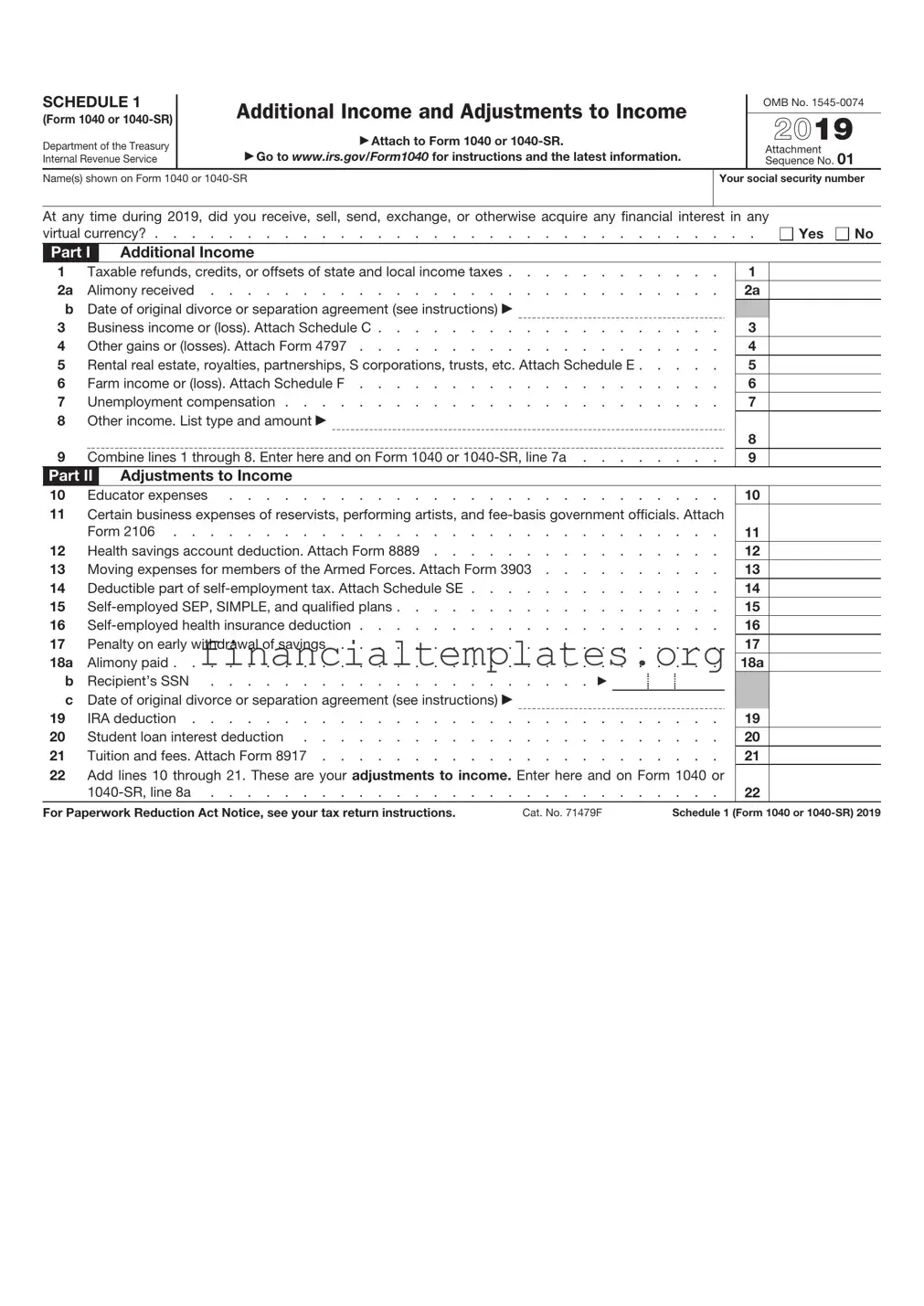

Get IRS Schedule 1 1040 or 1040-SR Form

Navigating the complex landscape of the IRS taxation forms can be a daunting task for many individuals, particularly when it comes to understanding the nuances of the Schedule 1 (Form 1040 or 1040-SR). This form plays a pivotal role in the tax filing process as it encompasses additional income and adjustments to income that are not directly reported on the standard Form 1040 or 1040-SR. The significance of Schedule 1 lies in its capacity to handle diverse types of income such as earnings from rental property, profits from business activities, alimony received, as well as less common income streams that do not fit neatly into other categories. Beyond reporting additional income, it offers taxpayers the opportunity to make adjustments to their gross income through deductions such as educator expenses, student loan interest, or contributions to retirement accounts, which can ultimately influence the taxpayer's adjusted gross income and overall tax liability. Understanding the critical components and implications of Schedule 1 is essential for anyone looking to accurately report their financial situation and potentially harness the benefits of lowered taxable income.

IRS Schedule 1 1040 or 1040-SR Example

SCHEDULE 1

(Form 1040)

Department of the Treasury Internal Revenue Service

Additional Income and Adjustments to Income

▶Attach to Form 1040,

▶Go to www.irs.gov/Form1040 for instructions and the latest information.

OMB No.

2021

Attachment Sequence No. 01

Name(s) shown on Form 1040,

Your social security number

Part I Additional Income

1 |

Taxable refunds, credits, or offsets of state and local income taxes |

1 |

|

||

2a |

Alimony received |

2a |

|||

b Date of original divorce or separation agreement (see instructions) ▶ |

|

|

|

|

|

3 |

Business income or (loss). Attach Schedule C |

3 |

|

||

4 |

Other gains or (losses). Attach Form 4797 |

4 |

|

||

5Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach

|

Schedule E |

5 |

6 |

Farm income or (loss). Attach Schedule F |

6 |

7 |

Unemployment compensation |

7 |

8Other income:

a |

Net operating loss |

8a |

( |

|

) |

|

||

b |

Gambling income |

8b |

|

|

|

|

||

c |

Cancellation of debt |

8c |

|

|

|

|

||

d |

Foreign earned income exclusion from Form 2555 |

8d |

( |

|

) |

|

||

e |

Taxable Health Savings Account distribution |

8e |

|

|

|

|

||

f |

Alaska Permanent Fund dividends |

8f |

|

|

|

|

||

g |

Jury duty pay |

8g |

|

|

|

|

||

h |

Prizes and awards |

8h |

|

|

|

|

||

i |

Activity not engaged in for profit income |

8i |

|

|

|

|

||

j |

Stock options |

8j |

|

|

|

|

||

k |

Income from the rental of personal property if you engaged in |

|

|

|

|

|

||

|

the rental for profit but were not in the business of renting such |

|

|

|

|

|

||

|

property |

8k |

|

|

|

|

||

l |

Olympic and Paralympic medals and USOC prize money (see |

|

|

|

|

|

||

|

instructions) |

8l |

|

|

|

|

||

m Section 951(a) inclusion (see instructions) |

8m |

|

|

|

|

|||

n |

Section 951A(a) inclusion (see instructions) |

8n |

|

|

|

|

||

o |

Section 461(l) excess business loss adjustment |

8o |

|

|

|

|

||

p |

Taxable distributions from an ABLE account (see instructions) . |

8p |

|

|

|

|

||

z |

Other income. List type and amount ▶ |

8z |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

9 |

Total other income. Add lines 8a through 8z |

. . . . . . |

. |

9 |

||||

10Combine lines 1 through 7 and 9. Enter here and on Form 1040,

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 71479F |

Schedule 1 (Form 1040) 2021 |

Schedule 1 (Form 1040) 2021 |

Page 2 |

Part II Adjustments to Income

11 Educator expenses . . . . . . . . . . . . . . . . . . . . . . . . . .

12Certain business expenses of reservists, performing artists, and

officials. Attach Form 2106 . . . . . . . . . . . . . . . . . . . . . . .

13 Health savings account deduction. Attach Form 8889 . . . . . . . . . . . .

14Moving expenses for members of the Armed Forces. Attach Form 3903 . . . . .

15 Deductible part of

16

17

18 |

Penalty on early withdrawal of savings |

|

19a |

Alimony paid |

|

b |

Recipient’s SSN . . . . . . . . . . . . . . . . . . . . ▶ |

|

cDate of original divorce or separation agreement (see instructions) ▶

20 |

IRA deduction |

21 |

Student loan interest deduction |

22 |

Reserved for future use |

23 |

Archer MSA deduction |

24Other adjustments:

a Jury duty pay (see instructions) . . . . . . . . . . . . . 24a

bDeductible expenses related to income reported on line 8k from

the rental of personal property engaged in for profit . . . . . 24b

cNontaxable amount of the value of Olympic and Paralympic

medals and USOC prize money reported on line 8l |

24c |

d Reforestation amortization and expenses |

24d |

eRepayment of supplemental unemployment benefits under the

Trade Act of 1974 . . . . . . . . . . . . . . . . . . . 24e

fContributions to section 501(c)(18)(D) pension plans . . . . . 24f

g |

Contributions by certain chaplains to section 403(b) plans . . |

24g |

h |

Attorney fees and court costs for actions involving certain |

|

|

unlawful discrimination claims (see instructions) |

24h |

iAttorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the

IRS detect tax law violations |

24i |

j Housing deduction from Form 2555 |

24j |

kExcess deductions of section 67(e) expenses from Schedule

(Form 1041) . . . . . . . . . . . . . . . . . . . . . 24k

zOther adjustments. List type and amount ▶

24z

25Total other adjustments. Add lines 24a through 24z . . . . . . . . . . . . .

26Add lines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or

11

12

13

14

15

16

17

18

19a

20

21

22

23

25

26

Schedule 1 (Form 1040) 2021

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The IRS Schedule 1 for the 1040 or 1040-SR form is used to report additional income that isn't entered directly on the Form 1040 or 1040-SR, as well as certain deductions that can be taken to reduce taxable income. |

| Types of Income Reported | This includes income from rental real estate, royalties, partnerships, S corporations, trusts, and more. It also covers taxable refunds of state and local income taxes, and unemployment compensation. |

| Adjustments to Income | Schedule 1 allows taxpayers to subtract certain expenses from their total income. These adjustments include educator expenses, student loan interest deduction, alimony payments for divorce agreements prior to 2019, and contributions to certain retirement accounts. |

| Effect on Taxable Income | By reporting additional streams of income and making adjustments for allowable deductions, Schedule 1 directly affects the calculation of adjusted gross income (AGI) on the 1040 or 1040-SR form. |

| Who Must File | Not all taxpayers need to file Schedule 1. It's required only if you have types of income or deductions that are listed on this schedule. |

Guide to Writing IRS Schedule 1 1040 or 1040-SR

Once you have completed the main sections of either the 1040 or 1040-SR form, you might find yourself in need of detailing additional income or adjustments to income that aren't covered in the main form. This is where Schedule 1 comes into play. It serves as an extension to provide further information required by the IRS. Filling out Schedule 1 can seem daunting at first glance, but breaking it down into steps makes the process more manageable. Below are detailed steps to guide you through each part of Schedule 1, ensuring you provide all necessary information accurately.

- Identification: At the top of Schedule 1, fill in your name and Social Security number. Make sure these match the details on your Form 1040 or 1040-SR.

- Additional Income: In Part I, you'll list types of income not included on your Form 1040 or 1040-SR. This includes items like taxable refunds, alimony received (applicable for agreements executed before 2019), business income, capital gains, and other sources not listed on the main tax form. Enter the amounts next to the appropriate descriptions.

- Total Additional Income: After listing all applicable incomes in Part I, add them up and write the total amount on the line provided at the bottom of this section.

- Adjustments to Income: Part II is used to note any adjustments to your income. This can include educator expenses, student loan interest deduction, IRA contributions, and others. Similar to Part I, enter the amounts next to the correct descriptions.

- Total Adjustments: Once all applicable adjustments are listed in Part II, total them up and write this amount in the space provided at the end of the section.

- Combine Total Additional Income and Adjustments: Add the total additional income from Part I to the total adjustments to income from Part II. This amount should be included on your Form 1040 or 1040-SR, as indicated by the instructions on Schedule 1.

After completing all steps, review Schedule 1 carefully to ensure all information is accurate and matches the documentation you have. This Schedule is an integral part of your tax return, and errors can lead to delays or adjustments by the IRS. If necessary, consult with a tax professional to verify that all income and adjustments are reported correctly and take advantage of all possible deductions and credits. Once finalized, attach Schedule 1 to your Form 1040 or 1040-SR and follow the instructions for submitting your tax return. Filing accurately not only keeps you in compliance with tax laws but can also impact your tax obligations and potential refunds.

Understanding IRS Schedule 1 1040 or 1040-SR

- What is the IRS Schedule 1 1040 or 1040-SR form?

The IRS Schedule 1 1040 or 1040-SR form is an additional form used when filing your taxes that provides the IRS with more detailed information about your income and adjustments to income that aren’t entered directly on the Form 1040 or 1040-SR. It's used by taxpayers to report certain types of income, such as business income, alimony, deductible part of self-employment tax, and student loan interest deduction, among others.

- Who needs to file a Schedule 1 form?

Any taxpayer who has additional income such as capital gains, unemployment compensation, prize or award money, or who has adjustments to their income such as educator expenses, student loan interest deduction, or deductible part of self-employment taxes, should file a Schedule 1 along with their 1040 or 1040-SR form.

- Can I file Schedule 1 electronically?

Yes, you can file Schedule 1 electronically along with your Form 1040 or 1040-SR through IRS e-file. Electronic filing is the fastest way to submit your taxes and ensures more accurate processing of your tax return.

- What are some common types of income reported on Schedule 1?

The Schedule 1 form is used to report various types of income, including, but not limited to:

- Alimony received

- Business income or loss

- Capital gains or losses

- Rental real estate, royalties, partnerships, S corporations, trusts, etc.

- Unemployment compensation

- Farm income or loss

- Prize or award money

- What are some common adjustments to income reported on Schedule 1?

There are several adjustments to income that can be reported on Schedule 1, such as:

- Educator expenses

- Student loan interest deduction

- Deductible part of self-employment tax

- Self-employed SEP, SIMPLE, and qualified plans

- Self-employed health insurance deduction

- Penalty on early withdrawal of savings

- Alimony paid (for agreements executed before 2019)

- What happens if I don’t file Schedule 1 with my tax return?

If you're required to file Schedule 1 because of your income or adjustments and you fail to do so, your tax return may be considered incomplete by the IRS. This can delay your refund, if applicable, and may result in interest and penalties for the underreporting of income.

- Do I need to attach documentation for income or adjustments reported on Schedule 1?

While you typically do not need to attach documentation for the income or adjustments reported on Schedule 1, it’s crucial to keep all relevant documentation for at least three years as proof in case the IRS audits your tax return. Documentation may include 1099 forms, bank statements, or receipts for deductible expenses.

- Where can I get help with filling out Schedule 1?

Help with filling out Schedule 1 can be found through several sources:

- The IRS website offers instructions and resources

- Tax preparation software often provides guidance for completing this schedule

- Professional tax preparers or accountants can provide personal assistance

Common mistakes

Filling out the IRS Schedule 1 form for the 1040 or 1040-SR can sometimes be complex and confusing. Common mistakes can lead to processing delays or even a potential audit. It's crucial for taxpayers to be minutely accurate and thoroughly informed about what is expected to avoid such pitfalls. Below is a list of common errors made when completing this form.

-

Not Reporting All Income: One of the most frequent mistakes is the omission of additional income sources, such as alimony received, business income, or unemployment compensation. All income must be reported to the IRS to avoid penalties.

-

Misunderstanding Eligible Deductions: Taxpayers often misunderstand which deductions they are eligible for. This can result in either underreporting, which might lead to paying more tax than necessary, or overreporting, which could trigger an audit.

-

Miscalculating Adjustments to Income: Adjustments to income can reduce taxable income, but they need to be calculated correctly. Common mistakes include incorrect IRA deductions, student loan interest deductions, and educator expenses.

-

Overlooking the Nonrefundable Credits Section: Nonrefundable credits can significantly reduce the amount of tax owed dollar for dollar. However, they are often overlooked or incorrectly calculated by taxpayers.

-

Not Utilizing the Qualified Business Income Deduction: Many eligible small business owners and self-employed individuals fail to claim the Qualified Business Income Deduction, potentially missing out on a substantial deduction.

-

Incorrectly Reporting Self-Employment Tax: Self-employed individuals sometimes miscalculate their self-employment tax or fail to report it correctly, leading to discrepancies in owed taxes.

-

Forgetting to Include Additional Tax Payments: Taxpayers often forget to include additional taxes that may apply, such as the Net Investment Income Tax or the Additional Medicare Tax, both of which should be reported on Schedule 1.

-

Failing to Attach Required Forms or Schedules: Tax returns that necessitate Schedule 1 often require additional forms and schedules based on the taxpayer's financial activities throughout the year. Failure to attach these could result in processing delays.

-

Misunderstanding Tax Filing Status and Dependents: Incorrectly reporting filing status or dependents can significantly affect tax calculations and credits, such as the Earned Income Credit, which is partially determined through Schedule 1 adjustments.

In order to ensure accuracy and completeness when filling out the IRS Schedule 1 1040 or 1040-SR form, it may be beneficial for individuals to consult with a tax professional or utilize reliable tax software. Both resources can provide guidance tailored to the taxpayer's unique financial situation, potentially avoiding these common errors.

Documents used along the form

Filing taxes can often involve more than just a straightforward form. Particularly, when working with the IRS Schedule 1 of the 1040 or 1040-SR form, additional documentation may be necessary. These documents can help provide a comprehensive picture of one's financial situation, ensuring that all income, deductions, and credits are accurately reported. Below is a list of forms and documents commonly used in conjunction with the IRS Schedule 1 form.

- W-2 Form: This form is issued by employers to report wages paid and taxes withheld for each employee. It is a crucial document for anyone who is employed, as it is needed to verify income and tax withholdings when filing tax returns.

- 1099 Forms: The 1099 forms are used to report various types of income other than wages, salaries, and tips. For example, the 1099-MISC is used for independent contractors, while the 1099-INT is for interest income. These forms help individuals report earnings that are not covered by a W-2.

- 1098 Form: Homeowners who have mortgages may receive this form, which reports the amount of mortgage interest and related expenses paid throughout the year. These expenses can often be deducted, making the 1098 an important form for those looking to itemize deductions.

- Schedule C: For individuals who operate a sole proprietorship, Schedule C is used to report profits or losses from the business. This form is essential for business owners to detail their business income and expenses.

- Schedule E: This is used by taxpayers to report income and losses from rental property, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. This form is necessary for those who have income from these sources.

- Schedule SE: Self-employment tax is reported using Schedule SE. This form calculates the tax owed based on net earnings from self-employment, ensuring that Social Security and Medicare contributions are made by those who work for themselves.

In summary, when preparing your taxes with the IRS Schedule 1 form, it's essential to gather all relevant documents to ensure an accurate and efficient filing process. Whether you're employed, self-employed, own a home, or have other sources of income and deductions, these documents play a critical role in the tax preparation process. Remember, when in doubt, consult with a tax professional to ensure that everything is filed correctly and on time.

Similar forms

The IRS Form W-2, often referred to as the Wage and Tax Statement, exhibits similarities to the IRS Schedule 1 1040 or 1040-SR form in that both are crucial for accurately reporting annual income to the Internal Revenue Service. While the Schedule 1 form is used by individuals to report additional income and adjustments to income that aren't entered directly on Form 1040 or 1040-SR, the Form W-2 is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. Both forms play integral roles in ensuring individuals' tax returns are complete and accurate.

Form 1099, like Schedule 1, is integral to the tax filing process, serving a somewhat parallel function in reporting various types of income not subject to automatic withholding. Where Schedule 1 allows taxpayers to report additional income such as business profit, alimony, rental income, or adjustments like student loan interest deduction, Form 1099 captures income from freelancer or independent contractor work, interest and dividends, and other miscellaneous sources. Both documents are fundamental in providing the IRS with a detailed account of an individual's income outside of standard wages.

The Schedule C (Form 1040) bears resemblance to the Schedule 1 form, primarily in its use for individual tax filers with self-employment income. While the Schedule 1 form is utilized to report additional income or adjustments, Schedule C is specifically designed for sole proprietors and single-member LLCs to report the profits or losses of their business. Both forms contribute to calculating the taxpayer's gross income, which is essential in determining their taxable income for the year.

The Schedule SE (Form 1040) is similar to Schedule 1 in its relation to self-employment and tax calculations. Schedule SE is used to calculate the self-employment tax owed by individuals who earned income as a freelancer, independent contractor, or sole proprietor. This form works in tandem with information provided on Schedule 1 and Schedule C, as it takes the profit from self-employment reported on Schedule C to compute the tax due. Both Schedule SE and Schedule 1 are indispensable for self-employed individuals in navigating their tax responsibilities.

Form 4868 is akin to the Schedule 1 1040 or 1040-SR form in the aspect of modifying the individuals' tax filing process. While Schedule 1 is used for reporting additional income and adjustments, Form 4868 is an application for an automatic extension of time to file a U.S. individual income tax return. Both forms assist taxpayers in managing their filing obligations, whether by supplementing their tax return with necessary details or granting them additional time to file.

Form 1040-ES, used for estimated tax for individuals, parallels the Schedule 1 form in its function of aiding taxpayers in managing their income tax. Schedule 1 helps individuals report additional income and adjustments, leading to a more accurate calculation of their taxable income. Conversely, Form 1040-ES is utilized to pay income tax that isn’t withheld from salaries or wages, essentially pre-paying tax on income reported through Schedule 1 and other sources. Both forms are pivotal in ensuring taxpayers meet their tax responsibilities throughout the year.

Lastly, the Schedule A (Form 1040) is similar to the Schedule 1 form in its way of enhancing the main income tax return document by offering a method to itemize deductions. Where Schedule 1 adds additional sources of income and adjustments to it, Schedule A allows taxpayers to itemize deductions such as medical and dental expenses, taxes paid, and interest paid, potentially lowering taxable income. Both forms play a crucial role in the comprehensive reporting and calculation of an individual's taxes, ensuring a more accurate reflection of their financial obligations to the IRS.

Dos and Don'ts

Filling out the IRS Schedule 1 for the 1040 or 1040-SR form is an important task that requires attention to detail and a clear understanding of the information being requested. To assist in this process, here are some essential dos and don'ts:

- Do review the instructions for Schedule 1 carefully before you begin to ensure you understand the requirements.

- Do gather all necessary documents related to additional income and adjustments to income before you start filling out the form. This can include records of earnings from a job, investments, and eligible deductions.

- Do double-check your Social Security Number and other personal information to ensure they are accurate. Errors here can lead to delays or issues with your return.

- Do use a calculator or tax software to accurately calculate any figures you report. Precise numbers are crucial for correct tax computation.

- Don’t overlook the smaller details. Even what seems like minor information can be important. This includes correctly reporting types of income or adjustments listed under Part I and Part II of Schedule 1.

- Don’t guess on numbers or leave blanks for items you’re unsure about. If in doubt, seek clarification from a tax professional or the instructions provided by the IRS.

- Don’t assume you don’t need to file Schedule 1. If you have additional income such as capital gains, unemployment compensation, or deductible expenses not listed on the standard form, Schedule 1 is necessary.

- Don’t forget to sign and date your tax return. An unsigned tax return is like an unsigned check – it’s not valid.

By following these guidelines, you can complete Schedule 1 more accurately and efficiently, helping to ensure your tax return is processed without unnecessary delays.

Misconceptions

Understanding the IRS Schedule 1 form for the 1040 or 1040-SR is crucial for accurate tax reporting. There are several misconceptions that can lead to errors or missed opportunities. Here are seven common misconceptions:

- Schedule 1 is only for self-employed individuals. This is incorrect. While it is used by the self-employed to report income and deductions, Schedule 1 is also for taxpayers who have additional income like alimony, rental income, or prize money, as well as adjustments to income.

- All taxpayers must fill out Schedule 1. Actually, not everyone needs to fill it out. Only taxpayers with types of income, adjustments, or deductions listed on Schedule 1 need to complete it.

- Filing Schedule 1 means you owe more taxes. Not necessarily. While it's used to report additional income, Schedule 1 also includes adjustments that can lower your taxable income, such as student loan interest deductions or educator expenses.

- There are no consequences for omitting Schedule 1 if you think you don’t need it. Incorrect. Failing to report income or adjustments on Schedule 1 can lead to audits, penalties, and interest on underpaid taxes. Always include it if you have income or deductions that require it.

- Only traditional employment income is reported on Schedule 1. This is a misconception. Schedule 1 is for reporting types of income outside of wages, salaries, and tips, such as gambling winnings or unemployment compensation.

- Schedule 1 deductions require itemizing. In fact, the adjustments to income on Schedule 1 are available whether you itemize deductions on Schedule A or take the standard deduction. These adjustments are referred to as "above-the-line" deductions and reduce your adjusted gross income.

- Information on Schedule 1 does not affect your refund or amount owed. This is false. The income and adjustments reported on Schedule 1 directly impact your taxable income, which in turn can affect your refund or the amount you owe.

Addressing these misconceptions ensures that taxpayers accurately report their income and take advantage of adjustments to lower their taxable income. Proper understanding and use of Schedule 1 can help avoid mistakes and potentially save money.

Key takeaways

When managing your taxes, the IRS Schedule 1 for the 1040 or 1040-SR form plays a crucial role for many taxpayers. Here are key takeaways to ensure the process is handled efficiently and effectively:

IRS Schedule 1 is used to report certain types of income that aren't entered directly on Form 1040 or 1040-SR. This includes income from rental properties, business operations, alimony received, and unemployment compensation.

It's also the form where deductions or adjustments to income are reported. These adjustments can include, but are not limited to, educator expenses, student loan interest, and contributions to IRAs.

Filling out Schedule 1 accurately is vital for calculating your adjusted gross income (AGI). Your AGI is critical because it impacts your eligibility for various tax deductions and credits.

To complete Schedule 1, you must have detailed information about your additional income and adjustments to income. Gathering all necessary documents before starting can save time and reduce errors.

If you are unsure whether a specific type of income or deduction applies to you, consulting the form's instructions or seeking professional advice can provide clarification.

After completing Schedule 1, the total of your additional income minus your adjustments to income is transferred to your 1040 or 1040-SR form. This step is crucial for determining your taxable income.

Remember, filing your taxes accurately and on time can help avoid penalties and interest charges. Schedule 1, along with Form 1040 or 1040-SR, typically needs to be filed by April 15th, unless an extension is requested and approved.

For those using tax preparation software, entering your information correctly will ensure that the software includes Schedule 1 if necessary. However, reviewing your forms before submission is always a good practice to catch any potential errors.

In summary, IRS Schedule 1 is an essential part of the tax filing process for individuals with additional income types or who qualify for specific deductions. Taking the time to understand and accurately complete this schedule can significantly affect one's financial well-being come tax time.

Popular PDF Documents

Power of Attorney Form Nh - While empowering representatives to handle taxes, the DP-2848 also imposes accountability, as these agents must act within the authority granted by the form.

California Workers Compensation Forms - Establishes a formal injury report, including necessary details for the insurance claim and workers' compensation process.