Get Irs 940 B Form

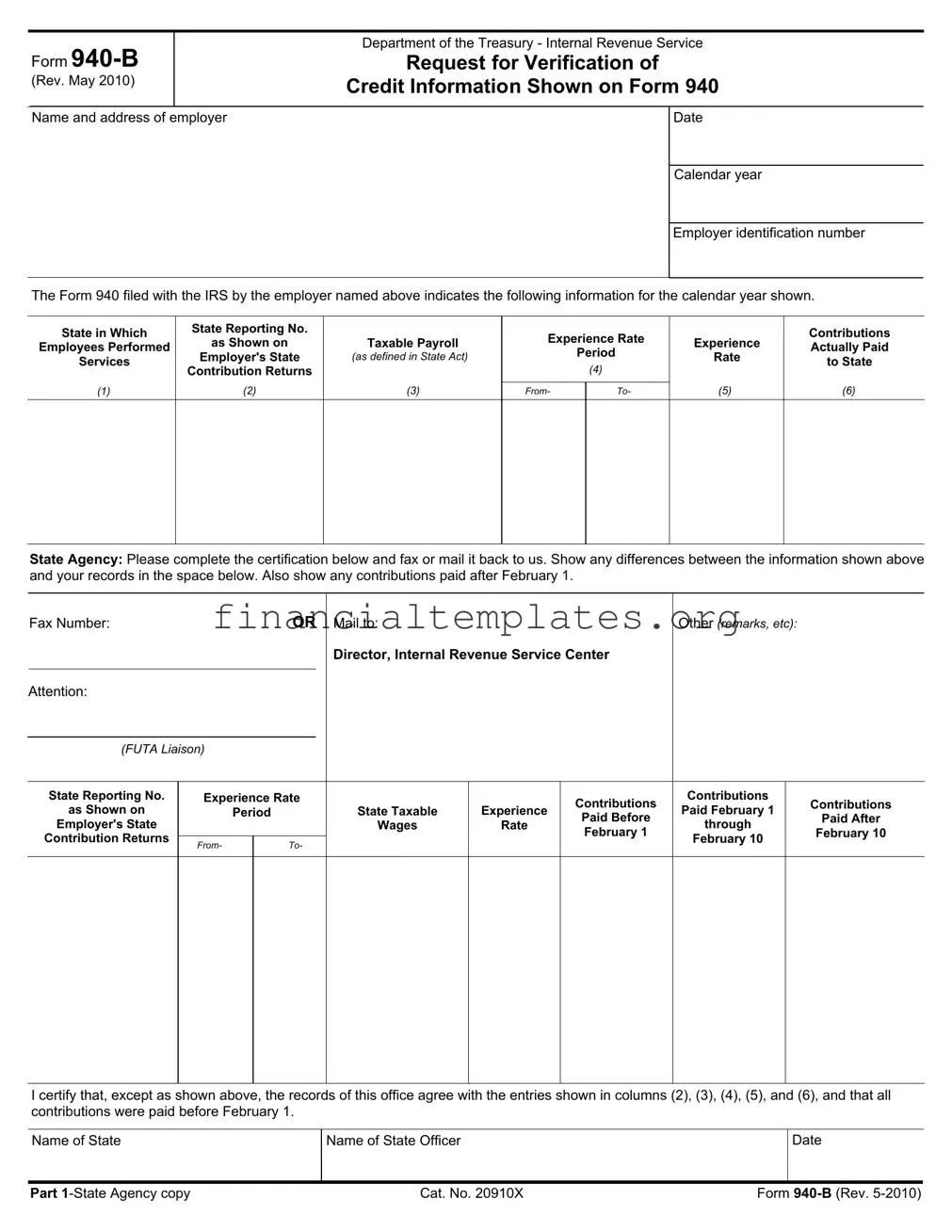

The intricacies of employment tax responsibilities involve several steps and documentation, notably when it comes to verifying credit information with the Internal Revenue Service (IRS). Among these critical documents is the IRS Form 940-B, a request for the verification of credit information as initially reported on Form 940. This form serves as a liaison between employers and state agencies, ensuring that the employment tax credits claimed by employers are accurate and substantiated. Specifically, it outlines details such as the name and address of the employer, the date, the calendar year in question, and the employer identification number. Crucially, it requests confirmation of the state in which employees performed services, state reporting numbers as shown on the employer's state contribution returns, taxable payroll as defined by state act, the experience rate period, the experience rate, and contributions actually paid to the state. State agencies are tasked to review and certify the accuracy of this information, reporting any discrepancies and confirming the timeliness of contributions. By facilitating a process for cross-referencing employer-reported data with state records, Form 940-B plays a pivotal role in maintaining the integrity of the employment tax reporting process.

Irs 940 B Example

|

Form 940B |

|

Department of the Treasury Internal Revenue Service |

|

|

|

Request for Verification of |

||

|

(Rev. May 2010) |

|

Credit Information Shown on Form 940 |

|

|

|

|

||

|

|

|

|

|

|

Name and address of employer |

|

Date |

|

|

|

|

|

|

|

|

|

|

Calendar year |

|

|

|

|

|

|

|

|

|

Employer identification number |

|

|

|

|

|

The Form 940 filed with the IRS by the employer named above indicates the following information for the calendar year shown.

State in Which

Employees Performed

Services

(1)

State Reporting No.

as Shown on

Employer's State

Contribution Returns

(2)

Taxable Payroll

(AS DEFINED IN STATE ACT)

(3)

Experience Rate

Period

(4)

FROM |

TO |

|

|

Experience

Rate

(5)

Contributions

Actually Paid

to State

(6)

State Agency: Please complete the certification below and fax or mail it back to us. Show any differences between the information shown above and your records in the space below. Also show any contributions paid after February 1.

Fax Number: |

OR Mail to: |

Other (REMARKS, ETC): |

Director, Internal Revenue Service Center

Attention:

(FUTA LIAISON) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

State Reporting No. |

Experience Rate |

|

|

Contributions |

Contributions |

Contributions |

||

as Shown on |

Period |

|

State Taxable |

Experience |

Paid February 1 |

|||

|

Paid Before |

Paid After |

||||||

Employer's State |

|

|

|

Wages |

Rate |

through |

||

|

|

|

February 1 |

February 10 |

||||

Contribution Returns |

|

|

|

|

|

February 10 |

||

FROM |

|

TO |

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I certify that, except as shown above, the records of this office agree with the entries shown in columns (2), (3), (4), (5), and (6), and that all contributions were paid before February 1.

Name of State

Name of State Officer

Date

Part 1State Agency copy |

Cat. No. 20910X |

Form 940B (Rev. 52010) |

|

Form 940B |

|

Department of the Treasury Internal Revenue Service |

|

|

|

Request for Verification of |

||

|

(Rev. May 2010) |

|

Credit Information Shown on Form 940 |

|

|

|

|

||

|

|

|

|

|

|

Name and address of employer |

|

Date |

|

|

|

|

|

|

|

|

|

|

Calendar year |

|

|

|

|

|

|

|

|

|

Employer identification number |

|

|

|

|

|

The Form 940 filed with the IRS by the employer named above indicates the following information for the calendar year shown.

State in Which

Employees Performed

Services

(1)

State Reporting No.

as Shown on

Employer's State

Contribution Returns

(2)

Taxable Payroll

(AS DEFINED IN STATE ACT)

(3)

Experience Rate

Period

(4)

FROM |

TO |

|

|

Experience

Rate

(5)

Contributions

Actually Paid

to State

(6)

State Agency: Please complete the certification below and fax or mail it back to us. Show any differences between the information shown above and your records in the space below. Also show any contributions paid after February 1.

Fax Number: |

OR Mail to: |

Other (REMARKS, ETC): |

Director, Internal Revenue Service Center

Attention:

(FUTA LIAISON) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

State Reporting No. |

Experience Rate |

|

|

Contributions |

Contributions |

Contributions |

||

as Shown on |

Period |

|

State Taxable |

Experience |

Paid February 1 |

|||

|

Paid Before |

Paid After |

||||||

Employer's State |

|

|

|

Wages |

Rate |

through |

||

|

|

|

February 1 |

February 10 |

||||

Contribution Returns |

|

|

|

|

|

February 10 |

||

FROM |

|

TO |

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I certify that, except as shown above, the records of this office agree with the entries shown in columns (2), (3), (4), (5), and (6), and that all contributions were paid before February 1.

Name of State

Name of State Officer

Date

Part 6 XVSHQVH&DVHI H copy

Cat. No. 20910X |

Form 940B (Rev. 2010) |

Document Specifics

| Fact Name | Detail |

|---|---|

| Purpose of Form 940-B | This form is used by the IRS to request verification of credit information shown on Form 940. |

| Specific Information Requested | The form seeks information about state in which employees performed services, state reporting number, taxable payroll, experience rate period, experience rate, and contributions paid to the state. |

| Recipients of Form 940-B | State agencies, which are tasked with completing the certification and noting any discrepancies between their records and the information provided. |

| Submission Methods | State agencies can return the completed form via fax or mail to the Director, Internal Revenue Service Center, ATTN: FUTA LIAISON. |

| Verification of Payment Deadline | The form includes a certification that all contributions were paid before February 1, except where noted otherwise. |

Guide to Writing Irs 940 B

Filling out the IRS Form 940-B is a straightforward process that involves providing specific information to verify the credit details shown on Form 940. This form is typically requested by state agencies and requires precise details to ensure that the information matches the state's records. The process of completing this form is crucial for employers to confirm their tax contributions and avoid discrepancies in their tax filings. By carefully following the steps outlined below, employers can accurately provide the necessary information.

- Start by entering the Name and address of the employer at the top of the form. This should match the information provided on the employer's Form 940.

- Fill in the Date when you are completing Form 940-B.

- Enter the Calendar year that is relevant to the Form 940 information being verified.

- Input the Employer identification number (EIN), ensuring it is the same number reported on Form 940.

- Under "State in Which Employees Performed Services", list each state where the employees worked during the calendar year in question.

- For each state listed, provide the State Reporting Number as shown on the employer's State Contribution Returns.

- Enter the Taxable Payroll, adhering to the definition as stated in the respective state's act, next to each state listed.

- Detail the Experience Rate Period, indicating the start and end dates, for each state where services were performed.

- Record the Experience Rate applied within the specified period for each state.

- List the total Contributions Actually Paid to State up to February 1 for the calendar year being verified.

- If there are any discrepancies or additional contributions made after February 1, specify these in the "Other (REMARKS, ETC.)" section.

- Ensure the State Agency completes the certification at the bottom of the form, verifying the information provided. This section must be filled out by an official state representative.

- Include the Fax Number or Mail to address at the bottom of the form, indicating where the state agency should return the completed verification.

- Review the completed form for accuracy and completeness before the state agency submits it via fax or mail to the provided contact details.

After the state agency has filled out their portion of the form and returned it to the designated IRS Service Center, the verification process will be considered complete. This collaboration between the employer, the state agency, and the IRS ensures that all contributions are accurately recorded and any discrepancies are addressed promptly.

Understanding Irs 940 B

What is Form 940-B?

Form 940-B is a document issued by the Internal Revenue Service (IRS) used by state agencies to verify credit information shown on Form 940. This includes information such as the state in which employees worked, taxable payroll, experience rate period, and contributions paid to the state.

Who needs to complete Form 940-B?

State agencies are required to complete Form 940-B. This form is sent to them by the IRS for the purpose of verifying the information employers have reported on Form 940.

What information does Form 940-B verify?

Form 940-B is used to verify several pieces of information that employers report on Form 940, including:

- State reporting number as shown on employer's state contribution returns

- Taxable payroll as defined in the state act

- Experience rate period

- Experience rate

- Contributions actually paid to the state

How can differences in reported information be indicated on Form 940-B?

If there are any discrepancies between the information the employers reported and the state agency's records, these differences must be shown on Form 940-B. State agencies should outline any differences in the space provided on the form, including contributions made after February 1.

What are the ways to submit Form 940-B?

State agencies can submit Form 940-B either by fax or mail. Specific fax numbers and mailing addresses are provided on the form to ensure it reaches the appropriate IRS Service Center.

What is the significance of the February 1 date mentioned on Form 940-B?

The February 1 date is significant because it is the deadline for contributions to be considered paid on time for the previous calendar year. Contributions paid after this date must be indicated separately on Form 940-B.

What happens if the information on Form 940-B does not match IRS records?

If the information provided by the state agency on Form 940-B does not match the IRS records, the IRS may reach out to either the state agency or the employer for clarification. It's important that the state agency accurately completes the certification section, ensuring that the IRS has the correct information regarding contributions and taxable payroll.

Common mistakes

When filling out the IRS Form 940-B, which is crucial for verifying credit information shown on Form 940, individuals often encounter common mistakes. Recognizing and avoiding these errors can simplify the process and ensure accurate verification from state agencies.

Not Updating the Employer Identification Number (EIN): Each employer has a unique EIN. Failure to accurately provide this number can result in the processing of the wrong entity's information.

Omitting the Calendar Year: The Form 940-B pertains to specific calendar years. Neglecting to specify the year can lead to confusion and incorrect verification of credit information.

Inaccurate Employer Name or Address: The details must match those on file. Discrepancies here could cause significant delays or miscommunication.

Incorrect State Reporting Numbers: These serve as a key identifier and must be entered correctly. An incorrect number can result in failed verification attempts.

Miscalculating the Taxable Payroll: As defined by the state act, this figure must align with state records. Misreporting can alter the experience rate and contribution amounts erroneously.

Misinterpreting the Experience Rate Period: Dates must be accurately reported from start to finish. Mistakes here could misrepresent employer qualification for specific rates.

Inputting an Incorrect Experience Rate: This rate affects the contributions and must reflect the rate assigned by the state.

Failing to Detail Contributions Paid Before and After February 1: This detail is essential for verifying timely payments. Omissions can lead to unrecognized contributions.

Leaving the Certification Section Incomplete: The signature of the state officer and the date are vital for the verification process. Without them, the form may not be considered valid.

Ignoring the Remarks Section: Important for noting discrepancies, the remarks section is often overlooked, which can lead to unresolved issues between recorded and actual contributions.

Correctly filling out the Form 940-B is a pivotal step in ensuring accurate communication between employers, state agencies, and the IRS. Paying close attention to these common mistakes can assist with compliance and streamline the verification process, fostering a smoother operation for all parties involved.

Documents used along the form

When dealing with the IRS Form 940-B, which is crucial for verifying credit information connected with unemployment taxes, individuals often find themselves in need of additional documentation. Form 940-B serves as a request to state agencies to verify the tax information provided by employers, ensuring accuracy in reporting and compliance with regulations. Understanding which documents frequently accompany Form 940-B can streamline the process, saving time and resources.

- Form 940: This is the Employer's Annual Federal Unemployment (FUTA) Tax Return. It reports the amount of unemployment taxes owed by the employer at the federal level. Form 940-B helps verify the correctness of the information reported on Form 940.

- Form 941: The Employer's Quarterly Federal Tax Return. It reports wages paid, tips, and other compensation, as well as collected income tax and FICA taxes (Social Security and Medicare).

- Form W-2: The Wage and Tax Statement provided to employees and the Social Security Administration, detailing the employee’s annual wages and the amount of taxes withheld from their paycheck.

- Form W-3: The Transmittal of Wage and Tax Statements, which is sent to the Social Security Administration along with Form W-2. Form W-3 summarizes the total earnings, social security wages, Medicare wages, and withholding for all employees during the previous year.

- Form W-4: Employee’s Withholding Certificate, used by employers to determine the correct amount of federal income tax to withhold from an employee's paycheck.

- Form 1099-MISC: Miscellaneous Income, used to report payments made in the course of a trade or business to people who aren't employees, such as independent contractors.

- Form 1096: Annual Summary and Transmittal of U.S. Information Returns. This form summarizes information returns like 1099s, which are reported to the IRS.

- Form SS-4: Application for Employer Identification Number (EIN), used to apply for an employer identification number, which is necessary for reporting taxes and other documents to the IRS.

- Schedule B (Form 941): Report of Tax Liability for Semiweekly Schedule Depositors, which is used by employers to record tax liabilities for each semiweekly deposit period.

- State Unemployment Quarterly Reports: While not a single form, these are essential for businesses operating in states that require quarterly reporting of unemployment insurance liable wages and contributions.

This collection of documents, when used alongside Form 940-B, ensures employers maintain comprehensive compliance with federal and state tax regulations. Accurate completion and timely submission of these forms safeguard businesses against potential penalties and aid in the smooth operation of their financial responsibilities to their employees and to regulatory bodies.

Similar forms

The IRS Form 941, Employer's Quarterly Federal Tax Return, shares similarities with the IRS 940-B form in that both deal with employment taxes, though they serve different functions. Form 941 is used to report wages paid, the amount of income tax withheld from employees, and both employee and employer shares of social security and Medicare taxes on a quarterly basis. Like Form 940-B, which requests verification of credit information shown on Form 940, Form 941 involves detailed reporting to the IRS to ensure compliance with tax obligations related to employment.

Form W-2, Wage and Tax Statement, is another document closely related to the IRS 940-B form. While Form 940-B is used to verify credit information for unemployment taxes, Form W-2 summarizes an employee's annual wages and the amount of taxes withheld from their paycheck. Both forms are crucial in the reconciliation of an employee's tax obligations; however, Form W-2 is more directly related to the employee, whereas Form 940-B and the corresponding Form 940 are primarily employer-focused documents.

The IRS Form 944, Employer’s Annual Federal Tax Return, is akin to the IRS 940-B as both are designed for businesses with employment tax obligations. Form 944 allows smaller employers to file annually instead of quarterly, underscoring the IRS's flexibility in accommodating various business sizes and needs. This form, similar to the 940-B, underscores the necessity for accurate reporting of taxes related to employment. Form 944, like Form 940 and its verification counterpart 940-B, ensures that employers fulfill their tax liabilities accurately and on time.

Lastly, Form W-3, Transmittal of Wage and Tax Statements, complements the functionality of the IRS 940-B form by summarizing the information presented on Form W-2 and transmitting it to the Social Security Administration (SSA). While Form 940-B focuses on verifying credit information for unemployment purposes with the IRS, Form W-3, in conjunction with Form W-2, facilitates a comprehensive report of wages and tax withholdings to the SSA. Both forms are vital components of the annual reporting responsibilities of employers, ensuring accurate documentation and compliance with tax laws.

Dos and Don'ts

When dealing with Form 940-B, a Document from the IRS for Requesting Verification of Credit Information Shown on Form 940, there are several do's and don'ts that employers should be aware of to ensure the accuracy and timeliness of their submission. Understanding these can prevent common errors and streamline the verification process with state agencies.

Do's:

Double-check the employer Identification number and contact information to ensure they match the records with the IRS and are correctly listed on the form. Accuracy in these details is crucial for correct processing.

Specify the exact calendar year for which the verification is requested, as this form is sensitive to the period being reported.

Accurately state the State in Which Employees Performed Services along with the State Reporting Number as shown on the employer's state contribution returns. This information is essential for the proper identification of the report within state records.

Report contributions and wages with precise figures, ensuring that the taxable payroll and contributions actually paid to the state align with the employer's state records and the experience rate period is correctly identified.

Use the remarks section to indicate any discrepancies or to notify about contributions paid after February 1, providing additional context that might be necessary for the state agency to verify your information.

Don'ts:

Do not leave any section incomplete, especially those related to the employer identification number, state reporting number, and the description of contributions paid. Incomplete information can lead to delays or errors in processing.

Avoid estimates or rounding off figures. Provide exact numbers for taxable payroll and contributions paid to ensure the verification process is accurate and corresponds to state agency records.

Do not forget to specify the period for the experience rate correctly — from and to dates. Incorrect periods can misrepresent your eligibility for certain rates or credits.

Refrain from delaying the submission of Form 940-B. Timely submission is essential, especially considering the deadlines for contributions mentioned in the form.

Avoid submitting the form without a thorough review for accuracy and completeness. Mistakes or omissions could lead to unnecessary complications or require resubmission, delaying the verification process.

Adhering to these do's and don'ts can greatly assist employers in the successful submission of Form 940-B to the IRS and ensure that the verification process with state agencies proceeds smoothly.

Misconceptions

There are several misconceptions surrounding the IRS Form 940-B, which is crucial for employers to understand to ensure compliance and accuracy in their tax filings and records. Below are five common misconceptions explained:

- Form 940-B is a tax return. Many inaccurately believe that Form 940-B is a tax return. In reality, it's a request for verification of credit information as shown on Form 940, which is the actual tax return related to Federal Unemployment Tax Act (FUTA) filings.

- All employers must file Form 940-B annually. This statement is incorrect. Only employers seeking verification of state unemployment contributions, as reported on their Form 940, need to file Form 940-B. It is not an annual requirement for all employers.

- Filing Form 940-B alters the tax liability shown on Form 940. Some may think that filing Form 940-B can change the tax liability reported on Form 940. However, Form 940-B's purpose is only to verify or correct the credit information related to unemployment tax contributions. It does not directly alter tax liabilities.

- The information on Form 940-B does not need to align with state records. Contrary to this belief, it is essential that the information on Form 940-B matches the state's records. Discrepancies can lead to errors in credit amounts claimed on Form 940, potentially affecting the employer's FUTA liability.

- Contributions reported after February 1 are not relevant. The misunderstanding here is that contributions made after the February 1 deadline have no impact. In fact, Form 940-B specifically requests information regarding contributions paid after February 1. These contributions can be crucial for accurate credit verification on Form 940.

Understanding these misconceptions is vital for employers to correctly utilize Form 940-B. Misinterpretations can lead to reporting errors, affecting the verification of credit information and ultimately impacting FUTA tax liabilities and compliance.

Key takeaways

Filling out and using the IRS Form 940-B is crucial for employers for verification of credit information related to unemployment taxes. Here are key takeaways that should be remembered:

- The Form 940-B, issued by the Department of the Treasury Internal Revenue Service, is designed for the request for verification of credit information shown on Form 940.

- This form requires the employer to list their name and address, the date, the calendar year in question, and the employer identification number at the beginning of the form.

- It focuses on verifying information regarding the state in which employees performed services, state reporting number, taxable payroll as defined in state act, experience rate period, experience rate, and contributions actually paid to the state.

- The state agency is asked to complete the certification at the bottom of the form, indicating any discrepancies between the employer's reported information and the agency's records. This includes noting any contributions made after February 1.

- Employers should note that the certification must include details like the state reporting number, experience rate period, taxable wages as defined by the state, the experience rate, contributions paid before February 1, contributions paid before February 10, and contributions paid after February 10.

- The form allows space for remarks or additional comments from the state agency, making it easier for employers to understand any differences noted.

- The completed form can be returned to the IRS via fax or mail, to the Director, Internal Revenue Service Center, with attention to the FUTA Liaison, demonstrating the flexible submission options available.

- By filling out and accurately completing Form 940-B, employers are ensuring that their records are verified and up-to-date, minimizing potential issues with unemployment tax credits.

- It is essential for employers to provide accurate information and to check the details they submit carefully against their own records to ensure consistency and correctness.

- Lastly, the signature and date by the state officer verify that, except as noted, the information provided by the employer matches the state agency's records, sealing the verification process.

Understanding and properly completing Form 940-B helps to maintain accurate tax records and ensures employers are credited the correct amount for unemployment tax contributions, which is essential for both the employer's financial health and compliance with tax laws.

Popular PDF Documents

Free Power of Attorney Form Indiana - The Tax POA form is an effective way to manage your tax responsibilities through a third party, maintaining control over the process while delegating the workload.

Federal Form 1310 - By completing Form 1310, you're making a formal request for a deceased's tax refund reallocation.