Get IRS 990-PF Form

Within the complex landscape of financial reporting for non-profit organizations, the IRS 990-PF form stands out as a crucial document, particularly for private foundations. This form serves not only as a financial report but also as a tool for transparency and compliance, allowing both the IRS and the public to review an organization's activities, financials, and contribution to society over the fiscal year. It delves into the specifics of receipts, expenditures, assets, and investments, painting a comprehensive picture of a foundation's financial health and operational effectiveness. Moreover, the 990-PF includes sections on charitable distributions and activities, ensuring foundations are held accountable for their philanthropic mission. Alongside acting as a regulatory requirement, it also enables foundations to showcase their contributions to potential donors and stakeholders, aligning with broader goals of transparency and trust within the philanthropic sector. Understanding and accurately completing this form is thereby essential, not only for compliance reasons but as part of a foundation's commitment to disclosure and ethical governance.

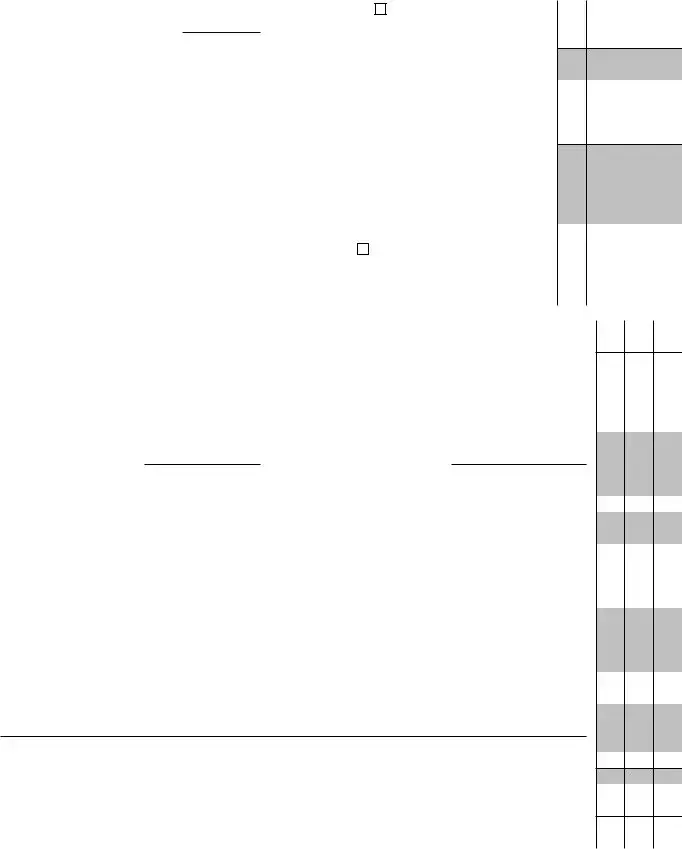

IRS 990-PF Example

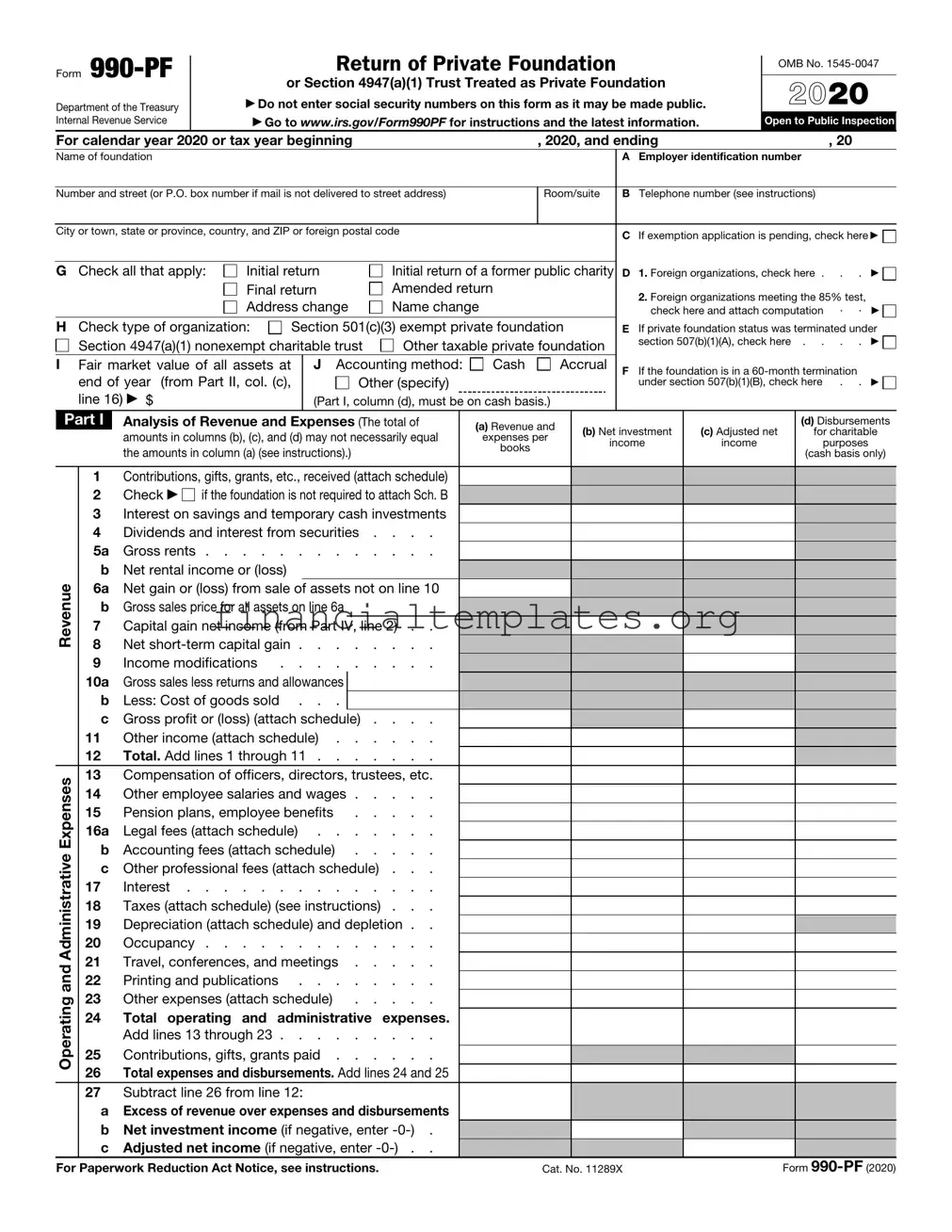

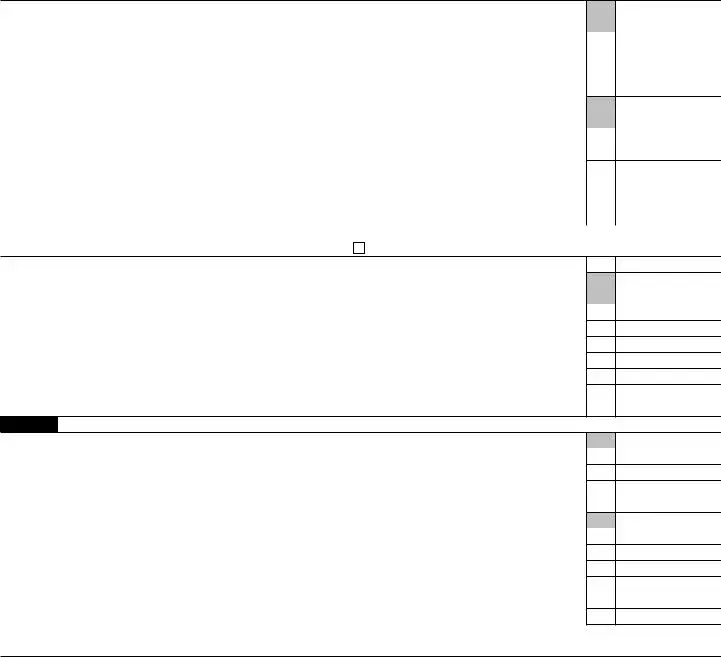

Form

Department of the Treasury Internal Revenue Service

Return of Private Foundation

or Section 4947(a)(1) Trust Treated as Private Foundation

▶Do not enter social security numbers on this form as it may be made public.

▶Go to www.irs.gov/Form990PF for instructions and the latest information.

OMB No.

2021

Open to Public Inspection

|

For calendar year 2021 or tax year beginning |

|

|

|

, 2021, and ending |

|

|

|

, 20 |

|

||||||||||||

|

Name of foundation |

|

|

|

|

|

|

|

|

|

|

|

|

A |

Employer identification number |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Number and street (or P.O. box number if mail is not delivered to street address) |

|

Room/suite |

|

B |

Telephone number (see instructions) |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

C If exemption application is pending, check here ▶ |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

G Check all that apply: |

Initial return |

Initial return of a former public charity |

D |

1. Foreign organizations, check here . |

. . |

▶ |

|||||||||||||||

|

|

|

|

|

Final return |

Amended return |

|

|

|

|

|

2. Foreign organizations meeting the 85% test, |

|

|||||||||

|

|

|

|

|

Address change |

Name change |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

check here and attach computation |

. . |

▶ |

||||||||||

|

H Check type of organization: |

Section 501(c)(3) exempt private foundation |

|

E |

If private foundation status was terminated under |

|||||||||||||||||

|

|

Section 4947(a)(1) nonexempt charitable trust |

Other taxable private foundation |

|

|

section 507(b)(1)(A), check here . . |

. . |

▶ |

||||||||||||||

|

I Fair market value of all assets at |

|

J Accounting method: |

Cash |

|

Accrual |

|

F |

If the foundation is in a |

|

||||||||||||

|

|

end of year (from Part II, col. (c), |

|

|

Other (specify) |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

under section 507(b)(1)(B), check here |

. . |

▶ |

||||||||||

|

|

line 16) ▶ $ |

|

|

|

(Part I, column (d), must be on cash basis.) |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

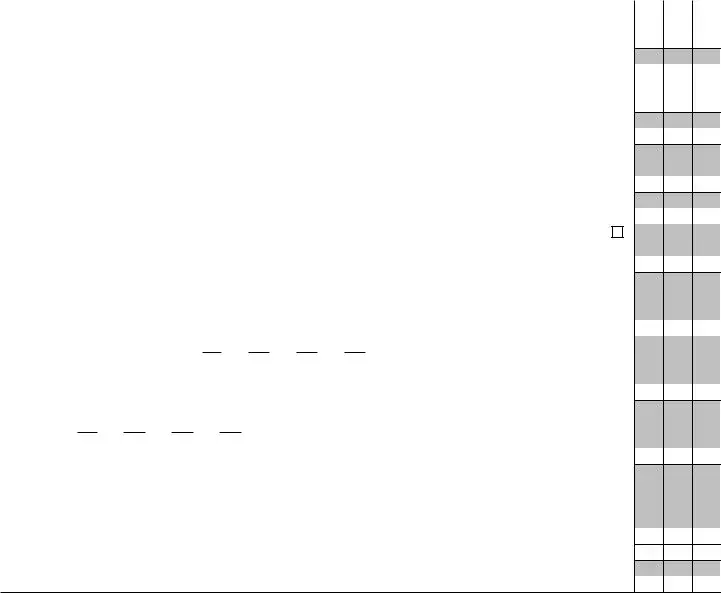

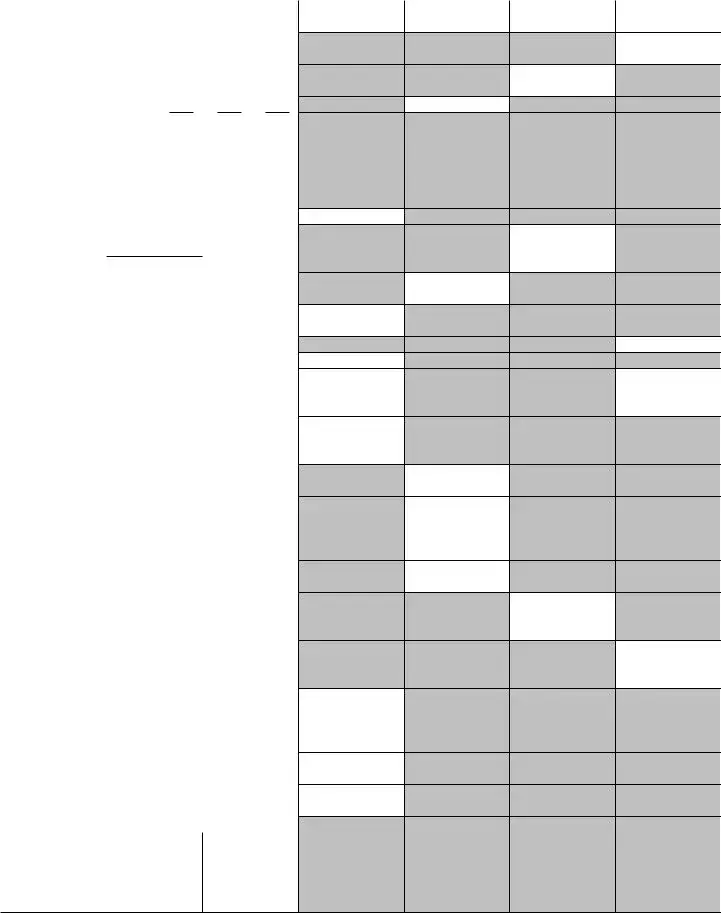

Part I |

Analysis of Revenue and Expenses (The total of |

|

(a) Revenue and |

|

(b) Net investment |

(c) Adjusted net |

|

(d) Disbursements |

|||||||||||||

|

|

|

amounts in columns (b), (c), and (d) may not necessarily equal |

|

expenses per |

|

|

for charitable |

||||||||||||||

|

|

|

|

|

|

income |

income |

|

purposes |

|

||||||||||||

|

|

|

the amounts in column (a) (see instructions).) |

|

|

books |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

(cash basis only) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

1 |

Contributions, gifts, grants, etc., received (attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

2 |

Check ▶ |

if the foundation is not required to attach Sch. B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

3 |

Interest on savings and temporary cash investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

4 |

Dividends and interest from securities . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

5a |

Gross rents |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

b |

Net rental income or (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Revenue |

6a |

Net gain or (loss) from sale of assets not on line 10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

b |

Gross sales price for all assets on line 6a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Capital gain net income (from Part IV, line 2) . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

8 |

Net |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

9 |

Income modifications |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

10a |

Gross sales less returns and allowances |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

b |

Less: Cost of goods sold . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

c |

Gross profit or (loss) (attach schedule) . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

11 |

Other income (attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

12 |

Total. Add lines 1 through 11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Expenses |

13 |

Compensation of officers, directors, trustees, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

14 |

Other employee salaries and wages |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

15 |

Pension plans, employee benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

16a |

Legal fees (attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Administrative |

b |

Accounting fees (attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

c |

Other professional fees (attach schedule) . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

17 |

Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

18 |

Taxes (attach schedule) (see instructions) . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

19 |

Depreciation (attach schedule) and depletion . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

20 |

Occupancy |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

and |

21 |

Travel, conferences, and meetings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

22 |

Printing and publications |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Operating |

23 |

Other expenses (attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

24 |

Total operating and administrative expenses. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Add lines 13 through 23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

25 |

Contributions, gifts, grants paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

26 |

Total expenses and disbursements. Add lines 24 and 25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

27 |

Subtract line 26 from line 12: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

a |

Excess of revenue over expenses and disbursements |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

b |

Net investment income (if negative, enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

c |

Adjusted net income (if negative, enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

For Paperwork Reduction Act Notice, see instructions. |

|

|

|

Cat. No. 11289X |

|

|

Form |

||||||||||||||

Form |

|

|

Page 2 |

|

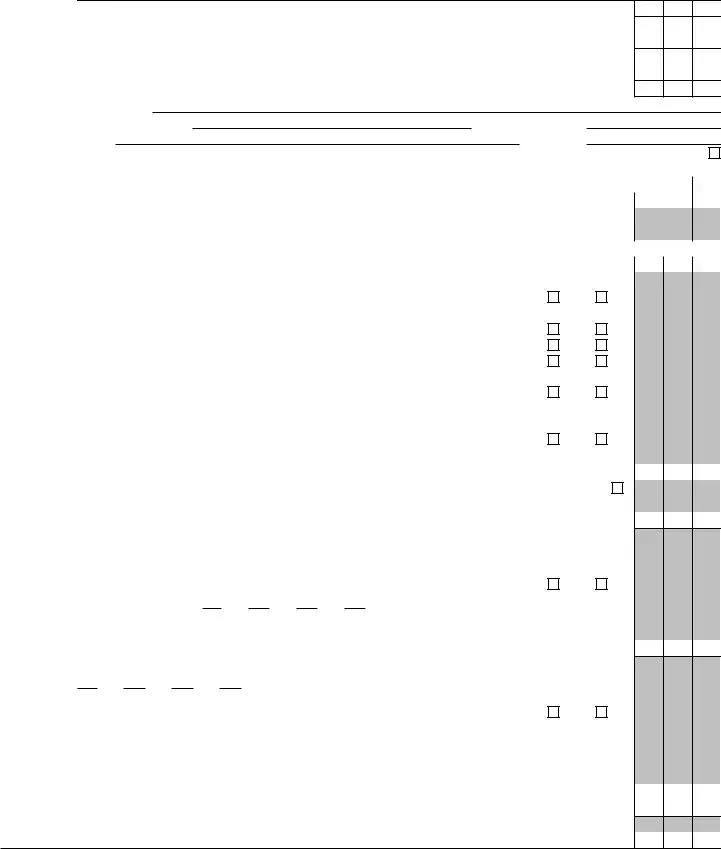

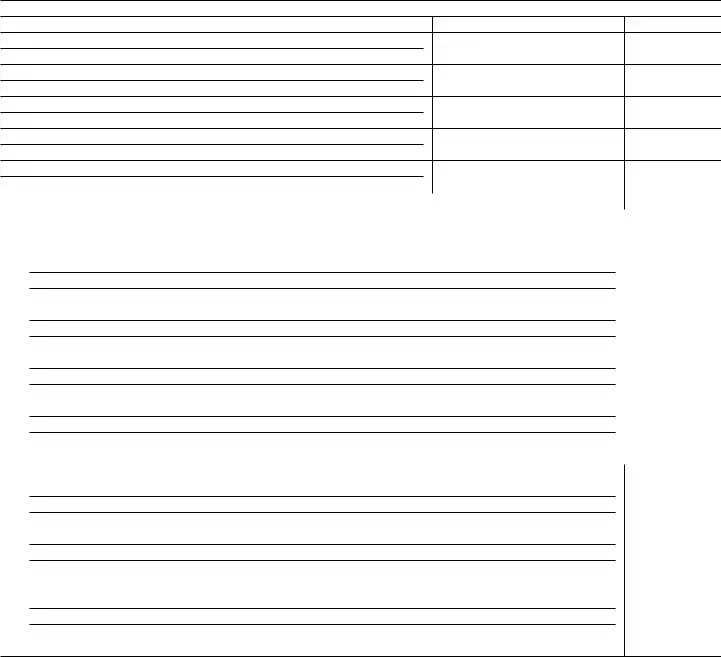

Part II |

Balance Sheets Attached schedules and amounts in the description column |

Beginning of year |

End of year |

|

|

should be for |

(a) Book Value |

(b) Book Value |

(c) Fair Market Value |

|

|

|

|

|

1 |

|

|

|

|

2 |

Savings and temporary cash investments |

|

|

|

3 |

Accounts receivable ▶ |

|

|

|

|

Less: allowance for doubtful accounts ▶ |

|

|

|

4 |

Pledges receivable ▶ |

|

|

|

|

Less: allowance for doubtful accounts ▶ |

|

|

|

5 |

Grants receivable |

|

|

|

6Receivables due from officers, directors, trustees, and other

|

|

disqualified persons (attach schedule) (see instructions) . . |

|

7 |

Other notes and loans receivable (attach schedule) ▶ |

|

|

Less: allowance for doubtful accounts ▶ |

Assets |

8 |

Inventories for sale or use |

9 |

Prepaid expenses and deferred charges |

|

10a |

b

c |

|

11 |

|

|

Less: accumulated depreciation (attach schedule) ▶ |

12

13 |

|

|

14 |

Land, buildings, and equipment: basis ▶ |

|

|

Less: accumulated depreciation (attach schedule) ▶ |

|

15 |

Other assets (describe ▶ |

) |

16Total assets (to be completed by all

|

|

instructions. Also, see page 1, item I) |

||

|

|

|

|

|

|

17 |

Accounts payable and accrued expenses |

|

|

Liabilities |

18 |

Grants payable |

|

|

19 |

Deferred revenue |

|

||

|

|

|||

|

20 |

Loans from officers, directors, trustees, and other disqualified persons |

|

|

|

21 |

Mortgages and other notes payable (attach schedule) . . . |

|

|

|

22 |

Other liabilities (describe ▶ |

) |

|

|

23 |

Total liabilities (add lines 17 through 22) |

|

|

Balances |

25 |

Foundations that follow FASB ASC 958, check here |

▶ |

|

Net assets with donor restrictions |

|

|||

|

|

and complete lines 24, 25, 29, and 30. |

|

|

|

24 |

Net assets without donor restrictions |

|

|

Fund |

|

Foundations that do not follow FASB ASC 958, check here ▶ |

|

|

|

|

|

||

|

|

and complete lines 26 through 30. |

|

|

or |

26 |

Capital stock, trust principal, or current funds |

|

|

27 |

|

|||

Assets |

|

|||

28 |

Retained earnings, accumulated income, endowment, or other funds |

|

||

|

29 |

Total net assets or fund balances (see instructions) . . . |

|

|

Net |

30 |

Total liabilities and net assets/fund balances (see |

|

|

|

instructions) |

|

||

Part III |

Analysis of Changes in Net Assets or Fund Balances |

|

||

1Total net assets or fund balances at beginning of

|

1 |

|

2 |

Enter amount from Part I, line 27a |

2 |

3 |

Other increases not included in line 2 (itemize) ▶ |

3 |

4 |

Add lines 1, 2, and 3 |

4 |

5 |

Decreases not included in line 2 (itemize) ▶ |

5 |

6 |

Total net assets or fund balances at end of year (line 4 minus line |

6 |

Form

Form |

|

|

Page 3 |

|

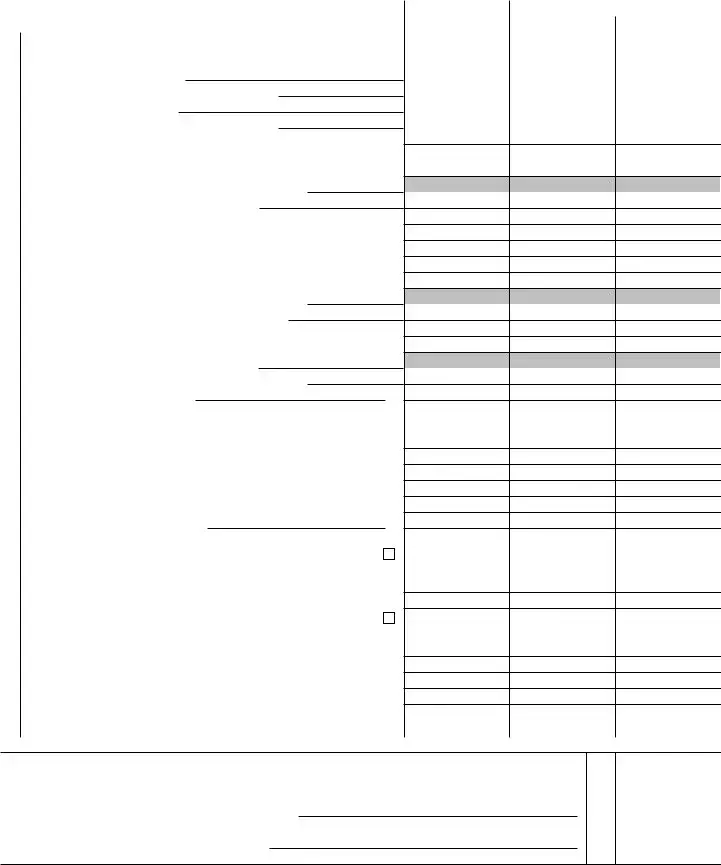

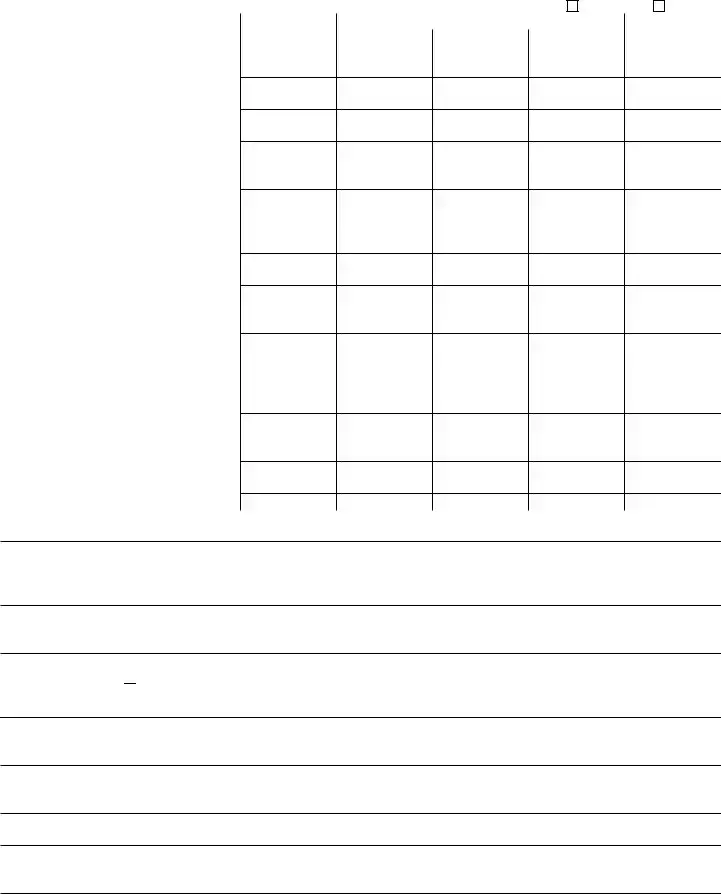

Part IV |

Capital Gains and Losses for Tax on Investment Income |

|

|

|

|

(a) List and describe the kind(s) of property sold (for example, real estate, |

(b) How acquired |

(c) Date acquired |

(d) Date sold |

|

||||

|

(mo., day, yr.) |

(mo., day, yr.) |

||

|

||||

|

|

|

|

|

1a |

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(e) Gross sales price |

(f) Depreciation allowed |

(g) Cost or other basis |

|

|

|

|

(h) Gain or (loss) |

||||

|

|

(or allowable) |

|

plus expense of sale |

|

|

|

|

((e) plus (f) minus (g)) |

||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete only for assets showing gain in column (h) and owned by the foundation on 12/31/69. |

|

|

|

(l) Gains (Col. (h) gain minus |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

(i) FMV as of 12/31/69 |

(j) Adjusted basis |

|

(k) Excess of col. (i) |

|

|

|

col. (k), but not less than |

|||||

|

|

|

|

|

|

Losses (from col. (h)) |

|||||||

|

as of 12/31/69 |

|

over col. (j), if any |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Capital gain net income or (net capital loss) { |

If gain, also enter in Part I, line 7 |

} |

|

|

|

|

|

|||||

If (loss), enter |

|

2 |

|

|

|

||||||||

3 Net |

} |

|

|

|

|

|

|||||||

|

If gain, also enter in Part I, line 8, column (c). See instructions. If (loss), enter |

|

|

|

|

|

|||||||

|

Part I, line 8 |

. . . . . . . . . . . . |

|

3 |

|

|

|

||||||

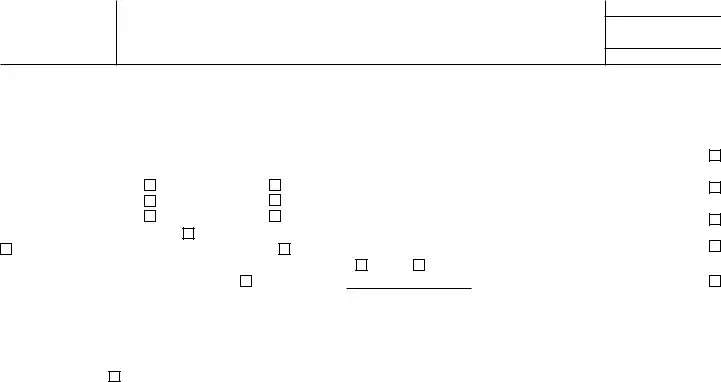

Part V |

|

Excise Tax Based on Investment Income (Section 4940(a), 4940(b), or |

|||||||||||

1a |

Exempt operating foundations described in section 4940(d)(2), check here ▶ |

and enter “N/A” on line 1. |

} |

|

|||||||||

|

Date of ruling or determination letter: |

(attach copy of letter if |

|

1 |

|||||||||

bAll other domestic foundations enter 1.39% (0.0139) of line 27b. Exempt foreign organizations,

enter 4% (0.04) of Part I, line 12, col. (b) . . . . . . . . . . . . . . . . . . .

2 |

Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only; others, enter |

2 |

3 |

Add lines 1 and 2 |

3 |

4 |

Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only; others, enter |

4 |

5 |

Tax based on investment income. Subtract line 4 from line 3. If zero or less, enter |

5 |

6Credits/Payments:

a |

2021 estimated tax payments and 2020 overpayment credited to 2021 . . |

|

6a |

|

|

|

|

|

b |

Exempt foreign |

|

6b |

|

|

|

|

|

c |

Tax paid with application for extension of time to file (Form 8868) . . . . |

|

6c |

|

|

|

|

|

d |

Backup withholding erroneously withheld |

|

6d |

|

|

|

|

|

7 |

Total credits and payments. Add lines 6a through 6d |

. . . . . . . . |

|

7 |

||||

8 |

Enter any penalty for underpayment of estimated tax. Check here |

if Form 2220 is attached |

|

|

8 |

|||

9 |

Tax due. If the total of lines 5 and 8 is more than line 7, enter amount owed |

. . . . . . . ▶ |

|

9 |

||||

10 |

Overpayment. If line 7 is more than the total of lines 5 and 8, enter the amount overpaid . . . |

▶ |

|

10 |

||||

11 |

Enter the amount of line 10 to be: Credited to 2022 estimated tax ▶ |

|

|

|

Refunded |

▶ |

11 |

|

Form

Form |

|

|

|

Page 4 |

|

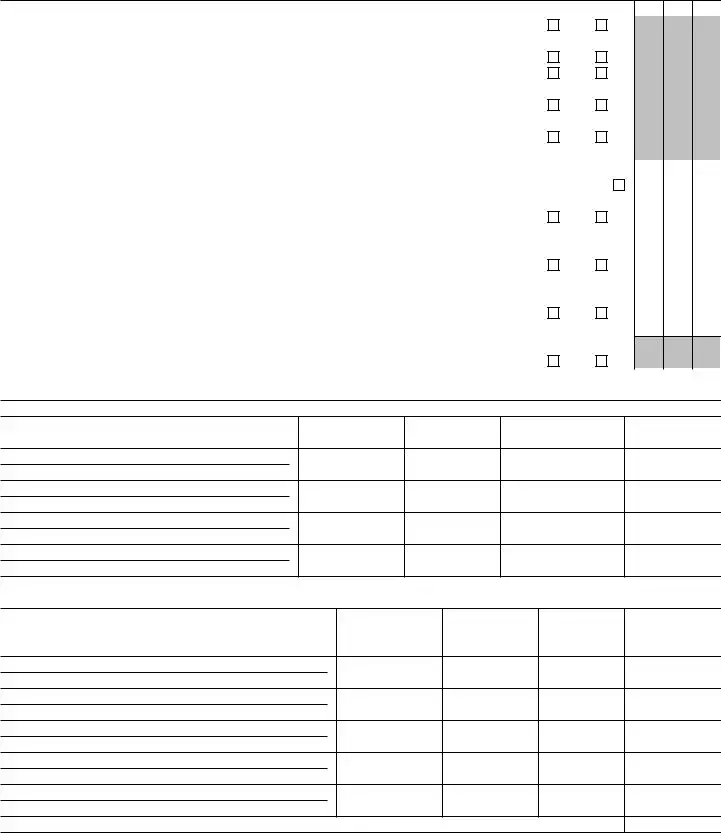

Part |

|

Statements Regarding Activities |

|

|

|

1a During |

the tax year, did the foundation attempt to influence any national, state, or local legislation or did it |

|

Yes No |

||

participate or intervene in any political campaign? |

|

1a |

|||

bDid it spend more than $100 during the year (either directly or indirectly) for political purposes? See the

instructions for the definition |

1b |

||

If the answer is “Yes” to 1a or 1b, attach a detailed description of the activities and copies of any materials |

|

|

|

published or distributed by the foundation in connection with the activities. |

|

||

c Did the foundation file Form |

|

1c |

|

d Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year: |

|

||

(1) On the foundation. ▶ $ |

(2) On foundation managers. ▶ $ |

|

|

eEnter the reimbursement (if any) paid by the foundation during the year for political expenditure tax imposed

on foundation managers. ▶ $ |

|

|

|

2 Has the foundation engaged in any activities that have not previously been reported to the IRS? . . . . |

2 |

||

If “Yes,” attach a detailed description of the activities. |

|

||

3Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles

|

of incorporation, or bylaws, or other similar instruments? If “Yes,” attach a conformed copy of the changes . |

3 |

4a |

Did the foundation have unrelated business gross income of $1,000 or more during the year? |

4a |

b |

If “Yes,” has it filed a tax return on Form |

4b |

5 |

Was there a liquidation, termination, dissolution, or substantial contraction during the year? |

5 |

|

If “Yes,” attach the statement required by General Instruction T. |

|

6Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either:

•By language in the governing instrument, or

•By state legislation that effectively amends the governing instrument so that no mandatory directions that

|

conflict with the state law remain in the governing instrument? |

6 |

7 |

Did the foundation have at least $5,000 in assets at any time during the year? If “Yes,” complete Part II, col. (c), and Part XIV |

7 |

8a |

Enter the states to which the foundation reports or with which it is registered. See instructions. ▶ |

|

bIf the answer is “Yes” to line 7, has the foundation furnished a copy of Form

(or designate) of each state as required by General Instruction G? If “No,” attach explanation |

8b |

9Is the foundation claiming status as a private operating foundation within the meaning of section 4942(j)(3) or

4942(j)(5) for calendar year 2021 or the tax year beginning in 2021? See the instructions for Part XIII. If “Yes,” |

|

complete Part XIII |

9 |

10Did any persons become substantial contributors during the tax year? If “Yes,” attach a schedule listing their

names and addresses |

10 |

11At any time during the year, did the foundation, directly or indirectly, own a controlled entity within the

meaning of section 512(b)(13)? If “Yes,” attach schedule. See instructions |

11 |

12Did the foundation make a distribution to a donor advised fund over which the foundation or a disqualified

|

person had advisory privileges? If “Yes,” attach statement. See instructions |

12 |

|

|

|||

13 |

Did the foundation comply with the public inspection requirements for its annual returns and exemption application? |

13 |

|

|

|||

|

Website address ▶ |

|

|

|

|

|

|

14 |

The books are in care of ▶ |

Telephone no. ▶ |

|

|

|

||

|

Located at ▶ |

ZIP+4 ▶ |

|

|

|

||

15 |

Section 4947(a)(1) nonexempt charitable trusts filing Form |

. . . |

▶ |

||||

|

and enter the amount of |

. . . . . ▶ |

15 |

|

|

|

|

16 |

At any time during calendar year 2021, did the foundation have an interest in or a signature or other |

authority |

|

Yes |

No |

||

|

over a bank, securities, or other financial account in a foreign country? |

|

|

|

|||

|

16 |

|

|

||||

|

See the instructions for exceptions and filing requirements for FinCEN Form 114. If “Yes,” enter the name of |

|

|

|

|||

|

the foreign country ▶ |

|

|

|

|

|

|

Form

Form |

|

|

|

Page 5 |

|

Part |

|

Statements Regarding Activities for Which Form 4720 May Be Required |

|

|

|

File Form 4720 if any item is checked in the “Yes” column, unless an exception applies. |

|

|

Yes No |

||

1a During the year, did the foundation (either directly or indirectly): |

|

|

|||

(1) Engage in the sale or exchange, or leasing of property with a disqualified person? |

1a(1) |

||||

(2)Borrow money from, lend money to, or otherwise extend credit to (or accept it from) a disqualified

|

person? |

1a(2) |

(3) |

Furnish goods, services, or facilities to (or accept them from) a disqualified person? |

1a(3) |

(4) |

Pay compensation to, or pay or reimburse the expenses of, a disqualified person? |

1a(4) |

(5)Transfer any income or assets to a disqualified person (or make any of either available for the benefit or

use of a disqualified person)? |

1a(5) |

(6)Agree to pay money or property to a government official? (Exception. Check “No” if the foundation agreed to make a grant to or to employ the official for a period after termination of government service, if

terminating within 90 days.) |

. . . . . . . . . . . . . . . . . . . . . . . . . |

1a(6) |

bIf any answer is “Yes” to

Regulations section |

. |

1b |

c Organizations relying on a current notice regarding disaster assistance, check here |

▶ |

|

dDid the foundation engage in a prior year in any of the acts described in 1a, other than excepted acts, that

were not corrected before the first day of the tax year beginning in 2021? |

1d |

2Taxes on failure to distribute income (section 4942) (does not apply for years the foundation was a private operating foundation defined in section 4942(j)(3) or 4942(j)(5)):

aAt the end of tax year 2021, did the foundation have any undistributed income (Part XII, lines 6d and 6e) for

tax year(s) beginning before 2021? . |

. . . |

. . . . . . . . . . . . . . . . . . . . |

2a |

||

If “Yes,” list the years ▶ |

20 |

, 20 |

, 20 |

, 20 |

|

bAre there any years listed in 2a for which the foundation is not applying the provisions of section 4942(a)(2)

(relating to incorrect valuation of assets) to the year’s undistributed income? (If applying section 4942(a)(2) to |

|

all years listed, answer “No” and attach |

2b |

cIf the provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here.

▶ 20 |

, 20 |

, 20 |

, 20 |

|

3a Did the foundation hold more than a 2% direct or indirect interest in any business enterprise at any time |

|

|||

during the year? |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

3a |

|

bIf “Yes,” did it have excess business holdings in 2021 as a result of (1) any purchase by the foundation or

disqualified persons after May 26, 1969; (2) the lapse of the |

|

Commissioner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequest; or (3) the lapse of |

|

the |

|

foundation had excess business holdings in 2021.) |

3b |

4a Did the foundation invest during the year any amount in a manner that would jeopardize its charitable purposes? |

4a |

bDid the foundation make any investment in a prior year (but after December 31, 1969) that could jeopardize its charitable purpose that had not been removed from jeopardy before the first day of the tax year beginning in 2021? 4b

Form

Form |

|

|

|

Page 6 |

|

Part |

|

Statements Regarding Activities for Which Form 4720 May Be Required (continued) |

|

|

|

5a During the year, did the foundation pay or incur any amount to: |

|

|

Yes No |

||

(1) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))? |

5a(1) |

||||

(2)Influence the outcome of any specific public election (see section 4955); or to carry on, directly or

indirectly, any voter registration drive? |

5a(2) |

(3) Provide a grant to an individual for travel, study, or other similar purposes? |

5a(3) |

(4)Provide a grant to an organization other than a charitable, etc., organization described in section 4945(d)

(4)(A)? See instructions |

5a(4) |

(5)Provide for any purpose other than religious, charitable, scientific, literary, or educational purposes, or for

the prevention of cruelty to children or animals? |

5a(5) |

bIf any answer is “Yes” to

in Regulations section 53.4945 or in a current notice regarding disaster assistance? See instructions |

. . |

5b |

c Organizations relying on a current notice regarding disaster assistance, check here |

▶ |

|

dIf the answer is “Yes” to question 5a(4), does the foundation claim exemption from the tax because it

|

maintained expenditure responsibility for the grant? |

|

5d |

|

If “Yes,” attach the statement required by Regulations section |

|

|

6a |

Did the foundation, during the year, receive any funds, directly or indirectly, to pay premiums on a personal |

|

|

|

benefit contract? |

|

6a |

b |

Did the foundation, during the year, pay premiums, directly or indirectly, on a personal benefit contract? . |

|

6b |

|

If “Yes” to 6b, file Form 8870. |

|

|

7a |

At any time during the tax year, was the foundation a party to a prohibited tax shelter transaction? |

|

7a |

b |

If “Yes,” did the foundation receive any proceeds or have any net income attributable to the transaction? . |

7b |

|

8Is the foundation subject to the section 4960 tax on payment(s) of more than $1,000,000 in remuneration or

excess parachute payment(s) during the year? |

8 |

|

Part VII |

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, |

|

|

and Contractors |

|

1 List all officers, directors, trustees, and foundation managers and their compensation. See instructions.

(a)Name and address

(b)Title, and average hours per week

devoted to position

(c)Compensation

(If not paid,

enter

(d)Contributions to employee benefit plans

and deferred compensation

(e)Expense account, other allowances

2Compensation of five

(a)Name and address of each employee paid more than $50,000

(b)Title, and average hours per week

devoted to position

(c)Compensation

(d)Contributions to employee benefit

plans and deferred

compensation

(e)Expense account, other allowances

Total number of other employees paid over $50,000 . . . . . . . . . . . . . . . . . . . . ▶

Form

Form |

Page 7 |

|

Part VII |

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, |

|

|

and Contractors (continued) |

|

3 Five

(a)Name and address of each person paid more than $50,000

(b)Type of service

(c)Compensation

Total number of others receiving over $50,000 for professional services |

. |

. . |

. |

. ▶ |

|

||

Part |

Summary of Direct Charitable Activities |

|

|

|

|

|

|

List the foundation’s four largest direct charitable activities during the tax year. Include relevant statistical information such as the number of |

Expenses |

||||||

organizations and other beneficiaries served, conferences convened, research papers produced, etc. |

|

|

|

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part |

Summary of |

|

|

|

|

|

|

Describe the two largest |

|

|

|

|

Amount |

||

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

All other |

|

|

|

|

|

||

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Total. Add lines 1 through 3 |

. |

. . |

. |

. ▶ |

|

||

Form

Form |

Page 8 |

|

Part IX |

Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations, |

|

|

see instructions.) |

|

1Fair market value of assets not used (or held for use) directly in carrying out charitable, etc., purposes:

a |

Average monthly fair market value of securities |

1a |

b |

Average of monthly cash balances |

1b |

c |

Fair market value of all other assets (see instructions) |

1c |

d |

Total (add lines 1a, b, and c) |

1d |

eReduction claimed for blockage or other factors reported on lines 1a and

|

1c (attach detailed explanation) |

1e |

|

|

|

2 |

Acquisition indebtedness applicable to line 1 assets |

. . . . . . . |

|

2 |

|

3 |

Subtract line 2 from line 1d |

. . . . . . . |

|

3 |

|

4Cash deemed held for charitable activities. Enter 1.5% (0.015) of line 3 (for greater amount, see

|

instructions) |

4 |

5 |

Net value of |

5 |

6 |

Minimum investment return. Enter 5% (0.05) of line 5 |

6 |

Part X Distributable Amount (see instructions) (Section 4942(j)(3) and (j)(5) private operating foundations and certain foreign organizations, check here ▶

and do not complete this part.)

and do not complete this part.)

1 |

Minimum investment return from Part IX, line 6 |

||

2a |

Tax on investment income for 2021 from Part V, line 5 |

2a |

|

b |

Income tax for 2021. (This does not include the tax from Part V.) . . . |

2b |

|

c |

Add lines 2a and 2b |

||

3 |

Distributable amount before adjustments. Subtract line 2c from line 1 |

||

4 |

Recoveries of amounts treated as qualifying distributions |

||

5 |

Add lines 3 and 4 |

||

6 |

Deduction from distributable amount (see instructions) |

||

7Distributable amount as adjusted. Subtract line 6 from line 5. Enter here and on Part XII, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part XI Qualifying Distributions (see instructions)

1

2c

3

4

5

6

7

1 Amounts paid (including administrative expenses) to accomplish charitable, etc., purposes: |

|

|

||

a |

Expenses, contributions, gifts, |

|

1a |

|

b |

1b |

|

||

2Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc.,

|

purposes |

|

2 |

|

3 |

Amounts set aside for specific charitable projects that satisfy the: |

|

|

|

a |

Suitability test (prior IRS approval required) |

|

3a |

|

b |

Cash distribution test (attach the required schedule) |

|

3b |

|

4 |

Qualifying distributions. Add lines 1a through 3b. Enter here and on Part XII, line 4 |

4 |

|

|

Form

Form |

|

|

Page 9 |

|

Part XII |

Undistributed Income (see instructions) |

|

|

|

|

(a) |

(b) |

(c) |

(d) |

|

Corpus |

Years prior to 2020 |

2020 |

2021 |

1Distributable amount for 2021 from Part X, line 7

2 Undistributed income, if any, as of the end of 2021:

a |

Enter amount for 2020 only |

||

b |

Total for prior years: 20 |

, 20 |

, 20 |

3 Excess distributions carryover, if any, to 2021:

a |

From 2016 |

|

b |

From 2017 |

|

c |

From 2018 |

|

d |

From 2019 |

|

e |

From 2020 |

|

f |

Total of lines 3a through e |

|

4Qualifying distributions for 2021 from Part XI, line 4: ▶ $

a Applied to 2020, but not more than line 2a .

bApplied to undistributed income of prior years (Election

cTreated as distributions out of corpus (Election

d Applied to 2021 distributable amount . . e Remaining amount distributed out of corpus

5Excess distributions carryover applied to 2021

(If an amount appears in column (d), the same amount must be shown in column (a).) . .

6Enter the net total of each column as indicated below:

a Corpus. Add lines 3f, 4c, and 4e. Subtract line 5

bPrior years’ undistributed income. Subtract

line 4b from line 2b . . . . . . . .

cEnter the amount of prior years’ undistributed income for which a notice of deficiency has been issued, or on which the section 4942(a) tax has been previously assessed . . . .

dSubtract line 6c from line 6b. Taxable

eUndistributed income for 2020. Subtract line

4a from line 2a. Taxable

fUndistributed income for 2021. Subtract lines 4d and 5 from line 1. This amount must be

distributed in 2022 . . . . . . . . .

7Amounts treated as distributions out of corpus to satisfy requirements imposed by section 170(b)(1)(F) or 4942(g)(3) (Election may be

8Excess distributions carryover from 2016 not applied on line 5 or line 7 (see instructions) .

9Excess distributions carryover to 2022.

|

Subtract lines 7 and 8 from line 6a . . . |

|

10 Analysis of line 9: |

||

a |

Excess from 2017 . . . . |

|

b |

Excess from 2018 . . . . |

|

c |

Excess from 2019 . . . . |

|

d |

Excess from 2020 . . . . |

|

e |

Excess from 2021 . . . . |

|

Form

Form |

|

|

|

|

|

|

Page 10 |

||

Part XIII |

Private Operating Foundations (see instructions and Part |

|

|

|

|||||

1a If the foundation has received a ruling or determination letter that it is a private operating |

|

|

|

|

|||||

|

foundation, and the ruling is effective for 2021, enter the date of the ruling . |

. . . . . ▶ |

|

|

|

|

|||

|

|

|

|

|

|||||

b Check box to indicate whether the foundation is a private operating foundation described in section |

4942(j)(3) or |

4942(j)(5) |

|||||||

2a |

Enter the lesser of the adjusted net |

Tax year |

|

Prior 3 years |

|

|

(e) Total |

||

|

income from Part I or the minimum |

|

|

|

|

|

|

||

|

(a) 2021 |

(b) 2020 |

(c) 2019 |

(d) 2018 |

|||||

|

investment return from Part IX for |

|

|||||||

|

|

|

|

|

|

|

|

||

|

each year listed |

|

|

|

|

|

|

|

|

b |

85% (0.85) of line 2a |

|

|

|

|

|

|

|

|

cQualifying distributions from Part XI, line 4, for each year listed . . . .

dAmounts included in line 2c not used directly for active conduct of exempt activities . .

eQualifying distributions made directly for active conduct of exempt activities.

Subtract line 2d from line 2c . . .

3Complete 3a, b, or c for the alternative test relied upon:

a“Assets” alternative

(1) Value of all assets . . . . .

(2)Value of assets qualifying under

section 4942(j)(3)(B)(i) . . . .

b“Endowment” alternative

Part IX, line 6, for each year listed . .

c“Support” alternative

(1)Total support other than gross investment income (interest, dividends, rents, payments on

securities loans (section 512(a)(5)), or royalties) . . . .

(2)Support from general public and 5 or more exempt organizations as provided in section 4942(j)(3)(B)(iii) . . . .

(3)Largest amount of support from

an exempt organization . . .

(4)Gross investment income . . .

Part XIV Supplementary Information (Complete this part only if the foundation had $5,000 or more in assets at any time during the

1 Information Regarding Foundation Managers:

aList any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation before the close of any tax year (but only if they have contributed more than $5,000). (See section 507(d)(2).)

bList any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the ownership of a partnership or other entity) of which the foundation has a 10% or greater interest.

2Information Regarding Contribution, Grant, Gift, Loan, Scholarship, etc., Programs:

Check here ▶  if the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds. If the foundation makes gifts, grants, etc., to individuals or organizations under other conditions, complete items 2a, b, c, and d. See instructions.

if the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds. If the foundation makes gifts, grants, etc., to individuals or organizations under other conditions, complete items 2a, b, c, and d. See instructions.

aThe name, address, and telephone number or email address of the person to whom applications should be addressed:

bThe form in which applications should be submitted and information and materials they should include:

cAny submission deadlines:

dAny restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other factors:

Form

Document Specifics

| Fact Number | Detail |

|---|---|

| 1 | The IRS 990-PF form is a tax document required for private foundations in the United States. |

| 2 | It is used annually to report a foundation's income, expenses, assets, and grants. |

| 3 | This form must be filed by tax-exempt private foundations regardless of their financial activity level. |

| 4 | The form includes sections for reporting contributions received, investments, disbursements for charitable activities, and administrative expenses. |

| 5 | IRS 990-PF helps to ensure transparency and public accountability of private foundations. |

| 6 | Failure to file the 990-PF form can result in penalties and loss of tax-exempt status. |

| 7 | The form is publicly accessible, allowing donors, researchers, and the public to view a foundation's financial activities and grantmaking. |

| 8 | There are no state-specific versions of the IRS 990-PF form; however, compliance with state reporting requirements may also be necessary. |

Guide to Writing IRS 990-PF

Filling out the IRS 990-PF form is a critical process for private foundations in the United States, ensuring they meet the Internal Revenue Service’s requirements for annual reporting. This form is designed to provide the IRS with information on the foundation's annual financial activities, including income, expenditures, and contributions given. The form’s completion aids in maintaining the organization's tax-exempt status and complying with federal regulations. The steps outlined below will guide you through filling out the form accurately.

- Begin by downloading the most current version of the IRS 990-PF form from the Internal Revenue Service website to ensure all information is up-to-date.

- Read through the form’s instructions thoroughly before starting to fill it out. The IRS provides detailed guidelines that can answer many questions you might have during the process.

- Enter the foundation's basic information, including its name, address, employer identification number (EIN), and the accounting period for which you are filing.

- Proceed to fill out the sections regarding the foundation's revenue. This includes all forms of income, such as investments, contributions received, and other sources of revenue.

- Document the foundation’s expenses meticulously. This part details how the organization used its funds over the reporting period, including grants awarded, operational expenses, and other expenditures.

- Complete the sections relating to the foundation’s assets and liabilities. This includes cash, investments, and any owed amounts at the end of the reporting period.

- Report on the foundation’s net assets or fund balances. This is a calculation of what remains after subtracting liabilities from assets.

- Fill out the analysis of income-producing activities if applicable. This section applies to foundations that receive income from activities unrelated to their exempt purposes.

- Ensure you detail the foundation's charitable activities, highlighting the grants and contributions made during the reporting period. Include recipient details and the purposes of the grants.

- Review the form thoroughly. Make sure all the information is accurate and that no required sections have been missed.

- Have the form signed by an officer of the foundation, such as the president or treasurer. An authorized signature is critical for the document’s validity.

- Save a copy of the completed form for the foundation's records before submitting it to the IRS.

- Finally, mail or electronically file the form with the IRS by the due date, which is the 15th day of the 5th month after the foundation’s accounting period ends.

The process of completing the IRS 990-PF form requires attention to detail and an understanding of the foundation’s financial activities throughout the year. By following these steps carefully, private foundations can ensure they meet federal requirements and maintain their important status as tax-exempt organizations.

Understanding IRS 990-PF

-

What is the IRS 990-PF form?

The IRS 990-PF form is a tax document filed annually by private foundations and certain non-exempt charitable trusts. It details the organization's financial activities over the past year, including grants given, investments, revenues, and expenses. This form allows the IRS and the public to evaluate the foundation's compliance with tax laws and its charitable contributions.

-

Who needs to file the IRS 990-PF form?

All 501(c)(3) private foundations, including nonexempt charitable trusts treated as private foundations, are required to file the IRS 990-PF form. This requirement applies regardless of the financial activity level; every private foundation must file it annually.

-

When is the IRS 990-PF form due?

The IRS 990-PF form is due by the 15th day of the fifth month after the end of the foundation's fiscal year. For example, if the fiscal year ends on December 31, the form must be filed by May 15 of the following year. Extensions can be requested using Form 8868, which grants an additional 6 months to file.

-

What information is required on Form 990-PF?

Form 990-PF requires detailed information about the foundation's financial activities. This includes, but is not limited to:

- Revenue and expenses for the year

- Assets and liabilities at the beginning and end of the year

- Grants and contributions made during the year

- Names and addresses of officers, directors, and trustees

- Compensation of officers, directors, and trustees

- Investment income

- Information on activities outside the United States

-

How can a foundation file the IRS 990-PF form?

The IRS 990-PF form can be filed either electronically or on paper. The IRS encourages organizations to file electronically to reduce errors and ensure faster processing. Paper filings must be sent to the IRS center designated for the foundation’s specific location. Information on electronic filing can be found on the IRS website.

-

Are there penalties for filing the IRS 990-PF form late?

Yes, foundations that file the IRS 990-PF form late may face penalties. The penalty is usually $20 per day for each day the form is late, with the maximum not exceeding the lesser of $10,000 or 5% of the foundation's gross receipts for the year. Larger foundations with gross receipts exceeding $1 million for the year can face penalties of $100 per day, up to a maximum of $50,000.

-

Can the public view a foundation's IRS 990-PF form?

Yes, the IRS 990-PF form is a public document. It can be accessed by the public to review the financial activities and grantmaking of the foundation. This transparency holds foundations accountable and allows potential donors to see where their contributions may go. Forms can typically be found on the IRS website or through various third-party organizations that compile these public records.

-

What happens if a foundation makes a mistake on the IRS 990-PF form?

If a foundation discovers an error or omission on their IRS 990-PF form after filing, it should file an amended return as soon as possible. The amended return must include all corrected information and should be clearly marked as "Amended." This proactive approach can help prevent potential penalties and ensures accurate public information.

-

Is there a way to request an extension for filing the IRS 990-PF form?

Yes, foundations needing more time to file the IRS 990-PF form can request a 6-month extension by filing Form 8868, "Application for Extension of Time To File an Exempt Organization Return," before the original due date. This extension is not automatic; approval must be granted by the IRS. Note, however, that the extension is for filing the form, not for payment of any taxes due.

-

What are the consequences of not filing the IRS 990-PF form?

Failure to file the IRS 990-PF form can have significant consequences. Beyond facing late filing penalties, an organization can lose its tax-exempt status if it fails to file for three consecutive years. Reinstating tax-exempt status after it’s been revoked is a complex and often costly process. It's crucial for foundations to file annually to maintain their compliance and uphold their commitment to transparency and accountability.

Common mistakes

-

Not providing complete information about the foundation's officers, directors, trustees, and foundation managers in Part VIIA is a common oversight. This crucial data helps the IRS understand the structure and governance of the entity.

-

Another frequent mistake is inaccurately calculating or reporting the minimum investment return in Part X. This calculation is essential for determining the foundation's distributable amount for the following year.

-

Forgetting to list all of the foundation's assets at fair market value in Part II can lead to significant discrepancies. Valuation is key to ensuring accurate reporting of the foundation’s financial status.

-

Omitting or improperly reporting contributions, grants, and gifts received during the year in Part I can significantly affect the foundation’s reported revenue and could trigger IRS scrutiny.

-

Failure to correctly report qualifying distributions in Part XII can misrepresent the foundation's compliance with its charitable distribution requirements, potentially leading to penalties.

-

Not adhering to the specific requirements about disclosing business transactions with interested persons in Part VIII is a crucial error. This transparency is critical for assessing potential conflicts of interest.

-

Incorrectly filling out the statements regarding activities not permitted for exemption in Part VII-B can put the foundation's tax-exempt status at risk. These declarations are critical for maintaining compliance with IRS regulations.

-

Failing to utilize the correct fiscal year information throughout the form can cause confusion and inaccuracies in the reported data. Consistency with the fiscal year helps in maintaining accurate financial records.

-

Overlooking the need to attach required schedules and additional statements for activities, investments, and other specific information requested throughout the form can lead to an incomplete return, necessitating further correspondence with the IRS.

Documents used along the form

The Internal Revenue Service (IRS) Form 990-PF is a tax document filed annually by private foundations in the United States. This form allows foundations to report their income, expenditures, and net assets. However, to comprehensively fulfill the reporting requirements, several other documents are often used in conjunction with the IRS 990-PF. These documents facilitate detailed financial transparency and regulatory compliance, ensuring that foundations maintain their tax-exempt status. The following list encapsulates the common forms and documents that accompany the IRS 990-PF.

- IRS Form 990-T: This form is used by tax-exempt organizations, including private foundations, to report and pay income tax on unrelated business income. It ensures that any income not directly related to the foundation's charitable purpose is properly taxed.

- IRS Form 8282: When a private foundation sells, exchanges, or otherwise disposes of charitable deduction property within three years after receiving it, this form must be filed. It alerts the IRS to any significant divergences from the initially stated intent for donated assets.

- IRS Schedule B (Form 990, 990-EZ, or 990-PF): This schedule is used to provide detailed information about donors who contribute $5,000 or more to the foundation. It supports transparency around significant contributions and conforms with federal regulations on donor disclosure.

- Grant Agreement Letters: While not a formal IRS document, grant agreement letters document the terms, conditions, and objectives of grants issued by the foundation. These agreements can be vital for audits and internal reviews, ensuring that funds are used in accordance with donor intent and regulatory standards.

- Conflict of Interest Policy: This policy document, though also not an IRS form, is critical for foundations to establish and maintain ethical standards and compliance with laws governing charitable organizations. It helps manage and disclose potential conflicts of interest among board members and staff.

- Audited Financial Statements: Prepared by an independent auditor, these statements provide a comprehensive overview of a foundation's financial health, including assets, liabilities, income, and expenses. They enhance the reliability of the financial information reported on IRS Form 990-PF.

Together, these forms and documents play essential roles in supporting the accurate and thorough reporting of a private foundation's activities and financial status to the IRS. By ensuring the proper preparation and filing of these documents, foundations can maintain compliance with IRS regulations, uphold their tax-exempt status, and foster trust among donors, beneficiaries, and the general public.

Similar forms

The IRS Form 1023 is one document that bears resemblance to the IRS 990-PF form, predominantly because it is also intricately linked with nonprofit entities. The Form 1023 is essentially the application used by organizations seeking to obtain tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. Similar to the 990-PF, which private foundations utilize to report their annual financial activities, the Form 1023 requires detailed financial information and narratives on the organization’s purpose, thereby ensuring compliance with tax-exemption requirements. Both forms serve as critical tools for the IRS to assess and confirm the nonprofit status of organizations, but from different stages of the nonprofit lifecycle.

Another document closely related to the IRS 990-PF form is the IRS 990 form. While the 990-PF is specifically for private foundations, the 990 form serves a broader category of tax-exempt organizations, including public charities and other nonprofit entities. Both forms are annual reporting requirements that provide the IRS and the public with financial information about the filing organization's operations, including revenue, expenses, and changes in net assets or fund balances. Although they cater to different types of organizations, the purpose of fostering transparency and compliance within the nonprofit sector unites them.

The IRS Form 8868 shares a functional similarity with the 990-PF in terms of its role in the filing process for tax-exempt organizations. This form is the Application for Extension of Time to File an Exempt Organization Return, utilized by nonprofits, including private foundations, when they need additional time to prepare their annual IRS filing. While the 990-PF reports the financial activities of a private foundation, the Form 8868 does not collect financial data but provides a mechanism to ensure that organizations can fulfill their reporting obligations without incurring penalties for late submission. The linkage between the two lies in the management of filing deadlines and maintaining compliance with federal reporting requirements.

The IRS Form 990-EZ stands as a simplified version of the IRS 990 form, designed for smaller tax-exempt organizations. It mirrors the IRS 990-PF in its aim to collect and report essential financial information and activities of the filing organization to the IRS and the public. However, it is tailored for organizations with gross receipts of less than $200,000 and total assets of less than $500,000. This form, while less detailed than the full IRS 990 and the 990-PF, maintains the objective of ensuring transparency and accountability among smaller nonprofits, illustrating how different forms can serve similar regulatory purposes across a spectrum of organizational sizes and complexities.

Dos and Don'ts

When filling out the IRS 990-PF form, private foundations must meticulously comply with IRS regulations to ensure accuracy and transparency in their financial reporting. Below are essential practices to follow and pitfalls to avoid during this process.

Do:

- Ensure all necessary schedules and attachments are completed and included. These documents are crucial for providing a comprehensive view of the foundation's financial activities.

- Verify the accuracy of the Employer Identification Number (EIN) and other identifying information. This is essential for the IRS to correctly process the form.

- Provide detailed descriptions and breakdowns of expenses, revenues, and contributions. Clarity and specificity give a clearer picture of the foundation's operations.

- Utilize the IRS instructions for the 990-PF form as a guide. These instructions offer valuable insights and clarifications that facilitate correct form completion.

- Report all financial activities with precision, including investments, grant distributions, and administrative expenses. Accuracy in reporting underscores the foundation's commitment to accountability.

- Sign and date the form; an unsigned form is considered incomplete and can cause delays in processing.

- Maintain a copy of the completed 990-PF form and all relevant documents for the foundation's records. This documentation is crucial for reference and potential future audits.

Don't:

- Overlook the requirement to list all officers, directors, trustees, and key employees, along with their compensation, if any. Transparency in governance and compensation is a fundamental aspect of the form.

- Miscalculate the fair market value of assets. This can lead to significant discrepancies in the financial overview of the foundation.

- Forget to detail foreign activities or grants if applicable. The IRS scrutinizes international activities closely, and accurate reporting is essential.

- Leave sections blank; if a section does not apply, mark it as "N/A" (Not Applicable). Blank sections can raise questions about the completeness of the form.

- Ignore the state filing requirements that may accompany the federal filing. Some states have specific requirements for foundations operating within their jurisdiction.

- Attempt to conceal or deliberately misreport information. Such actions can lead to penalties, audits, and damage to the foundation's reputation.

- Delay filing the form beyond the deadline to avoid penalties and possible loss of tax-exempt status. Timeliness in filing is a critical compliance aspect.

Misconceptions

Understanding the IRS 990-PF form can sometimes be complex, leading to a number of misconceptions. Here's a list of common misunderstandings and the truth behind them:

Only large foundations need to file the 990-PF: This is a misconception. In reality, most private foundations in the U.S., regardless of their size, are required to file a 990-PF form every year. This includes non-operating foundations as well as those that are actively granting funds.

990-PF form details are only for IRS use: Many people think that the information provided on the 990-PF is exclusively for IRS eyes. However, these documents are public records. This means that anyone can access them to learn about the finances and activities of a foundation.

Filing the form is solely about financial disclosure: While financial disclosure is a major part of the form, the 990-PF also includes information on grants given, trustees and officers, and the foundation's overall operations. It's a comprehensive document that provides a picture of the foundation's activities over the past year.

The 990-PF can be filed anytime during the year: Each foundation has a specific due date for filing the 990-PF, which is determined by the end of its fiscal year. Extensions can be requested, but they are not automatically granted and must be filed for separately.

Penalties for late filing aren't significant: This isn't true. Late filings can result in substantial penalties to the foundation. It's crucial to file on time or request an extension to avoid these costs.

There's no need to update information every year: The IRS requires current information. Foundations must report any changes to their status, operations, or finances annually. Using outdated information can lead to errors and potentially, penalties.

Only cash donations need to be reported: Another common misunderstanding is that only cash contributions require reporting. In reality, all donations, whether in cash, securities, or other types of assets, must be documented in the form.

Small mistakes on the form aren't a big deal: Accuracy is essential when filing the 990-PF. Even small errors can raise red flags with the IRS, leading to audits or reviews. It's important to review the form carefully before submission.

The IRS is the only entity interested in 990-PF filings: Besides the IRS, other stakeholders, including current and potential donors, watchdog organizations, and the general public, may review these filings. They provide valuable insights into the foundation's operations and financial health.

Electronic filing is optional: As of recent tax years, the IRS has mandated electronic filing for the 990-PF form for most filers. This push towards electronic filings aims to make the process more efficient and accessible.

Clearing up these misconceptions can help ensure that private foundations comply with IRS requirements and maintain transparency with the public.

Key takeaways

The IRS 990-PF form is an essential document for private foundations in the United States, required for tax reporting purposes. This form not only helps in maintaining transparency about the financial activities of a private foundation but also ensures compliance with IRS regulations. Here are key takeaways to consider when filling out and using the IRS 990-PF form:

- Understand the purpose: The IRS 990-PF form is specifically designed for private foundations to report their annual financial activities. It includes information on income, expenses, assets, and distributions to charities. Recognizing the form's purpose aids in accurate reporting and compliance.

- Know the deadlines: Timely submission is crucial. The IRS 990-PF form is due on the 15th day of the 5th month after the end of the foundation's fiscal year. Late submissions can result in penalties, emphasizing the importance of adhering to the deadline.

- Pay attention to detail: Accurate and complete information is paramount. The form requires detailed accounting of the foundation's financial activities, including grants made during the year. Ensuring accuracy prevents potential issues with the IRS and reflects well on the foundation's operational integrity.

- Maintain records: Good record-keeping practices support the accurate completion of the IRS 990-PF form. Foundations should maintain detailed records of all financial transactions, grants, and administrative expenses throughout the year to facilitate straightforward reporting.

- Understand public inspection rules: The IRS 990-PF form is a public document, and as such, it must be made available for inspection by the public upon request. Foundations should be prepared to provide access to their filed forms, reinforcing the importance of transparency and accountability in their operations.

- Seek professional advice: Given the complexities involved in tax reporting and the potential implications of inaccuracies, foundations may benefit from consulting with a tax professional or legal advisor when preparing their IRS 990-PF form. Professional guidance can help navigate the nuances of tax law and ensure compliance.

The IRS 990-PF form plays a critical role in maintaining the integrity and transparency of private foundations. By adhering to these key takeaways, foundations can ensure they meet their reporting obligations, avoid potential penalties, and maintain the trust of their stakeholders and the public.

Popular PDF Documents

What Is Form 4562 - Businesses use Form 4562 to detail amortization of expenses over time, impacting taxable income.

Are 100 Disabled Veterans Exempt From Property Taxes - Completing and submitting this form is a legal obligation for applicable businesses, integral to their operational compliance and civic duty.

IRS Schedule 3 1040 or 1040-SR - Adoptive parents will find Schedule 3 necessary for claiming the Adoption Expense Credit, helping offset the costs of adoption.