Get Irs Insolvency Form

When individuals or businesses face financial difficulties that lead to debt forgiveness, the IRS Form 982, titled "Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment)," comes into play. Created to help manage the tax implications of forgiven debt, this form, integral to the filing process, requires attachment to one's income tax return. Its purpose is manifold, offering pathways for taxpayers to exclude certain cancelled debts from their gross income under various circumstances such as bankruptcy, insolvency outside of bankruptcy, qualified farm indebtedness, and more. By checking the appropriate boxes and detailing the amount of debt discharged, taxpayers signal their eligibility for these exclusions. Beyond mere reporting, Form 982 also guides individuals in reducing their tax attributes, which could include adjusting the bases of depreciable and non-depreciable property, or applying the discharge to affect net operating losses, among others. Notably, the form includes conditions for corporations making consent for basis adjustments of property as per specific tax sections. The latest instructions and details, including adjustments post-2017 for qualified principal residence indebtedness, underscore the importance of staying current with tax law and guidance provided by the IRS, highlighting the necessity of this form in navigating the complexities of debt discharge and its impact on tax obligations.

Irs Insolvency Example

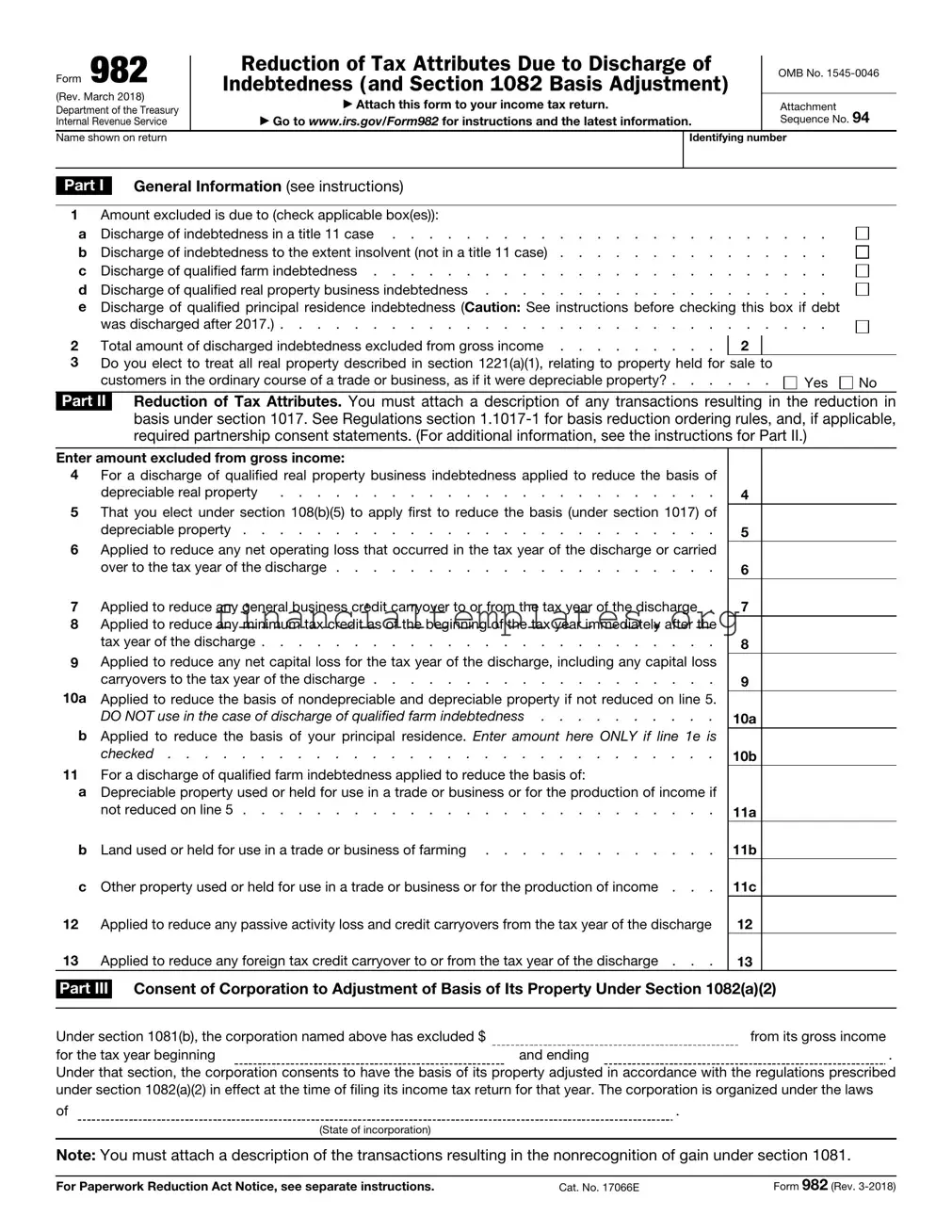

Form 982 |

|

Reduction of Tax Attributes Due to Discharge of |

|

OMB No. |

|

|

|

||||

|

Indebtedness (and Section 1082 Basis Adjustment) |

|

|

||

(Rev. March 2018) |

|

▶ Attach this form to your income tax return. |

|

Attachment |

|

Department of the Treasury |

|

|

|||

|

▶ Go to www.irs.gov/Form982 for instructions and the latest information. |

|

Sequence No. 94 |

||

Internal Revenue Service |

|

|

|||

Name shown on return |

|

|

Identifying number |

||

|

|

|

|

|

|

Part I General Information (see instructions)

1Amount excluded is due to (check applicable box(es)):

a |

Discharge of indebtedness in a title 11 case |

b |

Discharge of indebtedness to the extent insolvent (not in a title 11 case) |

c |

Discharge of qualified farm indebtedness |

d |

Discharge of qualified real property business indebtedness |

eDischarge of qualified principal residence indebtedness (Caution: See instructions before checking this box if debt

was discharged after 2017.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Total amount of discharged indebtedness excluded from gross income |

2 |

3Do you elect to treat all real property described in section 1221(a)(1), relating to property held for sale to

customers in the ordinary course of a trade or business, as if it were depreciable property? |

Yes |

No |

Part II Reduction of Tax Attributes. You must attach a description of any transactions resulting in the reduction in basis under section 1017. See Regulations section

Enter amount excluded from gross income:

4For a discharge of qualified real property business indebtedness applied to reduce the basis of

depreciable real property |

. . . . . . . . . . . . . . . . . . . . . . . . |

5That you elect under section 108(b)(5) to apply first to reduce the basis (under section 1017) of

depreciable property . . . . . . . . . . . . . . . . . . . . . . . . . .

6Applied to reduce any net operating loss that occurred in the tax year of the discharge or carried

over to the tax year of the discharge . . . . . . . . . . . . . . . . . . . . .

7 |

Applied to reduce any general business credit carryover to or from the tax year of the discharge . |

8Applied to reduce any minimum tax credit as of the beginning of the tax year immediately after the

tax year of the discharge . . . . . . . . . . . . . . . . . . . . . . . . .

9Applied to reduce any net capital loss for the tax year of the discharge, including any capital loss

carryovers to the tax year of the discharge . . . . . . . . . . . . . . . . . . .

10a Applied to reduce the basis of nondepreciable and depreciable property if not reduced on line 5. DO NOT use in the case of discharge of qualified farm indebtedness . . . . . . . . . .

bApplied to reduce the basis of your principal residence. Enter amount here ONLY if line 1e is

checked . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11For a discharge of qualified farm indebtedness applied to reduce the basis of:

aDepreciable property used or held for use in a trade or business or for the production of income if

not reduced on line 5 . . . . . . . . . . . . . . . . . . . . . . . . . .

b |

Land used or held for use in a trade or business of farming |

c |

Other property used or held for use in a trade or business or for the production of income . . . |

12Applied to reduce any passive activity loss and credit carryovers from the tax year of the discharge

13 |

Applied to reduce any foreign tax credit carryover to or from the tax year of the discharge . . . |

4

5

6

7

8

9

10a

10b

11a

11b

11c

12

13

Part III Consent of Corporation to Adjustment of Basis of Its Property Under Section 1082(a)(2)

Under section 1081(b), the corporation named above has excluded $ |

|

from its gross income |

for the tax year beginning |

and ending |

. |

Under that section, the corporation consents to have the basis of its property adjusted in accordance with the regulations prescribed under section 1082(a)(2) in effect at the time of filing its income tax return for that year. The corporation is organized under the laws

of |

. |

|

(State of incorporation) |

Note: You must attach a description of the transactions resulting in the nonrecognition of gain under section 1081.

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 17066E |

Form 982 (Rev. |

Document Specifics

| Fact Number | Fact Description |

|---|---|

| 1 | Form 982 is titled "Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment)" and is used to report the exclusion of forgiven debt from gross income under certain conditions. |

| 2 | The form is an attachment required to be filed with the individual's income tax return if applicable. |

| 3 | Debt discharge reasons that can be reported on this form include title 11 cases, insolvency, qualified farm indebtedness, qualified real property business indebtedness, and qualified principal residence indebtedness. |

| 4 | IRS requires taxpayers to reduce their tax attributes, like certain losses and credits, by the amount of the discharged indebtedness excluded from income. |

| 5 | Part II of Form 982 specifically deals with the reduction of tax attributes, requiring detailed information on how the discharged indebtedness amount is applied. |

| 6 | Form 982 includes a consideration for corporation consent under Section 1082(a)(2) related to adjustments of the basis of its property following the exclusion of debt discharge from gross income. |

| 7 | The OMB Number for Form 982 is 1545-0046, and the latest revision of this form is March 2018. |

| 8 | For instructions and the latest information regarding Form 982, the IRS directs filers to visit its official website. |

| 9 | Form 982 provides specific lines for applying discharged indebtedness amounts to reduce various tax attributes, such as depreciable property basis, net operating losses, and certain credit carryovers, among others. |

Guide to Writing Irs Insolvency

When dealing with financial challenges and solutions, understanding how to navigate tax forms becomes crucial for many people. The IRS Form 982 serves an important purpose in helping individuals communicate with the tax authorities about certain types of debt discharge and how these affect their tax liabilities. Completing this form correctly is essential to taking advantage of potential tax benefits. Here are the detailed steps needed to fill out the IRS Form 982, ensuring clear and correct submission:

- Start with Part I - General Information. If your debt was discharged under bankruptcy (a title 11 case), check box a. If the discharge was due to insolvency but not in a title 11 case, check box b. Check other boxes (c, d, or e) as applicable, based on the type of debt discharge you experienced.

- Enter the Total amount of discharged indebtedness excluded from gross income in the space provided for line 2. This amount refers to the portion of your debt that was forgiven and excludes from your taxable income.

- On line 3, answer Yes or No to whether you elect to treat all real property described in section 1221(a)(1) as if it were depreciable property. This decision impacts how you can apply reductions in your tax attributes.

- Move to Part II - Reduction of Tax Attributes. Here, you'll detail how the discharged debt impacts various tax attributes. You will need to attach a separate description of any transactions requiring a basis reduction. This is crucial as it informs how the forgiven debt influences your taxable assets and losses.

- In lines 4 through 13, enter amounts as instructed to indicate how the discharge of indebtedness applies to specific tax attributes like net operating losses, business credit carryovers, minimum tax credits, and more.

- If the form is being filed for a corporation, complete Part III to consent to the adjustment of basis of the corporation's property under section 1082(a)(2). This part requires stating the amount excluded from the gross income and the state of incorporation.

- Ensure that the Name shown on return and Identifying number at the top of the form match those on your tax return

- Review the entire form to make sure all applicable sections are completed and accurate. Attach any required descriptions or additional documents.

- Finally, attach Form 982 to your income tax return before submitting it according to the instructions for your specific tax return form.

Correctly completing and attaching Form 982 can significantly impact your tax situation following the discharge of indebtedness. If you are unsure about any steps in this process, consulting with a tax professional is highly recommended to ensure you are taking full advantage of possible tax benefits and complying with IRS requirements.

Understanding Irs Insolvency

When dealing with the blend of taxation and personal financial restructuring, IRS Form 982 is a cornerstone document. It might seem like a maze of checkboxes and tax jargon, but it's actually a tool designed to aid taxpayers navigating through the aftermath of debt discharge. Here are some of the frequently asked questions about IRS Form 982 that can help clarify its purpose and application.

What is IRS Form 982?

IRS Form 982, officially titled "Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment)", is a crucial form used to report the exclusion of forgiven debt from gross income on your tax return. When you're forgiven a debt you owe, the IRS typically views the forgiven amount as taxable income. However, under specific conditions outlined in the form, individuals may avoid taxes on this "income".

When should I use Form 982?

This form is used when you've had debt forgiven and qualify under certain exclusions to prevent that forgiven amount from being treated as taxable income. Common scenarios include bankruptcy, insolvency (where your total debts exceed the fair market value of your total assets), qualified farm indebtedness, qualified real property business indebtedness, and qualified principal residence indebtedness. Each of these scenarios is addressed by a different part of the form.

How does insolvency affect my use of Form 982?

If you're insolvent (meaning your total liabilities exceed your total assets) immediately before the cancellation of debt, you may exclude some or all of the canceled debt from your income. However, it requires accurately completing and attaching Form 982 to your tax return to specify how much of the debt discharge is attributable to insolvency.

What do they mean by "reduction of tax attributes"?

When excluding discharged debt from your income, the IRS requires you to reduce certain tax attributes, or future benefits on your tax return, like net operating losses or the basis in certain assets. This step, effectively, prevents taxpayers from double-dipping - benefiting from the exclusion of the debt income and later enjoying tax deductions or credits that wouldn't be available had the debt been paid in full. The specifics of how and what order to reduce these attributes are detailed in part II of Form 982.

Can I choose which tax attributes to reduce first?

Yes, in some cases. The form itself and accompanying instructions detail a specific order in which tax attributes must be reduced. However, there is an option under section 108(b)(5) allowing for a first reduction in the basis of depreciable property, offering some strategic flexibility in managing your tax consequences after a debt discharge.

Is there a deadline for filing Form 982?

Form 982 should be filed along with your income tax return for the year in which the debt was discharged. Thus, the deadline corresponds with the tax return's due date, including any extensions you've obtained. Late filings could result in the IRS failing to recognize your claim and potentially taxed for the forgiven debt.

Navigating through the complexities of tax obligations following debt relief is inherently challenging. Yet, understanding the ins and outs of IRS Form 982 can offer a lifeline, ensuring those eligible can rightfully claim exclusion on forgiven debt. When in doubt, seeking advice from a tax professional can help ensure you're taking the correct steps tailored to your situation.

Common mistakes

Filling out the IRS Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness, requires careful attention to detail. Unfortunately, mistakes can be easy to make but costly in their impact. Here are four common errors people often commit when completing this form:

- Not accurately identifying the type of discharge applicable - The form requires the taxpayer to check boxes relevant to their situation of discharge, such as insolvency or specific types of indebtedness like qualified farm indebtedness. An inaccurate selection can lead to incorrect processing of the form, potentially resulting in the denial of the tax relief sought.

- Failing to attach required documents - The form stipulates the need to attach it to your income tax return and, in certain parts, to provide descriptive documents of transactions affecting basis reduction. Overlooking these instructions can lead to incomplete submissions, thereby delaying or compromising the insolvency claim.

- Incorrect calculation of insolvency - Determining the extent of insolvency immediately before the discharge requires a precise calculation of liabilities and the fair market value of assets. Incorrect calculations or estimations can lead to either an underreported or overreported insolvency amount, affecting the discharged indebtedness that can be excluded from gross income.

- Improper allocation to tax attributes - When it comes to reducing tax attributes due to a discharge of indebtedness (Part II of the form), specific ordering rules apply. Misunderstanding how to apply these reductions to net operating losses, capital loss carryovers, or the basis of property, among others, can lead to errors that might result in unfavorable tax consequences.

Being mindful of these pitfalls and double-checking the requirements can significantly enhance the accuracy of filing Form 982. It might also be beneficial to consult with a tax professional, especially in complex scenarios, to ensure that all aspects of the tax relief process are handled appropriately.

Documents used along the form

Filing for insolvency comes with a complex web of financial disclosure and a comprehensive understanding of one’s financial standing. The IRS Insolvency Form, or Form 982, is vital in this process, allowing taxpayers to express the Reduction of Tax Attributes Due to Discharge of Indebtedness. However, this form does not live in isolation. To accurately complete and submit Form 982, individuals often need to gather additional documentation that provides a fuller picture of their financial situation. The following descriptions delve into other forms and documents commonly used alongside Form 982.

- Form 1040: This is the U.S. Individual Income Tax Return form. It's primarily used to file an annual income tax return. When dealing with insolvency and the discharge of indebtedness, your tax liability can significantly change. Thus, Form 1040 is essential as it serves as the base form where you report your income, deductions, and credits to the IRS.

- Form 1099-C: The Creditor’s Information Return for Cancellation of Debt provides details about the amount of debt forgiven, which needs to be reported on Form 982. This form is a critical piece of documentation for understanding how much debt has been discharged and potentially excluded from gross income due to insolvency.

- Schedule D (Form 1040): Capital Gains and Losses. If the discharge of indebtedness involves property, Schedule D becomes crucial. It helps to report any capital gain or loss resulting from the sale or exchange of capital assets not reported on another form or schedule. This includes adjustments to the basis of real and personal property.

- Financial Account Statements: Although not official IRS forms, personal financial account statements (such as bank statements, investment accounts, and retirement accounts) are often required to substantiate the financial position claimed on Form 982. They provide evidence of the taxpayer’s assets and liabilities at the time of insolvency.

- Property Appraisal Reports: Similar to financial account statements, property appraisals are important when declaring insolvency, especially when it involves real estate. These reports offer an independent valuation of property owned, helping to establish the taxpayer's net worth — or lack thereof — accurately.

Understanding and gathering these documents is a crucial step toward correctly navigating the insolvency process with the IRS. Each piece of information adds to a comprehensive overview of an individual’s financial standing, ensuring that taxpayers meet their obligations while taking full advantage of the relief offered by laws governing insolvency. By taking a careful and thorough approach, individuals can better manage the complexities of financial distress and the potential tax implications that follow.

Similar forms

The Form 433-A (OIC) or Collection Information Statement for Wage Earners and Self-Employed Individuals is quite similar to the IRS Insolvency form. Both documents require detailed financial information from the taxpayer to assess their financial situation. While Form 982 is used to determine the reduction of tax attributes due to discharge of indebtedness, Form 433-A (OIC) collects financial details to propose an offer in compromise to settle tax debts for less than the full amount owed. Each form, in its way, aids in evaluating a person's ability to satisfy their tax liabilities.

Form 433-F, Collection Information Statement, like the IRS Insolvency form, gathers extensive information about an individual's finances. This similarity lies in their use of financial data to evaluate a taxpayer's fiscal health and capacity. Where Form 982 is focused on identifying insolvency and adjusting tax attributes accordingly, Form 433-F is broader, used by the IRS to determine how an individual can fulfill outstanding tax obligations, possibly leading to payment plans or settlements.

Another document, the Schedule D (Form 1040), Capital Gains and Losses, shares a connection with the Insolvency form through its focus on adjustments to financial standings. While the Insolvency form addresses the overall adjustment of tax attributes post-discharge of debt, Schedule D involves calculating capital gains or losses which can affect taxable income. Both forms contribute to adjusting an individual's tax liabilities based on changes in their financial situation.

The Bankruptcy Forms, notably the schedules of assets and liabilities used in such proceedings, have similar objectives to the IRS Insolvency form regarding the disclosure of financial position. These bankruptcy documents, while part of the judicial process to address debt relief, similarly require detailed listings of an individual's financial standing. The Insolvency form's role in determining the tax implications of discharged indebtedness mirrors the bankruptcy process's goal of resolving insolvency.

The Form 1099-C, Cancellation of Debt, closely relates to the IRS Insolvency form as it involves identifying situations where a taxpayer may have realized income due to the cancellation of debt. Just as Form 982 can lead to the exclusion of such discharged debt from gross income for tax purposes, Form 1099-C alerts the taxpayer and the IRS to the occurrence of debt cancellation, requiring assessment of its impact on tax obligations.

Form 6252, Installment Sale Income, while serving a different primary purpose—reporting income from sales made over time—shares the concept of adjusting financial outcomes over periods, similar to what the IRS Insolvency form accomplishes for discharged indebtedness. Both involve recognizing changes to income across timeframes, affecting tax calculations and liabilities.

The Adjustment of Shareholders' Equity Statements found in corporate accounting and tax filings relates to the motive behind the IRS Insolvency form. Both documents are concerned with adjusting financial and tax attributes based on events impacting the taxpayer's economic status. While the Adjustment of Shareholders' Equity focuses on corporate entities, the principle of adjusting financial records for significant events is a common goal.

Form 1041, U.S. Income Tax Return for Estates and Trusts, is akin to Form 982 in its adjustment of tax attributes due to unique circumstances affecting financial status. Form 982's focus is on insolvency’s impact on an individual, Form 1041 involves tax considerations for estates and trusts, which may include addressing debts and distributions that can change the entity’s tax attributes.

The Statement of Financial Affairs in bankruptcy proceedings is another document with objectives parallel to those of the IRS Insolvency form. This statement provides a comprehensive look at the debtor's financial history and current status, analogous to how Form 982 assesses the taxpayer's financial situation to adjust tax attributes based on insolvency.

The Home Affordable Modification Program (HAMP) application forms, designed to assist homeowners in restructuring mortgages to avoid foreclosure, share an end goal with the IRS Insolvency form: relief in financial hardship situations. Where Form 982 provides tax relief through the reduction of tax attributes following debt discharge, HAMP sought to alleviate burdens by modifying loan terms, both aiming to aid individuals facing fiscal stress.

Dos and Don'ts

Filing for insolvency on the IRS Form 982 can be a critical step in managing your financial affairs. Understanding what to do and what not to do when completing this form is essential to ensure the process benefits you. Here’s a guide on the do’s and don’ts:

- Do thoroughly review the instructions provided by the IRS for Form 982 to ensure you understand all requirements and definitions.

- Do verify the specific type of debt discharge you are claiming. This form allows for different types of indebtedness discharges, including in the case of insolvency outside of bankruptcy.

- Do accurately calculate your insolvency amount immediately before the debt was discharged. This involves listing all liabilities and the fair market value of all assets.

- Do attach a detailed description of any transactions that led to the basis reduction in property as required in Part II if applicable.

- Do remember to include Form 982 with your tax return for the year in which the discharge of indebtedness occurred.

- Don't guess on values or make estimates. It’s important to use accurate numbers for assets and liabilities to correctly determine insolvency.

- Don't overlook any excluded debts from your gross income calculations. Make sure to report the correct amount of discharged indebtedness on line 2.

- Don't ignore sections that apply to your situation. If you’re electing to reduce the basis of depreciable property, for example, ensure you complete the relevant sections and lines accurately.

- Don't forget to sign and date your tax return and attach any required additional statements or descriptions as outlined in the Form 982 instructions.

Accurately completing Form 982 can significantly affect your tax situation. Taking the time to understand and properly fill out this form can help you navigate through your financial difficulties with more confidence and peace of mind.

Misconceptions

When it comes to the IRS Form 982, "Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment)," there are several misconceptions. This form is essential for reporting the exclusion of forgiven debt from gross income under specific conditions. Here are five common misunderstandings cleared up:

- Only for Bankruptcy: Many people mistakenly believe that Form 982 is only for debts discharged through bankruptcy. While bankruptcy is one of the conditions under which debt discharge can be excluded from income (box a), the form is also applicable for other types of debt forgiveness, such as when the debtor is insolvent but not in a bankruptcy case (box b), among other scenarios.

- Complexity Only for Large Companies: Another misconception is that Form 982's complexity is reserved for large corporations. In reality, individuals, including sole proprietors, can and do use this form when they meet conditions like insolvency or specific types of debt discharge. Understanding your eligibility can help you avoid unnecessary taxable income inclusions.

- Automatic Application: Some believe that if they qualify for a discharge of indebtedness, it automatically applies to their tax situation. However, to benefit, you must actively file Form 982 with your income tax return. The exclusion from gross income isn't automatic; it requires proper reporting and sometimes specific elections made on the form.

- One Time Use: There's a myth that Form 982 is a one-off measure. However, taxpayers may use it multiple times as long as they encounter qualifying debt discharge circumstances in different tax years. It's about the occurrence and qualification of the discharge, not a limit on the form's use.

- Limited to Personal Debts: Finally, some people incorrectly assume that Form 982 is only relevant for personal debts. While personal debts like forgiven credit card debt or a mortgage on a principal residence can qualify, the form also applies to business debts, including "qualified real property business indebtedness" (box d) and "qualified farm indebtedness" (box c). The key is understanding the type of debt discharged and how it aligns with the IRS provisions.

Understanding the truth behind these misconceptions can empower taxpayers dealing with debt forgiveness. By recognizing the eligibility for excluding forgiven debts from income under various scenarios, taxpayers can often avoid unnecessary tax burdens. As with any tax matter, consulting with a tax professional can provide clarity specific to your situation.

Key takeaways

- Completing the IRS Form 982 is essential for anyone who has had debt discharged not in a bankruptcy case (title 11) but was insolvent at the time. This form allows you to exclude this discharged debt from your gross income, potentially lowering your tax liability.

- It’s important to correctly identify the type of debt discharged on Form 982, as it impacts how you fill out the form. Among the types of debt that can be excluded are discharged indebtedness in a title 11 case, to the extent insolvent, qualified farm indebtedness, qualified real property business indebtedness, and qualified principal residence indebtedness.

- The total amount of discharged indebtedness that can be excluded from your gross income must be clearly specified. Knowing this amount is crucial because it directly affects your tax obligations.

- Form 982 also requires you to report how the discharged debt impacts your tax attributes. These effects include adjustments to the basis of depreciable and nondepreciable property, net operating losses, and specified tax credits. It’s a way of ensuring that the benefit of the discharge isn’t doubled by also reducing taxable income or tax in future years.

- If your discharged debt includes qualified real property business indebtedness, you have the option to elect treating all real property as if it were depreciable property. This election can influence your tax implications and must be carefully considered.

- Corp to Study Keto Diet in Detail

- Always consult the latest instructions and regulations detailed on the IRS website for Form 982. Tax laws evolve, and staying updated ensures you’re accurately meeting your obligations and maximizing your benefits under the law.

Additional Documentation May Be Required: For certain reductions, such as those under sections related to depreciation and property held for business, you might need to attach detailed descriptions of transactions that led to the reduction in basis. This ensures transparency and allows for proper verification.

Popular PDF Documents

Virginia 501c3 - Aids in budgeting by allowing government agencies to plan for purchases without the added cost of sales tax.

Income Based Repayment Eligibility - Annual reassessment of family size and income ensures your IBR payments reflect your current financial situation.

IRS 1040-V - The form has a specific section to detail the exact amount of tax payment you are making.