Get IRS Notice 703 Form

Every year, many Americans find themselves navigating the intricacies of their tax obligations, trying to ensure they meet legal requirements while maximizing potential returns. Among the myriad of forms and notices the Internal Revenue Service (IRS) sends out, IRS Notice 703 holds a special place. This notice is a crucial piece of communication for individuals who receive it, primarily because it pertains to the calculation of one's income tax return, specifically when it comes to pension or annuity payments. Its main purpose is to guide recipients through the process of figuring out if part of these payments is taxable and, consequently, how to report this information correctly on their tax return. The form comes with detailed instructions, encompassing various scenarios and conditions that might affect the taxable amount. Understanding the nuances of IRS Notice 703 can certainly feel daunting at first glance, but it's an essential step for those looking to accurately fulfill their tax responsibilities, especially for retirees or individuals who have started drawing from their retirement funds. By breaking down and closely following the guidance provided in the notice, taxpayers can navigate these waters more confidently, ensuring they remain in good standing with the IRS while potentially optimizing their tax liability.

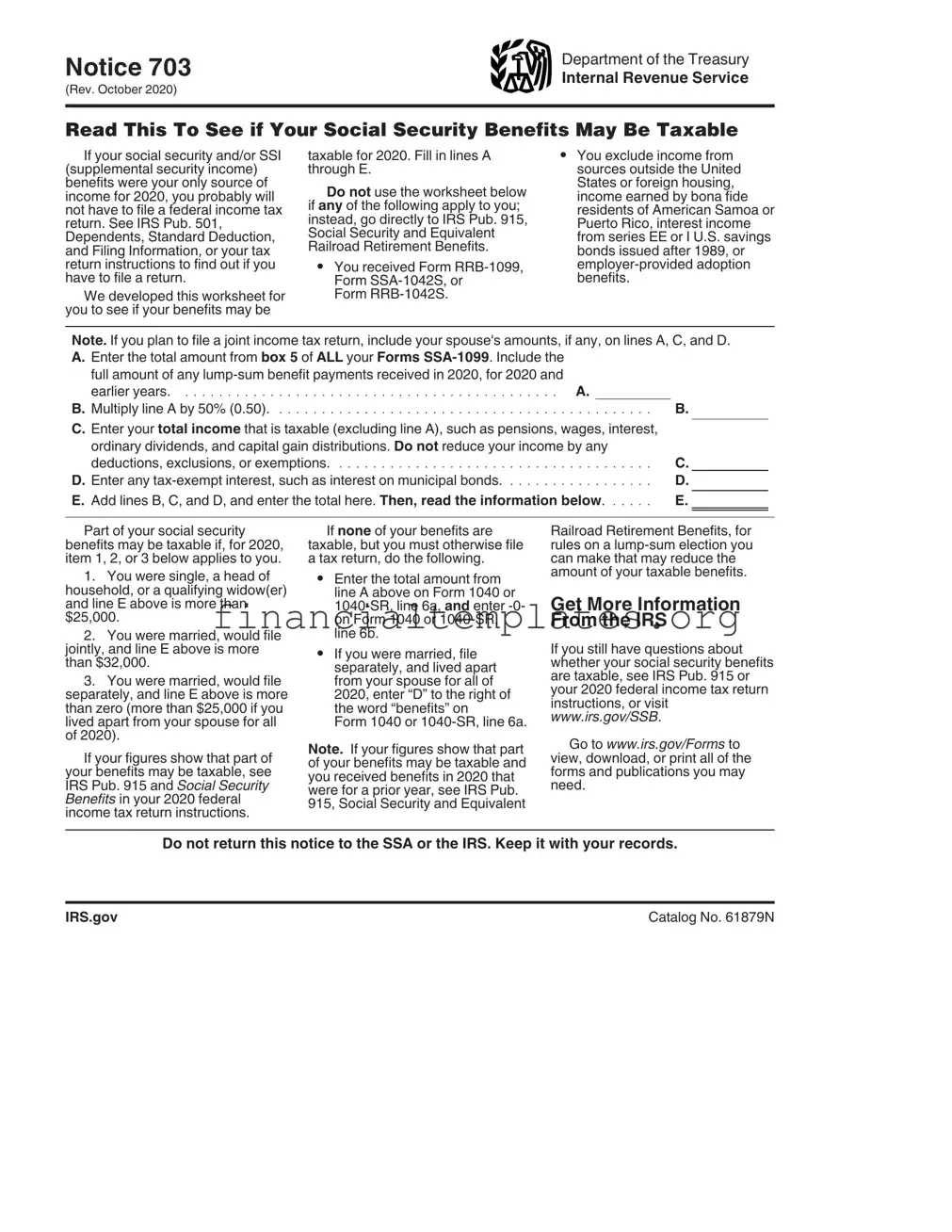

IRS Notice 703 Example

Notice 703 |

Department of the Treasury |

Internal Revenue Service |

|

(Rev. October 2021) |

|

Read This To See if Your Social Security Benefits May Be Taxable

If your social security and/or SSI (supplemental security income) benefits were your only source of income for 2021, you probably will not have to file a federal income tax return. See IRS Pub. 501, Dependents, Standard Deduction, and Filing Information, or your tax return instructions to find out if you have to file a return.

We developed this worksheet for you to see if your benefits may be

taxable for 2021. Fill in lines A through E.

Do not use the worksheet below if any of the following apply to you; instead, go directly to IRS Pub. 915, Social Security and Equivalent Railroad Retirement Benefits.

•You received Form

Form

•You exclude income from sources outside the United States or foreign housing, income earned by bona fide residents of American Samoa or Puerto Rico, interest income from series EE or I U.S. savings bonds issued after 1989, or

Note. If you plan to file a joint income tax return, include your spouse's amounts, if any, on lines A, C, and D. A. Enter the total amount from box 5 of ALL your 2021 Forms

Include the full amount of any

for 2021 and earlier years |

A. |

|

|

B. Multiply line A by 50% (0.50) |

. . . . . . . . . . |

B. |

|

C.Enter your total income that is taxable (excluding line A), such as pensions, wages, interest,

ordinary dividends, and capital gain distributions. Do not reduce your income by any

deductions, exclusions, or exemptions |

C. |

D. Enter any |

D. |

E. Add lines B, C, and D, and enter the total here. Then, read the information below |

E. |

Part of your social security benefits may be taxable if, for 2021, item 1, 2, or 3 below applies to you.

1.You were single, a head of household, or a qualifying widow(er) and line E above is more than $25,000.

2.You were married, would file jointly, and line E above is more than $32,000.

3.You were married, would file separately, and line E above is more than zero (more than $25,000 if you lived apart from your spouse for all of 2021).

If your figures show that part of your benefits may be taxable, see IRS Pub. 915 and Social Security Benefits in your 2021 federal income tax return instructions.

If none of your benefits are taxable, but you must otherwise file a tax return, do the following.

•Enter the total amount from line A above on Form 1040 or

•If you were married, file separately, and lived apart from your spouse for all of 2021, enter “D” to the right of the word “benefits” on

Form 1040 or

Note. If your figures show that part of your benefits may be taxable and you received benefits in 2021 that were for a prior year, see IRS Pub. 915, Social Security and Equivalent

Railroad Retirement Benefits, for rules on a

Get More Information From the IRS

If you still have questions about whether your social security benefits are taxable, see IRS Pub. 915 or your 2021 federal income tax return instructions, or visit www.irs.gov/SSB.

Go to www.irs.gov/Forms to view, download, or print all of the forms and publications you may need.

Do not return this notice to the SSA or the IRS. Keep it with your records.

IRS.gov |

Catalog No. 61879N |

Document Specifics

| Fact Name | Fact Detail |

|---|---|

| Form Purpose | The IRS Notice 703 is used to calculate the taxable amount of a pension or annuity. |

| Who Uses It | This form is typically used by individuals who have received a pension or annuity. |

| Where to Find | The form is available on the Internal Revenue Service (IRS) official website. |

| Relevant Laws | The calculation and reporting requirements are governed by federal tax laws and regulations. |

Guide to Writing IRS Notice 703

Filling out the IRS Notice 703 form is an important step in ensuring that your tax information is accurate and up-to-date. This form is used to help individuals understand how much of their social security benefits may be taxable. Completing this form accurately can impact your tax responsibilities and potential refunds. Following these steps carefully will guide you through the process smoothly, ensuring all necessary information is correctly reported.

- Begin by gathering all necessary documents related to your income, including your Social Security benefits statement and any other sources of income you have received throughout the year.

- On the form, enter your name and Social Security number at the top where indicated. This helps the IRS identify your tax records correctly.

- Calculate the total amount of your benefits. This includes any monthly Social Security benefits you have received. Enter this amount in the space provided on the form.

- Add up all other income, including wages, interest, dividends, and any other taxable income you have received during the year. Record this total in the designated area on the form.

- Follow the instructions on the form to subtract any deductions or exclusions you are entitled to claim. This could include contributions to retirement accounts or other deductible expenses.

- Using the instructions provided, determine the taxable portion of your Social Security benefits. The form includes a calculation guide to assist you with this step.

- Review all the information you have entered for accuracy. Ensuring that all amounts are correct and all necessary information is included is crucial for the correct processing of the form.

- Once you have verified all information is accurate, sign and date the form at the bottom. This verifies that all information provided is true to the best of your knowledge.

- Lastly, follow the instructions for submitting the form to the IRS. This may involve mailing it to a specific address or submitting it electronically, depending on your preference and the options available.

After submitting the IRS Notice 703 form, the next steps involve waiting for any communication from the IRS regarding your form. They may contact you if additional information is needed or to inform you of any changes to your tax liabilities based on the information provided. Ensure that all contact information provided on the form is current and accurate, facilitating timely correspondence. Remaining attentive to any IRS communication is important for resolving potential issues and clarifying any queries they might have.

Understanding IRS Notice 703

What is IRS Notice 703?

IRS Notice 703 is a form provided by the Internal Revenue Service (IRS) to individuals who receive pension or annuity payments. This notice is particularly utilized to help individuals determine the taxable amount of their pension or annuity for federal income tax purposes. Generally, it guides retirees or beneficiaries through a worksheet to calculate the portion of their pension that is subject to taxes, ensuring accurate reporting and compliance.

Who needs to fill out IRS Notice 703?

Typically, any individual who receives pension or annuity payments and needs assistance in figuring out the taxable portion of these payments for their federal tax return would benefit from completing IRS Notice 703. This includes retirees, beneficiaries of deceased employees, and individuals who have received a lump-sum distribution from a pension, profit-sharing, or stock bonus plan.

How can I get a copy of IRS Notice 703?

Copies of IRS Notice 703 can be obtained directly from the IRS website. One can download a PDF version suitable for printing. Additionally, individuals can request a physical copy by contacting the IRS directly or visiting a local IRS office. Tax professionals and preparer offices might also provide assistance and supply the form.

Is IRS Notice 703 required to be filed with my tax return?

IRS Notice 703 itself is not filed with your tax return. It serves as a calculation worksheet to assist you in determining the taxable amount of your pension or annuity. The figures calculated with the help of Notice 703 will be reported on your federal income tax return, but the form itself stays with your tax records and is not submitted to the IRS.

What information will I need to complete IRS Notice 703?

To accurately complete IRS Notice 703, individuals will need their pension or annuity payment information, including the total amount of the payments received during the tax year. Additionally, if you have previously recovered investment in the contract (as defined by the IRS), those amounts will also be necessary to determine the taxable portion of your current year’s income. Your year-end statements from the payer of your pension or annuity can typically provide this information.

How does the IRS Notice 703 affect my tax filing?

The completion of IRS Notice 703 directly influences the accuracy of your federal tax return by determining the taxable portion of pension or annuity payments. This calculation ensures that individuals only pay taxes on the correct portion of their pension or annuity, potentially impacting the overall amount of taxes owed or the size of a refund due.

Can IRS Notice 703 be used for state tax purposes?

While the primary purpose of IRS Notice 703 is to calculate the federal taxable amount, some states may also reference federal taxable income as a starting point for state tax returns. However, because state tax laws and regulations can differ significantly from federal rules, individuals should consult with a tax professional or the taxing authority in their state to determine if and how IRS Notice 703 calculations might affect their state tax obligations.

What should I do if I have questions about completing IRS Notice 703?

If you have questions or need assistance with IRS Notice 703, there are several resources available. The IRS offers guidance and assistance through its website, including instructions for many of its forms. Tax professionals, such as certified public accountants (CPAs) and tax attorneys, can also provide personalized advice and help with tax-related questions. Additionally, IRS Taxpayer Assistance Centers are located across the country to offer in-person support to taxpayers.

Common mistakes

Tackling the IRS Notice 703 form can be daunting for many. It's a critical piece in sorting out whether you need to file a federal income tax return or not. Unfortunately, small mistakes can lead to big headaches, and it's easy to trip up if you're not careful. Let's explore some common errors people make when filling out this form.

Not verifying personal information: It sounds simple, but incorrect names, Social Security numbers, or addresses can cause significant delays in processing.

Omitting income sources: Forgetting to include all sources of income, such as dividends or interest, can result in inaccuracies that might flag your submission.

Misunderstanding tax-exempt income: Sometimes, people wrongly classify income as tax-exempt. Ensuring you understand which types of income are truly exempt is crucial.

Missing deductions or credits: Overlooking potential deductions or tax credits means you could end up paying more tax than necessary.

Incorrectly calculating taxable income: A mistake in your arithmetic or misunderstanding what constitutes taxable income can lead to errors in your tax liability estimation.

Failure to consider dependents: How you account for dependents can significantly impact your tax situation. Ensure you’re accurate in who you claim.

Ignoring state and local taxes: State and local taxes can affect your federal tax return. Failing to account for them might result in inaccuracies.

Not seeking updated information: Tax laws change. Not using the most current form or adhering to the latest tax codes could mean missing out on new rules beneficial to you.

Attempting to file without necessary documents: Filing your tax return without all the required documentation, such as W-2s or 1099s, can lead to errors or even suspicion of fraud.

Many of these mistakes stem from a lack of understanding or attention to detail. Taking your time, double-checking your work, and seeking help when necessary can go a long way in ensuring your IRS Notice 703 form is filled out correctly. Remember, this form is a tool to help you, so being precise and careful benefits everyone involved.

Documents used along the form

When dealing with the IRS Notice 703, individuals are often navigating the process of understanding their income tax situation, specifically related to pensions, annuities, and retirement benefits. This process can be complex and requires additional forms and documents to ensure accurate and complete communication with the Internal Revenue Service (IRS). As such, several other forms and documents are commonly used alongside IRS Notice 703 to facilitate this process. Here's a look at some of these essential forms and documents.

- Form 1040: The U.S. Individual Income Tax Return is the starting point for most taxpayers. It is used to calculate income tax liability and report income, deductions, and credits to the IRS.

- Form 1099-R: This document reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc. It is crucial for accurately reporting retirement income.

- Schedule A (Form 1040): Itemized Deductions are reported on this schedule. Taxpayers use it to list and calculate deductions for medical expenses, taxes paid, interest paid, gifts to charity, and other eligible expenses.

- Form 4852: A Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, this form is used when the taxpayer does not receive the forms from the employer or payer, or when the information is incorrect.

- Form 8606: Nondeductible IRAs form is crucial for individuals making nondeductible contributions to their IRA. It helps track the basis in their IRA to calculate the taxable portion of any distribution correctly.

- Form 1040-ES: Estimated Tax for Individuals form is used by taxpayers to pay estimated taxes on income not subject to withholding, including self-employment income, interest, dividends, rents, and alimony.

- Form 5500: Annual Return/Report of Employee Benefit Plan needs to be filed for retirement plans to report their condition, investments, operations, and other essential details to the IRS and the Department of Labor.

- Form W-4P: Withholding Certificate for Pension or Annuity Payments, this document is for individuals receiving pensions, annuities, and other deferred compensation plans to determine the correct amount of federal income tax to be withheld from their payments.

Understanding and properly completing these forms and documents can significantly impact an individual's tax responsibilities and financial planning strategies. It's always recommended to seek professional advice if there are any uncertainties or complications in dealing with these documents. The accurate and strategic handling of these documents alongside IRS Notice 703 can assist in ensuring compliance and optimizing financial outcomes related to retirement benefits.

Similar forms

The IRS Form 1040, often referred to as the U.S. Individual Income Tax Return, bears similarities to the IRS Notice 703. Both forms are integral to understanding and fulfilling one's tax obligations, albeit serving different functions. While the Notice 703 is typically used to help a person understand how much of their Social Security benefits may be taxable, the Form 1040 is where this information, along with other income sources, is reported yearly. Essentially, findings from Notice 703 can affect the income reported on Form 1040, making these documents interconnected in the process of determining tax responsibility.

Form SSA-1099 is another document that shares a connection with the IRS Notice 703. This form is issued by the Social Security Administration and details the total amount of social security benefits received during the year. For individuals who receive social security benefits, the SSA-1099 is crucial for accurately filling out the IRS Notice 703, as it provides the raw data needed to calculate the portion of benefits that may be subject to taxation. Both documents play pivotal roles in managing taxes related to social security income.

IRS Schedule B (Form 1040), or Interest and Ordinary Dividends, also shares similarities with IRS Notice 703. Schedule B is designed for reporting interest and ordinary dividends, which can contribute to an individual's overall income, thus potentially affecting the taxability of social security benefits. Specifically, high amounts of interest and dividends can make more of one's social security benefits taxable, per the calculations carried out with Notice 703. In essence, both documents are instrumental in showcasing how various types of income can impact one's tax liabilities.

The IRS Form 8857, Request for Innocent Spouse Relief, while distinct in its purpose, has a tangential similarity to the IRS Notice 703. Form 8857 is used when one spouse seeks relief from joint tax liabilities. This document underscores the complexity of tax obligations and how circumstances such as marital status can influence them. In situations where social security benefits are jointly reported, the outcomes of Notice 703 could be impacted, indirectly relating the two forms in cases of marital tax issues.

Lastly, IRS Form W-4V, Voluntary Withholding Request, has a practical connection to the IRS Notice 703. Individuals receiving social security benefits may decide to have federal taxes withheld from their payments by submitting Form W-4V. This pre-emptive measure relates closely to the insights gained from Notice 703 regarding how much of one's social security benefits may be taxable. Effectively, individuals can use Notice 703 to gauge their potential tax liability on benefits and adjust their withholding accordingly via Form W-4V, thereby linking the operational purposes of these two forms in tax planning and management.

Dos and Don'ts

Filling out IRS Notice 703 requires attention to detail and a clear understanding of what is expected to accurately determine your pension or annuity's taxable amount. Below are essential do's and don'ts to guide you through the process effectively.

Do:

Read the instructions thoroughly before you begin. IRS forms often come with detailed instructions that are crucial for accurate completion.

Gather all necessary documents, including your 1099-R forms and any relevant pension or annuity statements, before starting. This ensures that the information you provide is accurate.

Use a calculator to ensure all numerical entries are correct. Precision is key when dealing with financial forms.

Consult with a tax professional if you have questions or uncertainties. Tax laws can be complex, and professional guidance can be invaluable.

Double-check your Social Security number and contact information for accuracy. Mistakes here can lead to processing delays or misfiled forms.

Sign and date the form if required. An unsigned form may be considered invalid and can lead to unnecessary delays.

Don't:

Rush through filling out the form. Taking your time can prevent errors that might complicate your tax situation.

Estimate numbers. Use exact figures from your financial documents to ensure the calculations are accurate.

Ignore the specific line instructions that apply to certain situations. These can significantly impact how you should complete the form.

Forget to update your personal information if it has changed. Accurate information is crucial for the IRS to process your form correctly.

Omit any relevant income. All pension and annuity income should be reported to avoid potential penalties.

Use pencil or erasable ink. Forms should be filled out in pen to ensure that they are permanent and unalterable once submitted.

Misconceptions

Understanding IRS Notice 703 is crucial for handling your tax documents correctly. However, there are several misconceptions about it. Here are nine common myths:

It's a bill: Many believe that receiving IRS Notice 703 means they owe money. This document actually helps you determine if you need to report any amount from your Social Security benefits on your tax return. It's not a bill.

Everyone receives it: Not everyone will receive IRS Notice 703. It's sent to individuals who might need to consider their Social Security benefits in their income tax filings.

It requires immediate action: While it's important to review any documents from the IRS, IRS Notice 703 does not usually require immediate action. It's informative, designed to help you with your tax filing.

It's only for the elderly: There's a misconception that only retirees receive this notice. However, anyone who receives Social Security benefits, regardless of age, might receive Notice 703 if their situation warrants it.

It means your benefits are taxable: Receiving the notice does not automatically mean your benefits are taxable. It guides you on how to determine if any of your Social Security benefits are taxable.

It's complicated: While tax forms can be complex, IRS Notice 703 is designed to be straightforward. It provides clear instructions on how to proceed with your tax filings in relation to your Social Security benefits.

Only applies to federal taxes: While IRS Notice 703 relates specifically to federal income taxes, your Social Security benefits might also affect your state tax filings. It's important to check your state's tax rules as well.

It can be ignored: Ignoring IRS Notice 703 could lead to mistakes in your tax return. While it may not require immediate action, you should review it to determine if your Social Security benefits are taxable.

It covers all tax questions regarding Social Security: IRS Notice 703 is focused on helping you figure out if you need to report Social Security benefits as income. It doesn't cover all possible tax situations related to Social Security benefits. For more complex issues, consulting a tax professional is advisable.

Clearing up these misconceptions can make tax season less stressful and help ensure you're handling your taxes correctly regarding Social Security benefits.

Key takeaways

Filing and utilizing the IRS Notice 703 form is an important task for individuals who receive it. This form is critical in determining your right to a potential tax deduction related to your Social Security benefits. Below are key takeaways to ensure that the process is handled correctly and effectively:

Determine Eligibility: Notice 703 is sent to individuals who may be eligible for a tax deduction on their Social Security benefits. Carefully reviewing this document is the first step to understanding if you qualify.

Read Instructions Thoroughly: Before filling out the form, it is crucial to read all instructions carefully. This will help you avoid common mistakes and ensure that the form is completed accurately.

Accurate Information: Provide accurate and complete information. The IRS uses this data to determine your eligibility for deductions. Inaccuracies can lead to delays or incorrect determinations.

Gather Required Documents: To fill out Notice 703 correctly, you'll need your Social Security benefits statement and other relevant financial documents from the tax year in question.

Calculations: Follow the calculation instructions precisely. The form may require you to calculate the portion of your Social Security benefits that could be tax-deductible. Making accurate calculations is crucial.

IRS Website Resources: Utilize resources available on the IRS website. The website provides detailed guides and frequently asked questions about Notice 703 and related tax topics.

Seek Professional Advice: If unsure about any part of the process, seek advice from a tax professional. They can provide personalized guidance and help ensure that the form is filled out correctly.

Submission Deadlines: Be aware of and adhere to submission deadlines. Late submissions can result in missed deductions or penalties.

Correctly handling IRS Notice 703 is essential for taking advantage of potential tax deductions on Social Security benefits. Following these guidelines will help navigate the process with greater ease and accuracy.

Popular PDF Documents

Oklahoma Tax Permit - The back of the form provides space to explain "Other Sales Tax Exemptions" not listed in the main sections.

Doctors First Report - A comprehensive tool for reporting workplace injuries, focusing on detailed incident and medical treatment documentation.