Get IRS Schedule 3 1040 or 1040-SR Form

Every year, millions of Americans navigate the complex process of filing their tax returns, seeking to ensure compliance while maximizing their potential refunds or minimizing liabilities. Amid this annual ritual, the IRS Schedule 3 (attached to the 1040 or 1040-SR forms) emerges as a critical document for many taxpayers. It serves as a vital tool for reporting additional credits and payments beyond the standard deductions and income figures. Specifically, Schedule 3 allows tax filers to report credits such as the foreign tax credit, education credits, and the general business credit. Additionally, it includes sections for reporting payments, including the estimated tax payments made throughout the year and the portion of a refund from a prior year applied to the current year’s tax. Understanding this form is essential for taxpayers looking to navigate the complexities of tax credits and payments effectively, ensuring they accurately report their financial details and take advantage of every credit and deduction available to them.

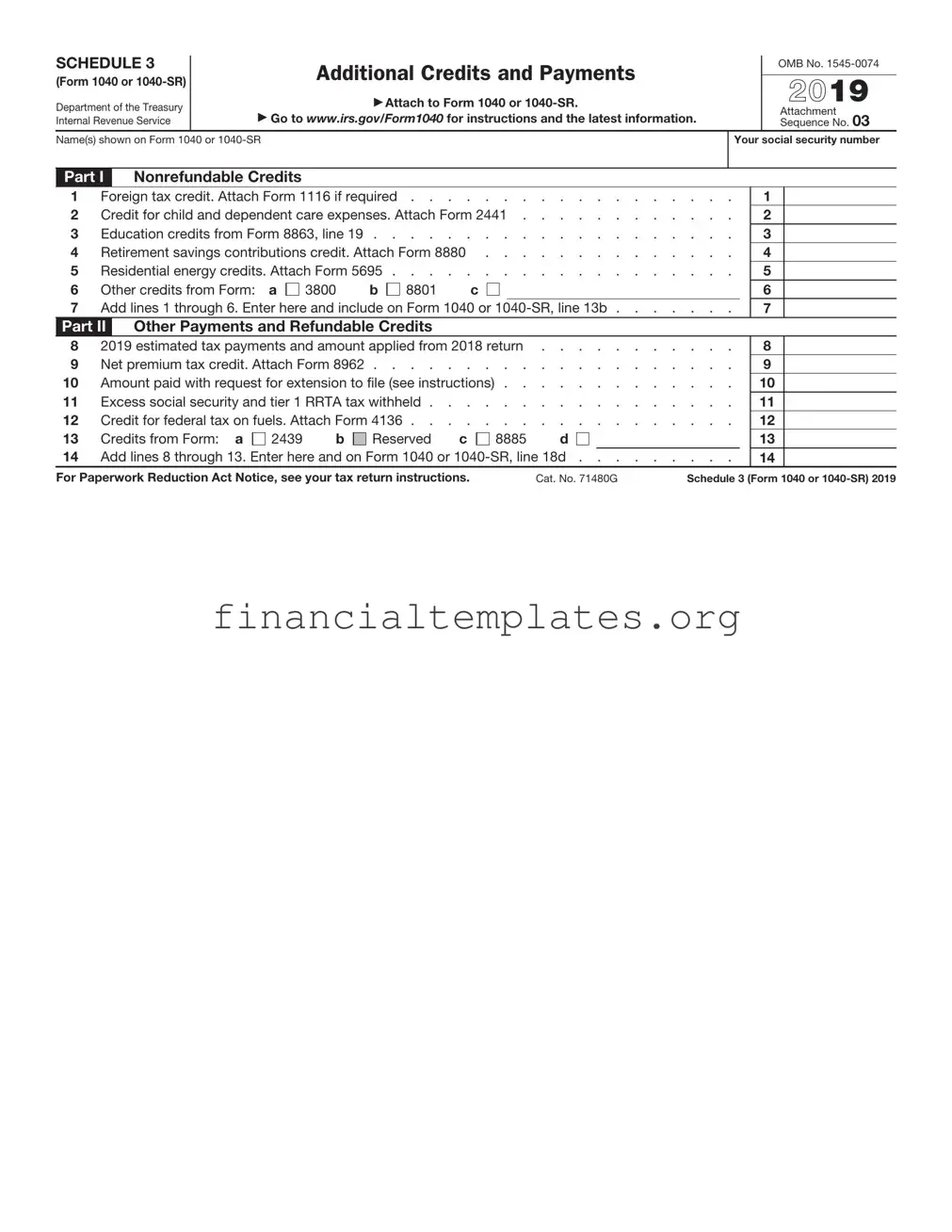

IRS Schedule 3 1040 or 1040-SR Example

SCHEDULE 3

(Form 1040)

Department of the Treasury Internal Revenue Service

Additional Credits and Payments

▶Attach to Form 1040,

▶Go to www.irs.gov/Form1040 for instructions and the latest information.

OMB No.

2020

Attachment Sequence No. 03

Name(s) shown on Form 1040,

Your social security number

Part I Nonrefundable Credits

1 |

Foreign tax credit. Attach Form 1116 if required |

2 |

Credit for child and dependent care expenses. Attach Form 2441 |

3 |

Education credits from Form 8863, line 19 |

4 |

Retirement savings contributions credit. Attach Form 8880 |

5 |

Residential energy credits. Attach Form 5695 |

6 |

Other credits from Form: a 3800 b 8801 c |

7Add lines 1 through 6. Enter here and on Form 1040,

1

2

3

4

5

6

7

Part II Other Payments and Refundable Credits

8 |

Net premium tax credit. Attach Form 8962 |

9 |

Amount paid with request for extension to file (see instructions) |

10Excess social security and tier 1 RRTA tax withheld . . . . . . . . . . . . .

11 Credit for federal tax on fuels. Attach Form 4136 . . . . . . . . . . . . . .

12Other payments or refundable credits:

a Form 2439 . . . . . . . . . . . . . . . . . . . . . 12a

bQualified sick and family leave credits from Schedule(s) H and

|

Form(s) 7202 |

12b |

c |

Health coverage tax credit from Form 8885 |

12c |

d |

Other: |

12d |

e |

Deferral for certain Schedule H or SE filers (see instructions) . |

12e |

f |

Add lines 12a through 12e |

|

13Add lines 8 through 12f. Enter here and on Form 1040,

8

9

10

11

12f

13

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 71480G |

Schedule 3 (Form 1040) 2020 |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Schedule 3 | Schedule 3 of the 1040 form is designed for reporting additional credits and payments not entered directly on the main 1040 or 1040-SR form. |

| Types of Credits Included | This schedule includes credits such as the foreign tax credit, education credits, and the general business credit. |

| Nonrefundable Credits | Credits listed on Schedule 3 are generally nonrefundable, meaning they can reduce the tax owed to $0, but won’t result in a refund beyond that. |

| Additional Payments Section | Schedule 3 also covers additional payments, such as the 2020 estimated tax payments and the net premium tax credit. |

| Use for Both 1040 and 1040-SR | Both the 1040 and the 1040-SR taxpayers use Schedule 3 to report these extra credits and payments. |

| Amended Returns | When amending a return, taxpayers also use Schedule 3 to adjust credits or payments previously reported. |

| Education Credits | It includes the American Opportunity Credit and Lifetime Learning Credit for eligible education expenses. |

| IRS Guidance | The IRS provides instructions for Schedule 3 on its website to assist taxpayers in accurately completing the form. |

| Electronic Filing | Taxpayers can file Schedule 3 electronically along with their 1040 or 1040-SR, promoting ease and efficiency in tax filing. |

| Governing Laws | Schedule 3 is governed by federal tax law, as it is a part of the federal income tax return process. |

Guide to Writing IRS Schedule 3 1040 or 1040-SR

Filling out the IRS Schedule 3 on Form 1040 or 1040-SR is an important step in the tax filing process for individuals who need to claim certain credits beyond the standard deductions. This form allows taxpayers to report additional credits such as education credits, foreign tax credits, credits for child and dependent care expenses, and the retirement savings contributions credit. Ensuring accurate completion of this form is crucial for maximizing one's eligible tax benefits. Below, you'll find a step-by-step guide designed to help streamline the process.

- Locate the most current version of IRS Schedule 3 and Form 1040 or 1040-SR from the IRS website to ensure you are using the latest form as tax laws and forms can change from year to year.

- Review the form thoroughly before filling it out. Schedule 3 is divided into parts for nonrefundable credits and other payments. Understanding each part is key to accurately completing the form.

- Begin with Part I of Schedule 3, which is for nonrefundable credits. Enter the amount for foreign tax credit on line 1, if applicable. If you're unsure about how to calculate this, refer to the instructions for Form 1116.

- For those eligible for education credits, fill in the amount on line 3. This includes credits such as the American Opportunity Credit and Lifetime Learning Credit. Detailed instructions and eligibility criteria can be found in the instructions for Form 8863.

- If you contributed to a retirement savings plan, like an IRA, and meet certain income criteria, you may be eligible for a credit. Enter this amount on line 4. To determine the amount, refer to the instructions for Form 8880.

- Continue down the form, filling in amounts for other credits you’re eligible for, such as the child and dependent care expenses on line 2 and the residential energy credits on line 5.

- Once all applicable sections in Part I are filled, add up the amounts and enter the total of these credits on line 6.

- Move to Part II of Schedule 3 where you will report additional taxes owed. Each line correlates to specific situations, like additional tax on IRAs or other qualified retirement plans. Enter the amounts as instructed by each line’s requirements.

- If you have amounts to report on Part III for additional credits such as the net premium tax credit or health coverage tax credit, fill these in the corresponding lines.

- After completing all relevant sections, add the totals from Parts II and III, if applicable. This total should then be transferred to your Form 1040 or 1040-SR.

- Review the entire Schedule 3 form for accuracy. Ensure that every credit and tax you're eligible for is accurately reported and that the total amounts are correctly calculated.

- Attach Schedule 3 to your Form 1040 or 1040-SR when you file your tax return. Electronic filers will find instructions on how to include this schedule within their tax preparation software.

Once you have completed and submitted Schedule 3 with your Form 1040 or 1040-SR, your next steps will depend on your individual tax situation. If you’re due a refund, the IRS will process this and issue it to you. If you owe taxes, ensure that you understand the options for payment. Regardless of the outcome, retaining copies of your tax return and all schedules for your records is an important practice. This documentation can be vital for future financial planning, tax inquiries, or audits.

Understanding IRS Schedule 3 1040 or 1040-SR

-

What is the IRS Schedule 3 1040 or 1040-SR form used for?

The IRS Schedule 3 1040 or 1040-SR form is a tax document used by taxpayers to report additional credits and payments that aren’t entered directly on the main form of the 1040 or 1040-SR. These include credits for education, the foreign tax credit, credits for child and dependent care expenses, the residential energy credit, and other payments such as the net premium tax credit or amounts paid with a request for an extension to file. Essentially, it allows taxpayers to claim a variety of credits that can reduce their tax bill or increase their refund.

-

How do I know if I need to fill out Schedule 3 for my 1040 or 1040-SR?

If you qualify for any of the credits or need to report any of the payments listed on Schedule 3, you'll need to fill it out and attach it to your 1040 or 1040-SR form. Review the individual credits mentioned in the form instructions to determine your eligibility. If in doubt, consulting a tax professional can provide clarity on whether these credits apply to your situation.

-

Can I file Schedule 3 electronically, or do I need to mail it in?

Yes, you can file Schedule 3 electronically along with your 1040 or 1040-SR tax return. Most tax software will guide you through filling out the Schedule 3 if it's applicable to your situation and include it in your electronic filing. If you elect to file your taxes by mail, you’ll need to attach Schedule 3 to your printed tax return before sending it to the IRS.

-

What are some examples of credits I can claim on Schedule 3?

On Schedule 3, you can claim several credits including, but not limited to:

- Education credits such as the American Opportunity Credit and the Lifetime Learning Credit

- Foreign tax credit

- Credit for child and dependent care expenses

- Residential energy credits

- General business credit

Each credit has specific eligibility requirements, so it's important to review the relevant instructions or consult with a tax professional.

-

What if I make a mistake on Schedule 3?

If you discover an error on your Schedule 3 after submitting your tax return, you should file an amended return using Form 1040-X, Amended U.S. Individual Income Tax Return. It's important to correct mistakes as they can affect your tax liabilities or refund amounts. Additionally, correcting errors promptly can help avoid potential interest and penalties. For guidance on amending your return, consider seeking assistance from a tax professional.

-

Where can I find more information or get help with filling out Schedule 3?

More information on filling out Schedule 3 can be found in the instructions for Form 1040 and 1040-SR, available on the IRS website. The IRS also offers free tax help through the Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs for those who qualify. Tax software and professional tax preparers can also provide assistance and ensure that the form is filled out correctly.

Common mistakes

-

Failing to report all additional income streams can be a significant mistake. People sometimes overlook or misunderstand the need to include income from sources other than their primary employer. This includes freelance work, gig economy jobs, or earnings from investments.

-

Incorrectly claiming deductions or credits is another common error. There are specific qualifications for different deductions and credits on the IRS Schedule 3 form, such as the Foreign Tax Credit or the Education Credits. Misunderstanding the eligibility criteria can lead to claiming these inaccurately.

-

Mismatching information reported by employers, banks, or other financial institutions happens when individuals do not cross-check the figures they report with the official documents they receive, like Form W-2 or 1099s. This inconsistency can trigger an audit or result in a processing delay.

-

Not seeking qualified advice when needed can lead to mistakes. The tax code can be complex, and its application may vary based on individual circumstances. Many individuals could benefit from consulting a tax professional to ensure they're filling out the form accurately and taking advantage of all possible tax benefits.

-

Overlooking carryover amounts from previous years is an error that can cost taxpayers money. Some credits or deductions may not be fully utilized in one tax year and are eligible to be carried over into future years. People often forget to apply these amounts to their current year’s tax calculations.

-

Mistakes in personal information, such as Social Security Numbers (SSNs) or addresses, might seem minor but can lead to significant issues. The IRS uses this information to confirm identity and send refunds. Incorrect information may delay these processes.

When filling out the IRS Schedule 3 for 1040 or 1040-SR forms, it’s crucial to take the time to ensure all information is accurate and complete. This minimizes the risk of errors and can help ensure taxpayers receive any refunds or credits they’re entitled to without unnecessary delays.

Documents used along the form

When handling your taxes, particularly if you're using the IRS Schedule 3 form with either Form 1040 or 1040-SR, it's common to encounter a variety of other forms and documents during the process. These additional forms play crucial roles in ensuring your tax return is complete and accurate. Below we'll explore a few of these essential documents, shedding light on their purposes and why they might be used alongside Schedule 3.

- Form 1040 or 1040-SR: This is the primary tax form for individuals in the U.S. Schedule 3 is actually a part of this larger form, used to calculate and report specific types of credits or additional taxes owed. If you're using Schedule 3, you're already familiar with Form 1040 or 1040-SR, as it serves as the backbone of your tax return.

- Schedule 2 (Form 1040 or 1040-SR): Just like Schedule 3, Schedule 2 is another form that supplements your main tax return. It is used for reporting additional taxes, such as the Alternative Minimum Tax or taxes on other forms of income that aren't entered directly on the Form 1040 or 1040-SR.

- Form 8962: This form plays a critical role for individuals who purchased health insurance through the marketplace. Form 8962 is used to calculate the Premium Tax Credit (PTC) and to reconcile any advance PTC payments. If you've received assistance to help pay for insurance, this form ensures you received the correct amount.

- Form 1099: The 1099 forms are a series of documents that report various types of income you may receive throughout the year, other than your salary. This can include interest, dividends, government payments, and more. These documents are essential for accurately reporting your income and could affect your tax calculations on Schedule 3.

- Form 8863: For those who are paying for higher education, Form 8863 is used to claim valuable credits like the American Opportunity Credit and the Lifetime Learning Credit. These credits can directly reduce the amount of tax you owe and are reported on Schedule 3.

- Form 2441: If you have child or dependent care expenses, Form 2441 helps you claim a credit for those costs. This form is necessary for determining the amount of credit you're eligible for, which could also be a part of your Schedule 3 calculations.

Mastering the complexities of tax preparation involves understanding how these various forms and documents interact with each other. Whether you're calculating additional credits, reporting unique forms of income, or reconciling previously received benefits, each document has its place in the broader picture of your financial landscape. Keeping track of these forms and accurately completing them can significantly impact your tax outcomes for the year.

Similar forms

The IRS Form 1040 is the foundational document that the IRS Schedule 3 1040 or 1040-SR form complements. It is the standard federal income tax form used by residents for filing their annual income tax returns. The Form 1040 collects basic information about the taxpayer's income, tax deductions, and credits to calculate the amount of tax owed or the refund due. Schedule 3, attached to this form, is specifically designed for reporting additional credits and payments not captured in the main form.

IRS Schedule 1 (Form 1040 or 1040-SR) bears similarity to Schedule 3 in that it is an additional form used by taxpayers to report specific types of income or adjustments not covered in the main Form 1040. Whereas Schedule 3 focuses on additional credits, Schedule 1 is mainly concerned with additional income and adjustments to income. This includes income from rental properties, business income, alimony received, and deductible part of self-employment tax.

IRS Schedule 2 (Form 1040 or 1040-SR) is another related document, akin to Schedule 3, used to report additional taxes that are not entered directly on Form 1040. This includes the Alternative Minimum Tax or specific other taxes like those on investments. Schedule 2 and Schedule 3 are complementary, with Schedule 2 focusing on additional taxes owed, and Schedule 3 on additional credits to offset those taxes.

IRS Schedule 4 (Form 1040), previously used in tax years before 2020, was similar to Schedule 3 in its function of reporting certain taxes. Although it has since been consolidated into Schedules 2 and 3 in the redesigned Form 1040, it historically related to Schedule 3 by dealing with taxes not directly reported on the Form 1040, such as self-employment tax and additional retirement account taxes.

The IRS Schedule A (Form 1040) resembles Schedule 3 in that it provides a platform for taxpayers to itemize their deductions, but its focus is primarily on deductions rather than credits. Schedule A includes specific expenses such as medical, dental, taxes paid, home mortgage interest, and charitable contributions. Taxpayers use it to potentially reduce their taxable income in contrast to the tax credits reported on Schedule 3.

The IRS Schedule E (Form 1040) is a form that, like Schedule 3, attaches to the primary Form 1040 for specific reporting purposes. Schedule E focuses on supplemental income and loss, particularly from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. It complements Schedule 3 by accounting for types of income that can affect a taxpayer’s overall tax situation and potential credits.

IRS Schedule D (Form 1040) has a focused purpose similar to that of Schedule 3, but it deals with the reporting of capital gains and losses from the sale or exchange of certain property. Taxpayers use Schedule D to calculate the tax on capital gains, which can then interact with credits reported on Schedule 3 to potentially reduce the overall tax liability.

The IRS Form 8863, titled "Education Credits (American Opportunity and Lifetime Learning Credits)," is a document that relates closely to Schedule 3 through its focus on tax credits. Specifically, it’s used to calculate and claim educational credits that directly reduce the amount of tax owed, not just the income subject to tax. These credits, once calculated on Form 8863, are then reported on Schedule 3.

IRS Form 2441, "Child and Dependent Care Expenses," is another form compatible with the intent behind Schedule 3. It allows taxpayers to calculate the credit for child and dependent care expenses, which can significantly reduce their tax liability. The credit calculated on Form 2441 is ultimately reported on Schedule 3, highlighting the interconnected nature of these forms in facilitating tax credits.

Lastly, IRS Form 8962, "Premium Tax Credit," shares the goal of Schedule 3 by providing a means to claim tax credits, in this case, those related to health insurance premiums for plans purchased through the Health Insurance Marketplace. Taxpayers use Form 8962 to calculate their Premium Tax Credit. The computed credit can then be reported on Schedule 3 to adjust the overall tax due or increase the refund.

Dos and Don'ts

When it comes to filling out the IRS Schedule 3 for the 1040 or 1040-SR form, individuals must approach this task with attentiveness and accuracy. Schedule 3 is used to calculate credits that are not directly entered on Form 1040 or 1040-SR. Here are some dos and don'ts to consider:

Do:

- Thoroughly review the instructions for Schedule 3 and the 1040 or 1040-SR forms to ensure you understand which credits you may be eligible for.

- Collect all necessary documentation related to the credits you plan to claim, such as receipts, forms, or other records that support your eligibility and the amount of the credit.

- Use accurate and up-to-date information when filling out the form to avoid any discrepancies that may arise from outdated or incorrect data.

- Double-check your calculations and the information you enter to minimize errors. Even small mistakes can lead to processing delays or audits.

- Consider consulting with a tax professional if you encounter any uncertainties or complex situations. Their expertise can provide clarity and help you navigate the intricacies of tax credits.

Don't:

- Overlook any potential credits you may be eligible for. Failing to claim what you're entitled to can result in paying more taxes than necessary.

- Misinterpret the eligibility requirements for the credits listed on Schedule 3. This can lead to erroneously claimed credits and potentially a penalty.

- Forget to sign and date the form after completing it. An unsigned form is considered incomplete and will not be processed by the IRS.

- Ignore the need to amend your Schedule 3 if you discover a mistake after filing. It's important to correct errors promptly to ensure your tax situation is accurately represented.

- Submit the form without first making a copy for your records. Keeping detailed tax records is crucial for future reference and in case of audits.

Misconceptions

When it comes to tax forms, especially the IRS Schedule 3 of the 1040 or 1040-SR, many misconceptions can lead taxpayers astray. Dispel these myths to navigate your tax filing more confidently and efficiently.

Only for the Self-Employed: A common misconception is that Schedule 3 is exclusively for self-employed individuals. In truth, it serves a broader purpose, catering to those needing to report additional credits not listed on the main form, such as the foreign tax credit or credits for child and dependent care expenses, affecting a wider range of taxpayers.

Direct Affect on Tax Refund: Many believe that filling out Schedule 3 guarantees a larger refund. While it's designed to report credits that can reduce your tax liability, not every credit will result in a dollar-for-dollar increase in your refund. The actual impact depends on your total tax situation.

Solely for Deductions: There's a misconception that Schedule 3 is used only for deductions. However, it's actually utilized for specific credits, not deductions. Credits directly reduce your tax owed, whereas deductions lower your taxable income. Understanding the difference is crucial for proper tax filing.

It Complicates Tax Filing: Some taxpayers avoid using Schedule 3, fearing it complicates their tax filing. While it adds an extra step, it's designed to be straightforward. Including it can be beneficial and is sometimes necessary to claim eligible credits, potentially making it worth the extra effort.

Doesn't Affect State Taxes: Many assume Schedule 3 impacts only federal taxes, overlooking potential effects on state taxes. Several states base their tax calculations on federal adjusted gross income or taxable income, which includes credits claimed on federal schedules. Therefore, Schedule 3 can indirectly influence state tax obligations as well.

Key takeaways

Understanding the IRS Schedule 3 on the 1040 or 1040-SR form is crucial to ensuring you get the credits and payments you're entitled to. Here are key takeaways to keep in mind when you're preparing or using this form:

- Know What Schedule 3 Is For: Schedule 3 is a tax form used to claim certain tax credits and make payments that aren't entered directly on Form 1040 or 1040-SR. These include credits for foreign tax paid, child and dependent care expenses, education credits, and residential energy credits, among others.

- Eligibility Is Key: Not everyone needs to fill out Schedule 3. It’s designed for taxpayers who qualify for any of the specific credits or need to report certain types of payments. Review the eligibility requirements for each credit or payment carefully to ensure you qualify before you include them on your Schedule 3.

- Accuracy Matters: Before submitting, double-check your entries on Schedule 3. Inaccurate information can delay processing your tax return or adjusting your refund amount. This step can save you time and prevent potential issues with the IRS.

- Documentation Is Crucial: Keep all documents that support your eligibility and calculations for the credits and payments you report on Schedule 3. In the event of an IRS inquiry or audit, having your documentation readily available can verify your claims and help the process go more smoothly.

Popular PDF Documents

What Is Power of Attorney California - The Tax POA E1285V4 is an indispensable tool for achieving peace of mind in tax management and representation.

What Is a Tax Lien - IRS Form 785 offers a deep dive into navigating property purchases amidst existing federal tax liens.

Philadelphia Wage Tax Refund - Remember to include detailed sales breakdowns if you're claiming that part of your earnings was generated through activities outside Philadelphia.