Get IRS Power of Attorney ( 2848) Form

When someone needs to appoint another person to handle their tax matters with the Internal Revenue Service (IRS), the IRS Power of Attorney (POA) Form 2848 comes into play. This critical document grants an individual or entity, commonly referred to as an agent or attorney-in-fact, the authority to represent and make decisions on behalf of the taxpayer before the IRS. The range of authority can vary widely, from dealing with simple tax filing matters to representing the taxpayer in audits or appeals. Understanding the specifics of the form—such as who can serve as an agent, the extent of authority granted, and the specific tax matters and years or periods the POA covers—is vital. Additionally, properly completing and submitting this form is key to its acceptance by the IRS, including ensuring all required sections are filled out accurately and that the document is signed by the taxpayer. This form not only facilitates smoother interactions with the IRS but also ensures that the taxpayer’s rights and interests are adequately represented. It’s a tool that, when used correctly, can significantly relieve the burden of tax issues by placing them in the hands of qualified individuals or professionals.

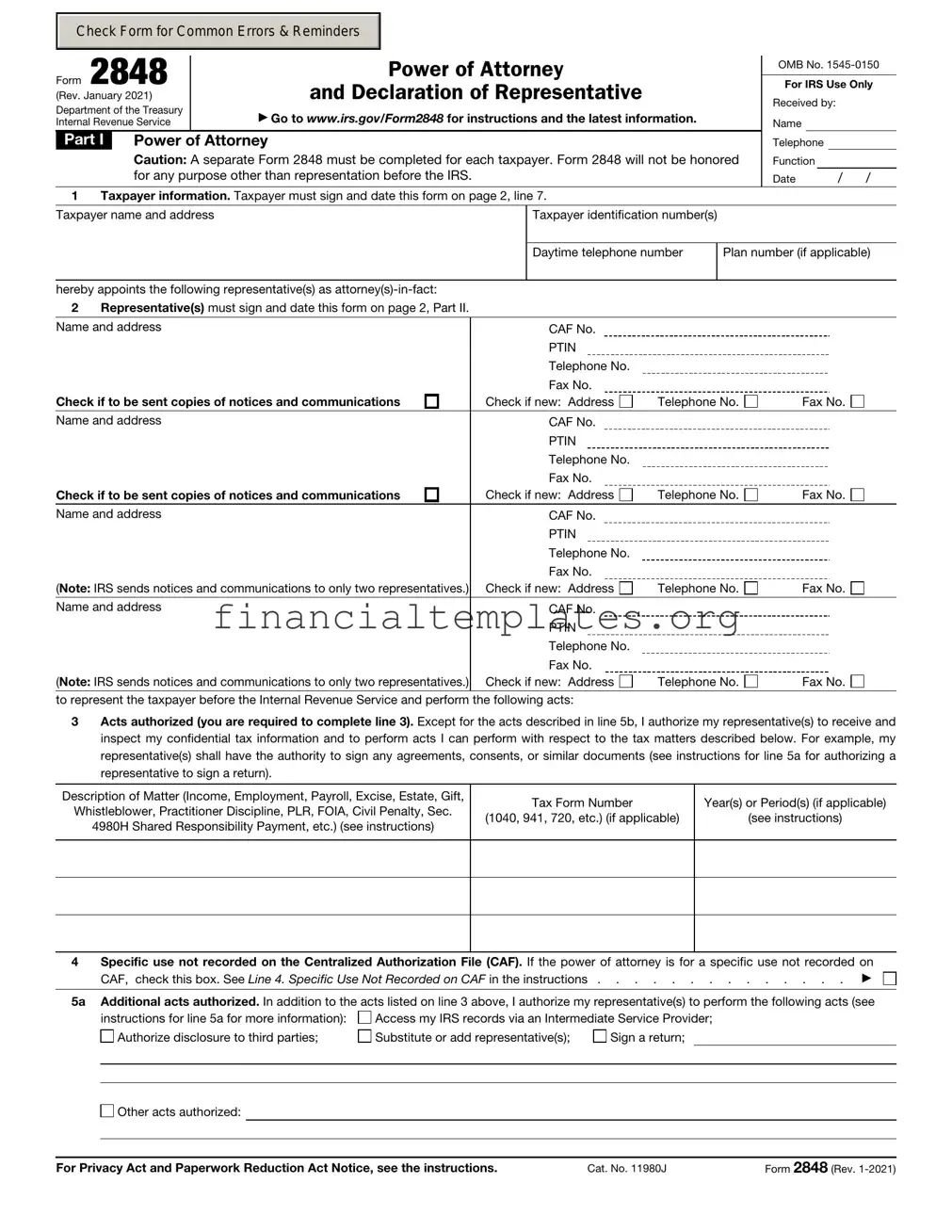

IRS Power of Attorney ( 2848) Example

Check Form for Common Errors & Reminders

Form 2848 |

|

Power of Attorney |

For IRS Use Only |

|||||

|

|

|

|

OMB No. |

||||

(Rev. January 2021) |

and Declaration of Representative |

|

|

|

|

|

||

Received by: |

|

|||||||

Department of the Treasury |

|

|

|

|||||

▶ Go to www.irs.gov/Form2848 for instructions and the latest information. |

|

|

|

|

|

|||

Internal Revenue Service |

Name |

|

|

|||||

|

|

|

||||||

Part I |

Power of Attorney |

Telephone |

|

|

||||

|

Caution: A separate Form 2848 must be completed for each taxpayer. Form 2848 will not be honored |

Function |

|

|

||||

|

for any purpose other than representation before the IRS. |

Date |

/ / |

|||||

1Taxpayer information. Taxpayer must sign and date this form on page 2, line 7.

Taxpayer name and address |

Taxpayer identification number(s) |

Daytime telephone number

Plan number (if applicable)

Name and address |

CAF No. |

|

|

|

PTIN |

|

|

|

Telephone No. |

|

|

|

Fax No. |

|

|

Check if to be sent copies of notices and communications |

Check if new: Address |

Telephone No. |

Fax No. |

Name and address |

CAF No. |

|

|

|

PTIN |

|

|

|

Telephone No. |

|

|

|

Fax No. |

|

|

Check if to be sent copies of notices and communications |

Check if new: Address |

Telephone No. |

Fax No. |

Name and address |

CAF No. |

|

|

|

PTIN |

|

|

|

Telephone No. |

|

|

|

Fax No. |

|

|

(Note: IRS sends notices and communications to only two representatives.) |

Check if new: Address |

Telephone No. |

Fax No. |

Name and address |

CAF No. |

|

|

|

PTIN |

|

|

|

Telephone No. |

|

|

|

Fax No. |

|

|

(Note: IRS sends notices and communications to only two representatives.) |

Check if new: Address |

Telephone No. |

Fax No. |

to represent the taxpayer before the Internal Revenue Service and perform the following acts:

3Acts authorized (you are required to complete line 3). Except for the acts described in line 5b, I authorize my representative(s) to receive and inspect my confidential tax information and to perform acts I can perform with respect to the tax matters described below. For example, my representative(s) shall have the authority to sign any agreements, consents, or similar documents (see instructions for line 5a for authorizing a representative to sign a return).

Description of Matter (Income, Employment, Payroll, Excise, Estate, Gift, |

Tax Form Number |

Year(s) or Period(s) (if applicable) |

|

Whistleblower, Practitioner Discipline, PLR, FOIA, Civil Penalty, Sec. |

|||

(1040, 941, 720, etc.) (if applicable) |

(see instructions) |

||

4980H Shared Responsibility Payment, etc.) (see instructions) |

|||

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Specific use not recorded on the Centralized Authorization File (CAF). If the power of attorney is for a specific use not recorded on |

|||

|

CAF, check this box. See Line 4. Specific Use Not Recorded on CAF in the instructions . |

. . . . . . . . . . . . . ▶ |

||

|

|

|

||

5a |

Additional acts authorized. In addition to the acts listed on line 3 above, I authorize my representative(s) to perform the following acts (see |

|||

|

instructions for line 5a for more information): |

Access my IRS records via an Intermediate Service Provider; |

||

|

Authorize disclosure to third parties; |

Substitute or add representative(s); |

Sign a return; |

|

|

|

|

|

|

|

|

|

|

|

Other acts authorized:

For Privacy Act and Paperwork Reduction Act Notice, see the instructions. |

Cat. No. 11980J |

Form 2848 (Rev. |

Form 2848 (Rev. |

Page 2 |

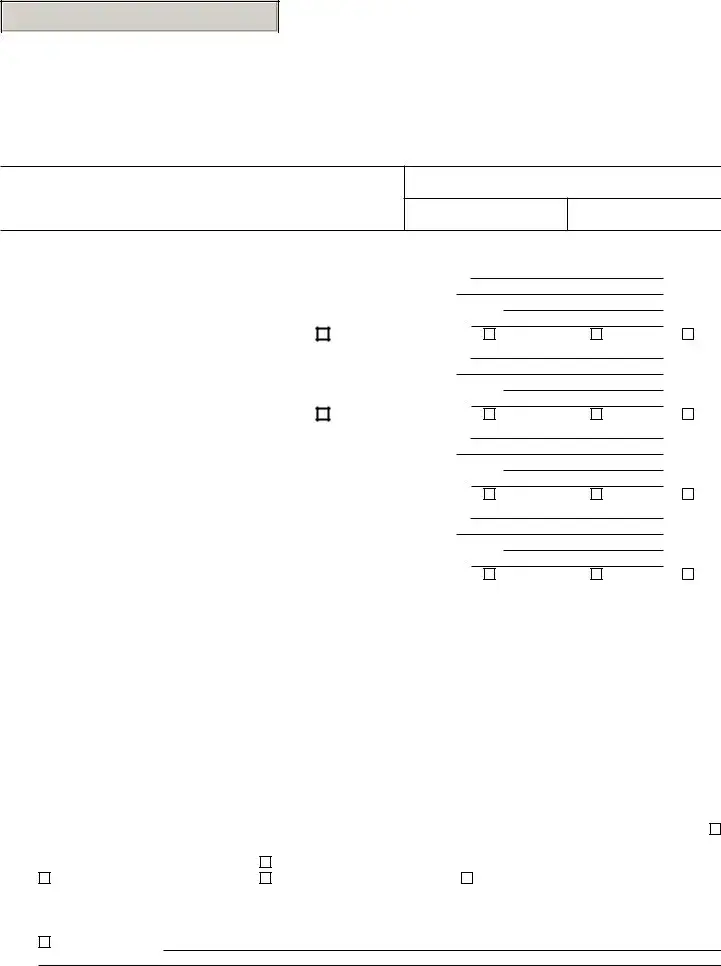

bSpecific acts not authorized. My representative(s) is (are) not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative(s) or any firm or other entity with whom the representative(s) is (are) associated) issued by the government in respect of a federal tax liability.

List any other specific deletions to the acts otherwise authorized in this power of attorney (see instructions for line 5b):

6Retention/revocation of prior power(s) of attorney. The filing of this power of attorney automatically revokes all earlier power(s) of attorney on file with the Internal Revenue Service for the same matters and years or periods covered by this form. If you do not want to

revoke a prior power of attorney, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

YOU MUST ATTACH A COPY OF ANY POWER OF ATTORNEY YOU WANT TO REMAIN IN EFFECT.

7Taxpayer declaration and signature. If a tax matter concerns a year in which a joint return was filed, each spouse must file a separate power of attorney even if they are appointing the same representative(s). If signed by a corporate officer, partner, guardian, tax matters partner, partnership representative (or designated individual, if applicable), executor, receiver, administrator, trustee, or individual other than the taxpayer, I certify I have the legal authority to execute this form on behalf of the taxpayer.

▶ IF NOT COMPLETED, SIGNED, AND DATED, THE IRS WILL RETURN THIS POWER OF ATTORNEY TO THE TAXPAYER.

Signature |

Date |

Title (if applicable) |

Print name |

|

Print name of taxpayer from line 1 if other than individual |

Part II Declaration of Representative

Under penalties of perjury, by my signature below I declare that:

•I am not currently suspended or disbarred from practice, or ineligible for practice, before the Internal Revenue Service;

•I am subject to regulations in Circular 230 (31 CFR, Subtitle A, Part 10), as amended, governing practice before the Internal Revenue Service;

•I am authorized to represent the taxpayer identified in Part I for the matter(s) specified there; and

•I am one of the following:

a

bCertified Public

cEnrolled

d

e

fFamily

gEnrolled

hUnenrolled Return

kQualifying Student or Law

rEnrolled Retirement Plan

▶IF THIS DECLARATION OF REPRESENTATIVE IS NOT COMPLETED, SIGNED, AND DATED, THE IRS WILL RETURN THE POWER OF ATTORNEY. REPRESENTATIVES MUST SIGN IN THE ORDER LISTED IN PART I, LINE 2.

Note: For designations

Designation—

Insert above

letter

Licensing jurisdiction

(State) or other

licensing authority

(if applicable)

Bar, license, certification, registration, or enrollment number (if applicable)

Signature

Date

Form 2848 (Rev.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 2848 | This form grants an individual or an entity the power to represent a taxpayer before the IRS, enabling them to receive and inspect confidential tax information. |

| Who Can Act as an Agent | Qualified individuals such as attorneys, certified public accountants, and certain other professionals who are eligible to practice before the IRS. |

| Areas of Authorization | The form allows specifying the tax matters for which the agent has authority, including the type of tax, tax form number, and the years or periods involved. |

| Difference from Form 8821 | While both forms authorize individuals to access tax information, only Form 2848 allows an agent to represent a taxpayer before the IRS and to perform acts like signing agreements. |

| State-Specific Forms | Some states require their own forms for state tax matters. These are governed by the individual state laws where the taxpayer resides or has a filing obligation. |

Guide to Writing IRS Power of Attorney ( 2848)

Completing the IRS Power of Attorney (Form 2848) is essential for authorizing someone to represent you before the IRS. This form allows your representative to receive and inspect your confidential tax information and to perform acts such as signing agreements on your behalf. It's crucial to fill out this form accurately to ensure that the IRS can process it without delays.

- Start by entering your full name and taxpayer identification number (TIN), which can be your social security number (SSN) or employer identification number (EIN), in the spaces provided at the top of the form.

- Specify your current address, including the city, state, and ZIP code, to ensure the IRS can correspond with you directly regarding your representation.

- List the name and TIN of each taxpayer if you're filing a joint form. This information should align with the records that the IRS has on file.

- Enter the name(s) and address(es) of the representative(s) you're authorizing. Make sure to include their phone number(s) and fax number(s) if available. Each representative must sign the form later, so ensure their information is accurate.

- In the "Representative(s) must complete the following section" area, your representative must provide their CAF number, PTIN, and the state and license number if applicable. This information is vital for the IRS to identify and communicate with your representative efficiently.

- Fill out the "Acts authorized" section, specifying which tax matters you're authorizing your representative to handle. This includes indicating the type of tax (e.g., income, corporate, etc.), the tax form number, and the year(s) or period(s) involved. Being specific here helps limit your representative's authority to only what you choose.

- Optional: Specify any restrictions in the representation rights in the space provided. If there are no restrictions, you can leave this section blank.

- If applicable, check the box in the "Retention/revocation of prior power(s) of attorney" section to indicate whether you are retaining any previous powers of attorney. If you're revoking a previous power of attorney but don't have a copy to submit with this form, provide a statement to that effect.

- The taxpayer must sign and date the form. If the form is being filed for a joint tax matter, both taxpayers must sign and date. Make sure you read the "Declaration of Representative" section before signing to understand the implications fully.

- Finally, the representative(s) named on the form must sign and date the "Declaration of Representative" section, certifying their eligibility to represent you before the IRS.

After completing these steps, review the form to ensure all information is accurate and complete. Mistakes or missing information can delay processing. Once satisfied, submit the form to the IRS as directed in the form's instructions. Timely and accurate submission will facilitate a smoother interaction with the IRS and ensure that your representative can begin acting on your behalf without unnecessary delays.

Understanding IRS Power of Attorney ( 2848)

-

What is the IRS Power of Attorney (Form 2848) and when should it be used?

The IRS Power of Attorney (Form 2848) is a document that grants an individual or organization (referred to as the "agent" or "representative") the authority to represent another individual (the "taxpayer") before the IRS. It should be used whenever a taxpayer needs someone else to handle their tax matters, which may include obtaining confidential tax information, communicating with the IRS, or representing the taxpayer in IRS proceedings. This form is essential for individuals who are unable to manage their tax affairs due to various reasons, such as being overseas, health issues, or lack of expertise.

-

Who can be designated as an agent on Form 2848?

Agents designated on Form 2848 must be eligible individuals or organizations per IRS criteria. Typically, eligible agents include attorneys, certified public accountants (CPAs), enrolled agents, and in some cases, family members who meet specific requirements. It is crucial that the agent chosen has the taxpayer's trust and a thorough understanding of their tax obligations.

-

How does one complete Form 2848?

To complete Form 2848, the taxpayer must provide detailed information about themselves and the appointed agent. This includes names, addresses, and identification numbers (such as Social Security numbers or employer identification numbers). The specific tax matters and periods for which the power of attorney is granted must also be clearly identified. Both the taxpayer and the designated agent must sign and date the form, affirming their agreement to its terms.

- One key section requires specifying the type of tax, the tax form number, and the year(s) or period(s) to which the power of attorney applies.

- Certain parts of the form also allow for specifying any limitations to the agent's authority.

-

Is there a filing fee for Form 2848?

No, there is no filing fee required to submit Form 2848 to the IRS. This means that once the form is properly completed and signed, it can be sent to the IRS without any payment.

-

How should Form 2848 be submitted?

Form 2848 can be submitted to the IRS through mail or fax, depending on the taxpayer’s preference or urgency. The IRS provides different addresses and fax numbers based on the taxpayer's location and the type of tax matter. It is crucial to use the most current submission information to avoid any processing delays.

-

How long does it take for Form 2848 to be processed by the IRS?

The processing time for Form 2848 can vary but generally, taxpayers should expect it to take around 4 to 6 weeks. During busier times, such as tax season, the processing time may be longer. Taxpayers are encouraged to submit the form well in advance of when they need the representation.

-

Can the powers granted in Form 2848 be revoked?

Yes, the powers granted in Form 2848 can be revoked by the taxpayer at any time. To revoke the authority, the taxpayer must provide written notice to the IRS. This notice must include the taxpayer's name, identification number, and a statement declaring the revocation of the power(s) initially granted. It is also recommended to notify the agent of the revocation in writing.

-

What happens if the taxpayer and the agent disagree on a tax matter?

If a disagreement occurs between the taxpayer and the agent concerning a tax matter, it is important for both parties to try to resolve the issue through communication and negotiation. If a resolution cannot be reached, the taxpayer has the right to revoke the agent's authority using the process mentioned above, and if necessary, appoint a new representative.

Common mistakes

Filling out the IRS Power of Attorney (Form 2848) is crucial for individuals who need someone else to deal with the IRS on their behalf. However, errors in completing this form can lead to delays and potential complications. Here are ten common mistakes to avoid:

-

Not providing complete information for the taxpayer: It's important to include all necessary identification details, such as full name, address, Social Security Number (SSN), or Employer Identification Number (EIN). Partial or incorrect information may result in the IRS being unable to process the form.

-

Failing to designate a specific tax form: The power of attorney must clearly state which tax forms it covers. A general authorization without specifying the forms is not sufficient for IRS purposes.

-

Overlooking to specify the tax periods: You must clearly list the tax years or periods the authorization covers. Leaving this section blank or being too vague may render the document invalid for IRS use.

-

Not accurately identifying the representative: The name, address, and phone number of the appointed representative must be correctly filled in, along with their Centralized Authorization File (CAF) number if they have one. Incorrect information can lead to processing delays.

-

Missing signatures: Both the taxpayer and the representative must sign the form. An unsigned form will not be honored by the IRS.

-

Using outdated forms: The IRS updates its forms periodically. Submitting an outdated version of Form 2848 can result in its rejection. Always check for the most recent version before submission.

-

Not specifying the powers granted: The form allows you to list specific acts your representative can perform on your behalf. Not stating these clearly can restrict your representative’s ability to act effectively.

-

Forgetting to revoke previous authorizations: If you're updating or changing your representative, ensure you indicate any previous authorizations you wish to revoke. Failure to do so could lead to confusion or conflicting instructions.

-

Lack of clarity in special instructions: If you have special conditions or limitations for the representation, these need to be clearly articulated. Vague instructions can lead to misunderstandings and issues in the representation.

-

Omission of foreign representatives’ information: If your representative is located in a foreign country, additional information such as the country code, foreign tax ID number, and other relevant details must be provided. Leaving this out can hinder the IRS's ability to communicate with them.

Avoiding these mistakes when filling out Form 2848 will help ensure that your representation arrangements are clear, valid, and processed in a timely manner. When in doubt, consulting with a tax professional is advisable to navigate the complexities of IRS documentation and ensure that all requirements are met accurately.

Documents used along the form

When handling IRS matters, particularly those involving representation or delegated financial decisions, it's essential not only to have an IRS Power of Attorney (POA) Form 2848 but also to be aware of other documents that often accompany it. These documents are vital in ensuring that all bases are covered and that the designated representative can act effectively on someone's behalf. Below, we provide an overview of some of these key documents, each playing a unique role in the tax management and representation process.

- Form 8821, Tax Information Authorization: This form allows a designated party, not necessarily an attorney or tax professional, to inspect and receive confidential tax information but not to represent the taxpayer. It's often used in conjunction with Form 2848 for broader access to a taxpayer's records.

- Form 4506-T, Request for Transcript of Tax Return: When representatives need to obtain a taxpayer's past tax return information, this form facilitates the request. It's crucial for tax preparation and resolving any discrepancies.

- Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals: This is essential for setting up payment plans or offers in compromise with the IRS, providing detailed financial information needed to negotiate such arrangements.

- Form 433-B, Collection Information Statement for Businesses: Similar to the 433-A, but designed for businesses. It helps companies negotiate payment terms with the IRS by outlining the business's financial situation.

- Form 9465, Installment Agreement Request: For taxpayers unable to pay their tax debt in full, this form requests a payment plan from the IRS. It can be used on its own or after submitting a 433-A or B as part of a comprehensive resolution request.

- Form 656, Offer in Compromise: This form is used when the taxpayer proposes to settle their tax debt for less than the full amount owed. It's a critical tool for financial relief but requires thorough documentation and often, the financial information provided in Form 433-A or B.

Understanding how each of these documents works in tandem with the IRS Power of Attorney (Form 2848) can significantly simplify the tax resolution process. Whether it's obtaining detailed tax history, negotiating payment plans, or authorizing someone to act on your behalf, each form plays a crucial role. By familiarizing oneself with these forms, taxpayers and their representatives can navigate the complexities of IRS interactions more effectively.

Similar forms

The IRS Power of Attorney (Form 2848) shares similarities with the Healthcare Power of Attorney. They both legally authorize someone else to act on your behalf, but while Form 2848 appoints someone to manage tax matters, the Healthcare Power of Attorney allows an appointed person to make medical decisions for you if you are incapacitated. This ensures your healthcare choices are respected when you cannot voice them yourself.

Likewise, the General Power of Attorney bears resemblance to Form 2848, as it grants broad powers to an agent to act on your behalf in a variety of situations, not limited to but including financial and legal matters. However, unlike the specific focus on tax issues with Form 2848, a General Power of Attorney covers a wider range of activities, effectively giving the agent the ability to make almost any legal decision in your stead.

The Durable Power of Attorney is another similar document, maintaining its validity even if you become mentally incapacitated. This is a critical feature that differs from standard powers of attorney, which may become null if the principal loses mental capacity. Like Form 2848, it delegates authority to another person, yet its applicability can extend beyond tax matters to encompass all-encompassing legal and financial decisions.

A Financial Power of Attorney closely relates to the IRS Power of Attorney (Form 2848) in that it specifically authorizes someone else to handle your financial affairs. While Form 2848 is tailored towards tax issues, a Financial Power of Attorney encompasses a broader range of financial actions, such as managing bank accounts, paying bills, and investing money on your behalf.

The Springing Power of Attorney is designed to become effective only under certain circumstances, typically when you become incapacitated. This feature makes it unique from Form 2848, which is effective immediately upon execution unless otherwise specified. The Springing Power of Attorney offers a level of control over when the document takes effect, providing peace of mind for those worried about prematurely relinquishing their autonomy.

The Limited Power of Attorney, or Special Power of Attorney, is much like Form 2848 in that it grants authority to another person but is restricted to specific matters. Unlike the broad authority conveyed in Form 2848 for dealing with the IRS and tax matters, a Limited Power of Attorney might authorize someone to sell a particular piece of property or to manage a specific legal claim, demonstrating its flexibility for singular tasks.

The Taxpayer Authorization (Form 8821) is quite similar to Form 2848, as it involves tax matters, allowing individuals to authorize someone else to receive and inspect their confidential tax information. However, unlike Form 2848, which allows for the representation before the IRS, Form 8821 does not permit the appointee to act on the taxpayer's behalf in terms of decisions or negotiations.

Lastly, the Advanced Directive or Living Will is somewhat akin to the IRS Power of Attorney. It enables an individual to outline their wishes regarding medical treatment in advance, should they become unable to communicate their decisions due to illness or incapacity. While focusing on healthcare decisions rather than tax representation, like Form 2848, it ensures an individual's preferences are known and respected in critical moments.

Dos and Don'ts

When engaging with the Internal Revenue Service (IRS) on matters requiring representation, the Form 2848, Power of Attorney and Declaration of Representative, plays a pivotal role. Here are several key dos and don'ts to keep in mind to ensure the process is smooth and effective:

- Do ensure you provide complete information regarding your identity. This includes your full name, Social Security Number (or Employer Identification Number, if applicable), and your current address. Accurate details are crucial for effective processing.

- Do clearly specify the tax forms, years, or periods you want the authorization to cover. Being precise helps prevent any misunderstandings or delays down the line.

- Do select a qualified representative. This person should be authorized to practice before the IRS and could include attorneys, certified public accountants, or enrolled agents. Their expertise is invaluable.

- Do make sure the representative’s information is filled out completely on the form. This includes their name, address, telephone number, and their Preparer Tax Identification Number (PTIN) or other relevant ID numbers.

- Don't forget to have all necessary parties sign the form. This includes the taxpayer(s) and the designated representative(s). An omission can invalidate the entire document.

- Don't leave sections blank that require your input. If a section does not apply, it’s better to mark it as “N/A” than to leave it empty, to avoid any assumptions of oversight or incomplete filling.

- Don't specify a blanket authorization without clear start and end dates. Incidents of abuse have been flagged in the past where "indefinite" timelines were given. The IRS prefers—and sometimes requires—specific timeframes.

- Don't hesitate to revoke a previous Power of Attorney if the situation changes. This can be done by filing a new Form 2848 or by notifying the IRS in writing. Keeping the IRS updated on your representation is critical for your financial security and peace of mind.

Handling the Form 2848 with attention and care not only ensures that your tax matters are in capable hands but also protects your rights and interests during IRS proceedings. Remember, professional advice can be critical in navigating these waters, so consider consulting a tax professional if you have any doubts or concerns.

Misconceptions

There are several misconceptions about the IRS Power of Attorney (POA) Form 2848 that can confuse taxpayers and their representatives. Understanding the truths behind these misconceptions can help ensure clarity and proper use of the form.

Filing Form 2848 grants unlimited rights to the representative. This is incorrect. The authority granted by Form 2848 is limited to the tax matters and years or periods specified on the form. Representatives cannot act beyond the scope defined by the taxpayer.

Only attorneys can be granted power of attorney. Many people believe that Form 2848 is exclusive to attorneys. In fact, certified public accountants (CPAs), enrolled agents (EAs), and other individuals authorized by the IRS can be granted power of attorney, provided they are eligible under IRS regulations.

Completing Form 2848 automatically resolves tax issues. Submitting Form 2848 does not resolve tax issues. It merely authorizes a representative to receive confidential tax information and to act on the taxpayer’s behalf in matters with the IRS. Resolving tax issues requires additional actions beyond the submission of Form 2848.

Form 2848 needs to be filed for each tax issue separately. This is a misconception. One Form 2848 can cover multiple tax issues and tax periods, as long as these are clearly specified on the form. However, separate Forms 2848 may be needed if different representatives are appointed for different issues or periods.

Electronic signatures are not allowed on Form 2848. The IRS now accepts electronic signatures on Form 2848 under certain conditions, adapting to modern workflow needs. This update facilitates quicker processing and convenience for taxpayers and their representatives.

There are no privacy concerns with Form 2848. Privacy concerns are important to consider when submitting Form 2848. This form contains sensitive information, including the taxpayer’s social security number and detailed tax information. Taxpayers and representatives should ensure the secure submission and handling of this document to protect personal information.

Key takeaways

The IRS Power of Attorney (POA) Form 2848 is a crucial document that enables individuals to appoint a representative to act on their behalf in dealing with the Internal Revenue Service. Understanding the key aspects of this form can help ensure that it is filled out and used effectively. Here are nine key takeaways:

- Specificity is crucial. When completing Form 2848, it's important to be as specific as possible regarding the tax matters and years or periods for which you're granting authority. This helps prevent any confusion about the representative's powers.

- Choosing a representative. The individual you designate as your representative should be eligible to practice before the IRS. They can include attorneys, certified public accountants, enrolled agents, and other individuals specified in the IRS instructions.

- Multiple representatives. You have the option to appoint more than one representative on a single Form 2848. However, you must specify whether each representative can act independently or if all must act together.

- Extent of authority. Be clear about the extent of authority you're granting. You can allow your representative broad actions or limit them to specific issues, such as communicating with the IRS on your behalf or negotiating a payment plan.

- Retention of copies. It's essential to keep a copy of the completed Form 2848 for your records. Additionally, your representative should also retain a copy.

- Revocation process. If you wish to revoke a previously granted power of attorney, you must do so in writing. Submitting a new Form 2848 does not automatically revoke earlier forms.

- Effective period. Understand that Form 2848 remains in effect until the expiration date you specify, or it can be revoked earlier. If no expiration date is provided, it will remain in effect until revoked.

- Filing with the IRS. Once completed, Form 2848 must be mailed or faxed to the IRS. The correct address or fax number to use depends on your state, which you can find in the form's instructions.

- IRS confirmation. After processing, the IRS will send a confirmation notice to both you and your representative. This notice indicates the form has been accepted and is in effect.

Proper completion and understanding of the IRS Power of Attorney Form 2848 are essential for effectively managing your tax-related matters through a designated representative. Always ensure that any individual you appoint is trustworthy and sufficiently experienced in tax law to competently represent your interests to the IRS.

Popular PDF Documents

1099s 2023 - Understanding how to accurately complete and file a 1099-S can save taxpayers from potential legal and financial penalties.

3rd Party Designee - It is a legal document that delegates tax handling responsibilities to another individual.