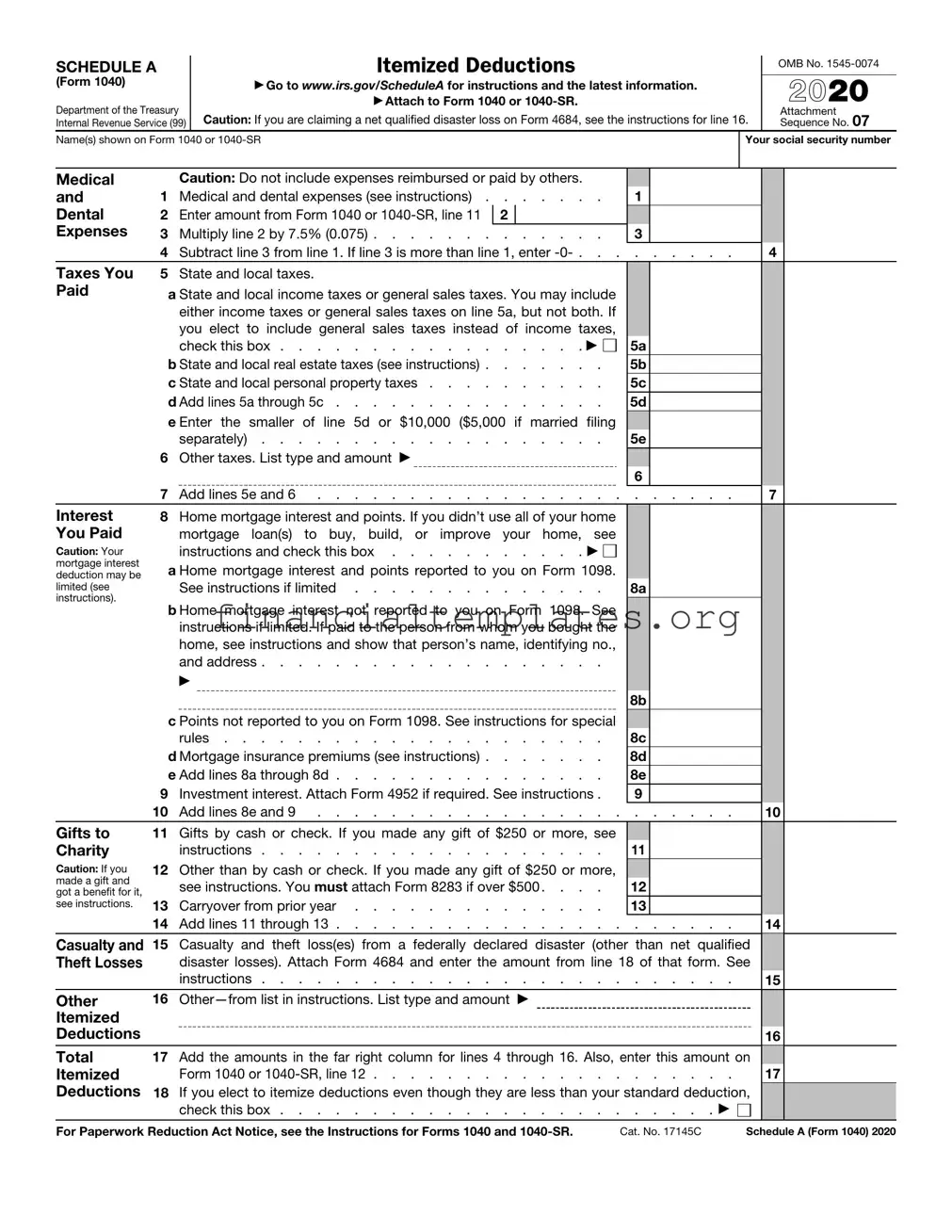

Get IRS Schedule A 1040 or 1040-SR Form

Filing taxes can often feel like navigating through a maze, especially when itemizing deductions to potentially lower tax bills. Key to this process is the IRS Schedule A (Form 1040 or 1040-SR), a crucial document for taxpayers seeking to itemize deductions rather than taking the standard deduction. This form allows taxpayers to outline various deductible expenses such as medical and dental expenses, taxes paid, interest paid, gifts to charity, casualty and theft losses, job expenses, and certain miscellaneous deductions. By meticulously itemizing these deductions, individuals can significantly reduce their taxable income, potentially leading to considerable savings on their taxes. Understanding the nuances of Schedule A is essential for maximizing these benefits, which can cover a broad spectrum of expenses, from home mortgage interest and property taxes to unreimbursed medical costs and charitable contributions. However, it's crucial to note that itemizing requires maintaining thorough records and receipts to support listed deductions, emphasizing the need for conscientious record-keeping throughout the year.

IRS Schedule A 1040 or 1040-SR Example

SCHEDULE A (Form 1040)

Department of the Treasury Internal Revenue Service (99)

Itemized Deductions

▶Go to www.irs.gov/ScheduleA for instructions and the latest information.

▶Attach to Form 1040 or

Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16.

OMB No.

2021

Attachment Sequence No. 07

Name(s) shown on Form 1040 or

Your social security number

Medical |

|

Caution: Do not include expenses reimbursed or paid by others. |

|

|

|

|

|

|

||

and |

1 |

Medical and dental expenses (see instructions) |

|

1 |

|

|

|

|

||

Dental |

2 |

Enter amount from Form 1040 or |

2 |

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

3 |

Multiply line 2 by 7.5% (0.075) |

|

3 |

|

|

|

|

|||

|

4 |

Subtract line 3 from line 1. If line 3 is more than line 1, enter |

. . . . |

. . |

4 |

|

||||

Taxes You |

5 |

State and local taxes. |

|

|

|

|

|

|

|

|

Paid |

|

a State and local income taxes or general sales taxes. You may include |

|

|

|

|

|

|

||

|

|

either income taxes or general sales taxes on line 5a, but not both. If |

|

|

|

|

|

|

||

|

|

you elect to include general sales taxes instead of income taxes, |

|

|

|

|

|

|

||

|

|

check this box |

. . . . ▶ |

|

5a |

|

|

|

|

|

|

|

b State and local real estate taxes (see instructions) |

|

5b |

|

|

|

|

||

|

|

c State and local personal property taxes |

|

5c |

|

|

|

|

||

|

|

d Add lines 5a through 5c |

|

5d |

|

|

|

|

||

|

|

e Enter the smaller of line 5d or $10,000 ($5,000 if married filing |

|

|

|

|

|

|

||

|

|

separately) |

|

5e |

|

|

|

|

||

|

6 |

Other taxes. List type and amount ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

7 |

Add lines 5e and 6 |

|

. |

. . . |

. . |

7 |

|

||

Interest |

8 |

Home mortgage interest and points. If you didn’t use all of your home |

|

|

|

|

|

|

||

You Paid |

|

mortgage loan(s) to buy, build, or improve your home, see |

|

|

|

|

|

|

||

Caution: Your |

|

instructions and check this box |

. . . . ▶ |

|

|

|

|

|

|

|

mortgage interest |

|

a Home mortgage interest and points reported to you on Form 1098. |

|

|

|

|

|

|

||

deduction may be |

|

|

|

|

|

|

|

|||

limited (see |

|

See instructions if limited |

|

8a |

|

|

|

|

||

instructions). |

|

b Home mortgage interest not reported to you on Form 1098. See |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||

|

|

instructions if limited. If paid to the person from whom you bought the |

|

|

|

|

|

|

||

|

|

home, see instructions and show that person’s name, identifying no., |

|

|

|

|

|

|

||

|

|

and address |

|

|

|

|

|

|

||

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8b |

|

|

|

|

|

|

c Points not reported to you on Form 1098. See instructions for special |

|

|

|

|

|

|

||

|

|

rules |

|

8c |

|

|

|

|

||

|

|

d Mortgage insurance premiums (see instructions) |

|

8d |

|

|

|

|

||

|

|

e Add lines 8a through 8d |

|

8e |

|

|

|

|

||

|

9 |

Investment interest. Attach Form 4952 if required. See instructions . |

|

9 |

|

|

|

|

||

|

10 |

Add lines 8e and 9 |

|

. . . . |

. . |

10 |

|

|||

Gifts to |

11 |

Gifts by cash or check. If you made any gift of $250 or more, see |

|

|

|

|

|

|

||

Charity |

|

instructions |

|

11 |

|

|

|

|

||

Caution: If you |

12 |

Other than by cash or check. If you made any gift of $250 or more, |

|

|

|

|

|

|

||

made a gift and |

|

see instructions. You must attach Form 8283 if over $500 . . . . |

|

12 |

|

|

|

|

||

got a benefit for it, |

|

|

|

|

|

|

||||

see instructions. |

13 |

Carryover from prior year |

|

13 |

|

|

|

|

||

|

14 |

Add lines 11 through 13 |

|

. . . . |

. . |

14 |

|

|||

Casualty and |

15 |

Casualty and theft loss(es) from a federally declared disaster (other than net qualified |

|

|

||||||

Theft Losses |

|

disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See |

|

|

||||||

|

|

instructions |

. . . . |

. . |

15 |

|

||||

Other |

16 |

▶ |

|

|

|

|

|

|

||

Itemized |

|

|

|

|

|

|

|

|

|

|

Deductions |

|

|

|

|

|

|

|

|

16 |

|

Total |

17 |

Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on |

|

|

||||||

Itemized |

|

Form 1040 or |

. . . . |

. . |

17 |

|

||||

Deductions |

18 If you elect to itemize deductions even though they are less than your standard deduction, |

|

|

|||||||

|

|

check this box |

. . . . |

. ▶ |

|

|

||||

For Paperwork Reduction Act Notice, see the Instructions for Forms 1040 and |

Cat. No. 17145C |

Schedule A (Form 1040) 2021 |

||||||||

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule A (Form 1040 or 1040-SR) is used by taxpayers to itemize deductions on their federal income tax return. |

| Deduction Types | It includes deductions such as medical and dental expenses, taxes paid, interest paid, gifts to charity, casualty and theft losses, and other miscellaneous deductions. |

| Requirement to File | Taxpayers only need to fill out and attach Schedule A to their Form 1040 or 1040-SR if they choose to itemize deductions instead of taking the standard deduction. |

| Impact on Taxpayers | Itemizing deductions can lead to a lower taxable income for individuals who have significant deductible expenses exceeding the standard deduction amount for their filing status. |

| Governing Law | The Internal Revenue Code (IRC) governs the use and requirements of the IRS Schedule A (Form 1040 or 1040-SR), as administered by the Internal Revenue Service (IRS). |

Guide to Writing IRS Schedule A 1040 or 1040-SR

After completing your initial US tax return forms, either the 1040 or 1040-SR, you might need to itemize deductions on Schedule A. This step is essential for taxpayers who believe their total deductions exceed the standard deduction amount for their filing status. Filling out Schedule A accurately can potentially lower your taxable income, thus affecting your tax liability or refund. Here are the straightforward steps to fill out Schedule A of the IRS 1040 or 1040-SR form to ensure you claim every deduction you're entitled to. Remember, careful documentation and calculation are key to maximizing these benefits.

- Prepare Your Documentation: Before you start, gather all your records of expenses you plan to itemize, such as medical and dental expenses, taxes paid, interest paid, gifts to charity, casualty and theft losses, job expenses, and certain miscellaneous deductions.

- Enter Your Medical and Dental Expenses: Start with Section 1 on the form. Sum up all qualified expenses and enter the total. Remember, you can only deduct the amount that exceeds 7.5% of your Adjusted Gross Income (AGI).

- Report Taxes You Paid: In Section 2, list the state and local income taxes or sales taxes, personal property taxes, and any real estate taxes you've paid during the tax year. The total goes on the lines designated for these categories.

- Detail Interest You Paid: Section 3 is for reporting interest payments, such as mortgage interest from Form 1098, mortgage insurance premiums, and investment interest expenses. Fill in the respective lines according to your documentation.

- Record Gifts to Charity: Section 4 allows you to list out any donations to qualified organizations. Separate cash contributions from property donations, and ensure you enter these amounts on the appropriate lines.

- List Casualty and Theft Losses: In Section 5, include details of any losses from casualties or thefts that are federally declared disasters. Calculate the deductible amount as instructed on the form.

- Fill in Job Expenses and Certain Miscellaneous Deductions: If you have expenses related to your job that were not reimbursed, or other specific allowable miscellaneous deductions, report them in Section 6 following the provided guidelines.

- Calculate Your Total Itemized Deductions: After completing all the relevant sections, add up the totals from each section to find your total itemized deductions. Enter this number at the bottom of Schedule A.

- Attach Schedule A to Form 1040 or 1040-SR: Once you have completed filling out Schedule A, attach it to your 1040 or 1040-SR form. Ensure all other necessary forms and documentation are included with your tax return before submission.

After successfully completing Schedule A and attaching it to your main tax form, the next steps involve reviewing your entire tax return for accuracy, signing it, and determining the best method to file it with the IRS, whether electronically or by mail. Taking advantage of itemized deductions requires diligence in record-keeping and understanding of the allowed deductions. This meticulous effort can lead to substantial tax savings. Ensure you keep copies of all submitted forms and documentation for your records.

Understanding IRS Schedule A 1040 or 1040-SR

-

What is the IRS Schedule A (Form 1040 or 1040-SR)?

IRS Schedule A is a tax form used by U.S. taxpayers to itemize deductions on their yearly tax returns. It provides a detailed account of deductible expenses, such as medical and dental expenses, taxes paid, interest paid, gifts to charity, casualty and theft losses, job expenses, and certain miscellaneous deductions. Using Schedule A can lower your taxable income and potentially increase your refund or reduce the taxes owed.

-

Who should file Schedule A?

Schedule A should be filed by taxpayers who choose to itemize their deductions instead of taking the standard deduction. If your total itemized deductions are more than your standard deduction, it's usually beneficial to itemize. This form is appended to either Form 1040 or 1040-SR during the tax filing process.

-

How do you determine if it's better to itemize deductions or take the standard deduction?

To decide whether to itemize deductions or take the standard deduction, add up all your deductible expenses that would be listed on Schedule A. Compare this total to the standard deduction amount for your filing status. If the itemized deductions are higher, itemizing will save you more on taxes. However, if the standard deduction is higher, it simplifies the process and typically provides a greater tax saving.

-

What types of expenses can be itemized on Schedule A?

Medical and dental expenses exceeding 7.5% of your adjusted gross income (AGI).

State, local, real estate, and personal property taxes up to $10,000 ($5,000 if married filing separately).

Home mortgage interest and investment interest expense.

Gifts to charity, both cash and non-cash donations.

Casualty and theft losses from a federally declared disaster.

Job expenses and certain miscellaneous deductions not reimbursed by your employer and exceed 2% of your AGI.

-

What are the limitations on itemized deductions?

There are limitations and thresholds for certain itemized deductions. For example, medical and dental expenses are only deductible to the extent that they exceed 7.5% of your AGI. Tax payments (state, local, and property taxes) are capped at $10,000 for most filers. Also, miscellaneous deductions subject to the 2% rule, such as unreimbursed job expenses, are no longer deductible for tax years 2018 through 2025, due to the Tax Cuts and Jobs Act. Always check for annual adjustments or changes in tax law.

-

How do you calculate deductions for gifts to charity on Schedule A?

When donating to charity, you can deduct cash contributions as well as the fair market value of any property donated. Deductions for cash donations are limited to 60% of your AGI, but this limit can vary depending on the tax year and the type of contribution. Ensure that you have the documentation for any donation, including a receipt from the charity for any contribution amount, and a formal appraisal for non-cash donations valued over $5,000.

-

Can I deduct medical expenses paid for someone else?

Yes, you can deduct medical expenses for someone else as long as they were your dependent either at the time the medical services were provided or at the time you paid the expenses. The person must also be a U.S. citizen, national, or resident, or a resident of Canada or Mexico for some part of the tax year.

-

What records should I keep for itemized deductions?

It's essential to keep detailed records of all expenses you plan to itemize. This documentation should include receipts, bank statements, and other proof of payment, as well as a log of any charitable contributions made throughout the year. For medical expenses, keep a list of all occasions, amounts paid, and to whom, along with the medical purpose of the payments. For each charitable donation, ensure you have a receipt or acknowledgment from the charity.

-

How does the mortgage interest deduction work on Schedule A?

Mortgage interest paid on up to $750,000 of indebtedness for mortgages taken out after December 15, 2017, to buy, build, or substantially improve your home can be deducted. For mortgages acquired before this date, the limit is $1 million. This deduction includes the interest you pay on your primary residence and a second home, provided you do not rent out the second home for more than a minimal amount of time during the year.

-

Where can I find more information or assistance with filling out Schedule A?

For more guidance on Schedule A and itemized deductions, the IRS provides resources and publications on its website, including instructions for Schedule A. Tax software can also help you determine deductions, or you may wish to consult with a tax professional to ensure you're maximizing your deductions and accurately filing your tax return.

Common mistakes

When preparing your taxes, particularly when detailing deductions on the IRS Schedule A (1040 or 1040-SR form), accuracy is crucial. However, several common mistakes can lead to errors in the filing process. Recognizing and avoiding these pitfalls can ensure that your tax return is both accurate and maximizes your deductions. Below are five typical errors taxpayers make:

-

Not itemizing when it's beneficial: Many taxpayers opt for the standard deduction because it's simpler. However, taking the time to itemize deductions can often lead to greater tax savings, especially if you have significant deductible expenses such as mortgage interest, state and local taxes, or charitable contributions.

-

Overlooking deductible expenses: Common deductions, such as medical expenses exceeding 7.5% of adjusted gross income, taxes paid, interest paid, gifts to charity, casualty and theft losses from a federally declared disaster, and other miscellaneous expenses, are often missed. Taxpayers should keep thorough records throughout the year and review all possible deductions.

-

Miscalculating deductions: Errors in arithmetic or misunderstanding the rules for qualifying expenses can lead to incorrect deduction amounts. Using software that automatically calculates deductions or consulting with a tax professional can help avoid these mistakes.

-

Not keeping adequate records: Receipts, bank statements, and other documentation are essential for substantiating deductions in case of an IRS audit. Failure to maintain these records can result in disallowed deductions and additional taxes owed.

-

Failing to report all required information: Schedule A requires taxpayers to provide detailed information about deductible expenses. Skipping sections or not providing complete information can trigger an IRS inquiry or audit.

Being mindful of these potential errors and taking care to avoid them can make the process of completing your IRS Schedule A form smoother and more beneficial. Whether you're itemizing deductions for the first time or you're a seasoned filer, paying attention to detail and adhering to IRS guidelines are crucial steps in maximizing your deductions and ensuring compliance with tax laws.

Documents used along the form

When preparing your taxes, the IRS Schedule A (Form 1040 or 1040-SR) is vital for itemizing deductions rather than taking the standard deduction. This form allows taxpayers to detail various deductions, including medical expenses, state and local taxes, mortgage interest, and charitable contributions. However, this form doesn't stand alone. To accurately and effectively complete Schedule A and ensure compliance with IRS requirements, several other forms and documents often come into play. Understanding these additional forms will streamline the preparation process and help taxpayers maximize their deductions.

- Form 1098: This document is the Mortgage Interest Statement, which lenders send to borrowers showing the total mortgage interest paid in a year. It is crucial for taxpayers who are itemizing their deductions on Schedule A and claiming a deduction for mortgage interest.

- Form 1098-T: Known as the Tuition Statement, this form is provided by educational institutions to students showing the amounts billed for qualified tuition and related expenses. It's essential for those claiming education credits or deductions.

- Form 1099-INT: This form reports interest income from banks and other financial institutions. Taxpayers need this information to report taxable interest on their returns, part of which may be deductible on Schedule A under certain conditions.

- Form 1099-DIV: Used to report dividends and distributions received during the tax year. While primarily for reporting income, it's also needed when itemizing deductions because some dividends qualify for special tax treatment or deductions.

- Form 8283: Required for those who donate property valued over $500. Form 8283 details non-cash charitable contributions and is necessary when claiming these donations as deductions on Schedule A.

- State and Local Tax Statements: Receipts or statements from state and local tax authorities, including property tax statements and taxed paid on purchases, are vital for completing Schedule A. These documents support claims for state and local tax deductions.

Navigating the complexities of tax preparation can be daunting, but understanding the relationship between IRS Schedule A and other tax forms eases the process. Armed with the right documents, taxpayers can confidently itemize deductions, ensuring they take full advantage of available tax benefits. Always remember, consulting with a tax professional can provide personalized advice tailored to individual financial situations.

Similar forms

The IRS Form 1040, also referred to as the U.S. Individual Income Tax Return, is closely related to Schedule A of the 1040 or 1040-SR forms in its function as a foundational document for personal tax filing in the United States. While Schedule A is used to itemize deductions that taxpayers can claim, the Form 1040 serves as the main form where taxpayers summarize their income, deductions, and credits to calculate their tax owed or refund due. Both forms work in conjunction to provide a comprehensive view of an individual's tax situation, but the Form 1040 acts as the "hub," linking various schedules and forms, including Schedule A, to present a full picture of the taxpayer's finances.

Form 1040EZ, which was a simplified version of the Form 1040, shares similarities with Schedule A in its aim to streamline the tax filing process for individuals with uncomplicated tax situations. Although the 1040EZ has been phased out and merged into a revised Form 1040, it historically catered to singles and married couples without dependents, with no itemizable deductions—which is what Schedule A is used for. The relationship between these forms highlights the evolution of tax filing from simplified processes to more inclusive methods that can cater to a wider range of financial scenarios.

The Schedule B form, titled "Interest and Ordinary Dividends," parallels Schedule A by focusing on specific types of income rather than deductions. Schedule B is used to report interest and dividend income in detail, which could be taxable or tax-exempt, and plays a significant role in the taxpayer's overall income calculation on Form 1040. Both Schedules A and B enhance the main tax return by providing detailed information crucial for accurate tax calculation, reflecting the comprehensive approach the IRS adopts in considering taxpayers' financial activities.

Schedule C is another complementary form to Schedule A, designed for sole proprietors and single-member LLCs to report profits or losses from a business they operate. While Schedule A facilitates the deduction of various personal expenses, Schedule C focuses on business-related financial activities. They serve similar purposes in ensuring taxpayers receive appropriate consideration for their expenses, yet they apply to distinctly different areas of a taxpayer's financial life—personal versus business.

Schedule D, "Capital Gains and Losses," is akin to Schedule A in that it deals with a specific aspect of financial matters—this time, the sale or exchange of capital assets. Where Schedule A is concerned with deductions for personal expenses, Schedule D calculates the tax implications of capital transactions, which can significantly affect the taxpayer's liability or refund on the Form 1040. Both forms are critical for accurately reporting financial activities that have tax consequences.

Schedule E, used for reporting income from rental property, royalties, partnerships, S corporations, estates, and trusts, shares a commonality with Schedule A through its impact on the taxpayer's overall tax situation. Schedule E focuses on supplemental income, which, much like the deductions on Schedule A, plays a crucial role in determining the taxpayer's taxable income and potential deductions. They both detail specific areas that contribute to the holistic assessment of an individual's tax responsibilities.

The IRS Form 8863, titled "Education Credits," relates to Schedule A as both enable taxpayers to claim specific expenses to reduce their taxable income—Schedule A through itemized deductions and Form 8863 through education credits. These documents are integral to the tax filing process, allowing individuals to benefit from their financial investments in personal, professional, or academic development. The goal of both forms is to alleviate the tax burden by acknowledging certain qualifying expenses.

Form 8962, "Premium Tax Credit," is part of the healthcare legislation aimed at making insurance more affordable for individuals with moderate incomes. This form correlates with Schedule A because it involves calculating the amount of premium tax credit individuals receive and reconciling it with any advance payments. Both forms have a financial impact on the taxpayer’s bottom line, focusing on reducing overall tax liability through different mechanisms—tax credits for healthcare costs on Form 8962 and deductions for varied personal expenses on Schedule A.

Last, Form 2441, "Child and Dependent Care Expenses," is somewhat similar to Schedule A because it allows taxpayers to claim a credit for expenses incurred in the care of a child or dependent, potentially lowering their tax liability. While Schedule A focuses on itemized deductions across a range of expenses, Form 2441 specializes in a specific subset of costs that benefit working parents and guardians. Both forms demonstrate the IRS's recognition of personal expenditures that impact a taxpayer’s financial health.

Dos and Don'ts

Filling out the IRS Schedule A for your 1040 or 1040-SR form can be daunting, but it's crucial for optimizing your deductions and ensuring compliance with tax laws. Here are eight dos and don'ts to guide you through the process efficiently and accurately.

Do's:

- Double-check your eligibility for itemized deductions. Before diving into Schedule A, make sure that itemizing is beneficial for your financial situation compared to taking the standard deduction.

- Gather all relevant documentation such as receipts for medical expenses, taxes paid, interest paid, gifts to charity, casualty and theft losses, job expenses, and certain miscellaneous deductions before you start.

- Use accurate figures. Estimate your deductions accurately. Rounding to the nearest dollar is acceptable, but guessing or inflating numbers can lead to discrepancies and potential audits.

- Understand the limitations. Some deductions on Schedule A are subject to limits. For instance, medical expenses must exceed a certain percentage of your adjusted gross income (AGI) to be deductible.

- Fill out the form carefully and check your math. Simple arithmetic errors can cause big problems with your tax return.

Don'ts:

- Don't overlook state and local taxes (SALT). You can deduct state and local income, sales, and property taxes up to a limit. Double-check the cap and how it applies to you.

- Don't forget to check for updates on tax laws. Tax codes change, and what was deductible last year may not be this year. Always use the most current version of Schedule A and be aware of new limitations or allowances.

- Don't ignore IRS instructions. The IRS provides detailed instructions for Schedule A, which can answer most questions about specific deductions. These instructions also include the latest thresholds and limitations.

- Don't assume deductions without records to back them up. If the IRS audits your return, you'll need to provide documentation for every deduction claimed on Schedule A.

Filling out Schedule A can significantly impact your tax return, potentially saving you money. However, accuracy, documentation, and adherence to updated guidelines are essential to avoid complications. With these dos and don'ts, you're better positioned to navigate Schedule A successfully.

Misconceptions

When navigating the complexities of tax filing, particularly with regards to itemizing deductions via IRS Schedule A (1040 or 1040-SR forms), taxpayers often encounter misconceptions. Understanding these can clarify the process and benefits of itemization.

Only Homeowners Benefit from Itemizing: A common misconception is that Schedule A benefits solely homeowners, typically through mortgage interest and real estate tax deductions. However, taxpayers without real estate may also gain advantages by itemizing charitable contributions, medical expenses exceeding a specific threshold, and certain types of state and local taxes, among others.

Itemizing Is Always Better Than the Standard Deduction: While itemizing can unlock valuable deductions, it's not universally advantageous. Taxpayers should calculate whether their total itemized deductions exceed the standard deduction for their filing status. In instances where the standard deduction is higher, it offers a greater tax benefit.

Miscellaneous Deductions Are No Longer Available: Following the Tax Cuts and Jobs Act of 2017, miscellaneous itemized deductions subject to the 2% floor were eliminated. However, this does not mean all miscellaneous deductions vanished. Deductions for gambling losses up to the amount of gambling winnings, certain casualty and theft losses from federally declared disasters, and other specific items remain valid.

All Charitable Contributions Are Deductible: While the IRS Schedule A form does allow for the deduction of charitable contributions, not all donations qualify. Contributions must be made to qualified organizations, and there is a limit to how much can be deducted based on adjusted gross income. Moreover, taxpayers need to maintain proper documentation, such as bank records or written acknowledgements for any donation of $250 or more.

Key takeaways

Filling out the IRS Schedule A 1040 or 1040-SR form is a key step for taxpayers who choose to itemize deductions instead of taking the standard deduction. Understanding the essential takeaways can ensure that you maximize your tax benefits while staying compliant with IRS rules. Here are nine key takeaways:

- Know Your Deductions: Schedule A is used to list itemized deductions. Common deductions include medical and dental expenses, taxes paid, home mortgage interest, gift to charity, casualty and theft losses, and other miscellaneous deductions.

- Medical and Dental Expenses: You can only deduct the amount of your total medical expenses that exceed 7.5% of your adjusted gross income (AGI).

- Taxes Paid: Deductions include state and local income taxes or sales taxes (but not both), real estate taxes, and personal property taxes.

- Interest You Paid: Interest deductions generally focus on mortgage interest from your primary or secondary residence, as well as certain investment interest.

- Charitable Contributions: Contributions to qualified organizations can be deducted. Ensure you have documentation for any contribution, especially those over $250.

- Casualty and Theft Losses: Only losses from a federally declared disaster area can be deducted.

- Limits on Deductions: Certain deductions, including charitable contributions, have limits based on a percentage of your AGI.

- Keep Records: Retaining receipts and detailed records for all deductions claimed is crucial for verifying their accuracy if questioned by the IRS.

- Filing Status Matters: Your filing status (e.g., single, married filing jointly) impacts your standard deduction amount, potentially influencing whether itemizing deductions benefits you.

By carefully considering each potential deduction, taxpayers can effectively lower their taxable income, ultimately affecting their tax liability. Remember, while itemizing can provide significant tax savings, it's essential to only claim legitimate deductions as per the IRS guidelines.

Popular PDF Documents

IRS 4506 - Risk management practices in corporations might involve the use of the 4506 form to assess financial stability through tax compliance history.

Opt Tax Denver - Incorporates a certification section ensuring accountability and veracity in the reporting process.

IRS 1040-SR - The form includes sections for standard deductions and a tax chart specifically for those 65 and older, addressing age-specific tax considerations.