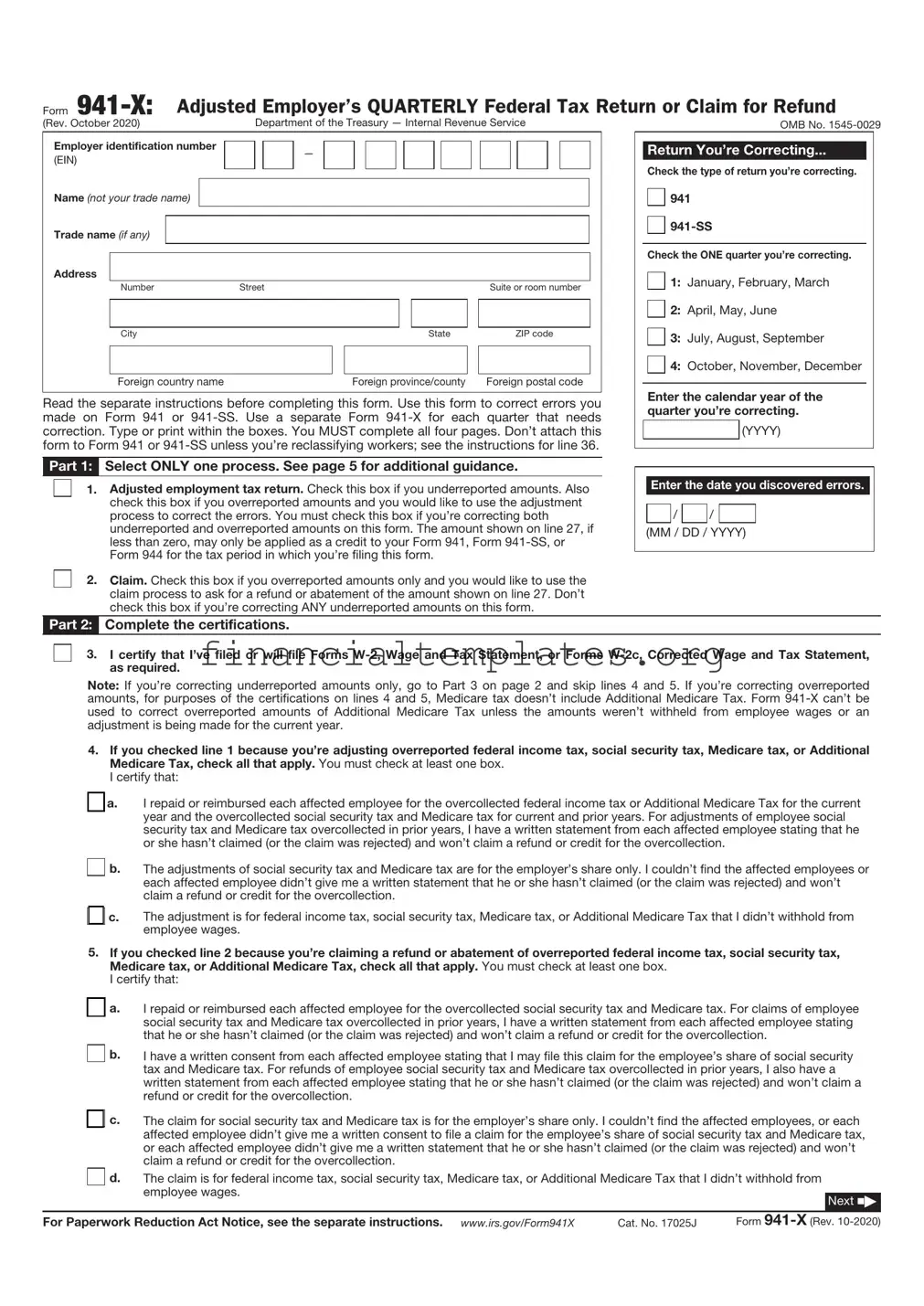

Get IRS 941-X Form

Business owners know that navigating the complexities of payroll taxes is part and parcel of the job. Errors happen, whether from simple miscalculations, misunderstanding the law, or changes in company information. Fortunately, the Internal Revenue Service (IRS) provides a means to correct these mistakes through the 941-X form. This form allows employers to make adjustments to previously filed Form 941s, the Employer's Quarterly Federal Tax Return. It can address corrections for wages, tips, and other compensation, income tax withheld from wages, and both the employer’s and employee’s share of social security and Medicare taxes. The 941-X is a critical tool for maintaining compliance and ensuring the accuracy of your payroll tax filings. Organizations need to understand when it's appropriate to use this form, how to accurately complete it, and the ramifications of any adjustments made. This detailed process involves identifying the types of errors, calculating the correct amounts, and understanding the deadlines and procedures to properly amend past returns. It's a testament to the IRS's recognition of the need for flexibility in the face of honest mistakes, as well as an invaluable resource for businesses striving to keep their tax records accurate and up to date.

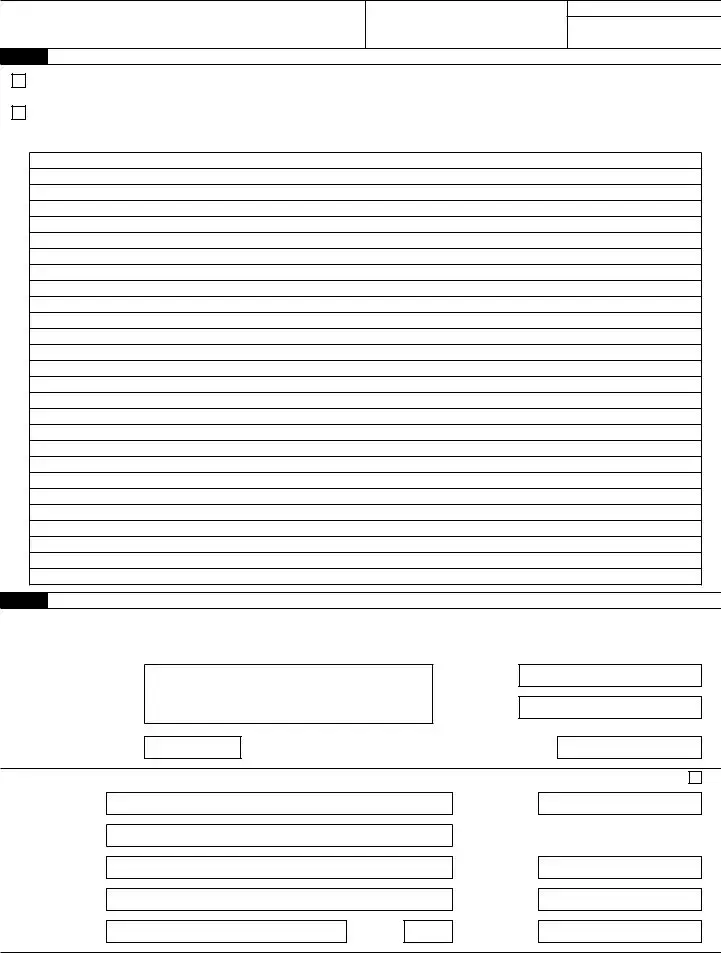

IRS 941-X Example

Form

(Rev. July 2021) |

Department of the Treasury — Internal Revenue Service |

OMB No. |

Employer identification number |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(EIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade name (if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Number |

Street |

|

|

|

Suite or room number |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

Foreign province/county |

Foreign postal code |

Read the separate instructions before completing this form. Use this form to correct errors you made on Form 941 or

Return You’re Correcting...

Check the type of return you’re correcting.

941

Check the ONE quarter you’re correcting.

1: January, February, March

2: April, May, June

3: July, August, September

4: October, November, December

Enter the calendar year of the quarter you’re correcting.

(YYYY)

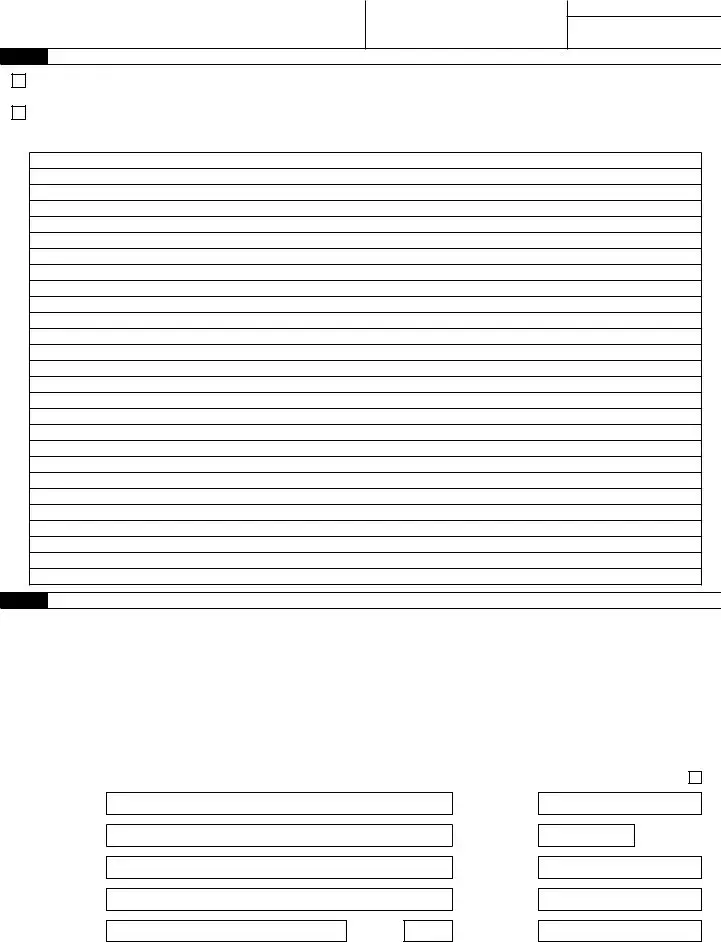

Part 1: Select ONLY one process. See page 6 for additional guidance, including information on how to treat employment tax credits and social security tax deferrals.

1.Adjusted employment tax return. Check this box if you underreported tax amounts. Also check this box if you overreported tax amounts and you would like to use the adjustment process to correct the errors. You must check this box if you’re correcting both underreported and overreported tax amounts on this form. The amount shown on line 27, if less than zero, may only be applied as a credit to your Form 941, Form

2. Claim. Check this box if you overreported tax amounts only and you would like to use the claim process to ask for a refund or abatement of the amount shown on line 27. Don’t check this box if you’re correcting ANY underreported tax amounts on this form.

Enter the date you discovered errors.

/ |

|

/ |

(MM / DD / YYYY)

Part 2: Complete the certifications.

3.I certify that I’ve filed or will file Forms

Note: If you’re correcting underreported tax amounts only, go to Part 3 on page 2 and skip lines 4 and 5. If you’re correcting overreported tax amounts, for purposes of the certifications on lines 4 and 5, Medicare tax doesn’t include Additional Medicare Tax. Form

4.If you checked line 1 because you’re adjusting overreported federal income tax, social security tax, Medicare tax, or Additional Medicare Tax, check all that apply. You must check at least one box.

I certify that:

a.I repaid or reimbursed each affected employee for the overcollected federal income tax or Additional Medicare Tax for the current year and the overcollected social security tax and Medicare tax for current and prior years. For adjustments of employee social security tax and Medicare tax overcollected in prior years, I have a written statement from each affected employee stating that he or she hasn’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

b. The adjustments of social security tax and Medicare tax are for the employer’s share only. I couldn’t find the affected employees or each affected employee didn’t give me a written statement that he or she hasn’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

b. The adjustments of social security tax and Medicare tax are for the employer’s share only. I couldn’t find the affected employees or each affected employee didn’t give me a written statement that he or she hasn’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

c.The adjustment is for federal income tax, social security tax, Medicare tax, or Additional Medicare Tax that I didn’t withhold from employee wages.

5.If you checked line 2 because you’re claiming a refund or abatement of overreported federal income tax, social security tax, Medicare tax, or Additional Medicare Tax, check all that apply. You must check at least one box.

I certify that:

|

|

a. |

I repaid or reimbursed each affected employee for the overcollected social security tax and Medicare tax. For claims of employee |

|||

|

|

|

social security tax and Medicare tax overcollected in prior years, I have a written statement from each affected employee stating |

|||

|

|

|

that he or she hasn’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection. |

|||

|

|

b. |

I have a written consent from each affected employee stating that I may file this claim for the employee’s share of social security |

|||

|

|

|

tax and Medicare tax. For refunds of employee social security tax and Medicare tax overcollected in prior years, I also have a |

|||

|

|

|

written statement from each affected employee stating that he or she hasn’t claimed (or the claim was rejected) and won’t claim a |

|||

|

|

|

refund or credit for the overcollection. |

|

|

|

|

|

c. |

The claim for social security tax and Medicare tax is for the employer’s share only. I couldn’t find the affected employees, or each |

|||

|

|

|||||

|

|

|

affected employee didn’t give me a written consent to file a claim for the employee’s share of social security tax and Medicare tax, |

|||

|

|

|

or each affected employee didn’t give me a written statement that he or she hasn’t claimed (or the claim was rejected) and won’t |

|||

|

|

|

claim a refund or credit for the overcollection. |

|

|

|

|

|

d. |

The claim is for federal income tax, social security tax, Medicare tax, or Additional Medicare Tax that I didn’t withhold from |

|||

|

|

|

employee wages. |

|

|

Next ■▶ |

|

|

|

|

|||

For Paperwork Reduction Act Notice, see the separate instructions. www.irs.gov/Form941X |

Cat. No. 17025J |

Form |

||||

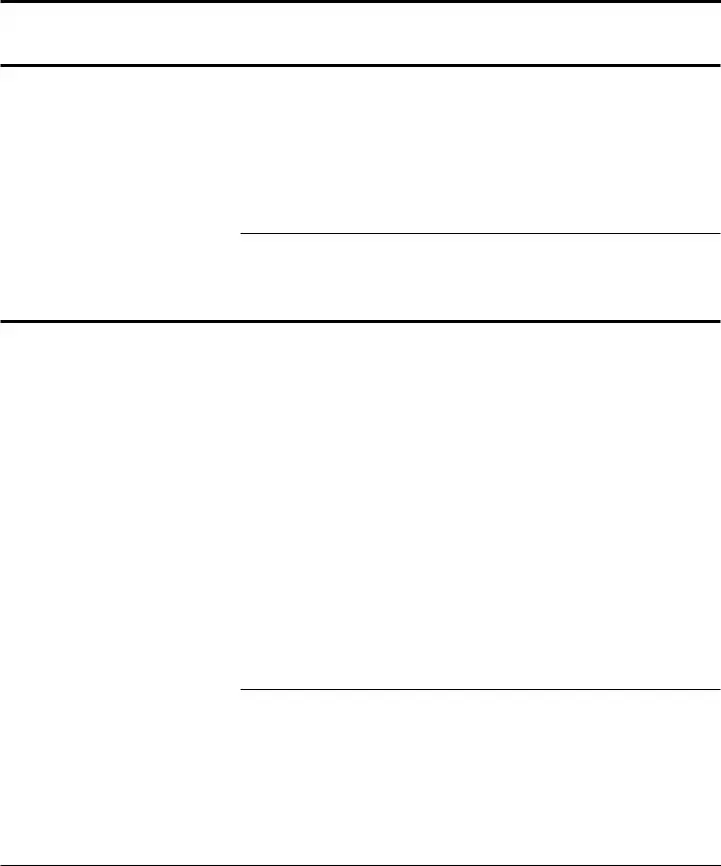

Name (not your trade name) |

Employer identification number (EIN) |

Correcting quarter |

(1, 2, 3, 4) |

Correcting calendar year (YYYY)

Part 3: Enter the corrections for this quarter. If any line doesn’t apply, leave it blank.

Column 1 |

Column 2 |

Column 3 |

Column 4 |

6. |

Wages, tips, and other |

|

compensation (Form 941, line 2) |

7. |

Federal income tax withheld |

|

from wages, tips, and other |

|

compensation (Form 941, line 3) |

8. |

Taxable social security wages |

|

(Form 941 or |

|

Column 1) |

Total corrected amount (for ALL employees)

.

.

.

Amount originally reported or as

—previously corrected (for ALL employees)

—.

—.

—.

=

=

=

=

Difference

(If this amount is a negative number, use a minus sign.)

.

.

.

Tax correction

Use the amount in Column 1 when you prepare your Forms

Copy Column |

. |

3 here ▶ |

|

|

|

|

|

× 0.124* = |

. |

9. |

Qualified sick leave wages* |

|

(Form 941 or |

|

Column 1) |

|

|

|

|

* If you’re correcting your employer share only, use 0.062. See instructions. |

|||

|

— |

|

= |

|

|

|

|

. |

. |

|

. |

× 0.062 = |

. |

||

* Use line 9 only for qualified sick leave wages paid after March 31, 2020, for leave taken before April 1, 2021.

10.Qualified family leave wages* (Form 941 or

11.Taxable social security tips (Form 941 or

. |

— |

. |

= |

. |

× 0.062 = |

. |

* Use line 10 only for qualified family leave wages paid after March 31, 2020, for leave taken before April 1, 2021.

. |

— |

. |

= |

. |

× 0.124* = |

. |

|

|

* If you’re correcting your employer share only, use 0.062. See instructions.

12.Taxable Medicare wages & tips (Form 941 or

.

—

.

= |

. |

× 0.029* = |

. |

|

* If you’re correcting your employer share only, use 0.0145. See instructions.

13. |

Taxable wages & tips subject to |

|

Additional Medicare Tax |

|

withholding (Form 941 or |

|

.

—

. |

= |

. |

× 0.009* = |

. |

|

* Certain wages and tips reported in Column 3 shouldn’t be multiplied by 0.009. See instructions.

14. |

Section 3121(q) Notice and |

|

|

|

unreported tips (Form 941 or |

|

|

15. |

Tax adjustments (Form 941 or |

|

|

16. |

Qualified small business payroll tax |

|

credit for increasing research |

|

activities (Form 941 or |

|

11a; you must attach Form 8974) |

17. |

Nonrefundable portion of credit |

|

for qualified sick and family |

|

leave wages for leave taken |

|

before April 1, 2021 (Form 941 |

|

or |

18a. Nonrefundable portion of employee retention credit

(Form 941 or

18b. Nonrefundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021 (Form 941

or

18c. Nonrefundable portion of COBRA premium assistance credit

(Form 941 or

18d. Number of individuals provided COBRA premium assistance

(Form 941 or

.

.

.

.

.

.

.

—

—

—

—

—

—

—

—

.

.

.

.

.

.

.

=

=

=

=

=

=

=

=

.

.

.

.

.

.

.

Copy Column 3 here ▶

Copy Column 3 here ▶

See instructions

See instructions

See instructions

See instructions

See instructions

.

.

.

.

.

.

.

19.Special addition to wages for federal income tax

20.Special addition to wages for social security taxes

21.Special addition to wages for Medicare taxes

.

.

.

—

—

—

. |

= |

. |

See |

. |

|

|

instructions |

||||

|

= |

|

See |

|

|

. |

. |

. |

|||

|

instructions |

||||

|

= |

|

See |

|

|

. |

. |

. |

|||

|

instructions |

Next ■▶

Page 2 |

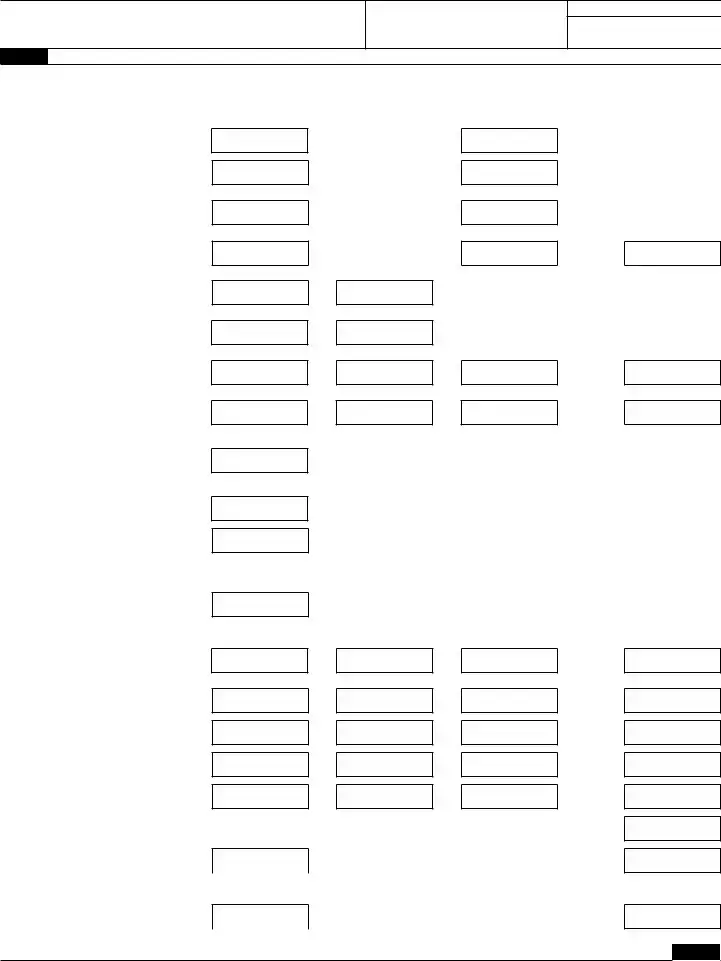

Form |

Name (not your trade name) |

Employer identification number (EIN) |

Correcting quarter |

(1, 2, 3, 4) |

Correcting calendar year (YYYY)

Part 3: Enter the corrections for this quarter. If any line doesn’t apply, leave it blank. (continued)

|

|

Column 1 |

|

|

Column 2 |

|

Column 3 |

|

|

|

Total corrected |

|

|

Amount originally |

|

Difference |

|

|

|

amount (for ALL |

|

reported or as |

= |

(If this amount is a |

|

|

|

|

employees) |

|

— |

previously corrected |

negative number, |

|

|

|

|

|

|

|

(for ALL employees) |

|

use a minus sign.) |

|

22. |

Special addition to wages for |

|

. |

— |

. |

= |

. |

See |

|

Additional Medicare Tax |

|

||||||

|

|

|

|

instructions |

||||

23. |

Combine the amounts on lines 7 through 22 of Column 4 |

|||||||

Column 4

Tax correction

.

.

24.Deferred amount of social security tax* (Form 941 or

. |

— |

. |

= |

. |

See |

. |

|

|

instructions |

* Use this line to correct the employer deferral for the second quarter of 2020 and the employer and employee deferral for the third and fourth quarters of 2020.

25.Refundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021 (Form 941 or 941- SS, line 13c)

.

—

.

=

.

See instructions

.

26a. Refundable portion of employee

retention credit (Form 941 or

26b. Refundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021 (Form 941 or

.

.

—

—

.

.

=

=

.

.

See instructions

See instructions

.

.

26c. |

Refundable portion of COBRA |

. |

— |

. |

= |

. |

See |

|

premium assistance credit |

||||||

|

|

|

instructions |

||||

|

(Form 941 or |

|

|

|

|

|

|

27. |

Total. Combine the amounts on lines 23 through 26c of Column 4 |

||||||

|

If line 27 is less than zero: |

|

|

|

|

|

|

.

.

•If you checked line 1, this is the amount you want applied as a credit to your Form 941 or

•If you checked line 2, this is the amount you want refunded or abated.

If line 27 is more than zero, this is the amount you owe. Pay this amount by the time you file this return. For information on how to pay, see Amount you owe in the instructions.

28.Qualified health plan expenses allocable to qualified sick leave wages for leave taken before April 1, 2021 (Form 941 or 941- SS, line 19)

29.Qualified health plan expenses allocable to qualified family leave wages for leave taken before April 1, 2021 (Form 941 or

30.Qualified wages for the employee retention credit (Form 941 or

.

.

.

—

—

—

.

.

.

=

=

=

.

.

.

31a. Qualified health plan expenses for the employee retention credit

(Form 941 or

.

—

.

=

.

31b. Check here if you’re eligible for the employee retention credit in the third or fourth quarter of 2021 solely because your business is a recovery startup business . . . . . . . . . . . .

32.Credit from Form

. |

— |

. |

= |

. |

|

|

|||

|

|

|

|

|

* Use line 32 to correct only the second, third, and fourth quarters of 2020, and the first quarter of 2021.

Next ■▶

Page 3 |

Form |

Name (not your trade name) |

Employer identification number (EIN) |

Correcting quarter |

(1, 2, 3, 4) |

Correcting calendar year (YYYY)

Part 3: Enter the corrections for this quarter. If any line doesn’t apply, leave it blank. (continued)

Column 1 |

Column 2 |

Column 3 |

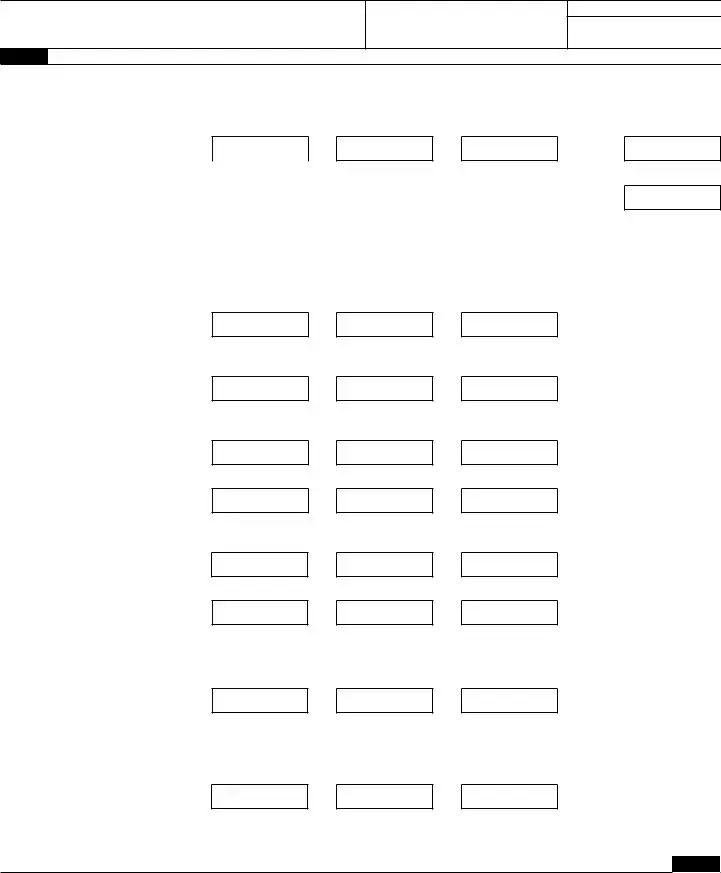

33a. Qualified wages paid March 13 through March 31, 2020, for the employee retention credit*

(Form 941 or

33b. Deferred amount of the employee share of social security tax included on Form 941 or

(Form 941 or

Total corrected |

|

Amount originally |

|

|

amount (for ALL |

|

reported or as |

= |

|

employees) |

— |

previously corrected |

||

|

|

(for ALL employees) |

|

|

|

— |

|

= |

|

. |

. |

|||

|

|

|||

|

|

|

|

* Use line 33a to correct only the second quarter of 2020.

. |

— |

. |

= |

|

|

||

|

|

|

|

* Use line 33b to correct only the third and fourth quarters of 2020.

Difference

(If this amount is a negative number, use a minus sign.)

.

.

34. |

Qualified health plan expenses |

. |

— |

. |

|

allocable to wages reported on |

|||

|

|

|||

|

Form 941 or |

|

|

|

|

* Use line 34 to correct only the second quarter of 2020. |

|||

|

(Form 941 or |

|

|

|

Caution: Lines

=

.

35.Qualified sick leave wages for leave taken after March 31, 2021 (Form 941 or

36.Qualified health plan expenses allocable to qualified sick leave wages for leave taken after March 31, 2021 (Form 941 or

37.Amounts under certain collectively bargained agreements allocable to qualified sick leave wages for leave taken after March 31, 2021 (Form 941 or

.

.

.

—

—

—

.

.

.

=

=

=

.

.

.

38.Qualified family leave wages for leave taken after March 31, 2021 (Form 941 or

39.Qualified health plan expenses allocable to qualified family leave wages for leave taken after March 31, 2021 (Form 941 or

.

.

—

—

.

.

=

=

.

.

40.Amounts under certain collectively bargained agreements allocable to qualified family leave wages for leave taken after March 31, 2021 (Form 941 or

.

—

.

=

.

Next ■▶

Page 4 |

Form |

Name (not your trade name) |

Employer identification number (EIN) |

Correcting quarter |

(1, 2, 3, 4) |

Correcting calendar year (YYYY)

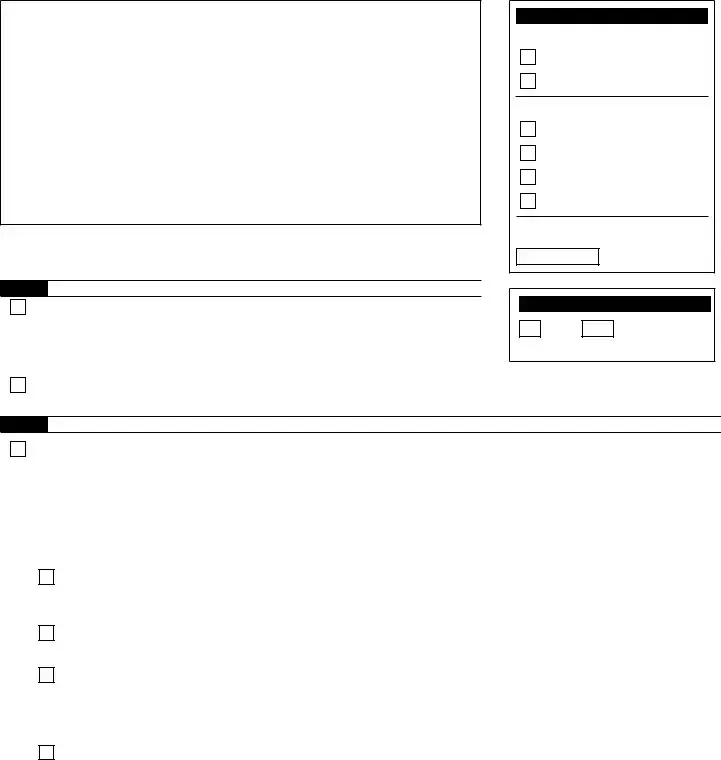

Part 4: Explain your corrections for this quarter.

41. Check here if any corrections you entered on a line include both underreported and overreported amounts. Explain both your underreported and overreported amounts on line 43.

42. Check here if any corrections involve reclassified workers. Explain on line 43.

43.You must give us a detailed explanation of how you determined your corrections. See the instructions.

Part 5: Sign here. You must complete all five pages of this form and sign it.

Under penalties of perjury, I declare that I have filed an original Form 941 or Form

✗ |

|

|

|

|

|

Print your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sign your |

|

|

|

|

name here |

|

|

|

|

|

|

|

|

Print your |

|

|

|

|

|

name here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

title here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

/ |

/ |

|

Best daytime phone |

|

|

|

|

|

|

|

|

|

||||

Paid Preparer Use Only |

|

|

|

Check if you’re |

|

||||

Preparer’s name

Preparer’s signature

Firm’s name (or yours if

Address

City

State

PTIN

Date

EIN

Phone

ZIP code

/ /

Page 5 |

Form |

Form

|

Unless otherwise specified in the separate instructions, an underreported employment tax credit or social |

|

|

security tax deferral should be treated like an overreported tax amount. An overreported employment tax credit |

|

Type of errors |

or social security tax deferral should be treated like an underreported tax amount. For more information, |

|

including which process to select on lines 1 and 2, see Correcting an employment tax credit or social security tax |

||

you’re correcting |

||

deferral in the separate instructions. |

||

|

||

|

|

|

Underreported |

Use the adjustment process to correct underreported tax amounts. |

|

• Check the box on line 1. |

||

tax amounts |

||

ONLY |

• Pay the amount you owe from line 27 by the time you file Form |

Overreported tax amounts

ONLY

The process you use depends on when you file Form

If you’re filing Form |

Choose either the adjustment process or the claim |

|

MORE THAN 90 days before |

process to correct the overreported tax amounts. |

|

the period of limitations on |

Choose the adjustment process if you want the |

|

credit or refund for Form 941 |

||

amount shown on line 27 credited to your Form 941, |

||

or Form |

||

Form |

||

|

||

|

file Form |

|

|

OR |

|

|

Choose the claim process if you want the amount |

|

|

shown on line 27 refunded to you or abated. Check |

|

|

the box on line 2. |

|

|

|

|

If you’re filing Form |

You must use the claim process to correct the |

|

WITHIN 90 days of the |

overreported tax amounts. Check the box on line 2. |

|

expiration of the period of |

|

|

limitations on credit or refund |

|

|

for Form 941 or Form |

|

BOTH underreported and overreported tax amounts

The process you use depends on when you file Form

If you’re filing Form |

Choose either the adjustment process or both the |

|

MORE THAN 90 days before |

adjustment process and the claim process when you |

|

the period of limitations on |

correct both underreported and overreported tax |

|

credit or refund for Form 941 |

amounts. |

|

or Form |

Choose the adjustment process if combining your |

|

|

underreported tax amounts and overreported tax |

|

|

amounts results in a balance due or creates a credit |

|

|

that you want applied to Form 941, Form |

|

|

Form 944. |

|

|

• File one Form |

|

|

• Check the box on line 1 and follow the instructions |

|

|

on line 27. |

|

|

OR |

|

|

Choose both the adjustment process and the |

|

|

claim process if you want the overreported tax |

|

|

amount refunded to you or abated. |

|

|

File two separate forms. |

|

|

1. For the adjustment process, file one Form |

|

|

to correct the underreported tax amounts. Check |

|

|

the box on line 1. Pay the amount you owe from |

|

|

line 27 by the time you file Form |

|

|

2. For the claim process, file a second Form |

|

|

to correct the overreported tax amounts. Check |

|

|

the box on line 2. |

|

|

|

|

If you’re filing Form |

You must use both the adjustment process and |

|

WITHIN 90 days of the |

the claim process. |

|

expiration of the period of |

File two separate forms. |

|

limitations on credit or |

1. For the adjustment process, file one Form |

|

refund for Form 941 or |

||

to correct the underreported tax amounts. Check |

||

Form |

||

the box on line 1. Pay the amount you owe from |

||

|

||

|

line 27 by the time you file Form |

|

|

2. For the claim process, file a second Form |

|

|

to correct the overreported tax amounts. Check |

|

|

the box on line 2. |

Page 6 |

Form |

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS 941-X form is used to correct mistakes made on the IRS Form 941, which is the Employer's Quarterly Federal Tax Return. |

| 2 | This form allows businesses to adjust wages, taxes, and tips reported previously. |

| 3 | Form 941-X can be filed at any time after the original Form 941 has been filed, but there are deadlines for claiming a refund or abatement of taxes. |

| 4 | There are two ways to correct errors using Form 941-X: the Adjusted Employment Tax Return and the Claim for Refund or Abatement. |

| 5 | Employers must provide detailed explanations of the errors on the original Form 941 and document the corrections on Form 941-X. |

| 6 | The form requires employers to calculate the difference in tax due as a result of the corrections. |

| 7 | If using the form to claim a refund, the employer may have to wait up to a year to receive it, depending on IRS backlog and processing times. |

| 8 | Form 941-X is subject to review by the IRS, and employers may be contacted for additional information or documentation. |

| 9 | Filing Form 941-X does not guarantee acceptance of the corrections by the IRS; discrepancies may lead to audits or penalties. |

| 10 | The IRS recommends that Form 941-X be filed electronically for faster processing, though it can also be submitted by paper mail. |

Guide to Writing IRS 941-X

Filing an IRS 941-X form is necessary for amending previously reported payroll taxes through Form 941. Errors or changes required in the tax amount, whether they are discovered by a business owner or pointed out during an IRS audit, need prompt correction to avoid potential penalties. The steps below are designed to guide you through the process of accurately completing the form, ensuring that your business remains in compliance with tax regulations. It is crucial for business owners or their representatives to carefully review each section of the form to ensure all amendments are accurately reflected.

- Obtain the latest version of the IRS 941-X form from the IRS website.

- Read the instructions provided by the IRS for filling out the form to understand the information required and how to accurately report your amendments.

- Identify the quarter and the year you are correcting in the designated section at the top of the form.

- Choose the reason for filing the amendment from the options provided on the form. This selection will guide the specifics of how you complete the rest of the form.

- Determine the total corrections for each line from the original 941 form that needs to be amended. This includes adjustments to wages, tax amounts, and any credits or adjustments to credits previously claimed.

- Calculate the correct amounts, considering both the overreported and underreported figures, and enter these in the appropriate lines on the form. It's important to carefully follow the instructions for each line to ensure accuracy.

- Explain each adjustment made on the form. The IRS requires a detailed explanation for every change to ensure the corrections are clear and justified.

- Sign and date the form. The signature attests that the information provided is accurate to the best of your knowledge. Ensure the form is signed by an authorized individual, such as the business owner, an officer of the corporation, a partner in a partnership, or an authorized representative.

- Refer to the IRS instructions for Form 941-X to determine where to file the amended return. The IRS may direct you to different addresses depending on your state and the specific corrections made.

- Mail the completed form to the appropriate IRS address. Ensure you keep a copy of the form and any supporting documents for your records.

After submitting the form, it's essential to monitor any correspondence from the IRS related to the amendment. The IRS may request additional information to process the correction, so responding promptly to any inquiries is important to finalize the amendment. Remember, the goal of filing Form 941-X is to correct payroll tax errors and ensure compliance with tax reporting requirements, thereby minimizing the risk of penalties and ensuring accurate tax payments to the IRS.

Understanding IRS 941-X

-

What is the IRS 941-X form?

The IRS 941-X form, officially titled "Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund," is used by employers to make corrections to previously filed Form 941, "Employer's Quarterly Federal Tax Return." This includes fixing mistakes related to wages, taxes withheld from employees, and the employer's share of social security and Medicare taxes. It's essential for maintaining accurate tax records and ensuring compliance with federal tax laws.

-

When should an employer file a 941-X form?

An employer should file a 941-X form when they need to correct errors discovered on a previously filed Form 941. Such corrections may include overreporting or underreporting amounts related to wages, tips, income taxes withheld from employees, and the employer's and employees' shares of social security and Medicare taxes. It's important to file this form as soon as the error is discovered to avoid potential penalties and interest for incorrect tax filings.

-

Can the 941-X form be filed electronically?

As of the last update, the 941-X form cannot be filed electronically. Employers must complete it and mail it to the appropriate address listed in the form's instructions. The IRS is working on expanding its electronic filing options, so it's a good idea to check the latest filing methods on the IRS website or consult with a tax professional for the most current information.

-

How do I complete the 941-X form?

Completing the 941-X form involves several steps. First, you must correctly identify the quarter and the year of the original 941 form that contains the mistake. Next, choose whether you’re adjusting the form due to an underpayment or overpayment of taxes. You must then detail the specific errors, calculate the correct amounts, and show the difference between the reported and correct amounts. Part 2 of the form requires information about the tax liability for each month of the quarter. It's necessary to attach any supporting documents or schedules that explain the corrections. Due to the complexity of the adjustments, it may be beneficial to seek assistance from a tax professional.

-

What happens after filing the 941-X form?

After the 941-X form is filed, the IRS will process it, which may take several weeks. If the form is completed correctly and additional tax is owed, the employer should make the payment to avoid accumulating interest. If the employer is due a refund, the IRS will issue it once the form is processed. The IRS might contact the employer for more information if there are any questions or discrepancies in the form. Keeping a copy of the 941-X and all supporting documents is crucial for your records and future reference.

Common mistakes

Filling out IRS Form 941-X can be a challenging task, requiring careful attention to detail to ensure accuracy. Throughout this process, several common mistakes can occur. Recognizing and avoiding these errors is crucial for the successful submission of the form.

Incorrect Reporting Period: One of the most frequent mistakes is not accurately reporting the specific quarter for which corrections are being made. Each adjustment must match the quarter in which the discrepancy occurred, and failure to do so can lead to processing delays or incorrect adjustments.

Failing to Explain the Corrections: The IRS requires a detailed explanation for each correction made on the 941-X form. People often make the mistake of submitting corrections without the necessary explanations, or the explanations provided are too vague. Detailed, accurate explanations ensure the IRS understands the reason behind each adjustment, leading to quicker processing times.

Calculation Errors: Arithmetic mistakes are common when adjusting figures on the 941-X. It’s crucial to double-check all calculations to ensure the corrected amounts are accurate. This includes accurately recalculating the tax liabilities based on the adjustments made.

Not Signing the Form: Although it may seem obvious, another common error is forgetting to sign the form. An unsigned form is considered incomplete by the IRS and will be returned, which could delay any necessary adjustments to payroll taxes.

Misunderstanding the Type of Correction Needed: The form is used for both overreporting and underreporting payroll taxes. Confusion often arises regarding how to properly document these different types of corrections. It’s vital to understand the nature of your correction to ensure it’s communicated clearly on the form, as this impacts how the adjustment is processed by the IRS.

These mistakes, while common, can be avoided with careful review and understanding of the IRS 941-X form’s requirements. Ensuring accurate and complete submissions not only minimizes delays but also helps in avoiding possible fines for reporting inaccuracies.

Documents used along the form

When an employer discovers errors on a previously filed Form 941, the Employer's Quarterly Federal Tax Return, the IRS 941-X form is essential to rectify those mistakes. This form is specifically tailored for correcting information on wages, tips, and other payroll taxes. However, to accurately amend errors or make adjustments on the IRS 941-X form, you may need to refer to or use additional documents and forms. These documents support the correction process by providing detailed information, ensuring compliance, and facilitating a smoother amendment procedure. Here’s a list of other forms and documents often used along with the IRS 941-X form.

- IRS Form 941 - The original Employer's Quarterly Federal Tax Return that was filed. It is essential for referencing the data reported and identifying discrepancies that need correction.

- IRS Form W-2 - The Wage and Tax Statement provided to employees and the Social Security Administration. It details employees' annual earnings and taxes withheld, crucial for verifying reported wages on Form 941-X.

- IRS Form W-3 - The Transmittal of Wage and Tax Statements that summarizes employee wages and tax withheld, used alongside W-2 forms for accuracy checks.

- IRS Form 940 - The Employer's Annual Federal Unemployment (FUTA) Tax Return, needed if adjustments affect unemployment tax liabilities.

- Schedule B (Form 941) - A record of the employer’s tax liability for each month of the quarter, which has to align with corrections made on the 941-X.

- IRS Form 944 - The Employer's Annual Federal Tax Return, relevant for small employers that are allowed to file annually instead of quarterly.

- IRS Form W-4 - The Employee's Withholding Certificate, which could impact corrections if initial withholdings were based on incorrect W-4 information.

- Canceled checks or payment records - Proof of previously made tax payments, necessary for verifying payments or identifying discrepancies.

- Detailed payroll records - These provide a comprehensive overview of wages, withholdings, and tax liabilities for each employee, crucial for accurate corrections.

- IRS Form 8655 - Reporting Agent Authorization, if a reporting agent was used to file the original 941 or is being used to file the 941-X. This authorizes agents to act on behalf of the employer.

Each of these documents and forms plays a vital role in the amendment process of the IRS 941-X form. By gathering and reviewing these items, employers can ensure they correct errors efficiently and comply with IRS regulations. Correct filing supports accurate reporting, maintains compliance, and avoids potential penalties, making the understanding and use of these documents crucial for all employers engaging in the correction process.

Similar forms

The IRS 941-X form shares similarities with the IRS 940 Schedule A form, which is used for multi-state employers to allocate their FUTA (Federal Unemployment Tax Act) liability. Both forms serve as adjustments to previously filed tax returns, allowing entities to report and correct discrepancies from past submissions. The 940 Schedule A, much like the 941-X, requires detailed past financial information to amend specific sections of originally filed forms, demonstrating how businesses' taxation responsibilities can shift over time.

Another related document is the IRS Form 1040-X, the Individual Income Tax Return Amendment form. This form is used by individuals to correct errors on previously filed Form 1040, 1040-A, or 1040-EZ. Similar to the IRS 941-X, Form 1040-X provides a structured way to make corrections to an already submitted tax return, ensuring accurate tax reporting and compliance. Both forms necessitate a thorough review of prior filings and precise adjustments to meet legal taxation requirements.

The IRS W-2c, Corrected Wage and Tax Statement, also parallels the IRS 941-X. Employers use the W-2c to correct mistakes on previously issued W-2 forms, such as employee information or wage reports. Like the 941-X, which amends employment tax return errors, the W-2c addresses the need for accuracy in employment tax reporting, correcting past information that affects both employer and employee tax liabilities.

The IRS 1120-X, Amended U.S. Corporation Income Tax Return, is the corporate equivalent of the 941-X form for individual and sole proprietor amendments. Companies file this form to correct errors on previously filed 1120 or 1120-A forms. Both the 1120-X and the 941-X highlight the importance of accurate tax reporting and allow for rectification post-submission to ensure compliance with tax laws.

Form 1065-X, Amended Return or Administrative Adjustment Request (AAR), is for partnerships that need to amend previously filed Form 1065. This form bears a resemblance to the 941-X in its purpose to correct or update information previously reported to the IRS. Both documents underscore the need for ongoing accuracy in tax reporting and provide a means to rectify errors in a structured and legally compliant manner.

The Amended Employer’s Quarterly Federal Tax Return or Claim for Refund, IRS Form 943-X, adjusts reports on federal tax returns for agricultural employees. This form's operational mechanism closely mirrors the 941-X, aiming to correct or modify previously submitted tax details regarding payroll. Both forms play a critical role in ensuring that employers accurately fulfill their tax obligations, highlighting the dynamic nature of tax reporting and compliance.

The IRS 1042-X, Amended Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, is tailored for corrections related to withholding taxes on income of foreign persons. Much like the 941-X, it is designed for adjustments post-original submission, stressing the importance of accurate withholding and reporting of taxes. The 1042-X and 941-X collectively address the nuanced areas of tax law, ensuring entities engage in precise tax practices.

IRS Form 2555-X, used for Amending U.S. Individual Income Tax Return to adjust foreign earned income, parallels the corrective nature of the 941-X. Individuals use it when amending specifics around foreign income exclusions or housing exclusions/deductions previously claimed. Both forms indicate the complexities of tax filings that can necessitate subsequent adjustments to capture the correct tax obligations and benefits accurately.

The IRS Form SS-8 Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding is indirectly related to the 941-X in its preparatory function. While not an amendment form, the SS-8 can lead to the need for a 941-X filing if a worker’s status changes from independent contractor to employee (or vice versa), requiring corrections in previously filed employment taxes. This connection emphasizes the interwoven nature of employment classifications and tax reporting obligations.

Lastly, the IRS Form 8822-B, Change of Address or Responsible Party — Business, serves a specific function highly relevant in the context of amending forms like the 941-X. When a business’s address or responsible party changes after filing a tax return, the 8822-B must be submitted to inform the IRS of this change. While not directly amending tax return information, the update can be critical for ensuring that any communications or corrected filings like the 941-X are accurately processed and sent to the correct address, aligning administrative records with current realities.

Dos and Don'ts

When correcting errors on your previously filed IRS Form 941, the IRS 941-X form is the document you'll need to use. Properly filling out this form is crucial for ensuring accuracy in your payroll tax records. Below are lists of do's and don'ts to guide you through the process accurately and efficiently.

Do's when filling out the IRS 941-X form:

- Ensure you have the correct form for the corresponding tax year and quarter you need to amend.

- Read the instructions thoroughly before beginning. Each line has specific instructions that are important for accurate completion.

- Use black ink or type your responses to ensure the information is legible and can be properly processed by the IRS scanning systems.

- Explain every adjustment or correction you make on the form. This is essential for clarifying the reasons behind the changes to the IRS.

- Report corrections using the appropriate tax liability dates. This helps the IRS understand when the original reported amounts were supposed to be assessed.

- Sign and date the form. An unsigned form is considered invalid and will not be processed, potentially leading to delays and penalties.

- Keep a copy of the completed 941-X form and all relevant documentation for your records. Having detailed records can be invaluable if questions or issues arise later.

- Attach any necessary documentation that supports the corrections made. This could include payroll records, tax calculations, or other relevant documents.

- Double-check all entries for accuracy and completeness before submission. Mistakes on the form can lead to further errors and complications.

- Consult with a tax professional if you're unsure about any part of the process. Tax laws and procedures can be complex, and professional guidance can be very helpful.

Don'ts when filling out the IRS 941-X form:

- Don't attempt to correct the original Form 941 by simply altering it. The 941-X is specifically designed for amendments.

- Don't forget to check the box at the top of the form indicating which quarter you're amending. This is a common oversight that can cause confusion.

- Don't use white-out or correction tape on the form. If a mistake is made, start over on a new form to avoid processing issues.

- Don't leave any fields blank. If a section doesn't apply, use “-0-” or “N/A” as appropriate to indicate this.

- Don't underestimate the importance of explaining your corrections. The IRS needs to understand your rationale to process the amendment.

- Don't neglect to adjust the employee’s share of taxes, if applicable. Corrections often impact both the employer's and the employee's contributions.

- Don't submit the form without double-checking the math. Arithmetic errors can cause delays in processing or further corrections.

- Don't ignore the IRS instructions regarding electronic filing versus paper filing. Certain criteria determine the appropriate submission method.

- Don't delay in submitting corrections. Timely filing helps avoid potential penalties and interest charges on owed amounts.

- Don't assume corrections will automatically resolve any penalties or interest you may owe. Separate action or communication with the IRS may be necessary.

Misconceptions

The IRS 941-X form, officially known as the Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, plays a critical role in ensuring the accuracy of payroll taxes submitted by employers. However, misconceptions about this form are not uncommon. Clearing up these misunderstandings is essential for accurate tax reporting and compliance.

The form is only for claiming refunds: A common misconception is that the IRS 941-X form is solely used to claim refunds. In reality, this form serves two primary purposes: to correct errors on previously filed IRS 941 forms and to claim refunds or request abatements of overpaid taxes. It is as much about rectifying mistakes as it is about seeking refunds.

Corrections can be made at any time: Many believe they can submit a 941-X form for correction purposes at any time. However, the IRS has set certain time limits for filing these corrections. Typically, adjustments must be made within three years from the date the original 941 was filed, or two years from the date the tax reported on the 941 was paid, whichever is later.

Small errors don’t need to be corrected: Some employers may think that minor mistakes do not necessitate filing a 941-X form. This is untrue; all errors, regardless of their size, should be corrected to ensure accurate tax reporting and compliance. Even small discrepancies can lead to issues or audits down the line.

You can correct any error made in the past: While it's true that many errors can be corrected using the 941-X form, there are limitations. Certain types of errors, such as a simple math mistake, are often corrected by the IRS during processing. Furthermore, some changes, especially those related to tax liability adjustments for reasons other than a previous error, might require different forms or procedures.

Filing a 941-X automatically leads to an audit: The fear of triggering an IRS audit discourages some employers from filing a 941-X form. However, correcting mistakes through a 941-X form does not automatically increase the likelihood of an audit. The IRS understands that mistakes happen and encourages correction without penalizing honest attempts to rectify errors.

Only the accountant or tax preparer can file Form 941-X: This misconception stems from the belief that tax forms are overly complicated and can only be handled by professionals. While it's advisable to consult with a tax professional when making corrections, employers can file a 941-X form themselves. Understanding the instructions provided by the IRS can help many navigate the process without professional assistance.

The corrected 941-X form replaces the original 941 form: Some might think that once a 941-X form is filed, it replaces the original 941 form. This is not the case; the 941-X serves as an amendment to the original filing, not a replacement. Both forms become part of the taxpayer's record and should be kept on file for future reference.

Every correction requires a separate 941-X form: Employers often mistakenly believe they need to file a separate 941-X form for each individual error across different quarters. However, if correcting the same type of error for multiple quarters, they can report these on a single form by providing detailed information for each quarter affected in the adjustments section of the form.

Key takeaways

The IRS Form 941-X is used for correcting errors on a previously filed Form 941, which reports quarterly federal tax returns. This includes mistakes in reporting wages, tips, and other compensation.

Before filling out Form 941-X, it's crucial to have the original Form 941 on hand for reference. This ensures the corrected information accurately reflects the initial errors.

Form 941-X must be filed separately for each quarter in which mistakes were made. One cannot correct errors from multiple quarters on a single form.

There are two methods to choose from when making corrections: the Adjusted Employer's QUARTERLY Federal Tax Return or Claim. The choice depends on whether the correction results in an overpayment or underpayment of taxes.

Accurate calculation is paramount when filling out Form 941-X. The form requires a detailed explanation of the errors and the corrected amounts. This helps the IRS understand exactly what is being corrected.

Documentation supporting the corrections should be kept on file but not sent to the IRS unless specifically requested. These documents serve as proof of the legitimacy of the corrections made.

It is important to sign and date the form. An unsigned or undated form may result in processing delays or the form being returned.

Deadlines matter when dealing with corrections. To qualify for a credit or refund, Form 941-X must be filed within three years from the date the original form was filed, or two years from the date the tax was paid, whichever is later.

After submitting Form 941-X, patience is required. Processing can take up to six months, during which the IRS may contact the filer for additional information.

Popular PDF Documents

IRS 5695 - It plays a critical role in the federal government’s efforts to promote renewable energy and reduce carbon emissions.

Sc Sos Annual Report - Clear instructions guide applicants through the process, including how to attach supplemental documents and certificates.