Get IRS Schedule B 941 Form

Delving into the intricacies of tax documentation, one encounters the IRS Schedule B 941 form, a document that plays a crucial role in the financial operations of many businesses across the United States. This form, designed for employers who withhold income, social security, or Medicare tax from employees' paychecks or who must pay the employer's portion of social security or Medicare tax, serves as a detailed record of these tax liabilities. Required for enterprises that fall under the semiweekly deposit schedule, the form aids in ensuring that payments are both timely and accurately aligned with the employer's payroll schedule. Its applicability spans various business models and sizes, highlighting the form’s significance in the broader context of tax compliance. The obligation to correctly fill out and submit this document underscores the necessity for employers to meticulously manage their payroll processes, thereby ensuring they meet federal tax obligations. The nuances of the Schedule B 941 form embody the complexities of tax administration, fostering a keen understanding of how adherence to such regulatory measures are fundamental to the responsible operation of businesses within the fabric of the American economy.

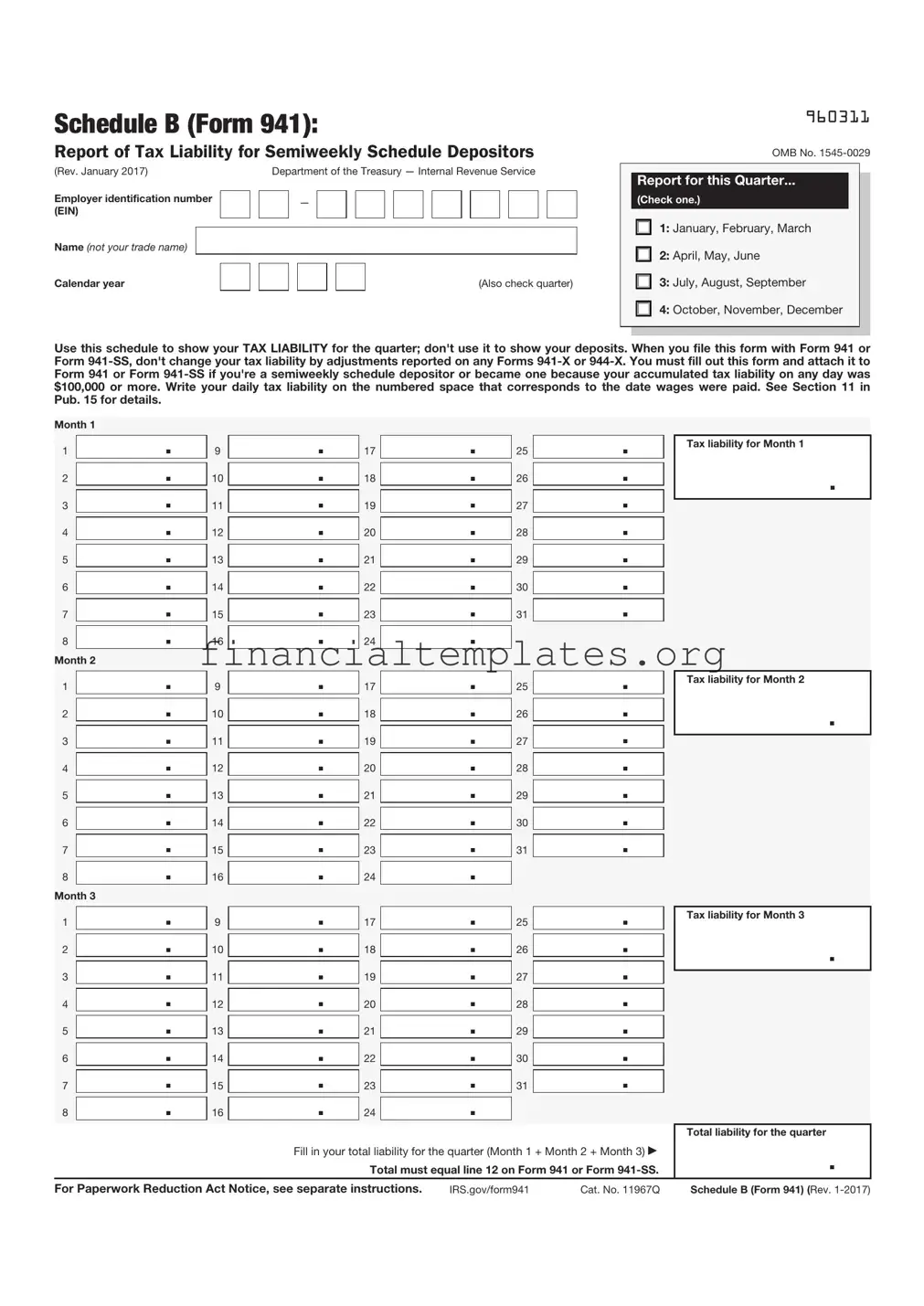

IRS Schedule B 941 Example

Schedule B (Form 941):

Report of Tax Liability for Semiweekly Schedule Depositors

(Rev. January 2017) |

|

|

Department of the Treasury — Internal Revenue Service |

|||||||||||||||||||

Employer identification number |

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(EIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calendar year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Also check quarter) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

960311

OMB No.

Report for this Quarter...

(Check one.)

1: January, February, March

2: April, May, June

3: July, August, September

4: October, November, December

Use this schedule to show your TAX LIABILITY for the quarter; don't use it to show your deposits. When you file this form with Form 941 or Form

Month 1

1 .

.

2 .

.

3 .

.

4 .

.

5 .

.

6 .

.

7 .

.

8 .

.

Month 2

1 .

.

2 .

.

3 .

.

4 .

.

5 .

.

6 .

.

7 .

.

8 .

.

Month 3

9 .

.

10 .

.

11 .

.

12 .

.

13 .

.

14 .

.

15 .

.

16 .

.

9 .

.

10 .

.

11 .

.

12 .

.

13 .

.

14 .

.

15 .

.

16 .

.

17 .

.

18 .

.

19 .

.

20 .

.

21 .

.

22 .

.

23 .

.

24 .

.

17 .

.

18 .

.

19 .

.

20 .

.

21 .

.

22 .

.

23 .

.

24 .

.

25 .

.

26 .

.

27 .

.

28 .

.

29 .

.

30 .

.

31 .

.

25 .

.

26 .

.

27 .

.

28 .

.

29 .

.

30 .

.

31 .

.

Tax liability for Month 1

.

Tax liability for Month 2

.

1 |

|

. |

9 |

|

. |

17 |

|

|

. |

25 |

|

. |

|

Tax liability for Month 3 |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

2 |

|

. |

10 |

|

. |

18 |

|

|

. |

26 |

|

. |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

. |

11 |

|

. |

19 |

|

|

. |

27 |

|

. |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

. |

12 |

|

. |

20 |

|

|

. |

28 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

. |

13 |

|

. |

21 |

|

|

. |

29 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

. |

14 |

|

. |

22 |

|

|

. |

30 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

. |

15 |

|

. |

23 |

|

|

. |

31 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

. |

16 |

|

. |

24 |

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liability for the quarter |

|

|

|

|

Fill in your total liability for the quarter (Month 1 + Month 2 + Month 3) |

. |

|||||||||

|

|

|

|

|

|

Total must equal line 12 on Form 941 or Form |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Paperwork Reduction Act Notice, see separate instructions. |

IRS.gov/form941 |

Cat. No. 11967Q |

Schedule B (Form 941) (Rev. |

|||||||||||

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Schedule B (Form 941) is used for reporting tax liability for semiweekly schedule depositors. It accompanies the main Form 941. |

| Who Must File | Employers who have accumulated a tax liability of $100,000 or more on any given day within a deposit period must file Schedule B (Form 941). |

| Filing Frequency | This schedule is filed quarterly, along with Form 941. |

| Key Contents | It details the dates on which payroll taxes were accrued and the amounts on those days. |

| Importance of Accuracy | Accuracy on Schedule B (Form 941) is crucial to avoid penalties, as it affects tax liability calculations. |

| Governing Law | Federal tax laws govern the preparation and submission of Schedule B (Form 941). |

| Submission Method | It can be submitted electronically through the IRS e-file system or mailed in paper format. |

Guide to Writing IRS Schedule B 941

Filling out the IRS Schedule B (941) Form is a straightforward process if you follow the steps carefully. Often, businesses use this form to report their tax liability for the quarter. It's vital for employers who deposit taxes semi-weekly or if their liability on any day during the quarter was $100,000 or more. Getting this form right ensures that your business stays compliant with federal tax obligations. Below are the detailed steps to fill out the form accurately.

- Start by entering your Employer Identification Number (EIN) in the designated area at the top of the form. Ensure it's accurate, as this identifies your business to the IRS.

- Fill in your business name and address in the spaces provided. Use the name and address under which your business files its taxes.

- Check the box for the quarter for which you are filing. Schedule B (941) must be filed every quarter, so make sure you're working on the correct period.

- On line 1, report your tax liability for each month of the quarter. This amount is not the tax deposited but the tax liability your business incurred. Break down this amount by semi-weekly deposit periods if your business has a semi-weekly deposit schedule.

- If any of the lines from 2 to 7 are applicable, fill them in according to the specific instructions provided for each. These lines capture any adjustments to your tax liability.

- Total your tax liability for the quarter on line 8. This should be the sum of your monthly liabilities plus any adjustments reported above.

- Review your entries carefully to ensure accuracy. Mistakes can lead to processing delays or unexpected liabilities.

- Sign and date the form. An authorized representative of your business, such as the owner, officer, or partner, should do this. By signing, you certify the information is true, correct, and complete.

After completing these steps, your IRS Schedule B (941) Form is ready to be filed. Remember, timely and accurate filing is crucial to avoid any penalties or interest charges. If you're unsure about any part of this process, consider seeking assistance from a tax professional to ensure your business complies with its tax obligations.

Understanding IRS Schedule B 941

-

What is the IRS Schedule B (Form 941) and who needs to file it?

The IRS Schedule B (Form 941) is a tax form used by employers to report tax liabilities that they've incurred due to payroll. It's specifically designed for employers who deposit payroll taxes on a semi-weekly schedule or whose tax liability on any day during a specific period reaches $100,000 or more. Typically, businesses that accumulate a larger amount of payroll taxes due to having more employees or higher wages might need to fill out this form alongside their regular Form 941 filings.

-

How is Schedule B (Form 941) related to Form 941?

Schedule B (Form 941) is essentially a detailed supplement to Form 941. While Form 941 is a quarterly tax return that reports the total taxes due for the quarter, Schedule B breaks down these amounts on a more granular level, showing tax liabilities for each semi-weekly deposit period within the quarter. Employers use Schedule B to list specific tax liabilities due dates, ensuring they meet the IRS's requirements for frequent tax deposits.

-

What are the filing deadlines for Schedule B (Form 941)?

The filing deadlines for Schedule B align with those of Form 941, which are due on the last day of the month following the end of a quarter. This means April 30th for the first quarter, July 31st for the second quarter, October 31st for the third quarter, and January 31st for the fourth quarter. It’s important to note that if any of these dates fall on a weekend or federal holiday, the deadline is extended to the next business day.

-

Can I file Schedule B (Form 941) electronically?

Yes, employers can file Schedule B (Form 941) electronically, and in fact, the IRS encourages electronic filing because it's faster and reduces the risk of errors. Employers can use IRS-approved e-file providers or software that supports the electronic filing of both Form 941 and Schedule B. Electronic filing can accelerate the processing of your payroll tax filings and confirmations of receipt from the IRS.

-

How can I correct a mistake on Schedule B (Form 941) after it has been filed?

If you discover an error on a filed Schedule B (Form 941), you should correct the mistake by filing Form 941-X, Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund. Form 941-X is used for correcting errors on previously filed Form 941 and its schedules. Be sure to carefully follow the instructions on Form 941-X, specifying the nature of the error and the correct information. Corrections to tax liabilities reported on Schedule B must be clear and accurate to avoid further issues with the IRS.

-

Is there a penalty for late filing of Schedule B (Form 941)?

Yes, employers may face penalties for late filing of Schedule B (Form 941). These penalties are based on how late the form is filed and the amount of unpaid taxes due. The IRS may impose a failure-to-file penalty, a failure-to-pay penalty, or both, depending on the circumstances. The longer the delay in filing and payment, the higher the penalties can accumulate. Therefore, it’s crucial to file and pay on time to avoid these additional costs.

-

Who is not required to file Schedule B (Form 941)?

Employers who deposit monthly, rather than semi-weekly, are typically not required to file Schedule B (Form 941). This includes smaller employers whose monthly payroll tax liability is less likely to exceed the $50,000 threshold that generally determines the requirement for semi-weekly deposits. Additionally, employers with a tax liability of less than $2,500 for the quarter may be able to pay their tax liability with their Form 941 instead of depositing it throughout the quarter, thereby bypassing the need for Schedule B.

-

How do I determine if I need to file Schedule B (Form 941)?

Employers need to review their tax liability for each payroll period. If your total tax liability for a given payroll exceeds the threshold that requires semi-weekly deposits, or if at any point in the quarter your accumulated tax liability reaches $100,000 or more, you're required to file Schedule B with your Form 941. The IRS also provides detailed guidance and criteria in the instructions for Form 941 and Schedule B, which can help employers determine their filing requirements based on their specific circumstances.

Common mistakes

When it comes to filling out the IRS Schedule B (941) form, accuracy is key. This form, used by employers to report tax liabilities, often trips up filers due to its specific demands. Common mistakes can lead to misreporting, which in turn might result in penalties. Here are eight common errors to be aware of:

Not reporting on a semi-weekly basis - The IRS requires employers who are semi-weekly depositors to report their tax liabilities for each semi-weekly period. Misunderstanding the reporting period can lead to incorrect filings.

Incorrectly calculating the tax amount - It is crucial to correctly calculate the tax based on the wages paid. Simple miscalculations can cause significant discrepancies in reported and actual liabilities.

Misunderstanding the deposit schedule - Employers often confuse the deposit schedule with the reporting schedule. While deposits may be made more or less frequently, reporting must follow the IRS's semi-weekly schedule.

Omitting adjustments - Failing to include adjustments for tips and group-term life insurance, for instance, can lead to underreporting of liabilities.

Forgetting to sign the form - An unsigned form is not valid. The IRS requires a signature to process the form.

Using incorrect Employer Identification Number (EIN) or name - The EIN and the employer's name should match IRS records exactly. Mismatches can lead to processing delays or errors.

Failure to file electronically - Employers with a certain threshold of employees are required to file electronically. Not adhering to this requirement can result in penalties.

Not keeping records - Employers must keep copies of filed tax forms for at least four years. Failure to maintain these records can create complications if the IRS requests documentation.

Avoiding these mistakes requires attention to detail and a thorough understanding of the form's requirements. When in doubt, review the IRS's instructions for Schedule B (941) or consult a tax professional. These steps can help ensure that the form is completed accurately and on time, avoiding unnecessary penalties and interest.

Documents used along the form

When preparing your tax documents, it's important to have a thorough understanding of all the necessary paperwork. The IRS Schedule B (Form 941) is a crucial document for reporting your employee's tax withholding. Alongside this form, there are several other important documents that businesses often need to complete their tax filings correctly and efficiently. Here's a list of seven documents typically used in conjunction with the IRS Schedule B (Form 941).

- Form 941: This is the primary form used by employers to report federal income taxes, social security tax, or Medicare tax withheld from their employees' paychecks. Additionally, it reports the employer's portion of Social Security or Medicare tax.

- Form W-2: Issued to employees, this form reports annual wages and the amount of taxes withheld from their paycheck. It's essential for employers to prepare and send out Form W-2 to every employee annually.

- Form W-3: This form serves as a summary of all W-2 forms an employer issues. It reports total earnings, Social Security wages, Medicare wages, and tax withholdings for all employees. It needs to be filed with the Social Security Administration alongside the W-2 forms.

- Form W-4: Completed by employees, this form indicates their tax situation to the employer so that the employer can withhold the correct federal income tax from their pay. It's important for the accuracy of Form 941 and Schedule B.

- Form 940: Employers use this form to report their annual Federal Unemployment Tax Act (FUTA) tax. This tax is solely an employer's responsibility and is not withheld from employee wages.

- Form 1099-MISC: This form is used to report payments made to freelance workers or independent contractors. It's essential for businesses that work with non-employees and need to report their payments.

- Form 1096: This is a summary form used with certain types of 1099 forms. It's a cover sheet that reports the total of information returns being sent to the IRS.

Accurately completing and filing each of these forms is crucial for compliance with IRS requirements. These documents work together to provide a comprehensive overview of a business's payroll tax obligations, ensuring that both the employer's and employees' taxes are reported correctly. Keeping track of these forms and understanding their purpose can help streamline the tax filing process, making it easier to meet deadlines and maintain accurate records.

Similar forms

The IRS Schedule B (Form 941), a companion to the Employer's Quarterly Federal Tax Return, closely aligns with Form 940, the Employer's Annual Federal Unemployment (FUTA) Tax Return. Both forms are integral components of federal tax reporting for employers, detailing tax liabilities owed to the federal government. However, while Schedule B breaks down a taxpayer's liability on a semi-weekly or monthly basis for each quarter, Form 940 captures an annual overview of unemployment taxes due. This key difference in the frequency of reporting does not diminish their similarity in purpose — to ensure employers report and pay taxes appropriately to support federal programs.

Similarly, Form 944, the Employer’s Annual Federal Tax Return, bears resemblance to Schedule B of Form 941 in its intention to streamline tax reporting and payment for small employers. The primary difference lies in the reporting period; as suggested by the title, Form 944 is utilized on an annual basis, aimed at businesses with a smaller tax liability. This offers a simpler alternative for smaller enterprises, reducing the need for frequent filings while maintaining the essential function of reporting employment taxes to the IRS. Both forms are designed with the employer's responsibility in mind — ensuring timely and accurate tax payments.

The IRS Schedule B is also akin to Form W-2, the Wage and Tax Statement. Though Schedule B and Form W-2 serve distinctly different functions — one being for the employer's quarterly tax liability and the other for reporting annual wages and taxes withheld from employees — they share a fundamental similarity. Both forms are critical for the IRS's collection and reconciliation of taxes, ensuring that employers are withholding and remitting the correct amount of taxes on behalf of their employees. Thus, despite their differences in scope and purpose, both documents are pivotal to the IRS's operations.

The Form W-3, Transmittal of Wage and Tax Statements, complements the functionality of IRS Schedule B by summarizing the total earnings, social security wages, Medicare wages, and withholding for all employees for the year. While Schedule B is used alongside Form 941 to report employment tax liabilities quarterly, Form W-3, in conjunction with Form W-2, provides an annual summary directly to the Social Security Administration. This form ensures that the data from individual W-2s are accurately totaled and reported, facilitating the cross-verification of reported tax liabilities and withheld taxes, an essential process paralleled in the intent behind Schedule B.

Lastly, the relationship between Schedule B (Form 941) and Form 1040, the U.S. Individual Income Tax Return, highlights the comprehensive ecosystem of tax reporting and collection. Although Form 1040 pertains to individual taxpayers and Schedule B to employers, both serve as critical links in the IRS's chain of tax collection and compliance. Schedule B details the employer's tax liabilities on a more granular, periodic basis, whereas Form 1040 summarizes an individual's annual income and taxes due. This contrast underscores the broader tax landscape's interconnected nature, where varied forms ensure thorough and equitable tax collection from all fronts.

Dos and Don'ts

Schedule B for Form 941 is crucial for employers who report payroll taxes on a semi-weekly schedule. Accuracy and timeliness are paramount. Here are ten essential guidelines for correctly completing this form, ensuring compliance with the Internal Revenue Service (IRS).

Do's:

- Ensure you're required to file Schedule B by verifying if your total taxes after adjustments and credits for the quarter exceed $50,000 or if you’ve accumulated a $100,000 tax liability on any given day during the tax year.

- Review the filing period and make certain you are filling out the form for the correct quarter. Each quarter has distinct deadlines and requirements.

- Use accurate payroll records to report taxes. Your total on Schedule B should match the amount on your Form 941, line 12.

- Enter your Employer Identification Number (EIN), the name of your business, and other required information correctly. Any discrepancy can lead to delays or misprocessing.

- List tax liabilities for each semiweekly deposit period in the quarter, even if you made no payments during that period.

- Report your tax liabilities, not the deposits made. It's crucial to differentiate between the amounts owed for each period from the actual deposits.

- Verify your calculations. Double-check that the total tax liability reported matches your records and Form 941.

- Sign and date the completed Schedule B. An unsigned form is considered incomplete.

- Keep a copy of Schedule B for your records. Documentation is key in the event of an IRS inquiry.

- File on time to avoid penalties. Adhere to the filing deadlines as they are strictly enforced.

Don'ts:

- Don’t estimate amounts. Use your payroll records to report exact figures.

- Don’t forget to include the Schedule B when filing Form 941 if you are a semiweekly depositor. It's an essential part of the filing process.

- Don’t report your deposits; report your liabilities for each semiweekly period. It’s a common mistake that can cause confusion and potentially lead to inaccuracies on your form.

- Don’t leave blanks if there were no liabilities for a period. Instead, enter “0” to indicate no liability was accrued.

- Don’t file late. Late filings can result in penalties and interest charges, compounding any existing tax liabilities.

- Don’t neglect to sign and date your form. An unsigned form is not valid and will not be processed by the IRS.

- Don’t ignore IRS notices. If you receive correspondence from the IRS regarding your Schedule B, respond promptly to avoid further issues.

- Don’t use corrections fluid or similar products on the form. If you make a mistake, start over with a new form to ensure legibility and accuracy.

- Don’t submit incomplete forms. Verify all entries for accuracy and completeness before submission.

- Don’t forget to check the IRS website or contact a professional if you’re unsure about how to complete Schedule B. Staying informed of the latest tax laws and regulations can prevent costly mistakes.

Misconceptions

The IRS Schedule B (941) form is a document that many businesses need to be familiar with, but there are several misconceptions about it. Understanding these can help ensure accurate tax reporting and compliance with IRS requirements.

It is required for all businesses. Not all businesses need to file Schedule B (941). This form is specifically for those who are depositing payroll taxes monthly or semiweekly. If your business does not fit this criteria, you may not need to file.

It’s the same as Form 941. While Schedule B (941) is closely related to Form 941, they are not the same. Form 941 is used to report wages and taxes for each quarter, while Schedule B (941) outlines when these taxes were actually deposited.

It can be filed separately from Form 941. Schedule B must be filed together with Form 941. It serves as a detailed record of tax liability dates, not a standalone report.

Filing late doesn’t have consequences. Late filing can result in penalties and interest charges on the unpaid taxes. It's crucial to adhere to IRS deadlines to avoid these additional costs.

The filing frequency is chosen by the business. The IRS determines your filing requirement (monthly or semiweekly) based on your reported tax liability in a lookback period. It is not up to the business to choose.

All errors can be corrected in subsequent filings. While some errors can be rectified on future forms, others may require filing an amended return or contacting the IRS directly. Understanding the appropriate course of action is essential for proper correction.

Electronic filing is optional. Depending on the amount of your deposits, electronic filing may be mandatory. The IRS has specific thresholds that determine when electronic filing is required, enforcing modern reporting standards and ensuring efficient and accurate processing.

Dispelling these misconceptions about the IRS Schedule B (941) form is vital for businesses to maintain compliance and avoid unnecessary penalties. Always consult current IRS guidelines or a tax professional when preparing your business taxes to ensure accuracy and compliance.

Key takeaways

The IRS Schedule B (941) form is essential for employers who report taxes on a semiweekly schedule. When handling this form, it is critical to understand its purpose, how to fill it out correctly, and the implications of submissions. Below are five key takeaways to guide individuals and businesses in managing this part of their tax responsibilities effectively:

Understand the Purpose: Schedule B (941) is designed for employers who are required to report taxes associated with Form 941, Employer's Quarterly Federal Tax Return, on a semiweekly basis. This form helps track tax liabilities as they occur within each month of the quarter, ensuring accurate and timely tax payments.

Determine if You Need to File: Not every employer needs to file Schedule B (941). This requirement is specifically for those who have accumulated $50,000 or more in employment taxes in the lookback period or have been notified by the IRS to make semiweekly deposits. Understanding whether your business falls into this category is crucial before proceeding.

Accurately Report Tax Liabilities: When filling out Schedule B (941), report the taxes accurately for each semiweekly deposit period. The amounts entered should reflect the liabilities accrued, not the amounts deposited. This distinction is vital for the IRS to reconcile your reported liabilities with your deposits.

Pay Attention to Deadlines: The filing deadlines for Schedule B align with the quarterly Form 941. However, the semiweekly deposit schedule means that employers may need to make deposits more frequently, depending on their tax liability amounts and the specific days wages are paid. Familiarizing yourself with these deadlines can prevent late submissions and potential penalties.

Maintain Accurate Records: Keeping detailed records of all employment tax liabilities and deposits is essential. In the event of any discrepancies or audits by the IRS, having accurate and accessible records can support your filings and clarify any questions about your tax responsibilities.

Handling IRS Schedule B (941) with care and attention ensures compliance with tax regulations, supporting smooth operational practices for employers managing semiweekly tax deposits. Engaging with a tax professional or accountant who understands these requirements can also provide valuable guidance and peace of mind throughout this process.

Popular PDF Documents

Federal Form 1310 - Can be a crucial component in the final tax return filing for someone who has died.

941 Taxes - Employers looking to fully understand their tax duties can benefit from workshops and guidance provided by the IRS specifically regarding the 941 form.

Irs Form 9423 Where to Mail - Includes reference to specific Internal Revenue Code sections that authorize the IRS to request information from taxpayers.