Get IRS 9465 Form

Finding oneself in a position where taxes owed to the Internal Revenue Service (IRS) cannot be paid in a lump sum is a situation many taxpayers may face. It is at this juncture that IRS Form 9465, the Installment Agreement Request, becomes an invaluable tool. This form is designed to assist individuals in setting up a payment plan with the IRS, allowing for the balance to be paid over time, rather than in one overwhelming amount. The purpose behind this form is to simplify the process of requesting manageable monthly payments. Employing the 9465 form can alleviate some of the stress associated with owing taxes by providing a structured way to clear tax debts without causing undue financial hardship. Key to successfully navigating this process is understanding the form's eligibility requirements, the application procedure, and the implications of entering into an installment agreement, including potential fees and the necessity of staying current with all future tax obligations while the agreement is in effect. The IRS 9465 form is, therefore, not just a mere paperwork exercise; it represents a critical lifeline for taxpayers facing financial difficulties, allowing them to maintain their fiscal responsibilities in a manner that suits their current financial situation.

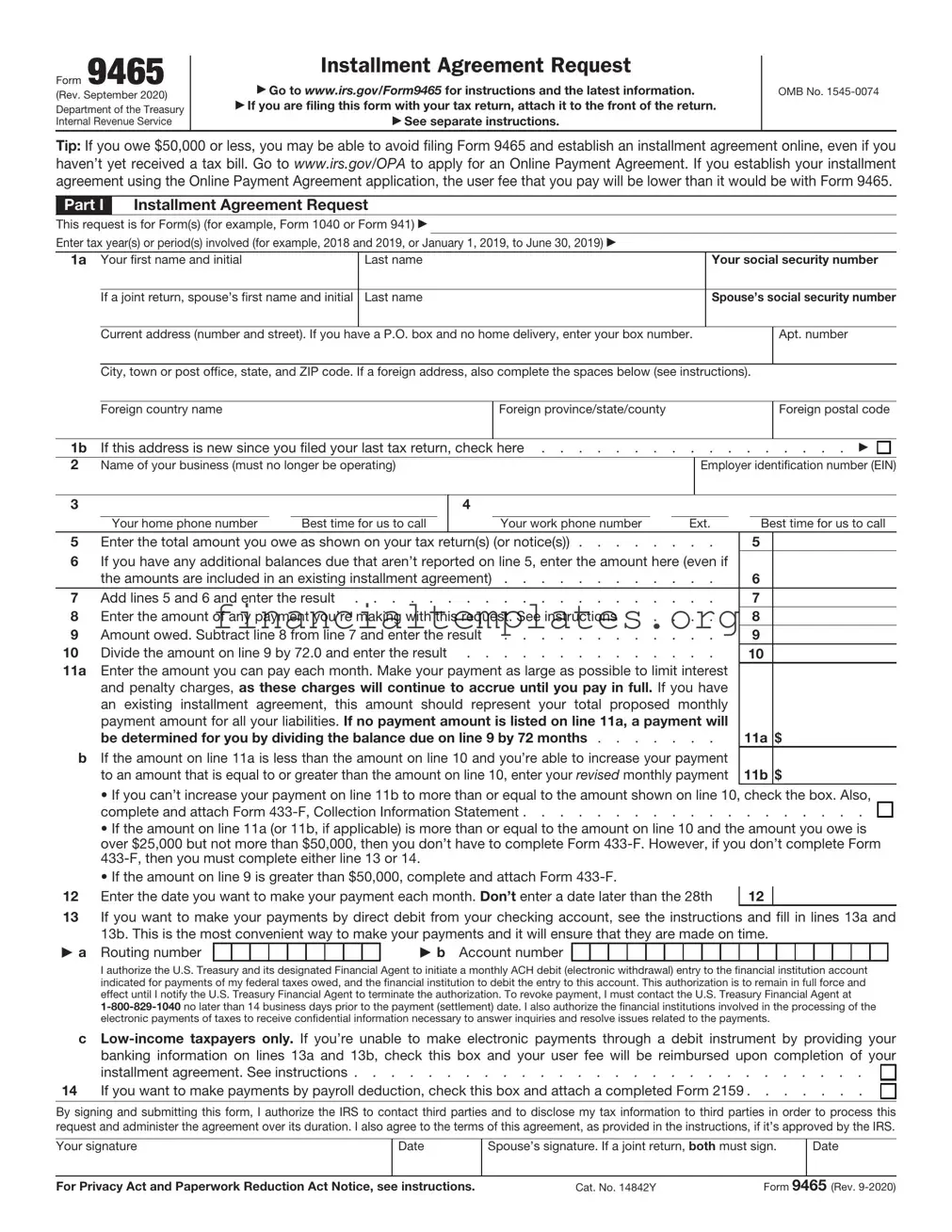

IRS 9465 Example

Form 9465

(Rev. September 2020)

Department of the Treasury

Internal Revenue Service

Installment Agreement Request

Go to www.irs.gov/Form9465 for instructions and the latest information.

If you are filing this form with your tax return, attach it to the front of the return.

See separate instructions.

OMB No.

Tip: If you owe $50,000 or less, you may be able to avoid filing Form 9465 and establish an installment agreement online, even if you haven’t yet received a tax bill. Go to www.irs.gov/OPA to apply for an Online Payment Agreement. If you establish your installment agreement using the Online Payment Agreement application, the user fee that you pay will be lower than it would be with Form 9465.

Part I Installment Agreement Request

This request is for Form(s) (for example, Form 1040 or Form 941)

Enter tax year(s) or period(s) involved (for example, 2018 and 2019, or January 1, 2019, to June 30, 2019)

1a Your first name and initial

Last name

Your social security number

If a joint return, spouse’s first name and initial

Last name

Spouse’s social security number

Current address (number and street). If you have a P.O. box and no home delivery, enter your box number.

Apt. number

City, town or post office, state, and ZIP code. If a foreign address, also complete the spaces below (see instructions).

|

Foreign country name |

Foreign province/state/county |

Foreign postal code |

|

|

|

|

1b |

If this address is new since you filed your last tax return, check here |

||||||||||||

2 |

Name of your business (must no longer be operating) |

|

|

|

|

|

Employer identification number (EIN) |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Your home phone number |

Best time for us to call |

Your work phone number |

Ext. |

Best time for us to call |

||||||||

5 |

Enter the total amount you owe as shown on your tax return(s) (or notice(s)) |

. . . |

|

5 |

|

||||||||

6 |

If you have any additional balances due that aren’t reported on line 5, enter the amount here (even if |

|

|

|

|

||||||||

|

the amounts are included in an existing installment agreement) |

. . . |

|

6 |

|

||||||||

7 |

Add lines 5 and 6 and enter the result |

. . . |

|

7 |

|

||||||||

8 |

Enter the amount of any payment you’re making with this request. See instructions . . |

. . . |

|

8 |

|

||||||||

9 |

Amount owed. Subtract line 8 from line 7 and enter the result |

. . . |

|

9 |

|

||||||||

10 |

Divide the amount on line 9 by 72.0 and enter the result |

. . . |

|

10 |

|

||||||||

11a |

Enter the amount you can pay each month. Make your payment as large as possible to limit interest |

|

|

|

|

||||||||

|

and penalty charges, as these charges will continue to accrue until you pay in full. If you have |

|

|

|

|

||||||||

|

an existing installment agreement, this amount should represent your total proposed monthly |

|

|

|

|

||||||||

|

payment amount for all your liabilities. If no payment amount is listed on line 11a, a payment will |

|

|

|

|

||||||||

|

be determined for you by dividing the balance due on line 9 by 72 months . . . . |

. . . |

|

11a $ |

|||||||||

bIf the amount on line 11a is less than the amount on line 10 and you’re able to increase your payment

to an amount that is equal to or greater than the amount on line 10, enter your revised monthly payment

• If you can’t increase your payment on line 11b to more than or equal to the amount shown on line 10, check the box. Also, complete and attach Form

•If the amount on line 11a (or 11b, if applicable) is more than or equal to the amount on line 10 and the amount you owe is over $25,000 but not more than $50,000, then you don’t have to complete Form

•If the amount on line 9 is greater than $50,000, complete and attach Form

12 Enter the date you want to make your payment each month. Don’t enter a date later than the 28th |

12 |

|

13If you want to make your payments by direct debit from your checking account, see the instructions and fill in lines 13a and 13b. This is the most convenient way to make your payments and it will ensure that they are made on time.

a Routing number |

|

|

|

|

|

|

|

|

|

b Account number |

I authorize the U.S. Treasury and its designated Financial Agent to initiate a monthly ACH debit (electronic withdrawal) entry to the financial institution account indicated for payments of my federal taxes owed, and the financial institution to debit the entry to this account. This authorization is to remain in full force and effect until I notify the U.S. Treasury Financial Agent to terminate the authorization. To revoke payment, I must contact the U.S. Treasury Financial Agent at

c

installment agreement. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14 If you want to make payments by payroll deduction, check this box and attach a completed Form 2159 . . . . . . .

By signing and submitting this form, I authorize the IRS to contact third parties and to disclose my tax information to third parties in order to process this request and administer the agreement over its duration. I also agree to the terms of this agreement, as provided in the instructions, if it’s approved by the IRS.

Your signature

Date

Spouse’s signature. If a joint return, both must sign.

Date

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 14842Y |

Form 9465 (Rev. |

Form 9465 (Rev. |

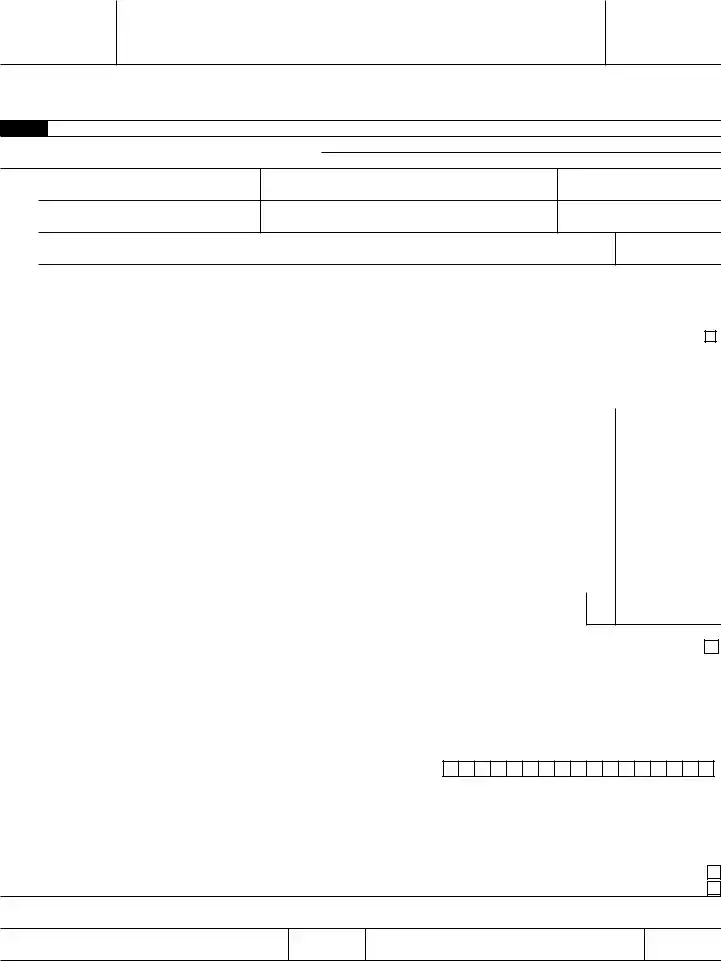

Page 2 |

|

Part II |

Additional Information |

|

Complete this Part only if all three conditions below apply: |

|

|

1.You defaulted on an installment agreement in the past 12 months;

2.You owe more than $25,000 but not more than $50,000; and

3.The amount on line 11a (or 11b, if applicable) is less than line 10.

Note: If you owe more than $50,000, also complete and attach Form

15In which county is your primary residence?

16a Marital status:

Single. Skip question 16b and go to question 17. Married. Go to question 16b.

bDo you share household expenses with your spouse?

Yes.

No.

17How many dependents will you be able to claim on this year’s tax return?. . . . . . . . .

18 How many people in your household are 65 or older? . . . . . . . . . . . . . . .

19How often are you paid?

Once a week.

Once every 2 weeks.

Once a month.

Twice a month.

17

18

20 What is your net income per pay period (take home pay)? . . . . . . . . . . . . . .

20$

Note: Complete lines 21 and 22 only if you have a spouse and meet certain conditions (see instructions). If you don’t have a spouse, go to line 23.

21How often is your spouse paid?

Once a week.

Once every 2 weeks.

Once a month.

Twice a month.

22What is your spouse’s net income per pay period (take home pay)? . . . . . . . . . . .

23 How many vehicles do you own? . . . . . . . . . . . . . . . . . . . . . .

24 How many car payments do you have each month? . . . . . . . . . . . . . . . . . . .

22$

23

24

25a Do you have health insurance? Yes. Go to question 25b.

No. Skip question 25b and go to question 26a.

bAre your health insurance premiums deducted from your paycheck?

Yes. Skip question 25c and go to question 26a. |

No. Go to question 25c. |

cHow much are your monthly health insurance premiums? . . . . . . . . . . . . . .

26a Do you make |

|

Yes. Go to question 26b. |

No. Go to question 27. |

25c $

bAre your

Yes. Go to question 27. |

No. Go to question 26c. |

c How much are your

27Not including any

26c $

27$

Form 9465 (Rev.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 9465 | It is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of taxes they owe. |

| Eligibility Criteria | Taxpayers must owe $50,000 or less in combined tax, penalties, and interest to use this form. |

| Available Online | Taxpayers have the option to set up installment agreements online through the IRS website, which can be a faster alternative to mailing Form 9465. |

| Processing Time | The IRS typically processes requests within 30 days, allowing taxpayers to know if their installment plan has been approved or denied. |

| Fees | Setting up an installment plan using Form 9465 may involve a setup fee, which can vary depending on payment method and if the taxpayer qualifies for low-income status. |

| State-Specific Forms and Laws | Some states have their own version of an installment payment request form for state taxes owed, governed by that state's tax laws. |

Guide to Writing IRS 9465

After recognizing the need to manage your tax payments better, the IRS Form 9465 is a valuable tool for requesting an installment agreement that's manageable for your situation. This form is essential for individuals who cannot pay their tax debt in full and need a structured payment plan. Here's a helpful guide on how to fill it out efficiently and accurately to ensure your request is processed smoothly.

- Begin by providing your full name as it appears on your tax return. If you have a joint return, include your spouse's name as well.

- Enter your social security number (SSN). If it's a joint return, also include your spouse's SSN beside yours.

- Provide your address, including street, city, state, and ZIP code. This should match the address on your most recent tax return.

- Add your phone number(s) where you can be reached during the day and the best time for the IRS to call you.

- Specify the tax form number you used for your return (for example, 1040, 1040-SR) and the tax period(s) for the debt you owe. If you owe for multiple years, list each year separately.

- Enter the amount owed as of the form's filing date. If you're unsure, estimate to the best of your ability or check your last notice from the IRS.

- Decide on the monthly payment amount you can afford. Be realistic in your assessment, considering your monthly income and expenses.

- Choose the payment date. This is the day of the month when you'll make your payment (1st-28th). Pick a date that aligns with your financial schedule.

- Fill in your bank information for the Direct Debit Installment Agreement section if you wish to have payments automatically deducted from your account. This includes your bank's routing number and your account number.

- Sign and date the form. If it's a joint request, both you and your spouse must sign.

After completing the form, review it for accuracy to avoid any delays with the IRS processing your request. Then, send the form to the IRS address provided in the instructions for Form 9465. Keep a copy for your records. By taking these steps, you're on your way to managing your tax debt more effectively, reducing stress, and avoiding potential penalties.

Understanding IRS 9465

-

What is the IRS 9465 form used for?

The IRS 9465 form, otherwise known as the Installment Agreement Request, is utilized by individuals who are financially incapable of settling their tax debt in full by the due date. This form allows taxpayers to request a payment plan from the Internal Revenue Service (IRS), enabling them to pay off their outstanding taxes in monthly installments over a period of time. It aims to provide a structured and manageable approach for taxpayers to fulfill their obligations without incurring significant financial hardship.

-

Who is eligible to file a Form 9465?

Eligibility to file a Form 9465 generally includes taxpayers who cannot pay the full amount owed by the tax deadline but can make monthly payments towards their tax debt. However, the IRS imposes certain conditions for eligibility, which might include the total amount owed, the taxpayer's history of filing and paying taxes, and the status of any previous installment agreements. Typically, individuals who owe $50,000 or less in combined tax, penalties, and interest may qualify to use this form.

-

How do I submit Form 9465?

Form 9465 can be submitted in several ways. The most direct method is through filing electronically via the IRS e-file system, which is accessible through many tax preparation software platforms or through a tax professional. Alternatively, taxpayers can fill out a paper form and mail it to the IRS at the address provided for their state in the instructions that accompany the form. It's important to ensure that all sections of the form are completed accurately to avoid delays in processing.

-

Can I file Form 9465 if I am already on an installment plan?

If you are currently on an installment plan with the IRS and wish to amend the terms or if you have incurred new tax debts, you may need to renegotiate your agreement or file a new Form 9465. The ability to revise an existing plan depends on your specific circumstances, such as your compliance with the terms of your current plan and the extent of your new tax liabilities. Contacting the IRS directly is advised to discuss your situation and options.

-

What information do I need to complete Form 9465?

To complete Form 9465, individuals should gather the following information: the total amount of taxes owed (including penalties and interest), personal identification information (such as Social Security Numbers for individuals or EIN for businesses), and accurate financial information to propose a monthly payment amount. A detailed estimate of your monthly living expenses and income will also be necessary to determine an appropriate payment amount that you can afford.

-

How does the IRS determine my monthly payment amount?

The IRS determines your monthly payment amount based on the information provided in your Form 9465 and any other relevant financial information available to them. The amount largely depends on your ability to pay, taking into consideration your reported income and expenses. While taxpayers can propose a monthly payment amount in their request, the IRS has the final authority to set the amount, aiming to collect the debt as efficiently as possible without causing undue hardship.

-

What are the associated fees with setting up an installment agreement?

Setting up an installment agreement with the IRS involves certain fees, which vary depending on how the agreement is established and whether you qualify for low-income status. Fees can also differ if you choose to pay through direct debit from a bank account versus other payment methods. It's important to review the most current fee structure on the IRS website or in the instructions for Form 9465, as these amounts can be adjusted.

-

Is it possible to change my installment agreement once it is set up?

Yes, it is possible to amend your installment agreement if your financial situation changes or if you wish to adjust your payment amount. To make changes, you must contact the IRS directly. They may require you to provide updated financial information to justify the requested changes. Be aware that there may be additional fees to modify your agreement depending on the nature of the change.

-

What happens if I fail to make a payment on my installment agreement?

If you miss a payment under your installment agreement, the IRS will typically send a notice indicating the missed payment and may give you the opportunity to correct the default. However, if you continue to miss payments without communicating with the IRS to explain your financial situation, the IRS has the authority to terminate your agreement. This could lead to enforcement actions such as liens or levies. Proactively reaching out to the IRS before missing a payment is crucial to avoid default.

-

Can interest and penalties continue to accrue after I set up an installment agreement?

Yes, even after you've set up an installment agreement with the IRS, interest and penalties can continue to accrue on any unpaid tax balance throughout the duration of your agreement. The IRS applies both failure-to-pay penalties and interest on the outstanding balance until it is paid in full. The ongoing accrual of these charges highlights the importance of paying off the balance as quickly as financial circumstances allow.

Common mistakes

Filing a Form 9465, also known as an Installment Agreement Request with the Internal Revenue Service (IRS), allows taxpayers to make monthly payments on the total amount of their federal taxes owed if they cannot pay in full immediately. This option can help manage financial strain, but it’s crucial to avoid common mistakes when completing the form. Here, we’ll elaborate on ten frequent errors to watch for.

-

Not verifying eligibility: Before even filling out the form, some individuals neglect to check if they meet the eligibility criteria for an installment agreement. The IRS has specific guidelines, including owing $50,000 or less in combined tax, penalties, and interest.

-

Inaccurate financial information: Another common error is the submission of inaccurate or incomplete financial details. Accurately reporting income, expenses, and liabilities is essential to formulating a realistic payment plan.

-

Failing to propose a feasible monthly payment amount: Individuals often propose payment amounts that are unrealistically low, not taking into account the IRS criteria for monthly payment calculations. It’s important to suggest a payment that reflects one’s financial capacity and adheres to IRS guidelines.

-

Omitting required signatures: A form 9465 submission is incomplete without the taxpayer's signature, and if filing jointly, both spouses must sign. Overlooking this step can delay processing.

-

Not specifying the tax form number for the tax debt: The IRS needs to know which type of tax debt is being paid off through the installment plan. Failing to specify the tax form number associated with the debt can lead to unnecessary complications.

-

Ignoring the setup fee: There is typically a fee to set up an installment agreement with the IRS, which varies by application method and whether one qualifies as a low-income taxpayer. Not factoring in this fee can affect the initial payment calculations.

-

Choosing an unsuitable payment due date: Taxpayers have the option to choose the date their monthly payment is due. Selecting a date that doesn’t align with one’s financial cycle can result in missed payments.

-

Failure to account for interest and penalties: Just because a payment plan is in place doesn’t mean interest and penalties stop accruing. Not incorporating these into one’s budget planning is a mistake.

-

Not updating personal information: If personal information changes after submitting the form, but before the agreement is finalized, not updating the IRS can result in miscommunication and process delays.

-

Overlooking IRS Notices: Once the form is submitted, the IRS will typically send a notice confirming the agreement or requesting additional information. Ignoring these notices can void the agreement and have serious repercussions.

To prevent these mistakes, it’s advisable to consult with a professional or thoroughly review the IRS guidelines before and during the completion of Form 9465. A careful approach can lead to a successful installment agreement with the IRS, enabling individuals to manage their tax obligations more effectively.

Documents used along the form

When individuals or businesses cannot pay the full amount of taxes due to the IRS, Form 9465, or the Installment Agreement Request, becomes a crucial document. It is used to set up a payment plan that allows the taxpayer to pay over time. Along with this form, several other documents are typically required to support the taxpayer's request for an installment agreement or to comply with other tax-related obligations.

- Form 1040: This is the U.S. Individual Income Tax Return form. It is essential because it provides the IRS with detailed information about the taxpayer's annual income, tax deductions, and credits. This information is necessary to assess the taxpayer's ability to pay the owed amounts.

- Form 433-F: The Collection Information Statement is used by the IRS to collect financial information from taxpayers who are requesting an installment agreement or offering to compromise among other things. It helps the IRS understand the taxpayer's financial situation in detail to determine the feasibility of the proposed payment plan.

- Form 2848: Power of Attorney and Declaration of Representative is used when taxpayers want to authorize an individual, such as an accountant or attorney, to represent them before the IRS. This form is crucial for individuals who prefer professional assistance in handling their installment agreement and other tax matters.

- Form 433-D: The Installment Agreement is the formal agreement between the taxpayer and the IRS. Once the IRS approves the request made with Form 9465, Form 433-D is used to outline the terms of the payment plan, including payment amounts and due dates.

These documents collectively ensure that the taxpayer's request for an installment agreement is adequately supported and that the IRS has a clear understanding of the taxpayer's financial situation. It's also important for taxpayers to keep these documents updated and comply with any requests for additional documentation from the IRS to maintain their installment agreement.

Similar forms

The IRS Form 9465, commonly associated with setting up installment agreements for taxpayers who cannot pay their tax debt in full, shares similarities with several other documents within and outside the realm of tax regulation. Notably, it mirrors the structure and purpose of the Form 433-F, "Collection Information Statement." Like the 9465, Form 433-F is designed for individuals who need to disclose their financial situations to the IRS, facilitating a determination on how taxpayers can fulfill their tax obligations, either through installment agreements or other means. Whereas the 9465 is the request for the payment plan itself, the 433-F provides the detailed financial information that supports the request.

Another document bearing resemblance to the IRS 9465 is the Form 1203-FX, also known as the "Offer in Compromise" application. While this form is used by taxpayers seeking to settle their tax liabilities for less than the full amount owed, it shares the principle of providing an alternative solution for those unable to pay their taxes in full. Both forms necessitate thorough disclosure of financial information and are seen as potential relief avenues for taxpayers under financial strain, illustrating a commitment by the IRS to offer flexible payment solutions.

Outside the IRS domain, the IRS 9465 form finds a counterpart in loan modification applications offered by mortgage lenders. These applications, similar in their intent to Form 9465, allow borrowers to negotiate terms that enable them to avoid defaulting on loans. They both require a detailed statement of financial hardship and a proposal for how the applicant intends to meet their obligation under modified terms. This parallels the purpose of the 9465 form, which essentially is a negotiation tool for new payment terms on tax liabilities.

Lastly, the similarity between the IRS 9465 and credit card hardship programs is notable. Many credit card companies offer programs to assist customers experiencing financial difficulties, allowing for modified payment plans to help avoid default. Like the 9465 form, these programs necessitate an explanation of financial hardship and a proposal for how the consumer plans to meet their payment obligations, underlining a shared ethos between various sectors: the provision of pathways to financial stability for those undergoing temporary financial challenges.

Dos and Don'ts

When dealing with the IRS Form 9465, which is an installment agreement request form, it's crucial to approach the process with care. This form is your way to ask the Internal Revenue Service (IRS) for a payment plan if you cannot pay the full amount of taxes you owe upfront. Here are some essential dos and don'ts to help guide you through filling out this form accurately and effectively.

Do:- Review your tax documents thoroughly before starting. Make sure you understand the amount you owe and why, to ensure accurate information on the form.

- Gather all necessary information and documentation in advance, such as your Social Security number, tax ID, the amount owed, and your financial details.

- Be honest and detailed about your financial situation. The IRS uses this information to determine your payment plan.

- Consider your budget carefully when proposing monthly installment amounts. Ensure the amount you suggest is realistic and manageable within your budget.

- Double-check your form for any errors or omissions before submission. Accurate information will prevent delays or issues with your request.

- Attach a copy of the tax bill you received if applicable. This helps the IRS process your form more efficiently.

- Seek professional advice if you're unsure about any part of the form. A tax professional or a financial advisor can offer valuable guidance.

- Rush through filling out the form without understanding each section fully. Mistakes can lead to processing delays or a denial of your request.

- Ignore IRS notices or warnings about past due amounts. Addressing your tax obligations proactively can prevent additional penalties and interest.

- Underestimate your monthly payment amount. Proposing an unrealistically low payment could result in your agreement being denied.

- Forget to sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Omit necessary financial details or documentation. Incomplete information can lead to a delay in the approval of your payment plan.

- Delay sending in the form if you need a payment plan. The sooner you submit Form 9465, the sooner you can avoid further penalties and interest on your balance due.

- Assume approval without confirmation from the IRS. Wait for written confirmation of your installment agreement before reducing or ceasing payments.

Misconceptions

Many people have misconceptions about the IRS Form 9465, which is the form used to request an installment agreement for paying off your federal tax debt. Here are nine common misunderstandings and the truth behind each.

Only individuals can use Form 9465. In reality, both individuals and businesses that owe taxes to the IRS can use Form 9465 to request an installment agreement.

You can use Form 9465 for any amount of debt. This is not entirely true. There are limits to the amount of debt for which you can use this form. For larger debts, the IRS may require additional information or suggest alternative ways to address the debt.

If you fill out Form 9465, your request will automatically be approved. Submission of Form 9465 does not guarantee approval. The IRS considers various factors before approving a payment plan, including your past compliance and financial situation.

You must pay off your debt immediately if your Form 9465 is rejected. Not necessarily. If your request is denied, the IRS may offer alternative solutions or you may appeal the decision.

Interest and penalties stop once you submit Form 9465. Interest and penalties continue to accrue until your tax debt is fully paid off, even if you are making payments under an installment agreement.

Filing Form 9465 is a complicated process. While dealing with tax matters can seem overwhelming, Form 9465 is designed to be straightforward. Instructions are provided to help taxpayers complete the form correctly.

You don’t need to file your tax return if you submit Form 9465. You must file all required tax returns before the IRS can consider your installment agreement request. Filing Form 9465 does not exempt you from this requirement.

You can't make changes to your installment agreement once it's established. If your financial situation changes, you can request to modify the terms of your agreement. The IRS understands that circumstances can change and may allow for adjustments.

There’s no option to apply for an installment agreement online. Contrary to this belief, the IRS does offer an Online Payment Agreement tool on their website, which many taxpayers can use to set up installment agreements.

Understanding the facts about IRS Form 9465 can help taxpayers make informed decisions when seeking to arrange installment payments for outstanding tax debts.

Key takeaways

The IRS 9465 form is utilized to request an installment agreement for paying your federal taxes if you can't pay the total amount due immediately. This allows for a payment plan that can fit individual financial situations.

Before filling out the form, make sure you've filed all required tax returns. Approval for an installment plan is contingent upon this prerequisite. It's essential to be up to date with your tax filings.

To complete the form accurately, gather all pertinent financial information. This includes your income, expenses, and asset details. The IRS uses this information to determine your ability to pay and to establish an appropriate monthly payment amount.

There is a fee to set up an installment agreement using Form 9465, which can vary depending on the payment method you choose and whether you apply online or by mail, phone, or in-person. Reduced fees may be available for qualifying individuals.

Typically, the IRS will respond to your request for an installment agreement within 30 days. It’s important to continue making payments to the extent possible while waiting for a response to avoid additional penalties and interest.

If the IRS approves your installment agreement request, you must adhere to the terms, including making regular payments and filing all future tax returns on time. Failure to comply can result in termination of the agreement and enforcement actions from the IRS.

Popular PDF Documents

IRS W-8BEN - Financial institutions use information from the W-8BEN form to report account holdings and income to the IRS correctly.

Massachusetts Tax Payment - Supports Massachusetts' financial processes by providing a structured format for paying vendor invoices, including detailed service descriptions.

Does Wisconsin Have Sales Tax - The form outlines exemptions for tangible personal property used in farming, such as tractors and all-terrain vehicles, excluding lawn and garden tractors to ensure accurate tax benefits.