Get IRS Schedule J 1040 Form

When navigating the complexities of the U.S. tax system, taxpayers often encounter various forms that document specific types of income, deductions, or financial situations. Among these, the IRS Schedule J (Form 1040) stands out for those who must calculate tax on income averaging over a span of years. This method can significantly impact how much tax is owed, offering a more equitable tax payment solution for those who have experienced fluctuating income levels. Typically utilized by farmers and fishermen, Schedule J allows these workers to smooth out the highs and lows of their annual income, potentially reducing the tax burden during prosperous years by averaging the income over a three-year period. This method acknowledges the cyclical nature of agricultural and fishing income, ensuring that taxpayers in these industries are not disproportionately taxed in years of abundance. By understanding how to properly fill out and file Schedule J, taxpayers can navigate their annual tax responsibilities with greater ease and potential financial benefit.

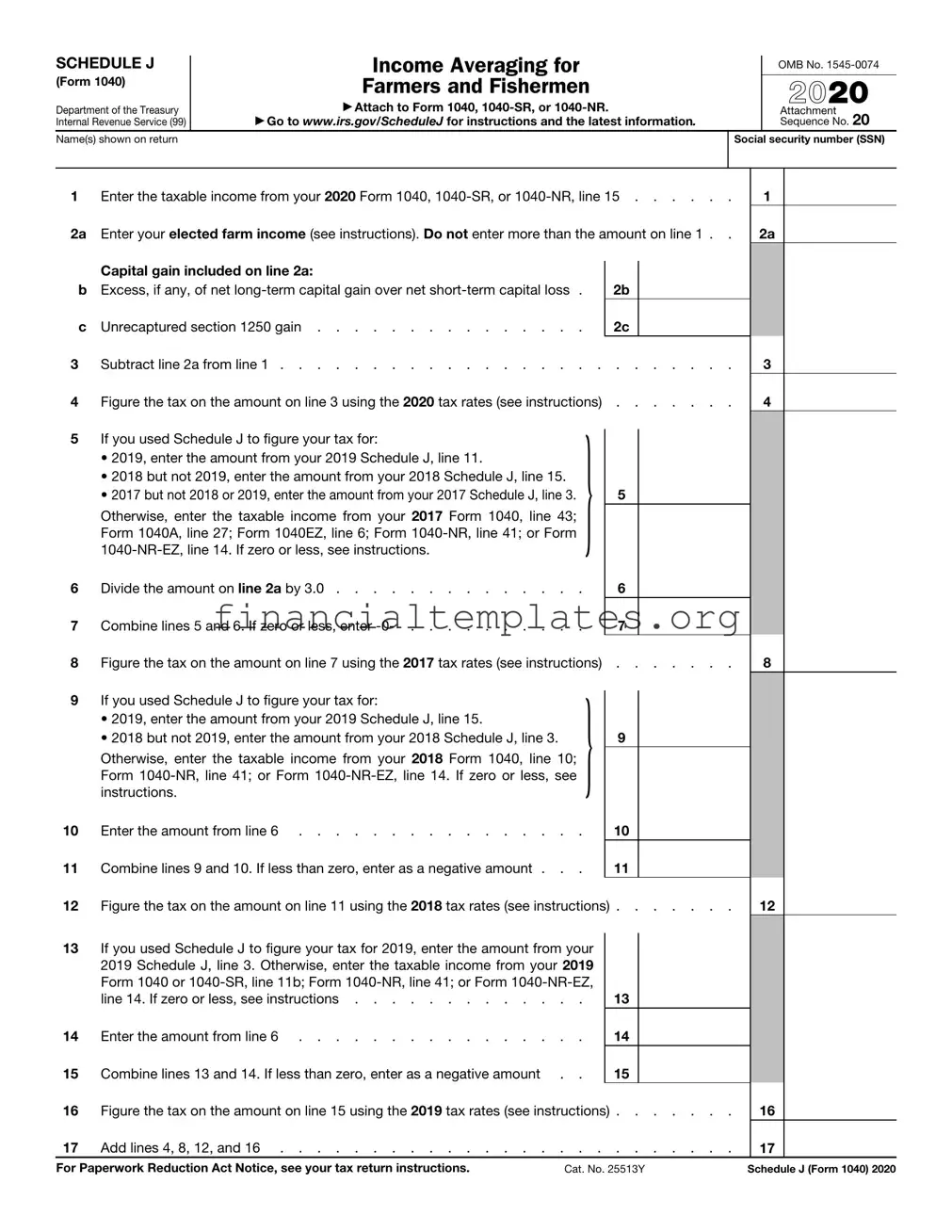

IRS Schedule J 1040 Example

SCHEDULE J |

|

Income Averaging for |

|

OMB No. |

|

|

|||

(Form 1040) |

|

Farmers and Fishermen |

|

|

|

▶ Attach to Form 1040, |

|

2021 |

|

Department of the Treasury |

|

|

||

|

|

▶ Go to www.irs.gov/ScheduleJ for instructions and the latest information. |

|

Attachment |

Internal Revenue Service (99) |

|

|

Sequence No. 20 |

|

Name(s) shown on return |

|

|

Social security number (SSN) |

|

|

|

|

|

|

1 |

Enter the taxable income from your 2021 Form 1040, |

||

2a |

Enter your elected farm income (see instructions). Do not enter more than the amount on line 1 . . |

||

|

Capital gain included on line 2a: |

|

|

|

|

|

|

b |

Excess, if any, of net |

2b |

|

c |

Unrecaptured section 1250 gain |

2c |

|

3 |

Subtract line 2a from line 1 |

||

1

2a

3

4 |

Figure the tax on the amount on line 3 using the 2021 tax rates (see instructions) |

|

5 |

If you used Schedule J to figure your tax for: |

} |

|

• 2020, enter the amount from your 2020 Schedule J, line 11. |

|

|

• 2019 but not 2020, enter the amount from your 2019 Schedule J, line 15. |

|

|

• 2018 but not 2019 or 2020, enter the amount from your 2018 Schedule J, line 3. |

|

|

Otherwise, enter the taxable income from your 2018 Form 1040, line 10; |

|

|

Form |

|

|

instructions. |

|

6 |

Divide the amount on line 2a by 3.0 |

|

7 |

Combine lines 5 and 6. If zero or less, enter |

|

. . . . . . .

5

6

7

4

8 Figure the tax on the amount on line 7 using the 2018 tax rates (see instructions)

9 Otherwise, enter the taxable income from your 2019 Form 1040 and

10 Enter the amount from line 6 . . . . . . . . . . . . . . . .

11 Combine lines 9 and 10. If less than zero, enter as a negative amount . . .

. . . . . . .

9

10

11

8

12Figure the tax on the amount on line 11 using the 2019 tax rates (see instructions) . . . . . . .

13If you used Schedule J to figure your tax for 2020, enter the amount from your 2020 Schedule J, line 3. Otherwise, enter the taxable income from your 2020

|

Form 1040, |

13 |

14 |

Enter the amount from line 6 |

14 |

15 |

Combine lines 13 and 14. If less than zero, enter as a negative amount . . |

15 |

16Figure the tax on the amount on line 15 using the 2020 tax rates (see instructions) . . . . . . .

17Add lines 4, 8, 12, and 16 . . . . . . . . . . . . . . . . . . . . . . . . .

12

16

17

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 25513Y |

Schedule J (Form 1040) 2021 |

Schedule J (Form 1040) 2021 |

Page 2 |

18 |

Amount from line 17 |

|

19 |

If you used Schedule J to figure your tax for: |

|

|

• 2020, enter the amount from your 2020 Schedule J, line 12. |

} |

|

• 2019 but not 2020, enter the amount from your 2019 Schedule J, line 16. |

|

|

• 2018 but not 2019 or 2020, enter the amount from your 2018 Schedule J, |

|

|

line 4. |

|

|

Otherwise, enter the tax from your 2018 Form 1040, line 11a; Form |

|

|

line 42;* or Form |

|

20 |

If you used Schedule J to figure your tax for: |

} |

|

• 2020, enter the amount from your 2020 Schedule J, line 16. |

|

|

• 2019 but not 2020, enter the amount from your 2019 Schedule J, line 4. |

|

|

Otherwise, enter the tax from your 2019 Form 1040 and |

|

|

Form |

|

21If you used Schedule J to figure your tax for 2020, enter the amount from your 2020 Schedule J, line 4. Otherwise, enter the tax from your 2020 Form 1040,

. . . . . . .

19

20

21

18

*Only include tax reported on this line that is imposed by section 1 of the Internal Revenue Code (see instructions).

22 Add lines 19 through 21 . . . . . . . . . . . . . . . . . . . . . . . . . .

23Tax. Subtract line 22 from line 18. Also include this amount on Form 1040,

Caution: Your tax may be less if you figure it using the 2021 Tax Table, Tax Computation Worksheet, Qualified Dividends and Capital Gain Tax Worksheet, or Schedule D Tax Worksheet. Attach Schedule J only if you are using it to figure your tax.

22

23

Schedule J (Form 1040) 2021

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | Schedule J is used by individuals to calculate and report their tax on income averaging over a three-year period, specifically for those involved in farming and fishing activities. |

| 2 | This form is an attachment to Form 1040, the U.S. Individual Income Tax Return. |

| 3 | The purpose of using Schedule J is to potentially reduce the tax burden for taxpayers by averaging their income, which can be particularly beneficial in years where their income significantly fluctuates. |

| 4 | To be eligible to file Schedule J, taxpayers must have income from farming or fishing that accounts for at least two-thirds of their total gross income. |

| 5 | Income eligible for averaging on Schedule J includes, but is not limited to, income from the sale of crops, livestock, and fish, as well as certain federal agricultural program payments. |

| 6 | Schedule J requires the taxpayer to report their current year income as well as their income for the previous two years for the averaging calculation. |

| 7 | Using Schedule J does not affect self-employment tax; it only applies to the income tax calculation. |

| 8 | The IRS provides instructions for Schedule J, including examples and detailed explanations on how to properly calculate and report income averaging. |

| 9 | Amendments or corrections to previously filed Schedule J forms require filing an amended Form 1040 along with a revised Schedule J. |

| 10 | There are no state-specific versions of Schedule J, as it is a federal form used solely for federal income tax purposes. However, taxpayers should verify whether their state has similar provisions for income averaging for state income tax purposes. |

Guide to Writing IRS Schedule J 1040

After completing your initial tax return forms, you might find yourself needing to fill out IRS Schedule J (1040 form) if you have income that fluctuates throughout the year. This form helps to adjust your tax payments accordingly, potentially leading to a more accurate tax bill or refund. The process may seem daunting at first, but by following the steps outlined, you can complete the form efficiently and accurately. Remember to gather all necessary documents related to your income before you begin, as this will make the process smoother.

- Start by downloading the IRS Schedule J (1040 form) from the official IRS website. Ensure you have the correct year’s form to avoid any discrepancies with tax law changes.

- Enter your name and Social Security number at the top of the form. This is crucial for matching your Schedule J to your main 1040 form.

- Proceed to Part I of the form, where you will list your income for each month of the tax year. This includes all taxable income sources. If your income is the same each month, you only need to fill out the first month, and the IRS will assume it’s consistent throughout the year.

- In Part II of the form, calculate the adjustments to your income. This section is for adjusting your monthly income figures based on specific deductions allowed by the IRS. Follow the instructions carefully to determine what adjustments apply to your situation.

- Part III is where you summarize the previous sections and calculate the tax on your adjusted seasonal income. Use the IRS provided tables and charts for this section to determine your tax responsibilities accurately.

- If you owe additional taxes beyond what was already paid, you'll enter this amount in Part IV. This section also includes calculations for any interest owed due to underpayment throughout the year.

- Review your form for accuracy. Double-check your calculations and ensure that all income and adjustments are accurately reported.

- Attach Schedule J to your Form 1040 and other tax documents. Ensure everything is signed and dated correctly.

- Submit your tax return by mail or electronically by the filing deadline. If you owe taxes, make sure to include any payment required.

After submitting Schedule J along with your other tax forms, the next step is simply to wait for the IRS to process your tax return. Processing times can vary, so it's essential to submit as early as possible if you expect a refund. Both electronic and paper filers can check the status of their return through the IRS's website. Remember, accurately completing and submitting Schedule J can help alleviate some of the tax burdens associated with fluctuating income, ensuring you pay the correct amount of tax.

Understanding IRS Schedule J 1040

Welcome to the FAQ section about the IRS Schedule J (Form 1040). Here you'll find answers to some common questions that might help as you navigate through this tax document.

- What is the purpose of IRS Schedule J (Form 1040)?

- Who needs to fill out Schedule J?

- How does Schedule J affect my tax due?

- What information do I need to complete Schedule J?

Schedule J is used by taxpayers to calculate and report their income tax for farming and fishing activities. This form allows individuals to average their farm or fishing income over the past three years. The aim is to potentially reduce the current year's tax liability, taking into consideration the nature of these industries where income can significantly fluctuate from year to year.

This schedule should be completed by taxpayers who have income from farming or fishing. Specifically, if you are an individual, a partner in a partnership, or a shareholder in an S corporation, and at least two-thirds of your total gross income for the year or any of the preceding two years comes from farming or fishing, then filing Schedule J could be beneficial for you.

By averaging your income from the past three years, Schedule J might lower your tax obligation for the current year. If this year was particularly profitable compared to the previous two years, averaging could result in a lower taxable income and thus, lower taxes owed. It's a method that acknowledges the volatility of farming and fishing income, aiming to provide a form of tax relief.

To properly complete Schedule J, you will need your tax return for the current year and your total gross income from farming or fishing for the current and the previous two years. Calculations will involve these figures to average out the income. It may also require additional forms or schedules if you have deductions, credits, or other income to report separately.

Common mistakes

Not verifying eligibility: Before beginning, it's essential to check if you actually qualify to use Schedule J based on the specific criteria set by the IRS. This includes income sources and proportions from farming or fishing.

Incorrect income reporting: Mixing up gross income with net profit or not including all income sources from farming and fishing can lead to inaccuracies in tax calculations.

Forgetting to include carryover amounts: Previous years' losses or credits that can be carried over must be appropriately accounted for, as they can significantly affect the current year's tax liability.

Misinterpreting the averaging rules: The specific rules for income averaging must be thoroughly understood and correctly applied. Misinterpretation can result in either an overpayment or underpayment of taxes.

Not attaching required forms or schedules: Schedule J is an addition to Form 1040, and its proper filing may necessitate including other forms or schedules that provide detailed income and loss information.

Oversights in electing income averaging: Failing to properly elect to use income averaging by not checking the appropriate box on Schedule J can lead to the IRS rejecting the use of this beneficial method.

Failing to double-check for math errors: Simple mathematical mistakes can significantly impact your tax situation. It's crucial to double-check all calculations or use software that minimizes such errors.

Ignoring state-specific requirements: Some states may have unique rules regarding income averaging for farmers and fishermen, and failing to consider these can result in discrepancies between federal and state tax filings.

Correcting these mistakes involves carefully reviewing the instructions provided by the IRS for Schedule J and other related tax forms, consulting a tax professional if needed, and paying attention to detail throughout the tax preparation process. Using tax preparation software or services can also help minimize errors by guiding filers through each step of the process and automating calculations.

Documents used along the form

In the process of preparing and filing taxes, taxpayers often find that completing the IRS Schedule J (Form 1040) is just one step in a broader series of tasks. The IRS Schedule J is designed for calculating and reporting tax on income that's averaged over a period of time, often used by farmers and fishermen. However, to accurately prepare and file this form, it might be necessary to complete additional documents that provide further details about income, deductions, and tax credits. The following is a concise list of other forms and documents commonly utilized alongside the IRS Schedule J form.

- Schedule F (Form 1040) - This form is used by farmers to report farm income and expenses. It plays a critical role in determining the taxable income from farming activities, which is needed to accurately complete Schedule J.

- Schedule SE (Form 1040) - Schedule SE is required for self-employed individuals to calculate the tax due on net earnings, including those from farming and fishing. Its figures are vital for those using Schedule J to understand their full tax obligations.

- Form 4797 - This form is used to report sales, exchanges, or involuntary conversions of certain business properties, including assets used in farming. The results from Form 4797 can affect income calculations on Schedule J.

- Form 8862 - Used to claim certain tax credits that were previously disallowed, Form 8862 may be necessary if a taxpayer needs to requalify for credits that could impact the income calculation on Schedule J.

Combining these forms with the IRS Schedule J is common for individuals who must navigate complex tax situations, especially those involved in farming and fishing. Each document serves to ensure that all income is accurately reported and taxes are correctly calculated, providing the necessary details to comply with tax laws. Understanding the purpose and requirement of each form can streamline the tax preparation process, securing both peace of mind and compliance with the Internal Revenue Service.

Similar forms

The IRS Schedule J 1040 form is closely related to the Schedule A (Itemized Deductions) form. Both forms are attachments to the main Form 1040 used for individual tax returns. While Schedule J focuses on averaging farm income over a three-year period for farmers, Schedule A allows taxpayers to itemize deductions such as medical expenses, state taxes, and charitable contributions. Each serves to adjust gross income, albeit for different purposes and populations, making them critical tools for reducing taxable income through specific, eligible expenses or averaging methods.

Another document similar to the IRS Schedule J 1040 form is the Schedule C (Profit or Loss from Business). Schedule C is designed for sole proprietors to report income or loss from a business. Just like Schedule J provides a mechanism for farmers to calculate taxable income by averaging their earnings, Schedule C enables business owners to report their business's financial activity, detailing income, expenses, and the resulting profit or loss. This parallel lies in their objective to align taxable income with actual income fluctuations over time or within the fiscal year.

The Schedule D (Capital Gains and Losses) form also shares similarities with Schedule J. Both forms cater to specific subsets of taxpayers - Schedule D for individuals realizing gains or losses from the sale of assets, and Schedule J for farmers opting to average their income. Each form adjusts the taxpayer's income based on particular financial activities or strategies, influencing the overall tax calculation by considering either capital transaction outcomes or averaged farm income.

Similarly, the Schedule E (Supplemental Income and Loss) is akin to Schedule J in that it provides taxpayers with a method to report specific types of income. Schedule E is used for reporting income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. Like Schedule J, it's an adjunct form allowing for the detailed reporting of income that doesn't fit the standard wage or salary mold, thereby affecting tax liabilities by highlighting specialized income streams.

The Schedule F (Profit or Loss From Farming) form is particularly akin to Schedule J, as both directly serve farmers. Schedule F outlines the income and expenses related to farming, thereby calculating the profit or loss from farming activities. Its close relationship with Schedule J is found in its target demographic and its purpose to accurately reflect farm operations' financial realities in tax calculations. Together, they offer a comprehensive framework for farmers to report their income, with Schedule J providing an option to smooth out income variability.

The Schedule SE (Self-Employment Tax) form, while focusing on calculating the self-employment tax owed, shares an audience with Schedule J: individuals whose earnings primarily come from non-wage sources. Schedule SE is crucial for self-employed individuals, including farmers who may also file Schedule J, to report Social Security and Medicare taxes. Both forms facilitate accurate tax responsibility accounting for earnings that aren't subject to withholding by an employer, emphasizing the diverse income streams and tax scenarios self-employed individuals face.

The Form 4562 (Depreciation and Amortization) provides a mechanism for taxpayers to account for the depreciation and amortization of property, which is a concept somewhat parallel to the income averaging of Schedule J. Although serving different ends—Form 4562 deals with expensing asset depreciation over time, and Schedule J averages income—both allow taxpayers to spread the financial impact of significant business-related factors over multiple years, offering a more accurate picture of annual financial health.

The Schedule K-1 (Partner's Share of Income, Deductions, Credits, etc.) resembles Schedule J in that it is used by partners and S corporation shareholders to report their share of the business's income, deductions, credits, etc. Just like Schedule J allows individual farmers to smooth out their income reporting, Schedule K-1 ensures that individual business owners can account for their personal share of a business entity's financial activity, impacting their personal tax obligations with precision.

Lastly, Form 2210 (Underpayment of Estimated Tax by Individuals, Estates, and Trusts) shares a connection with Schedule J by addressing taxpayers' management of their tax payments throughout the year. While Form 2210 is used when taxpayers haven't paid enough taxes through withholding or estimated tax payments, it intersects with Schedule J’s purpose by potentially affecting how much tax is due each quarter when a farmer chooses to average their income. In essence, both documents are critical in planning and reconciling tax responsibilities to avoid underpayment penalties.

The Form 8824 (Like-Kind Exchanges) provides a way for taxpayers to defer recognizing a gain or loss on the exchange of certain types of property, which aligns with the purpose of Schedule J in terms of offering taxpayers a more favorable approach to reporting financial movement. Though Form 8824 deals with the specifics of property exchange and Schedule J with income averaging, both forms aim at reducing immediate tax burden by recognizing the continuity and long-term strategy in financial and operational decisions.

Dos and Don'ts

When preparing to fill out the IRS Schedule J Form 1040, which is pertinent to calculating tax over a specific period, it's crucial to approach the task with a keen attention to detail and thoroughness. Below are some essential dos and don'ts to bear in mind to ensure accuracy and compliance with IRS requirements.

Do:

- Ensure all information from your Form 1040 matches the details you provide on Schedule J. Consistency between forms is vital for accuracy and to prevent processing delays.

- Gather all necessary documents related to your income, deductions, and credits before starting. This upfront preparation will streamline the process and reduce the likelihood of mistakes.

- Use the IRS instructions for Schedule J as a guide. The IRS provides detailed instructions that can clarify what amounts need to be reported and how to calculate them.

- Consider using tax software or consulting with a tax professional if you're unsure about how to complete the form. Their expertise can be invaluable and might help you avoid common pitfalls.

- Double-check your calculations and the information you provide. Simple errors in arithmetic or transposed numbers can lead to discrepancies and potentially trigger an audit.

Don't:

- Estimate amounts. It is important to use exact numbers from your financial records. Estimations can lead to inaccuracies and potential issues with the IRS.

- Ignore IRS notices or instructions. If you receive any communication from the IRS, particularly regarding Schedule J, respond promptly and carefully follow any instructions provided.

- Forget to sign and date the form. An unsigned form is considered incomplete and will not be processed until corrected, delaying any refund or processing.

- Fill out the form without reviewing the previous year's return. Comparing with last year's return can help ensure consistency and completeness in reporting.

- Overlook the necessity to amend a previously submitted Schedule J if you discover errors or omissions after filing. It's better to correct mistakes as soon as possible to avoid possible penalties.

Misconceptions

The Internal Revenue Service (IRS) Schedule J (Form 1040) is often misunderstood, leading to confusion and potential errors when individuals file their taxes. By clarifying these misconceptions, taxpayers can more accurately navigate their tax obligations. Below are nine common misconceptions about IRS Schedule J:

Schedule J is for everyone. A prevalent misconception is that all taxpayers must fill out Schedule J. In reality, Schedule J is specifically designed for calculating taxes for certain farmers and fishermen. It is not applicable to the majority of taxpayers.

It's too complicated for individuals to complete on their own. While Schedule J does involve specific calculations, including the averaging of income over three years, with the proper guidance and resources, individuals can complete it without professional help. The IRS provides instructions and free resources to assist.

Using Schedule J will automatically trigger an audit. Some taxpayers avoid using Schedule J due to the fear of an audit. However, using Schedule J appropriately, by itself, does not increase the likelihood of an audit. The IRS uses multiple factors to determine which tax returns to audit.

Income from all sources is eligible for averaging on Schedule J. This is incorrect. Schedule J is designed specifically for the averaging of income from farming and fishing. Income from other sources must be reported through the regular channels on the tax return.

Farmers and fishermen must always use Schedule J. Another misunderstanding is the compulsory use of Schedule J for farmers and fishermen. While it can offer tax benefits by potentially lowering the tax liability through income averaging, it's not always advantageous or obligatory for every farmer or fisherman.

Schedule J affects state tax returns. The reality is that Schedule J is a federal tax form and does not directly affect state tax liabilities. State tax obligations can be influenced by federal taxable income, but the specifics of Schedule J averaging do not directly apply to state taxes.

Amending a prior year's tax return is not possible after using Schedule J. Taxpayers retain the right to amend prior year tax returns regardless of whether Schedule J was used. If errors are discovered or tax situations change, amending the return is an available recourse.

Only individual taxpayers can file Schedule J. This statement is misleading. While Schedule J is prepared in conjunction with Form 1040, which is an individual tax return form, estates and trusts can also use Schedule J to average their farming or fishing income.

All losses are treated equally on Schedule J. Schedule J specifically deals with income averaging for tax calculation purposes. Not all types of losses can be averaged in the same way as income. Losses have specific treatments under tax law, and not all can be applied or averaged using Schedule J.

Understanding these distinctions about Schedule J is crucial for taxpayers who wish to utilize this form correctly. Misinterpretations can lead to missed opportunities for tax savings or, conversely, complications with tax liabilities. Taxpayers should carefully evaluate their eligibility and the potential benefits or drawbacks of using Schedule J, considering consulting with a tax professional for personalized advice.

Key takeaways

Filling out and using the IRS Schedule J (Form 1040) involves several key takeaways crucial for individuals seeking to accurately report their income tax, especially when their earnings fluctuate throughout the tax year. This document is particularly relevant for those who have income that is not consistent month-to-month.

- Schedule J is used to calculate tax based on an average income over the past few years for those who experience significant fluctuation in annual income. This method can often result in a lower tax liability compared to the standard method.

- This form is applicable for individuals, including sole proprietors, who may have income from farming or fishing, as these types of earnings typically vary greatly from year to year.

- When filling out Schedule J, you will need detailed financial records from the past three years. This documentation is essential for accurately reporting your income and calculating your tax using the averaging method.

- Note that electing to use Schedule J for your taxes might impact eligibility for certain credits and deductions. It’s important to weigh the benefits of potentially reduced tax against possibly losing out on some tax benefits.

- Completing Schedule J requires careful attention to detail. Mistakes on this form can lead to processing delays or even an audit. It’s advisable to consult with a tax professional if you are unsure about how to proceed.

- Electing to use Schedule J is not permanent. Taxpayers have the flexibility to choose whether or not to use it each tax year, depending on which method is most beneficial for their situation.

Successfully navigating the IRS Schedule J (Form 1040) can help individuals with fluctuating incomes significantly manage their tax liabilities. Keeping detailed financial records and considering the potential impacts on deductions and credits are critical steps in this process. As with any tax document, seeking the advice of a tax professional can provide valuable guidance tailored to an individual’s specific financial situation.

Popular PDF Documents

What Is Severance Tax - Tips to ensure accurate severance tax filing in Colorado, including common pitfalls and how to avoid them.

What Are the 4 Due Diligence Requirements - IRS 8867 leverages a series of yes or no questions to guide preparers through the verification process efficiently.