Get IRS Schedule 2 1040 or 1040-SR Form

Navigating the complexities of tax filing can often feel like a daunting task, especially when one encounters forms such as the IRS Schedule 2 for 1040 or 1040-SR. This particular document plays a crucial role in the tax preparation process, serving as a vehicle for taxpayers to report additional taxes that may not be covered in the main form 1040 or 1040-SR. From taxes on investment income to household employment taxes, and even the often-overlooked alternative minimum tax, Schedule 2 encompasses a variety of scenarios that could affect an individual's financial obligations to the federal government. Moreover, understanding the nuances of this form is essential, not only to comply with U.S. tax laws but also to ensure that one is not inadvertently overpaying or underpaying their taxes. Designed with the taxpayer in mind, this form, while complex, is structured to guide individuals through the process of identifying and reporting these additional taxes, ensuring that every taxpayer can navigate their fiscal responsibilities with confidence.

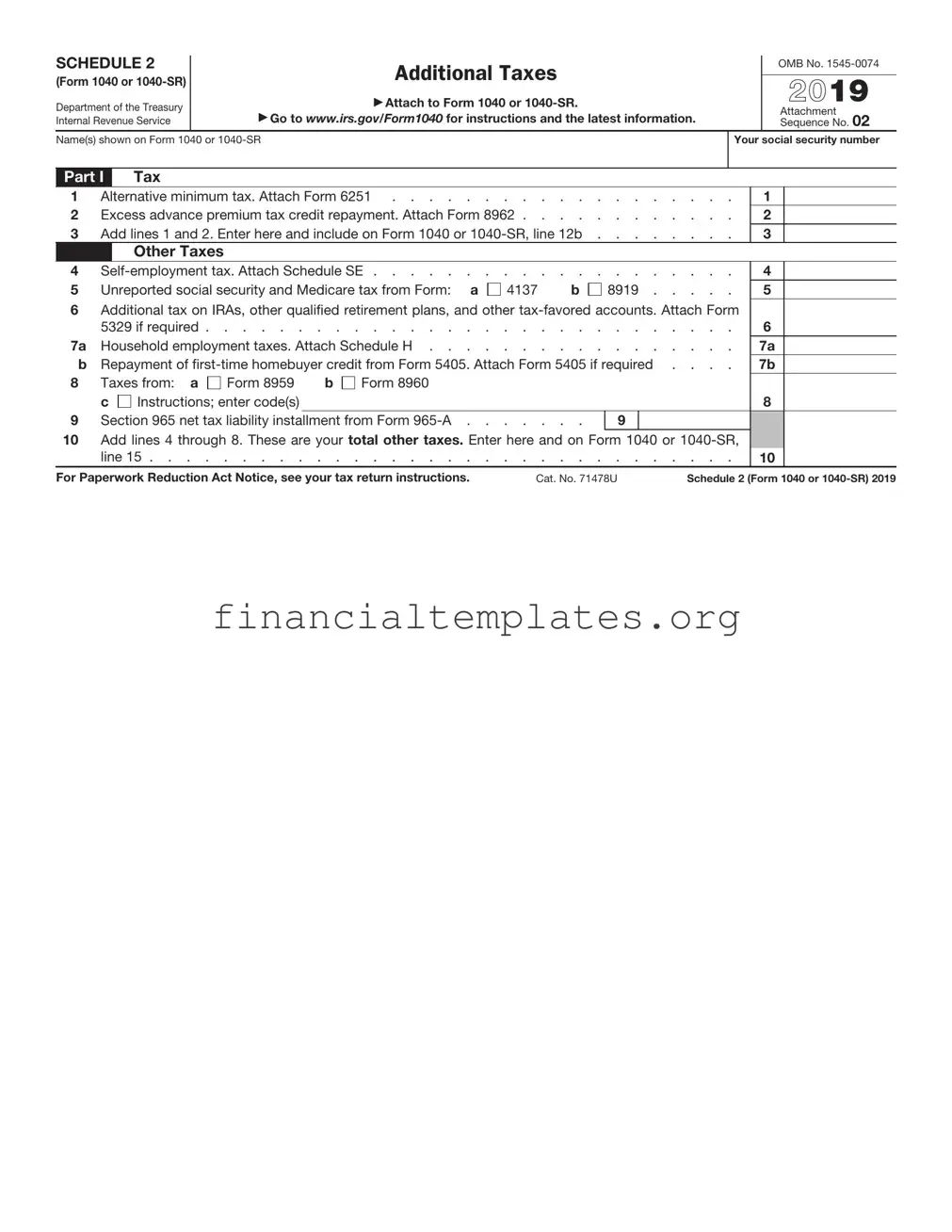

IRS Schedule 2 1040 or 1040-SR Example

SCHEDULE 2

(Form 1040)

Department of the Treasury Internal Revenue Service

Additional Taxes

▶Attach to Form 1040,

▶Go to www.irs.gov/Form1040 for instructions and the latest information.

OMB No.

2021

Attachment Sequence No. 02

Name(s) shown on Form 1040, |

Your social security number |

|

|

Part I |

Tax |

|

|

|

|

|

|

|

|

1 |

Alternative minimum tax. Attach Form 6251 |

1 |

|

|

2 |

Excess advance premium tax credit repayment. Attach Form 8962 |

2 |

|

|

3 |

Add lines 1 and 2. Enter here and on Form 1040, |

3 |

|

|

Part II |

Other Taxes |

|

|

|

|

|

|

|

|

4 |

4 |

|

||

5Social security and Medicare tax on unreported tip income.

Attach Form 4137 |

5 |

6Uncollected social security and Medicare tax on wages. Attach

|

Form 8919 |

6 |

|

|

7 |

Total additional social security and Medicare tax. Add lines 5 and 6 |

|

7 |

|

8 |

Additional tax on IRAs or other |

|

8 |

|

9 |

Household employment taxes. Attach Schedule H |

9 |

||

10Repayment of

11 |

Additional Medicare Tax. Attach Form 8959 |

11 |

12 |

Net investment income tax. Attach Form 8960 |

12 |

13Uncollected social security and Medicare or RRTA tax on tips or

insurance from Form

14Interest on tax due on installment income from the sale of certain residential lots

and timeshares . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15Interest on the deferred tax on gain from certain installment sales with a sales price

over $150,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16Recapture of

|

|

(continued on page 2) |

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 71478U |

Schedule 2 (Form 1040) 2021 |

Schedule 2 (Form 1040) 2021 |

Page 2 |

Part II Other Taxes (continued)

17Other additional taxes:

a |

Recapture of other credits. List type, form number, and |

|

|

|

|

|||

|

amount ▶ |

|

|

17a |

|

|||

b |

Recapture of federal mortgage subsidy. If you sold your home in |

|

|

|

|

|||

|

2021, see instructions |

17b |

|

|||||

c |

Additional tax on HSA distributions. Attach Form 8889 . . . . |

17c |

|

|||||

d |

Additional tax on an HSA because you didn’t remain an eligible |

|

|

|

|

|||

|

individual. Attach Form 8889 |

17d |

|

|||||

e |

Additional tax on Archer MSA distributions. Attach Form 8853 . |

17e |

|

|||||

f |

Additional tax on Medicare Advantage MSA distributions. Attach |

|

|

|

|

|||

|

Form 8853 |

17f |

|

|||||

g |

Recapture of a charitable contribution deduction related to a |

|

|

|

|

|||

|

fractional interest in tangible personal property |

17g |

|

|||||

h |

Income you received from a nonqualified deferred compensation |

|

|

|

|

|||

|

plan that fails to meet the requirements of section 409A . . . |

17h |

|

|||||

i |

Compensation you received from a nonqualified deferred |

|

|

|

|

|||

|

compensation plan described in section 457A |

17i |

|

|||||

j |

Section 72(m)(5) excess benefits tax |

17j |

|

|||||

k |

Golden parachute payments |

17k |

|

|||||

l |

Tax on accumulation distribution of trusts |

17l |

|

|||||

m Excise tax on insider stock compensation from an expatriated |

|

|

|

|

||||

|

corporation |

17m |

|

|||||

n |

|

|

|

|

||||

|

8697 or 8866 |

17n |

|

|||||

o |

Tax on |

|

|

|

|

|||

|

year you were a nonresident alien from Form |

17o |

|

|||||

p |

Any interest from Form 8621, line 16f, relating to distributions |

|

|

|

|

|||

|

from, and dispositions of, stock of a section 1291 fund . . . . |

17p |

|

|||||

q |

Any interest from Form 8621, line 24 |

17q |

|

|||||

z |

Any other taxes. List type and amount ▶ |

17z |

|

|||||

18 |

|

|

|

|

18 |

|||

Total additional taxes. Add lines 17a through 17z |

. . . . . . . |

|

||||||

19 |

Additional tax from Schedule 8812 |

. . . . . . . |

|

19 |

||||

20 |

Section 965 net tax liability installment from Form |

20 |

|

|

|

|||

21Add lines 4, 7 through 16, 18, and 19. These are your total other taxes. Enter here and on Form 1040 or

Schedule 2 (Form 1040) 2021

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Schedule 2 | It's used for reporting additional taxes not entered directly on Form 1040 or 1040-SR, such as Alternative Minimum Tax or taxes on other forms of income. |

| Who Needs to File | Those who owe AMT or have to make other less common payments to the IRS beyond their standard income tax. |

| Two Parts of Schedule 2 | Part I deals with AMT, and Part II covers other additional taxes like self-employment tax or household employment taxes. |

| Relation to Form 1040 | The total from Schedule 2 is added to the tax liability on Form 1040 or 1040-SR, making it integral to calculating total taxes due. |

| Governing Law | This form, like all federal tax forms, is governed by the Internal Revenue Code and associated Treasury Regulations. |

Guide to Writing IRS Schedule 2 1040 or 1040-SR

Filling out the IRS Schedule 2 (Form 1040 or 1040-SR) correctly is essential for taxpayers who need to report additional taxes such as the Alternative Minimum Tax or household employment taxes. It's a straightforward process if you follow the instructions step by step. Remember, this form allows the IRS to assess additional taxes that aren't initially covered on your standard tax return. Ensuring accuracy on this form can help avoid any unexpected tax liabilities or delays in processing your return.

- Start by obtaining the latest version of Schedule 2 (Form 1040 or 1040-SR) from the IRS website.

- Enter your name and Social Security Number at the top of the form, ensuring that it matches the information on your Form 1040 or 1040-SR.

- Look at Part I labeled "Alternative Minimum Tax." You only need to complete this section if it applies to you. Use the instructions provided by the IRS to calculate your alternative minimum tax, if required.

- In Part II, "Additional Taxes," enter any additional amounts owed for specific situations not covered in your original tax return. This could include extra taxes on things like certain types of income, health care policies, or household employment taxes.

- For each line that applies to you in Part II, carefully follow the accompanying instructions to calculate the correct amount to report. These instructions are detailed in the Schedule 2 instructions document and may require additional forms or schedules to be completed.

- Review each line item to double-check your work and ensure that all necessary parts of the form are filled out and calculated correctly.

- Add up the totals from Part I and Part II, and enter these on the correct lines as indicated to arrive at your total additional tax owed. This amount will then be carried over to your Form 1040 or 1040-SR.

- Once you have completed filling out Schedule 2, attach it to your Form 1040 or 1040-SR when you file your tax return.

After completing Schedule 2, ensure all your tax documents are organized and retain copies for your records. Submit your tax return by the filing deadline to avoid any penalties or interest for late submission. If you find the process challenging or have unique tax situations, consider seeking the help of a tax professional to ensure everything is filed correctly.

Understanding IRS Schedule 2 1040 or 1040-SR

-

What is the IRS Schedule 2 1040 or 1040-SR form?

The IRS Schedule 2 form for either 1040 or 1040-SR is a supplementary form used by taxpayers to report additional taxes that aren’t directly entered on the main form 1040 or 1040-SR. These may include alternative minimum tax or taxes on other specific types of income, and additional taxes such as self-employment tax, household employment taxes, and the tax penalty for not having health insurance (although this penalty is no longer applicable from 2019 onwards).

-

Who needs to file Schedule 2 with their 1040 or 1040-SR?

Individuals who have additional taxes that can’t be reported directly on the Form 1040 or 1040-SR need to complete Schedule 2. This includes people with alternative minimum tax obligations, those who owe tax on a child’s unearned income (commonly referred to as the "kiddie tax"), or those with other specific taxable situations.

-

How do I know if I need to fill out Schedule 2?

Determining whether you need to fill out Schedule 2 involves reviewing your financial situation against the specific scenarios listed on the form. If you have income or other financial obligations that are subject to additional taxes not captured on Form 1040 or 1040-SR, such as self-employment tax or certain other types of taxes, then you will likely need to complete Schedule 2.

-

Where do I find Schedule 2?

Schedule 2 can be downloaded directly from the IRS website. Additionally, tax preparation software often includes the option to fill out this schedule if it’s needed based on the income and deductions you report.

-

Is there a deadline for filing Schedule 2?

Yes, the deadline for filing Schedule 2 is the same as your tax return. Typically, this is April 15th of the year following the tax year. If the 15th falls on a weekend or holiday, the deadline is the next business day. Remember, filing for an extension on your 1040 or 1040-SR also extends the deadline for Schedule 2.

-

How does filing Schedule 2 affect my tax return?

Filing Schedule 2 can increase your tax bill, as it is used to report additional taxes owed beyond standard income taxes. However, accurately reporting and paying these taxes is crucial to comply with tax laws and avoid penalties. It’s part of ensuring your tax return is complete and accurate.

-

Can I e-file Schedule 2 with my 1040 or 1040-SR?

Yes, you can e-file Schedule 2 along with your Form 1040 or 1040-SR through IRS e-file. Most tax preparation software will guide you through the process of completing Schedule 2 if it applies to your situation and will include it with your electronic tax return submission.

-

What happens if I make a mistake on Schedule 2?

If you realize you've made a mistake on Schedule 2 after filing, you should amend your tax return as soon as possible. This involves filing an amended return using Form 1040-X and providing the correct information. Amending your return can help avoid potential penalties and interest charges for underpayment.

-

Are there resources available to help me fill out Schedule 2?

Yes, there are several resources to assist you in completing Schedule 2 correctly. The IRS provides instructions for filling out the form on their website. Many taxpayers also find it helpful to use tax preparation software, which automates much of the process and ensures that the schedule is filled out based on the information you enter. Additionally, tax professionals can provide valuable guidance and support if you're unsure about your tax situation.

Common mistakes

Filing taxes can be a complex process, and the IRS Schedule 2 (Form 1040 or 1040-SR) is no exception. This form is used for reporting additional taxes that may not be covered on the main 1040 or 1040-SR form, such as alternative minimum tax or taxes on unearned income of minors. Errors on this form can lead to processing delays or even an unexpected tax bill. Below are nine common mistakes to avoid when completing the IRS Schedule 2 (Form 1040 or 1040-SR).

Not filing Schedule 2 when necessary: Many individuals might overlook the need to file Schedule 2 altogether. This error usually occurs if they are unaware of certain taxes that apply to them, leading to underreported liabilities.

Misinterpretation of instructions: The IRS provides detailed instructions for Schedule 2, but they can be complex and difficult to understand. Mistaking these instructions often leads to inaccurately reported taxes.

Incorrect calculations: Arithmetic errors are common and can result in reporting either too much or too little tax. Always double-check calculations or use tax software to mitigate these mistakes.

Failing to report additional taxes: Schedule 2 is specifically designed for additional taxes. Omitting entries, like the alternative minimum tax or household employment taxes, can have serious repercussions.

Incorrect Social Security Numbers (SSNs) or names: Entering an incorrect SSN or name is a simple but significant mistake that can delay processing and potentially misalign tax records.

Forgetting to sign and date the form: Just like the main tax form, Schedule 2 requires a signature and date to be considered valid. An unsigned form is considered incomplete.

Using outdated forms: Tax laws and forms change regularly. Filling out an outdated version of Schedule 2 can lead to reporting errors based on old laws or rates.

Not attaching Schedule 2 to the 1040 or 1040-SR form: If Schedule 2 is required, it must be attached to your main tax return. Forgetting to attach it can lead to unprocessed additional taxes.

Ignoring IRS notices for further information: Sometimes, the IRS may request additional information or clarification regarding entries on Schedule 2. Not responding to these notices can lead to penalties or an audit.

Avoiding these errors requires careful attention to detail and a thorough understanding of the filing requirements. When in doubt, consulting a tax professional or utilizing IRS resources can help ensure that the Schedule 2 form is completed accurately and efficiently.

Documents used along the form

When individuals prepare their income tax returns, the IRS Schedule 2 form for the 1040 or 1040-SR is often complemented by other forms and documents. These documents are critical for accurately reporting additional taxes owed beyond standard income tax, including self-employment tax, uncollected Social Security and Medicare taxes, and additional taxes on IRAs and other retirement accounts. Understanding these complementary forms is key to ensuring a thorough and precise submission to the IRS.

- Form 8962: This form is essential for individuals who purchase health insurance through the Marketplace. It is used to calculate the Premium Tax Credit (PTC) and reconcile it with any advance payment of the premium tax credit (APTC). Essentially, it ensures that individuals receive the correct amount of financial aid for their healthcare coverage.

- Form 5329: For those with various retirement accounts, such as IRAs, Coverdell ESAs, or Archer MSAs, this form is crucial. It's used to report additional taxes on these accounts. For example, it addresses taxes due to early withdrawals, excess contributions, and required minimum distribution (RMD) issues.

- Form 6251: The Alternative Minimum Tax (AMT) is a parallel tax system designed to ensure that high-income individuals, corporations, estates, and trusts pay at least a minimum amount of tax. Form 6251 is used to calculate the AMT for individuals, capturing income and adjustments that might not be subject to regular income tax.

- Form 8801: This form is relevant for individuals who have overpaid the AMT in prior years. It allows for the calculation of the credit for this overpayment. Then, it can be applied to reduce future tax liabilities. It helps in smoothing out the instances where the AMT was higher than the regular tax bill, ensuring taxpayers do not overpay taxes over time.

These forms represent just a slice of the complex web of documentation necessary for a thorough and compliant tax return. For individuals navigating additional taxes beyond their standard income tax, integrating these forms with the IRS Schedule 2 form for the 1040 or 1040-SR is crucial. Each document addresses a unique aspect of the taxpayer's financial life, from healthcare subsidies to retirement account management and the minimization of their overall tax liability through credits for overpaid taxes. As tax situations vary widely, selecting and properly filling out the applicable forms is a critical step in the tax preparation process.

Similar forms

The IRS Form 8962, Premium Tax Credit (PTC), bears similarity to the IRS Schedule 2 1040 or 1040-SR form as both involve calculations related to tax adjustments. Specifically, the Form 8962 is used to calculate the amount of premium tax credit an individual can claim, along with the reconciliation of any advance payments of the premium tax credit. Like Schedule 2, it impacts the overall tax liability or refund an individual may expect during tax filing.

Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts, is akin to the IRS Schedule 2 in that both forms deal with taxes owed beyond basic income tax calculations. While Schedule 2 encompasses additional taxes people might owe, Form 2210 is specific to penalties for underpaying estimated taxes throughout the year. Each form ultimately adjusts the taxpayer's total tax payment responsibility to the IRS.

Similar to Schedule 2, Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, involves calculating additional taxes that aren't directly related to standard income tax. Form 5329 focuses on taxes due to early withdrawals or insufficient distributions from retirement accounts, offering a detailed look into specific situations that could result in increased tax liability — akin to how Schedule 2 covers diverse additional tax scenarios.

Form 6251, Alternative Minimum Tax—Individuals, runs parallel to the IRS Schedule 2 1040 or 1040-SR in its focus on ensuring that taxpayers contribute a minimum amount of tax. While Schedule 2 adds to an individual's tax bill through various additional taxes, Form 6251 identifies whether the taxpayer owes alternative minimum tax (AMT), a separate calculation designed to prevent high-income earners from paying too little in taxes.

The Schedule SE (Form 1040), Self-Employment Tax, shares similarities with the IRS Schedule 2 form in that it deals with taxes not withheld by employers. Self-employment tax, covering Social Security and Medicare taxes for those who work for themselves, adds to one's tax due, akin to how Schedule 2 compiles various other additional taxes payable to the IRS.

Finally, Form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gains, parallels Schedule 2's function as it pertains to informing shareholders of additional tax-related information that affects their overall tax liability. While distinctly aimed at handling undistributed capital gains from mutual funds or other regulated investment companies, it plays a role in the broader picture of an individual's tax situation, akin to the miscellaneous additional taxes addressed in Schedule 2.

Dos and Don'ts

Filling out IRS Schedule 2 for Form 1040 or 1040-SR, which deals with additional taxes, requires careful attention to detail. Below are essential dos and don'ts to help ensure accuracy and compliance.

Do:

- Double-check your calculations. Ensure that you accurately calculate any additional taxes owed, such as alternative minimum tax or additional taxes on things like retirement plans.

- Verify your Social Security Number (SSN). Always make sure the SSN on your Schedule 2 matches the one on your Form 1040 or 1040-SR.

- Refer to the IRS instructions. The instructions for Schedule 2 provide detailed information on how to fill out the form correctly, including which lines to complete for specific situations.

- Use ink to fill out the form. Your entries should be clear and legible to avoid any misunderstandings or processing delays.

- Keep a copy for your records. Always keep a copy of the completed Schedule 2 and your entire tax return for at least three years.

- Consult a tax professional if unsure. If you have questions or uncertainties, getting advice from a tax expert can prevent costly errors.

Don't:

- Rush through the form. Take your time to carefully read and answer each section accurately to avoid costly mistakes.

- Estimate amounts. Ensure all amounts are precise and backed up by documentation, such as W-2s, 1099s, and other tax documents.

- Forget to sign the form. An unsigned tax return is like an unsigned check – it's not valid.

- Ignore IRS notices. If you receive a notice from the IRS regarding your Schedule 2, respond promptly and provide any requested information or corrections.

- Use pencil or erasable ink. Entries made in pencil or erasable ink can smear or be altered, leading to potential issues with your tax return.

- Omit related forms or schedules. If you report additional taxes on Schedule 2, make sure you also include any other schedules or forms that support or are related to those taxes.

Misconceptions

The Internal Revenue Service (IRS) Schedule 2 form, related to the 1040 or 1040-SR tax returns, is often misunderstood by taxpayers. These misconceptions can lead to errors in filing, potentially resulting in penalties or missed opportunities for a more favorable tax outcome. Here are four common misunderstandings about this form and clarifications to help taxpayers navigate their taxes more accurately.

- Misconception 1: Schedule 2 is only for individuals with high income.

This belief stems from the notion that certain forms and schedules are designed exclusively for the wealthy. However, Schedule 2 is required for taxpayers who need to pay alternative minimum tax or have additional taxes on items like self-employment tax, household employment taxes, and withdrawal penalties on IRAs or other qualified retirement plans, among others. This requirement is based on specific financial situations, not income brackets.

- Misconception 2: Filing Schedule 2 always results in owing more to the IRS.

The fear of owing additional taxes leads many to believe that Schedule 2 can only add to their tax liability. While it's true that this form is used to report additional taxes, it's part of ensuring one's tax liability is accurately represented. Sometimes, these additional taxes have already been estimated and paid throughout the year, making the true impact on an individual's tax due less daunting than expected.

- Misconception 3: If you didn't owe additional taxes last year, you won't need to file Schedule 2 this year.

Tax situations can change from year to year due to various factors like changes in employment, investment outcomes, or new tax laws. Thus, even if an individual didn't file Schedule 2 in the previous year, certain changes in their financial situation could make it necessary for the current year. Relying on past tax filings without considering current circumstances may lead to unintentional filing errors.

- Misconception 4: You can decide not to file Schedule 2 if your additional taxes are minimal.

Another common error is thinking that minimal additional taxes don't require reporting on Schedule 2. Regardless of the amount, the IRS requires accurate reporting of all applicable taxes. Failing to properly report these taxes, even if minimal, can result in penalties. Diligent reporting ensures compliance with tax laws and can prevent unnecessary scrutiny from the IRS.

In summary, understanding the purpose and requirements of Schedule 2 is vital for accurate tax reporting. Misconceptions can lead to avoidable mistakes, potentially impacting one’s financial responsibilities to the IRS. Taxpayers should review their tax situation each year to determine if Schedule 2 is applicable, consulting a tax professional if they are uncertain about their obligations.

Key takeaways

Understanding how to properly fill out and use the IRS Schedule 2 (Form 1040 or 1040-SR) is crucial for taxpayers. This form is essential for reporting certain tax situations. Here are key takeaways to ensure accurate and compliant submission:

- Identify if You Need Schedule 2: Schedule 2 is required for individuals who need to report additional taxes not covered on the standard Form 1040 or 1040-SR. This includes, but is not limited to, alternative minimum tax and taxes on other specific types of income.

- Understand the Parts: Schedule 2 is divided into two parts. Part I deals with alternative minimum tax, while Part II addresses other taxes, such as additional tax on IRAs, other qualified retirement plans, and other tax-favored accounts.

- Gather Necessary Documents: Before filling out Schedule 2, ensure you have all relevant financial statements and records, including income statements and records of any deductions or credits that might impact your additional tax calculations.

- Review Instructions Carefully: The IRS provides specific instructions for each line of Schedule 2. These instructions are crucial to accurately report your additional taxes and avoid common mistakes.

- Use Updated Forms: Tax laws change frequently. Always use the most current version of Schedule 2 to ensure compliance with the latest tax regulations and rates.

- Consider Electronic Filing: Filing electronically through IRS-approved software can simplify the process of including Schedule 2 with your tax return. It can also reduce errors and speed up processing times.

- Check for Common Errors: Before submitting, double-check your entries, especially the calculations in Part I and II, to avoid potential errors that could lead to delays or audits.

- Keep Copies for Your Records: After submitting your tax return and Schedule 2, keep a copy of all documents for your records. This is important for future reference and in case of IRS inquiries.

Properly addressing the requirements of the IRS Schedule 2 can help ensure accurate tax reporting and avoid possible penalties. If you're unsure about any aspect of filling out Schedule 2 or how additional taxes apply to your situation, consider seeking professional tax advice.

Popular PDF Documents

Ptax 300 - The PTAX-300 serves as a pivotal component in Illinois’ framework for ensuring property tax exemptions are granted appropriately and fairly to qualifying entities.

Tax POA Form 21-002-13 - Legally empowers a representative to act in the best interest of the taxpayer regarding tax filings and issues.