Get Irs Gov Ptin Renewal Form

Navigating the complexities of tax preparation requirements becomes significantly easier with a clear understanding of the IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal process, as outlined in Form W-12. This essential form, updated in May 2021 by the Department of the Treasury - Internal Revenue Service, is designed for tax preparers who seek to either obtain a new PTIN or renew an existing one. At its core, the form captures personal and business details, alongside crucial tax compliance and professional credentials information. Importantly, it mandates that preparers are up-to-date with their own tax obligations and possess a robust data security plan to protect taxpayer information. The option to apply for or renew a PTIN for the current or next calendar year, and to declare any past felony convictions, underscores the IRS’s commitment to maintaining high standards of integrity and security in tax preparation. Applicants are subject to a fee, which underscores the procedural nature of this application, and are offered guidance on how to submit their application either online for immediate processing or via mail with a longer processing timeframe. This underscores a structured approach to ensuring that tax preparers are equipped, verified, and ready to offer their services legally in the United States.

Irs Gov Ptin Renewal Example

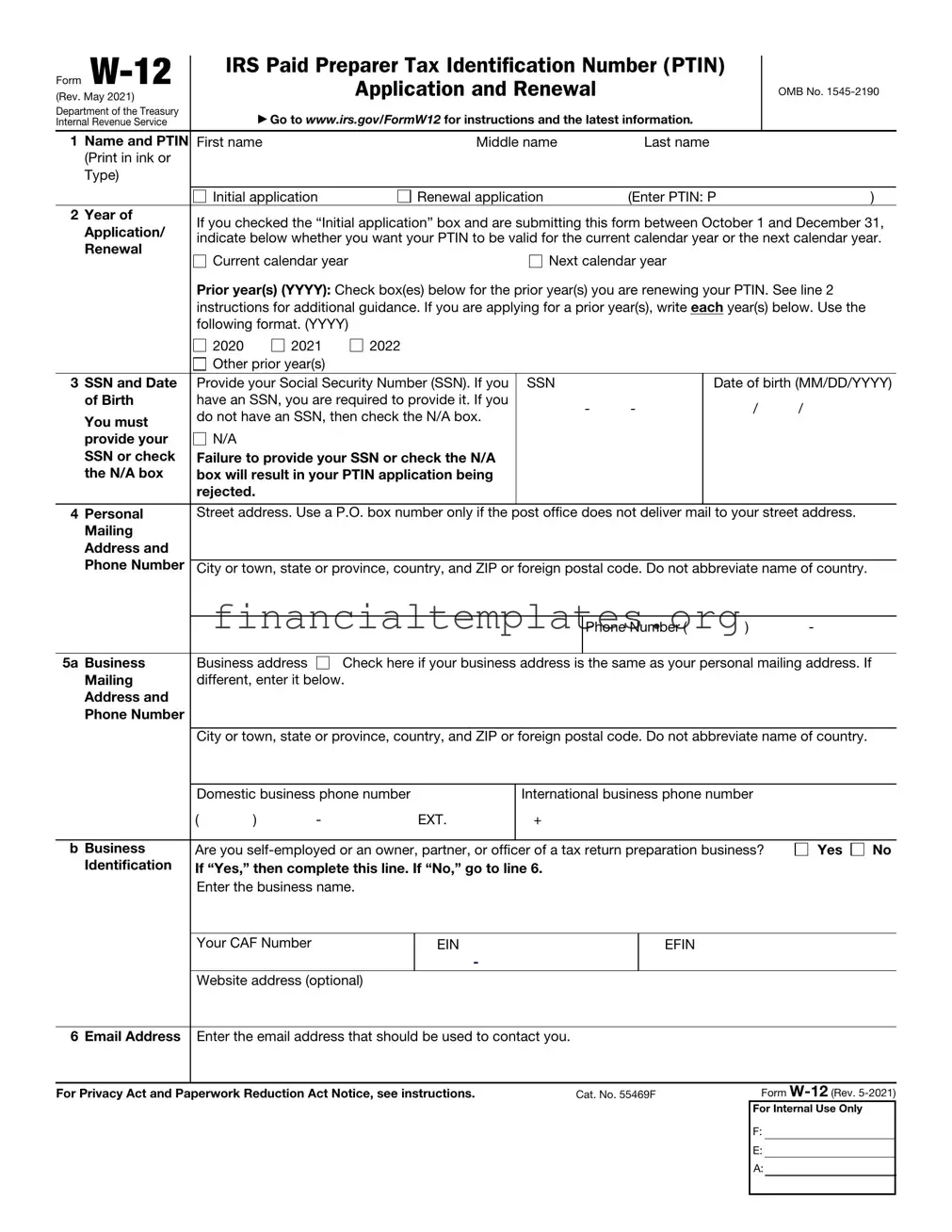

Form

(Rev. May 2021)

Department of the Treasury

Internal Revenue Service

IRS Paid Preparer Tax Identification Number (PTIN)

Application and Renewal

▶Go to www.irs.gov/FormW12 for instructions and the latest information.

OMB No.

1 Name and PTIN First name |

|

|

Middle name |

|

Last name |

|

|

||||

|

(Print in ink or |

|

|

|

|

|

|

|

|

|

|

|

Type) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial application |

|

Renewal application |

|

(Enter PTIN: P |

|

) |

|||

2 |

Year of |

If you checked the “Initial application” box and are submitting this form between October 1 and December 31, |

|||||||||

|

Application/ |

||||||||||

|

indicate below whether you want your PTIN to be valid for the current calendar year or the next calendar year. |

||||||||||

|

Renewal |

||||||||||

|

Current calendar year |

|

Next calendar year |

|

|

||||||

|

|

|

|

|

|||||||

|

|

Prior year(s) (YYYY): Check box(es) below for the prior year(s) you are renewing your PTIN. See line 2 |

|||||||||

|

|

instructions for additional guidance. If you are applying for a prior year(s), write each year(s) below. Use the |

|||||||||

|

|

following format. (YYYY) |

|

|

|

|

|

|

|

||

|

|

2020 |

2021 |

|

2022 |

|

|

|

|

|

|

|

|

Other prior year(s) |

|

|

|

|

|

|

|

|

|

3 |

SSN and Date |

Provide your Social Security Number (SSN). If you |

SSN |

|

|

Date of birth (MM/DD/YYYY) |

|||||

|

of Birth |

have an SSN, you are required to provide it. If you |

|

- |

- |

|

/ |

/ |

|||

|

You must |

do not have an SSN, then check the N/A box. |

|

|

|||||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

provide your |

N/A |

|

|

|

|

|

|

|

|

|

|

SSN or check |

Failure to provide your SSN or check the N/A |

|

|

|

|

|

|

|||

|

the N/A box |

box will result in your PTIN application being |

|

|

|

|

|

|

|||

|

|

rejected. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

4 |

Personal |

Street address. Use a P.O. box number only if the |

post office does not deliver mail to your street address. |

||||||||

|

Mailing |

|

|

|

|

|

|

|

|

|

|

|

Address and |

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

||||||||

|

City or town, state or province, country, and ZIP or foreign postal code. Do not abbreviate name of country. |

||||||||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Phone Number ( |

) |

- |

||

|

|

|

|

|

|||||||

5a |

Business |

Business address |

Check here if your business address is the same as your personal mailing address. If |

||||||||

|

Mailing |

different, enter it below. |

|

|

|

|

|

|

|

||

|

Address and |

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

|

|

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code. Do not abbreviate name of country.

|

Domestic business phone number |

|

|

International business phone number |

|

|

|||

|

( |

) |

- |

EXT. |

|

+ |

|

|

|

|

|

|

|

|

|

|

|||

b Business |

Are you |

Yes |

No |

||||||

Identification |

If “Yes,” then complete this line. If “No,” go to line 6. |

|

|

||||||

|

Enter the business name. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Your CAF Number |

|

EIN |

|

|

EFIN |

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

Website address (optional) |

|

|

|

|

|

|

||

6Email Address Enter the email address that should be used to contact you.

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 55469F |

Form |

|

|

|

For Internal Use Only |

|

|

|

F: |

|

|

|

E: |

|

|

|

A: |

|

|

|

|

|

Form |

Page 2 |

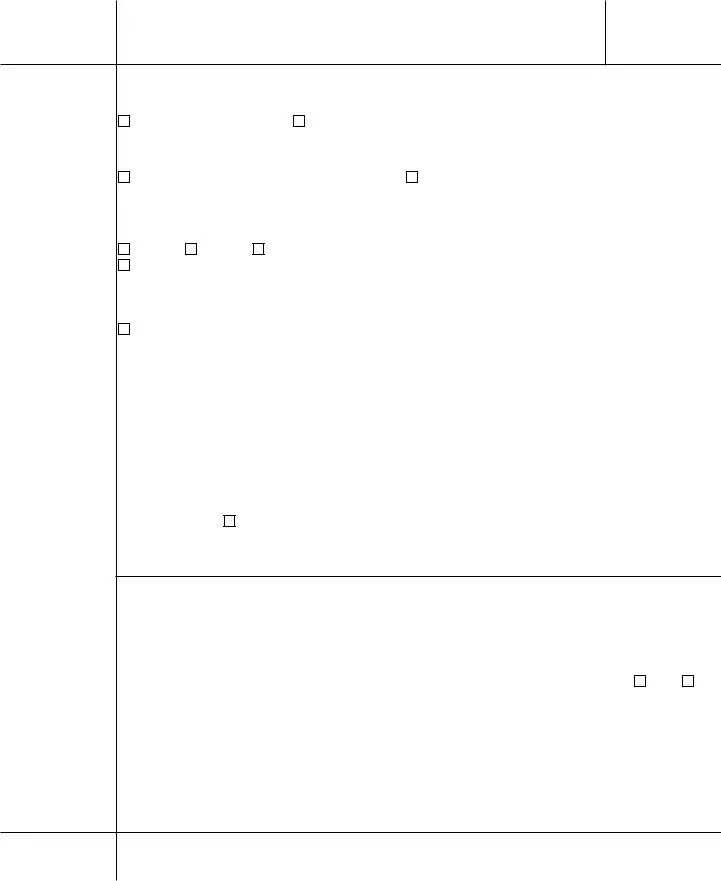

7Past Felony Convictions You must check a box. If “Yes,” you must provide an explanation.

Have you been convicted of a felony in the past 10 years?

If “Yes,” list the date and the type of felony conviction(s).

Yes No

If this is your initial application for a PTIN, continue to line 8. If you are renewing your PTIN, go to line 10.

8 |

Address of |

Enter the address used on your last U.S. individual income tax return you filed. |

|||

|

Your |

|

|

|

|

|

Last U.S. |

|

|

|

|

|

Individual |

|

|

|

|

|

Income Tax |

|

|

|

|

|

Check here if you have never filed a U.S. income tax return or do not have a U.S. income tax filing |

||||

|

Return Filed |

||||

|

requirement. See line 8 instructions for documents that must be submitted with this form and continue to |

||||

|

|

||||

|

|

line 10. |

|

|

|

|

|

|

|

|

|

9 |

Filing Status |

Single |

Head of Household |

||

|

and Tax Year |

|

|

|

|

|

on Last U.S. |

Married filing jointly |

Qualifying widow(er) with dependent child |

||

|

Individual |

|

|

|

|

|

Income Tax |

Married filing separately |

Tax Year (YYYY) |

|

|

|

Return Filed |

||||

|

Note: If your last return was filed more than 4 years ago, see instructions. |

||||

|

|

||||

|

|

|

|||

10 |

Federal Tax |

Are you current on both your individual and business federal taxes, including any corporate and employment |

|||

|

Compliance |

tax obligations? Note: If you have never filed a U.S. individual income tax return because you are not required |

|||

|

|

to do so, check the “Yes” box. |

|

|

Yes |

|

|

|

|

|

No |

|

|

If “No,” provide an explanation. |

|

|

|

11Data Security I am aware that paid tax return preparers must have a data security plan to provide data and system security Responsibilities protections for all taxpayer information.

Form

Form |

|

|

|

|

|

|

Page 3 |

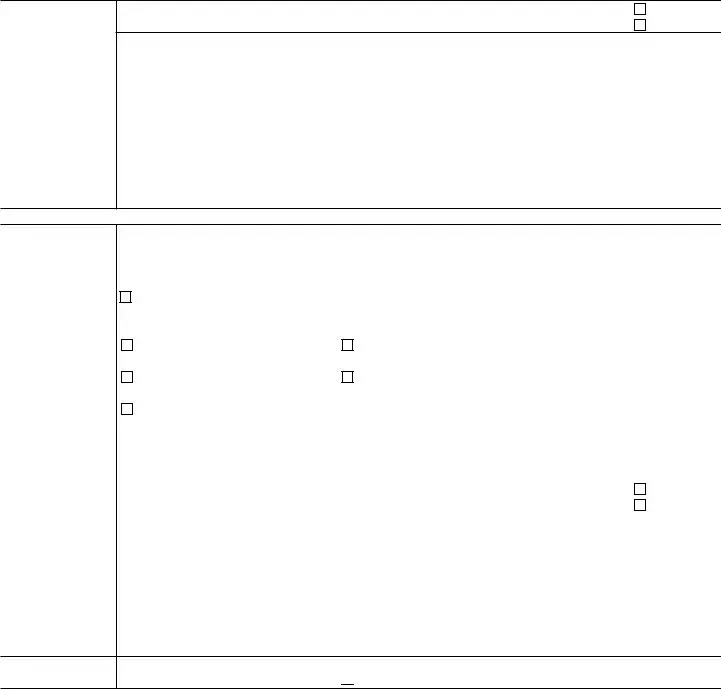

12 Professional |

Check all that apply. Note: DO NOT check any professional credentials that are currently expired or |

||||||

Credentials |

retired. Enter state abbreviation and appropriate number(s). If the expiration date is left blank or incomplete, |

||||||

|

then NO professional credential will be added when the application is processed. |

||||||

|

|

|

|

|

|

||

|

jurisdiction(s): |

Number(s): |

Expiration Date(s): |

||||

|

|

|

|

|

|

|

|

|

Certified Public Accountant (CPA)— |

|

|

|

|

|

|

|

Licensed in which jurisdiction(s): |

Number(s): |

Expiration Date(s): |

||||

|

|

|

|

|

|

|

|

|

Enrolled Agent (EA) |

Number(s): |

|

Expiration Date(s): |

|

||

|

Enrolled Actuary |

Number(s): |

|

Expiration Date(s): |

|

||

|

Enrolled Retirement Plan Agent (ERPA) |

Number(s): |

Expiration Date(s): |

||||

|

State Regulated Tax Return Preparer |

|

|

|

|

|

|

|

Number(s): |

Expiration Date(s): |

|||||

|

|

|

|

|

|

|

|

|

Certifying Acceptance Agent (CAA) |

Number: |

|

|

|||

|

None |

|

|

|

|

|

|

13 Fees |

If you are applying for a PTIN or renewing your PTIN, your fee is $35.95. The fee is an application processing |

||||||

|

fee and is nonrefundable. Full payment must be included with your application or it will be rejected. If your |

||||||

application is incomplete and you do not supply the required information upon request, the IRS will be unable

to process your application. Make your check or money order payable to IRS Tax Pro PTIN Fee. Do not

paper clip, staple, or otherwise attach the payment to Form

year you are applying for. No payment is due for 2020 and prior years.

|

Under penalties of perjury, I declare that I have examined this application and to the best of my knowledge and belief, it |

|||

Sign |

is true, correct, and complete. I understand any false or misleading information may result in criminal penalties and/or |

|||

the denial or termination of a PTIN. |

|

|

||

Here |

▲ |

Your signature (Please use blue or black ink) |

Date (MM/DD/YYYY) |

|

|

/ |

/ |

||

|

|

|

|

|

How To File

Online. Go to the webpage www.irs.gov/ptin for information. Follow the instructions to submit Form

By mail. Complete Form

IRS Tax Professional PTIN Processing Center PO Box 380638

San Antonio, TX 78268

Note: Allow 4 to 6 weeks for processing of PTIN applications. For additional information, refer to the separate Instructions for Form

For Internal Use Only |

Form |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | The form is known as Form W-12, titled "IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal". |

| Revision Date | The revision date of the form is May 2021. |

| Purpose | The purpose of the form is for the application and renewal of an IRS Paid Preparer Tax Identification Number (PTIN). |

| Application Window | For initial applications submitted between October 1 and December 31, applicants can choose whether the PTIN is valid for the current or the next calendar year. |

| Fee Requirement | The application or renewal fee for a PTIN is $35.95, which is nonrefundable. |

| Submission Instructions | Applicants can submit Form W-12 online for immediate PTIN provision or by mail, which may take 4 to 6 weeks for processing. |

Guide to Writing Irs Gov Ptin Renewal

Renewing a PTIN (Preparer Tax Identification Number) is an important step for tax preparers to ensure they’re authorized to prepare federal tax returns for compensation. Here's how to accurately complete the IRS PTIN Renewal Form, ensuring that this annual requirement is met without hassle.

- First, locate the section titled Name and PTIN. If you are renewing, tick the "Renewal application" box, and enter your current PTIN beginning with 'P'.

- Under Year of Application/Renewal, select the years for which you are applying or renewing your PTIN. For a renewal, check the current calendar year or other prior years if applicable.

- In the SSN and Date of Birth section, provide your Social Security Number and date of birth. If you do not have an SSN, mark the N/A box to indicate this.

- For Personal Mailing Address and Phone Number, enter your current street address or P.O. box, city or town, state or province, country, and ZIP or foreign postal code, along with your phone number.

- Under Business Mailing Address and Phone Number, check the box if it’s the same as your personal mailing address. If different, fill in the business address details and phone number.

- In the Business Identification section, indicate whether you’re self-employed or hold a position such as an owner, partner, or officer in a tax preparation business. If yes, provide the requested business details.

- Provide your Email Address for contact purposes.

- If this is an initial application, the form asks about Past Felony Convictions. Renewing applicants can skip to the next relevant section.

- For first-time applicants, Address of Your Last U.S. Individual Income Tax Return Filed is required. Renewals proceed to the next step.

- Filing Status and Tax Year on Last U.S. Individual Income Tax Return Filed might be applicable for new applicants.

- Assess your Federal Tax Compliance by confirming if you’re current with your individual and business federal taxes. If not, you must provide an explanation.

- Acknowledge your Data Security Responsibilities, agreeing to have a data security plan for taxpayer information.

- Review and answer the section regarding Professional Credentials, if applicable.

- Under Fees, the renewal fee is listed. Prepare to submit the $35.95 fee with your application, following the instructions for payment.

- Sign and date the form, using blue or black ink.

- To submit, choose to file either online for immediate processing or by mail. Follow the corresponding instructions for your chosen submission method.

After submitting, expect processing to take around 4 to 6 weeks for mail applications. Online submissions will generally provide immediate PTIN issuance. Your diligence in accurately completing and promptly submitting this form will ensure you remain in good standing to legally prepare federal tax returns for another year.

Understanding Irs Gov Ptin Renewal

- What is a PTIN and who needs one?

- How do I renew my PTIN and is there a deadline?

To renew your PTIN, you must complete and submit Form W-12, IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal. It's recommended to renew online for a quicker process, which you can do by visiting the official IRS website and following the instructions there. The renewal period begins in October each year and it's best to renew your PTIN as soon as possible to avoid any last-minute rush. Although there's no official deadline to renew your PTIN each year, tax preparers should ideally have their PTIN renewed before the start of the next filing season.

- What is the cost to apply for or renew a PTIN?

As of the last update, the cost to apply for or renew your PTIN is $35.95. This fee is for processing your application and is non-refundable. Make sure your application is complete and accurate to avoid delays. You must submit a separate payment for each year you’re applying for. Payment instructions are detailed in the Form W-12 application process.

- What should I do if I don’t have a Social Security Number (SSN)?

If you don't have a Social Security Number, you should check the 'N/A' box in the SSN field of the Form W-12. Not having an SSN requires additional steps, and your application could be rejected if you fail to properly indicate the lack of an SSN. Ensure you follow the specific instructions for applicants without an SSN, detailed in the form's instructions.

- Can I apply for or renew my PTIN by mail?

Yes, you can apply for or renew your PTIN by mail using Form W-12. Complete the form following the instructions provided, and mail it to the IRS Tax Professional PTIN Processing Center at the address listed. Note that processing times for mail applications can take 4 to 6 weeks, so online application is recommended for faster processing. When mailing, ensure your application is complete to avoid delays.

A PTIN, or Preparer Tax Identification Number, is a unique number assigned by the IRS to tax preparers who are compensated for preparing or assisting in the preparation of U.S. federal tax returns or claims for refund. If you prepare tax returns for compensation or if you plan to do this, you're required to have a valid PTIN. This includes both certified professionals like CPAs (Certified Public Accountants) and individuals who are not certified.

Common mistakes

When completing the IRS Gov PTIN Renewal form, individuals often make mistakes that can delay the processing of their application or even lead to its rejection. Being aware of these common errors can help ensure a smoother application process.

-

Incorrect or missing PTIN in the Renewal application: Individuals sometimes forget to enter their Preparer Tax Identification Number (PTIN) or enter it incorrectly when renewing. The correct PTIN must be filled in the specified area for renewal applications.

-

Choosing the wrong year of application: Applicants often select the incorrect year for which they are applying or renewing their PTIN. It's crucial to indicate whether the PTIN should be valid for the current calendar year or the next calendar year.

-

Failure to provide SSN or checking the N/A box incorrectly: Every applicant must supply their Social Security Number (SSN) unless they genuinely do not have one, in which case, the N/A box should be checked. Omitting the SSN or improperly checking the N/A box will result in the rejection of the application.

-

Not updating personal and business mailing addresses: A common oversight is not providing the current personal and business mailing addresses, or not indicating if they are the same. This information is crucial for contact purposes.

-

Skipping the felony conviction declaration: The form requires disclosure of any felony convictions within the past 10 years. Failing to check the appropriate box or provide necessary details if applicable can lead to issues with the application.

-

Incomplete professional credentials: Applicants often forget to include complete details of their professional credentials, such as state jurisdiction, numbers, or expiration dates. Missing information will result in those credentials not being added to the application.

Being meticulous when filling out the IRS Gov PTIN Renewal form is critical. Avoiding these mistakes not only facilitates a smoother application process but also ensures compliance with IRS requirements.

Documents used along the form

When handling the IRS Gov PTIN Renewal form, it's essential to understand the other forms and documents that often accompany this process. These forms play critical roles in ensuring comprehensive compliance and accurate submission of information to the IRS. The list below provides a snapshot of these essential documents and briefly describes their purpose.

- Form 1040 - The U.S. Individual Income Tax Return is often required for verifying personal income and tax information, fundamental for preparers who file individual tax returns.

- Form 8822 - Change of Address, is used to notify the IRS of a change in mailing or business addresses, ensuring all correspondence reaches the correct location.

- Schedule C (Form 1040) - Profit or Loss from Business is crucial for self-employed tax preparers, indicating their business income and expenses.

- Form 2848 - Power of Attorney and Declaration of Representative, allows tax professionals to represent taxpayers before the IRS, crucial for those handling clients' IRS matters.

- Form 8867 - Paid Preparer's Due Diligence Checklist, is required for preparers who claim certain credits or head of household filing status on returns they prepare.

- Form SS-4 - Application for Employer Identification Number (EIN), required for tax preparers running their business and employing other individuals.

- Form 8962 - Premium Tax Credit, is vital for preparers assisting clients with claiming premium tax credits, ensuring accurate calculation and reporting.

- Form 4506-T - Request for Transcript of Tax Return, often used by tax preparers to obtain prior year tax information for their clients, facilitating accurate current year tax preparation.

Understanding and properly managing these documents can streamline the PTIN renewal process and enhance a tax preparer's effectiveness in serving their clients. Whether it's maintaining personal compliance, managing a tax preparation business, or ensuring clients' filings are accurate and beneficial, each form serves a crucial purpose in the broader context of tax preparation responsibilities.

Similar forms

The IRS Form 1040, "U.S. Individual Income Tax Return," is closely related to the PTIN Renewal form (Form W-12) due to its relevance for tax professionals who prepare or assist in preparing federal tax returns. Similar to how Form W-12 requires personal and business information from tax preparers, Form 1040 gathers a taxpayer's income, deductions, and credits to determine their tax liability or refund. Both forms are integral to the tax filing process, with Form W-12 ensuring the preparer is authorized by the IRS, and Form 1040 serving as the primary tool for individuals filing their income taxes.

Form SS-4, "Application for Employer Identification Number (EIN)," shows similarities with the IRS PTIN Renewal form in terms of its application process for obtaining an identification number required for tax purposes. While Form W-12 allows tax preparers to obtain or renew their PTIN, Form SS-4 is used by entities to obtain an EIN necessary for business identification with the IRS. Both are foundational documents for their respective applicants, enabling them to comply with federal tax regulations.

Form 2848, "Power of Attorney and Declaration of Representative," is akin to the PTIN Renewal form because it involves authorization in the tax domain. Form 2848 is used to authorize an individual, usually a tax professional with a PTIN, to represent another person before the IRS. This connection underscores the PTIN's purpose, as it's a prerequisite for tax professionals seeking to represent clients. Both forms are pivotal in fostering trust and accountability within tax preparation and representation.

The Application for Enrollment to Practice Before the Internal Revenue Service, commonly referred to as Form 23, is another document related to the PTIN Renewal form. Form 23 is aimed at individuals seeking to become Enrolled Agents, a professional designation that allows unrestricted representation rights before the IRS. Candidates must have a valid PTIN as part of the eligibility criteria, linking both forms in the pathway to becoming a recognized tax professional capable of offering extensive services to taxpayers.

Lastly, Form 8867, "Paid Preparer's Due Diligence Checklist," though more of a compliance tool than an application form, is closely related to Form W-12. It is used by tax preparers to ensure they meet the due diligence requirements when claiming certain tax credits or deductions for their clients. The necessity of a PTIN to legally prepare federal tax returns connects Form 8867 and the PTIN Renewal form, emphasizing the professional responsibilities upheld through the PTIN system.

Dos and Don'ts

Filling out the IRS Gov PTIN Renewal form is a necessary step for tax preparers who want to stay compliant with the law and continue preparing tax returns professionally. To help you successfully complete your application or renewal, here are things you should and shouldn't do.

Things You Should Do

- Double-check all the information you provide, especially your Social Security Number (SSN) and PTIN, to ensure there are no errors. Incorrect information can delay the processing of your application.

- Provide your current mailing and email addresses to ensure you receive any communications from the IRS regarding your PTIN status without delay.

- If applicable, disclose any felony convictions within the past 10 years by checking the appropriate box and providing the required explanation. Transparency is crucial for avoiding complications with your application.

- Make sure to include the correct fee amount for your application and use a payment method acceptable to the IRS. Failing to do so can result in your application being rejected.

Things You Shouldn't Do

- Don't leave any required fields blank. If a question does not apply to you, make sure to select the "N/A" box if available. Incomplete forms may be rejected.

- Avoid using outdated or incorrect professional credentials. Only include credentials that are current and accurate to maintain the integrity of your application.

- Don't forget to sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Do not staple or otherwise attach your payment to the Form W-12. Payments should be included with, but not attached to, your application to avoid processing delays.

Misconceptions

There are several misconceptions about the IRS PTIN (Preparer Tax Identification Number) Renewal form that need to be cleared up for individuals looking to navigate the process smoothly. Understanding these nuances can help avoid common pitfalls.

Renewal Is Optional: Some may think renewing their PTIN is optional. However, it is mandatory for any tax preparer who charges for their services and wants to continue preparing federal tax returns.

SSN Disclosure: There's a misconception that individuals without a Social Security Number (SSN) cannot apply for or renew their PTIN. While you must provide an SSN if you have one, individuals without an SSN can check the N/A box, although additional documentation may be required to process the application.

Renewal Frequency: Another common belief is that PTINs are renewed on a one-time basis. In reality, PTINs must be renewed annually to remain active.

No Fee for Renewal: Contrary to what some believe, there is a renewal fee associated with the PTIN. As of the latest update, the fee is $35.95, which covers the application processing and is non-refundable.

Application Timing: A frequent misconception is that the PTIN can be renewed at any time of the year. While this was somewhat true in the past, the IRS now has a designated renewal period, typically towards the end of each calendar year.

Business Address Requirement: Some preparers think a business address is necessary to apply or renew. If your business location is the same as your personal mailing address, you can indicate this on the form without providing a separate business address.

Felony Convictions Automatically Disqualify: There's a misconception that having a felony conviction within the past 10 years automatically disqualifies you from obtaining or renewing a PTIN. While a conviction requires disclosure and may impact your application, it does not automatically disqualify you.

Understanding these key aspects of the PTIN application and renewal process can help tax preparers ensure they are in compliance with IRS requirements and avoid unnecessary delays or complications.

Key takeaways

Filling out and using the IRS Gov PTIN Renewal form, officially known as Form W-12, is an essential process for tax preparers who wish to remain compliant and authorized to prepare federal tax returns. Here are key takeaways about this process:

- Individuals applying for or renewing a Paid Preparer Tax Identification Number (PTIN) must use Form W-12, as outlined by the Internal Revenue Service (IRS).

- The application can be submitted as either an initial application or a renewal. It is important to mark the appropriate box at the beginning of the form.

- Applicants need to provide personal information, including their Social Security Number (SSN). If an applicant does not have an SSN, they must check the N/A box. Failure to provide this information will result in the rejection of the application.

- A valid mailing address is required. Applicants should use a street address unless mail is not delivered there, in which case a P.O. box is acceptable.

- For those with a business, the form requires information about the business address and whether the applicant is self-employed or holds a significant role in a tax preparation business.

- Email addresses are essential for communication regarding the PTIN application, ensuring the IRS can send relevant updates and information.

- Applicants must disclose any felony convictions within the past 10 years. Providing false information can have severe consequences, including criminal penalties.

- Form W-12 requests information about the applicant’s last filed U.S. individual income tax return, including filing status and tax year. This helps confirm the applicant’s compliance history.

- Federal Tax Compliance is verified through a question asking whether the applicant is current on both personal and business federal taxes. An explanation is required if the answer is "No."

- Data Security Responsibilities are highlighted, reminding applicants that paid tax preparers must have a data security plan to protect taxpayer information.

- Professional Credentials section allows applicants to list any relevant licenses or certifications, which must be current and not expired.

- The application fee for a PTIN is $35.95, non-refundable, required at the time of application. Payment instructions are provided on the form.

- Applicants can file the PTIN application or renewal online for immediate processing or by mail, which takes 4 to 6 weeks for processing.

- Signing the form under penalty of perjury ensures that the applicant understands the importance of providing accurate and complete information.

This comprehensive overview ensures tax preparers understand the importance and requirements of maintaining an updated PTIN through the careful completion of Form W-12.

Popular PDF Documents

Form 593 Instructions - Form 593-V is tailored for electronic funds transfer (EFT) payments, providing a seamless method for transmitting real estate withholding taxes to the state authority.

Noncash Charitable Contributions - The IRS Form 8283 is required for taxpayers who want to claim a deduction for property they have donated to a qualified organization.