Get IRS Schedule D 1040 or 1040-SR Form

Filing taxes can seem overwhelming, especially when capital gains or losses come into play. That's where IRS Schedule D for the 1040 or 1040-SR form steps in, serving as a crucial document for many taxpayers. This form is designed to report the sale or exchange of capital assets, not only simplifying the process but also ensuring that individuals pay the right amount of taxes on their investments. It encompasses everything from stocks and bonds to real estate properties, capturing both short-term transactions, which are taxed at higher ordinary income tax rates, and long-term transactions, which benefit from lower tax rates. By accurately filling out this form, taxpayers can also identify opportunities for tax savings, such as capital loss deductions. Moreover, the form plays a pivotal role in tax planning and management, providing a detailed record of investment activity over the fiscal year. Navigating through Schedule D requires careful attention to detail to accurately report each transaction and avoid common pitfalls that could lead to audits or penalties.

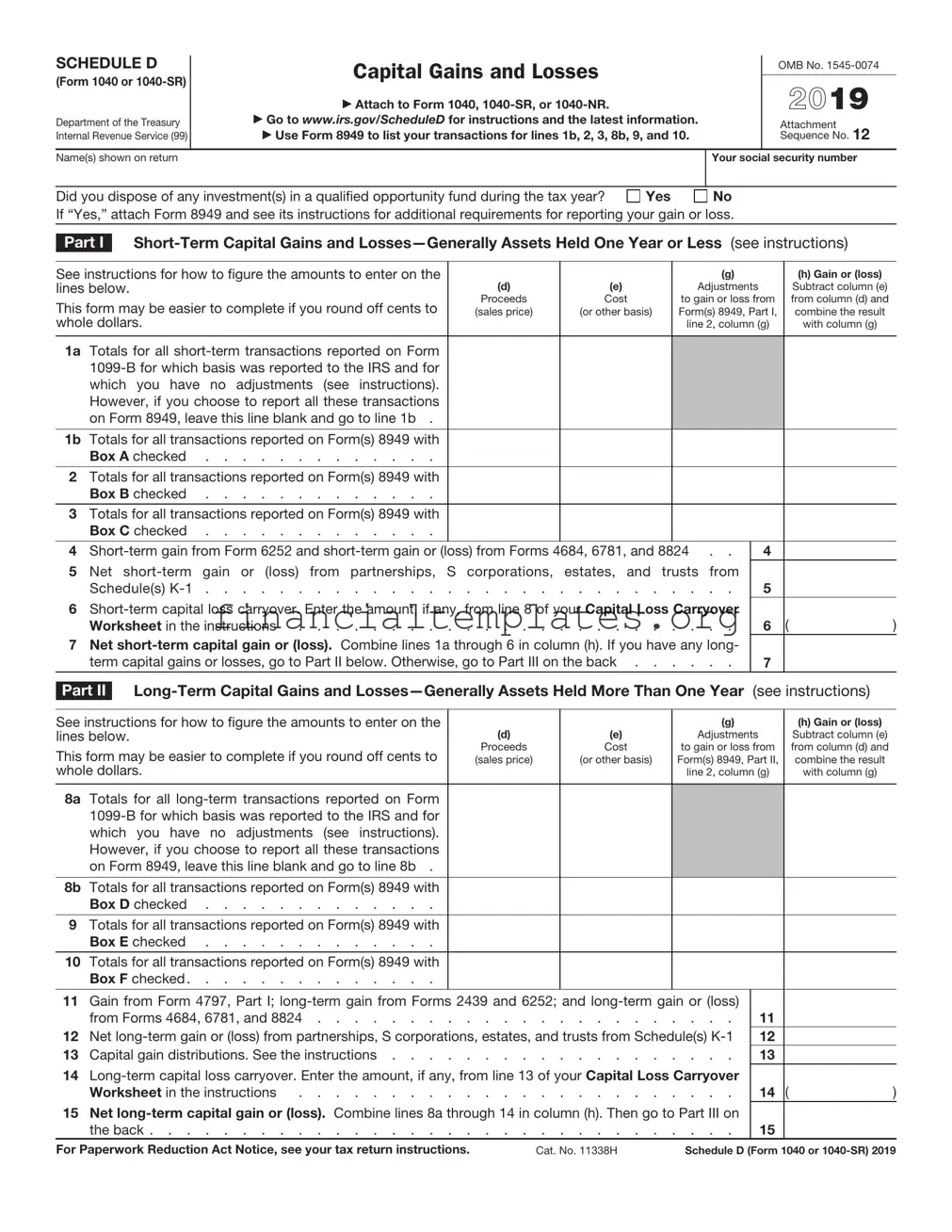

IRS Schedule D 1040 or 1040-SR Example

SCHEDULE D |

|

Capital Gains and Losses |

|

|

|

|

|

OMB No. |

|||||||

|

|

|

|

|

|

||||||||||

(Form 1040) |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

2021 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

▶ Attach to Form 1040, |

|

|

|

|

|

|

||||

Department of the Treasury |

|

▶ Go to www.irs.gov/ScheduleD for instructions and the latest information. |

|

|

Attachment |

12 |

|||||||||

|

▶ Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. |

|

|

||||||||||||

Internal Revenue Service (99) |

|

|

|

Sequence No. |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name(s) shown on return |

|

|

|

|

|

|

Your social security number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? |

Yes |

|

No |

|

|

|

|

||||||||

If “Yes,” attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. |

|

|

|

|

|||||||||||

|

|

|

|

||||||||||||

Part I |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

See instructions for how to figure the amounts to enter on the |

|

|

|

|

(g) |

|

|

(h) Gain or (loss) |

|||||||

lines below. |

|

|

|

(d) |

(e) |

|

Adjustments |

|

|

Subtract column (e) |

|||||

This form may be easier to complete if you round off cents to |

Proceeds |

Cost |

|

to gain or loss from |

from column (d) and |

||||||||||

(sales price) |

(or other basis) |

Form(s) 8949, Part I, |

combine the result |

||||||||||||

whole dollars. |

|

|

|

|

|

line 2, column (g) |

with column (g) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

1a |

Totals for all |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

which you have no adjustments (see instructions). |

|

|

|

|

|

|

|

|

|

|

||||

|

However, if you choose to report all these transactions |

|

|

|

|

|

|

|

|

|

|

||||

|

on Form 8949, leave this line blank and go to line 1b . |

|

|

|

|

|

|

|

|

|

|

||||

1b |

Totals for all transactions reported on Form(s) 8949 with |

|

|

|

|

|

|

|

|

|

|

||||

|

Box A checked |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

2 |

Totals for all transactions reported on Form(s) 8949 with |

|

|

|

|

|

|

|

|

|

|

||||

|

Box B checked |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

3 |

Totals for all transactions reported on Form(s) 8949 with |

|

|

|

|

|

|

|

|

|

|

||||

|

Box C checked |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||||||

4 |

|

4 |

|

|

|||||||||||

5 |

Net |

|

|

|

|

|

|||||||||

|

Schedule(s) |

. . . |

|

5 |

|

|

|||||||||

6 |

|

|

|

( |

) |

||||||||||

|

Worksheet in the instructions |

. . . |

|

6 |

|||||||||||

7 |

Net |

|

|

|

|

|

|||||||||

|

term capital gains or losses, go to Part II below. Otherwise, go to Part III on the back . . . |

. . . |

|

7 |

|

|

|||||||||

|

|

||||||||||||||

Part II |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||

See instructions for how to figure the amounts to enter on the |

|

|

|

|

(g) |

|

|

(h) Gain or (loss) |

|||||||

lines below. |

|

|

|

(d) |

(e) |

|

Adjustments |

|

|

Subtract column (e) |

|||||

This form may be easier to complete if you round off cents to |

Proceeds |

Cost |

|

to gain or loss from |

from column (d) and |

||||||||||

(sales price) |

(or other basis) |

Form(s) 8949, Part II, |

combine the result |

||||||||||||

whole dollars. |

|

|

|

|

|

line 2, column (g) |

with column (g) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

8a |

Totals for all |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

which you have no adjustments (see instructions). |

|

|

|

|

|

|

|

|

|

|

||||

|

However, if you choose to report all these transactions |

|

|

|

|

|

|

|

|

|

|

||||

|

on Form 8949, leave this line blank and go to line 8b . |

|

|

|

|

|

|

|

|

|

|

||||

8b |

Totals for all transactions reported on Form(s) 8949 with |

|

|

|

|

|

|

|

|

|

|

||||

|

Box D checked |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

9 |

Totals for all transactions reported on Form(s) 8949 with |

|

|

|

|

|

|

|

|

|

|

||||

|

Box E checked |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

10 |

Totals for all transactions reported on Form(s) 8949 with |

|

|

|

|

|

|

|

|

|

|

||||

|

Box F checked |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||||||

11 |

Gain from Form 4797, Part I; |

|

|

|

|

|

|||||||||

|

from Forms 4684, 6781, and 8824 |

. . . |

|

11 |

|

|

|||||||||

12 |

Net |

|

12 |

|

|

||||||||||

13 |

Capital gain distributions. See the instructions |

. . . |

|

13 |

|

|

|||||||||

14 |

|

|

|

( |

) |

||||||||||

|

Worksheet in the instructions |

. . . |

|

14 |

|||||||||||

15 |

Net |

|

|

|

|

|

|||||||||

|

on the back |

. . . |

|

15 |

|

|

|||||||||

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 11338H |

Schedule D (Form 1040) 2021 |

Schedule D (Form 1040) 2021 |

Page 2 |

|

|

Summary |

|

Part III |

|

|

16 Combine lines 7 and 15 and enter the result . . . . . . . . . . . . . . . . . .

•If line 16 is a gain, enter the amount from line 16 on Form 1040,

•If line 16 is a loss, skip lines 17 through 20 below. Then, go to line 21. Also be sure to complete line 22.

•If line 16 is zero, skip lines 17 through 21 below and enter

17Are lines 15 and 16 both gains?

Yes. Go to line 18.

Yes. Go to line 18.

No. Skip lines 18 through 21, and go to line 22.

No. Skip lines 18 through 21, and go to line 22.

18If you are required to complete the 28% Rate Gain Worksheet (see instructions), enter the

amount, if any, from line 7 of that worksheet . . . . . . . . . . . . . . . . . ▶

19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, if any, from line 18 of that worksheet . . . . . . . . . ▶

20Are lines 18 and 19 both zero or blank and are you not filing Form 4952?

Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and

Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and

No. Complete the Schedule D Tax Worksheet in the instructions. Don’t complete lines 21 and 22 below.

No. Complete the Schedule D Tax Worksheet in the instructions. Don’t complete lines 21 and 22 below.

21If line 16 is a loss, enter here and on Form 1040,

• The loss on line 16; or |

} |

• ($3,000), or if married filing separately, ($1,500) |

Note: When figuring which amount is smaller, treat both amounts as positive numbers.

22Do you have qualified dividends on Form 1040,

Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and

Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and

No. Complete the rest of Form 1040,

No. Complete the rest of Form 1040,

16

18

19

21 ( |

) |

Schedule D (Form 1040) 2021

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | Schedule D (Form 1040 or 1040-SR) is used to report capital gains or losses resulting from the sale or exchange of capital assets. |

| Attachment Requirement | This form is an attachment to the main Form 1040 or 1040-SR, the U.S. Individual Income Tax Return. |

| Sections Included | It includes sections for short-term and long-term capital transactions, which are classified based on the asset's holding period. |

| Impact on Tax Calculation | The net result of gains and losses reported on Schedule D affects the taxpayer's income tax liability. |

Guide to Writing IRS Schedule D 1040 or 1040-SR

Filling out the IRS Schedule D for Form 1040 or 1040-SR is a crucial step for taxpayers who need to report capital gains or losses from investments or real estate sales during the tax year. This process might seem daunting at first, but by following these step-by-step instructions, the task can be completed with clarity and accuracy. After completing this form, the taxpayer will have successfully reported their capital transactions, allowing for an accurate calculation of their tax liability or refund related to these activities.

- Gather all necessary documentation: Before beginning, collect all records of sales and exchanges of capital assets, including stocks, bonds, and real estate. This includes purchase and sales dates, prices, and any applicable adjustments.

- Review the form's instructions: The IRS provides detailed instructions for Schedule D, which can be found on the IRS website. These instructions can help clarify any confusion about how to report specific transactions.

- Complete Part I: If you have short-term capital gains or losses, typically held for one year or less, report the details in Part I. Fill in the description of the property, the date acquired and sold, sales price, cost or other basis, and the gain or loss incurred.

- Complete Part II: For long-term capital gains or losses, on assets held for more than one year, report the necessary details in Part II following the same process as for Part I.

- Calculate the totals: Add up the totals for both short-term and long-term sections. This will give you the total gains or losses to report on your Form 1040 or 1040-SR.

- Complete Part III: If required, fill out Part III to calculate the tax on unrecaptured section 1250 gain, section 1202 exclusion, and to determine the amount eligible for the 28% rate.

- Transfer the totals to Form 1040: Transfer the sum of your net short-term and long-term gains or losses to Form 1040 or 1040-SR, as instructed by the form and instructions.

- Verify and sign: Double-check all entries for accuracy. Mistakes can result in processing delays or a potential audit. Once verified, ensure that the Schedule D is attached to your Form 1040 or 1040-SR before submission.

- Submit the form: File your form in accordance with IRS guidelines. You may submit it electronically through tax software or mail a paper copy to the IRS, depending on your preference and the specific instructions for the tax year.

By successfully completing the IRS Schedule D for Form 1040 or 1040-SR, taxpayers ensure accurate reporting of capital gains and losses, which is essential for the correct calculation of taxes owed to the federal government. Accurate and timely submission of this form, along with the proper documentation, helps maintain compliance with IRS regulations and avoids potential complications.

Understanding IRS Schedule D 1040 or 1040-SR

What is the IRS Schedule D 1040 or 1040-SR form?

The IRS Schedule D is a form used to report the sale or exchange of capital assets not reported on another form or schedule. It's attached to and filed alongside the Form 1040 or 1040-SR, the standard forms used for individual income tax returns. This includes stocks, bonds, real estate, and similar transactions that result in capital gains or losses.

Who needs to file the Schedule D form?

Individuals who have engaged in transactions involving capital assets during the tax year must file Schedule D. This includes selling stocks, bonds, real estate, or experiencing capital gains or losses from investments. If you received a Form 1099-B or 1099-S that shows you have capital gains or if you wish to report a capital loss, filing Schedule D is required.

What are the key components of Schedule D?

Schedule D is divided into multiple parts. Part I deals with short-term capital gains or losses for assets held for one year or less. Part II addresses long-term capital gains or losses on assets held for more than one year. Part III summarizes the totals from Parts I and II and calculates the net gain or loss that is transferred to your Form 1040 or 1040-SR.

How do I know if my gains are short-term or long-term?

Capital gains or losses are classified based on how long you held the asset before selling it. If you owned the asset for one year or less, the gain or loss is considered short-term. If you owned it for more than one year, it’s considered long-term. The period of ownership affects the tax rate applied to the gain or loss.

Do I need to report all transactions on Schedule D?

Yes, all transactions involving the sale or exchange of capital assets should be reported on Schedule D, regardless of whether they result in a gain or loss. This includes transactions that may not necessarily be reflected on Form 1099-B or 1099-S.

What if I have a loss? Can I deduct it?

Yes, capital losses can be used to offset capital gains. If your losses exceed your gains, you can deduct the difference on your tax return, up to an annual limit of $3,000 ($1,500 if married filing separately). Any loss exceeding this limit can be carried over to future years.

How are capital gains taxed?

Capital gains tax rates depend on how long you held the asset and your overall taxable income. Short-term capital gains are taxed at ordinary income tax rates, while long-term capital gains benefit from lower tax rates, which could be 0%, 15%, or 20%, depending on your income level.

What if I didn’t receive a Form 1099-B?

If you didn’t receive a Form 1099-B but sold or exchanged capital assets, you're still required to report these transactions on Schedule D. It's important to keep your own records of purchase and sale dates, amounts, and related expenses to correctly fill out the Schedule D form.

Can I file Schedule D electronically?

Yes, Schedule D can be filed electronically as part of your tax return. Most tax preparation software will guide you through the process of reporting your capital gains and losses and include it with your electronically filed return.

Where can I find more information or help with Schedule D?

For more guidance on filing Schedule D, you can refer to the instructions provided by the IRS on their official website. Tax professionals and certified public accountants can also provide assistance and ensure your form is filed correctly.

Common mistakes

Filling out the IRS Schedule D for Form 1040 or 1040-SR, which pertains to capital gains and losses, can be a complex process. Attention to detail is essential to avoid common mistakes that could potentially lead to an audit, penalties, or a delay in processing. When individuals prepare their Schedule D, they often overlook or incorrectly handle critical elements. Below are eight common mistakes made during the preparation of this important document.

Not reporting all transactions: Many individuals mistakenly believe that if they didn’t make a profit, they don’t have to report the transaction. However, the IRS requires all sales and exchanges of capital assets to be reported, regardless of a gain or loss.

Mixing up short-term and long-term transactions: It's crucial to distinguish between short-term and long-term capital gains or losses. Assets held for more than a year before they're sold are considered long-term, whereas assets sold sooner are considered short-term. These are taxed at different rates, and mixing them up can lead to inaccuracies.

Overlooking the cost basis: Some taxpayers forget to correctly calculate or report the cost basis of the asset sold. The cost basis is what you paid for the asset plus any improvements, minus any depreciation. This mistake can significantly impact the reported gain or loss.

Disregarding carryover losses: If you have capital losses that exceed your capital gains, you can carry over the excess to future years. Failing to account for these in Schedule D can lead to overpayment of taxes.

Incorrectly reporting mutual funds or dividends reinvestments: Reinvested dividends and capital gains from mutual funds increase the tax basis of the investment and must not be overlooked. Failing to adjust the cost basis for these reinvestments can artificially inflate the gain or reduce the loss on the sale.

Failing to use the proper form: Certain transactions, like the sale of a business or real estate, may require additional forms or schedules to be completed. Not using the correct form can result in incomplete or incorrect filing.

Incorrectly calculating wash sales: A wash sale occurs when you sell a stock or security at a loss and then repurchase the same or a substantially identical stock or security within 30 days before or after the sale. These cannot be claimed as losses, and failing to apply the wash sale rule correctly can lead to errors in your reported gains and losses.

Omitting additional necessary information or documents: Sometimes, additional documentation is needed to support the entries made on Schedule D. Not providing this information can lead to questions from the IRS or even audit triggers.

By being aware of these common pitfalls and dedicating the necessary time and attention to accurately complete Schedule D, individuals can ensure their tax filings are correct, potentially saving money and avoiding trouble with the IRS.

Documents used along the form

When preparing your tax return, particularly if you're dealing with capital gains or losses, you'll find that the IRS Schedule D form (for 1040 or 1040-SR filers) is crucial. However, it's seldom the only document you'll need. Completing your tax picture for these situations often involves gathering a variety of forms and documents that support, complement, or provide necessary information to properly fill out Schedule D. Let's explore some of these key forms and documents that are often used together with Schedule D to ensure a comprehensive and accurate tax filing process.

- Form 8949: This form is essential for reporting the sale and exchange of capital assets. It provides details on individual transactions, which are then summarized on Schedule D. It helps in distinguishing between short-term and long-term capital gains and losses.

- Form 1099-B: Brokerage firms and mutual fund companies issue Form 1099-B. It reports the sale of stocks, bonds, or mutual funds through the brokerage. Information from 1099-B is crucial for filling out Form 8949.

- Form 1099-DIV: This document is issued by banks and financial institutions to report dividends and distributions received during the tax year. It is important for Schedule D when dividends qualify for capital gain tax rates.

- Form 4868: If you need more time to file your taxes, Form 4868 is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. It's not directly related to capital gains or losses but gives you additional time to gather and prepare all necessary documents.

- Form 8824: If you've conducted a like-kind exchange, which allows you to defer capital gains tax, you'll need to file Form 8824. This form helps calculate the deferred gain and is relevant for Schedule D.

- Form 6252: For those who have sold property under an installment sale, Form 6252 is required. It helps report income from the sale over more than one year, affecting how you report gains on Schedule D.

- Form 2439: Issued by mutual funds or Real Estate Investment Trusts (REITs), Form 2439 reports undistributed long-term capital gains. Shareholders must include this information on their Schedule D.

- Form 8949-S: Specifically designed for reporting transactions involving bitcoin and other cryptocurrency sales, Form 8949-S complements the information needed for Schedule D from a growing investment area.

Utilizing these forms and documents in conjunction with Schedule D can seem daunting at first. However, each serves a critical role in ensuring that all necessary details are captured and reported accurately. Whether you're dealing with stock sales, real estate transactions, or cryptocurrency investments, taking the time to understand and properly fill out these forms can significantly influence the accuracy of your tax return and potentially impact your tax liability. Always consult with a tax professional if you have questions or concerns about how to use these forms in your specific situation.

Similar forms

The IRS Form 8949 "Sales and Other Dispositions of Capital Assets" closely relates to the IRS Schedule D (Form 1040 or 1040-SR), as both forms are integral in reporting capital gains and losses from the sale or exchange of capital assets. Form 8949 is used to list out each individual transaction that contributes to the totals on Schedule D, providing a detailed record that supports the summary provided on Schedule D. Essentially, Form 8949 feeds into Schedule D, outlining the specifics of each transaction before consolidating this information into a comprehensive summary.

The IRS Schedule 1 (Form 1040 or 1040-SR), "Additional Income and Adjustments to Income," is also related to Schedule D in that it serves as a conduit for various types of additional income, including taxable refunds, alimony received, and business income, which are not directly tied to capital gains but contribute to the overall income calculation. Some adjustments and lesser-known income sources that may indirectly affect the investment income reported on Schedule D could be detailed here, making it important for an accurate overall tax picture.

IRS Form 4797, "Sales of Business Property," shares a connection with Schedule D, as both deal with the reporting of sales. However, Form 4797 specifically focuses on property used in a trade or business and is usually related to Section 1231 gains or losses, which can have different tax implications than the capital gains or losses reported on Schedule D. Investors who also own and sell business assets will likely encounter both forms during the tax filing process.

The IRS Form 6781, "Gains and Losses From Section 1256 Contracts and Straddles," parallels the Schedule D for taxpayers who deal with more complex investments. This form is used to report gains and losses from section 1256 contracts, such as futures contracts, which are taxed under a unique 60/40 rule of long-term and short-term capital gains rates, regardless of the holding period. This adds another layer to the capital gains puzzle, illustrating the variety of investment activities that might affect an individual's taxes.

Schedule E (Form 1040 or 1040-SR), "Supplemental Income and Loss," while primarily used for reporting income from rental real estate, royalties, partnerships, S corporations, trusts, etc., overlaps with Schedule D in the sense that both can involve investment income. Rental real estate and royalties, for example, constitute investment activities, and the income or loss from these ventures could indirectly influence the individual's investment strategy and capital gains or losses reported on Schedule D.

The IRS Schedule B (Form 1040 or 1040-SR), "Interest and Ordinary Dividends," is akin to Schedule D in that it pertains to investment income, albeit focusing on the more common types such as interest and dividends rather than capital gains and losses. Both schedules are essential for a taxpayer with investments, as they address different facets of investment-generated income that must be reported to the IRS.

Lastly, the IRS Form 6251, "Alternative Minimum Tax—Individuals," connects to Schedule D, as significant capital gains can sometimes trigger the Alternative Minimum Tax (AMT). This form is used to calculate the AMT liability, ensuring that taxpayers pay at least a minimum amount of tax. Therefore, the results of Schedule D can have direct implications on the calculation of the AMT, highlighting the intertwined nature of various tax forms and obligations.

Dos and Don'ts

When filing the IRS Schedule D for Form 1040 or 1040-SR, understanding the do's and don'ts can significantly impact your tax filing process. Schedule D is a crucial document for reporting capital gains or losses from your investments, real estate, and other assets. Below are key pointers to help you navigate this process more effectively.

What You Should Do

Gather all necessary documentation on your transactions such as sales proceeds, purchase costs, and dates of transactions. Accurate records are essential for calculating capital gains or losses correctly.

Review the instructions for Schedule D and Form 8949 if applicable. These forms often work together, and understanding their requirements can ensure accurate reporting of your capital gains and losses.

Report all transactions, even if they result in a loss. Not only can reporting losses offset other gains, but failure to report can also lead to penalties.

Consider consulting with a tax professional if you have complex transactions. The tax laws regarding capital gains and losses can be complicated, and professional guidance can help avoid mistakes.

What You Shouldn't Do

Don’t overlook the importance of reporting smaller transactions. Even if a transaction seems insignificant, it must be reported on Schedule D.

Avoid guessing or estimating figures if actual documentation is missing. Effort should be made to obtain accurate information to prevent possible issues with the IRS.

Don’t ignore the holding period of your assets. The tax rates for long-term gains (assets held more than a year) are typically more favorable than for short-term gains.

Do not wait until the last minute to start filling out Schedule D. Rushing through the process increases the risk of errors, which could lead to audits or penalties.

Adhering to these guidelines can greatly smooth the process of filing Schedule D as part of your IRS Form 1040 or 1040-SR. Proper preparation, thorough review, and careful reporting are key components of successfully navigating your tax obligations.

Misconceptions

When it comes to dealing with taxes, especially concerning the IRS Schedule D forms (1040 or 1040-SR), there's a lot of confusion. These forms are crucial for reporting capital gains or losses from investments, but several misconceptions often lead to mistakes. Understanding these misconceptions can save individuals from unnecessary stress and possibly money. Here are ten common misunderstandings about these forms:

- Only for Stock Traders: Many believe that Schedule D is only for those who trade stocks. In reality, this form is required for reporting gains or losses from a variety of investments, including but not limited to real estate, bonds, and cryptocurrency transactions.

- No Need to Report if Under a Threshold: Some think that if their gains or losses are under a certain amount, they don't need to report them. This is false. All capital gains and losses, no matter how small, should be reported to the IRS.

- Losses Are Fully Deductible: There's a misconception that all losses reported on Schedule D can be fully deducted from one’s income. However, the deduction of losses is limited to $3,000 per year for individuals or $1,500 if married and filing separately, with the excess carried over to future years.

- I Don't Need to Report If I Reinvested the Gains: Many believe that if they reinvest their gains, they don't have to report them. This is not true. All capital gains, even those reinvested, must be reported.

- Sale of Primary Residence Is Always Tax-Exempt: Some homeowners think that the sale of their primary residence is always free from taxation. Nonetheless, there are caps ($250,000 for single filers, $500,000 for joint filers) above which gains from the sale of a primary residence must be reported.

- Schedule D Is Complicated and Best Left to Professionals: While it's advisable to consult with a tax professional if you're unsure, many taxpayers can accurately complete Schedule D by carefully following the instructions or using tax preparation software.

- Gains Are Taxed at the Same Rate as Ordinary Income: It's a common belief that capital gains are taxed at the same rate as ordinary income. In fact, long-term capital gains are taxed at lower rates, which can be significantly more favorable.

- You Don't Need to Report Transactions That Occur in a Tax-Deferred Account: This is true. Transactions that occur within retirement accounts like IRAs or 401(k)s are not reported on Schedule D. However, withdrawals from these accounts might be subject to different tax rules.

- Only Securities Investments Are Reported: This is false. Schedule D is also used to report transactions involving other forms of property, including real estate and collectibles.

- Amending a Previous Year's Schedule D Is Not Possible: Sometimes, taxpayers discover errors in a previously filed Schedule D. It is absolutely possible—and sometimes necessary—to amend a prior year's tax return to correct mistakes related to capital gains and losses.

Clearing up these misconceptions can help ensure that taxpayers handle their investment income and losses more confidently and accurately. When in doubt, seeking the guidance of a tax professional is always a wise decision.

Key takeaways

The IRS Schedule D form for 1040 or 1040-SR tax returns is an essential document for taxpayers who need to report capital gains or losses from their investments. Understanding the key aspects of this form can greatly simplify the tax filing process. Here are important takeaways:

- Identification of capital assets requires careful analysis. Stocks, bonds, and real estate are common examples. Reporting the sale or exchange of these assets on Schedule D is crucial for an accurate tax return.

- Short-term and long-term capital gains or losses must be differentiated. The holding period determines this classification, with assets held for over a year qualifying for potentially lower tax rates as long-term.

- The form is divided into parts. Part I deals with short-term transactions not reported on Form 1099-B. Part II covers long-term transactions. This organization helps in calculating taxes based on distinct rates applicable to short-term and long-term gains.

- Utilizing capital loss carryover can offer tax relief. If your capital losses exceed your gains, you may use the loss to offset up to $3,000 ($1,500 if married filing separately) of other income. You can carry over unused losses to future tax years.

Accurately completing Schedule D is vital for taxpayers with investment activities to ensure they pay the correct amount of tax or claim the appropriate deductions and credits. Consulting with a tax professional can provide personalized guidance based on individual financial situations.

Popular PDF Documents

IRS 2106 - This form helps employees to claim deductions for work-related education costs, if not reimbursed by their employer.

IRS 4868 - Form 4868 is a beneficial option for those who are dealing with complex tax situations requiring extra time to resolve.

Pag-ibig Calamity Loan Online - Features a section for bank account details for the loan proceeds to be credited, facilitating direct transfer to the applicant’s account for immediate relief.