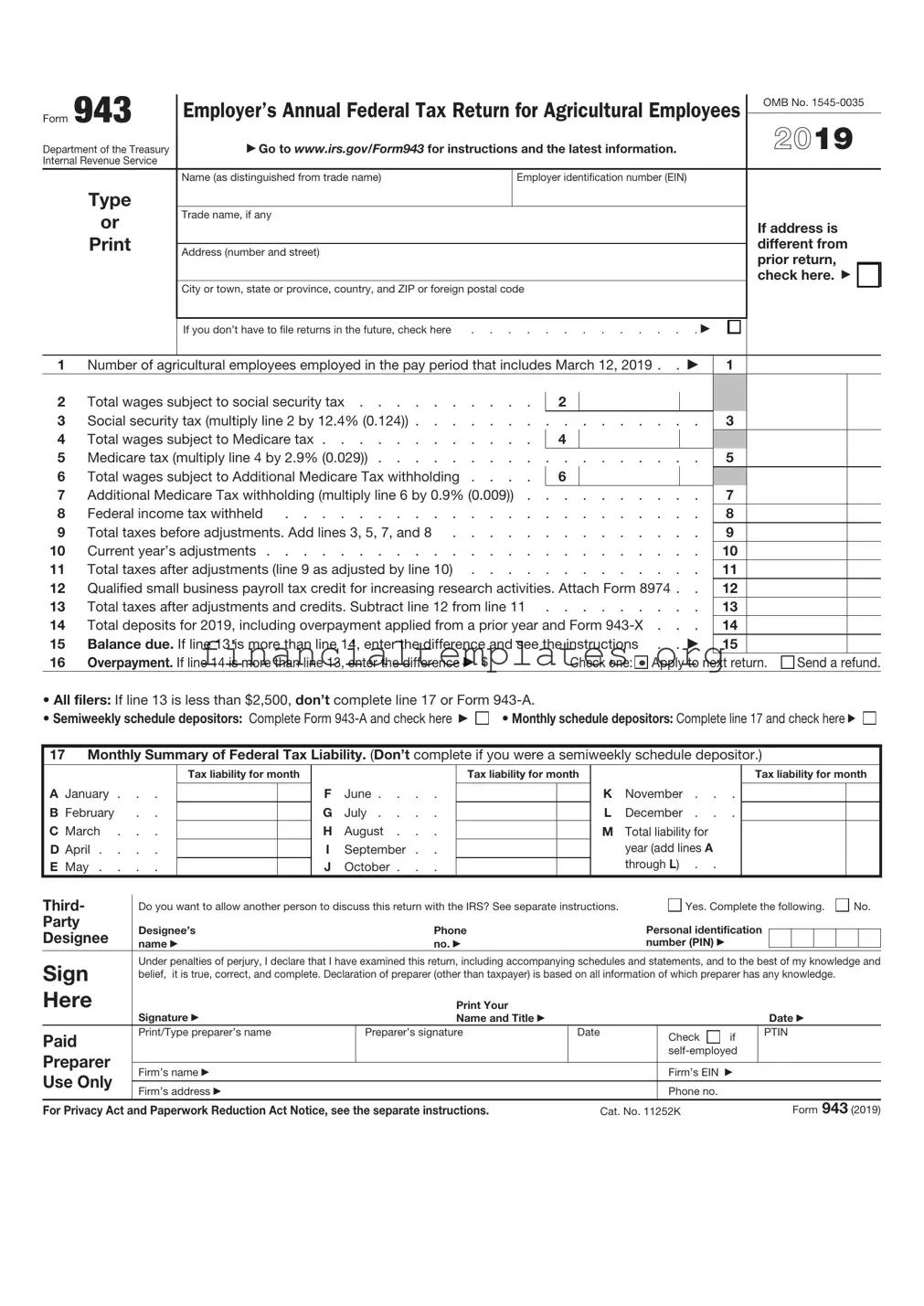

Get IRS 943 Form

Farmers and agricultural employers navigate a unique set of challenges when it comes to managing payroll taxes for their workers. Central to this process is the IRS 943 form, a critical document specifically designed for reporting annual federal tax returns for agricultural employees. This form plays a pivotal role in ensuring that wages are accurately reported and the correct amount of taxes is withheld, thereby facilitating compliance with tax regulations. It encompasses information on the total wages paid to farmworkers, the federal income tax withheld from these wages, and both the employer’s and employees’ share of social security and Medicare taxes. Understanding the specifics of the IRS 943 form is essential for agricultural business owners to effectively fulfill their tax obligations, avoid potential penalties, and maintain a stable financial standing. By staying informed about the requirements and deadlines associated with this form, employers can ensure their operations run smoothly while supporting the well-being and legal rights of their employees.

IRS 943 Example

Form 943 |

Employer’s Annual Federal Tax Return |

430121 |

|||||||

|

|

OMB No. |

|||||||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

for Agricultural Employees |

|

|

|

||||

Department of the Treasury |

|

|

2021 |

||||||

▶ Go to www.irs.gov/Form943 for instructions and the latest information. |

|

|

|||||||

Internal Revenue Service |

|

|

|||||||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Name (as distinguished from trade name) |

Employer identification number (EIN) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Type |

Trade name, if any |

|

|

|

|

|

|

If address is |

|

|

|

|

|

|

|

|

different from |

|

|

or |

|

|

|

|

|

|

|

|

|

Address (number and street) |

|

|

|

|

|

|

prior return, |

|

|

|

|

|

|

|

|

|

check here ▶ |

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

If you don’t have to file returns in the future, check here |

. . . . . . ▶ |

||||||

1 |

Number of agricultural employees employed in the pay period that includes March 12, 2021 . ▶ |

1 |

|

|

|||||

2 |

Wages subject to social security tax* |

|

2 |

|

|

|

|

*Include taxable qualified |

|

|

|

|

|

|

sick and family leave wages |

||||

|

|

|

|

|

|

|

|

|

for leave taken after March |

a |

Qualified sick leave wages* |

|

2a |

|

|

|

|

31, 2021, on line 2. Use lines |

|

|

|

|

|

|

2a and 2b only to report |

||||

b |

Qualified family leave wages* |

|

2b |

|

|

|

|

wages paid for leave taken |

|

|

|

|

|

|

before April 1, 2021. |

||||

3 |

Social security tax (multiply line 2 by 12.4% (0.124)) |

3 |

|

|

|||||

a |

Social security tax on qualified sick leave wages (multiply line 2a by 6.2% (0.062)) |

3a |

|||||||

b |

Social security tax on qualified family leave wages (multiply line 2b by 6.2% (0.062)) |

3b |

|||||||

4 |

Wages subject to Medicare tax |

|

4 |

|

|

|

|

|

|

5 |

Medicare tax (multiply line 4 by 2.9% (0.029)) |

5 |

|

|

|||||

6 |

Wages subject to Additional Medicare Tax withholding |

|

6 |

|

|

|

|

|

|

7 |

Additional Medicare Tax withholding (multiply line 6 by 0.9% (0.009)) |

7 |

|

|

|||||

8 |

Federal income tax withheld |

8 |

|

|

|||||

9 |

Total taxes before adjustments. Add lines 3, 3a, 3b, 5, 7, and 8 |

9 |

|

|

|||||

10 |

Current year’s adjustments |

10 |

|

|

|||||

11 |

Total taxes after adjustments (line 9 as adjusted by line 10) |

11 |

|

|

|||||

12a |

Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 . . |

12a |

|||||||

bNonrefundable portion of credit for qualified sick and family leave wages for leave taken before

April 1, 2021 |

12b |

c Nonrefundable portion of employee retention credit |

12c |

dNonrefundable portion of credit for qualified sick and family leave wages for leave taken after

|

March 31, 2021 |

12d |

|||||

e |

Nonrefundable portion of COBRA premium assistance credit |

12e |

|||||

f |

Number of individuals provided COBRA premium assistance |

|

|

|

|

|

|

g |

Total nonrefundable credits. Add lines 12a, 12b, 12c, 12d, and 12e |

12g |

|

|

|

||

13 |

Total taxes after adjustments and nonrefundable credits. Subtract line 12g from line 11 . . . . |

13 |

|

|

|

||

|

You MUST complete all three pages of Form 943 and SIGN it. |

|

|

|

|||

|

|

|

Next ■▶ |

||||

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. |

Cat. No. 11252K |

Form 943 (2021) |

|

|

|

|

|

|

|

430221 |

||

Form 943 (2021) |

|

|

|

|

|

|

Page 2 |

||

14a |

Total deposits for 2021, including overpayment applied from a prior year and Form |

14a |

|

|

|||||

b |

Reserved for future use |

14b |

|

|

|||||

c |

Reserved for future use |

14c |

|

|

|||||

d |

Refundable portion of credit for qualified sick and family leave wages for leave taken before |

|

|

|

|||||

|

April 1, 2021 |

14d |

|

|

|||||

e |

Refundable portion of employee retention credit |

14e |

|

|

|||||

f |

Refundable portion of credit for qualified sick and family leave wages for leave taken after |

|

|

|

|||||

|

March 31, 2021 |

14f |

|

|

|||||

g |

Refundable portion of COBRA premium assistance credit |

14g |

|

|

|||||

h |

Total deposits and refundable credits. Add lines 14a, 14d, 14e, 14f, and 14g |

14h |

|

|

|||||

i |

Total advances received from filing Form(s) 7200 for the year |

14i |

|

|

|||||

j |

Total deposits and refundable credits less advances. Subtract line 14i from line 14h |

14j |

|

|

|||||

15 |

Balance due. If line 13 is more than line 14j, enter the difference and see the instructions |

. |

. |

▶ |

15 |

|

|

||

16 |

Overpayment. If line 14j is more than line 13, enter the difference |

. |

. |

▶ |

16 |

|

|

||

|

Check one: |

Apply to next return. |

Send a refund. |

|

|

|

|

|

|

• All filers: If line 13 is less than $2,500, don’t complete line 17 or Form |

|

• Semiweekly schedule depositors: Complete Form |

▶ |

• Monthly schedule depositors: Complete line 17 and check here |

▶ |

17Monthly Summary of Federal Tax Liability. (Don’t complete if you were a semiweekly schedule depositor.)

A January . . .

B February . . .

C March . . .

D April . . . .

E May . . . .

Tax liability for month

F June . . . .

G July . . . .

H August . . .

I September . . J October . . .

Tax liability for month

K November . .

L December . .

M Total liability for year (add lines A through L) . .

Tax liability for month

18Qualified health plan expenses allocable to qualified sick leave wages for leave taken before

April 1, 2021 |

18 |

19Qualified health plan expenses allocable to qualified family leave wages for leave taken before

April 1, 2021 |

19 |

20 Qualified wages for the employee retention credit |

20 |

21Qualified health plan expenses for the employee retention credit . . . . . . . . . . . . 21

You MUST complete all three pages of Form 943 and SIGN it. |

|

Next ■▶ |

|

|

|

|

Form 943 (2021) |

|

430321

Form 943 (2021) |

Page 3 |

22 |

Qualified sick leave wages for leave taken after March 31, 2021 |

23 |

Qualified health plan expenses allocable to qualified sick leave wages reported on line 22 . . . |

24Amounts under certain collectively bargained agreements allocable to qualified sick leave wages

reported on line 22 . . . . . . . . . . . . . . . . . . . . . . . . . . .

25 |

Qualified family leave wages for leave taken after March 31, 2021 |

26 |

Qualified health plan expenses allocable to qualified family leave wages reported on line 25 . . |

27Amounts under certain collectively bargained agreements allocable to qualified family leave wages

reported on line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . .

28If you're eligible for the employee retention credit in the third quarter solely because your business is a recovery startup business, enter the total of any amounts included on lines 12c and 14e for

the third quarter . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29If you're eligible for the employee retention credit in the fourth quarter solely because your business is a recovery startup business, enter the total of any amounts included on lines 12c and 14e for the fourth quarter . . . . . . . . . . . . . . . . . . . . . . . . .

22

23

24

25

26

27

28

29

Third- |

Do you want to allow another person to discuss this return with the IRS? See the separate instructions. |

Yes. Complete the following. |

|

No. |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Party |

|

|

|

|

Personal identification |

|

|

|

|

|

|

||||

Designee |

Designee’s |

Phone |

|

|

|

|

|

|

|

||||||

|

number (PIN) ▶ |

|

|

|

|

|

|

|

|||||||

|

name ▶ |

no. ▶ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||||

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of |

||||||||||||||

|

my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which |

||||||||||||||

Sign |

preparer has any knowledge. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Here |

Signature ▶ |

|

|

|

Date ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Print your name and title ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid |

Print/Type preparer’s name |

Preparer’s signature |

Date |

|

Check |

if |

PTIN |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name ▶ |

|

|

|

|

Firm’s EIN |

▶ |

|

|

|

|

|

|

|||

Use Only |

|

|

|

|

|

|

|

|

|

|

|||||

Firm’s address ▶ |

|

|

|

|

Phone no. |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

Form 943 (2021) |

|

|||

430621

This page intentionally left blank

Form

Purpose of Form

Complete Form

Making Payments With Form 943

To avoid a penalty, make your payment with your 2021 Form 943 only if:

•Your total taxes after adjustments and nonrefundable credits for the year (Form 943, line 13) are less than $2,500 and you’re paying in full with a timely filed return, or

•You’re a monthly schedule depositor making a payment in accordance with the Accuracy of Deposits Rule. See section 7 of Pub. 51 for details. In this case, the amount of your payment may be $2,500 or more.

Otherwise, you must make deposits by electronic funds transfer. See section 7 of Pub. 51 for deposit instructions. Don’t use Form

▲! Use Form

CAUTION Form 943 that should’ve been deposited, you may be subject to a penalty. See Deposit Penalties in section 7 of Pub. 51.

Specific Instructions

Box

Box

Box

•Enclose your check or money order made payable to “United States Treasury.” Be sure to enter your EIN, “Form 943,” and “2021” on your check or money order. Don’t send cash. Don’t staple Form

•Detach Form

Note: You must also complete the entity information above line 1 on Form 943.

✁▼ Detach Here and Mail With Your Payment and Form 943. ▼

✃

Form |

|

|

|

|

Payment Voucher |

|

OMB No. |

|||

|

|

|

||||||||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Department of the Treasury |

|

|

▶ |

Don’t staple this voucher or your payment to Form 943. |

|

|

2021 |

|||

Internal Revenue Service |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|||

1 Enter your employer identification number (EIN). |

|

2 Enter the amount of your payment . . . ▶ |

|

Dollars |

|

Cents |

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

Make your check or money order payable to “United States Treasury” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Enter your business name (individual name if sole proprietor). |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter your address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter your city or town, state or province, country, and ZIP or foreign postal code. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS 943 form is primarily used by farmers to report annual federal tax withheld for their farmworkers. |

| Who Must File | Employers engaged in a farming business who have paid wages to farmworkers that are subject to social security and Medicare taxes must file this form. |

| Filing Deadline | The due date for filing Form 943 is January 31st of the year following the tax year for which the payments are being reported. |

| Electronic Filing | Employers have the option to file Form 943 electronically through the IRS e-file system, offering a more efficient filing process. |

| Penalties for Late Filing | Failing to file on time without reasonable cause can result in penalties, including fines based on the amount of tax that is late. |

| Governing Law | Form 943 is regulated by the IRS under the Internal Revenue Code (IRC), specifically applicable sections governing employment taxes. |

Guide to Writing IRS 943

Filling out the IRS 943 form is a necessary task for agricultural employers who have paid wages to farmworkers that were subject to social security and Medicare taxes, or federal income tax withholding. This document plays a crucial role in the annual reporting process, ensuring compliance with tax obligations. With attention to detail and the right information in hand, completing the IRS 943 form can be a streamlined process. Here's a step-by-step guide to help you through each part of the form, ensuring accuracy and timeliness in your submission.

- Gather all necessary information, including your Employer Identification Number (EIN), the total wages paid to farmworkers, and any federal income tax withheld from those wages.

- Enter your business’s name and address in the designated spaces at the top of the form.

- Fill in your EIN in the space provided for identification numbers.

- Report total wages paid to all farmworkers in the section asking for compensation details. This includes both cash and non-cash wages that are subject to social security and Medicare taxes.

- Calculate and enter the total amount of federal income tax you withheld from your employees throughout the year.

- Document the total amount due for both the employer and employee portions of social security and Medicare taxes.

- If you made any advance payments toward your tax liability through the Federal Tax Deposit system, report these amounts in the designated section.

- Subtract your total deposits (or advance payments) from the total taxes due to find out if you have an overpayment or if you owe more taxes. Enter this amount in the proper section.

- Sign and date the form. Don't forget to include your title along with your contact information.

- Review the form for accuracy and completeness before submission to avoid any processing delays or penalties.

- Submit the form to the IRS by mail or electronically, as per the instructions provided for the tax year you are filing.

Correctly filling out and submitting the IRS 943 form is a vital step in fulfilling your responsibilities as an agricultural employer. By carefully following these steps, you can help ensure that you meet your tax commitments efficiently, avoiding common mistakes that can lead to penalties or additional scrutiny from the IRS. Always double-check your form for errors and consult the IRS guidelines or a tax professional if you have any questions during the process.

Understanding IRS 943

What is the IRS 943 form used for?

The IRS 943 form, titled "Employer's Annual Federal Tax Return for Agricultural Employees", is utilized by agricultural employers to report the federal income taxes, social security tax, and Medicare taxes withheld from their agricultural employees' wages. Additionally, it encompasses the employer's share of social security and Medicare taxes.

Who needs to file form 943?

This form must be filed by agricultural employers who have paid wages that are subject to social security and Medicare taxes or subject to federal income tax withholding. Specifically, if an employer has paid more than $150 in wages to an agricultural worker or if the total wages of all agricultural workers exceed $2,500 in a calendar year, filing form 943 is obligatory.

When is the deadline to file form 943?

Form 943 must be filed by January 31 of the year following the reported tax year. If an employer makes deposits on time and in full, there is an extension until February 10. It is crucial to adhere to these deadlines to avoid possible penalties.

How can form 943 be filed?

Employers have the option to file form 943 either electronically through the IRS e-file system or by mailing a paper form to the designated IRS address. Electronic filing is encouraged as it's faster and reduces errors.

What information is required on form 943?

- Employer identification number (EIN).

- Total wages paid to agricultural employees.

- Amount of federal income tax withheld.

- Amounts of employer and employee shares of social security and Medicare taxes.

- Any adjustments to social security and Medicare taxes.

- Total deposits made for the year, including any overpayment credit applied from the previous year.

Can form 943 be corrected if a mistake is made?

Yes, if an error is discovered after filing, form 943-X, "Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund", can be submitted. This form allows employers to correct previously reported information and calculate the correct tax amount.

Is it possible to get an extension for filing form 943?

An extension of time to file form 943 may be requested by submitting form 8809, "Application for Extension of Time to File Information Returns". Note, however, that this extension does not apply to tax payments, only to the filing of the form itself.

What happens if form 943 is filed late or with incorrect payment?

Filing form 943 late or not paying the correct amount may result in penalties. Penalties are based on how late the form and payments are submitted. These can include a failure-to-file penalty, a failure-to-pay penalty, and interest on the amount owed.

Can employers deposit taxes for form 943 electronically?

Yes, employers are encouraged to use the Electronic Federal Tax Payment System (EFTPS) to submit their taxes. This secure government system ensures timely and accurate payment submissions free of charge.

Where can additional guidance on form 943 be found?

Employers seeking further assistance with form 943 can refer to the IRS publication 51, "Agricultural Employer’s Tax Guide", which provides detailed information on completing the form accurately. Additionally, the IRS website offers resources and a FAQ section for quick reference.

Common mistakes

Filling out the IRS 943 form, specifically designed for agricultural employers to report annual tax returns for agricultural employees, can be a meticulous process. Errors in its completion can lead to processing delays, fines, or audits. Below are eight common mistakes individuals make when completing this form.

-

Incorrect Employer Identification Number (EIN): Failing to provide the correct EIN can lead to misidentification of the employer’s tax account.

-

Miscalculating Totals: Many people inadvertently enter incorrect totals for taxes withheld from employees, often due to simple arithmetic errors or misunderstanding which wages are taxable.

-

Forgetting to Sign the Form: An unsigned form is considered incomplete by the IRS and will not be processed until properly signed.

-

Using the Wrong Year’s Form: Tax laws and form requirements can change each year; using an outdated form can result in compliance issues.

-

Incorrect Classification of Workers: Misclassifying employees as independent contractors or vice versa can lead to reporting and payment errors of Social Security, Medicare, and federal income taxes.

-

Failure to Report All Wages, Tips, and Other Compensation: Not including all forms of compensation, such as non-cash payments and fringe benefits, can lead to underreported taxes.

-

Misunderstanding of the Form’s Instructions: The IRS form instructions provide crucial guidance on how to complete the form correctly. Overlooking these instructions can increase the likelihood of errors.

-

Omitting Required Attachments: Certain situations require additional forms or schedules to be filed with IRS Form 943. Neglecting these attachments can result in an incomplete submission.

Understanding these common pitfalls can help individuals ensure a more accurate and smooth filing process for the IRS 943 form. Engaging with a tax professional can also be beneficial in navigating these challenges.

Documents used along the form

The IRS Form 943 is an essential document for employers in the agricultural sector, used to report annual federal tax returns for agricultural employees. Along with Form 943, several other forms and documents are frequently used to ensure compliance with tax regulations. Below is a description of up to 10 additional forms and documents often utilized in conjunction with the IRS Form 943.

- Form W-2: This form is issued to employees and the Social Security Administration by employers to report wages, tips, and other compensation paid to an employee, as well as the taxes withheld from their paycheck.

- Form W-3: This is the transmittal form that accompanies Form W-2 when sent to the Social Security Administration. It summarizes the total earnings, Social Security wages, Medicare wages, and withholding for all employees for the year.

- Form 940: Employers use this form to report their annual Federal Unemployment Tax Act (FUTA) tax. This tax funds unemployment compensation paid to workers who have lost their jobs.

- Form 941: This form is used by employers to report quarterly federal tax returns – including withheld income tax, and Social Security and Medicare taxes.

- Form W-4: Employees provide this form to their employers to indicate their tax situation (such as marital status and number of dependents) so that the employer can withhold the correct federal income tax from their pay.

- Form 1099-MISC: Employers use this form to report payments made in the course of a trade or business to others for services. This can include rent, prizes and awards, medical and health care payments, and payments to attorneys.

- Form 1099-NEC: This form is used to report non-employee compensation, such as payments to independent contractors. Starting in the tax year 2020, it has replaced Form 1099-MISC for reporting payments to non-employees.

- Schedule H (Form 1040): This schedule is for homeowners who employ household help and is used to report household employment taxes. It can often be used in conjunction with Form 943 when agricultural business owners also have household employees.

- Form 8974: Qualifying employers file this form to determine the amount of their qualified small business payroll tax credit for increasing research activities.

- Form 945: This is used to report withheld federal income tax from nonpayroll payments, including backup withholding and withholding on pensions, annuities, IRAs, gambling winnings, and payments of Indian gaming profits to tribal members.

Together, these forms and documents support the comprehensive reporting and tax compliance required for employers in the agricultural sector and beyond. They ensure that the necessary tax information is accurately reported to both employees and the federal government, facilitating a transparent and accountable tax filing process.

Similar forms

The IRS Form 943 is closely related to Form 941, "Employer's Quarterly Federal Tax Return." Both are tax forms used by employers to report federal taxes withheld from their employees' wages. While Form 943 is specifically designed for agricultural employers reporting annual taxes withheld for farmworkers, Form 941 is used by most other employers on a quarterly basis. The primary similarity lies in their purpose of reporting employees' income, Social Security, and Medicare taxes that have been withheld by the employer.

Form 940, "Employer's Annual Federal Unemployment (FUTA) Tax Return," shares similarities with Form 943 in that both are annual filings required by the IRS from employers. Form 943 focuses on reporting federal income tax and FICA taxes withheld for farmworkers, whereas Form 940 is concerned with reporting unemployment taxes owed by the employer. Despite their different focuses, each form plays a crucial role in ensuring employers fulfill their tax obligations related to employment.

Another similar document is Form W-2, "Wage and Tax Statement." This form is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. Similar to Form 943, which agricultural employers file to report taxes withheld for employees, Form W-2 provides this information on an individual employee basis. Both forms are integral in ensuring that employees are credited for their withheld taxes and that the IRS can accurately track income and tax obligations.

Form W-3, "Transmittal of Wage and Tax Statements," complements Form W-2 by summarizing the total wages and taxes reported by an employer on all issued W-2 forms. Like Form 943, which is used by agricultural employers to report aggregate employee tax withholdings, Form W-3 serves as a summary document, allowing the IRS to efficiently process employee wage and tax information. Both forms are essential for the compilation and review of reported tax information on a broader scale.

The IRS Form 944, "Employer's Annual Federal Tax Return," is also akin to Form 943. Form 944 is designed for smaller employers who have been notified by the IRS to file annually instead of quarterly (like with Form 941). The similarities between Forms 943 and 944 lie in their annual reporting requirement and their purpose, which is to report withheld income, Social Security, and Medicare taxes from employees' wages. However, Form 943 is specific to agricultural employers, while Form 944 can apply to a broader category of small employers.

Lastly, Form 1099-MISC, "Miscellaneous Income," is somewhat similar to Form 943 in that it involves reporting payments related to employment. While Form 943 is used by employers to report taxes withheld for employees, Form 1099-MISC is used to report payments made to independent contractors who are not considered employees. Both forms are part of the IRS's mechanism to capture income that is subject to federal tax, ensuring that all earnings are reported accurately.

Dos and Don'ts

Navigating the complexities of the IRS 943 form, a crucial document for agricultural employers reporting annual tax withheld for their employees, can be less daunting with a clear set of guidelines. Below, we present essential dos and don'ts to assist you in accurately completing this form.

Do's

- Double-check your Employer Identification Number (EIN) for accuracy. This unique number is vital for identifying your business and ensuring your submissions are correctly processed.

- Ensure all information is current and accurate, including your business name and address. Changes or updates should be promptly reported to the IRS to avoid any discrepancies.

- Calculate all wages, taxes withheld, and deposits meticulously. Errors in these calculations can lead to discrepancies, potentially resulting in penalties or additional scrutiny from the IRS.

- Sign and date the form. An unsigned form is considered incomplete and will not be processed by the IRS, potentially leading to delays or penalties.

- Use the IRS's electronic filing system if possible. E-filing is faster, more secure, and typically provides immediate confirmation of receipt.

- Keep a copy of the submitted form and any related documentation for at least four years. This documentation can be crucial in the event of questions or audits from the IRS.

Don'ts

- Don't leave any required fields blank. Incomplete forms can cause processing delays or be returned to you unprocessed.

- Don't guess on numbers or make estimations. Use actual figures from your payroll records to ensure accuracy.

- Don't ignore deadlines. Submitting your IRS 943 form late can result in penalties and interest charges.

- Don't use correction fluid or similar products on the form. If you make a mistake, it's best to start over with a new form to ensure legibility.

- Don't forget to report any and all applicable taxes, including social security and Medicare taxes. Omitting these can lead to underreporting and potential penalties.

- Don't hesitate to seek professional advice if you're unsure about any aspects of the form. Mistakes can be costly, and professional guidance can provide peace of mind and accuracy in reporting.

Misconceptions

Understanding the IRS 943 form is crucial for agricultural employers, but there are misconceptions that often lead to confusion. Here, we aim to clarify some of the most common misunderstandings about this important document.

Only large farms need to file Form 943. In reality, any agricultural employer who pays wages to farmworkers must file Form 943, regardless of the size of their operation, if those wages meet or exceed the threshold set by the IRS.

Form 943 is due at the end of the tax year. This is incorrect. The due date for filing Form 943 is January 31 of the year following the tax year for which it is being filed. If employers make deposits on time and in full, they may have until February 10 to file.

Form 943 covers all types of employees. Actually, Form 943 is specifically for agricultural employers paying wages to farmworkers. Employers with other types of employees must use different forms, such as Form 941 for non-agricultural employees.

The same tax rates apply each year to Form 943. Tax rates can change. Each year, employers need to check for updates to ensure they comply with the current rates and any changes in tax laws.

If no wages are paid, filing Form 943 is unnecessary. Incorrect. Even if no farmworkers were paid during the year, agricultural employers must file a Form 943 indicating no wages were paid.

Electronic filing of Form 943 is optional. While the IRS encourages electronic filing and it may be more convenient, it is not required. Employers have the option to file on paper, but electronic filing can expedite the process and reduce errors.

Casual labor does not need to be reported on Form 943. This is a misconception. All farmworkers, including those in casual labor, provided their earnings meet or exceed the IRS threshold for the year, must be reported on Form 943.

Form 943 is only for reporting wages. Besides wages, Form 943 is also used to report federal income tax withheld from employees, employer's portion of social security and Medicare taxes, and any advances from the Earned Income Credit (EIC) to employees.

Corrections to Form 943 cannot be made after it’s filed. Employers can correct errors on Form 943 by filing Form 943-X, Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund. This form allows corrections to previously reported amounts.

Clearing up these misconceptions about Form 943 helps ensure that agricultural employers are well-informed and can remain compliant with IRS regulations, avoiding potential penalties and fostering a smoother operational flow.

Key takeaways

The IRS 943 form is essential for agricultural employers to understand and utilize properly. Below are seven key takeaways regarding the completion and use of the form:

- The IRS 943 form is designated for agricultural employers to report annual federal tax withholdings from their employees' wages. This includes both income taxes and payroll taxes such as social security and Medicare.

- Employers must file this form if they have paid wages to one or more farmworkers and those wages were subject to social security and Medicare taxes, or subject to federal income tax withholding.

- Deadlines are crucial: The form is typically due on January 31st of the year following the reported tax year. For example, for taxes withheld in 2022, the form should be filed by January 31, 2023.

- Employers can choose to file electronically or by mail, but the IRS encourages electronic filing for more efficient processing.

- It’s important for employers to accurately calculate the taxes withheld and to report any deposits made during the year to avoid potential penalties for underpayment or late filing.

- In the event of an error after filing, employers must correct the mistake by filing an amended 943 form, known as 943-X, to adjust any previously reported information.

- Avoid common mistakes: Pay special attention to the accuracy of employer identification numbers (EIN), the total amounts of wages paid, and the total taxes reported. Discrepancies in these areas are common culprits of processing delays and could potentially trigger audits.

This concise overview provides agricultural employers with a fundamental understanding of the IRS 943 form's purpose, deadlines, and filing practices to ensure compliance with federal tax reporting requirements.

Popular PDF Documents

Tax Form 4506-t - This form serves as a request tool for obtaining past tax return information, essential for financial analysis or loan approval processes.

Mtc Form - The online TAP system enhances access to NTTCs, allowing for efficient application, execution, and management of certificates, benefitting tech-savvy businesses.