Get Irs 940 Schedule A Form

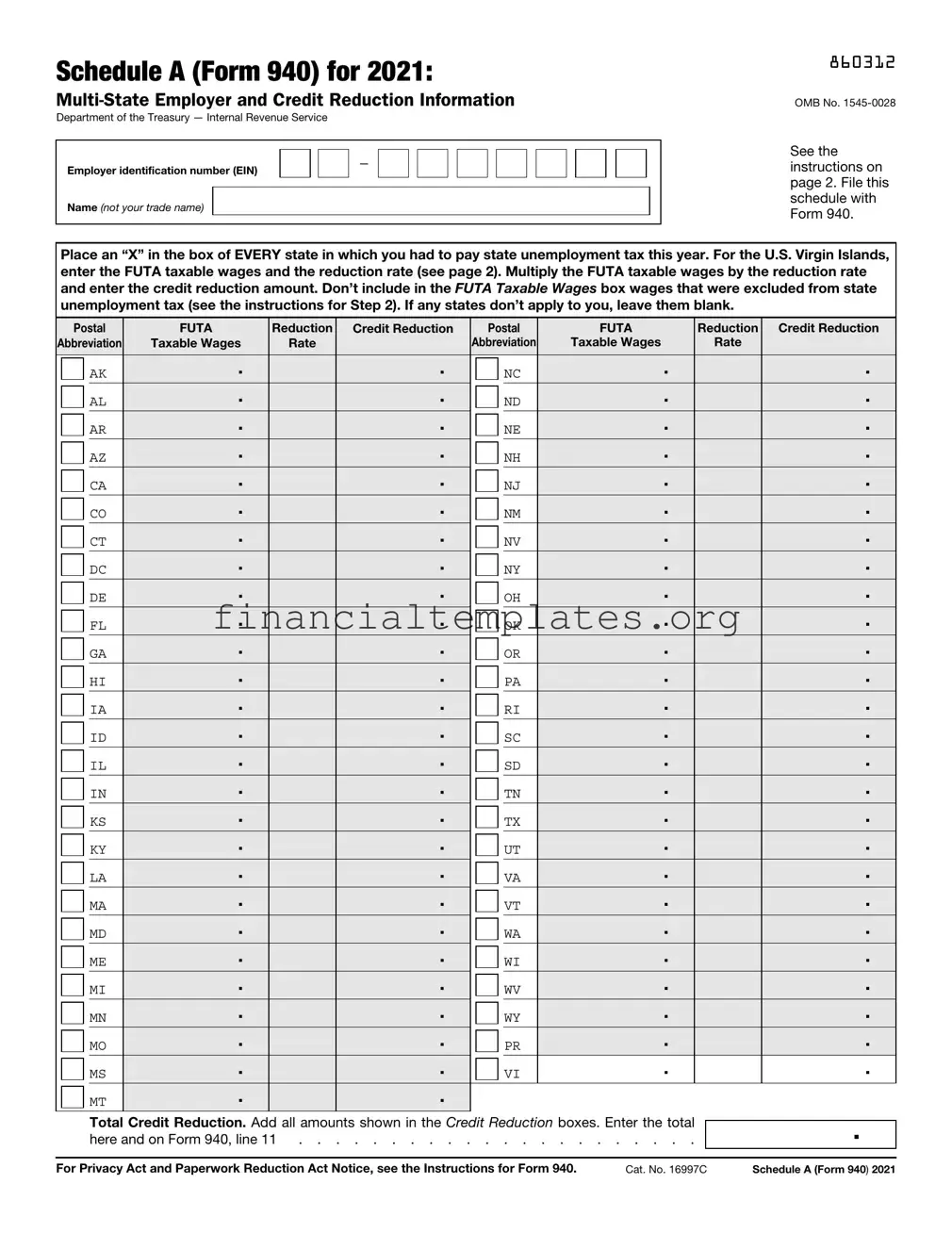

Navigating the intricacies of federal unemployment tax obligations can be daunting for employers, especially those operating across multiple states. The Schedule A (Form 940) for 2021 is a crucial document for employers who find themselves in this multi-state operation scenario. This form, officially titled "Multi-State Employer and Credit Reduction Information," is a part of the Department of the Treasury — Internal Revenue Service suite of forms. Its primary function is to assist employers in computing their federal unemployment tax liability, particularly focusing on the credit reduction for states where the federal government has lent funds to the state unemployment insurance programs that haven't been repaid in full. Employers are required to mark the states in which they have paid state unemployment tax by placing an “X” in the respective boxes provided in the form. An intriguing aspect of this form is its inclusion of the only credit reduction state for 2021, the U.S. Virgin Islands, where specific calculations are necessary to determine the credit reduction amount to be reported on Form 940, line 11. The form further advises on exclusions, displaying the method to correctly report FUTA taxable wages, ensuring employers don't inadvertently include wages exempt from state unemployment tax. This form, therefore, not only aids in ensuring compliance with federal tax obligations but also helps prevent common pitfalls that can occur when reporting state-unemployment-taxed wages across different jurisdictions.

Irs 940 Schedule A Example

Schedule A (Form 940) for 2021:

Department of the Treasury — Internal Revenue Service

Employer identification number (EIN) |

|

|

|

— |

|

|

|

|

Name (not your trade name)

860312

OMB No.

See the instructions on page 2. File this schedule with Form 940.

Place an “X” in the box of EVERY state in which you had to pay state unemployment tax this year. For the U.S. Virgin Islands, enter the FUTA taxable wages and the reduction rate (see page 2). Multiply the FUTA taxable wages by the reduction rate and enter the credit reduction amount. Don’t include in the FUTA Taxable Wages box wages that were excluded from state unemployment tax (see the instructions for Step 2). If any states don’t apply to you, leave them blank.

|

Postal |

FUTA |

Reduction |

Credit Reduction |

|

Postal |

FUTA |

Reduction |

Credit Reduction |

||||||

Abbreviation |

Taxable Wages |

Rate |

|

|

Abbreviation |

Taxable Wages |

Rate |

|

|||||||

|

|

|

AK |

|

. |

|

|

. |

|

|

|

NC |

. |

|

. |

|

|

|

|

|

|

|

|||||||||

|

|

|

AL |

|

. |

|

|

. |

|

|

|

ND |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

AR |

|

. |

|

|

. |

|

|

|

NE |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

AZ |

|

. |

|

|

. |

|

|

|

NH |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

CA |

|

. |

|

|

. |

|

|

|

NJ |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

CO |

|

. |

|

|

. |

|

|

|

NM |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

CT |

|

. |

|

|

. |

|

|

|

NV |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

DC |

|

. |

|

|

. |

|

|

|

NY |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

DE |

|

. |

|

|

. |

|

|

|

OH |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

FL |

|

. |

|

|

. |

|

|

|

OK |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

GA |

|

. |

|

|

. |

|

|

|

OR |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

HI |

|

. |

|

|

. |

|

|

|

PA |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

IA |

|

. |

|

|

. |

|

|

|

RI |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

ID |

|

. |

|

|

. |

|

|

|

SC |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

IL |

|

. |

|

|

. |

|

|

|

SD |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

IN |

|

. |

|

|

. |

|

|

|

TN |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

KS |

|

. |

|

|

. |

|

|

|

TX |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

KY |

|

. |

|

|

. |

|

|

|

UT |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

LA |

|

. |

|

|

. |

|

|

|

VA |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

MA |

|

. |

|

|

. |

|

|

|

VT |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

MD |

|

. |

|

|

. |

|

|

|

WA |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

ME |

|

. |

|

|

. |

|

|

|

WI |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

MI |

|

. |

|

|

. |

|

|

|

WV |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

MN |

|

. |

|

|

. |

|

|

|

WY |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

MO |

|

. |

|

|

. |

|

|

|

PR |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

MS |

|

. |

|

|

. |

|

|

|

VI |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

MT |

|

. |

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Credit Reduction. Add all amounts shown in the Credit Reduction boxes. Enter the total here and on Form 940, line 11 . . . . . . . . . . . . . . . . . . . . . .

.

For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Form 940. |

Cat. No. 16997C |

Schedule A (Form 940) 2021 |

Instructions for Schedule A (Form 940) for 2021: |

860412 |

|

|

|

|

|

|

Specific Instructions: Completing Schedule A |

|

Step 1. Place an “X” in the box of every state (including the District of Columbia, Puerto Rico, and the U.S. Virgin Islands) in which you had to pay state unemployment taxes this year, even if the state’s credit reduction rate is zero.

Note: Make sure that you have applied for a state reporting number for your business. If you don’t have an unemployment account in a state in which you paid wages, contact the state unemployment agency to receive one. For a list of state unemployment agencies, visit the U.S. Department of Labor’s website at https://oui.doleta.gov/unemploy/agencies.asp.

The table below provides the

|

Postal |

|

Postal |

State |

Abbreviation |

State |

Abbreviation |

|

|

|

|

Alabama |

AL |

Montana |

MT |

Alaska |

AK |

Nebraska |

NE |

Arizona |

AZ |

Nevada |

NV |

Arkansas |

AR |

New Hampshire |

NH |

California |

CA |

New Jersey |

NJ |

Colorado |

CO |

New Mexico |

NM |

Connecticut |

CT |

New York |

NY |

Delaware |

DE |

North Carolina |

NC |

District of Columbia |

DC |

North Dakota |

ND |

Florida |

FL |

Ohio |

OH |

Georgia |

GA |

Oklahoma |

OK |

Hawaii |

HI |

Oregon |

OR |

Idaho |

ID |

Pennsylvania |

PA |

Illinois |

IL |

Rhode Island |

RI |

Indiana |

IN |

South Carolina |

SC |

Iowa |

IA |

South Dakota |

SD |

Kansas |

KS |

Tennessee |

TN |

Kentucky |

KY |

Texas |

TX |

Louisiana |

LA |

Utah |

UT |

Maine |

ME |

Vermont |

VT |

Maryland |

MD |

Virginia |

VA |

Massachusetts |

MA |

Washington |

WA |

Michigan |

MI |

West Virginia |

WV |

Minnesota |

MN |

Wisconsin |

WI |

Mississippi |

MS |

Wyoming |

WY |

Missouri |

MO |

Puerto Rico |

PR |

|

|

U.S. Virgin Islands |

VI |

Credit reduction state. For 2021, the U.S. Virgin Islands (USVI) is the only credit reduction state. The credit reduction rate is 0.033 (3.3%).

Step 2. You’re subject to credit reduction if you paid FUTA taxable wages that were also subject to state unemployment taxes in the USVI.

In the FUTA Taxable Wages box, enter the total FUTA taxable wages that you paid in the USVI. (The FUTA wage base for all states is $7,000.) However, don’t include in the FUTA Taxable Wages box wages that were excluded from state unemployment tax. For example, if you paid $5,000 in FUTA taxable wages in the USVI but $1,000 of those wages were excluded from state unemployment tax, report $4,000 in the FUTA Taxable Wages box.

Note: Don’t enter your state unemployment wages in the FUTA Taxable Wages box.

Enter the reduction rate and then multiply the total FUTA taxable wages by the reduction rate.

Enter your total in the Credit Reduction box at the end of the line.

Step 3. Total credit reduction

To calculate the total credit reduction, add up all of the Credit Reduction boxes and enter the amount in the Total Credit Reduction box.

Then enter the total credit reduction on Form 940, line 11.

Example 1

You paid $20,000 in wages to each of three employees in State A. State A is subject to credit reduction at a rate of 0.033 (3.3%). Because you paid wages in a state that is subject to credit reduction, you must complete Schedule A and file it with Form 940.

Total payments to all employees in State A . . . . . . $60,000

Payments exempt from FUTA tax

(see the Instructions for Form 940) . . . . . . . . . . $0

Total payments made to each employee in

excess of $7,000 (3 x ($20,000 - $7,000)) . . . . . . . $39,000

Total FUTA taxable wages you paid in State A entered in

the FUTA Taxable Wages box ($60,000 - $0 - $39,000) . . . $21,000 Credit reduction rate for State A . . . . . . . . . . 0.033 Total credit reduction for State A ($21,000 x 0.033) . . . . $693.00

|

Don’t include in the FUTA Taxable Wages box wages |

▲ |

|

! |

in excess of the $7,000 wage base for each employee |

subject to state unemployment insurance in the credit |

|

CAUTION |

reduction state. The credit reduction applies only |

|

to FUTA taxable wages that were also subject to state unemployment tax.

In this case, you would write $693.00 in the Total Credit Reduction box and then enter that amount on Form 940, line 11.

Example 2

You paid $48,000 ($4,000 a month) in wages to Mary Smith and no payments were exempt from FUTA tax. Mary worked in State B (not subject to credit reduction) in January and then transferred to State C (subject to credit reduction) on February

1.Because you paid wages in more than one state, you must complete Schedule A and file it with Form 940.

The total payments in State B that aren’t exempt from FUTA tax are $4,000. Since this payment to Mary doesn’t exceed the $7,000 FUTA wage base, the total FUTA taxable wages paid in State B are $4,000.

The total payments in State C that aren’t exempt from FUTA tax are $44,000. However, $4,000 of FUTA taxable wages was paid in State B with respect to Mary. Therefore, the total FUTA taxable wages with respect to Mary in State C are $3,000 ($7,000 (FUTA wage base) - $4,000 (total FUTA taxable wages paid in State B)). Enter $3,000 in the FUTA Taxable Wages box, multiply it by the Reduction Rate, and then enter the result in the Credit Reduction box.

Attach Schedule A to Form 940 when you file your return.

Page 2

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Schedule A (Form 940) | Used by multi-state employers and those paying wages in credit reduction states to calculate and report additional FUTA tax owed. |

| Filing Requirement | Must be filed with Form 940 by employers who paid state unemployment taxes in more than one state or in any credit reduction state. |

| Credit Reduction States for 2021 | For the year 2021, the only credit reduction state is the U.S. Virgin Islands (USVI), with a reduction rate of 0.033 (3.3%). |

| Calculation of Credit Reduction | Employers must enter FUTA taxable wages paid in the credit reduction state(s), multiply by the reduction rate, and report the total credit reduction amount. |

| Governing Law | Federal Unemployment Tax Act (FUTA) governs alongside state-specific unemployment insurance laws for state-specific forms and credit reductions. |

Guide to Writing Irs 940 Schedule A

Filling out the IRS 940 Schedule A form is important for employers who have paid state unemployment taxes in multiple states or in the U.S. Virgin Islands. This form is used to report credit reduction information, something that arises if state unemployment insurance taxes were also paid on the same wages. The process requires accuracy and attention to detail to ensure that all necessary information is reported correctly. Here’s a step-by-step guide to help you complete the form properly.

- Start by entering your Employer Identification Number (EIN) and your business name at the top of the Schedule A (Form 940).

- Review the list of states and their postal abbreviations provided in the instructions to identify any states where you paid state unemployment taxes.

- In the table provided on Schedule A, place an “X” in the box corresponding to each state where you were required to pay state unemployment taxes. Remember to include the District of Columbia, Puerto Rico, and the U.S. Virgin Islands if applicable.

- If you paid FUTA taxable wages in the U.S. Virgin Islands, which is listed as a credit reduction state for 2021, you will need to enter the amount of FUTA taxable wages in the designated box. Ensure you do not include wages that were exempt from state unemployment tax. Calculate the credit reduction by multiplying the FUTA taxable wages by the reduction rate provided (.033 or 3.3% for the U.S. Virgin Islands).

- Enter the resulting credit reduction amount in the Credit Reduction box next to the U.S. Virgin Islands.

- To calculate the total credit reduction, add up the amounts in all of the Credit Reduction boxes for each state where you have marked an “X”. This includes the calculation you did for the U.S. Virgin Islands if applicable.

- Write the sum of your credit reductions in the Total Credit Reduction box located at the bottom of the form.

- Transfer the total credit reduction amount to the designated line (line 11) on your Form 940. This integrates the credit reduction information from Schedule A into your main FUTA tax return.

- Before attaching Schedule A to Form 940, review both documents to ensure all information is accurate and complete. Any inaccuracies might lead to processing delays or incorrect tax liabilities.

- Attach the completed Schedule A to your Form 940 when filing your return with the IRS.

By carefully following these steps, employers can accurately report their credit reduction information on the IRS Form 940 Schedule A. This process not only ensures compliance with the IRS requirements but also assists in the accurate calculation of FUTA tax liabilities, incorporating any adjustments needed for state unemployment taxes paid.

Understanding Irs 940 Schedule A

What is the purpose of IRS 940 Schedule A?

Schedule A (Form 940) is designed for multi-state employers and serves to report their credit reduction information. It is a necessary part of Form 940 for employers who have paid state unemployment tax in any state subject to credit reduction, such as the U.S. Virgin Islands in 2021. This schedule allows the Internal Revenue Service (IRS) to calculate the correct Federal Unemployment Tax Act (FUTA) tax, taking into account the credit reduction for states where unemployment funds are insolvent.

How do I know if I need to file Schedule A (Form 940)?

You need to file Schedule A (Form 940) if you are an employer who has paid wages subject to state unemployment tax in any state that is also subject to a credit reduction. For 2021, the only credit reduction state was the U.S. Virgin Islands. Even if the state’s credit reduction rate is zero, you must place an “X” in the box for every state where you paid state unemployment taxes. If you operated in multiple states or in any credit reduction states, completing Schedule A is a requirement when filing your Form 940.

What are the steps to complete Schedule A (Form 940)?

The form requires a few key steps for completion:

- Step 1: Mark an “X” in the box for each state, including the District of Columbia, Puerto Rico, and the U.S. Virgin Islands, where you paid state unemployment taxes. Ensure you have a state reporting number for these locations.

- Step 2: For any credit reduction state like the U.S. Virgin Islands in 2021, enter the total FUTA taxable wages paid in that state and apply the specific reduction rate to calculate the credit reduction amount. Do not include wages above the FUTA wage base or those exempt from state unemployment tax.

- Step 3: Add all amounts in the Credit Reduction boxes to find the total credit reduction. This amount is then entered on Form 940, line 11.

What are FUTA taxable wages and how do they affect Schedule A (Form 940)?

FUTA taxable wages are wages subjected to the Federal Unemployment Tax Act. These are calculated per employee up to a wage base of $7,000 annually. When completing Schedule A (Form 940), you will only include wages that are also subject to state unemployment tax in credit reduction states. Any wages beyond the $7,000 FUTA wage base or exempt from state unemployment tax should not be included in the FUTA Taxable Wages box. This precise calculation helps determine the credit reduction amount, crucial for accurately assessing your FUTA tax responsibilities.

Common mistakes

When filling out the IRS 940 Schedule A form, it's important to avoid common mistakes. Here's a breakdown of the five most frequent errors:

Not marking all the states where state unemployment tax was paid. Employers often forget to place an “X” in the box for each state, including the District of Columbia, Puerto Rico, and the U.S. Virgin Islands, where they have obligations.

Entering FUTA taxable wages in the wrong box. Some employers mistakenly include wages exempt from state unemployment tax in the FUTA Taxable Wages box, which leads to incorrect credit reduction calculations.

Failing to apply for a state reporting number. Before filing, it's crucial to have a state unemployment account in any state where wages were paid. Neglecting this results in the inability to accurately report and pay state unemployment taxes.

Miscalculating the total credit reduction. The process involves adding up all entries in the Credit Reduction boxes. Errors in this calculation can cause discrepancies in the total reported on Form 940, line 11.

Omitting the credit reduction information for the U.S. Virgin Islands, the only credit reduction state for 2021. Specific care is needed to correctly enter FUTA taxable wages, the reduction rate, and the resulting credit reduction amount.

To ensure accuracy when completing Schedule A of Form 940, keep these mistakes in mind and double-check your entries before submission.

Documents used along the form

When businesses handle their federal unemployment tax obligations, especially if they operate across multiple states, the IRS 940 Schedule A form becomes instrumental. This form is specifically designed for multi-state employers and encompasses details such as credit reduction information. However, preparing to file this form often requires gathering additional documents and forms to ensure accuracy and compliance. Below is a list of other forms and documents frequently used alongside the IRS 940 Schedule A form, each serving its unique purpose in the filing process.

- Form 940: The primary form associated with Schedule A, the Employer's Annual Federal Unemployment (FUTA) Tax Return, helps employers report yearly federal unemployment taxes. Schedule A is attached to this form, especially by employers operating in multiple states or those affected by credit reduction states.

- Form 941: Employer's Quarterly Federal Tax Return. This form is used to report income taxes withheld from employees' wages, as well as Social Security and Medicare taxes, providing a quarterly update that complements the annual reporting on Form 940.

- State Unemployment Tax Forms: Each state has its own form for reporting state unemployment taxes. Since Schedule A requires information on state unemployment taxes paid, having these forms at hand is necessary for accurate completion.

- Wage and Tax Statement (W-2 Forms): These provide a record of an employee’s annual wages and the taxes withheld from their paycheck, aiding in verifying the total wages on which unemployment taxes were paid.

- Payroll Records: Keeping detailed payroll records is crucial, as these documents help in determining the FUTA tax liability by showing the total amount paid to employees throughout the year.

- State Unemployment ID Numbers: Employers must provide their state unemployment insurance (SUI) account numbers on Schedule A. These numbers are usually obtained when the business first registers with the state unemployment agency.

- Instructions for Form 940 and Schedule A: The official IRS instructions provide guidance on filling out these forms, including definitions, calculations, and specific requirements for multi-state employers and credit reduction states.

Accurate and thorough documentation is vital for filling out the IRS 940 Schedule A form correctly. By gathering these forms and documents, employers can navigate the complexities of reporting their federal and state unemployment taxes, ensuring they meet all legal obligations and avoid potential penalties. Understanding the purpose of each document within this process not only aids in compliance but also helps in managing workforce expenses more effectively.

Similar forms

The IRS Form 940 is a federal tax form used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax. Schedule A (Form 940) serves a specific function similar to that of Form 941, Employer's Quarterly Federal Tax Return. While Form 940 is an annual summary, Form 941 is filed quarterly, detailing an employer's withholding of income taxes and Social Security and Medicare taxes. Both forms require employers to report amounts related to payroll taxes, though for different purposes and time periods, making them interconnected in the overarching process of payroll tax reporting.

Form W-2, Wage and Tax Statement, is similar to Schedule A (Form 940) in that it involves reporting employment taxes. Form W-2 is issued by employers to employees and the Social Security Administration, detailing an employee's annual wages and the amount of taxes withheld from their paycheck. Like Schedule A, it is integral to tax filing for both individuals and employers, focusing on the specifics of wages and tax withholdings, which play a role in determining FUTA liability.

Form W-3, Transmittal of Wage and Tax Statements, complements Form W-2 by summarizing the total earnings, Social Security wages, Medicare wages, and withholding for all employees of a business. This form, akin to Schedule A (Form 940), aggregates information pertinent to employment taxes, albeit primarily aimed at the Social Security Administration. It facilitates an overview, similar to how Schedule A consolidates state unemployment taxes for multi-state employers.

The State Unemployment Tax Act (SUTA) forms, although specific to each state, share a core purpose with Schedule A (Form 940), highlighting employment tax obligations at the state level. SUTA forms require employers to report wages paid to employees and calculate unemployment tax due to the state. This directly relates to the information needed on Schedule A, as state unemployment taxes influence the credit reduction calculation on FUTA taxes.

Form 1099-NEC, Nonemployee Compensation, is used to report payments to independent contractors and is somewhat analogous to Schedule A (Form 940) in its role in tax reporting. While Form 940 Schedule A focuses on the employer's state unemployment tax obligations, Form 1099-NEC addresses the reporting of payments that aren't subject to withholding but are still relevant for the contractor's income taxes. Both are essential for accurate tax reporting, ensuring that different kinds of worker compensation are documented.

Form 1096, Annual Summary and Transmittal of U.S. Information Returns, operates similarly to Schedule A (Form 940) by serving as a summary document. Form 1096 is used to transmit paper copies of all Form 1099, 1098, and other information returns filed by an entity to the IRS. Like Schedule A, which aggregates credit reduction information, Form 1096 compiles data from multiple forms for submission, playing a crucial summary role in the context of informational returns.

Form 944, Employer's ANNUAL Federal Tax Return, is designed for smaller employers to report their federal income tax withholding and FICA taxes once a year rather than quarterly. This form's relation to Schedule A (Form 940) lies in its annual reporting frequency and focus on employment taxes. Both cater to specific employer needs, with Form 944 offering a simplified, once-a-year filing alternative that still encompasses critical tax information, akin to how Schedule A clarifies multi-state unemployment tax liabilities.

Form 945, Annual Return of Withheld Federal Income Tax, is for reporting federal income tax withheld from non-payroll payments, such as gambling winnings, and backup withholding. It parallels Schedule A (Form 940) by targeting a particular aspect of tax reporting (withholding on specific payments) and necessitating annual filing. Both forms play specific roles in ensuring the proper reporting and payment of taxes related to payments the business makes.

Form SS-4, Application for Employer Identification Number (EIN), while not a tax return, is crucial for businesses to file taxes correctly, including Schedule A (Form 940). Obtaining an EIN is a pre-requisite for filing employment taxes, making Form SS-4 foundational. Just as Schedule A categorizes state unemployment taxes, Form SS-4 initiates a business's tax reporting process by assigning the unique identifier necessary for all future tax documentation and correspondence with the IRS.

Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, directly relates to Form 941 but shares core reporting elements with Schedule A (Form 940). It demands a more frequent and detailed report of tax liabilities. Unlike the annual aggregation in Schedule A, Schedule B breaks down tax liabilities by pay period for more precise tracking and payment. Both schedules augment a primary form, supplying necessary, detailed information that fulfills the employer's tax reporting obligations.

Dos and Don'ts

When filling out the IRS 940 Schedule A form, being accurate and informed can save you from potential mistakes and penalties. Here's a guide to help you navigate this process smoothly:

Things You Should Do:

- Ensure that you place an "X" in the box for every state where you paid state unemployment tax, including the District of Columbia, Puerto Rico, and the U.S. Virgin Islands.

- Accurately calculate and enter FUTA taxable wages, making sure you don’t include wages that were exempt from state unemployment tax.

- Double-check the credit reduction rate for the U.S. Virgin Islands or any other states listed as credit reduction states for the filing year.

- Sum up all the credit reduction amounts accurately to report on Form 940, line 11.

- Attach Schedule A to Form 940 when you file your return.

Things You Shouldn't Do:

- Don't neglect to mark an "X" in the box of every state where you’re liable for state unemployment tax. This includes checking for employees who might have worked in multiple states.

- Avoid entering FUTA taxable wages without subtracting wages exempt from state unemployment tax.

- Do not use improper state abbreviations or incorrectly calculate credit reduction rates, as this could lead to miscalculations.

- Never forget to add all credit reduction amounts before reporting the total on Form 940, line 11.

- Don't file Form 940 without Schedule A if you are a multi-state employer or if you have paid FUTA taxable wages in a credit reduction state.

Misconceptions

When navigating through the intricacies of the IRS 940 Schedule A Form, many employers stumble upon common misconceptions. Let's clarify some of the most prevalent misunderstandings to ensure accurate reporting and compliance:

- It's only for businesses that operate in multiple states: This is a partial truth. While Schedule A is crucial for multi-state employers to report FUTA tax accurately, it's also required for any business that pays wages in a credit reduction state, such as the U.S. Virgin Islands for 2021. This aspect emphasizes the need for all employers to review Schedule A carefully, regardless of the number of states they operate in.

- All states have the same credit reduction rate: A common fallacy is that the credit reduction rate is uniform across all states. In reality, the rate varies and applies only to states deemed "credit reduction states" by the IRS due to loans the state has taken to pay unemployment benefits. For 2021, only the U.S. Virgin Islands is listed, with a specified rate of 0.033 (3.3%), highlighting the importance of checking the current year's rates and applicable states.

- You must pay additional FUTA tax for all wages paid: This misunderstanding can cause unnecessary stress. The truth is more nuanced. The additional FUTA tax, resulting from credit reduction, applies solely to FUTA taxable wages paid in credit reduction states and only to wages up to the FUTA wage base of $7,000 per employee. This detail underscores the importance of accurately calculating taxable wages to avoid overpayment.

- Only the total FUTA taxable wages matter, regardless of individual state rules: This statement is misleading. While the IRS form requires reporting of total FUTA taxable wages, it's crucial to not include wages excluded from state unemployment tax in these calculations. Each state's rules on what constitutes taxable wages can differ, thus affecting the figure entered in the FUTA Taxable Wages box for each applicable state.

- Filing Schedule A is a one-time task: Many employers mistakenly believe that completing Schedule A is not an annual requirement. However, an employer's obligations may change from year to year, depending on operations in new states or changes in which states are credit reduction states. Constant vigilance and annual review are essential to remain compliant and avoid possible penalties.

Understanding these nuances of the IRS 940 Schedule A Form can save employers from costly errors and penalties. It's crucial to approach this form with up-to-date information and a clear grasp of its requirements.

Key takeaways

Filling out and understanding the IRS 940 Schedule A form is vital for multi-state employers and those seeking to calculate their credit reduction accurately. Here are key takeaways to ensure compliance and optimize your filing:

Identify applicability: The 940 Schedule A form is specifically designed for multi-state employers and is utilized when calculating credit reductions related to state unemployment taxes.

Check the states: Employers must mark an “X” in the box for every state (including the District of Columbia, Puerto Rico, and the U.S. Virgin Islands) where they have paid state unemployment taxes within the year.

State unemployment account: It’s crucial to have a state reporting number for your business if you pay wages in any state. Without this, you must contact the state’s unemployment agency to obtain one. A list of these agencies is available on the U.S. Department of Labor’s website.

Understanding the credit reduction state: For 2021, the U.S. Virgin Islands is noted as the only credit reduction state, with a specific reduction rate to calculate additional taxes owed.

FUTA taxable wages: Calculate the total FUTA taxable wages carefully, ensuring not to include wages exempt from state unemployment tax in your calculation.

Calculating credit reduction: Multiply the FUTA taxable wages by the reduction rate provided for the applicable states, then total these figures for your overall credit reduction amount.

Comprehensive documentation: Ensure all payment records, state tax numbers, and calculations are accurately documented in case of audits or queries from the IRS.

Form submission: Attach Schedule A to Form 940 when filing your return. This attachment is crucial for employers that paid wages in states subject to credit reduction.

Review instructions: Detailed instructions accompanying Schedule A provide crucial insights, including how to properly identify states, calculate taxable wages, and determine the correction reduction accurately.

Comprehending these key aspects can help avoid mistakes and ensure that your business complies with federal requirements, potentially saving time and reducing the risk of penalties.

Popular PDF Documents

Ptax 230 - The appeal process, initiated by submitting the PTAX-230, does not address tax bill amounts but the assessment's fairness.

Tax Lump Sum - Form 4972 allows taxpayers over 59 ½ to possibly lower the tax rate on their retirement plan lump-sum distribution.