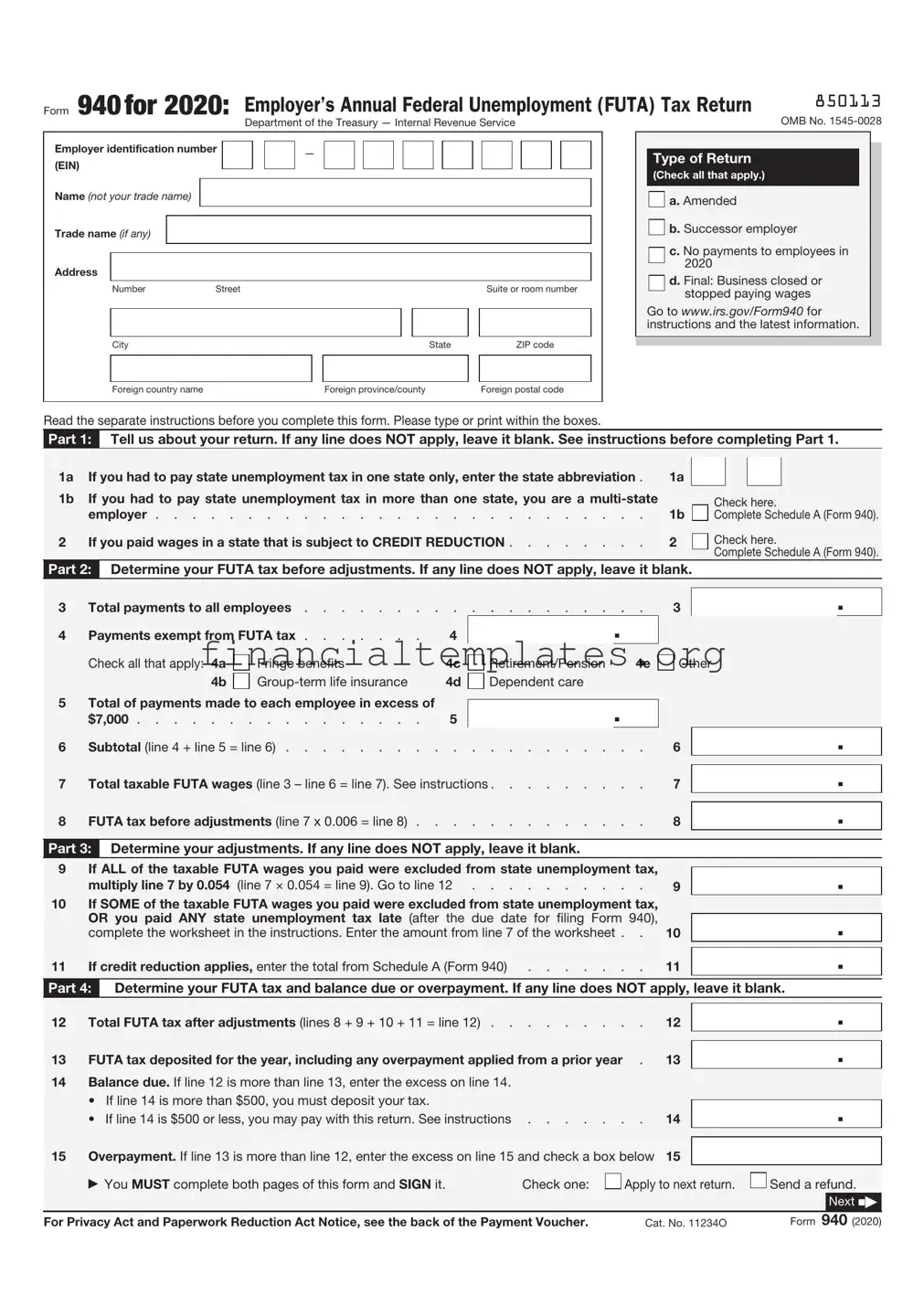

Get IRS 940 Form

Navigating the intricacies of federal employment taxes can often feel daunting for employers, but understanding the IRS 940 form is a crucial component of this process. This particular form serves as the employer's annual federal unemployment (FUTA) tax return, enabling businesses to report their yearly dues to the government. The significance of the form cannot be overstated, as it not only ensures compliance with federal laws but also provides critical funding for the state unemployment agencies that offer benefits to workers during periods of joblessness. Key aspects of the form include determining eligibility, calculating owed taxes based on the annual pay of employees, and identifying any adjustments that might apply based on state unemployment insurance contributions. The completion and timely submission of this form signify an essential step in fulfilling an employer's federal tax obligations, underscoring the vital role it plays in the broader financial and social safety net systems in the United States.

IRS 940 Example

Form 940for 2020: Employer’s Annual Federal Unemployment (FUTA) Tax Return |

850113 |

|

OMB No. |

||

Department of the Treasury — Internal Revenue Service |

Employer identification number |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(EIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade name (if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Number |

Street |

|

|

|

|

Suite or room number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

|

|

Foreign province/county |

|

Foreign postal code |

||

Type of Return

(Check all that apply.)

a. Amended

a. Amended

b. Successor employer

b. Successor employer

c. No payments to employees in 2020

d. Final: Business closed or stopped paying wages

Go to www.irs.gov/Form940 for instructions and the latest information.

Read the separate instructions before you complete this form. Please type or print within the boxes.

Part 1: Tell us about your return. If any line does NOT apply, leave it blank. See instructions before completing Part 1.

1a |

If you had to pay state unemployment tax in one state only, enter the state abbreviation . |

1a |

|

1b |

If you had to pay state unemployment tax in more than one state, you are a |

|

|

|

employer |

1b |

|

2 |

If you paid wages in a state that is subject to CREDIT REDUCTION |

2 |

|

|

Check here.

Complete Schedule A (Form 940).

Check here.

Complete Schedule A (Form 940).

Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank.

3 |

Total payments to all employees |

. |

3 |

|

|

|

|

. |

||||||||||

4 |

Payments exempt from FUTA tax |

4 |

|

|

|

. |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Check all that apply: 4a |

|

Fringe benefits |

4c |

|

Retirement/Pension |

4e |

|

Other |

|

|

|

|

|||||

|

|

4b |

|

4d |

|

Dependent care |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

5 |

Total of payments made to each employee in excess of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

. |

|

|

|

|

|

|

|

|

||||||

|

$7,000 |

5 |

|

|

|

|

|

|

|

|

|

|

|

|||||

6 |

Subtotal (line 4 + line 5 = line 6) |

. |

6 |

|

|

|

. |

|||||||||||

|

|

|

|

|

|

|

|

|||||||||||

7 |

Total taxable FUTA wages (line 3 – line 6 = line 7). See instructions |

. |

7 |

|

|

|

|

. |

||||||||||

|

|

|

|

|

|

|

|

|||||||||||

8 |

FUTA tax before adjustments (line 7 x 0.006 = line 8) |

. |

8 |

|

|

|

|

. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 3: |

Determine your adjustments. If any line does NOT apply, leave it blank. |

|

|

|

|

|

|

|

|

|||||||||

9 |

If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

. |

||||||||||||

|

multiply line 7 by 0.054 |

(line 7 × 0.054 = line 9). Go to line 12 |

. |

9 |

|

|

|

|||||||||||

10 |

If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, |

|

|

|

|

|

|

|

||||||||||

|

OR you paid ANY state unemployment tax late (after the due date for filing Form 940), |

|

|

|

|

|

|

. |

||||||||||

|

complete the worksheet in the instructions. Enter the amount from line 7 of the worksheet . |

. |

10 |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|||||||||||

11 |

If credit reduction applies, enter the total from Schedule A (Form 940) |

. |

11 |

|

|

|

|

. |

||||||||||

|

|

|

||||||||||||||||

Part 4: |

Determine your FUTA tax and balance due or overpayment. If any line does NOT apply, leave it blank. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||

12 |

Total FUTA tax after adjustments (lines 8 + 9 + 10 + 11 = line 12) |

. |

12 |

|

|

|

|

. |

||||||||||

|

|

|

|

|

|

|

|

|||||||||||

13 |

FUTA tax deposited for the year, including any overpayment applied from a prior year |

. |

13 |

|

|

|

|

. |

||||||||||

14 |

Balance due. If line 12 is more than line 13, enter the excess on line 14. |

|

|

|

|

|

|

|

|

|||||||||

|

• If line 14 is more than $500, you must deposit your tax. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

14 |

|

|

|

|

. |

|||||

|

• |

If line 14 is $500 or less, you may pay with this return. See instructions |

. |

|

|

|

||||||||||||

|

|

|

|

|

|

|

||||||||||||

15 |

Overpayment. If line 13 is more than line 12, enter the excess on line 15 and check a box below |

15 |

|

|

|

|

. |

|||||||||||

|

|

You MUST complete both pages of this form and SIGN it. |

|

|

Check one: |

|

|

|

Apply to next return. |

|

Send a refund. |

|||||||

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Next N |

|

|

|

|

|

|

||||||||||||||

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. |

Cat. No. 11234O |

|

Form |

940 (2020) |

||||||||||||||

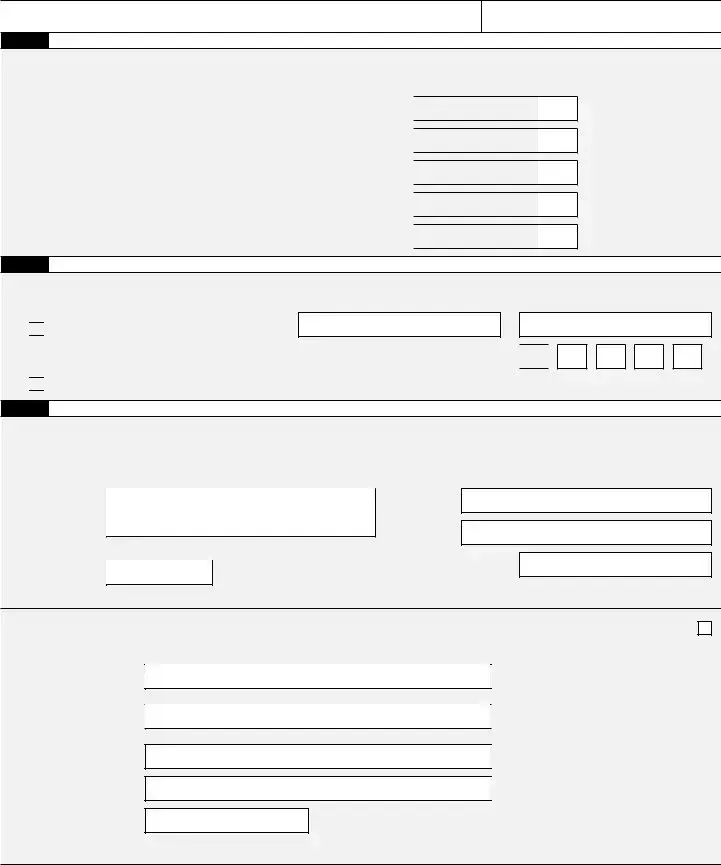

850212

Name (not your trade name)

Employer identification number (EIN)

Part 5: Report your FUTA tax liability by quarter only if line 12 is more than $500. If not, go to Part 6.

16Report the amount of your FUTA tax liability for each quarter; do NOT enter the amount you deposited. If you had no liability for a quarter, leave the line blank.

16a |

1st quarter (January 1 – March 31) . . |

. . |

. |

. |

. |

. |

. |

16a |

16b |

2nd quarter (April 1 – June 30) . . . |

. . |

. |

. |

. |

. |

. |

16b |

16c |

3rd quarter (July 1 – September 30) . |

. . |

. |

. |

. |

. |

. |

16c |

16d |

4th quarter (October 1 – December 31) |

. . |

. |

. |

. |

. |

. |

16d |

17 Total tax liability for the year (lines 16a + 16b + 16c + 16d = line 17) 17

.

.

.

.

.

.

.

.

.

.

Total must equal line 12.

Part 6: May we speak with your

Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for details.

Yes. Designee’s name and phone number

Yes. Designee’s name and phone number

Select a

No.

No.

Part 7: Sign here. You MUST complete both pages of this form and SIGN it.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete, and that no part of any payment made to a state unemployment fund claimed as a credit was, or is to be, deducted from the payments made to employees. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign your name here

Date

/ /

Print your name here

Print your title here

Best daytime phone

Paid Preparer Use Only

Preparer’s name

Preparer’s signature

Firm’s name (or yours if

Address

City

Check if you are

|

|

PTIN |

|

|

|

|

|

|

|

|

|

|

|

Date |

/ |

/ |

|

|

|

EIN |

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

Page 2 |

Form 940 (2020) |

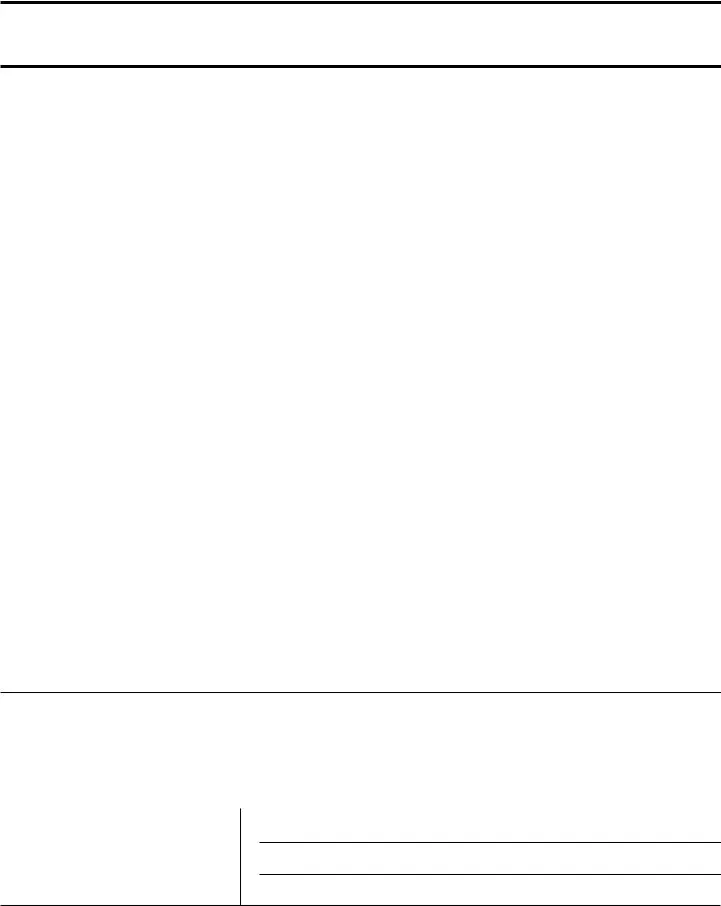

Form

Purpose of Form

Complete Form

Making Payments With Form 940

To avoid a penalty, make your payment with your 2020 Form 940 only if your FUTA tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. If your total FUTA tax after adjustments (Form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. See When Must You Deposit Your FUTA Tax? in the Instructions for Form

940.Also see sections 11 and 14 of Pub. 15 for more information about deposits.

Use Form

may be subject to a penalty. See Deposit Penalties in section 11 of Pub. 15.

Specific Instructions

Box

Box

Box

•Enclose your check or money order made payable to “United States Treasury.” Be sure to enter your EIN, “Form 940,” and “2020” on your check or money order. Don’t send cash. Don’t staple Form

•Detach Form

Note: You must also complete the entity information above Part 1 on Form 940.

Detach Here and Mail With Your Payment and Form 940. |

|

|||||

|

|

|

|

|||

Form |

|

Payment Voucher |

|

OMB No. |

||

|

|

|||||

|

|

|

|

|

||

|

|

|

|

|

|

|

Department of the Treasury |

|

Don’t staple or attach this voucher to your payment. |

|

2020 |

||

Internal Revenue Service |

|

|

||||

1 Enter your employer identification number (EIN). |

2 |

|

Dollars |

|

Cents |

|

|

|

Enter the amount of your payment. |

|

|

|

|

|

|

Make your check or money order payable to “United States Treasury” |

|

|

|

|

|

|

|

|

|

|

|

3Enter your business name (individual name if sole proprietor).

Enter your address.

Enter your city, state, and ZIP code; or your city, foreign country name, foreign province/county, and foreign postal code.

Form 940 (2020)

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. We need it to figure and collect the right amount of tax. Chapter 23, Federal Unemployment Tax Act, of Subtitle C, Employment Taxes, of the Internal Revenue Code imposes a tax on employers with respect to employees. This form is used to determine the amount of the tax that you owe. Section 6011 requires you to provide the requested information if you are liable for FUTA tax under section 3301. Section 6109 requires you to provide your identification number. If you fail to provide this information in a timely manner or provide a false or fraudulent form, you may be subject to penalties.

You’re not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books and records relating to a form or instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

Generally, tax returns and return information are confidential, as required by section 6103. However, section 6103 allows or requires the IRS to disclose or give the information shown on your tax return to others as described in the Code. For example, we may disclose

your tax information to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions to administer their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

9 hr., 19 min. |

Learning about the law or the form . . |

1 hr., 23 min. |

Preparing, copying, assembling, and |

|

sending the form to the IRS |

1 hr., 36 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making Form 940 simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/FormComments. Or you can send your comments to Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS Form 940 is used to report annual Federal Unemployment Tax Act (FUTA) tax. |

| 2 | This form is required for employers who have paid wages of $1,500 or more in any calendar quarter, or had one or more employees for at least some part of a day in any 20 or more different weeks during the year. |

| 3 | FUTA tax, combined with state unemployment systems, funds unemployment compensation to workers who have lost their jobs. |

| 4 | The standard FUTA tax rate is 6.0%, but employers can receive a credit of up to 5.4% for state unemployment taxes paid, making the effective rate as low as 0.6%. |

| 5 | Employers must file Form 940 annually, typically by January 31st for the preceding year's taxes. |

| 6 | If all FUTA tax obligations were paid on time, the deadline for filing Form 940 can be extended to February 10th. |

| 7 | Form 940 includes parts for calculating the FUTA tax liability, adjustments for state unemployment tax contributions, and any balance due or overpayment. |

| 8 | Employers who fail to file Form 940, file late, or incorrectly file may face penalties and interest charges. |

| 9 | There are specific situations and types of employment that may be exempt from FUTA tax, which are detailed in the IRS's instructions for Form 940. |

| 10 | Although Form 940 is a federal form, employers must also consider state-specific unemployment tax requirements, which may have different rates, taxable wage bases, and filing procedures. |

Guide to Writing IRS 940

Completing the IRS 940 form is an essential task for employers as it pertains to federal unemployment tax. This annual report helps the government assess and collect the necessary funds to support state unemployment agencies. While the form may seem daunting at first, breaking down the process into clear, manageable steps can simplify the task considerably. Below is a straightforward guide to help you meticulously fill out the IRS 940 form.

- Begin by gathering your Employer Identification Number (EIN), business name, and address. These are critical for identifying your business in the IRS records.

- Enter the business details at the top of the form, including your EIN, business name, trade name (if different), and address.

- Tick the box in Part 1 if your business is a 501(c)(3) organization, as different rules apply.

- In Part 2, calculate your total payments to all employees. This includes all wages, tips, and other compensation.

- Determine the payments that are exempt from FUTA tax. This could include fringe benefits, group term life insurance, retirement/pension contributions, and dependent care. Subtract these from the total payments calculated in the previous step.

- Calculate the FUTA taxable wages. If your state is a credit reduction state, refer to the instructions to make the necessary adjustments.

- Part 3 requires you to calculate your FUTA tax before adjustments. Multiply the taxable wages by the FUTA tax rate (0.6%).

- Part 4 is for adjustments. If you deposited all FUTA tax when due, check the box on line 11. If there are any adjustments, such as for a credit reduction state, calculate them accordingly.

- In Part 5, calculate the total FUTA tax after adjustments. Subtract any payments made throughout the year from this amount to find out if you owe additional tax or are due a refund.

- Sign and date the form. Include the title of the person completing the form, their contact number, and the date.

Filing the IRS 940 form is a yearly responsibility that supports the unemployment insurance system. Tackling it step by step not only ensures compliance with federal regulations but also contributes to a smoother operational flow within your business. Remember, attentiveness to detail when filling out this form is essential to avoid errors and potential penalties.

Understanding IRS 940

-

What is the IRS 940 form?

The IRS 940 form, also known as the "Employer's Annual Federal Unemployment (FUTA) Tax Return," is a document that employers must file annually. It reports the amount of federal unemployment taxes an employer must pay on the wages paid to employees. The purpose of this tax is to collect funds that pay for unemployment compensation to workers who have lost their jobs.

-

Who needs to file the IRS 940 form?

Generally, any business with employees is required to file an IRS 940 form if it paid wages of $1,500 or more in any quarter of the calendar year, or if it had one or more employees for at least some part of a day in any 20 or more different weeks in a year. However, there are exceptions, so checking the specific requirements outlined by the IRS is recommended.

-

When is the due date for filing the IRS 940 form?

The IRS 940 form is due annually by January 31st for the previous calendar year's taxes. However, if an employer has deposited all the FUTA tax when it was due, the deadline can extend to February 10th.

-

What information is required to complete the IRS 940 form?

To properly complete the IRS 940 form, you'll need details such as your Employer Identification Number (EIN), the amount of wages paid to employees that are subject to FUTA tax, and the FUTA tax calculations based on those wages. Additionally, adjustments for state unemployment tax contributions must be reported if applicable.

-

How is the FUTA tax calculated?

FUTA tax is calculated at a rate of 6.0% on the first $7,000 of wages paid to each employee throughout the calendar year. However, employers generally receive a credit of up to 5.4% for any state unemployment taxes paid, effectively lowering the FUTA tax rate to 0.6% if they qualify for the maximum credit.

-

Can you file the IRS 940 form electronically?

Yes, the IRS encourages employers to file the IRS 940 form electronically through the IRS e-file system. This method offers faster confirmation of receipt and reduces potential for error.

-

Are there penalties for late filing of the IRS 940 form?

Yes, failing to file the IRS 940 form on time or failing to pay the due FUTA tax may result in penalties and interest charges. The penalty rates depend on how late the form and payments are submitted.

-

Can the IRS 940 form be amended?

Yes, if mistakes were made on the original IRS 940 form, it can be amended by filing a corrected form. Employers should clearly mark the form as "Amended" and provide the corrected information in the designated sections of the form.

-

Do state unemployment taxes affect the IRS 940 form?

Yes, state unemployment taxes directly affect the calculation of FUTA tax liability on the IRS 940 form. Employers receive a credit for up to 5.4% of state unemployment taxes paid, which can significantly reduce the FUTA tax rate. Therefore, proper reporting of state unemployment contributions is crucial for accurate FUTA tax calculation.

-

Where can I find more information and assistance with the IRS 940 form?

For more detailed information, guidance, and resources on the IRS 940 form, employers can visit the official IRS website or consult with a professional tax preparer or accountant. The IRS also provides a detailed instruction booklet for Form 940 that outlines the filing requirements, tax calculations, and special situations that may apply to some employers.

Common mistakes

When filling out the IRS 940 form, which is used for reporting annual Federal Unemployment Tax Act (FUTA) tax, many individuals encounter common errors. Avoiding these mistakes is crucial for ensuring accurate tax reporting and compliance. Here's a list of the ten most common mistakes:

- Failing to provide the correct Employer Identification Number (EIN) leads to processing delays and possible misclassification.

- Incorrectly calculating FUTA tax due to misunderstanding the taxable wage base or rates can result in underpayment or overpayment.

- Omitting state unemployment amounts, a vital piece for determining your FUTA credit, can lead to inaccuracies in the amount of credit you’re eligible for.

- Not checking the correct box for “Type of Return,” which distinguishes between amended returns and regular filings, can lead to processing issues.

- Misclassifying employees as independent contractors or vice versa, leading to incorrect tax obligations.

- Entering incorrect payment amounts in the liability section, which can cause discrepancies in owed vs. paid amounts.

- Failing to attach Schedule A (Form 940) for multi-state employment or credit reduction situations can result in errors in tax calculation.

- Not signing the form or missing the date of signing, which can invalidate the submission or delay processing.

- Incorrectly reporting exempt payments, such as fringe benefits, which should not be included in taxable wages for FUTA.

- Forgetting to complete all required sections, including the contact information section, which is essential for any necessary follow-up.

Avoiding these mistakes ensures that filers remain in compliance and avoid potential penalties. Paying attention to detail, understanding the requirements, and seeking guidance when necessary can significantly mitigate these errors.

Documents used along the form

The IRS Form 940 is a critical document for employers, as it is used to report their annual Federal Unemployment Tax Act (FUTA) tax. Completing and submitting this form is just one part of employers' obligations regarding payroll and taxes. Alongside Form 940, there are several other important forms and documents that employers might need to fill out and submit to comply with federal regulations and ensure proper payroll management. Here's an overview of five such documents.

- Form W-2, Wage and Tax Statement: This form is essential for reporting the wages paid to employees and the taxes withheld from them for the year. Employers must send out Form W-2 to each employee annually and submit copies to the Social Security Administration.

- Form W-3, Transmittal of Wage and Tax Statements: Accompanying Form W-2 submissions, Form W-3 is a summary page that reports the total of all wages and taxes withheld for all employees. This form is sent directly to the Social Security Administration alongside the W-2 forms.

- Form 941, Employer's Quarterly Federal Tax Return: Employers use this form to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks. Form 941 is also used to pay the employer's portion of Social Security or Medicare tax.

- Form 944, Employer's Annual Federal Tax Return: This form is designed for smaller employers to report federal income tax withholdings and Social Security and Medicare taxes owed and paid. The IRS notifies employers eligible to file Form 944 instead of Form 941 annually.

- Form W-4, Employee's Withholding Certificate: Although not submitted to the IRS, this form is crucial as it is used by employees to indicate their tax situation to the employer, dictating how much federal income tax to withhold from their paychecks.

Together with IRS Form 940, these documents form a comprehensive suite of forms that are integral to the compliance and operational functionality of payroll processes within organizations. Proper completion and timely submission of these forms ensure compliance with federal tax obligations, contributing to the smooth operation of the broader tax system. Familiarization with these documents is essential for employers to navigate their responsibilities effectively.

Similar forms

The IRS 940 Form, used for reporting annual Federal Unemployment Tax Act (FUTA) tax, shares similarities with the IRS 941 Form. The 941 Form is utilized by employers to report quarterly payroll taxes, including withheld federal income tax, Social Security, and Medicare taxes. Both forms are essential for employers to comply with federal tax obligations, but while the 940 focuses on unemployment taxes paid by the employer, the 941 deals with payroll taxes withheld from employees' wages and the employers’ portion of Social Security and Medicare taxes.

Another document related to the IRS 940 Form is the IRS Form W-2. The W-2 Form is issued by employers to employees and the IRS at the end of each year. It details the employee's annual wages and taxes withheld. While the 940 Form reports the employer's annual contribution to unemployment taxes, the W-2 summarizes the employee's earnings and the federal, state, and other taxes withheld from their paycheck throughout the year.

The IRS 944 Form is also closely related to the IRS 940 Form. Designed for smaller employers, the 944 Form allows them to report their federal income tax and FICA tax obligations annually instead of quarterly, like the 941 Form. Both the 940 and 944 Forms facilitate annual reporting, but the 940 focuses on unemployment tax, whereas the 944 concentrates on income and social security taxes.

Further, the IRS 1099 Form series, particularly the 1099-MISC and 1099-NEC, bear relevance to the IRS 940 Form. These forms are used to report payments made to independent contractors or for miscellaneous income. While the 1099 Forms capture payments excluding employment taxes, the 940 Form accounts for unemployment taxes employers pay for their employees, signifying the distinction between direct employment and contractual relationships.

The Schedule H Form is a document used primarily in household employment situations. It is filed by individuals who pay wages to household employees and are liable for Social Security, Medicare, and Federal Unemployment Taxes (FUTA). Similar to the 940 Form, Schedule H is concerned with reporting taxes related to employment; however, it specifically caters to domestic employment settings.

The IRS Form 1094-C, alongside Form 1095-C, plays a pivotal role in enforcing the Affordable Care Act's employer mandate by reporting employees' health insurance coverage offered by employers. While contrasting in purpose, both the 1094-C/1095-C forms and the 940 share the commonality of employer reporting obligations to the federal government, reflecting various dimensions of employment.

Another document, the State Unemployment Tax Act (SUTA) returns, while not a federal form, is intrinsically linked to the purpose of the IRS 940 Form. Employers file SUTA returns to report wages and pay unemployment insurance taxes at the state level. Although managed separately, SUTA taxes complement FUTA taxes in funding unemployment insurance, underscoring the dual state and federal systems of unemployment insurance in the United States.

Lastly, the IRS Form 1023 shares a connection with the IRS 940 Form in the broader context of tax obligations and benefits. The 1023 Form is used by organizations seeking recognition of tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. While fundamentally different in their applications, both the 940 Form and the 1023 involve formal reporting to the IRS to fulfill specific tax-related requirements or attain tax benefits.

Dos and Don'ts

When it comes to filling out the IRS 940 form, which is used to report annual Federal Unemployment Tax Act (FUTA) tax, careful attention to detail is crucial. Given its importance in ensuring compliance with federal tax obligations, there are several do's and don’ts you should be aware of. Below are key guidelines to follow:

Do's:

- Double-check your Employer Identification Number (EIN): Ensure that the EIN on your form matches the one the IRS has on file for your business.

- Report all wages accurately: Include all taxable FUTA wages paid throughout the year, ensuring your calculations are precise.

- Verify state unemployment contributions: Confirm that the state unemployment tax contributions you are reporting are correct and were paid on time to potentially qualify for a credit.

- Fill out the form completely: Ensure every required line and section of the form is filled out to avoid processing delays.

- Sign and date the form: The IRS 940 form is not valid without the appropriate signature and date, confirming the veracity of the information provided.

- Use the correct version of the form: Ensure you are using the most current version of the IRS 940 form. The IRS updates forms periodically, and using an outdated version might result in errors.

- Consult the instructions: The IRS provides detailed instructions for filling out the form. Reviewing these can clarify requirements and help avoid mistakes.

Don'ts:

- Don’t leave fields blank: If a section does not apply, enter "0" or "N/A" instead of leaving it blank to indicate the question was not overlooked.

- Don’t underestimate your liability: Ensure you accurately calculate your FUTA tax liability to avoid potential penalties for underpayment.

- Don’t ignore filing deadlines: Submitting the IRS 940 form after the due date can result in penalties. Note the deadline and plan accordingly to ensure timely filing.

- Don’t use incorrect payment methods: Follow the IRS guidelines for how to make your FUTA tax payments properly to avoid processing issues.

- Don’t forget to keep a copy for your records: After submitting, retain a copy of the form and any correspondence for at least four years as proof of compliance.

- Don’t guess: If you’re unsure about how to answer a specific question, it’s better to seek clarification from a professional than to risk inaccuracies by guessing.

- Don’t neglect electronic filing options: For convenience and to reduce errors, consider filing the form electronically through the IRS e-file system.

Misconceptions

The IRS 940 form, also known as the Federal Unemployment Tax Act (FUTA) tax return, is often surrounded by misconceptions. This document plays a crucial role in the world of employment taxes, but misunderstandings can lead to mistakes in filing or compliance. Let's clarify some of these common misconceptions:

- Only large businesses need to file it: There's a common belief that the IRS 940 is only for large corporations. In reality, any business that pays wages of $1,500 or more in any quarter, or has at least one employee for a portion of a day in any 20 or more different weeks in a year, needs to file this form.

- It's the same as the IRS 941 form: Although both forms are related to employment taxes, they serve different purposes. The IRS 941 form is used to report an employer's federal income tax withholding and the employees' social security and Medicare taxes each quarter. In contrast, the 940 form is specifically for reporting annual federal unemployment tax.

- Filing electronically is optional: Many employers believe that filing Form 940 electronically is a matter of preference. However, the IRS encourages electronic filing for its accuracy and efficiency. For businesses that meet certain criteria, electronic filing may actually be a requirement.

- Only taxable wages are reported: While it's true that Form 940 is used to report wages, it's a misconception that only taxable wages need to be included. Employers must report all wages paid to employees, but the tax is calculated only on the first $7,000 paid to each employee as FUTA wages within the year.

- Paying unemployment tax through 940 clears all state unemployment tax obligations: This misunderstanding can lead businesses into trouble. The IRS 940 form deals with federal unemployment tax obligations only. Employers are also required to pay state unemployment taxes, and those obligations are entirely separate. Compliance with state requirements is just as crucial as federal compliance.

Understanding these misconceptions about the IRS 940 form can help employers navigate their tax responsibilities with greater accuracy and confidence, ensuring they remain in good standing with federal and state tax agencies.

Key takeaways

Filing the IRS 940 form is an essential task for employers as it relates to the reporting of federal unemployment tax. This tax, known as FUTA, helps to fund state workforce agencies. Here are five key takeaways to ensure the process is handled accurately and efficiently:

- Know the deadlines: It's important to be aware of when the IRS 940 form needs to be filed. Generally, the form must be submitted by January 31st following the end of the year you're reporting for. If you've deposited all FUTA tax when it was due, you may have up until February 10th to file.

- Determine eligibility: Not every employer is required to file the IRS 940 form. Typically, you need to file if you paid wages of $1,500 or more in any calendar quarter or had one or more employees for at least some part of a day in any 20 or more different weeks in a year.

- Calculate your FUTA tax correctly: FUTA tax is not withheld from an employee's wages but is paid by the employer. The tax rate can change, so it's important to verify the current rate. In addition to the federal rate, employers might receive a credit for state unemployment taxes paid.

- Fill out the form meticulously: Accuracy is crucial when completing the IRS 940 form. Make sure to provide detailed information about your business, including the Employer Identification Number (EIN), and carefully calculate the FUTA tax liability. Any mistakes could lead to delays or penalties.

- Know how to submit the form: The IRS allows for both electronic and paper filing options. Choosing electronic filing can expedite the process and reduce the chances of errors. If you prefer to mail the form, be sure to check the correct mailing address for your state, as it can vary.

Understanding these key aspects of the IRS 940 form can help employers maintain compliance with federal regulations and avoid potential issues. Always ensure that you're using the most current version of the form and consult with a professional if you have specific questions or concerns.

Popular PDF Documents

Oregon Income Tax Form - All lodging providers in Oregon are subjected to the state lodging tax and must comply with quarterly reporting.

IRS 6781 - This form is an important component for those utilizing advanced financial strategies to optimize their tax situation.