian employment credit

M Orphan drug credit

N Credit for

ADepreciation

BDepletion

CAmortization

10.Estate tax deduction

11.Final year deductions

AExcess deductions – Section 67(e) expenses

Form 8582 or Schedule E, line 33, column (c) or (e)

Form 8582 or Schedule E, line 33, column (c) or (e)

Form 8582 or Schedule E, line 33, column (c) or (e)

Schedule A, line 16

See the beneficiary’s instructions

R Recapture of credits Z Other credits

14. Other information A

B Excess deductions –

Schedule D, line 5

Schedule D, line 12; line 5 of the wksht. for Sch. D, line 18; and line 16 of the wksht. for Sch. D, line 19

Schedule 1 (Form 1040), line 8a

12. Alternative minimum tax (AMT) items}Form 6251, line 2f A Adjustment for minimum tax purposes Form 6251, line 2j

B AMT adjustment attributable to qualified dividends

See the beneficiary’s instructions and the Instructions for Form 6251

FAMT adjustment attributable to 28% rate gain

GAccelerated depreciation

HDepletion

I Amortization |

|

J Exclusion items |

2022 Form 8801 |

C Reserved for future use

D Reserved for future use E Net investment income

F Gross farm and fishing income

G Foreign trading gross receipts (IRC 942(a))

H Adjustment for section 1411 net investment income or deductions

I Section 199A information

Z Other information

Note: If you are a beneficiary who does not file a Form 1040 or

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS Schedule K-1 1041 form is used to report a beneficiary's share of income, deductions, and credits from an estate or trust. |

| 2 | This form is a part of the Form 1041, U.S. Income Tax Return for Estates and Trusts, and serves to pass through the tax information to the beneficiaries. |

| 3 | It ensures that the income taxed to the estate or trust is correctly reported and taxed to the beneficiary, to avoid double taxation. |

| 4 | Beneficiaries use the information on Schedule K-1 to complete their own tax returns, reporting their share of the estate's or trust's income. |

| 5 | It includes details such as the type of income, whether it's interest, dividends, capital gains, etc., and the amount attributable to the beneficiary. |

| 6 | Schedule K-1 also reports deductions and credits that the beneficiary is entitled to claim on their personal tax return. |

| 7 | The fiduciary of the estate or trust is responsible for completing and issuing Schedule K-1s to all beneficiaries annually. |

| 8 | Depending on the beneficiary's circumstances, Schedule K-1 income may be subject to different tax treatments. |

| 9 | The form does not vary by state, but beneficiaries must ensure that they comply with any specific state tax obligations related to their K-1 income. |

Guide to Writing IRS Schedule K-1 1041

When completing the IRS Schedule K-1 (Form 1041) for an estate or trust, one navigates through a detailed process involving the allocation of income, deductions, and credits to the beneficiaries. This document is crucial for beneficiaries to accurately report their share of the estate or trust's income on their personal tax returns. To ensure accuracy and compliance, follow these structured steps, keeping organized records of all related financial activities throughout the fiscal year.

- Start by gathering all necessary financial statements and reports for the estate or trust. This includes income statements, deductions, and any relevant financial documents that pertain to the estate or trust's activities over the tax year.

- Obtain the latest version of IRS Schedule K-1 (Form 1041) from the Internal Revenue Service website to ensure you are using the most current form.

- Fill out the top section of the form with the estate or trust's name, Employer Identification Number (EIN), and the estate or trust's address.

- Enter the beneficiary's name, address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the designated section.

- Report the beneficiary's share of income, deductions, and credits according to the estate or trust’s financial documents. This part requires careful attention to detail to accurately reflect the beneficiary's share.

- For each type of income, deduction, and credit, fill in the corresponding amount in the appropriate box on the form. Be sure to follow the instructions for each line to correctly report each item.

- Review the form for accuracy. Double-check each entry against the estate or trust’s records to ensure that all information is correctly reported and that the beneficiary's share of income, deductions, and credits are accurately reflected.

- Sign and date the form if you are the fiduciary or authorized to act on behalf of the estate or trust. This verifies that the information provided is true, correct, and complete to the best of your knowledge.

- Distribute a copy of the completed Schedule K-1 (Form 1041) to each beneficiary listed on the form. They will need this document to report their share of the estate or trust's income on their personal tax returns.

- File the form with the IRS along with Form 1041, U.S. Income Tax Return for Estates and Trusts. Ensure this is done by the IRS filing deadline to avoid penalties.

By methodically following these steps, you will help ensure that the IRS Schedule K-1 (Form 1041) is correctly filled out and filed. This thorough approach aids in the accurate reporting of income, deductions, and credits to the beneficiaries and supports compliance with IRS regulations.

Understanding IRS Schedule K-1 1041

-

What is a Schedule K-1 1041 form?

The Schedule K-1 1041 form is a document used by estates and trusts to report the income, deductions, and credits of beneficiaries. It informs the IRS and the beneficiary of the share of income and deductions they are responsible for on their personal tax return.

-

Who needs to file a Schedule K-1 1041 form?

Estates and trusts that have distributed income to beneficiaries during the tax year are required to file a Schedule K-1 1041 form for each beneficiary. This is necessary whether the beneficiaries are individuals, corporations, or other entities.

-

What information is needed to fill out a Schedule K-1 1041 form?

To complete the Schedule K-1 1041 form, information about the estate or trust's income, deductions, and credits for the year will be needed. Additionally, details about each beneficiary, including their name, address, and taxpayer identification number, must be provided.

-

How does a beneficiary use a Schedule K-1 1041 form?

A beneficiary uses the information on the Schedule K-1 1041 form to complete their own tax return. It helps them understand their portion of the income, deductions, and credits that they must report on their personal income tax return.

-

When is the Schedule K-1 1041 form due?

The Schedule K-1 1041 form must be filed by the estate or trust and sent to the beneficiaries by April 15th of the year following the tax year in which the income was received.

-

Can a Schedule K-1 1041 be corrected after it has been filed?

Yes, if an error is discovered on a Schedule K-1 1041 after it has been filed, the estate or trust can file an amended form. This corrected form should be sent to the IRS and all affected beneficiaries as soon as possible.

-

What should a beneficiary do if they do not receive their Schedule K-1 1041?

If a beneficiary does not receive their Schedule K-1 1041, they should first contact the estate or trust responsible for distributing it. If it still cannot be obtained, they may have to estimate their income using other financial records and potentially consult a tax advisor for assistance.

-

Are distributions from an estate or trust always taxable to the beneficiary?

Not all distributions from an estate or trust are taxable. The taxability depends on the type of income being distributed. For example, income that has already been taxed at the estate or trust level may not be taxable to the beneficiary. Consulting the Schedule K-1 1041 form can provide clarity on this issue.

-

How does an estate or trust determine the amounts to report on Schedule K-1 1041?

The estate or trust calculates the amounts to report on each beneficiary's Schedule K-1 1041 based on the income and deductions of the estate or trust. This involves allocating the taxable income and deductions among the beneficiaries according to the will or trust agreement.

-

Can a beneficiary file their tax return without a Schedule K-1 1041?

It is not advised to file a personal tax return without the Schedule K-1 1041 if you are expecting to receive one. Missing or incorrect income information can lead to errors in tax calculation and potential issues with the IRS. If the form is delayed, it may be necessary to request a filing extension.

Common mistakes

Filling out IRS Schedule K-1 (Form 1041) is an important task that requires careful attention to detail. When completing this form, individuals often make several common mistakes that can lead to complications or errors in reporting. Here are eight of these mistakes:

Not reporting all income distributions properly. Income distributed to beneficiaries must be reported accurately to avoid issues with the Internal Revenue Service.

Misunderstanding how to allocate deductions among beneficiaries. This can result in an inaccurate reflection of the income and deductions applicable to each beneficiary.

Failing to accurately report foreign taxes paid or accrued, which might lead to beneficiaries missing out on potential tax credits.

Omitting important information such as the estate or trust’s employer identification number (EIN), or incorrect information, can delay processing and potentially cause penalties.

Mistakenly reporting the same item of income or deduction in both the estate or trust’s return and the beneficiaries’ personal returns, which could result in double taxation.

Forgetting to include state-specific information that may be required on the beneficiary's state tax return, possibly leading to state tax complications.

Inaccurately calculating the adjusted basis of distributed property, which can affect the beneficiary's capital gains or losses when the property is eventually sold.

Ignoring the instructions for Schedule K-1 can lead to a variety of mistakes, as the instructions provide critical information on how to properly fill out the form.

To avoid these common errors:

Always double-check the information provided for accuracy.

Consult the comprehensive instructions provided by the IRS for Schedule K-1 (Form 1041).

Consider seeking guidance from a tax professional, especially if dealing with complex issues or substantial amounts of money.

With careful attention to detail and adherence to IRS guidelines, one can minimize errors and ensure proper reporting for the estate or trust and its beneficiaries.

Documents used along the form

When dealing with the IRS Schedule K-1 1041 form, commonly used in the administration of estates and trusts, it's crucial to understand that this document does not stand alone. Instead, it's part of a broader set of documents and forms that are essential for correctly reporting income, deductions, and beneficiaries' gains. These documents are pivotal for ensuring compliance with tax laws and facilitating the efficient management of trusts and estates. Here's an overview of some critical documents often used alongside the IRS Schedule K-1 1041 form.

- Form 1041 - U.S. Income Tax Return for Estates and Trusts: This is the primary tax form for estates and trusts, reporting income, deductions, and the income distribution to beneficiaries. The Schedule K-1 1041 form complements this by detailing the share of income and deductions allocated to each beneficiary.

- Form 1040 - U.S. Individual Income Tax Return: Beneficiaries of a trust or estate may need to file this form to report their own personal income, including any distributions received as detailed in the Schedule K-1 1041.

- Form 706 - United States Estate (and Generation-Skipping Transfer) Tax Return: For estates subject to estate tax, this form is used to report the estate's value and calculate any owed estate tax. It's vital during the settling of large estates that may have tax implications.

- Form 709 - United States Gift (and Generation-Skipping Transfer) Tax Return: This form is necessary when the deceased or the trust has made gifts above the annual exclusion amount, requiring the reporting of these gifts for gift tax purposes.

- W-9 - Request for Taxpayer Identification Number and Certification: This form is often collected from beneficiaries to ensure their taxpayer identification numbers are reported correctly on the Schedule K-1 1041.

- Form 8971 - Information Regarding Beneficiaries Acquiring Property from a Decedent: Required in certain circumstances, this form reports the value of assets received by beneficiaries, which can be essential for calculating basis and potential capital gains.

- Form 8821 - Tax Information Authorization: Allows designated representatives to access the trust or estate's tax information, crucial for facilitators or attorneys involved in preparing or overseeing the tax filing process.

- Form 2848 - Power of Attorney and Declaration of Representative: This document grants an individual the authority to represent the estate or trust before the IRS, allowing them to make decisions, submit documents, and communicate on behalf of the entity.

Each of these documents plays a unique role in the larger framework of estate and trust administration, contributing to a comprehensive approach towards managing and reporting financial activities. By understanding the purpose and requirement of each form, individuals charged with handling these responsibilities can navigate the complexities of tax law with greater confidence and accuracy, ensuring compliance and facilitating smoother operations of estates and trusts.

Similar forms

The IRS Schedule K-1 1041 form is closely related to several other tax documents, each serving a unique purpose in the realm of tax reporting, yet sharing commonalities in function and structure. For instance, the IRS Form 1065 Schedule K-1 is one such document used by partnerships. Similar to the 1041 Schedule K-1, which reports the income, deductions, and credits of a trust or estate, the Form 1065 Schedule K-1 reports each partner's share of the partnership's income, deductions, and credits. Both forms are pivotal in ensuring that the income from entities that are not taxed at the business level is properly reported on the individual tax returns of the owners or beneficiaries.

Another analogous document is the IRS Form 1120S Schedule K-1, relevant for S corporations. This form parallels the 1041 Schedule K-1 by delineating each shareholder's proportionate share of the corporation's income, losses, deductions, and credits. Despite the difference in the type of entity (trusts and estates vs. S corporations), both documents serve the critical role of linking the entity's financial activities with the individual tax obligations of its beneficiaries or shareholders, ensuring the flow-through of income and losses to their personal tax returns.

The IRS Form 1040 Schedule E is also akin to the Schedule K-1 1041, but it is used by individual taxpayers to report income from rental properties, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. While Schedule E is a reporting tool for individuals to declare additional income, the Schedule K-1 1041 provides the necessary information for beneficiaries of an estate or trust to accurately complete their Schedule E. The two forms work in tandem, with Schedule K-1 1041 supplying the details that feed into Schedule E, ensuring the individual's income is comprehensively reported.

Lastly, the IRS Form 8832, although not a direct counterpart to the Schedule K-1 1041, shares a conceptual similarity. Form 8832 allows entities to choose their tax classification, which ultimately dictates the type of Schedule K-1 form the entity will use. For example, an entity classified as a partnership will use Form 1065 Schedule K-1, while an entity electing to be treated as an S corporation will use Form 1120S Schedule K-1. The classification decision impacts how income is reported and taxed, demonstrating the interconnected nature of these forms in the broader tax reporting landscape.

Dos and Don'ts

- Do review the instructions for the IRS Schedule K-1 Form 1041 thoroughly before beginning. The IRS provides detailed guidance to help you understand the requirements and how to properly fill out the form.

- Don't rush through it. Take your time to accurately report all the necessary information. Mistakes or omissions can result in processing delays or unwanted attention from the IRS.

- Do double-check the trust's or estate's identification information. Ensure that the Employer Identification Number (EIN) and the entity's name are correctly entered to avoid mismatches in IRS records.

- Don't overlook the beneficiary's information. Make sure that the beneficiary's social security number (SSN) or individual taxpayer identification number (ITIN), as well as their full name and address, are correctly reported. This information is crucial for the IRS to properly attribute the reported income or deductions.

- Do accurately report the income distribution. Schedule K-1 is designed to outline how income from the estate or trust is distributed among beneficiaries. It’s vital to get this right to ensure the proper taxation on each beneficiary's income.

- Don't forget to sign and date the form if you are the fiduciary responsible for filing it. This verifies that the information provided is true and correct to the best of your knowledge.

- Do consult with a tax professional if you have any uncertainties or need clarification. The nuances of tax law and IRS forms can be complex, and professional guidance can help you avoid costly mistakes.

When dealing with the IRS Schedule K-1 Form 1041, it's important to navigate this complex document with care. This form is a tool for reporting a beneficiary's share of an estate or trust's income, deductions, credits, etc., to the IRS. Below are several do's and don'ts to consider for a smoother experience:

Misconceptions

Understanding the IRS Schedule K-1 1041 form is essential for anyone dealing with estates or trusts, but there's plenty of confusion about what this form is and how it's used. Let's clarify some common misconceptions to help you navigate this important part of tax filings more confidently.

- Only Beneficiaries Need To Worry About It: While it's true the form pertains to beneficiaries of estates and trusts, executors and trustees also need a deep understanding of how to properly complete and distribute Schedule K-1s to ensure accurate reporting and to meet their fiduciary responsibilities.

- It's Similar to W-2s or 1099s: Although Schedule K-1 1041 does report income, like W-2s or 1099s, it's different because it also provides information on deductions, credits, and the beneficiary’s share of the estate or trust during the tax year. This makes it more comprehensive than the typical income forms.

- Income Reported Is Always Taxable: Not all income reported on a Schedule K-1 1041 is immediately taxable. Depending on the estate or trust's type and the beneficiary's circumstances, some income could be sheltered or taxed at different rates.

- It Only Deals with Cash Distributions: The form goes beyond just cash, including property distributions and detailing how different types of income, like interest, dividends, and capital gains, are allocated among beneficiaries.

- Filing It Is the Beneficiary's Responsibility: It's actually the responsibility of the trustee or executor to prepare and file Schedule K-1s with the IRS, in addition to providing copies to all beneficiaries, who will then use this information to complete their own tax returns.

- There's No Need to Report It If the Trust or Estate Is Small: Size doesn't negate the need to file. All estates and trusts that engage in activities generating income need to file a Form 1041, and beneficiaries receiving income must be issued a Schedule K-1, regardless of the amount.

- All States Treat K-1 Income the Same Way: This is incorrect. State tax treatment of income reported on Schedule K-1 1041 can vary significantly. Some states offer exemptions or special tax treatment for certain types of income, so it's important to understand the rules in each state where you file.

- Amendments Are Rarely Necessary: Errors happen, and when they do, amending the K-1 and possibly the Form 1041 is not just necessary; it's a requirement to ensure compliance and avoid potential penalties.

- Beneficiaries Can't Deduct Losses: In certain situations, beneficiaries may be able to deduct losses reported on a Schedule K-1 on their personal tax returns, especially if the estate or trust incurred business or investment losses.

- Once Distributed, the Estate or Trust No Longer Deals with the Income: Even after distributions, the executor or trustee must manage and report the trust or estate's income annually, distributing Schedule K-1s as necessary until the entity is formally dissolved.

Key takeaways

The IRS Schedule K-1 (Form 1041) is essential for trustees and executors to understand, as it pertains to trusts and estates. Properly filling out and utilizing this form ensures accurate tax reporting for beneficiaries. Below are five key takeaways individuals should keep in mind:

- The primary function of Schedule K-1 (Form 1041) is to report a beneficiary's share of an estate's or trust's income, deductions, credits, etc. This form helps beneficiaries understand their tax obligations associated with distributions received.

- Schedule K-1 (Form 1041) must be filed by the executor or trustee for each beneficiary of the estate or trust. It’s important to prepare this schedule with accuracy to prevent beneficiaries from facing issues with their personal tax returns.

- Beneficiaries use the information on Schedule K-1 (Form 1041) to complete their own tax returns. This form provides important details about the type of income received, such as interest, dividends, or capital gains, which impacts how the income is taxed.

- There are deadlines for issuing Schedule K-1 (Form 1041) to beneficiaries. These deadlines are set to ensure that beneficiaries have sufficient time to file their personal tax returns. Late distribution of the K-1 forms may result in penalties.

- It’s crucial for trustees and executors to maintain detailed records. Documentation supporting the amounts entered on Schedule K-1 should be thorough and precise, as this data directly affects the taxation of beneficiaries and the estate or trust itself.

Comprehending the requirements and obligations associated with the IRS Schedule K-1 (Form 1041) is vital for trustees, executors, and beneficiaries alike. Proper attention to detail and adherence to deadlines can greatly streamline the tax reporting process, ensuring compliance and minimizing the burden on all parties involved.

Popular PDF Documents

Innocent Spouse Irs - Ultimately, those considering Form 8857 should be prepared for a thorough examination of their claim, as well as potential interactions with their spouse during the review process.

2hf - Form 2HF is not open to public inspection, safeguarding the privacy of the taxpayer’s personal property information.

Ohio It 4 - Vendors receive this certificate from purchasers to process sales without adding sales tax.