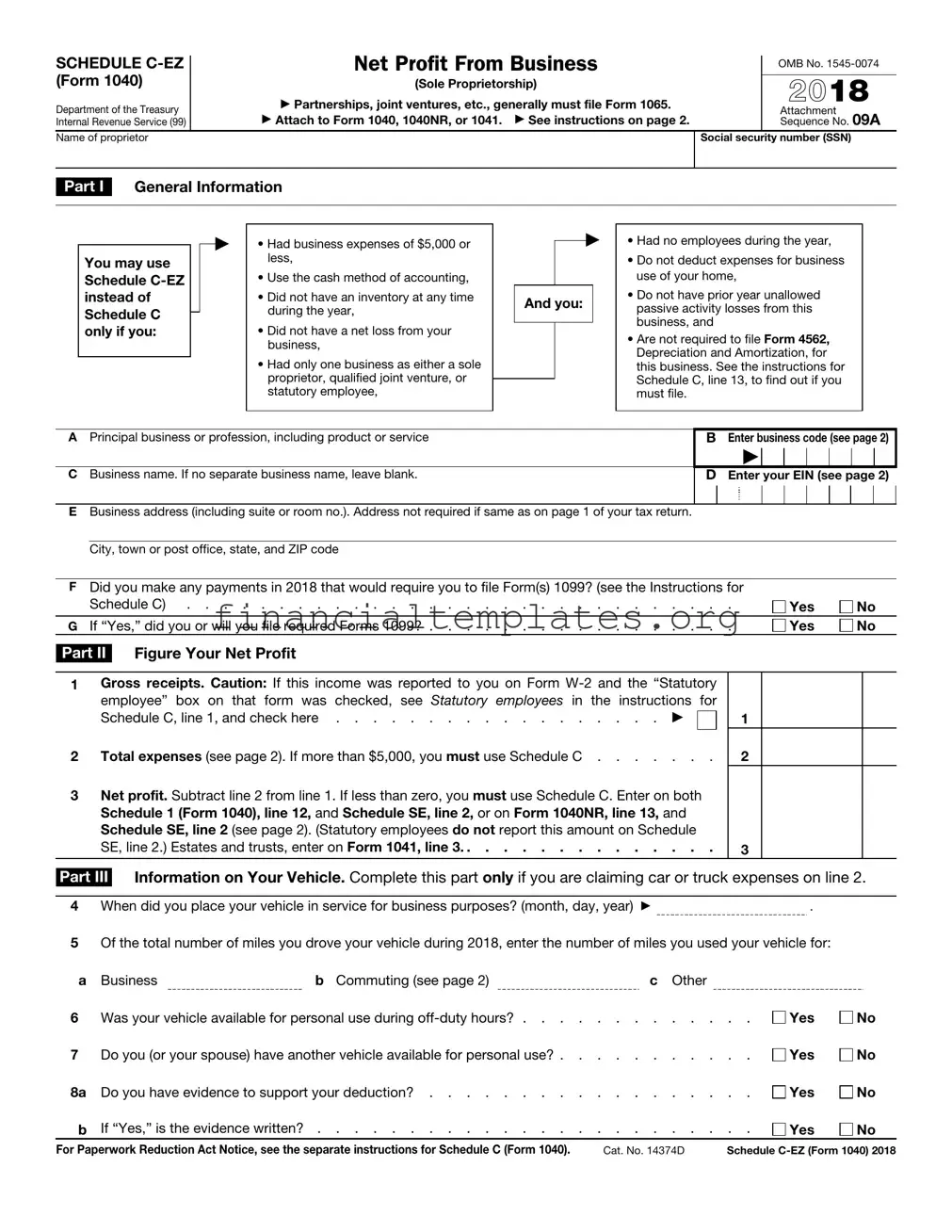

Get Irs Schedule C Ez Form

The IRS Schedule C-EZ form is tailored for individuals who operate as sole proprietors and have relatively straightforward business financials to report. This simplified version of the Schedule C form allows for an easier and faster way to report profits or losses from a business. Specifically designed for sole proprietorships, the form is applicable when the business has expenses of $5,000 or less and does not require the depreciation of assets or deduct expenses for business use of the home. Additionally, it is for those who have not had employees within the tax year, did not maintain an inventory, and operated only one business. The clear advantages of using Schedule C-EZ lie in its simplified reporting process, making it a suitable tool for small business owners and self-employed individuals to report their net profit from business operations directly on their Form 1040, 1040NR, or 1041. The form further simplifies the reporting process by providing sections to outline gross receipts, total expenses, and vehicle information if claiming car or truck expenses. This form not only streamlines the tax filing process for eligible taxpayers but also clarifies the obligations towards reporting payments that might require the filing of Form(s) 1099. It’s an important document that requires careful consideration of one’s business activities and financial practices throughout the tax year to ensure accurate and compliant reporting to the Internal Revenue Service.

Irs Schedule C Ez Example

SCHEDULE |

|

|

|

|

Net Profit From Business |

|

|

OMB No. |

||||||||||||||

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

(Form 1040) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

(Sole Proprietorship) |

|

|

2018 |

|

||||||||||||||

Department of the Treasury |

|

|

|

|

▶ Partnerships, joint ventures, etc., generally must file Form 1065. |

|

|

|||||||||||||||

|

|

|

|

▶ Attach to Form 1040, 1040NR, or 1041. |

▶ See instructions on page 2. |

|

Attachment |

|||||||||||||||

Internal Revenue Service (99) |

|

|

|

|

|

Sequence No. 09A |

||||||||||||||||

Name of proprietor |

|

|

|

|

|

|

|

|

|

|

|

|

Social security number (SSN) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Part I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

▶ |

• Had business expenses of $5,000 or |

|

|

|

• Had no employees during the year, |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||

|

You may use |

|

|

|

less, |

|

|

|

|

|

• Do not deduct expenses for business |

|

|

|||||||||

|

Schedule |

|

|

|

• Use the cash method of accounting, |

|

|

|

|

|

use of your home, |

|

|

|||||||||

|

instead of |

|

|

|

• Did not have an inventory at any time |

|

And you: |

|

• Do not have prior year unallowed |

|

|

|||||||||||

|

Schedule C |

|

|

|

during the year, |

|

|

passive activity losses from this |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

only if you: |

|

|

|

• Did not have a net loss from your |

|

|

|

|

|

business, and |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

• Are not required to file Form 4562, |

|

|

|||||||||||

|

|

|

|

|

|

|

business, |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and Amortization, for |

|

|

||||||||

|

|

|

|

|

|

|

• Had only one business as either a sole |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

this business. See the instructions for |

|

|

||||||||

|

|

|

|

|

|

|

proprietor, qualified joint venture, or |

|

|

|

|

|

|

Schedule C, line 13, to find out if you |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

statutory employee, |

|

|

|

|

|

must file. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

A Principal business or profession, including product or service |

|

|

|

|

|

B Enter business code (see page 2) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

C Business name. If no separate business name, leave blank. |

|

|

|

|

|

D Enter your EIN (see page 2) |

||||||||||||||||

EBusiness address (including suite or room no.). Address not required if same as on page 1 of your tax return. City, town or post office, state, and ZIP code

FDid you make any payments in 2018 that would require you to file Form(s) 1099? (see the Instructions for

Schedule C) |

Yes |

No |

G If “Yes,” did you or will you file required Forms 1099? |

Yes |

No |

Part II Figure Your Net Profit

1Gross receipts. Caution: If this income was reported to you on Form

Schedule C, line 1, and check here . . . . . . . . . . . . . . . . . . ▶  2 Total expenses (see page 2). If more than $5,000, you must use Schedule C . . . . . . .

2 Total expenses (see page 2). If more than $5,000, you must use Schedule C . . . . . . .

3Net profit. Subtract line 2 from line 1. If less than zero, you must use Schedule C. Enter on both Schedule 1 (Form 1040), line 12, and Schedule SE, line 2, or on Form 1040NR, line 13, and Schedule SE, line 2 (see page 2). (Statutory employees do not report this amount on Schedule SE, line 2.) Estates and trusts, enter on Form 1041, line 3. . . . . . . . . . . . . . .

1

2

3

Part III Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 2.

4 When did you place your vehicle in service for business purposes? (month, day, year) ▶ |

. |

5Of the total number of miles you drove your vehicle during 2018, enter the number of miles you used your vehicle for:

a |

Business |

b Commuting (see page 2) |

c |

Other |

|

|

6 |

Was your vehicle available for personal use during |

. |

. . . . . |

Yes |

No |

|

7 |

Do you (or your spouse) have another vehicle available for personal use? |

. |

. . . . . |

Yes |

No |

|

8a |

Do you have evidence to support your deduction? |

. |

. . . . . |

Yes |

No |

|

b |

If “Yes,” is the evidence written? |

. |

. . . . . |

Yes |

No |

|

For Paperwork Reduction Act Notice, see the separate instructions for Schedule C (Form 1040). |

Cat. No. 14374D |

Schedule |

Schedule |

Page 2 |

Instructions

Future developments. For the latest information about developments related to Schedule

! |

Before you begin, see General Instructions in the 2018 |

▲ |

Instructions for Schedule C. |

CAUTION |

|

You can use Schedule

•You operated a business or practiced a profession as a sole proprietorship or qualified joint venture, or you were a statutory employee, and

•You have met all the requirements listed in Schedule

For more information on electing to be taxed as a qualified joint venture (including the possible social security benefits of this election), see Qualified Joint Venture in the Instructions for Schedule C. You can also go to www.irs.gov/QJV.

Line A

Describe the business or professional activity that provided your principal source of income reported on line 1. Give the general field or activity and the type of product or service.

Line B

Enter the

Line D

Enter on line D the employer identification number (EIN) that was issued to you and in your name as a sole proprietor. If you are filing Form 1041, enter the EIN issued to the estate or trust. Do not enter your SSN. Do not enter another taxpayer’s EIN (for example, from any Forms

EIN, leave line D blank.

You need an EIN only if you have a qualified retirement plan or are required to file an employment, excise, alcohol, tobacco, or firearms tax return, are a payer of gambling winnings, or are filing Form 1041 for an estate or trust. If you need an EIN, see the Instructions for Form

Line E

Enter your business address. Show a street address instead of a box number. Include the suite or room number, if any.

Line F

See the instructions for Schedule C, line I, to help determine if you are required to file any Forms 1099.

Line 1

Enter gross receipts from your trade or business. Include amounts you received in your trade or business that were properly shown on Form

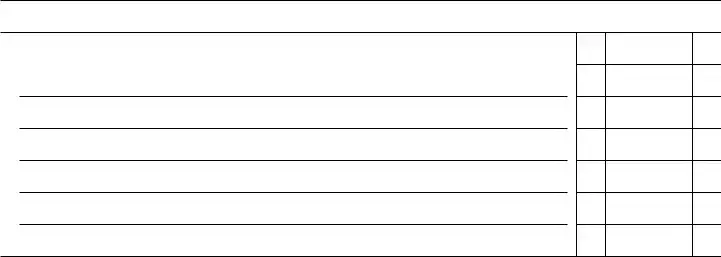

Line 2

Enter the total amount of all deductible business expenses you actually paid during the year. Examples of these expenses include advertising, car and truck expenses, commissions and fees, insurance, interest, legal and professional services, office expenses, rent or lease expenses, repairs and maintenance, supplies, taxes, travel, the allowable percentage of business meals and entertainment, and utilities (including telephone). For details, see the instructions for Schedule C, Parts II and V. You can use the optional worksheet below to record your expenses. Enter on lines b through f the type and amount of expenses not included on line a.

If you claim car or truck expenses, be sure to complete Schedule

Line 3

Nonresident aliens using Form 1040NR should also enter the total on Schedule SE, line 2, if you are covered under the U.S. social security system due to an international social security agreement currently in effect. See the Instructions for Schedule SE for information on international social security agreements.

Line 5b

Generally, commuting is travel between your home and a work location. If you converted your vehicle during the year from personal to business use (or vice versa), enter your commuting miles only for the period you drove your vehicle for business. For information on certain travel that is considered a business expense rather than commuting, see the instructions for Schedule C, line 44b.

Optional Worksheet for Line 2 (keep a copy for your records)

a Deductible meals (see the instructions for Schedule C, line 24b) . . . . . . . . . . . . .

b

c

d

e

f

g Total. Add lines a through f. Enter here and on line 2 . . . . . . . . . . . . . . . .

a

b

c

d

e

f

g

Schedule

Document Specifics

| Fact Name | Description |

|---|---|

| Form Designation | Schedule C-EZ (Form 1040) is designated for sole proprietorships. |

| Eligibility Criteria | Eligible if business expenses are $5,000 or less, no employees, no inventory, and only one business. |

| Accounting Method | Users must utilize the cash method of accounting. |

| Form Exclusions | Cannot deduct home office expenses, or have prior year unallowed passive activity losses. |

| Depreciation and Amortization | No filing of Form 4562 for depreciation and amortization is required. |

| Type of Businesses | For sole proprietors, qualified joint ventures, or statutory employees only. |

| Form 1099 Requirements | Questions on payments requiring Form 1099 and if such forms were or will be filed. |

| Vehicle Expense Deductions | Includes a section for claiming car or truck expenses with specific questions about vehicle use. |

| Gross Receipts Reporting | Requires reporting of gross receipts; warns if Form 1099-MISC amounts exceed reported income. |

| Deductions and Net Profit | Allows for the calculation of net profit by deducting business expenses from gross receipts. |

Guide to Writing Irs Schedule C Ez

Filling out the IRS Schedule C-EZ form is a necessary step for sole proprietors with simple business financial structures to report their net profit from business on their tax returns. This form is designed for those who had business expenses of $5,000 or less, no employees during the tax year, did not maintain an inventory, and meet several other criteria simplifying the tax filing process. This guide walks through the steps needed to accurately complete the Schedule C-EZ.

- At the top of the form, enter your name and Social Security Number as it appears on your tax return.

-

Part I - General Information:

- A: Describe your principal business or profession, the main source of your income. Include the type of product or service you provide.

- B: Enter the six-digit code that best describes your business activity. Refer to the instructions for Schedule C for the code list.

- C: If your business has a separate name, enter it. If not, leave this line blank.

- D: Enter your Employer Identification Number (EIN) if you have one. If you do not have an EIN or operate as a sole proprietor without an EIN, leave this blank.

- E: Provide the address of the business only if it's different from the address on your tax return. Include suite or room number if applicable.

- For F and G, answer whether you made any payments that would require filing Form(s) 1099. If "Yes," confirm whether you filed, or will file, the required Forms 1099.

-

Part II - Figure Your Net Profit:

- Line 1: Enter your gross receipts or sales. Do not deduct returns and allowances or cost of goods sold.

- Line 2: Enter your total expenses. Remember that if your expenses exceed $5,000, you must use Schedule C instead of Schedule C-EZ.

- Line 3: Calculate your net profit by subtracting line 2 from line 1. Report this amount on your Form 1040 and, if applicable, on your Schedule SE for self-employment tax.

- Part III - Information on Your Vehicle (if you are claiming car or truck expenses on line 2):

- Fill in the date when your vehicle was first used for business purposes.

- Report the total number of miles driven in 2018, dividing them into business, commuting, and other.

- Answer whether your vehicle was available for personal use during off-duty hours, and if you, or your spouse, have another vehicle available for personal use.

- Confirm if you have evidence to support your vehicle expense deduction and if the evidence is written.

Once you've filled out the form, attach it to your Form 1040, 1040NR, or 1041 tax return. Make sure you've reviewed all instructions and requirements to ensure your Schedule C-EZ is filled out completely and correctly. Accurate reporting assists in the smooth processing of your tax return and can help avoid unnecessary audits. Remember, the goal is to report your business profits accurately, taking advantage of the simplified process the Schedule C-EZ offers to eligible sole proprietors.

Understanding Irs Schedule C Ez

Who can file a Schedule C-EZ form?

To be eligible to file a Schedule C-EZ, you must operate a business as a sole proprietor, qualified joint venture, or were a statutory employee. Additionally, you should have business expenses of $5,000 or less, no employees during the year, not have an inventory at any time during the year, and must not be required to file Form 4562 for depreciation and amortization. If your business meets these conditions, you can opt to file Schedule C-EZ instead of the more detailed Schedule C form.

What are the advantages of using Schedule C-EZ?

Filing Schedule C-EZ provides a simplified method to report your business income and calculate your net profit. It's designed for smaller businesses with straightforward tax situations, making the tax filing process quicker and easier. Since it requires fewer details than the regular Schedule C form, it can save time and reduce the potential for errors in reporting.

What information is needed for Schedule C-EZ?

To complete Schedule C-EZ, you'll need your total gross receipts, total business expenses (not exceeding $5,000), information on your vehicle if you're claiming car or truck expenses, and details on payments if you're filing Forms 1099. The form also requests basic business information like your principal business or profession, business code, name, and address.

How does one report vehicle expenses on Schedule C-EZ?

If you claim vehicle expenses, you must complete Part III of the Schedule C-EZ. This section requires you to report when the vehicle was first used for business purposes, the number of miles driven for business, commuting, and personal use, and whether the vehicle was available for personal use during off-duty hours. Additionally, you're asked if you have evidence to support your deduction and if it's written.

Can I still file Schedule C-EZ if I received Form 1099-MISC?

Yes, receiving a Form 1099-MISC does not disqualify you from using Schedule C-EZ, as long as the total income and expenses meet the form's requirements. However, you must include amounts reported on Form 1099-MISC as part of your gross receipts when filing. If there's a discrepancy between the amounts on Form 1099-MISC and what you report, you should attach a statement explaining the difference.

What if my business expenses exceed $5,000?

If your business expenses exceed $5,000, you are not eligible to use Schedule C-EZ. You will need to file the regular Schedule C form, which provides a more detailed record of your business income and expenses. The Schedule C form is designed to accommodate more complex tax situations, offering space to report a wider range of expenses and potentially identify more deductions.

Common mistakes

Failing to Verify Eligibility: One common mistake is not confirming eligibility for using the Schedule C-EZ form. Sole proprietors and qualified joint ventures must meet specific criteria, such as having business expenses of $5,000 or less and no employees, to use this simplified form. Overlooking the eligibility requirements can lead to inaccuracies in filing.

Incorrectly Reporting Gross Receipts: Another error involves miscalculating or misreporting gross receipts on line 1. It's crucial to accurately report all income, including amounts shown on Form 1099-MISC. Omitting or incorrectly stating income can result in discrepancies and potentially trigger an audit.

Neglecting to Report Deductible Expenses: On line 2, taxpayers must enter the total amount of deductible business expenses. Sometimes, expenses are either overlooked or not properly documented, which can lead to a lower net profit figure on line 3. Ensuring that all eligible expenses are included can significantly affect the net profit or loss reported.

Omitting Vehicle Information: If claiming car or truck expenses, it's a mistake to leave Part III blank. Line 4 asks for the date the vehicle was placed in service for business purposes, and subsequent questions detail the business use of the vehicle. Incomplete information or failure to validate expenses with evidence (as required on lines 8a and 8b) can lead to disallowed deductions.

Not Providing Required Forms 1099: Question F on the form inquires if any payments were made during the year that would necessitate filing Form(s) 1099. Failing to file required Forms 1099 (if "Yes" is the answer to Question F and G) not only violates tax reporting rules but can also affect deductions for expenses related to those payments.

Understanding and avoiding these mistakes can help ensure that the filing process is smooth and accurate, potentially saving taxpayers from future headaches caused by IRS audits or adjustments.

Documents used along the form

The IRSSchedule C-EZ form, titled "Net Profit From Business," is specifically designed for sole proprietors to report simple business profits and losses. Although the process of filing taxes can be overwhelming, particularly for small business owners, the use of Schedule C-EZ aims to simplify this process. However, it is rarely completed in isolation. Several other forms and documents often accompany Schedule C-EZ to provide a comprehensive picture of a taxpayer's financial situation and obligations. Understanding these additional requirements is crucial for accurate and efficient tax filing.

- Form 1040 or 1040-SR: This is the main tax form used by individuals to file their annual income tax returns in the United States. It serves as the summary document for all personal income, deductions, and tax credits. Schedule C-EZ results are reported on Form 1040, which aggregates the total income taxes due from various sources.

- Form 1099-MISC: This form is used to report payments made in the course of a business to a person who isn't an employee (such as independent contractors), or other unincorporated businesses. If a business owner makes any such payments, they might need to file Form 1099-MISC, which also influences the income reported on Schedule C-EZ.

- Schedule SE (Form 1040): For individuals who file Schedule C-EZ, Schedule SE is necessary to calculate the self-employment tax owed. This form helps determine the amount of Social Security and Medicare taxes a self-employed individual must pay, based on the net profit reported on Schedule C-EZ.

- Form 4562: Depreciation and Amortization, is used by taxpayers to claim deductions for the depreciation of property used in their business, including vehicles, equipment, and buildings. While Schedule C-EZ filers typically do not have expenses that necessitate this form, it is required if the business owns substantial assets that depreciate.

In conclusion, the Schedule C-EZ form streamlines the process of reporting simple business income for sole proprietors, but it's often just one piece of the larger tax filing puzzle. Properly integrating it with other necessary forms and documents ensures compliance and maximizes potential tax benefits. Each document plays a pivotal role in painting a full picture of an individual’s financial landscape, affecting tax responsibilities and benefits. For small business owners navigating tax season, understanding and accurately completing these forms is key to fulfilling legal obligations and optimizing financial outcomes.

Similar forms

The IRS Form 1040 Schedule 1 is quite similar to Schedule C-EZ in that both are integral parts of the individual tax return process. Schedule 1, specifically, is used for reporting additional income or adjustments to income that cannot be entered directly on Form 1040. While Schedule 1 covers a broader scope, Schedule C-EZ focuses specifically on reporting the net profit from a sole proprietorship. Both forms allow taxpayers to report diverse types of income or adjustments, contributing to the calculation of the adjusted gross income on the main Form 1040.

Form 1065, U.S. Return of Partnership Income, shares a connection with Schedule C-EZ through its focus on reporting business income, yet from a partnership perspective. While Schedule C-EZ is designed for sole proprietors to report their business profit or loss, Form 1065 is utilized by partnerships to detail the income, gains, losses, deductions, credits, etc., of the business. Both forms require detailed financial reporting and are essential for calculating the tax obligations related to business operations.

Form 4562, Depreciation and Amortization, is used for reporting the depreciation or amortization of property, which can include assets used in a business. This form is relevant to filers of Schedule C-EZ in situations where a business owner purchases equipment or vehicles for business purposes. Although Schedule C-EZ filers are advised not to use this form if they don’t have expenses that exceed a certain threshold or didn't have a net loss from their business, the calculation of depreciation can affect the total business expenses and, consequently, the profit reported on Schedule C-EZ.

Form 1099-MISC, Miscellaneous Income, parallels Schedule C-EZ since it often serves as a documentation source for the gross receipts or income reported by the sole proprietor on Schedule C-EZ. This form is typically used by businesses to report payments made to non-employees, such as independent contractors. For a small business owner or sole proprietor, receiving a Form 1099-MISC means they must report that income on their Schedule C-EZ, making both documents closely related in the context of business income reporting.

Form 1041, U.S. Income Tax Return for Estates and Trusts, like Schedule C-EZ, is used for reporting income, but specifically from estates and trusts. While Schedule C-EZ reports income from a sole proprietorship, Form 1041 reports income that is subject to taxation under an estate or trust. Both forms deal with the nuances of income within their respective realms and both are necessary for accurate tax reporting and compliance within those frameworks.

Form SS-4, Application for Employer Identification Number (EIN), is indirectly related to Schedule C-EZ by virtue of its role in the business setup and tax reporting process. An EIN is required for sole proprietors who have employees or meet other conditions. While Schedule C-EZ itself does not require an EIN for all sole proprietors, those expanding their business or meeting specific criteria mentioned in Schedule C-EZ instructions might need to file Form SS-4. Thus, the business journey might start with acquiring an EIN through Form SS-4 and then proceed to annual income reporting with Schedule C-EZ.

Schedule SE, Self-Employment Tax, complements Schedule C-EZ by calculating the tax due on net earnings from self-employment, which includes earnings reported on Schedule C-EZ. Essentially, Schedule C-EZ calculates the net profit from a business, which is then used as part of the base for computing self-employment tax on Schedule SE. Both forms are essential for sole proprietors to determine their total tax liability related to their business activities.

Dos and Don'ts

When approaching the task of filling out the IRS Schedule C-EZ form, it's crucial to adhere to specific do's and don'ts for accuracy and compliance. Here's a guide:

- Do carefully read all instructions associated with the Schedule C-EZ form to ensure you understand the criteria for eligibility, including expense thresholds and business types.

- Do make sure you meet all the eligibility requirements listed in Part I before deciding to fill out the Schedule C-EZ, as it is intended for simpler business structures with fewer deductions.

- Do use the correct business code when filling out Line B, referring to the provided list in the instructions to accurately describe your principal business or professional activity.

- Do include your Employer Identification Number (EIN) on Line D if applicable, especially if your business structure requires one, but do not use your Social Security Number in its place.

- Do accurately report your gross receipts and deductible expenses, ensuring that you do not underestimate or overestimate, to maintain compliance with tax laws.

- Don't use Schedule C-EZ if your expenses exceed $5,000, as you will need to utilize the more detailed Schedule C form to report these accurately.

- Don't fail to report any payments that necessitate filing Form(s) 1099, as indicated on Line F, since compliance with reporting requirements is mandatory.

- Don't forget to attach any required statements if your reported income on Line 1 differs from the amounts reported on Form 1099-MISC, resolving any discrepancies to avoid audit flags.

By meticulously following these do's and don'ts, you help ensure that your Schedule C-EZ is accurately completed and complies with IRS requirements, minimizing the risk of errors or audits.

Misconceptions

There are several misconceptions about the IRS Schedule C-EZ form. Understanding the facts can help sole proprietors file their taxes accurately.

Misconception 1: Schedule C-EZ can be used by any type of business. In reality, only sole proprietorships and qualified joint ventures without employees, without inventory, and with expenses under $5,000 can use this form.

Misconception 2: It's always better to file Schedule C-EZ because it's easier. The truth is, while it is simpler, using Schedule C might benefit businesses that have more complex deductions that can lead to a lower tax liability.

Misconception 3: You can use Schedule C-EZ if your business had a net loss. Actually, if your business expenses exceed your income (resulting in a net loss), you must use Schedule C.

Misconception 4: All businesses that file Schedule C-EZ must have an Employer Identification Number (EIN). In fact, an EIN is not required unless the business needed to file employment, excise, or other types of tax returns, or had a qualified retirement plan.

Misconception 5: You can deduct expenses for the business use of your home on Schedule C-EZ. This is incorrect as Schedule C-EZ does not allow for home office deductions.

Misconception 6: Any vehicle expenses can be deducted using Schedule C-EZ. The truth is that only businesses with actual vehicle expenses for business use and under the $5,000 expense limit can use this form for such deductions.

Misconception 7: Filing Schedule C-EZ automatically means you will be audited. The type of form used does not necessarily increase or decrease the chance of an IRS audit; accuracy and completeness of the tax return are more important factors.

Misconception 8: You can report income received as a statutory employee on Schedule C-EZ. Statutory employees should instead report their income and expenses on Schedule C, as specific rules apply to them.

Understanding these common misconceptions about the IRS Schedule C-EZ form can help ensure that sole proprietors choose the appropriate form for their situation, take advantage of all available tax benefits, and comply with IRS requirements.

Key takeaways

Understanding how to properly fill out the IRS Schedule C-EZ form is crucial for small business owners and sole proprietors who seek to simplify their tax filing process. Below are key takeaways from the document to help guide through its completion and use:

- Eligibility for using Schedule C-EZ includes having business expenses of $5,000 or less, no employees, no inventory, and utilizing the cash method of accounting among other qualifiers.

- The form is intended for sole proprietorships, qualified joint ventures, or statutory employees with only one business entity.

- It is mandatory to attach Schedule C-EZ to Form 1040, 1040NR, or 1041, as per the filing requirements of the Department of the Treasury Internal Revenue Service.

- Schedule C-EZ simplifies the process by allowing specific deductions and avoiding the more detailed and complex Schedule C form, provided the business does not exceed the stipulated expense limit and meets other specific conditions outlined in Part I of the Schedule C-EZ.

- Businesses required to file Form 4562 for Depreciation and Amortization, or having prior-year unallowed passive activity losses from the business, are excluded from using this simplified form.

- Accurate reporting of gross receipts, deductible business expenses up to the $5,000 limit, and the net profit or loss is essential for computing obligations or refunds accurately. The optional worksheet provided in the instructions can assist in totaling expenses.

These key points help streamline the reporting process for eligible business owners, ensuring compliance with IRS regulations while minimizing the complexity often associated with tax filing.

Popular PDF Documents

940 Taxes - For the U.S. Virgin Islands, specific computations are required on Schedule A to adjust for the FUTA credit reduction.

Write the Lists Which Should Accompany the Statement of Affairs, in Case of a Winding Up by Court? - Calls for information regarding property repossessions, foreclosures, or transfers through deeds in lieu of foreclosure within the last year.

Form Dr-835 - This form is an important tool for non-resident taxpayers who need someone within the jurisdiction to handle their tax matters.