Get IRS 9423 Form

In the realm of taxpayer rights and the complex procedures that can unfold during a disagreement with the Internal Revenue Service (IRS), understanding the tools at one's disposal becomes paramount. Among these tools, the IRS 9423 form plays a crucial role, offering a structured pathway for individuals to contest collection actions that they believe are incorrectly applied to them. This form is integral to initiating a Collection Appeal Request, which allows taxpayers to voice their concerns regarding lien notices, levies, seizure of assets, and rejection or termination of installment agreements. It is designed to offer an immediate and efficient means for resolution before taking the dispute to court, providing a platform for review and dialogue between the taxpayer and the IRS. The form requires detailed information from the taxpayer, including the reason for disagreement, specific details of the disputed decision, and what outcome the taxpayer desires. It is a critical step for those seeking to challenge the IRS's actions, ensuring taxpayers have a fair chance to present their case. Understanding its function, the process of completing and submitting the form, and the potential outcomes is fundamental for individuals navigating through the IRS's collection process.

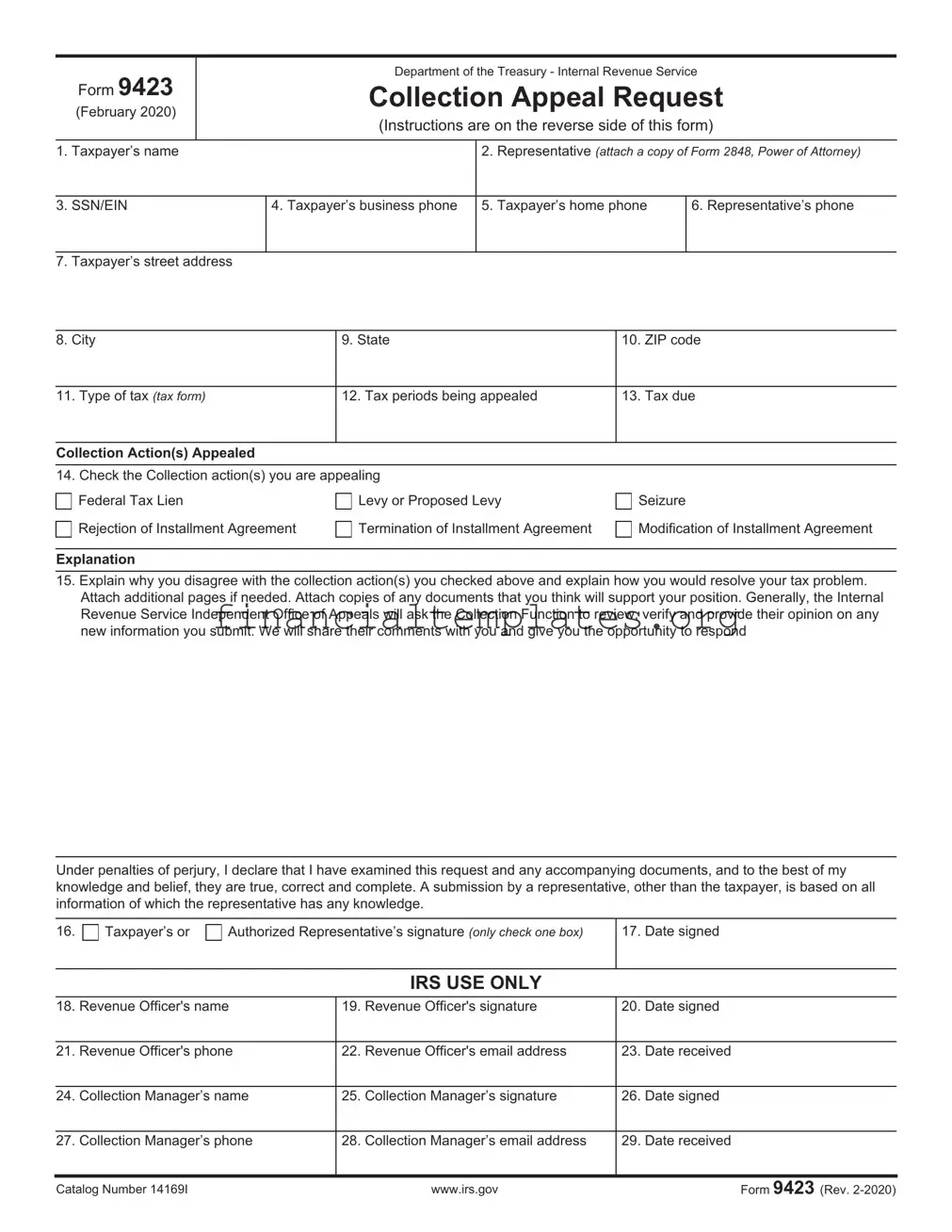

IRS 9423 Example

Form 9423

(February 2020)

Department of the Treasury - Internal Revenue Service

Collection Appeal Request

(Instructions are on the reverse side of this form)

1. Taxpayer’s name

2.Representative (attach a copy of Form 2848, Power of Attorney)

3. SSN/EIN

4. Taxpayer’s business phone |

5. Taxpayer’s home phone |

6. Representative’s phone

7. |

Taxpayer’s street address |

|

|

|

|

|

|

|

|

8. |

City |

9. State |

10. |

ZIP code |

|

|

|

|

|

11. Type of tax (tax form) |

12. Tax periods being appealed |

13. |

Tax due |

|

|

|

|

|

|

Collection Action(s) Appealed |

|

|

|

|

14. Check the Collection action(s) you are appealing |

|

|

||

|

Federal Tax Lien |

Levy or Proposed Levy |

Seizure |

|

|

Rejection of Installment Agreement |

Termination of Installment Agreement |

Modification of Installment Agreement |

|

Explanation

15.Explain why you disagree with the collection action(s) you checked above and explain how you would resolve your tax problem. Attach additional pages if needed. Attach copies of any documents that you think will support your position. Generally, the Internal Revenue Service Independent Office of Appeals will ask the Collection Function to review, verify and provide their opinion on any new information you submit. We will share their comments with you and give you the opportunity to respond

Under penalties of perjury, I declare that I have examined this request and any accompanying documents, and to the best of my knowledge and belief, they are true, correct and complete. A submission by a representative, other than the taxpayer, is based on all information of which the representative has any knowledge.

16. |

Taxpayer’s or |

Authorized Representative’s signature (only check one box) |

17. Date signed |

|

|

|

|

|

|

|

IRS USE ONLY |

|

|

18. |

Revenue Officer's name |

19. |

Revenue Officer's signature |

20. |

Date signed |

|

|

|

|

|

|

21. |

Revenue Officer's phone |

22. |

Revenue Officer's email address |

23. |

Date received |

|

|

|

|

|

|

24. |

Collection Manager’s name |

25. |

Collection Manager’s signature |

26. |

Date signed |

|

|

|

|

|

|

27. |

Collection Manager’s phone |

28. |

Collection Manager’s email address |

29. |

Date received |

|

|

|

|

|

|

Catalog Number 14169I |

www.irs.gov |

Form 9423 (Rev. |

Instructions for Form 9423, Collection Appeal Request

For Liens, Levies, Seizures, and Rejection, Modification or Termination of Installment Agreements

A taxpayer, or third party whose property is subject to a collection action, may appeal the following actions under the Collection Appeals Program (CAP):

a. Levy or seizure action that has been or will be taken.

b. A Notice of Federal Tax Lien (NFTL) that has been or will be filed.

c. The filing of a notice of lien against an

d. Denials of requests to issue lien certificates, such as subordination, withdrawal, discharge or

e. Rejected, proposed for modification or modified, or proposed for termination or terminated installment agreements. f. Disallowance of taxpayer's request to return levied property under IRC 6343(d).

g. Disallowance of property owner's claim for return of property under IRC 6343(b).

How to Appeal If You Disagree With a Lien, Levy, or Seizure Action

1.If you disagree with the decision of the IRS employee, and wish to appeal, you must first request a conference with the employee's manager. If you do not resolve your disagreement with the Collection manager, submit Form 9423 to request consideration by Appeals. Let the Collection office know within two (2) business days after the conference with the Collection manager that you plan to submit Form 9423. The Form 9423 must be received or postmarked within three (3) business days of the conference with the Collection manager or collection action may resume.

Note: If you request an appeal after IRS makes a seizure, you must appeal to the Collection manager within 10 business days after the Notice of Seizure is provided to you or left at your home or business.

2.If you request a conference and are not contacted by a manager or his/her designee within two (2) business days of making the request, you can contact Collection again or submit Form 9423. If you submit Form 9423, note the date of your request for a conference in Block 15 and indicate that you were not contacted by a manager. The Form 9423 should be received or postmarked within four (4) business days of your request for a conference as collection action may resume.

3.On the Form 9423, check the collection action(s) you disagree with and explain why you disagree. You must also explain your solution to resolve your tax problem. Submit Form 9423 to the Collection office involved in the lien, levy or seizure action.

4.In situations where the IRS action(s) are creating an economic harm or you want help because your tax problem has not been resolved through normal channels, you can reach the Taxpayer Advocate Service at

How to Appeal An Installment Agreement Which Has Been Rejected, Proposed for Modification or Modified, or Proposed for Termination or Terminated

1.If you disagree with the decision regarding your installment agreement, you should appeal by completing a Form 9423, Collection Appeal Request.

2.You should provide it to the office or revenue officer who took the action regarding your installment agreement, within 30 calendar days.

Note: A managerial conference is not required. However, it is strongly recommended a conference be held with the manager whenever possible.

Important: Never forward your request for an Appeals conference directly to Appeals. It must be submitted to the office which took the action on your installment agreement.

What Will Happen When You Appeal Your Case

Normally, we will stop the collection action(s) you disagree with until your appeal is settled, unless we have reason to believe that collection or the amount owed is at risk.

You May Have a Representative

You may represent yourself at your Appeals conference or you may be represented by an attorney, certified public accountant or a person enrolled to practice before the IRS. If you want your representative to appear without you, you must provide a properly completed Form 2848, Power of Attorney and Declaration of Representative. You can obtain Form 2848 from your local IRS office, by calling

Decision on the Appeal

Once Appeals makes a decision regarding your case, that decision is binding on both you and the IRS. You cannot obtain a judicial review of Appeals' decision following a CAP. However, there may be other opportunities to obtain administrative or judicial review of the issue raised in the CAP hearing. For example, a third party may contest a wrongful levy by filing an action in district court. See Publication 4528, Making an Administrative Wrongful Levy Claim Under Internal Revenue Code (IRC) Section 6343(b).

Note: Providing false information, failing to provide all pertinent information or fraud will void Appeals' decision.

Refer to Publication 594, The IRS Collection Process, and Publication 1660, Collection Appeal Rights, for more information regarding the Collection Appeals Program. Copies of these publications can be obtained online at www.irs.gov.

Privacy Act

The information requested on this Form is covered under Privacy Acts and Paperwork Reduction Notices which have already been provided to the taxpayer.

Catalog Number 14169I |

www.irs.gov |

Form 9423 (Rev. |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 9423 | The IRS Form 9423 is used for submitting an appeal to the IRS Office of Appeals. It is formally titled as a Collection Appeal Request which allows taxpayers to request a review of certain IRS decisions. |

| Eligible Issues for Appeal | Form 9423 can be used to appeal a variety of collection actions including liens, levies, seizure of property, or denial of installment agreements. |

| Time Frame for Submission | Taxpayers must submit Form 9423 within a specific timeframe that varies depending on the action being appealed. Typically, a rapid response is required, often within 30 days of the IRS notification. |

| Process after Submission | Once submitted, the IRS Office of Appeals will review the appeal. The process includes a thorough review of the collection action and may include a hearing or conference. |

| Governing Laws | The appeals process through Form 9423 is governed by federal tax laws and regulations. Specific statutes include sections of the Internal Revenue Code that concern taxpayer rights and appeals. |

| Impact of Filing | Filing Form 9423 may temporarily suspend collection actions depending on the appeal's nature. However, interest and penalties may continue to accrue during this period. |

| State-Specific Forms | Form 9423 is a federal form, and its use is uniform across the United States. State-specific tax disputes do not apply to this form, and separate state procedures exist for such appeals. |

Guide to Writing IRS 9423

Filling out IRS forms can be a significant step in resolving tax issues. It is essential to approach this task with care and attention to detail. To ensure that the IRS 9423 form is completed accurately, the following instructions will guide individuals through each step. It's essential to gather all necessary documentation before beginning to fill out the form to avoid any delays in the process. After the form is submitted, the responsible IRS office will review the provided information and take appropriate action based on the case's specifics.

- Start by providing your full name as it appears on your tax documents. This ensures that your submission is accurately matched to your tax records.

- Enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to help the IRS correctly identify your tax account.

- List your current mailing address, including the street name and number, city, state, and ZIP code. This address will be used for all correspondence related to your case.

- Specify the best telephone number at which you can be reached. Include area code and, if applicable, an extension number.

- Indicate the tax period(s) or year(s) your submission concerns. This helps clarify which specific filings or assessments your inquiry or issue relates to.

- Detail the action taken by the IRS that you are responding to or seeking clarification about. Be as specific as possible to ensure a clear understanding of the situation.

- Describe in detail why you disagree with the IRS's action. Present any relevant facts or arguments clearly and concisely to support your position.

- List any additional documentation you are submitting with the form. These documents should support your case or provide necessary clarification.

- Check the declaration box to affirm that the information provided is accurate and complete to the best of your knowledge. This is a crucial step for the integrity of your submission.

- Sign and date the form in the designated area. If you are submitting the form on behalf of a business, include your title or role within the organization.

Once the form is fully completed and reviewed for accuracy, submit it following the instructions provided by the IRS. This may involve mailing it to a specific address or submitting it through an online portal, if available. After submission, you may need to allow several weeks for processing. During this time, the IRS may contact you for additional information or clarification regarding your case. It is important to respond promptly to any requests from the IRS to ensure a timely resolution to your situation.

Understanding IRS 9423

-

What is the IRS 9423 form and why is it important?

The IRS 9423 form, also known as the "Collection Appeal Request," plays a crucial role when you disagree with certain collection actions by the IRS. This might include situations like a levy on your wages or bank account, or the denial of an installment agreement. Filing this form allows you to formally request an appeal, offering a pathway to dispute the action taken by the IRS. It's a critical step in ensuring your rights are protected and gives you a chance to present your case.

-

How can I obtain the IRS 9423 form?

You can get the IRS 9423 form by downloading it directly from the official IRS website. This ensures you have the most current version of the form. Additionally, the form might be available at local IRS offices or through tax professionals, but downloading it from the website is often the quickest and most reliable method.

-

Is there a deadline for filing the IRS 9423 form?

Yes, timing is very important with the IRS 9423 form. The deadline for filing depends on the type of collection action you're appealing. Generally, you must file the form within 30 days from the date of the IRS’s action notice. Missing this deadline might forfeit your right to appeal, making it crucial to act swiftly once you decide to appeal a collection action.

-

What information do I need to provide on the IRS 9423 form?

When filling out the IRS 9423 form, you need to include your personal details, tax identification number, and contact information. You'll also need to describe the collection action you're appealing and the reason for your appeal. Providing detailed information and any supporting documents you have can strengthen your case and help the appeals process move faster.

-

Where should I send the completed IRS 9423 form?

The completed IRS 9423 form should be sent to the IRS office handling your case. The exact address can be found on the notice of action you received from the IRS. It’s important to send the form to the correct office to avoid any delays in the appeal process.

-

What happens after I submit the form?

After submitting the IRS 9423 form, the IRS will review your appeal and may request additional information. You might also have the opportunity for a conference with an Appeals or Settlement Officer. This is your chance to further explain your situation. The IRS will then make a determination on your appeal, which you will be notified of in writing. It's important to keep a copy of all documents submitted and received throughout this process.

Common mistakes

Filling out the IRS 9423 form, also known as the Collection Appeal Request, requires attention to detail and an understanding of specific IRS procedures. Mistakes can lead to delays or unfavorable outcomes in the appeal process. Below are nine common errors individuals often make when completing this form:

-

Not specifying the correct tax period or year. It is crucial to accurately identify the tax periods in question to ensure the appeal relates to the correct timeframe.

-

Failing to clearly identify the specific IRS action being appealed. The IRS handles a wide array of actions; precisely detailing the action under dispute aids in proper processing of the appeal.

-

Omitting relevant supporting documents. Comprehensive documentation supports your appeal and provides evidence for your arguments against the IRS's actions.

-

Incorrectly stating the grounds for appeal. It's vital to understand the legal basis of your appeal and articulate it clearly to strengthen your case.

-

Not providing a clear solution or desired outcome. Articulating what resolution you seek helps the IRS understand your perspective and what you consider a fair resolution.

-

Delaying the submission of the form beyond deadlines. Timing is critical; submitting the form late can forfeit your right to appeal.

-

Sending the form to the wrong IRS office. Each type of appeal may have a specific office or address to which it should be sent; sending it to the wrong place can result in delays or misprocessing.

-

Failure to sign and date the form. An unsigned form may be considered incomplete and can be rejected or returned, delaying the process.

-

Overlooking the option for a conference or hearing. You may have the option to request a conference or hearing, which can be beneficial for your case but is often overlooked.

Attention to these details can significantly affect the outcome of the appeal process. Being thorough and precise ensures that your appeal is considered on its merits without being hindered by procedural mistakes.

Documents used along the form

When dealing with the IRS, especially in matters of collection appeals, it is paramount to have the right documentation in order. The IRS Form 9423, known as the Collection Appeal Request form, is often just one piece of the puzzle. Accompanying it, a variety of forms and documents may be necessary to provide a comprehensive appeal or request. Each document serves a unique purpose in the process, ensuring that taxpayers can present a transparent and detailed case to the IRS. Let us explore some of the other forms and documents that are frequently used alongside Form 9423.

- Form 433-A (OIC) – This form, the Collection Information Statement for Wage Earners and Self-Employed Individuals, is vital for offering detailed financial information. It's often used when proposing an Offer in Compromise or setting up a payment plan.

- Form 433-B (OIC) – Similar to Form 433-A but designed for businesses, the Collection Information Statement for Businesses provides the IRS with the necessary financial information of a business to assist in resolution decisions.

- Form 656 – When submitting an Offer in Compromise, this form is required. It allows taxpayers to propose a different amount to settle their tax debts than what is owed.

- Form 2848 – The Power of Attorney and Declaration of Representative form authorizes individuals or entities to represent the taxpayer before the IRS, allowing them to handle tax matters and negotiations.

- Form 8857 – Request for Innocent Spouse Relief is critical when one seeks relief from joint tax liabilities under the innocent spouse relief provisions.

- Form 12153 – Request for a Collection Due Process or Equivalent Hearing form is often filed in conjunction with Form 9423 to request a hearing regarding certain collection actions.

- Letter of Explanation – Though not a form, a detailed letter explaining the taxpayer's situation, discrepancies, or disputations provides necessary context and can be vital to the case.

- Financial Statements – Comprehensive financial statements may be requested to provide a full picture of the taxpayer's financial status, especially when proving hardship or negotiating payment plans.

- Supporting Legal Documents – Including divorce decrees, death certificates, or court orders, these documents can be crucial in proving the taxpayer's claim or situation.

Understanding and compiling the right forms and documents is a crucial step in effectively managing one's interactions with the IRS. Each form or document plays a role in illustrating the taxpayer's financial situation, making appeals, or negotiating payment terms. Proper preparation and organization of these materials can significantly impact the resolution of tax issues, emphasizing the importance of diligence and accuracy in tax matters.

Similar forms

The IRS 9423 form, known as the Collection Appeal Request, serves as a procedural gateway for taxpayers to challenge the collection actions proposed or taken by the Internal Revenue Service. A document bearing resemblance to the IRS 9423 in purpose and procedure is the IRS Form 12153, Request for a Collection Due Process or Equivalent Hearing. Both forms provide taxpayers with a platform to dispute collection decisions made by the IRS, essentially acting as an appeal against aggressive tax collection measures like levies and liens. Whereas the IRS 9423 form is specifically designed for appealing against the filing of a lien, levy, seizure, or the denial or termination of an installment agreement, Form 12153 is more narrowly focused on the rights under the Collection Due Process (CDP), typically invoked after receiving a Notice and Demand for Payment or a Final Notice of Intent to Levy.

Another document with similarities to the IRS 9423 form is the Form 656, Offer in Compromise. This form allows taxpayers to negotiate with the IRS to settle their tax liabilities for less than the full amount owed, providing a crucial lifeline for those under significant financial duress. The similarity lies in the objective - both forms aim to provide relief to taxpayers facing challenging circumstances with the IRS. However, while the IRS 9423 is an appeal mechanism for specific collection actions, Form 656 requires a detailed submission of financial information for the IRS to consider any reduction in liability.

The IRS Form 8379, Injured Spouse Allocation, also shares similarities with the IRS 9423 form. This form is used by taxpayers seeking relief from a situation where their share of a joint refund was (or is expected to be) applied against their spouse's past due federal debts, state taxes, child or spousal support, or federal non-tax debt like a student loan. Comparable to the IRS 9423 form, Form 8379 offers a procedural remedy to taxpayers seeking to contest the allocation of their refunds and to protect their portion from being used to satisfy their spouse’s debt. Although both forms offer recourse for taxpayers, Form 8379 specifically addresses issues of refund allocation among spouses, unlike the broad collection actions covered by the IRS 9423.

Form 433-A (OIC), Collection Information Statement for Wage Earners and Self-Employed Individuals, bears a functional relationship to the IRS 9423 form in that it is primarily used in the process of negotiating tax liabilities—specifically for those submitting an Offer in Compromise. While the IRS 9423 form facilitates the appeal against collection actions, Form 433-A (OIC) requires a comprehensive disclosure of financial information for individuals, aiding the IRS in determining the taxpayer's ability to pay. It’s a requisite part of the process for reaching a compromise on tax debt, in contrast to the appeal nature of the IRS 9423. However, both documents are crucial for individuals seeking relief from arduous financial obligations to the IRS.

Last but not least, Form 8857, Request for Innocent Spouse Relief, while tailored towards a specific subset of taxpayers, shares the common thread of contestation and relief from IRS actions, much like the IRS 9423 form. This form is used by taxpayers seeking relief from liability for tax, interest, and penalties resulting from the underreporting or underpayment of tax on a jointly filed return due to the actions or inaction of their spouse. Despite its specific focus, the essential similarity with IRS 9423 lies in providing a recourse for taxpayers to challenge decisions or circumstances that they believe unfairly impact their tax liabilities. Both forms stand as testament to the tax code’s recognition of individual circumstances and the need for avenues of redress.

Dos and Don'ts

Filling out the IRS 9423 form, also known as the Collection Appeal Request, necessitates careful attention to detail and a methodical approach. Here are some crucial dos and don'ts to keep in mind:

Do:

- Thoroughly read the instructions before starting the form to ensure a complete understanding of the required information.

- Provide accurate detail for every section to support your appeal adequately and convincingly.

- Use clear, concise language to explain the situation or the issue you are appealing against.

- Include all relevant documents and evidence that support your appeal. Proper documentation can be pivotal in the decision-making process.

- Double-check the form for any errors or omissions before submission. Accuracy is key in these matters.

- Ensure that your contact information is current and correct. Miscommunication can lead to delays or negative outcomes.

- Keep a copy of the form and all accompanying documents for your records. It's always good practice to have your own records.

- Be aware of the deadline for filing the appeal and submit the form in a timely manner to avoid missing the opportunity for your appeal to be heard.

- Consider seeking advice from a tax professional or advisor if you're unsure about any part of the appeals process.

- Use IRS electronic services if available, for a faster and more secure submission process.

Don't:

- Leave any sections blank. If a section does not apply, note it with “N/A” (not applicable) instead of leaving it empty.

- Provide incomplete or vague information. This can lead to misunderstandings or a rejection of your appeal.

- Misrepresent facts or circumstances. Always be truthful and transparent in your documentation and explanations.

- Forget to sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Overlook the importance of attaching supporting documents. These can strengthen your case and provide clarity to your situation.

- Submit the form without checking for updates or changes to the appeal process. The IRS occasionally updates its procedures, which could affect your appeal.

- Ignore instructions about where to send the form. Sending it to the wrong office can delay processing times significantly.

- Assume that submission is confirmation of receipt. If sending by mail, consider using certified mail for proof of delivery.

- Be impatient. The appeals process can take time, so it's important to wait for a response before taking further action.

- Rely solely on this form for urgent tax matters. If you're facing an immediate action from the IRS, contact them directly to discuss your situation.

Misconceptions

Understanding the IRS 9423 form can sometimes be challenging, leading to various misconceptions. This document is crucial for those involved in appealing against the IRS decisions. Let's clear up some of the common misunderstandings:

The IRS 9423 form is optional during the appeals process. Contrary to this belief, the IRS 9423 form, or the Collection Appeal Request form, plays a vital role. It's required for taxpayers who wish to challenge the IRS's decisions regarding lien, levy, seizure, or denial of an installment agreement. Without this form, the appeals process cannot move forward.

It's too complex for individuals to fill out without professional help. Although the form involves legal and financial information, with careful reading and perhaps guidance from IRS resources, many individuals can accurately complete the form. Assistance from a tax professional or legal advisor can be beneficial but is not always necessary.

The form can be filed at any time. There are specific timeframes within which appeals need to be made using the IRS 9423 form. Generally, there's a 30-day window from the date of the IRS’s decision. Filing beyond this timeframe could result in the loss of the right to appeal.

Once filed, the IRS 9423 form ensures a stop to collection actions immediately. While filing this form does generally halt collection actions until the appeals process is concluded, there are exceptions. It's important to understand that in certain cases, the IRS may continue with collections if they deem it's necessary to protect the government's interest.

Filing this form guarantees a favorable outcome. While the appeals process is in place to ensure fairness and allow taxpayers to challenge decisions, filing the IRS 9423 form does not guarantee the decision will be in the taxpayer’s favor. The outcome will depend on the specifics of the case, as assessed by the appeals officer.

Addressing these misconceptions head-on helps in setting realistic expectations and prepares individuals for the process ahead. It's always recommended to approach such matters with accurate information and, if possible, the guidance of a professional.

Key takeaways

The IRS 9423 form, officially known as the Collection Appeal Request, is a document individuals and businesses can use if they disagree with certain IRS collection actions. Understanding how to properly fill out and use this form is crucial in ensuring your rights are protected during disputes with the IRS. Below are key takeaways to help guide you through this process:

- Before filling out the form, it is important to identify the specific collection action you are appealing. Common actions include liens, levies, and seizure of property.

- Accuracy is paramount when completing the IRS 9423 form. Ensure all information provided, including your name, address, tax identification number, and the tax period in question, is correct and up-to-date.

- State your reason for disagreeing with the IRS's collection action clearly and concisely in the form. Providing a detailed explanation will help the IRS understand your perspective and basis for the appeal.

- Attach any relevant documentation that supports your case when you submit the form. This can include letters you have received from the IRS, any evidence that payments were made, or other documents that substantiate your appeal.

- Timeliness is crucial. There are strict deadlines for when the IRS 9423 form must be submitted following notification of a collection action. Failing to adhere to these deadlines may result in the forfeiture of your appeal rights.

- After submitting your Collection Appeal Request, prepare for the possibility of a hearing. This may be your opportunity to present your case in more detail and further argue your position against the IRS's actions.

- Consider seeking assistance from a tax professional or advocate if you are unsure about how to proceed with your appeal. They can offer valuable guidance and representation throughout the process.

- Be aware that the appeal does not stop interest from accruing on any tax amount owed unless the IRS decides in your favor. Therefore, it's wise to consider ways to settle any outstanding tax liabilities in parallel with your appeal.

By taking the time to carefully prepare and submit the IRS 9423 form, you can help ensure that your concerns are heard and duly considered. Remember, the goal of the appeals process is to resolve disputes fairly and impartially, so providing a complete and honest account of your situation is always in your best interest.

Popular PDF Documents

966 - This form is also applicable when a corporation is involved in a merger or consolidation that results in its dissolution.

Irs Form 851 - Form 851 must be attached to the consolidated return, making it a crucial piece of the overall tax filing process for corporate groups.