Get Irs Schedule F Form

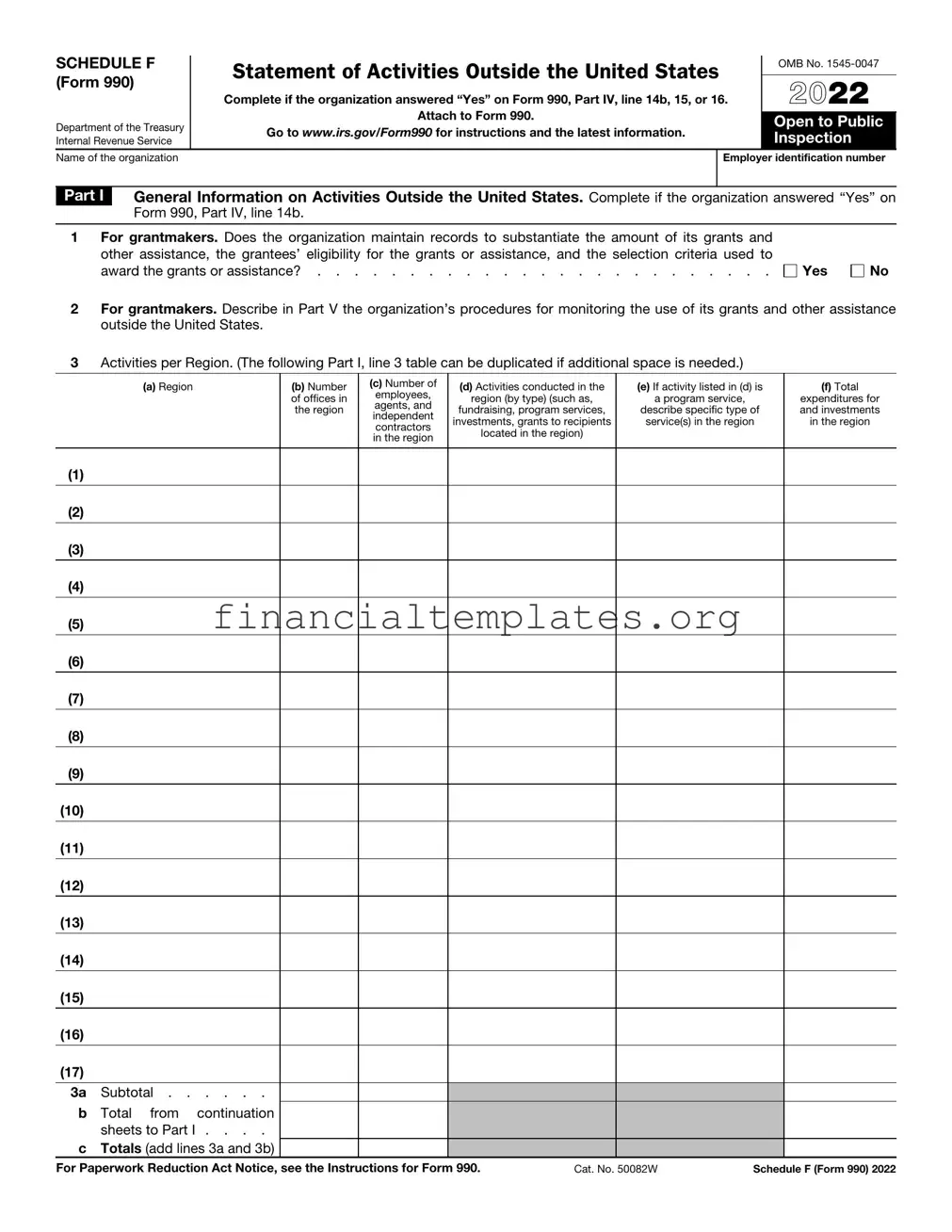

The IRS Schedule F (Form 990) is an essential document for organizations that engage in activities outside the United States, offering a structured way to report such activities to the Department of the Treasury. Required for organizations that answer "Yes" on Form 990, Part IV, lines 14b, 15, or 16, this form covers a wide range of information regarding an organization's international operations. This includes general information on activities conducted outside of the U.S., detailed reporting on grants and other assistance provided to organizations, entities, and individuals abroad, as well as any ownership interests or transactions with foreign corporations, foreign trusts, foreign partnerships, and any operations in or related to boycotting countries. The form also delves into the methods used for monitoring the use and disbursement of grants and assistance, and the procedures in place to ensure compliance and proper use of funds. Through Schedule F, the IRS aims to ensure transparency and accountability of U.S.-based organizations' international activities, while also providing the public open access to this information for inspection, demonstrating the interconnectedness of global philanthropy and the stringent guidelines that govern it.

Irs Schedule F Example

SCHEDULE F |

STATEMENT OF ACTIVITIES OUTSIDE THE UNITED STATES |

OMB No. |

|||

(Form 990) |

2022 |

||||

|

|

||||

|

|

Complete if the organization answered “Yes” on Form 990, Part IV, line 14b, 15, or 16. |

|||

|

|

Attach to Form 990. |

|

||

Department of the Treasury |

Open to Public |

||||

Go to WWW.IRS.GOV/FORM990 for instructions and the latest information. |

|||||

Inspection |

|||||

Internal Revenue Service |

|||||

|

|

||||

Name of the organization |

|

Employer identification number |

|||

|

|

|

|||

Part I |

General Information on Activities Outside the United States. Complete if the organization answered “Yes” on |

||||

|

Form 990, Part IV, line 14b. |

|

|||

|

|

|

|

|

|

1For grantmakers. Does the organization maintain records to substantiate the amount of its grants and other assistance, the grantees’ eligibility for the grants or assistance, and the selection criteria used to award the grants or assistance? . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

2For grantmakers. Describe in Part V the organization’s procedures for monitoring the use of its grants and other assistance outside the United States.

3Activities per Region. (The following Part I, line 3 table can be duplicated if additional space is needed.)

|

(a) Region |

|

(b) Number |

(c) Number of |

(d) Activities conducted in the |

(e) If activity listed in (d) is |

(f) Total |

|

|

employees, |

|||||

|

|

|

of offices in |

region (by type) (such as, |

a program service, |

expenditures for |

|

|

|

|

agents, and |

||||

|

|

|

the region |

fundraising, program services, |

describe specific type of |

and investments |

|

|

|

|

independent |

||||

|

|

|

|

investments, grants to recipients |

service(s) in the region |

in the region |

|

|

|

|

|

contractors |

|||

|

|

|

|

located in the region) |

|

|

|

|

|

|

|

in the region |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(11) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(13) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(14) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(15) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(16) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(17) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3a |

Subtotal |

|

|

|

|

|

|

b |

Total from |

continuation |

|

|

|

|

|

|

sheets to Part I . . . . |

|

|

|

|

|

|

c Totals (add lines 3a and 3b) |

|

|

|

|

|

||

For Paperwork Reduction Act Notice, see the Instructions for Form 990. |

Cat. No. 50082W |

Schedule F (Form 990) 2022 |

Schedule F (Form 990) 2022 |

|

|

|

|

|

|

|

Page 2 |

||

|

|

|

|

|

|

|

|

|

|

|

Part II |

Grants and Other Assistance to Organizations or Entities Outside the United States. Complete if the organization answered “Yes” on Form 990, |

|||||||||

|

Part IV, line 15, for any recipient who received more than $5,000. Part II can be duplicated if additional space is needed. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

1 (a) Name of |

|

(b) IRS code |

(c) Region |

(d) Purpose of |

(e) Amount of |

(f) Manner of |

(g) Amount of |

(h) Description |

(i) Method of |

|

organization |

|

section and EIN |

|

grant |

cash grant |

cash |

noncash |

of noncash assistance |

valuation |

|

|

|

|

(if applicable) |

|

|

|

disbursement |

assistance |

|

(book, FMV, |

|

|

|

|

|

|

|

|

|

|

appraisal, other) |

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

|

|

|

|

(3) |

|

|

|

|

|

|

|

|

|

|

(4) |

|

|

|

|

|

|

|

|

|

|

(5) |

|

|

|

|

|

|

|

|

|

|

(6) |

|

|

|

|

|

|

|

|

|

|

(7) |

|

|

|

|

|

|

|

|

|

|

(8) |

|

|

|

|

|

|

|

|

|

|

(9) |

|

|

|

|

|

|

|

|

|

|

(10) |

|

|

|

|

|

|

|

|

|

|

(11) |

|

|

|

|

|

|

|

|

|

|

(12) |

|

|

|

|

|

|

|

|

|

|

(13) |

|

|

|

|

|

|

|

|

|

|

(14) |

|

|

|

|

|

|

|

|

|

|

(15) |

|

|

|

|

|

|

|

|

|

|

(16) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2Enter total number of recipient organizations listed above that are recognized as charities by the foreign country, recognized as a tax

|

exempt 501(c)(3) organization by the IRS, or for which the grantee or counsel has provided a section 501(c)(3) equivalency letter . . |

▶ |

3 |

Enter total number of other organizations or entities |

▶ |

Schedule F (Form 990) 2022

Schedule F (Form 990) 2022Page 3

Part III Grants and Other Assistance to Individuals Outside the United States. Complete if the organization answered “Yes” on Form 990, Part IV, line 16.

Part III can be duplicated if additional space is needed.

(a) Type of grant or assistance |

(b) Region |

(c) Number of |

(d) Amount of |

(e) Manner of |

(f) Amount of |

(g) Description |

(h) Method of |

|

|

recipients |

cash grant |

cash |

noncash |

of noncash assistance |

valuation |

|

|

|

|

disbursement |

assistance |

|

(book, FMV, |

|

|

|

|

|

|

|

appraisal, other) |

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(11) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(13) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(14) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(15) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(16) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(17) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(18) |

|

|

|

|

|

|

|

Schedule F (Form 990) 2022

Schedule F (Form 990) 2022 |

Page 4 |

|

|

|

|

Part IV |

Foreign Forms |

|

1Was the organization a U.S. transferor of property to a foreign corporation during the tax year? If “Yes,” the organization may be required to file Form 926, Return by a U.S. Transferor of Property to a Foreign

Corporation (see Instructions for Form 926) . . . . . . . . . . . . . . . . . . . . .

2Did the organization have an interest in a foreign trust during the tax year? If “Yes,” the organization may

be required to separately file Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, and/or Form

3Did the organization have an ownership interest in a foreign corporation during the tax year? If “Yes,” the organization may be required to file Form 5471, Information Return of U.S. Persons With Respect to

Certain Foreign Corporations (see Instructions for Form 5471) . . . . . . . . . . . . . .

4Was the organization a direct or indirect shareholder of a passive foreign investment company or a

qualified electing fund during the tax year? If “Yes,” the organization may be required to file Form 8621, Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund (see Instructions for Form 8621) . . . . . . . . . . . . . . . . . . . . . .

5Did the organization have an ownership interest in a foreign partnership during the tax year? If “Yes,”

the organization may be required to file Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships (see Instructions for Form 8865) . . . . . . . . . . . . . . . . .

6Did the organization have any operations in or related to any boycotting countries during the tax year? If “Yes,” the organization may be required to separately file Form 5713, International Boycott Report (see Instructions for Form 5713; don't file with Form 990) . . . . . . . . . . . . . . . . . .

Yes

Yes

Yes

Yes

Yes

Yes

No

No

No

No

No

No

Schedule F (Form 990) 2022

Schedule F (Form 990) 2022 |

Page 5 |

|

|

|

|

Part V |

Supplemental Information |

|

Provide the information required by Part I, line 2 (monitoring of funds); Part I, line 3, column (f) (accounting method; amounts of investments vs. expenditures per region); Part II, line 1 (accounting method); Part III (accounting method); and Part III, column (c) (estimated number of recipients), as applicable. Also complete this part to provide any additional information. See instructions.

Schedule F (Form 990) 2022

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | Schedule F is completed by organizations that engage in activities outside the United States as part of their operations. |

| Form Attachment | This form is an attachment to Form 990, which is the reporting form used by tax-exempt organizations to provide the IRS with the annual financial information. |

| Public Inspection | The completed Schedule F, like Form 990, is open to public inspection, emphasizing transparency in the operation of tax-exempt entities. |

| Part I General Information | This section collects detailed information about the organization's activities in each region outside the United States, including grants, offices, investments, and more. |

| Grants and Assistance | Parts II and III of Schedule F focus on grants and other forms of assistance to organizations, entities, and individuals outside the United States, specifying the amount, purpose, and method of disbursement. |

| Foreign Forms | Part IV requires disclosure of any interactions that may necessitate the filing of additional forms related to foreign corporations, partnerships, trusts, or transactions. |

| Supplemental Information | Part V is reserved for providing additional details about the organization's foreign activities not covered in other sections, including monitoring and accounting methods. |

| Documentation and Record Keeping | Organizations must maintain records to substantiate their activities, including grants and other assistance given abroad, to comply with IRS requirements. |

| OMB Number | The Office of Management and Budget (OMB) number for Schedule F is 1545-0047, which is a part of the standard identification for forms used by the IRS and other government agencies. |

Guide to Writing Irs Schedule F

Filling out the IRS Schedule F form is an important task for organizations that operate internationally. This form is a way to report activities outside the United States and is necessary for organizations that have answered "Yes" on certain lines of Form 990. The process might seem complex, but breaking it down into steps can make it manageable. In addition to following these steps, it's also crucial to consult the form's official instructions for detailed guidance on each part.

- Start by confirming that your organization needs to fill out Schedule F. If you answered "Yes" on Form 990, Part IV, lines 14b, 15, or 16, you need to complete this form.

- Enter the Name of the organization and its Employer identification number at the top of the form.

- Part I: General Information on Activities Outside the United States.

- If you’re a grantmaker, answer whether your organization maintains records to substantiate grants and other assistance (line 1).

- Describe your organization's procedures for monitoring use of grants and other assistance outside the U.S. in Part V, as instructed in line 2.

- For line 3, list each region where your organization operates. You'll need to include information such as the number of offices, type of activities conducted, total expenditures, and employees or agents in the region.

- Fill in the subtotal (line 3a), total from continuation sheets (line 3b), and calculate the combined total (line 3c).

- Part II: Grants and Other Assistance to Organizations or Entities Outside the United States.

- Complete this part if your organization answered "Yes" on Form 990, Part IV, line 15, for any recipient who received more than $5,000. List each organization or entity, the purpose of grant, amount, and method of assistance.

- For lines 1 and 2, provide detailed information about each recipient organization, including name, IRS code section, region, and amount of assistance.

- Calculate the total number of recipient organizations and other entities and enter these totals on lines 2 and 3.

- Part III: Grants and Other Assistance to Individuals Outside the United States. Complete this part if "Yes" was the answer on Form 990, Part IV, line 16.

- List each type of grant or assistance, region, number of recipients, amount, and method of disbursement.

- Provide details for each type of noncash assistance and the method of valuation.

- Part IV: Foreign Forms. Answer questions related to transactions with foreign entities, interests in foreign trusts or corporations, and operations related to boycotting countries.

- Part V: Supplemental Information. Use this part to provide required details from previous sections and any additional information that the form requires or allows you to include.

- Review all information for accuracy and completeness. Make sure every applicable part and line of the form has been addressed.

- Attach Schedule F to Form 990 and submit it by the Form 990 deadline.

While filling out Schedule F, careful attention to detail is necessary to ensure all international activities are properly reported. This form allows the IRS and the public to understand the extent of an organization's global operations. If any sections do not apply to your organization’s activities, simply leave them blank. For complex situations, consider seeking guidance from a professional experienced in nonprofit tax filing.

Understanding Irs Schedule F

Frequently Asked Questions about IRS Schedule F:

- What is IRS Schedule F?

Schedule F is a document required by the IRS, specifically attached to Form 990. It's designed for organizations to report their activities outside the United States if they answered "Yes" to certain questions on Form 990, Part IV - specifically lines 14b, 15, or 16. This form allows the IRS to evaluate the extent and nature of an organization's international activities, including grants and other types of assistance provided abroad.

- Who needs to file Schedule F with their Form 990?

Organizations that engage in activities outside the United States as part of their operations are required to complete and attach Schedule F to their Form 990. This includes, but isn't limited to, organizations that make grants to individuals or entities in foreign countries, have offices or employees overseas, or make investments in foreign regions. The determination of whether you need to file this schedule is made based on answers to specific questions in Form 990, Part IV.

- What information is required on Schedule F?

The form is divided into several parts wherein the organization discloses:

- General information about its activities in each region outside the United States, including the types of activities, the number of offices or agents, and expenditures in each region.

- Details on grants and other assistance to organizations or entities outside the U.S., including the amounts disbursed, the manner of disbursement, and the purpose of the grant.

- Information pertaining to grants and assistance to individuals outside the U.S., specifying the type of assistance, number of recipients, and amount of cash or non-cash assistance provided.

- Supplemental information that provides additional context or details not covered in the earlier sections of the schedule.

- How does an organization monitor the use of its grants and other assistance outside the United States?

Organizations are required to maintain records that substantiate the amount of grants and other assistance, verify the grantees' eligibility, and document the criteria used for selecting recipients. Part V of Schedule F requires organizations to describe their procedures for monitoring the use of funds. These procedures often include regular reporting from the grantee, site visits, independent audits, or other methods to ensure the funds are used as intended and comply with both the organization's objectives and IRS regulations.

Common mistakes

When it comes to managing the complexities of tax forms, ensuring accuracy is key—especially with the IRS Schedule F form, which details activities outside the United States. Here are five common mistakes people make that can lead to misunderstandings or delays with the IRS:

Overlooking Required Attachments: Many filers forget that Schedule F is an attachment to Form 990, not a standalone document. This oversight can lead to incomplete submissions, as the IRS expects these forms to be filed together.

Incorrectly Reporting Activities: Detailing your organization's activities outside the U.S. requires precision. A common blunder is misreporting the nature or scope of these activities, which can range from grantmaking to direct services. This could not only muddy the waters for tax purposes but also impact the organization's reported accomplishments.

Failing to Properly Describe Monitoring Procedures: Part I, line 2 of Schedule F asks organizations to describe how they monitor the use of grants and other assistance abroad. Vague or incomplete descriptions here can raise red flags with the IRS about the organization's oversight of its funds.

Not Accurately Listing All Regions and Expenditures: Organizations must list each region where activities are conducted and report related expenditures. Overlooking regions or misreporting expenses can lead to inaccuracies in understanding the organization's reach and financial flows.

Mishandling the Value of Noncash Assistance: Determining the value of noncash assistance can be tricky, yet it's critical for accurate reporting. Using inappropriate methods to value these items, or simply guessing, can significantly skew the total assistance value reported to the IRS.

Avoiding these mistakes requires a careful review of the form instructions and a deep understanding of your organization's international activities. When in doubt, consulting with a tax professional who has expertise in non-profit operations can provide clarity and help ensure your filings are both accurate and compliant.

Documents used along the form

When an organization completes the IRS Schedule F form, which details their activities and financial engagements outside the United States, it often needs to provide additional documentation to give a full picture of its international operations. Here is a list of documents and forms that are frequently used alongside the Schedule F form:

- Form 990: This is the base form that the Schedule F attaches to, providing a comprehensive overview of the organization’s financial health, activities, governance, and compliance with tax regulations.

- Form 926: Titled "Return by a U.S. Transferor of Property to a Foreign Corporation," this form is needed if the organization transferred property to a foreign corporation, as indicated in Part IV of the Schedule F form. It helps ensure that any property transfers are properly reported and taxed.

- Form 3520: The "Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts" is required if the organization had dealings with a foreign trust or received large gifts from foreign entities. It ensures transparency in these types of international transactions.

- Form 5471: Named "Information Return of U.S. Persons With Respect to Certain Foreign Corporations," this form is essential for organizations that have an interest in or control over foreign corporations, providing details about the corporation's finances and operations.

- Form 8865: The "Return of U.S. Persons With Respect to Certain Foreign Partnerships" must be filed by organizations that either control or have a significant interest in a foreign partnership. This form collects information about the partnership's activities and financial situation.

Collecting and filing these documents alongside the Schedule F form can be an involved process but it's crucial for maintaining compliance with U.S. tax laws and regulations. By ensuring all necessary paperwork is accurately completed and submitted, organizations can avoid potential issues with the IRS and provide a clear account of their international activities.

Similar forms

The IRS Form 926, "Return by a U.S. Transferor of Property to a Foreign Corporation," resembles the Schedule F in its focus on international transactions. Form 926 is required when a U.S. person transfers property to a foreign corporation, detailing the nature and value of the property transferred. This form ensures compliance with U.S. tax laws on international transfers, similar to how Schedule F tracks activities and financial assistance outside the United States, highlighting the IRS's effort to monitor and regulate international financial activities.

Form 3520, "Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts," shares similarities with Schedule F through its emphasis on reporting international financial dealings. This form is used to report transactions with foreign trusts, large gifts, or bequests from foreign entities. Like Schedule F, Form 3520 helps the IRS keep track of money moving across borders, ensuring that individuals and entities comply with U.S. tax obligations related to international activities.

Further paralleling Schedule F, Form 5471, "Information Return of U.S. Persons With Respect to Certain Foreign Corporations," is mandated for U.S. persons who are officers, directors, or shareholders in certain foreign corporations. It serves a similar purpose by requiring detailed reporting of the filer's relationship with the foreign corporation, the corporation's activities, and its financial condition. This enhances transparency and enforces U.S. tax laws on foreign income and operations, akin to how Schedule F addresses activities outside the U.S.

The requirement for Form 8621, "Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund," similarly aligns with Schedule F through the lens of international investment activity. Form 8621 is necessary for taxpayers who hold investments in passive foreign investment companies (PFICs), to report income and gains from these entities. Like Schedule F, Form 8621 aids in ensuring U.S. taxpayers properly report and tax their foreign income, maintaining accountability for overseas investments.

Form 8865, "Return of U.S. Persons With Respect to Certain Foreign Partnerships," is akin to Schedule F in its international purview. Required from U.S. persons who have an interest in, or authority over, a foreign partnership, this form involves reporting the partnership's activities, partners, and financial details. It mirrors the intent of Schedule F by monitoring U.S. entities' involvement in international operations, maintaining oversight on how these activities affect U.S. tax obligations.

Lastly, Form 5713, "International Boycott Report," shares a common ground with Schedule F concerning international regulations and compliance. This form is utilized by taxpayers involved in, or related to, operations in boycotting countries, requiring detailed reporting on the nature and extent of these activities. Similar to Schedule F’s goal of transparency in international dealings, Form 5713 aims to enforce U.S. laws and policies regarding participation in international boycotts, underlining the IRS’s role in regulating cross-border economic activities.

Dos and Don'ts

When filling out the IRS Schedule F form, part of the larger Form 990 reporting requirements for organizations operating internationally, it's crucial to approach the task with attention to detail and adherence to IRS guidelines. This form provides the IRS with details on an organization's activities outside the United States, including grants and other assistance. Below is a list of dos and don'ts to help ensure the accurate and compliant completion of Schedule F.

- Do thoroughly review the instructions provided by the IRS for completing Schedule F. The IRS offers detailed guidelines that can help clarify what information is needed for each part.

- Do accurately report all activities conducted outside the United States. This includes specifying the region, types of activities, and financial details related to these operations.

- Do maintain and prepare detailed records. This is crucial for substantiating the amounts of grants and other assistance reported, as well as the eligibility of the grantees.

- Do use the correct method of valuation for any noncash assistance provided, ensuring to adhere to the options specified in the form such as book value, fair market value (FMV), appraisal, or other.

- Don't overlook the supplemental information part (Part V). Use this section to provide required additional details or explanations not covered in other sections of the form.

- Don't guess or estimate figures. Use accurate financial records to report expenditures, investments, and amounts of assistance provided.

- Don't ignore columns that apply to your organization's international activities. Each column in the forms provides important information that helps the IRS understand your organization's scope of operations.

- Don't forget to attach Schedule F to Form 990 when submitting. The form is an integral part of reporting for organizations with activities outside the United States.

Adherence to these dos and don'ts can assist in the accurate completion of Schedule F, ensuring compliance with IRS regulations and helping present your organization's international activities transparently and comprehensively.

Misconceptions

Understanding the IRS Schedule F form is crucial for organizations that engage in activities outside the United States. However, there are several misconceptions that can lead to confusion. Let's clarify these misconceptions to ensure accurate completion and compliance.

Misconception 1: Schedule F is only for large organizations. In reality, size doesn't matter when it comes to filling out Schedule F. Any organization that answers "Yes" on Form 990, Part IV, lines 14b, 15, or 16, regardless of its size, must complete and attach Schedule F to Form 990.

Misconception 2: Only direct grants need to be reported. This is not entirely true. While direct grants are a focal point, Schedule F also requires reporting on other forms of assistance to organizations or individuals outside the United States. This can include non-cash assistance, and organizations need to provide details on the method of valuation for such assistance.

Misconception 3: All foreign activities must be reported individually. Organizations are not required to report every single foreign activity individually. Instead, they report activities by region, and significant activities or grants might necessitate more detailed descriptions or explanations in Part V of the schedule.

Misconception 4: If an organization only has minimal foreign activity, it doesn't need to complete Schedule F. The threshold for reporting is not based on the scale of the foreign activities but rather on the presence of any foreign activities fitting the criteria set in Form 990, Part IV. Even minimal activities outside the United States require accurate reporting on Schedule F.

Misconception 5: The purpose of grants or assistance is not important, only the amounts. Both the purpose and the amount of grants or other assistance are crucial for Schedule F. Organizations must detail not only how much was given but also the purpose of the grant or assistance to provide a clear understanding of their activities outside the U.S.

Misconception 6: Schedule F filing is independent of other IRS forms. Actually, the filing of Schedule F can require the filing of additional forms, as detailed in Part IV of Schedule F. For instance, if an organization transfers property to a foreign corporation, it may need to file Form 926. The completion of Schedule F should be considered within the broader context of an organization’s overall filing obligations.

Clearing up these misconceptions helps organizations accurately report their foreign activities and ensures they remain compliant with IRS regulations. Remember, when in doubt, consulting with a professional knowledgeable in nonprofit tax law can be invaluable.

Key takeaways

Filling out and utilizing the IRS Schedule F form is a crucial process for organizations engaging in activities outside the United States. Here are seven key takeaways to guide you through this process:

- Organizations must complete Schedule F if they answer "Yes" to specific questions on Form 990, Part IV, regarding activities outside the U.S. This ensures transparency and compliance with IRS regulations.

- Part I of Schedule F requires detailed information about your organization's activities in various regions, including the number of offices and employees, types of activities conducted, and financial investments in those regions.

- For grantmakers, it's essential to maintain records that substantiate the grants and assistance provided, confirming grantees' eligibility and the criteria used for selection. This documentation must demonstrate accountability and proper use of funds.

- In Part II, organizations providing grants and other assistance to entities outside the U.S., where any recipient receives more than $5,000, must furnish details such as the recipient's name, grant purpose, and the amount of assistance.

- Part III addresses grants and other assistance to individuals outside the United States, requiring information on the type of assistance, number of recipients, and methodology of disbursement and valuation.

- Depending on your organization's international financial interactions, you may be required to file additional forms concerning property transfer to foreign corporations, interests in foreign trusts, corporations, partnerships, or operations related to boycotting countries.

- The Supplemental Information part, Part V, provides space for clarifications or additional details regarding the monitoring of funds, accounting methods used, and any other pertinent information not covered in the previous sections.

Understanding and accurately completing Schedule F is essential for organizations to ensure compliance with IRS requirements and to provide a clear view of their international operations. This process underscores the importance of maintaining detailed records and being forthcoming about activities beyond U.S. borders.

Popular PDF Documents

Mied - Insights into the loan's operational guidelines, like direct payment to institutions, underscore an emphasis on transparency and direct application of funds.

Uncollected Social Security and Medicare Tax on Wages - This form is a critical step for workers seeking to rectify their employment status and ensure they're in compliance with IRS rules.

Irs Power of Attorney - Serves as a safeguard for taxpayers ensuring that their tax responsibilities are managed effectively and timely.