Get IRS Schedule B 1040 Form

Filing taxes can often feel like navigating through a maze, with each turn introducing new forms and requirements. Among these forms, IRS Schedule B for the 1040 form stands out for individuals who have more complex financial backgrounds, particularly those with substantial interest and dividend income. This form is crucial for taxpayers who need to report interest and dividends that exceed certain amounts, typically making it an essential document for individuals with investments. Beyond its primary function of reporting interest and dividends, Schedule B also plays a pivotal role in foreign accounts and trusts reporting, necessitating detailed information about foreign assets, which adds another layer of complexity and importance to this document. Understanding the intricacies of Schedule B can not only ensure compliance with tax regulations but also potentially uncover avenues for financial optimization. Thus, grasping the major aspects of this form is a step toward demystifying the tax filing process and achieving a more thorough and accurate submission.

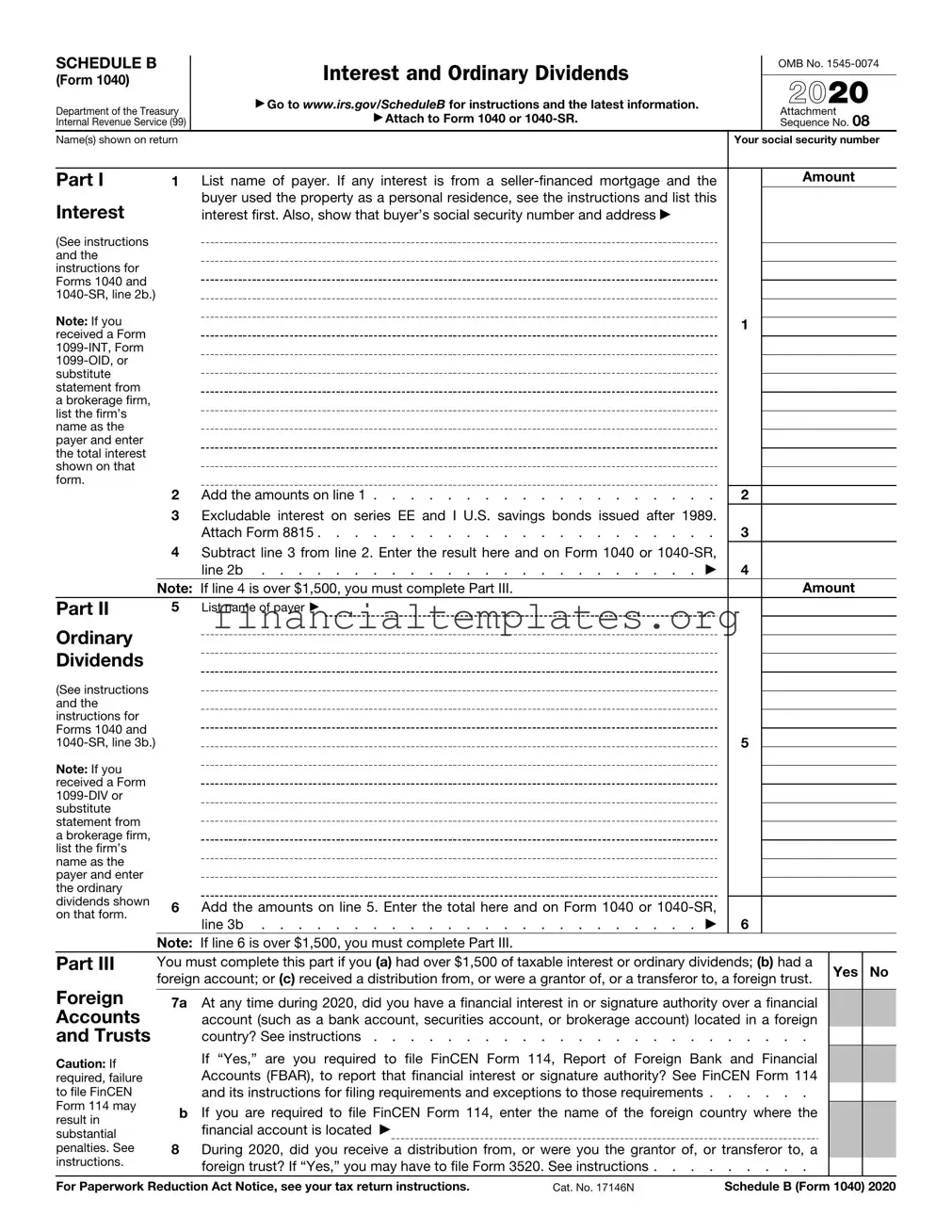

IRS Schedule B 1040 Example

SCHEDULE B |

|

Interest and Ordinary Dividends |

|

OMB No. |

|||

|

|

||||||

(Form 1040) |

|

|

|

|

|

|

|

|

|

2022 |

|

||||

Department of the Treasury |

Go to www.irs.gov/ScheduleB for instructions and the latest information. |

|

|

||||

Attach to Form 1040 or |

|

Attachment |

|||||

|

|

|

|||||

Internal Revenue Service |

|

Sequence No. 08 |

|||||

Name(s) shown on return |

|

Your social security number |

|||||

|

|

|

|

|

|

|

|

Part I |

1 |

List name of payer. If any interest is from a |

|

Amount |

|||

Interest |

|

buyer used the property as a personal residence, see the instructions and list this |

|

|

|

|

|

|

interest first. Also, show that buyer’s social security number and address: |

|

|

|

|

|

|

(See instructions |

|

|

|

|

|

|

|

and the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 1040, |

|

|

|

|

|

|

|

line 2b.) |

|

|

|

|

|

|

|

Note: If you |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

received a |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

||

Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Form |

|

|

|

|

|

|

|

or substitute |

|

|

|

|

|

|

|

statement from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a brokerage firm, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

list the firm’s |

|

|

|

|

|

|

|

name as the |

|

|

|

|

|

|

|

payer and enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the total interest |

|

|

|

|

|

|

|

shown on that |

|

|

|

|

|

|

|

form. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Add the amounts on line 1 |

2 |

|

|

|

|

|

3 Excludable interest on series EE and I U.S. savings bonds issued after 1989. |

|

|

|

|

|

|

|

|

Attach Form 8815 |

3 |

|

|

|

|

|

4 |

Subtract line 3 from line 2. Enter the result here and on Form 1040 or |

4 |

|

|

|

|

|

Note: If line 4 is over $1,500, you must complete Part III. |

|

Amount |

||||

Part II |

5 |

List name of payer: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(See instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 1040, |

|

|

5 |

|

|

|

|

line 3b.) |

|

|

|

|

|

|

|

Note: If you |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

received a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or substitute |

|

|

|

|

|

|

|

statement from |

|

|

|

|

|

|

|

a brokerage firm, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

list the firm’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

name as the |

|

|

|

|

|

|

|

payer and enter |

|

|

|

|

|

|

|

the ordinary |

6 |

Add the amounts on line 5. Enter the total here and on Form 1040 or |

|

|

|

|

|

6 |

|

|

|

|

|||

dividends shown |

|

|

|

|

|||

on that form. |

Note: If line 6 is over $1,500, you must complete Part III. |

|

|

|

|

|

|

Part III |

You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends; (b) had a foreign |

||||||

Foreign |

account; or (c) received a distribution from, or were a grantor of, or a transferor to, a foreign trust. |

||||||

Accounts |

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

||

and Trusts |

7a |

At any time during 2022, did you have a financial interest in or signature authority over a financial |

|

|

|

||

|

|

|

|||||

Caution: If |

|

account (such as a bank account, securities account, or brokerage account) located in a foreign |

|

|

|

||

required, failure to |

|

country? See instructions |

|

|

|||

file FinCEN Form |

|

If “Yes,” are you required to file FinCEN Form 114, Report of Foreign Bank and Financial |

|

|

|

||

|

|

|

|

||||

114 may result in |

|

|

|

|

|||

substantial |

|

Accounts (FBAR), to report that financial interest or signature authority? See FinCEN Form 114 |

|

|

|

||

penalties. |

|

and its instructions for filing requirements and exceptions to those requirements |

|

|

|

||

Additionally, you |

b |

If you are required to file FinCEN Form 114, list the name(s) of the foreign |

|

|

|

||

may be required |

|

|

|

||||

to file Form 8938, |

|

financial account(s) are located: |

|

|

|

|

|

Statement of |

|

|

|

|

|

|

|

Specified Foreign |

8 |

During 2022, did you receive a distribution from, or were you the grantor of, or transferor to, a |

|

|

|

||

Financial Assets. |

|

|

|

||||

See instructions. |

|

foreign trust? If “Yes,” you may have to file Form 3520. See instructions |

|

|

|||

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 17146N |

Schedule B (Form 1040) 2022 |

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS Schedule B (Form 1040) pertains to the reporting of interest and ordinary dividends. |

| 2 | This form is used by individuals who receive amounts of interest or dividends that exceed the standard threshold set by the IRS. |

| 3 | Schedule B (Form 1040) is an attachment to the IRS Form 1040, the U.S. Individual Income Tax Return. |

| 4 | The requirement to file Schedule B is determined by the amount of taxable interest or dividend income received during the tax year. |

| 5 | Part I of Schedule B is where taxpayers list the total interest income, naming each payer and the amount received from each. |

| 6 | Part II of Schedule B is dedicated to reporting ordinary dividends, again listing each payer and the amounts received. |

| 7 | The form also asks about foreign accounts and trusts, requiring information if the taxpayer has signature authority over or financial interest in foreign financial accounts. |

| 8 | Filing Schedule B may also be required if a taxpayer received distributions from a nonqualified retirement plan or if they incurred a financial loss in a Ponzi scheme. |

| 9 | Schedule B is not just for reporting income but also plays a part in international tax compliance, helping to enforce tax laws on foreign accounts and trusts. |

| 10 | Filing accuracy for Schedule B is crucial for avoiding potential penalties associated with underreporting income or failing to disclose foreign accounts. |

Guide to Writing IRS Schedule B 1040

Filling out IRS Schedule B (Form 1040) is an important step in accurately reporting your interest and dividend income for the year. This form is specifically meant for individuals who have received certain types of income, including interest from bank accounts or dividends from stock investments. Ensuring that this form is completed correctly can help you meet your tax obligations and avoid potential issues with the Internal Revenue Service. The process involves a detailed report of your income sources. Here are the steps to guide you through the completion of Form 1040's Schedule B.

- Start by gathering all your financial statements that report interest and dividends, such as bank statements, savings accounts, and investment accounts documentation.

- At the top of Schedule B, fill in your name and your Social Security Number. Make sure this information matches what's on your Form 1040 or 1040-SR.

- In Part I of the form, list all sources of interest income. For each source, you'll need to provide the name of the payer and the amount of interest received. Ensure you report every source, even if you haven't received a Form 1099-INT.

- Calculate the total interest income from all sources and enter this amount at the bottom of Part I.

- Move to Part II for dividend income. Similar to what you did for interest in Part I, list all sources of dividend income. Provide the name of each payer along with the amount of dividends received.

- Add up all your dividend income and write the total at the bottom of Part II.

- If your total interest and dividend income exceed certain thresholds, you may also need to complete Part III regarding foreign accounts and trusts. This section asks about the existence of foreign financial accounts and certain foreign trusts.

- Review your form for accuracy. Double-check the names of payers, amounts received, and your Social Security Number for typos or mistakes.

- Once you've completed Schedule B, attach it to your Form 1040 or 1040-SR. If you're filling out your tax return electronically, follow the software's instructions for including Schedule B information.

- Retain copies of Schedule B along with your other tax return documents for at least three years from the date you file your return or two years from the date you paid the tax, whichever is later. This documentation is crucial for your records and potential future inquiries.

After you've successfully filled out and attached Schedule B to your tax return, it's crucial to send everything to the IRS by the tax filing deadline to avoid penalties. If you're unsure about any details concerning your interest and dividend income, or if you need assistance with other parts of your tax return, consider consulting with a tax professional. They can offer personalized advice and help ensure your tax return is complete and accurate.

Understanding IRS Schedule B 1040

What is IRS Schedule B (Form 1040) and who needs to file it?

Schedule B (Form 1040) is a document used by taxpayers to report the amount of interest and ordinary dividends earned during the tax year that exceed certain thresholds set forth by the Internal Revenue Service (IRS). It's an attachment to the standard Form 1040. Taxpayers who receive interest or dividend income above $1,500 for the year or have foreign accounts and trusts they're involved with typically need to complete this form.

What types of income should be reported on Schedule B?

The form is specifically designed for reporting two main types of income:

- Interest income, such as that earned from bank accounts, certificates of deposit, and bonds.

- Dividend income, including distributions from stock investments or mutual funds.

Are there exceptions to who must file Schedule B based on the amount of interest and dividends?

Yes, if the total amount of interest and dividend income received during the tax year is $1,500 or less, the taxpayer usually does not need to file Schedule B. However, certain situations, such as receiving income from a foreign trust or having a financial interest in or signature authority over a foreign bank account, may still require Schedule B, regardless of income level.

How does one report foreign accounts and trusts on Schedule B?

Part III of Schedule B is dedicated to reporting foreign accounts and trusts. Taxpayers must disclose the country in which each account is located, and they may need to provide additional forms, such as the FinCEN Form 114 (FBAR) or Form 8938 (Statement of Specified Foreign Financial Assets), depending on their situation.

Can Schedule B impact the amount of taxes owed or refund received?

Yes, the income reported on Schedule B directly impacts taxable income, which can affect the amount of taxes owed or the size of the refund. Properly reporting interest and dividend income ensures that taxpayers meet their legal obligations and calculate their taxes correctly.

What are the deadlines for filing Schedule B?

Schedule B is filed as part of the Form 1040, so its deadline aligns with the regular tax return due date, typically April 15. If an extension is filed for the Form 1040, it also applies to Schedule B. For those reporting foreign accounts with the FBAR, the deadline is April 15, with an automatic extension to October 15.

Where can taxpayers get assistance with filling out Schedule B?

Help can be found in several places, including the IRS website, which offers instructions and resources. Tax preparation software often guides individuals through the process of filling out Schedule B as part of their tax return. Professional tax advisors or accountants can also provide personal assistance and advice.

How should taxpayers file Schedule B?

Taxpayers can file Schedule B electronically with their Form 1040 through IRS e-file or attach it to their paper tax return if mailing. E-filing is encouraged by the IRS for its ease and faster processing times.

Common mistakes

Filling out the IRS Schedule B 1040 form can sometimes be confusing. People often make mistakes that could be avoided with careful attention. Below are some common errors:

Not reporting all interest or dividend incomes, even if they are small amounts. Every amount counts and must be reported.

Failing to include interest from foreign accounts, which also needs to be disclosed, regardless of the amount.

Mixing up the interest and dividend sections, leading to incorrect reporting of income types.

Inputting the wrong amounts due to misreading financial statements or summaries provided by banks or financial institutions.

Forgetting to attach supplemental schedules for interests from partnerships, S corporations, estates, and trusts when required.

Omitting nominee distributions — amounts reported in your name but actually belong to someone else.

Incorrectly filing the form when not required. Schedule B is necessary only if interests and dividends exceed certain amounts or under specific conditions.

Overlooking the need to report a financial interest in, or signature authority over, foreign accounts, which might necessitate filling out FinCEN Form 114.

Avoid these mistakes by thoroughly reviewing your financial documents, understanding the requirements for foreign accounts, and knowing when and what to report. Consider consulting with a tax professional if you have questions or concerns about your specific situation.

Documents used along the form

When preparing your taxes, especially if you have interests and ordinary dividends that necessitate the filing of an IRS Schedule B (Form 1040), there are several other forms and documents you may need to complete your tax return accurately. These documents accompany Schedule B to provide a comprehensive overview of your financial situation to the IRS.

- Form 1099-INT: This document is issued by banks and other financial institutions to report interest income you've earned during the tax year. It's crucial for accurately filling out Schedule B since it includes details on interest earned that you must report to the IRS.

- Form 1099-DIV: Similar to Form 1099-INT, this form is used to report dividends and distributions received from investments. If you own stock or mutual funds that pay dividends, you'll need this form to report the income on Schedule B properly.

- Form 8938, Statement of Specified Foreign Financial Assets: If you have certain foreign financial assets that exceed the reporting threshold, you'll need to file Form 8938. This form requires detailed information about your foreign assets, which could include foreign bank accounts or foreign stocks, relevant for taxpayers who also need to file Schedule B due to foreign accounts or trusts.

- FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR): Separate from, but often required alongside Schedule B, this form is filed with the Financial Crimes Enforcement Network (not the IRS) to report foreign bank accounts and financial assets if they total more than $10,000 at any point during the tax year. While it's filed separately from your tax return, it's a critical component for taxpayers with foreign income or accounts.

Gathering these documents will ensure you have all the necessary information to accurately report your interest and dividend income, as well as any foreign financial activity. By understanding and collecting the relevant forms and documents up front, you can make the process of filling out Schedule B, and your entire tax return, smoother and more accurate.

Similar forms

The IRS Schedule B (Form 1040) is a document that taxpayers in the United States use to report certain types of income, particularly interest and dividend income. It bears similarity to several other tax-related documents, each serving its unique purpose within the framework of the IRS's mission to collect taxes efficiently while maintaining fairness in the tax system. One of these documents is the IRS Form 1099-INT, which is used by banks and other financial institutions to report the interest income paid to investors. Both Schedule B and Form 1099-INT focus on tracking income from investments, but while Schedule B is where the taxpayer reports this income, Form 1099-INT is the document through which the payer of the interest income reports how much was paid, effectively acting as a source document for the Schedule B.

Another document closely related to Schedule B is the IRS Form 1099-DIV. This form is used by corporations and mutual funds to report dividends and distributions to investors. Similar to the way interest income is reported, Schedule B is used to summarize the dividend income a taxpayer receives, which is initially reported by the payer on Form 1099-DIV. This ensures that all dividend earnings are accounted for in the taxpayer’s income, reflecting the interconnected nature of these forms in reporting investment income.

The Foreign Bank and Financial Accounts Report (FBAR) is another form that shares a common purpose with Schedule B, but with a more specific focus. It is required for reporting financial interests in, or signature authority over, foreign financial accounts when the aggregate value of those accounts exceeds $10,000 at any time during the calendar year. While Schedule B asks if the taxpayer had such financial interests, the FBAR goes into detail, requiring the taxpayer to list every qualifying foreign account. This interconnected requirement emphasizes compliance and transparency in foreign asset reporting.

Similarly, the IRS Form 8938, Statement of Specified Foreign Financial Assets, has objectives that align closely with Schedule B’s Section III, which deals with foreign accounts and trusts. Both require disclosure of foreign financial assets, yet Form 8938 is more comprehensive, asking for specific details regarding the type and value of assets. The aim is to ensure individuals report their foreign financial assets above a certain threshold, complementing the Schedule B with more detailed information.

The IRS Form 8960, Net Investment Income Tax, is yet another form that relates to Schedule B, particularly for individuals who need to calculate an additional tax on their investment income, which includes interest and dividends. While Schedule B helps report this type of income, Form 8960 calculates the tax due based on that income, among other types, indicating how these forms work together to ensure proper taxation of investment income.

Lastly, the IRS Schedule D (Form 1040) is intricately connected to Schedule B as both deal with income from investments. However, while Schedule B focuses on interest and dividends, Schedule D is used to report capital gains and losses from the sale of investments. This distinction delineates different types of investment income and losses, showcasing the IRS’s comprehensive approach to investment reporting. Together, they cover the spectrum of taxable investment activity, ensuring that taxpayers report their income accurately and completely.

These documents collectively form a network that captures various facets of an individual’s financial profile, from interest and dividends to foreign accounts and capital gains. Understanding each form’s role and how it complements others is essential for accurate and complete tax reporting, highlighting the IRS’s multifaceted approach to tracking and taxing income.

Dos and Don'ts

Filling out the IRS Schedule B (Form 1040) involves detailing interest and ordinary dividends. When approaching this task, it’s essential to pay close attention to detail and adhere to IRS guidelines to ensure accuracy and compliance. Here are key dos and don'ts to guide you through the process:

Do:- Review your financial statements. Before starting, gather all necessary documents such as bank statements, investment accounts summaries, and any 1099 forms. This preparation ensures all sources of interest and dividends are accurately reported.

- Understand the requirements. Know if you need to file Schedule B. Generally, you must if you received over $1,500 in interest and ordinary dividends, or if you have foreign accounts or received distributions from, or were a grantor of, or transferor to, a foreign trust.

- Report every source of interest and dividends. Even if you have not received a Form 1099 from an institution, it's your responsibility to report all interest and dividend income on your tax return.

- Look into foreign accounts. If you have foreign bank accounts, stocks, securities, or trusts, you might need to report these interests. Be accurate to avoid penalties related to underreporting or failure to disclose foreign assets.

- Double-check your entries. Before filing, review your form for accuracy. Ensure that all figures are correctly entered and add up, as even small mistakes can lead to processing delays or audits.

- Ignore small amounts. All interest and dividend income must be reported, no matter how small. The IRS receives copies of 1099 forms and will know if any income is omitted.

- Forget to include your taxpayer identification number (TIN). It is crucial for processing your form. The lack of a TIN can result in processing delays and potential penalties.

- Mistake taxable and tax-exempt interest. Schedule B requires separate reporting of these amounts. Tax-exempt interest, while not taxable, still must be reported on your tax return.

- Overlook the necessity to acknowledge foreign accounts. If you check "Yes" to having financial interest in or signature authority over foreign accounts, you may also need to file FinCEN Form 114, "Report of Foreign Bank and Financial Accounts (FBAR)." Not complying with FBAR requirements can lead to severe penalties.

- Wait until the last minute. Rushing can lead to mistakes. Allocate sufficient time to accurately fill out the Schedule B form, especially if you have to research or gather financial documents.

Misconceptions

The IRS Schedule B (Form 1040) often brings confusion and misunderstanding among taxpayers. Here are eight misconceptions that require clarification to help individuals navigate their taxes more effectively:

- All taxpayers must file Schedule B. This is incorrect. Only those who have a certain level of interest or dividend income, or have foreign accounts, need to include Schedule B with their Form 1040.

- It's only for reporting interest and dividends. While it's true that Schedule B is primarily used to report interest and dividends, it's also necessary for reporting foreign accounts and trusts.

- Interest earned from all sources is reportable on Schedule B. In reality, certain types of interest, such as interest from a qualified savings bond used for education, may not have to be reported.

- Filling out Schedule B automatically means you have to pay more taxes. Filing Schedule B does not inherently increase your tax bill. It is simply a way to report the types of income and foreign activities that the form covers.

- You don’t need to report interest or dividends that are tax-exempt on Schedule B. Even if your interest or dividends are exempt from federal taxes, you may still need to report them on Schedule B to provide a complete account of your income.

- If your dividends are reinvested, you don't need to report them on Schedule B. This is not true. Reinvested dividends are still considered income and must be reported accordingly.

- Only large foreign accounts need to be reported on Schedule B. The reality is that any foreign financial accounts or trusts must be disclosed on Schedule B if the total value exceeds specific thresholds, which can be relatively low.

- The information on Schedule B is only used for tax purposes. While the primary function of Schedule B is for the taxpayer to report interest, dividends, and foreign accounts, this information may also be used by the IRS for compliance and monitoring of foreign account reporting laws.

Understanding these misconceptions is crucial for accurately completing your tax return and ensuring compliance with IRS requirements.

Key takeaways

When managing your taxes, understanding how to accurately fill out and use IRS Schedule B (Form 1040) is crucial for taxpayers who have certain types of income. Here's a concise guide to help you navigate this process efficiently.

Identify the Need to File Schedule B: Schedule B is required if you receive more than $1,500 in taxable interest or ordinary dividends, or if you have foreign accounts or receive distributions from foreign trusts. It’s an essential form for reporting interest and dividend income accurately.

Report All Interest and Dividends: On Schedule B, you must list all sources of interest (Part I) and dividends (Part II) separately. Ensure that you report income from all sources, including banks, credit unions, and investments, to avoid any discrepancies or potential audits.

Understand Foreign Accounts and Trusts Reporting: Part III of Schedule B asks about foreign accounts and trusts. If you have an interest in or signature authority over a financial account in a foreign country, or if you received a distribution from, or were a grantor of, or a transferor to a foreign trust, you must disclose this information. This part helps comply with international reporting requirements and the Foreign Account Tax Compliance Act (FATCA).

Combine Interest and Dividends with Other Income: Once you've completed Schedule B, combine the total interest and dividends reported with your other income. This sum goes onto your Form 1040, which is used to calculate your total income and tax liability.

Accuracy is Key: Ensure the information provided on Schedule B matches records from banks, financial institutions, and other entities that provided you with income. Discrepancies can lead to audits, penalties, or additional taxes. If you're unsure about some information, it's better to consult with a tax professional than to guess.

Keep Records: Even if not all detail about every source of interest or dividends must be reported on Schedule B, it's crucial to keep detailed records of all income received. This documentation is vital for your records and necessary should the IRS request more information.

Effectively managing your Schedule B can simplify the tax filing process, ensure compliance, and avoid potential issues with the IRS. Remember, when in doubt, seeking advice from a tax professional can provide clarity and peace of mind.

Popular PDF Documents

IRS 8919 - It requires detailed information about the employment situation and the reason for the misclassification claim.

Irs Form 2159 - Acts as a direct link between businesses and the EFTPS, facilitating efficient communication and transactions.

IRS 5405 - The form is used for both calculating the repayment amount and for reporting it on the federal tax return.