Get IRS 966 Form

Filing important documents with the Internal Revenue Service (IRS) is a crucial task for corporations, especially when it comes to significant changes in their structure or operations. Among the various forms that need to be navigated, the IRS 966 form holds a special place. This form, which is officially titled "Corporate Dissolution or Liquidation," is used by a corporation to report a resolution or plan to dissolve the corporation or liquidate any of its stock. The necessity for this form arises at a pivotal moment in a corporation's lifecycle, often marking the end of its business activities or a major restructuring. Completing and submitting this form correctly is not just about adhering to regulations; it also ensures that the dissolution process is acknowledged by the IRS, potentially affecting future tax obligations and filings. Understanding when and how to file IRS 966 is essential for any corporation looking to navigate this process smoothly, highlighting the importance of being well-informed about the procedural steps, deadlines, and documentation requirements involved.

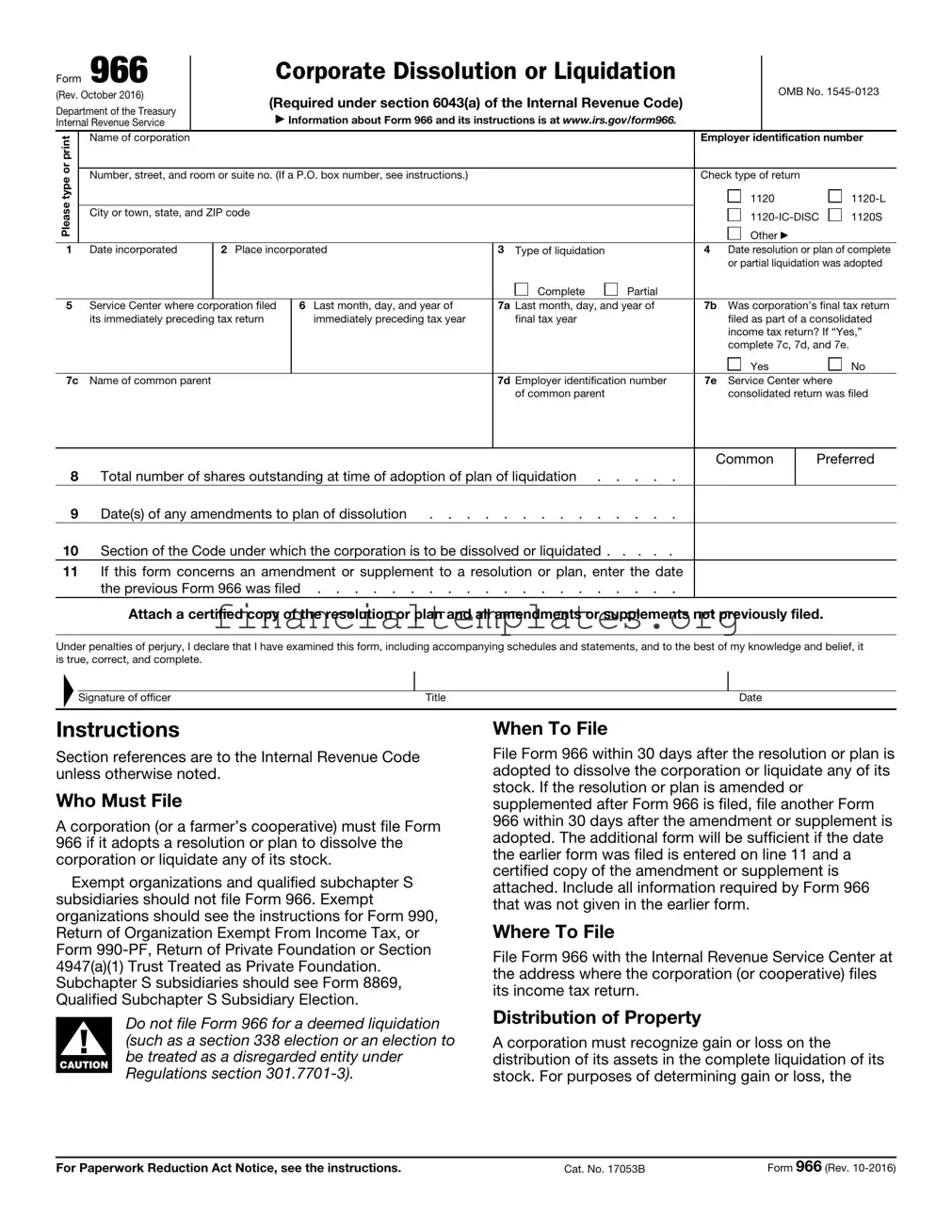

IRS 966 Example

|

Form |

966 |

|

|

Corporate Dissolution or Liquidation |

|

OMB No. |

|||||||

|

|

|

|

|||||||||||

|

(Rev. October 2016) |

|

|

(Required under section 6043(a) of the Internal Revenue Code) |

|

|||||||||

|

Department of the Treasury |

|

|

|

|

|

|

|

||||||

|

|

|

▶ Information about Form 966 and its instructions is at www.irs.gov/form966. |

|

|

|

|

|

||||||

|

Internal Revenue Service |

|

|

|

|

|

|

|

||||||

|

or print |

|

Name of corporation |

|

|

|

|

|

|

Employer |

identification number |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number, street, and room or suite no. (If a P.O. box number, see instructions.) |

|

|

Check type of return |

|

|

||||||||

|

type |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

1120 |

|

|

|||

|

Please |

|

|

|

|

|

|

|

|

|

|

|||

|

|

City or town, state, and ZIP code |

|

|

|

|

1120S |

|||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Other ▶ |

|

|

||

|

1 |

|

Date incorporated |

2 Place incorporated |

3 Type of liquidation |

|

4 Date resolution or plan of complete |

|||||||

|

|

|

|

|

|

|

|

|

|

or partial liquidation was adopted |

||||

|

|

|

|

|

|

|

|

Complete |

Partial |

|

|

|

|

|

|

5 |

|

Service Center where corporation filed |

6 Last month, day, and year of |

7a Last month, day, and year of |

7b Was corporation’s final tax return |

||||||||

|

|

|

its immediately preceding tax return |

|

immediately preceding tax year |

final tax year |

|

filed as part of a consolidated |

||||||

|

|

|

|

|

|

|

|

|

|

income tax return? If “Yes,” |

||||

|

|

|

|

|

|

|

|

|

|

complete 7c, 7d, and 7e. |

|

|||

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

||

|

7c |

Name of common parent |

|

|

|

7d Employer identification number |

7e Service Center where |

|

||||||

|

|

|

|

|

|

|

|

of common parent |

|

consolidated return was filed |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Common |

|

Preferred |

||

|

8 |

|

Total number of shares outstanding at time of adoption of plan of liquidation |

|

|

|

|

|

||||||

9 |

|

Date(s) of any amendments to plan of dissolution |

|

|

|

|

|

|||||||

|

10 Section of the Code under which the corporation is to be dissolved or liquidated |

|

|

|

|

|

||||||||

|

11 If this form concerns an amendment or supplement to a resolution or plan, enter the date |

|

|

|

|

|

||||||||

|

|

|

the previous Form 966 was filed |

|

|

|

|

|

||||||

|

|

|

Attach a certified copy of the resolution or plan and all amendments or supplements not previously filed. |

|

||||||||||

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

▲ |

|

Signature of officer |

Title |

Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Who Must File

A corporation (or a farmer’s cooperative) must file Form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock.

Exempt organizations and qualified subchapter S subsidiaries should not file Form 966. Exempt organizations should see the instructions for Form 990, Return of Organization Exempt From Income Tax, or Form

! |

Do not file Form 966 for a deemed liquidation |

(such as a section 338 election or an election to |

▲ be treated as a disregarded entity under |

|

CAUTION |

Regulations section |

|

|

Date

When To File

File Form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. If the resolution or plan is amended or supplemented after Form 966 is filed, file another Form 966 within 30 days after the amendment or supplement is adopted. The additional form will be sufficient if the date the earlier form was filed is entered on line 11 and a certified copy of the amendment or supplement is attached. Include all information required by Form 966 that was not given in the earlier form.

Where To File

File Form 966 with the Internal Revenue Service Center at the address where the corporation (or cooperative) files its income tax return.

Distribution of Property

A corporation must recognize gain or loss on the distribution of its assets in the complete liquidation of its stock. For purposes of determining gain or loss, the

For Paperwork Reduction Act Notice, see the instructions. |

Cat. No. 17053B |

Form 966 (Rev. |

Form 966 (Rev. |

Page 2 |

distributed assets are valued at fair market value. Exceptions to this rule apply to a liquidation of a subsidiary and to a distribution that is made according to a plan of reorganization.

Foreign Corporations

A corporation that files a U.S. tax return must file Form 966 if required under section 6043(a). Foreign corporations that are not required to file Form

U.S. shareholders of foreign corporations may be required to report information regarding a corporate dissolution or liquidation. See Form 5471, Information Return of U.S. Persons With Respect To Certain Foreign Corporations, and its instructions for more information.

Address

Include the suite, room, or other unit number after the street address. If the post office does not deliver mail to the street address and the corporation has a P.O. box, enter the box number instead.

Line 5

If the immediately preceding tax return was filed electronically, enter

Line 7e

If the consolidated return was filed electronically, enter

Line 10

Identify the code section under which the corporation is to be dissolved or liquidated. For example, enter “section 331” for a complete or partial liquidation of a corporation or enter “section 332” for a complete liquidation of a subsidiary corporation that meets the requirements of section 332(b).

Signature

The return must be signed and dated by the president, vice president, treasurer, assistant treasurer, chief accounting officer, or any other corporate officer (such as tax officer) authorized to sign. If a return is filed on behalf of a corporation by a receiver, trustee, or assignee, the fiduciary must sign the return, instead of the corporate officer.

Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for business taxpayers filing this form is approved under OMB control number

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/formspubs/. Click on “More Information” and then on “Give us feedback.” Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW,

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 966 | The IRS Form 966 is required to be filed by a corporation when it undergoes a dissolution or liquidation. |

| Who Must File | Any corporation that decides to dissolve or liquidate must file Form 966. |

| Filing Deadline | The form must be filed within 30 days after the resolution or plan of dissolution or liquidation is adopted. |

| Required Information | Form 966 requires information about the corporation, including the date of incorporation, the reason for filing, and details about the resolution or plan of dissolution or liquidation. |

| Consequences of Not Filing | Failure to file Form 966 can result in penalties for the corporation, complicating its legal and financial processes of dissolution. |

| Governing Law | This form is governed by federal law, as it is a requirement of the Internal Revenue Service (IRS), which is a federal agency. |

Guide to Writing IRS 966

Filling out Form 966 is a crucial step for corporations undergoing significant changes, such as dissolution or liquidation. This form informs the Internal Revenue Service (IRS) about a company's resolution to dissolve, allowing them to ensure all tax obligations are properly handled. It's essential to complete this form accurately to avoid potential legal and financial complications. The following step-by-step instructions are designed to guide you through the process, ensuring clarity and compliance with IRS requirements.

- Start by gathering all necessary information, including the corporation's Employer Identification Number (EIN), the date of incorporation, and the exact name and address as registered with the IRS.

- Access the IRS 966 form directly from the IRS website. Ensure you are using the latest version of the form for the current tax year.

- Enter the corporation's EIN in the designated field at the top of the form.

- Fill in the corporate name and address in the corresponding fields, making sure they match the information the IRS has on file.

- Specify the type of return the corporation will file for its final tax year in the section provided.

- Input the date of the resolution or plan of liquidation. If there have been multiple resolutions or plans, include the dates of each, adhering to the form's instructions for listing these dates.

- Detail the nature of the resolution or plan in the appropriate area of the form. This description should briefly outline the action taken by the corporation, such as dissolution or complete liquidation.

- If available, attach a copy of the resolution or plan of liquidation. This can be crucial for providing the IRS with a clear understanding of the corporation's intentions and actions.

- Review all information entered on Form 966 for accuracy and completeness. Errors or omissions can lead to processing delays or scrutiny from the IRS.

- Sign and date the form. The signature must be that of an authorized officer of the corporation. By signing, they certify that the information provided is accurate to the best of their knowledge.

- Mail the completed Form 966 to the appropriate IRS office. The address can vary, so consult the form's instructions or the IRS website to find the correct mailing address for your specific circumstances.

After submitting Form 966, it's advisable for corporations to keep a copy of the form and any attached documents for their records. This will help with future reference and in the event the IRS has questions or requires additional information. Completing Form 966 is a straightforward process when approached with care and attention to detail, paving the way for a smoother transition during corporate changes.

Understanding IRS 966

-

What is the IRS Form 966?

IRS Form 966, also known as the "Corporate Dissolution or Liquidation" form, is used by corporations to inform the Internal Revenue Service (IRS) when they decide to dissolve or liquidate. Whether the decision comes from a board of directors' resolution or shareholders’ consent, filing this form is a critical step in finalizing the closure of a corporation.

-

Who needs to file IRS Form 966?

Any corporation that is undergoing dissolution, complete liquidation, or redemption of all its stock must file Form 966. This requirement applies to both domestic and foreign corporations operating in the United States, provided they are dissolving or liquidating entirely.

-

When should Form 966 be filed?

Form 966 must be filed within 30 days of the resolution or decision to dissolve the corporation or completely liquidate all its stock. It's important to adhere to this timeframe to avoid potential penalties for late filing.

-

What information is required on Form 966?

The form requires detailed information about the corporation, including the Employer Identification Number (EIN), the date of the dissolution or liquidation resolution, and a certified copy of the resolution. It will also ask for details about the plan of liquidation and any related forms or returns filed in connection with the dissolution.

-

Are there any penalties for not filing Form 966?

The IRS can impose penalties on corporations that fail to file Form 966 in a timely manner. These penalties can vary, depending on the circumstances, but they emphasize the importance of fulfilling this filing requirement as part of the dissolution process.

-

Can Form 966 be filed electronically?

As of the last update, IRS Form 966 must be filed in paper format via mail. This means you cannot submit it electronically. Be sure to check the most current IRS instructions or consult with a tax professional to see if this has changed and for the most up-to-date filing methods.

-

What happens after filing Form 966?

After filing Form 966, the corporation should continue with the dissolution process, which includes settling debts, distributing remaining assets to shareholders, and filing a final tax return. The IRS may also request additional information to ensure all obligations have been met.

-

Is Form 966 the only form needed to dissolve a corporation?

No, Form 966 is just one part of the process. Corporations might also need to file final annual tax returns, such as Form 1120, and other forms depending on their circumstances. Additionally, state-level filings with the Secretary of State or other regulatory bodies are typically required to formally conclude the dissolution.

-

Where can one find more information about Form 966?

For more detailed information, instructions, and the latest updates regarding Form 966, visiting the official IRS website is recommended. Additionally, consulting with a tax professional or legal advisor who specializes in corporate dissolutions can provide personalized advice and help navigate the dissolution process more smoothly.

Common mistakes

When completing the IRS 966 form, which is required for the dissolution or liquidation of a corporation, individuals often encounter a series of common errors. These mistakes can lead to delays and complications with the Internal Revenue Service (IRS). It's imperative to approach this form with careful attention to detail to ensure the process is completed smoothly. Here are six mistakes frequently made:

Not Providing Complete Information: Many people forget to fill out every required field on the IRS 966 form. This includes the corporation's name, address, and Employer Identification Number (EIN), along with other critical details. Omitting this information can result in the IRS rejecting the form.

Incorrect Date of Corporate Action: A common mistake is providing an inaccurate date for the corporate action being reported, such as the resolution or plan of dissolution. The date must accurately reflect when the corporate action was officially adopted.

Failure to Sign the Form: The form requires a signature from an authorized officer of the corporation. Neglecting to sign the IRS 966 form renders it invalid.

Misinterpretation of Terms: Terms like "resolution" or "plan of dissolution" are sometimes misunderstood. Clarify these terms to make sure the information provided corresponds accurately to the corporate actions taken.

Not Attaching Required Documents: Certain situations require additional documents to be attached to the IRS 966 form. This may include the resolution to dissolve, articles of dissolution, or other pertinent legal documents. Failing to attach these necessary documents can delay processing.

Submitting the Form Late: The IRS imposes a specific deadline for submitting the IRS 966 form - typically within 30 days of the adoption of the resolution to dissolve the corporation. Late submissions can lead to penalties.

Bearing in mind these potential pitfalls can help ensure the dissolution or liquidation process is handled accurately and efficiently. Attention to detail and thoroughness are paramount when completing the IRS 966 form to avoid unnecessary delays or inquiries from the IRS.

Documents used along the form

When a corporation decides to dissolve, it must file IRS Form 966, Corporate Dissolution or Liquidation, to notify the Internal Revenue Service (IRS) of its intent. However, this form is just one piece of the puzzle in the dissolution process. Several other forms and documents are often necessary to fully comply with legal requirements and ensure a smooth transition. Understanding these documents is crucial for any corporation navigating the dissolution process.

- Articles of Dissolution: Before or after submitting IRS Form 966, a corporation must file Articles of Dissolution with the state in which it is incorporated. This document legally ends the corporation's existence in that state and outlines the decision to dissolve, along with other relevant details such as the effective date of dissolution and how the decision was reached.

- Final Corporate Tax Return (IRS Form 1120): Alongside or after filing IRS Form 966, the corporation must file a final corporate tax return using IRS Form 1120. This form reports the corporation's income, gains, losses, deductions, and credits for its final year of existence. It's crucial for settling any outstanding tax liabilities.

- Employment Tax Forms: If the corporation had employees, it must file final employment tax forms. These include IRS Form 940, the Employer's Annual Federal Unemployment (FUTA) Tax Return, and IRS Form 941, the Employer's Quarterly Federal Tax Return, among others. These forms reconcile the corporation's payroll tax responsibilities for its final operating period.

- Certificate of Account Status for Dissolution/Termination: In some states, corporations are required to obtain a Certificate of Account Status (or similar document) as proof that all state tax liabilities are settled before they can officially dissolve. This certificate must be submitted to the state’s filing office, sometimes as a prerequisite for or in conjunction with the Articles of Dissolution.

While IRS Form 966 marks the federal notification of a corporation's intent to dissolve, these accompanying documents ensure that all legal, tax, and regulatory responsibilities are addressed. Collectively, they facilitate a compliant and orderly wind-up of the corporation's affairs. It's advisable for businesses to consult with legal and tax professionals to navigate this multi-step process efficiently and accurately.

Similar forms

The IRS 966 form, required for corporate dissolution or liquidation, bears similarity to several other documents in the realm of business and taxation. When a corporation decides to dissolve, the IRS 966 form becomes a crucial part of the process, ensuring the IRS is informed about the company's decision to cease operations and liquidate its assets. This action bears resemblance to other forms and legal documents used for various purposes related to business activities, taxation, and legal notifications.

One such document comparable to the IRS 966 is the IRS Form 1120, the U.S. Corporation Income Tax Return. Both forms are integral to corporate tax obligations; while Form 966 notifies the IRS of a corporation's dissolution, Form 1120 is used annually to report the corporation's income, gains, losses, deductions, and credits. Each plays a pivotal role in the life cycle of a corporate entity, tracking its financial responsibilities to the government.

Similarly, the IRS Form 8832, Entity Classification Election, shares functionality with the IRS 966. Form 8832 allows an entity to elect how it will be classified for federal tax purposes, a decision that can significantly impact the entity's tax obligations and liabilities. Like the IRS 966, it involves strategic decisions about the company’s tax status, albeit from a different point in the entity's lifecycle.

The Statement of Dissolution (Form LLC-3) in many states mirrors the purpose of the IRS 966. While the IRS form is for federal notification, the LLC-3 form is usually filed with a state's secretary of state to officially dissolve a limited liability company. Both documents are crucial for legally ending the operations of a business entity and ensuring compliance with federal and state laws.

The Articles of Dissolution is another document utilized when a corporation decides to terminate its existence officially. Like the IRS 966, it's filed with the state government and serves as a formal announcement of the company's decision to dissolve. This document ensures that the state acknowledges the corporation's end and its obligations come to a close.

Form 8594, Asset Acquisition Statement, while used in a different context, is related to the dissolution process. When a business is sold, Form 8594 is used to report the sale of business assets, which can be part of the liquidation process covered by IRS Form 966. Both forms deal with the transfer or liquidation of business assets, though in different circumstances.

The IRS Form 5472, Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business, though focusing on international aspects, shares the theme of corporate entities reporting significant financial information to the IRS. Like Form 966, it's a disclosure to the IRS but focuses on transactions with foreign-related parties.

Form 5500, Annual Return/Report of Employee Benefit Plan, also intersects with the IRS 966 in the broader sense of reporting obligations of entities. This form reports information about employee benefit plans, which might be terminated or significantly altered as part of the corporate dissolution process reported via Form 966. Both forms ensure compliance with federal regulations, though they focus on different aspects of the business.

Lastly, the IRS Form 990, Return of Organization Exempt from Income Tax, is somewhat analogous to the IRS 966. While the 990 is for nonprofit organizations to report their annual financial information, the essence of reporting financial activities to the IRS aligns with the intention behind Form 966. Both are critical for maintaining transparency and compliance with federal regulations, albeit for different types of entities.

In conclusion, while the IRS 966 form has a unique purpose in the corporate dissolution process, its foundational goals of ensuring compliance, reporting financial information, and notifying federal or state authorities resonate through several other forms and documents. Each plays a distinct role in the lifecycle and management of business entities, reflecting various stages and aspects of corporate and tax responsibilities.

Dos and Don'ts

When completing the IRS Form 966, associated with the dissolution or liquidation of a corporation, attention to detail and adherence to the Internal Revenue Service's guidelines ensure the process is conducted correctly. The following are considered best practices and common pitfalls to avoid for individuals tasked with this responsibility:

Do:

Ensure that you have all the required information before you begin filling out the form. This includes the date of the corporate action, a detailed description of the action, and the effective date of the dissolution or liquidation.

Verify the corporation's Employer Identification Number (EIN) is correct. This number is essential for the IRS to process the form accurately.

Sign and date the form. An authorized officer of the corporation must sign Form 966. Without a signature, the form may be considered invalid.

Keep a copy of the completed Form 966 for your records. This can be helpful in case of discrepancies or for future reference.

File the form timely. Form 966 should be filed within 30 days after the resolution or plan of dissolution or liquidation is adopted.

Include any additional required documents. Depending on the circumstances of the dissolution or liquidation, other forms or documents may need to be filed alongside Form 966.

Don't:

Do not overlook the need to notify state or local tax authorities of the dissolution. Filing Form 966 with the IRS does not absolve you of obligations to other taxing authorities that may require their own notifications or filings.

Avoid submitting the form without reviewing it for errors. Mistakes can lead to processing delays or inquiries from the IRS.

Do not forget to report any final tax obligations the corporation may have. Form 966 itself does not relieve the corporation of its final tax liabilities.

Refrain from waiting until the last minute to file. Missing the 30-day deadline can result in penalties and complicate the dissolution process.

Do not neglect the importance of consulting with a tax professional or attorney. Especially for complex dissolutions, professional advice ensures compliance with all applicable laws and regulations.

Avoid assuming the process is complete upon filing. Stay informed about IRS correspondence and be prepared to provide additional information if requested.

Misconceptions

There are several widespread misconceptions about the IRS Form 966, which is required when a corporation decides to dissolve. Understanding these misconceptions can help individuals and businesses navigate the dissolution process more smoothly.

Only large corporations need to file Form 966. This is a common misconception. In reality, any corporation that is dissolving and has elected to wind up its affairs is required to file Form 966 with the IRS, regardless of its size. This requirement applies to small and large businesses alike.

Form 966 is filed after the dissolution process is complete. Actually, the form should be filed within 30 days after the resolution or plan to dissolve the corporation is adopted. Filing the form is one of the initial steps in the dissolution process, not a concluding step.

Filing Form 966 is the only step in dissolving a corporation. Many believe that once Form 966 is filed, the corporation is officially dissolved. However, this form is just one part of the process. States require additional steps, such as settling debts, distributing remaining assets, and filing final tax returns, among others.

There is no penalty for not filing Form 966. This is incorrect. While the IRS may not impose specific penalties for the failure to file Form 966, not filing can result in complications with the IRS, including audits or questions concerning the corporation’s dissolution state. It's crucial to adhere to all IRS requirements during the dissolution process to avoid potential issues.

Key takeaways

Filling out the IRS 966 form, associated with the dissolution or liquidation of a corporation, is a procedure that requires careful attention to detail and an understanding of its implications. Below are key takeaways that might help individuals navigate through this process more efficiently:

Timely Filing is Critical: Corporations must file Form 966 within 30 days after the resolution or plan to dissolve or liquidate is adopted. This timeline is stringent and failing to adhere can lead to penalties or legal complications.

Document Requirements: Alongside Form 966, corporations may need to attach copies of the resolutions or plans for dissolution or liquidation. This requirement ensures that the IRS has all necessary documentation to process the corporate action.

Careful Detailing of Corporate Actions: When filling out the form, it’s essential to precisely detail the actions taken towards dissolution or liquidation. This information helps the IRS understand the context and specifics of the corporate decision.

Notification of Final Tax Return: Form 966 asks whether the corporation has filed, or plans to file, a final income tax return. This section must be carefully addressed to ensure compliance with tax obligations during the dissolution process.

Impact on State Filings: Though Form 966 is a federal requirement, its filing can have implications on state-level filings. Corporations should consult with state agencies to understand any parallel requirements or notifications needed at the state level.

Legal and Financial Consultation: Given the complexity of dissolving or liquidating a corporation, consulting with legal and financial experts is advisable. These professionals can provide guidance on the IRS requirements, as well as any broader legal or financial implications of the corporate action.

Understanding these key points can help ensure that the process of completing and using the IRS 966 form is conducted smoothly, compliantly, and with a full appreciation of its impact on the corporation’s dissolution or liquidation process.

Popular PDF Documents

Utah Sales Tax License - Leaseback arrangements that meet specific criteria can be certified for tax exemption, facilitating financial and operational flexibility for businesses.

IRS 8801 - It is a valuable tool for those who have previously paid alternative minimum tax and are looking to lower future taxes.