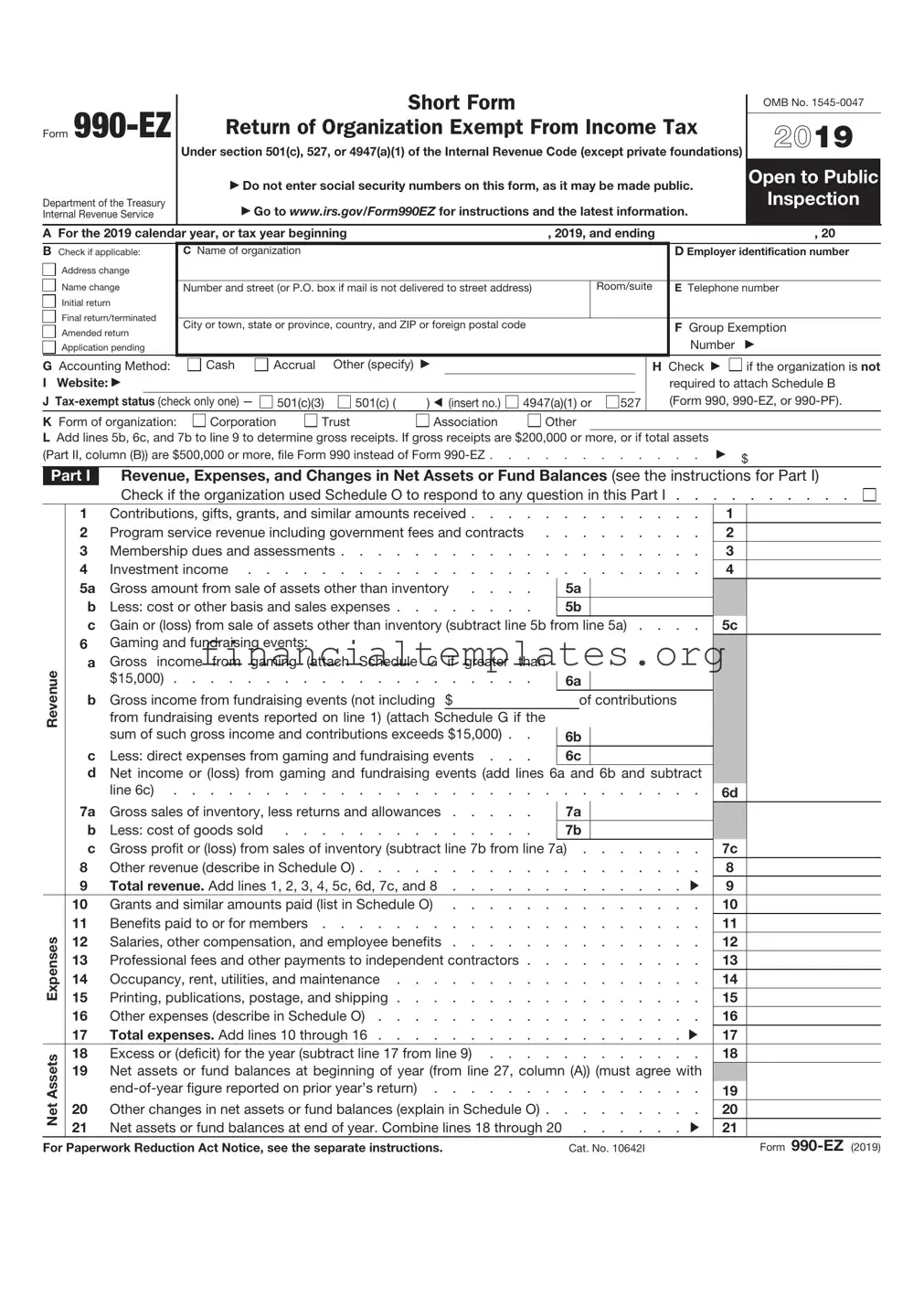

Get IRS 990-EZ Form

In the landscape of nonprofit financial reporting, the IRS 990-EZ form emerges as a crucial document, designed to streamline the annual filing process for certain charitable organizations. While its primary purpose is to allow smaller nonprofits to maintain their tax-exempt status through a simplified submission, the form also serves as a public disclosure, offering a snapshot of the organization's financial health, activities, and governance. Employing a more navigable structure than its longer counterpart, the Form 990, the 990-EZ encompasses areas such as revenue, expenses, and changes in net assets, alongside questions pertaining to organizational compliance with tax laws and regulations. This balance of brevity and detail affords smaller entities the opportunity to demonstrate transparency and accountability without the burden of more complex reporting requirements. The intricate design of the form, coupled with its implications for both the filing organization and its stakeholders, underpins its significance in the nonprofit ecosystem, providing insightful data that fuels donor confidence, informs public perception, and supports regulatory oversight.

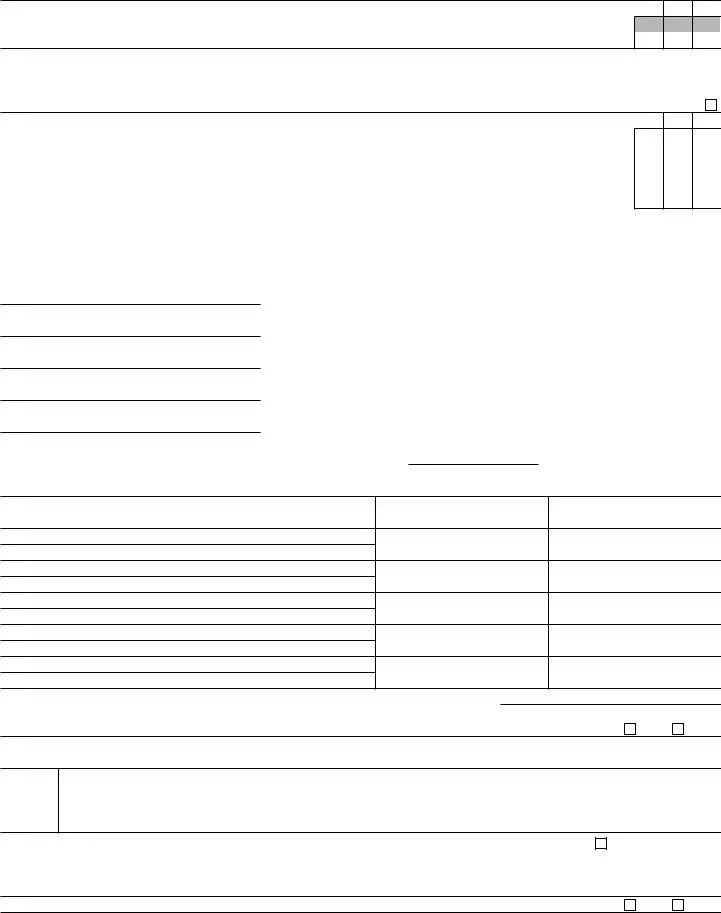

IRS 990-EZ Example

Click on the

The information provided will enable you to file a more complete return and reduce the chances the IRS will need to contact you.

Form |

Short Form |

OMB No. |

|

|

|

|

Return of Organization Exempt From Income Tax |

2021 |

|

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations) |

|

|

Open to Public |

|

|

▶ Do not enter social security numbers on this form, as it may be made public. |

|

Department of the Treasury |

▶ Go to www.irs.gov/Form990EZ for instructions and the latest information. |

Inspection |

Internal Revenue Service |

|

|

|

|

|

A For the 2021 calendar year, or tax year beginning |

, 2021, and ending |

|

|

, 20 |

|

|||

B Check if applicable: |

C Name of organization |

?? |

|

|

D Employer identification number |

?? |

||

Address change |

|

|

|

|

|

|

|

|

Name change |

Number and street (or P.O. box if mail is not delivered to street address) |

?? |

Room/suite |

E Telephone number |

|

|||

Initial return |

|

|

|

|

|

|

|

|

Final return/terminated |

City or town, state or province, country, and ZIP or foreign postal code |

|

|

F Group Exemption |

|

|||

Amended return |

|

|

|

|||||

|

|

|

|

Number |

|

|

|

|

Application pending |

|

|

|

|

▶ |

?? |

|

|

G Accounting Method: |

Cash |

Accrual |

Other (specify) |

▶ |

|

|

|

||

I Website: ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

J |

501(c)(3) |

501(c) ( |

) ◀ (insert no.) |

4947(a)(1) or |

527 |

||||

H Check ▶ |

if the organization is not |

||

required to attach Schedule B |

|

|

|

?? |

|

||

(Form 990). |

|

|

|

K Form of organization: |

Corporation |

Trust |

Association |

Other |

LAdd lines 5b, 6c, and 7b to line 9 to determine gross receipts. If gross receipts are $200,000 or more, or if total assets

(Part II, column (B)) are $500,000 or more, file Form 990 instead of Form |

▶ |

$ |

|

|

Part I Revenue, Expenses, and Changes in Net Assets or Fund Balances (see the instructions for Part I)

??

Check if the organization used Schedule O to respond to any question in this Part I . . . . . . . . . .

?? |

1 |

Contributions, gifts, grants, and similar amounts received |

. . . . . . . . |

1 |

?? |

2 |

Program service revenue including government fees and contracts . |

. . . . . . . . |

2 |

?? |

3 |

Membership dues and assessments |

. . . . . . . . |

3 |

?? |

4 |

Investment income |

. . . . . . . . |

4 |

|

5a |

Gross amount from sale of assets other than inventory . . . . |

5a |

|

|

b |

Less: cost or other basis and sales expenses |

5b |

|

|

c |

Gain or (loss) from sale of assets other than inventory (subtract line 5b from line 5a) . . . . |

5c |

|

|

6 |

Gaming and fundraising events: |

|

|

Revenue |

a |

Gross income from gaming (attach Schedule G if greater than |

|

|

|

$15,000) |

6a |

|

|

b |

Gross income from fundraising events (not including $ |

of contributions |

|

|

|

from fundraising events reported on line 1) (attach Schedule G if the |

|

|

|

|

sum of such gross income and contributions exceeds $15,000) . . |

6b |

|

|

|

|

|

||

|

c |

Less: direct expenses from gaming and fundraising events . . . |

6c |

|

dNet income or (loss) from gaming and fundraising events (add lines 6a and 6b and subtract

|

|

line 6c) |

. . . . . . . . |

6d |

|||

|

7a |

Gross sales of inventory, less returns and allowances |

7a |

|

|

|

|

|

b |

Less: cost of goods sold |

7b |

|

|

|

|

|

c |

Gross profit or (loss) from sales of inventory (subtract line 7b from line 7a) |

7c |

||||

|

8 |

Other revenue (describe in Schedule O) |

. . . . . . . . |

8 |

|||

|

9 |

Total revenue. Add lines 1, 2, 3, 4, 5c, 6d, 7c, and 8 |

. . . . . |

. |

. ▶ |

9 |

|

|

10 |

Grants and similar amounts paid (list in Schedule O) |

. . . . . . . . |

10 |

|||

|

11 |

Benefits paid to or for members |

. . . . . . . . |

11 |

|||

Expenses |

12 |

Salaries, other compensation, and employee benefits |

. . . . . . . . |

12 |

|||

|

?? |

|

|

|

|

||

13 |

Professional fees and other payments to independent contractors .?? . |

. . . . . . . . |

13 |

||||

|

|||||||

|

14 |

Occupancy, rent, utilities, and maintenance |

. . . . . . . . |

14 |

|||

|

15 |

Printing, publications, postage, and shipping |

. . . . . . . . |

15 |

|||

|

16 |

Other expenses (describe in Schedule O) |

. . . . . . . . |

16 |

|||

|

|

?? |

|

|

|

|

|

|

17 |

Total expenses. Add lines 10 through 16 |

. . . . . |

. |

. ▶ |

17 |

|

Assets |

18 |

Excess or (deficit) for the year (subtract line 17 from line 9) . . . . |

. . . . . . . . |

18 |

|||

19 |

. . . . . . . . |

19 |

|||||

|

Net assets or fund balances at beginning of year (from line 27, column (A)) (must agree with |

|

|||||

Net |

20 |

Other changes in net assets or fund balances (explain in Schedule O) . |

. . . . . . . . |

20 |

|||

21 |

Net assets or fund balances at end of year. Combine lines 18 through 20 |

. . . . |

. |

. ▶ |

21 |

||

|

|||||||

For Paperwork Reduction Act Notice, see the separate instructions. |

Cat. No. 10642I |

Form |

?? |

?? |

?? |

Form |

Page 2 |

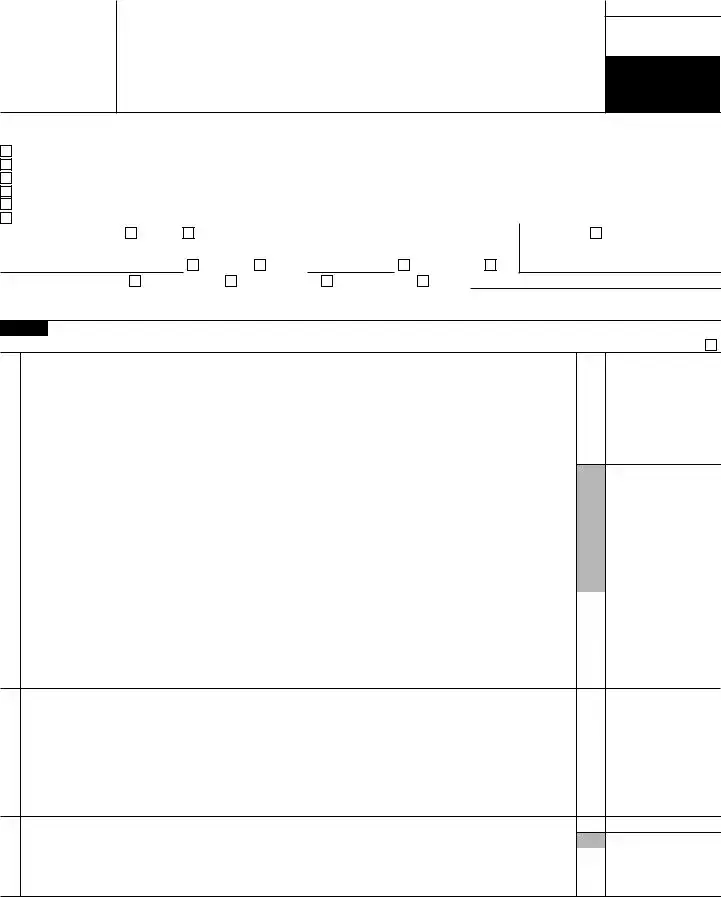

Part II Balance Sheets (see the instructions for Part II)

Check if the organization used Schedule O to respond to any question in this Part II . . . . . . . . . .

|

|

|

|

|

|

|

|

|

(A) Beginning of year |

|

(B) End of year |

||

|

|

|

|

|

|

|

|

|

|

|

|||

22 |

|

|

Cash, savings, and investments |

|

|

|

22 |

|

|||||

23 |

|

|

Land and buildings |

|

|

|

23 |

|

|||||

24 |

|

|

Other assets (describe in Schedule O) |

|

|

|

24 |

|

|||||

25 |

|

|

Total assets |

|

|

|

25 |

|

|||||

26 |

|

|

Total liabilities (describe in Schedule O) |

|

|

|

26 |

|

|||||

27 |

|

|

Net assets or fund balances (line 27 of column (B) must agree with line 21) . . |

|

|

|

27 |

|

|||||

Part III |

Statement of Program Service Accomplishments (see the instructions for |

Part III) |

|

|

|

Expenses |

|||||||

|

|

|

|

|

Check if the organization used Schedule O to respond to any question in this Part III . . |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

(Required for section |

|

What is the organization’s primary exempt purpose? |

|

|

|||||||||||

|

|

501(c)(3) and 501(c)(4) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Describe the organization’s program service accomplishments for each of its three largest program services, |

organizations; optional for |

||||||||||||

as measured by expenses. In a clear and concise manner, describe the services provided, the number of |

others.) |

||||||||||||

persons benefited, and other relevant information for each program title. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Grants $ |

) |

If this amount includes foreign grants, check here . . . . |

|

28a |

|||||||

|

?? |

|

|

▶ |

|||||||||

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

(Grants $ |

) |

If this amount includes foreign grants, check here . . . . |

▶ |

29a |

|||||

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Grants $ |

) |

If this amount includes foreign grants, check here . . . . |

▶ |

30a |

|||||

31 |

|

|

Other program services (describe in Schedule O) |

|

|

||||||||

|

|

|

(Grants $ |

) |

If this amount includes foreign grants, check here . . . . |

▶ |

31a |

||||||

32 |

|

|

Total program service expenses (add lines 28a through 31a) |

. ▶ |

32 |

||||||||

Part IV List of Officers, Directors, Trustees, and Key Employees (list each one even if not

Check if the organization used Schedule O to respond to any question in this Part IV . . . . . . . . .

|

(b) Average |

(c) Reportable |

?? |

(d) Health benefits, |

|

?? |

compensation |

|

|

||

|

|

|

|||

(a) Name and title |

hours per week |

(Forms |

|||

|

devoted to position |

|

benefit plans, and |

other compensation |

|

|

|

deferred compensation |

|

||

|

|

(if not paid, enter |

|

||

|

|

|

|

||

?? |

Form

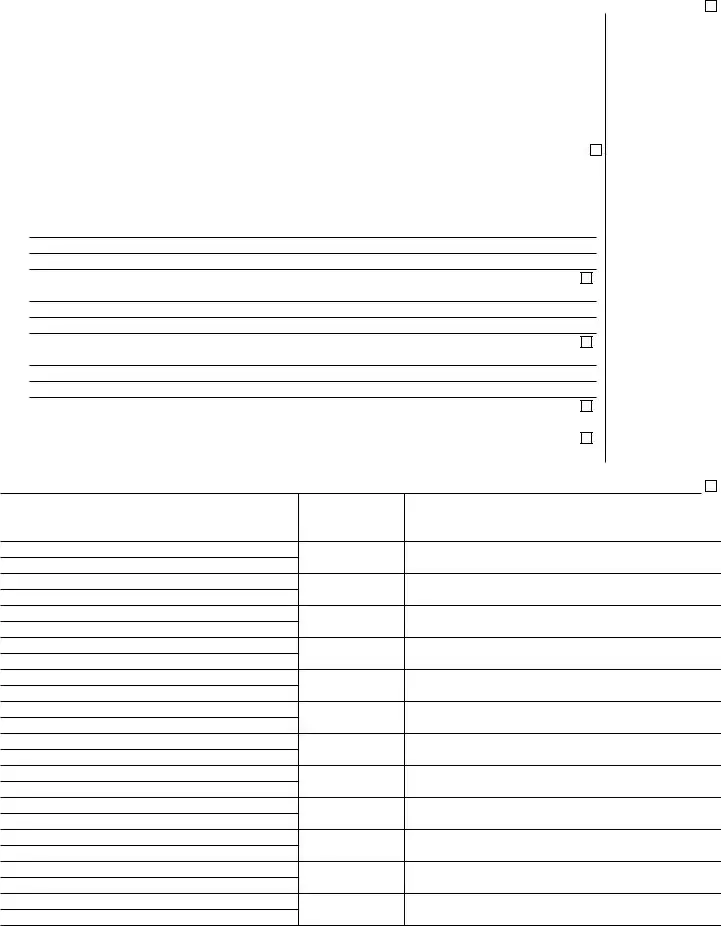

Form |

Page 3 |

|

Part V |

Other Information (Note the Schedule A and personal benefit contract statement requirements in the |

|

|

instructions for Part V.) Check if the organization used Schedule O to respond to any question in this Part V . |

|

33Did the organization engage in any significant activity not previously reported to the IRS? If “Yes,” provide a

detailed description of each activity in Schedule O . . . . . . . . . . . . . . . . . . .

?? 34 Were any significant changes made to the organizing or governing documents? If “Yes,” attach a conformed |

copy of the amended documents if they reflect a change to the organization’s name. Otherwise, explain the |

change on Schedule O. See instructions . . . . . . . . . . . . . . . . . . . . . .

35a Did the organization have unrelated business gross income of $1,000 or more during the year from business activities (such as those reported on lines 2, 6a, and 7a, among others)? . . . . . . . . . . . .

bIf “Yes” to line 35a, has the organization filed a Form

cWas the organization a section 501(c)(4), 501(c)(5), or 501(c)(6) organization subject to section 6033(e) notice, reporting, and proxy tax requirements during the year? If “Yes,” complete Schedule C, Part III . . . . .

36Did the organization undergo a liquidation, dissolution, termination, or significant disposition of net assets

during the year? If “Yes,” complete applicable parts of Schedule N . . . . . . . . . . . . .

Enter amount of political expenditures, direct or indirect, as described in the instructions ▶ 37a

Did the organization file Form

Did the organization borrow from, or make any loans to, any officer, director, trustee, or key employee; or were any such loans made in a prior year and still outstanding at the end of the tax year covered by this return? .

b |

If “Yes,” complete Schedule L, Part II, and enter the total amount involved . . . . |

38b |

|

39 |

Section 501(c)(7) organizations. Enter: |

|

|

a |

Initiation fees and capital contributions included on line 9 |

39a |

|

b |

Gross receipts, included on line 9, for public use of club facilities |

39b |

|

40a |

Section 501(c)(3) organizations. Enter amount of tax imposed on the organization during the year under: |

||

section 4911 ▶ |

; section 4912 ▶ |

; section 4955 ▶ |

bSection 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Did the organization engage in any section 4958 excess benefit transaction during the year, or did it engage in an excess benefit transaction in a prior year that has not been reported on any of its prior Forms 990 or

cSection 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912,

4955, and 4958 . . . . . . . . . . . . . . . . . . . . . . . ▶

dSection 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Enter amount of tax on line

40c reimbursed by the organization . . . . . . . . . . . . . . . . ▶

eAll organizations. At any time during the tax year, was the organization a party to a prohibited tax shelter transaction? If “Yes,” complete Form

List the states with which a copy of this return is filed ▶

Yes No

33

34

35a

35b

35c

36

37b

38a

40b

40e

??

??

??

??

|

The organization’s books are in care of ▶ |

|

Telephone no. ▶ |

|

|

|

|

|

|||

b |

Located at ▶ |

ZIP + 4 ▶ |

|

|

|

|

|

||||

At any time during the calendar year, did the organization have an interest in or a signature or other authority |

over |

|

Yes |

No |

|||||||

|

a financial account in a foreign country (such as a bank account, securities account, or other financial |

account)? |

42b |

|

|

||||||

|

If “Yes,” enter the name of the foreign country ▶ |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||

|

See the instructions for exceptions and filing requirements for FinCEN Form 114, Report of Foreign Bank and |

|

|

|

|

||||||

|

Financial Accounts (FBAR). |

|

|

|

|

|

|

|

|

||

c |

At any time during the calendar year, did the organization maintain an office outside the United States? . |

42c |

|

|

|||||||

|

If “Yes,” enter the name of the foreign country ▶ |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||||

43 |

Section 4947(a)(1) nonexempt charitable trusts filing Form |

. . . |

▶ |

||||||||

|

and enter the amount of |

. . . |

. ▶ |

|

43 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Yes |

No |

44a |

Did the organization maintain any donor advised funds during the year? If “Yes,” Form 990 must be |

|

|

|

|||||||

|

completed instead of Form |

44a |

|

||||||||

bDid the organization operate one or more hospital facilities during the year? If “Yes,” Form 990 must be

completed instead of Form |

44b |

c Did the organization receive any payments for indoor tanning services during the year? |

44c |

dIf “Yes” to line 44c, has the organization filed a Form 720 to report these payments? If “No,” provide an

explanation in Schedule O |

44d |

45a Did the organization have a controlled entity within the meaning of section 512(b)(13)? |

45a |

bDid the organization receive any payment from or engage in any transaction with a controlled entity within the meaning of section 512(b)(13)? If “Yes,” Form 990 and Schedule R may need to be completed instead of

Form |

45b |

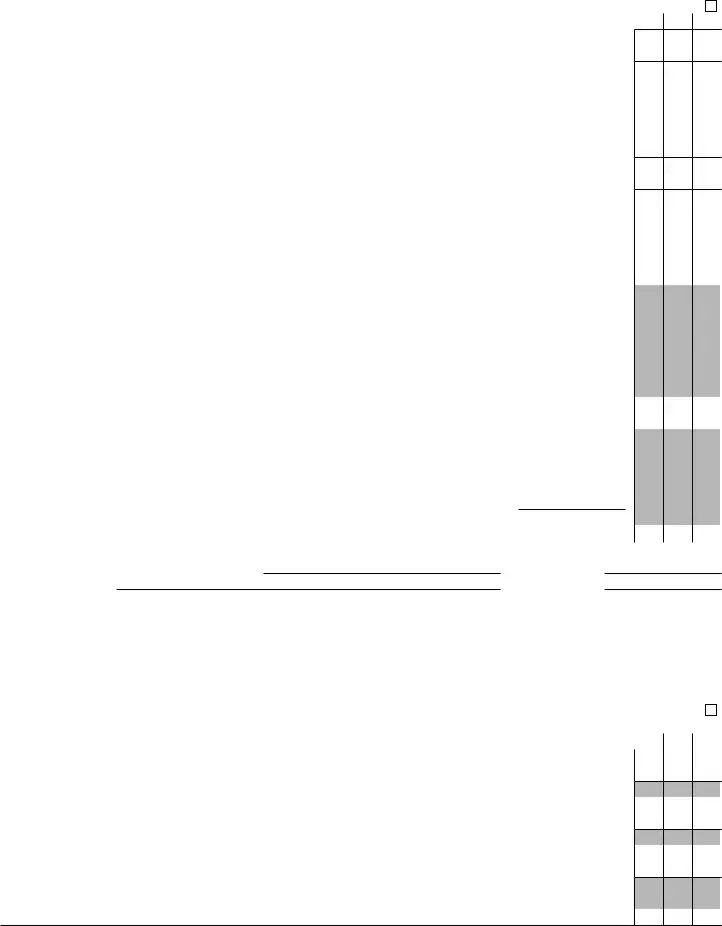

Form

Form |

Page 4 |

Yes No

46Did the organization engage, directly or indirectly, in political campaign activities on behalf of or in opposition

to candidates for public office? If “Yes,” complete Schedule C, Part I |

46 |

|

Part VI |

Section 501(c)(3) Organizations Only |

|

All section 501(c)(3) organizations must answer questions

Check if the organization used Schedule O to respond to any question in this Part VI . . . . . . . . .

Yes No

47Did the organization engage in lobbying activities or have a section 501(h) election in effect during the tax

|

year? If “Yes,” complete Schedule C, Part II |

47 |

48 |

Is the organization a school as described in section 170(b)(1)(A)(ii)? If “Yes,” complete Schedule E . . . . |

48 |

49a |

Did the organization make any transfers to an exempt |

49a |

b |

If “Yes,” was the related organization a section 527 organization? |

49b |

50Complete this table for the organization’s five highest compensated employees (other than officers, directors, trustees, and key employees) who each received more than $100,000 of compensation from the organization. If there is none, enter “None.”

|

(b) Average |

(c) Reportable |

(d) Health benefits, |

(e) Estimated amount of |

|

(a) Name and title of each employee |

compensation |

contributions to employee |

|||

hours per week |

|||||

(Forms |

benefit plans, and deferred |

other compensation |

|||

|

devoted to position |

||||

|

compensation |

|

|||

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f Total number of other employees paid over $100,000 . . . . ▶

51Complete this table for the organization’s five highest compensated independent contractors who each received more than $100,000 of compensation from the organization. If there is none, enter “None.”

(a) Name and business address of each independent contractor |

(b) Type of service |

(c) Compensation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d Total number of other independent contractors each receiving over $100,000 . . ▶

52Did the organization complete Schedule A? Note: All section 501(c)(3) organizations must attach a

completed Schedule A . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶ |

Yes |

No |

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge.

Sign |

|

▲Signature of officer |

Date |

Here |

?? |

▲Type or print name and title |

|

|

|

|

Paid |

Print/Type preparer’s name |

Preparer’s signature |

Date |

|

|

Check |

if |

PTIN |

|

|

|

|

|

|

|

|

|||

Preparer |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Use Only |

Firm’s name ▶ |

|

|

|

Firm’s EIN ▶ |

|

|

|

|

Firm’s address ▶ |

|

|

|

Phone no. |

|

|

|

||

|

|

|

|

|

|

|

|||

May the IRS discuss this return with the preparer shown above? See instructions . . . . |

. . . . . . |

▶ |

Yes |

No |

|||||

??

??

??

Form

Document Specifics

| Fact Name | Description |

|---|---|

| Eligibility Criteria | Organizations with gross receipts less than $200,000 and total assets less than $500,000 at the end of the year may file Form 990-EZ. |

| Form Purpose | Form 990-EZ is a shortened version of Form 990, intended for smaller tax-exempt organizations to report their annual financial information to the IRS. |

| Filing Deadline | Organizations must file Form 990-EZ by the 15th day of the 5th month after the organization's fiscal year ends. For example, if the fiscal year ends on December 31, the filing deadline is May 15. |

| State-Specific Forms | Some states may require organizations to file additional forms along with or instead of Form 990-EZ, depending on the state's specific regulations and the organization's activities within that state. |

Guide to Writing IRS 990-EZ

Filing the IRS 990-EZ form is a necessary step for many smaller tax-exempt organizations to ensure they maintain their status while remaining compliant with federal tax requirements. This streamlined version of the Form 990 is designed for certain charities and non-profit organizations with gross receipts of less than $200,000 and total assets less than $500,000 at the end of their tax year. The process can be straightforward if you have all your financial information at hand. Let's walk through the steps to accurately complete and submit your IRS 990-EZ form.

- Gather necessary documents, including your organization's financial statements for the year, any relevant expense reports, and records of donations received.

- Begin by entering the organization's legal name, any other names used, website, and Employer Identification Number (EIN) in the header section of the form.

- Specify the tax year for the report in the designated area at the top of the form.

- Complete Part I, Revenue, Expenses, and Changes in Net Assets or Fund Balances, by reporting your organization's revenue, expenses, and changes in net assets. Ensure that all amounts are reported accurately.

- In Part II, Balance Sheets, provide details about your organization’s assets and liabilities. This includes cash, investments, and property for assets, as well as debts and other obligations for liabilities.

- Answer the questions in Part III, Statement of Program Service Accomplishments, detailing your organization’s mission and the programs or services provided. This section helps the IRS understand what your organization does and its impact.

- Fill out Part IV, List of Officers, Directors, Trustees, and Key Employees, including all compensation, if any, paid to them during the reporting period.

- If your organization made any significant changes to its operations or structure, describe these changes in Part V, Other Information. This includes changes in articles of incorporation, bylaws, or accounting methods.

- Review the form for accuracy and completeness. Double-check all the financial information and the organization’s details to ensure everything is correct.

- Have an authorized officer of the organization sign and date the form. This verifies that all information is true, complete, and correct to the best of their knowledge.

- Finally, submit the form to the IRS by the 15th day of the 5th month after your organization's fiscal year ends. Submission can be done either electronically through an IRS approved e-file provider or via mail, depending on your preference.

Completing the IRS 990-EZ form is crucial for maintaining your organization's tax-exempt status and demonstrating transparency and accountability. By following these steps and ensuring the accuracy of the information provided, you can confidently fulfill your filing obligations.

Understanding IRS 990-EZ

-

What is the IRS 990-EZ form?

The IRS 990-EZ form is a shorter version of the IRS Form 990, designed for tax-exempt organizations to report their annual financial information. It provides the IRS and the public with a snapshot of the organization's activities, finances, and compliance with tax requirements. Organizations with gross receipts less than $200,000 and total assets less than $500,000 at the end of the year may be eligible to file this form.

-

Who is eligible to file the IRS 990-EZ form?

Eligibility to file the IRS 990-EZ form is primarily determined by an organization's gross receipts and total assets. Specifically, if an organization has gross receipts of less than $200,000 and total assets of less than $500,000 at the end of the year, it can opt to file Form 990-EZ instead of the more detailed Form 990. However, it's important for organizations to review the specific eligibility criteria each year, as requirements may change.

-

What kind of information is required on Form 990-EZ?

Form 990-EZ requires organizations to provide detailed information about their finances, operations, and compliance with certain legal and tax regulations. This includes data on sources of income, expenditures, changes in net assets, balance sheet items, information about significant activities, compliance with other IRS filings, and a list of officers, directors, and key employees. It is less comprehensive than Form 990 but still provides a thorough overview of the organization's financial health and activities.

-

When is the IRS 990-EZ form due?

The deadline for filing Form 990-EZ is the 15th day of the 5th month after the organization's fiscal year ends. For example, if an organization's fiscal year ends on December 31, the Form 990-EZ is due by May 15th of the following year. Organizations that need more time can request a 6-month extension by filing Form 8868 before the original due date.

-

Can the IRS 990-EZ form be filed electronically?

Yes, organizations can file Form 990-EZ electronically through the IRS's electronic filing system. In fact, the IRS encourages electronic filing because it's faster, more secure, and reduces the risk of errors. Some organizations may be required to file electronically depending on the volume of their returns, but all are encouraged to consider this option.

-

Is there a penalty for filing Form 990-EZ late?

Organizations that fail to file Form 990-EZ by the deadline may face penalties. The penalty is usually $20 for each day the form is late, with a maximum penalty of $10,000 or 5% of the organization's gross receipts for the year, whichever is less. However, if the organization's gross receipts exceed $1 million for the year, the penalty increases to $100 per day with a maximum of $50,000. Organizations facing reasonable causes for delay may have these penalties abated.

-

What happens if an organization files the wrong form between 990, 990-EZ, and 990-N?

If an organization mistakenly files the wrong version of the Form 990 series, the IRS may notify the organization and request the correct form. It's crucial for organizations to carefully assess their eligibility and choose the right form to avoid processing delays and potential compliance issues. If uncertain, consulting a tax professional or the IRS directly can help clarify which form is appropriate.

-

How can an organization amend a previously filed 990-EZ form?

If an organization needs to correct information on a previously filed Form 990-EZ, it can file an amended return. To do so, the organization should check the "Amended Return" box at the top of the Form 990-EZ and include all the schedules from the original filing, with corrections clearly noted. The amended return should also include a statement detailing the changes and reasons for the amendments.

-

Are there any resources available to help fill out the IRS 990-EZ form?

The IRS website offers a range of resources to assist organizations in filling out Form 990-EZ, including instructions, tips, and frequently asked questions. Additionally, many nonprofit sector professional associations and legal advisories provide guidance or services to help organizations understand and complete their filings accurately. Software solutions designed for tax preparation also support Form 990-EZ, often simplifying the process with step-by-step assistance.

-

Can an organization be exempt from filing the IRS 990-EZ form?

Certain organizations may be exempt from filing Form 990-EZ or any variant of Form 990. These typically include churches and their integrated auxiliaries, certain state institutions, and organizations covered under group exemptions. However, even exempt organizations should verify their status annually, as eligibility for exemption can change based on activities, financial thresholds, or IRS regulations.

Common mistakes

Filling out the IRS 990-EZ form can be a complicated process for many. While it's designed to be simpler than other forms, there are still common mistakes that people make during the process. These errors can lead to delays or issues with the IRS, so being aware of them is crucial. Here's an expanded look at four such errors:

-

Not Reporting All Sources of Income: Often, organizations overlook or mistakenly exclude some sources of income. Every source, including donations, fundraising event revenues, membership fees, and grants, needs to be reported. Failure to accurately report all income can lead to discrepancies that may trigger audits.

-

Incorrectly Filling Out the Expenses Section: Misclassifying expenses is a common mistake. It's vital to distinguish between program expenses, fundraising expenses, and administrative expenses accurately. The IRS scrutinizes these classifications to determine if an organization is allocating its resources appropriately in line with its mission.

-

Leaving Fields Blank: When sections applicable to the organization are left blank, it might seem like a minor oversight, but it leads to incomplete filing in the eyes of the IRS. If a particular section does not apply, it's recommended to enter "N/A" (not applicable) or "0," as appropriate, rather than leaving it blank. This practice ensures the form is fully completed and can help avoid unnecessary follow-up questions from the IRS.

-

Failing to Attach Required Schedules: The 990-EZ form may require additional schedules based on specific activities or financial situations of the organization. Not attaching required schedules or supporting documents is a mistake that can lead to the IRS considering the submission incomplete. It's important to review the form instructions carefully to identify and include all necessary attachments.

Avoiding these mistakes can make the process smoother and help ensure that the organization remains in good standing with the IRS. It's always recommended to consult with a professional if there are any uncertainties during the preparation of the form.

Documents used along the form

The IRS 990-EZ form serves a crucial role in ensuring nonprofits maintain their exempt status by reporting their annual financial information. While this form is a simplified version of the more detailed 990 form, several other documents are often prepared and filed alongside it to comply fully with federal requirements. These supporting documents provide additional, necessary detail about the organization's activities, finances, and governance.

- Schedule A (Form 990 or 990-EZ): This form is essential for organizations that claim tax-exempt status under section 501(c)(3). It requires details about the organization's public charity status and public support. It helps the IRS determine if the organization continues to meet the public support requirements.

- Schedule O (Form 990 or 990-EZ): Schedule O is used to provide the IRS with additional information about the organization’s operations that is not captured on the main form 990-EZ. This might include further explanations of the data entered in other forms, detailing governance practices, or elaborating on the nature of the organization's programs.

- Form 990-T: If a nonprofit generates income from business activities unrelated to its exempt purposes (unrelated business income), it must file Form 990-T in addition to the 990-EZ. This form is used to report unrelated business income and calculate any tax owed on that income.

- Form 8868: This is an application for Extension of Time To File an Exempt Organization Return. Nonprofits finding themselves unable to meet the filing deadline for their 990-EZ can use this form to request an automatic 6-month extension, ensuring they avoid penalties for late filing.

Understanding and preparing these forms in conjunction with the IRS 990-EZ requires meticulous attention to the nonprofit's financial activities and a clear grasp of federal tax requirements. While the process can be complex, proper preparation and filing of these forms ensure that nonprofits can continue to operate and serve their communities without jeopardizing their tax-exempt status.

Similar forms

The IRS Form 1023 is closely related to the IRS 990-EZ form, as they both play crucial roles for non-profit organizations. While the 990-EZ form is used annually by small to medium-sized tax-exempt organizations to report their income, expenses, and activities to the IRS, Form 1023 is the application used by organizations to obtain the status of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Essentially, while Form 1023 is the starting point for non-profits seeking tax exemption, the 990-EZ form ensures compliance with ongoing tax-exempt reporting requirements.

Similar to the IRS 990-EZ form, the IRS Form 990 serves as an annual reporting requirement, but it is specifically designed for larger tax-exempt organizations. The Form 990 requires a more detailed account of an organization's financial activities, governance, and operational practices. While the 990-EZ form provides a simplified reporting option for smaller organizations, the detailed disclosures in Form 990 cater to stakeholders who may require a comprehensive understanding of an organization's financial health and operations.

The IRS Form 990-N, also known as the e-Postcard, presents another parallel to the IRS 990-EZ form. This form is designed for the smallest of tax-exempt organizations, those with annual gross receipts normally $50,000 or less. The 990-N is much simpler and is filed electronically; it requires only basic information about the organization. While the 990-EZ offers a more detailed snapshot suitable for small to medium-sized organizations, the 990-N ensures that even the smallest entities comply with IRS reporting standards in a streamlined manner.

The IRS Form 990-PF is a variant of the standard reporting forms and is akin to the 990-EZ form in its function for a specific subset of tax-exempt organizations—private foundations. The 990-PF form collects detailed information about charitable distributions, financial status, and operations of private foundations. It parallels the 990-EZ in its annual reporting requirement but is tailored to the unique transparency needs and regulatory requirements of private foundations.

Similarly, the IRS Form 8868 is associated with the IRS 990-EZ form through its function of providing additional time for tax-exempt organizations to file their returns. While not a reporting form itself, Form 8868 is used to request an automatic 6-month extension for filing forms such as the 990, 990-EZ, and 990-PF. It acknowledges the complexities and challenges organizations may face in gathering the required information by the original deadline, offering a critical link in ensuring compliance without penalty.

The Schedule A form is an attachment to the IRS Form 990 or 990-EZ and shares a connection through its role in providing more detailed information about an organization's public charity status and public support. It requires organizations to substantiate their public support over a five-year period, ensuring they meet certain criteria to maintain their tax-exempt status. The Schedule A form complements the information provided on the 990-EZ by focusing on the nuances of public charity status, which is essential for organizations to demonstrate compliance with tax exemption qualifications.

Dos and Don'ts

Filing the IRS 990-EZ form is an essential process for many nonprofit organizations, ensuring compliance with federal regulations and maintaining their tax-exempt status. When completing this form, attention to detail and adherence to IRS instructions are vital. Here's a handy guide to help navigate what you should and shouldn't do during this process.

Things You Should Do

- Ensure your organization qualifies to file the 990-EZ form. It's designed for smaller nonprofits, so check the IRS criteria to confirm eligibility.

- Provide accurate information about your organization's revenue, expenses, and activities. Inaccurate reporting can lead to penalties or audits.

- Review the form instructions carefully. The IRS provides detailed guidelines to help you fill out the form correctly.

- Use the correct tax year. Nonprofits can operate on a different fiscal year than the calendar year, so ensure the form corresponds to the correct period.

- Sign and date the form. An unsigned form is not valid and will be returned, potentially leading to late filing penalties.

- Keep a copy of the filed form and all relevant documentation for at least three years. This documentation can be crucial if your organization is selected for an audit.

- Check the IRS website for the latest version of the form. The IRS occasionally updates forms and their instructions.

- Consider electronic filing. The IRS encourages electronic filing because it's faster and more secure than paper filing.

- Verify all mathematical computations. Errors in calculations can cause delays or trigger an IRS inquiry.

- Seek professional advice if needed. If certain sections of the form are confusing, consulting with a tax professional familiar with nonprofit regulations can be beneficial.

Things You Shouldn't Do

- Do not leave required fields blank. If a section does not apply, enter "N/A" or "0," as appropriate.

- Do not guess or estimate financial figures. Use actual numbers from your organization's financial records.

- Do not ignore the form's instructions. Each question and section has specific instructions that can help avoid common mistakes.

- Do not file late. Late filing can result in penalties and may jeopardize your organization's tax-exempt status.

- Do not forget to update your address or contact information with the IRS if it has changed.

- Do not use the form to report changes in your organization's structure or activities. Use the appropriate IRS process for reporting significant changes.

- Do not attempt to hide or manipulate financial information. Transparency is crucial for maintaining your organization's integrity and tax-exempt status.

- Do not neglect state filing requirements. Some states have separate filing requirements for nonprofit organizations.

- Do not overlook the need to attach schedules or additional information as required by the form.

- Do not submit the form without reviewing it for completeness and accuracy. A final review can catch errors that might have been missed.

Correctly filing the IRS 990-EZ form is an important responsibility that helps maintain your organization's compliance and supports its mission. By following these guidelines, you can smooth the process and avoid potential pitfalls.

Misconceptions

Many organizations, especially smaller nonprofits, may misunderstand the complexity and requirements of the IRS 990-EZ form. Clarifying these misconceptions is crucial for compliance and the accurate representation of an organization's financial health.

All nonprofits can file the 990-EZ form. In reality, only those with gross receipts less than $200,000 and total assets less than $500,000 at the end of the year are eligible. Organizations exceeding these thresholds must file Form 990, while those with gross receipts normally <$50,000 file Form 990-N (e-Postcard).

Filing the 990-EZ form is optional. This is a common misconception. Eligible nonprofits are required to file annually. Failure to file for three consecutive years will result in the automatic revocation of tax-exempt status by the IRS.

The 990-EZ form is just a simple financial summary. While less detailed than Form 990, the 990-EZ requires significant information on an organization's programs, revenue, expenses, and changes in net assets. It demands accuracy and transparency about the nonprofit's activities and financial situation.

There's no need for detailed records if you file the 990-EZ. Even though the form is "simpler," maintaining comprehensive records is essential. These records support the information reported on the form, ensure compliance, and prepare organizations for potential audits.

The IRS automatically notifies organizations if they're eligible for the 990-EZ. It's the organization's responsibility to determine which form they are eligible to file based on their financial thresholds. Reliance on IRS for this guidance can lead to compliance issues or missed filing opportunities.

Understanding these misconceptions about the IRS 990-EZ form helps organizations ensure they remain in good standing and maintain their tax-exempt status, while contributing to the transparency and accountability that donors expect.

Key takeaways

The IRS 990-EZ form is a streamlined version of the more comprehensive Form 990. It is tailored for smaller tax-exempt organizations to ease their annual reporting requirements. Below are key takeaways for properly filling out and utilizing the IRS 990-EZ form:

- Eligibility: Organizations with gross receipts less than $200,000 and total assets less than $500,000 at the end of the year may use Form 990-EZ. This criterion helps determine whether the simplified form can be used instead of the full Form 990.

- Accuracy is crucial: Ensure all information provided on Form 990-EZ is accurate and complete. Inaccuracies can lead to penalties or further scrutiny from the IRS.

- Revenue and Expense Reporting: Organizations must report all sources of income and expenses, categorized properly to reflect the nature of the transactions accurately.

- Statement of Program Service Accomplishments: Section III requires a description of the organization's mission and a detailed account of its program services, emphasizing achievements and expenditures.

- Supplemental Information: Additional schedules may need to be filed along with Form 990-EZ to provide further details about the organization’s activities, finances, and governance practices.

- Public Inspection: Remember that Form 990-EZ is a public document. Information provided on the form will be available to the public, highlighting the importance of maintaining transparency and protecting sensitive information as appropriate.

- Filing Deadline: The form is due on the 15th day of the 5th month after the organization's fiscal year ends. If needed, organizations can request a six-month extension by filing Form 8868 before the initial due date.

- Electronic Filing: The IRS encourages organizations to file Form 990-EZ electronically to speed up the processing time and reduce errors that can occur with paper filing.

- Signatures: Form 990-EZ must be signed by an officer of the organization, such as the president, vice president, treasurer, assistant treasurer, chief accounting officer, or other authorized officer.

- Penalties: Failing to file, filing late, or not providing complete information can result in penalties. It is important to adhere to filing requirements and deadlines to avoid potential fines.

Compliance with the IRS by properly completing and filing Form 990-EZ is essential for maintaining tax-exempt status and demonstrating accountability and transparency to the public.

Popular PDF Documents

Irs Tax Lien - The process guided by Form 12277 involves providing proof of tax lien satisfaction and reasons for the withdrawal request.

Nc Poa - The document can be revoked at any time by the taxpayer, ensuring flexibility and control over their tax affairs.