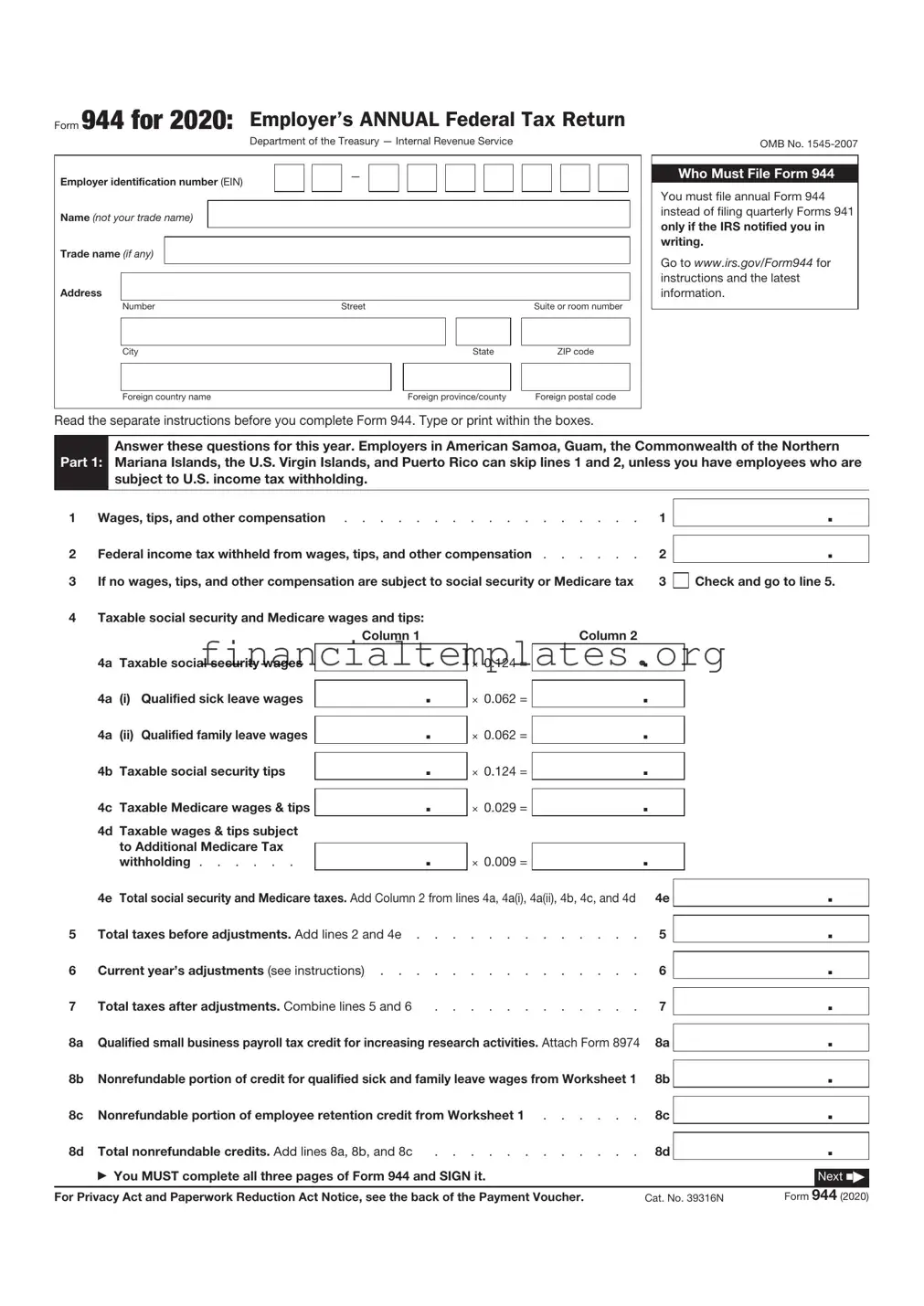

Get IRS 944 Form

For small business owners navigating the complexities of tax documentation, understanding the essentials of the IRS 944 form marks a vital step in ensuring compliance with federal tax obligations. Tailored specifically for smaller employers, this form serves as an annual tax return that reports withheld federal income tax and both employee and employer social security and Medicare taxes. Its design simplifies the process of reporting these critical financial responsibilities, offering an alternative to the more frequent filings required from larger businesses. Embracing the IRS 944 form not only aids in aligning with legal requirements but also streamlines the administrative burden on small business owners, allowing them to focus more on the growth and operational aspects of their ventures. A grasp of when and how to file this form, alongside recognizing eligibility criteria, can significantly ease the annual tax reporting process, ensuring that small businesses remain in good standing with the IRS while avoiding potential penalties for oversight or non-compliance.

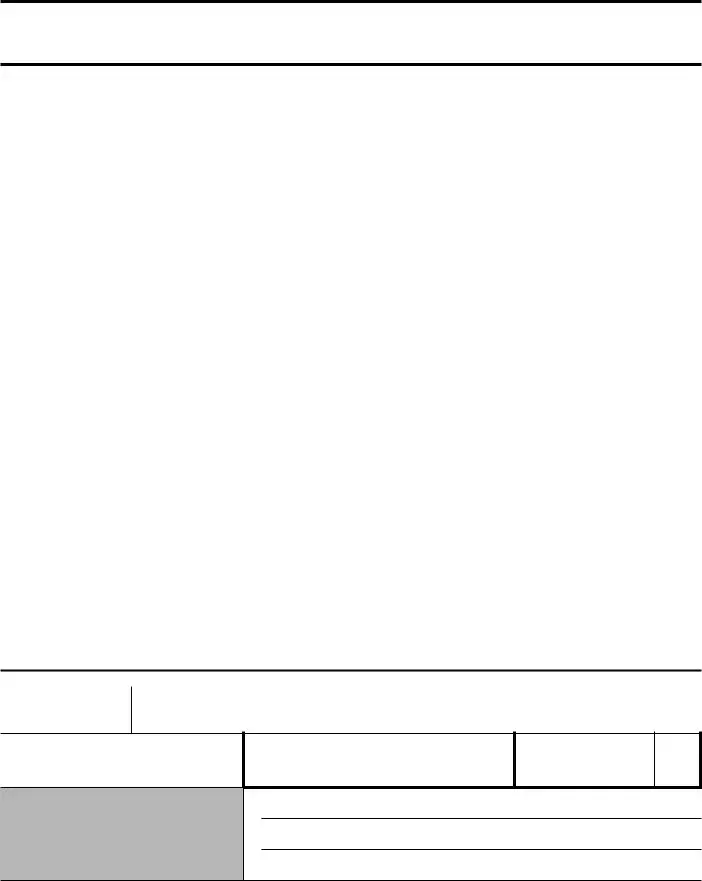

IRS 944 Example

Form 944 for 2022: Employer’s ANNUAL Federal Tax Return

Department of the Treasury — Internal Revenue Service

Employer identification number (EIN) |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade name (if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Number |

Street |

|

Suite or room number |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Foreign country name |

|

|

Foreign province/county |

|

Foreign postal code |

||

OMB No.

Who Must File Form 944

You must file annual Form 944 instead of filing quarterly Forms 941 only if the IRS notified you in writing.

Go to www.irs.gov/Form944 for instructions and the latest information.

Read the separate instructions before you complete Form 944. Type or print within the boxes.

Answer these questions for this year. Employers in American Samoa, Guam, the Commonwealth of the Northern

Part 1: Mariana Islands, the U.S. Virgin Islands, and Puerto Rico can skip lines 1 and 2, unless you have employees who are subject to U.S. income tax withholding.

1 |

Wages, tips, and other compensation |

1 |

|

2 |

Federal income tax withheld from wages, tips, and other compensation |

2 |

|

3 |

If no wages, tips, and other compensation are subject to social security or Medicare tax |

3 |

|

4 |

Taxable social security and Medicare wages and tips: |

|

|

|

Column 1 |

Column 2 |

|

.

.

Check and go to line 5.

4a Taxable social security wages*

4a (i) Qualified sick leave wages*

4a (ii) Qualified family leave wages*

4b Taxable social security tips

4c Taxable Medicare wages & tips

4d Taxable wages & tips subject to Additional Medicare Tax withholding . . . . . .

.

.

.

.

.

.

×0.124 =

×0.062 =

×0.062 =

×0.124 =

×0.029 =

×0.009 =

.

.

.

.

.

.

*Include taxable qualified sick and family leave wages paid in 2022 for leave taken after March 31, 2021, and before October 1, 2021, on line 4a. Use lines 4a(i) and 4a(ii) only for taxable qualified sick and family leave wages paid in 2022 for leave taken after March 31, 2020, and before April 1, 2021.

|

4e Total social security and Medicare taxes. Add Column 2 from lines 4a, 4a(i), 4a(ii), 4b, 4c, and 4d |

|

5 |

Total taxes before adjustments. Add lines 2 and 4e |

|

6 |

Current year’s adjustments (see instructions) |

|

7 |

Total taxes after adjustments. Combine lines 5 and 6 |

. . . . . . . . . . . . |

8a |

Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 |

|

8b |

Nonrefundable portion of credit for qualified sick and family leave wages for leave taken |

|

|

before April 1, 2021 |

|

8c |

Reserved for future use |

|

8d |

Nonrefundable portion of credit for qualified sick and family leave wages for leave taken |

|

|

after March 31, 2021, and before October 1, 2021 |

|

You MUST complete all three pages of Form 944 and SIGN it.

4e

5

6

7

8a

8b

8c

8d

.

.

.

.

.

.

.

.

.

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. |

Cat. No. 39316N |

Form 944 (2022) |

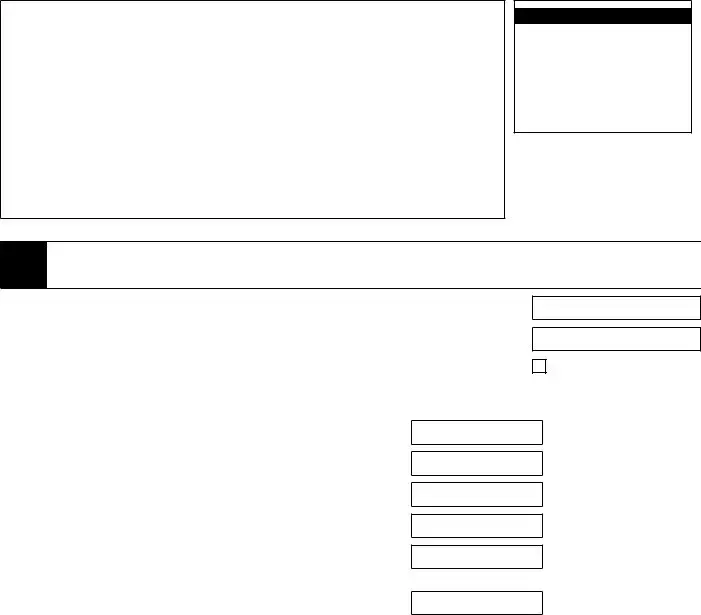

Name (not your trade name)

Employer identification number (EIN)

–

Part 1: Answer these questions for this year. (continued)

8e Nonrefundable portion of COBRA premium assistance credit . . . . . . . . . 8e

8f Number of individuals provided COBRA premium assistance

.

8g |

Total nonrefundable credits. Add lines 8a, 8b, 8d, and 8e |

. . |

8g |

9 |

Total taxes after adjustments and nonrefundable credits. Subtract line 8g from line 7 |

. . |

9 |

10a |

Total deposits for this year, including overpayment applied from a prior year |

and |

|

|

overpayments applied from Form |

. . |

10a |

.

.

.

10b |

Reserved for future use |

. . . . . . . . . . . |

. |

. |

. |

10b |

10c |

Reserved for future use |

. . . . . . . . . . . |

. |

. |

. |

10c |

10d Refundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021 . . . . . . . . . . . . . . . . . . . . . . . . 10d

.

.

.

.

.

10e |

Reserved for future use |

10e |

10f |

Refundable portion of credit for qualified sick and family leave wages for leave taken |

|

|

after March 31, 2021, and before October 1, 2021 |

10f |

10g |

Refundable portion of COBRA premium assistance credit |

10g |

10h |

Total deposits and refundable credits. Add lines 10a, 10d, 10f, and 10g |

10h |

10i |

Reserved for future use |

10i |

10j |

Reserved for future use |

10j |

11 |

Balance due. If line 9 is more than line 10h, enter the difference and see instructions . . . |

11 |

.

.

.

.

.

.

.

.

.

.

12Overpayment. If line 10h is more than line 9, enter the difference

.

Check one:

Apply to next return.

Send a refund.

Part 2: Tell us about your deposit schedule and tax liability for this year.

13 Check one:

Line 9 is less than $2,500. Go to Part 3.

Line 9 is $2,500 or more. Enter your tax liability for each month. If you’re a semiweekly schedule depositor or you became one because you accumulated $100,000 or more of liability on any day during a deposit period, you must complete Form

|

Jan. |

|

Apr. |

|

|

July |

13a |

. |

13d |

. |

13g |

|

. |

|

Feb. |

|

May |

|

|

Aug. |

13b |

. |

13e |

. |

13h |

|

. |

|

Mar. |

|

June |

|

|

Sept. |

13c |

. |

13f |

. |

13i |

|

. |

Total liability for year. Add lines 13a through 13l. Total must equal line 9. |

13m |

|||||

You MUST complete all three pages of Form 944 and SIGN it.

|

Oct. |

13j |

. |

|

Nov. |

13k |

. |

|

Dec. |

13l |

. |

.

Page 2 |

Form 944 (2022) |

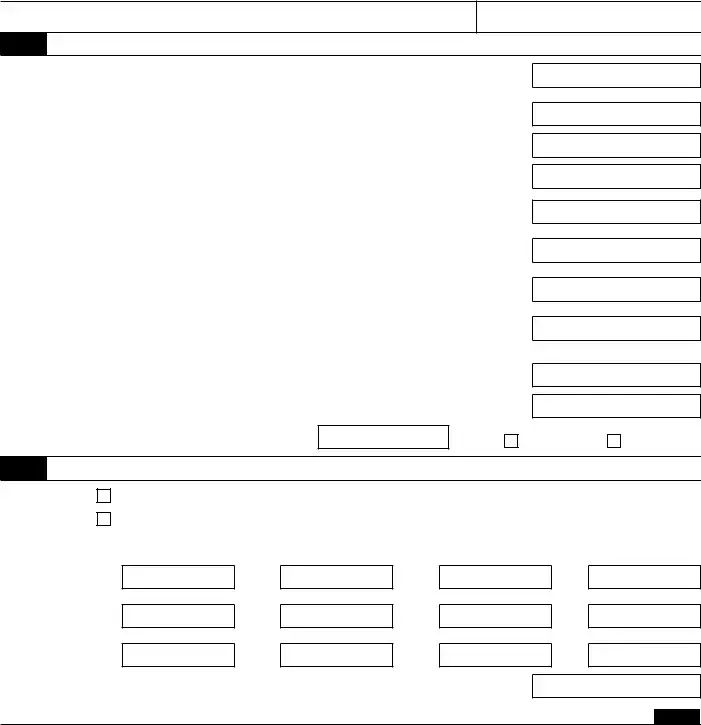

Name (not your trade name)

Employer identification number (EIN)

–

Part 3: Tell us about your business. If any question does NOT apply to your business, leave it blank.

14 If your business has closed or you stopped paying wages |

. . . . . . . . . . . . . . |

Check here, and

enter the final date you paid wages

/ /

; also attach a statement to your return. See instructions.

15Qualified health plan expenses allocable to qualified sick leave wages for leave taken before April 1, 2021

16Qualified health plan expenses allocable to qualified family leave wages for leave taken before April 1, 2021

17 |

Reserved for future use |

18 |

Reserved for future use |

19Qualified sick leave wages for leave taken after March 31, 2021, and before October 1, 2021

20Qualified health plan expenses allocable to qualified sick leave wages reported on line 19

21Amounts under certain collectively bargained agreements allocable to qualified sick

leave wages reported on line 19 . . . . . . . . . . . . . . . . . . .

22Qualified family leave wages for leave taken after March 31, 2021, and before October 1, 2021

23Qualified health plan expenses allocable to qualified family leave wages reported on line 22

24Amounts under certain collectively bargained agreements allocable to qualified family leave wages reported on line 22 . . . . . . . . . . . . . . . . . . .

15

16

17

18

19

20

21

22

23

24

.

.

.

.

.

.

.

.

.

.

.

.

25 |

Reserved for future use |

25 |

26 |

Reserved for future use |

26 |

.

.

.

.

Part 4: May we speak with your

Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for details.

Yes. Designee’s name and phone number

Select a

No.

Part 5: Sign here. You MUST complete all three pages of Form 944 and SIGN it.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign your name here

Date

Print your name here

Print your title here

Best daytime phone

Paid Preparer Use Only

Preparer’s name

Preparer’s signature

Firm’s name (or yours if

Address

City

State

Check if you’re

PTIN

Date

EIN

Phone

ZIP code

Page 3 |

Form 944 (2022) |

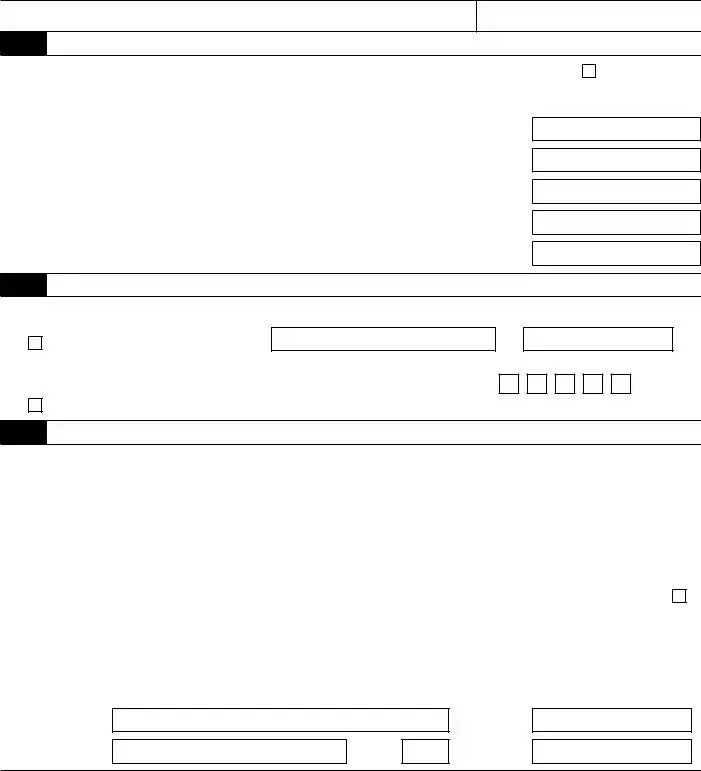

This page intentionally left blank

Form

Purpose of Form

Complete Form

Making Payments With Form 944

To avoid a penalty, make your payment with your 2022 Form 944 only if one of the following applies.

•Your net taxes for the year (Form 944, line 9) are less than $2,500 and you’re paying in full with a timely filed return.

•Your net taxes for the year (Form 944, line 9) are $2,500 or more and you already deposited the taxes you owed for the first, second, and third quarters of 2022; your net taxes for the fourth quarter are less than $2,500; and you’re paying, in full, the tax you owe for the fourth quarter of 2022 with a timely filed return.

•You’re a monthly schedule depositor making a payment in accordance with the Accuracy of Deposits Rule. See section 11 of Pub. 15, section 8 of Pub. 80, or section 11 of Pub. 179 for details. In this case, the amount of your payment may be $2,500 or more.

Otherwise, you must make deposits by electronic funds transfer. See section 11 of Pub. 15, section 8 of Pub. 80, or section 11 of Pub. 179 for deposit instructions. Don’t use Form

Use Form

may be subject to a penalty. See section 11 of Pub. 15, section 8 of Pub. 80, or section 11 of Pub. 179 for details.

Specific Instructions

Box

Box

Box

•Enclose your check or money order made payable to “United States Treasury.” Be sure to enter your EIN, “Form 944,” and “2022” on your check or money order. Don’t send cash. Don’t staple Form

•Detach Form

Note: You must also complete the entity information above Part 1 on Form 944.

Detach Here and Mail With Your Payment and Form 944.

Form

Department of the Treasury

Internal Revenue Service

1Enter your employer identification number (EIN).

–

|

Payment Voucher |

|

OMB No. |

|

|||

|

|

|

|

|

|

|

|

Don’t staple this voucher or your payment to Form 944. |

|

2022 |

|

|

|

||

|

|

|

|

2 |

Dollars |

Cents |

Enter the amount of your payment.

Make your check or money order payable to “United States Treasury.”

3 Enter your business name (individual name if sole proprietor).

Enter your address.

Enter your city, state, and ZIP code; or your city, foreign country name, foreign province/county, and foreign postal code.

Form 944 (2022)

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. We need it to figure and collect the right amount of tax. Subtitle C, Employment Taxes, of the Internal Revenue Code imposes employment taxes on wages and provides for income tax withholding. This form is used to determine the amount of the taxes that you owe. Section 6011 requires you to provide the requested information if the tax is applicable to you. Section 6109 requires you to provide your identification number. If you fail to provide this information in a timely manner, or provide false or fraudulent information, you may be subject to penalties.

You’re not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books and records relating to a form or instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

Generally, tax returns and return information are confidential, as required by section 6103. However, section 6103 allows or requires the IRS to disclose or give the information shown on your tax return to others as described in the Code. For example, we may disclose your tax information to the Department of Justice for civil

and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

The time needed to complete and file Form 944 will vary depending on individual circumstances. The estimated average time is:

Recordkeeping . . . . . . . . . . 18 hr., 39 min.

Learning about the law or the form . . |

. 1 hr., 2 min. |

Preparing, copying, assembling, and |

|

sending the form to the IRS |

3 hr., 46 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making Form 944 simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/FormComments. Or you can send your comments to Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,

Document Specifics

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Purpose of Form 944 | Designed for small employers to report annual federal tax returns instead of quarterly. |

| 2 | Eligibility Criteria | Employers with an annual liability for social security, Medicare, and withheld federal income taxes of $1,000 or less may be eligible to file Form 944. |

| 3 | Filing Deadline | The form is typically due by January 31 of the following year. If taxes are paid timely and in full, the deadline can extend to February 10. |

| 4 | Electronic Filing | The IRS encourages electronic filing for quicker processing and convenience. |

| 5 | Payment Options | Employers can pay any taxes due using the Electronic Federal Tax Payment System (EFTPS), credit or debit card, or by check or money order. |

| 6 | IRS Notification | The IRS notifies eligible employers that they must file Form 944. If not notified, employers should continue to file Form 941, the quarterly report. |

| 7 | State-Specific Forms | Form 944 is a federal form. States may have their own reporting requirements for unemployment taxes; these are separate from the IRS Form 944. |

Guide to Writing IRS 944

After completing the IRS 944 form, it's important to understand the next steps in the process to ensure compliance and accuracy in filing. This crucial tax document helps simplify the reporting of annual tax liabilities for some smaller employers, streamlining their federal tax responsibilities. Proper completion and timely submission of this form can aid in avoiding potential penalties and ensuring that the financial obligations to the IRS are met accurately.

To fill out the IRS 944 form, follow these steps:

- Begin by entering the employer identification number (EIN), name, and address of your business in the designated sections at the top of the form.

- Proceed to line 1 and enter the total wages, tips, and other compensation paid to employees throughout the year.

- On line 2, calculate and report the federal income tax withheld from employees' paychecks.

- Lines 3 through 6 focus on adjustments for tips and group-term life insurance, which may not apply to all employers. Fill these out if applicable.

- Line 7 requires the total of lines 1, 2, 3, and 6 minus line 4 and 5, providing a summary of taxable wages and tips.

- For line 8, calculate and enter the employer’s share of social security and Medicare taxes.

- Line 9 allows for adjustments to social security and Medicare taxes, applicable in specific situations such as fractions of cents and sick pay.

- On line 10, add lines 7 and 8, then subtract line 9. This total represents the taxes before adjustments.

- Line 11 through 14 cover adjustments for research activities, COBRA premium assistance payments, and others. Fill these in if they apply to your situation.

- Line 15 calculates your total taxes after adjustments, combining previous line totals and adjustments as instructed.

- Deposit your total taxes according to federal tax deposit rules, enter the amount on line 16, and if applicable, line 17 details any overpayment to be applied to the next return or refunded.

- Complete the certification section at the bottom of the form, signing and dating to verify the information is accurate and complete.

- Review the entire form for accuracy, then submit it to the IRS either electronically or by mail, depending on your preference and the IRS regulations.

Once the IRS 944 form is submitted, the focus shifts to ensuring that all reported amounts and deposits are accurate and that any due taxes are paid. Keeping a copy of the filed form and all relevant calculations and payment records is essential for future reference or in case of IRS inquiries. Timely and accurate completion of this form contributes to the smooth operation of your business's tax obligations.

Understanding IRS 944

-

What is the IRS 944 form, and who needs to file it?

The IRS 944 form is designed for small employers to report their annual federal tax returns. This includes taxes withheld from employees, such as federal income tax and both the employee's and employer's share of social security and Medicare taxes. Typically, it is intended for businesses whose annual liability for these taxes is $1,000 or less, translating to about $4,000 in wages if all the wages are subject to these taxes. The goal of the form is to simplify the reporting process so these smaller employers can file once a year instead of quarterly.

-

How do employers determine if they should file Form 944?

Employers cannot decide on their own whether to file Form 944 or the more common quarterly Form 941; instead, the IRS notifies them. The determination is based on the employer's annual tax liability. Employers who have been notified in writing by the IRS that they should file Form 944 must do so unless the IRS instructs otherwise. If an employer's business grows and their annual tax liability exceeds the threshold, they must contact the IRS to request a change to their filing requirements.

-

Can an employer switch between filing Form 944 and Form 941?

Yes, but solely at the discretion of the IRS. If an employer's annual tax liability increases such that they no longer meet the requirements for filing Form 944, or if they prefer to file quarterly returns using Form 941, they must contact the IRS to request the change. This request can be made by calling the designated IRS number or by sending a written request. However, employers should not switch forms without receiving confirmation from the IRS, as doing so can result in penalties or the misapplication of tax payments.

-

What are the deadlines for filing Form 944?

Form 944 is due annually by January 31st of the year following the reported tax year. If employers have made deposits in full and on time throughout the year, they may have until February 10th to file. It's critical for employers to adhere to these deadlines to avoid penalties and interest. To ensure timely filing and payment, employers should mark these dates on their calendars and consider setting reminders.

-

How can an employer correct mistakes on a previously filed Form 944?

To correct errors on a Form 944 that has already been submitted, employers need to file Form 944-X, Adjusted Employer’s ANNUAL Federal Tax Return or Claim for Refund. This form is used to make corrections to previously reported wages, taxes withheld, and the employer’s share of social security and Medicare taxes. Form 944-X can be filed at any time after the original form has been filed, but there are deadlines for claiming a refund or credit. Employers need to carefully follow the instructions on Form 944-X to ensure that corrections are processed correctly.

Common mistakes

Filling out IRS Form 944, designated for small business employers to report annual tax returns, requires attention to detail and a strong grasp of your fiscal responsibilities. Unfortunately, many people stumble over common pitfalls during the completion process. Recognizing these errors can save you from potentially costly consequences and ensure your filings are accurate and compliant.

-

Not Verifying Social Security Numbers

One frequent oversight is the failure to verify employees' Social Security numbers against official records. This error can lead to mismatches in IRS records, which not only complicates the processing of your form but could also delay tax refunds or credits owed to you or your employees.

-

Incorrectly Calculating Taxes

Another common mistake lies in the miscalculation of taxes owed. Whether it's not properly accounting for all taxable wages, or misunderstanding the current tax rates, these errors can result in underpayment or overpayment of taxes. Underpayments can lead to penalties and interest, while overpayments may affect your cash flow and financial planning.

-

Failing to Claim All Allowable Deductions and Credits

Businesses often miss out on valuable deductions and credits because they are either unaware of them or unsure how to accurately claim them. Overlooking these can significantly increase your tax liability, robbing your business of hard-earned savings.

-

Not Filing Electronically When Required

For employers who reach a certain threshold, the IRS mandates electronic filing of Form 944. Ignoring this requirement, whether intentionally or due to lack of knowledge, can result in penalties. Furthermore, electronic filing is generally faster and more secure, thereby reducing the likelihood of errors and delays.

Common errors in filling out IRS Form 944 are more than just mere oversights; they can have substantial implications for your business. Familiarizing yourself with the form, along with careful review and compliance with the IRS guidelines, can help you navigate the process more smoothly. Consider consulting with a tax professional if you're uncertain about any aspects of your filing obligations. They can provide personalized advice and assistance, ensuring your business stays on the right side of tax laws.

Documents used along the form

Filing taxes, especially for businesses, involves more than just filling out one form. The IRS 944 form is a prime example of this—a form used by small employers to report annual tax returns. However, completing this task typically requires additional documentation to ensure compliance with the Internal Revenue Service's regulations. Here are several forms and documents often utilized alongside the IRS 944 form, each serving its unique purpose in the tax filing process.

- W-2 Form: This document is essential for employers as it reports an employee's annual wages and the amount of taxes withheld from their paycheck. Each employee should receive a W-2 form to file their personal taxes.

- W-3 Form: The W-3 form is a transmittal document summarizing the information of all W-2 forms for the Social Security Administration. It acts as a cover sheet for the W-2 forms sent by an employer.

- 941 Form: While some small employers use Form 944, others may need to file a Form 941 quarterly. This form reports income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks and the employer's portion of Social Security or Medicare tax.

- 940 Form: Employers use this form to report their annual Federal Unemployment Tax Act (FUTA) tax. This tax funds state workforce agencies and must be filed by employers who have paid wages of $1,500 or more to employees or had at least one employee for a portion of a day in any 20 or more weeks in a year.

- W-4 Form: The Employee’s Withholding Certificate allows employees to indicate their tax situation to their employer, determining the amount of federal income tax to withhold from their wages. While it's not filed with the IRS by the employer, it is necessary for accurately calculating withholdings.

- I-9 Form: This form is used for verifying the identity and employment authorization of individuals hired for employment in the United States. It is a critical document for compliance but is not submitted to the IRS.

- 1099 Forms: Used for reporting various types of income other than wages, salaries, and tips. For example, independent contractors receive a 1099-NEC form from businesses that pay them $600 or more in a year. This form is part of the documentation that businesses need to manage during tax season.

Filing taxes can be a complex process, requiring a careful approach and attention to detail. Understanding the purposes and requirements of these forms can significantly simplify the process, ensuring compliance and reducing the likelihood of errors. Whether you are a small employer working on your tax returns or just aiming to understand the broader landscape of tax-related documentation, becoming familiar with these forms is a good place to start.

Similar forms

The IRS 944 form, which is designed for small employers to report annual tax, shares similarities with several other IRS documents, each catering to specific tax-related reporting requirements. Among these, the IRS 941 form stands out as closely related. This form is used by employers to report quarterly federal income tax withheld from wages, social security, and Medicare taxes. Like the 944, it provides a systematic way for employers to report wages paid to employees, albeit on a more frequent basis. This similarity makes the 941 form a cornerstone for businesses that do not qualify for the annual reporting schedule permitted by the 944 form.

Another document echoing the IRS 944 form's purpose is the W-2 form. This wage and tax statement is issued by employers to every employee and the Social Security Administration. While the 944 form summarizes the total tax liability of an employer for the year, the W-2 details the annual wages paid to an individual employee and the taxes withheld from their earnings. The interconnectedness of these forms is critical in the overarching framework of employment tax reporting, ensuring that both the employer's and employees' tax information is meticulously recorded and reported to the federal government.

The IRS 940 form, which employers use to report federal unemployment tax (FUTA), also parallels the 944 form in its annual reporting requirement. The 940 form, however, focuses on unemployment contributions rather than income, Social Security, or Medicare taxes. Employers are thus tasked with navigating both forms (if applicable) to fully comply with federal tax obligations. The design of these forms reflects the broader tax structure, directing funds into different federal programs and initiatives through specific tax contributions.

Lastly, the Schedule H form (Form 1040) is somewhat analogous to the IRS 944 in its aim, as it is used by household employers to report employment taxes. If someone hires household help, such as a nanny or a gardener, and pays them above a certain threshold, they become responsible for Social Security, Medicare, and possibly federal unemployment tax. While Schedule H integrates into an individual's personal tax return and the Form 944 addresses small business employer obligations, both fulfill the common goal of tax reporting related to employment.

Dos and Don'ts

Filling out IRS Form 944, Employer's Annual Federal Tax Return, requires careful attention to detail. Here are essential dos and don'ts to ensure the process goes smoothly.

- Do review your eligibility to file Form 944 before you start. The IRS selects certain small employers to file annually. If you're unsure about your eligibility, contact the IRS directly.

- Do double-check all your calculations. Errors can lead to processing delays or unwelcome scrutiny from the IRS.

- Do include accurate employee information, including Social Security numbers and wages paid. This information must match what you've reported on Forms W-2.

- Do use the IRS's electronic filing system if possible. E-filing is faster, more secure, and provides instant confirmation that your return has been received.

- Don't miss the deadline. Late filing can result in penalties and interest charges. Mark your calendar for January 31st, the due date for filing Form 944, unless otherwise directed by the IRS.

- Don't guess on amounts or figures. If you're unsure about what to report in a section, seek clarification from a tax professional or the IRS directly.

- Don't ignore IRS notices or letters regarding your Form 944. If the IRS contacts you with questions or requests for additional information, respond promptly to avoid penalties.

- Don't forget to sign and date your return. An unsigned return is like an incomplete return and will not be processed until corrected.

Misconceptions

When it comes to understanding IRS forms, misconceptions can lead to errors in tax filings and potential issues with the Internal Revenue Service. The IRS Form 944, designed for small employers to report annual tax withholdings, is no exception. Here are five common misconceptions about this form:

All businesses must file Form 944. This is incorrect. Only small employers, specifically those whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less, are eligible to file Form 944. The IRS notifies eligible businesses that they should file this form instead of the quarterly Form 941.

Form 944 is optional for eligible small employers. Once the IRS notifies a small employer to file Form 944, it becomes a requirement, not an option. To switch back to filing Form 941 quarterly or to change the filing frequency for any reason, the employer must receive approval from the IRS.

Employers can file Form 944 at any time during the year. Form 944 is an annual form that must be filed by January 31st of the year following the reported tax year. For example, taxes withheld in 2022 must be reported on Form 944 by January 31, 2023. If employers make deposits in full and on time, they have until February 10th to file.

If you start a business and expect to file Form 944, you do not need to notify the IRS. New employers should indicate on their application for an Employer Identification Number (Form SS-4) that they expect their employment taxes to be $1,000 or less. The IRS will then notify the employer whether to file Form 944 or Form 941. Not all new employers will qualify to file Form 944; the IRS makes this determination.

You can switch between filing Form 944 and Form 941 anytime during the year. The process to change filing requirements is not at the employer's discretion. Employers must strictly follow IRS instructions and receive notification or permission from the IRS to switch their filing method. Changes in filing status are typically initiated by employer request before the start of a tax year, and the IRS will confirm the change in writing.

Understanding these aspects of Form 944 can help employers avoid common pitfalls and ensure compliance with IRS requirements. Misconceptions can lead to unnecessary complications and penalties, highlighting the importance of staying informed about tax filing obligations and procedures.

Key takeaways

To ensure accurate and timely processing, individuals and businesses should accurately fill out all required sections of the IRS 944 form. This form is designed for employers whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less, allowing them to file and pay these taxes once a year instead of quarterly.

Before proceeding with the form, confirm eligibility to use it by referencing IRS guidelines. The IRS selects some employers to file Form 944 instead of Form 941 based on their estimated annual tax liability; however, employers can also request to file this form if they believe their liability falls within the required threshold.

It is critical to provide accurate employee information, including total wages paid and federal income tax withheld, on the IRS 944 form. This ensures the correct calculation of the employer’s tax liability. Reporting errors can lead to processing delays or unforeseen tax assessments.

File the form by the due date, which is typically January 31st of the year following the reported tax year. If an employer made deposits on time and in full payment of the taxes due for the year, the deadline extends to February 10th. Missing these deadlines may result in penalties and interest charges.

Popular PDF Documents

IRS 720 - It serves as a record of tax payments for business auditing and financial planning purposes, highlighting the importance of proper record-keeping.

How to Create a Purchase Order - Enables businesses to exercise control over their spending and inventory by pre-approving purchases and expenditure.