Get Irs 9297 Form

Engaging with the IRS can often be a daunting encounter, especially when it involves providing specific documents and information under tight deadlines. The IRS Form 9297, Summary of Taxpayer Contact, plays a crucial role in this interaction, offering a structured way for taxpayers and the IRS to outline the details of required information or documents, along with their respective submission deadlines. This form serves as a formal acknowledgment between the taxpayer and the agency, depicting the taxpayer's name, identification number, the details of the requested documents or information, and by when these are required to be submitted to avoid potential repercussions. Additionally, it highlights the consequences of not adhering to these deadlines, which may include, but are not limited to, the issuance of a summons, a Notice of Levy, or other actions deemed necessary by the IRS. Form 9297, last revised in May 2009, also includes contact information for the Revenue Officer handling the case, thereby providing a direct line for any queries or concerns. This form is an essential tool for ensuring clear communication and understanding of obligations between taxpayers and the IRS, emphasizing the importance of timely compliance with IRS requests to avoid unnecessary legal actions.

Irs 9297 Example

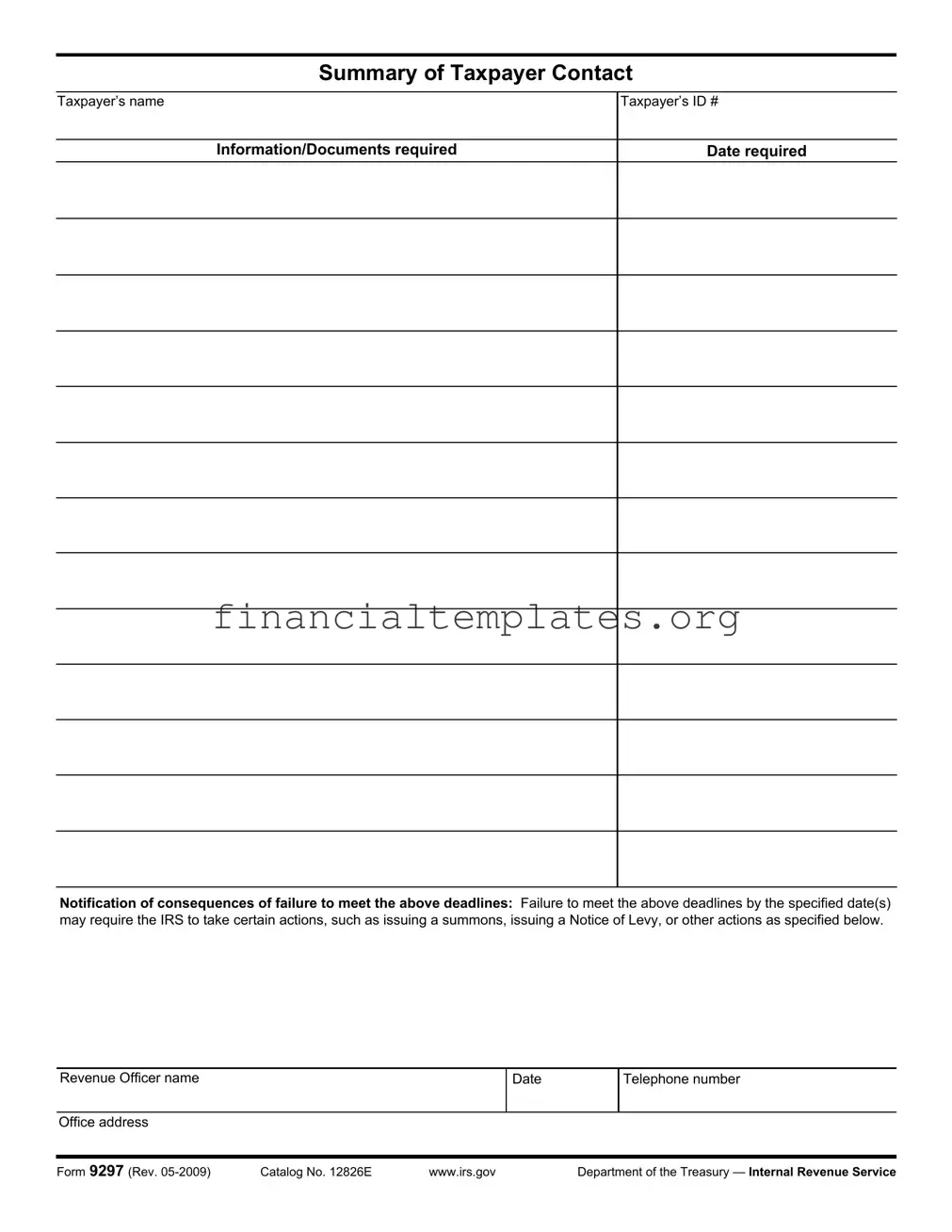

Summary of Taxpayer Contact

Taxpayer’s name

Taxpayer’s ID #

Information/Documents required

Date required

Notification of consequences of failure to meet the above deadlines: Failure to meet the above deadlines by the specified date(s) may require the IRS to take certain actions, such as issuing a summons, issuing a Notice of Levy, or other actions as specified below.

Revenue Officer name

Office address

Date

Telephone number

Form 9297 (Rev. |

Catalog No. 12826E |

www.irs.gov |

Department of the Treasury — Internal Revenue Service |

Summary of Taxpayer Contact

Taxpayer’s name

Taxpayer’s ID #

Information/Documents required

Date required

Notification of consequences of failure to meet the above deadlines: Failure to meet the above deadlines by the specified date(s) may require the IRS to take certain actions, such as issuing a summons, issuing a Notice of Levy, or other actions as specified below.

Revenue Officer name

Office address

Date

Telephone number

Form 9297 (Rev. |

Catalog No. 12826E |

www.irs.gov |

Department of the Treasury — Internal Revenue Service |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title | Summary of Taxpayer Contact |

| Key Components | The form includes Taxpayer’s name, Taxpayer’s ID #, Information/Documents required, Date required, and Notification of consequences of failure to meet the specified deadlines. |

| Purpose of Form | It is used to summarize the contact between a taxpayer and a revenue officer, including the request for documents or information and the deadlines for those requests. |

| Potential Consequences | Failure to meet the deadlines can lead to actions by the IRS such as issuing a summons, issuing a Notice of Levy, or other specified actions. |

| Revision Information | The form was last revised in May 2009, as indicated by its revision date (Rev. 05-2009) and its catalog number is 12826E. |

Guide to Writing Irs 9297

Filling out the IRS Form 9297 is an essential step in communicating with the Internal Revenue Service about required documentation and deadlines. This form serves as a summary of taxpayer contact, outlining what information or documents are needed, the due dates for these materials, and the possible outcomes if the deadlines are not met. The process includes specifying taxpayer details, required documents or information, the associated deadlines, and information about the revenue officer handling the case. Here's a step-by-step guide on how to complete this form accurately.

- Begin by entering the Taxpayer’s name at the top of the form. Ensure that the name is written exactly as it appears on all official IRS documents to avoid any discrepancies.

- Fill in the Taxpayer’s ID #, which can be either the Social Security Number for individuals or the Employer Identification Number for businesses.

- In the Information/Documents required section, clearly list all documents or pieces of information that the IRS is requesting. Be precise to prevent any misunderstandings or further requests.

- Specify the Date required by which the requested information or documents must be submitted to the IRS. It’s important to adhere to this deadline to avoid potential penalties or additional actions from the IRS.

- Under the Notification of consequences of failure to meet the above deadlines, read and understand the listed actions that the IRS may take if the deadline is not met. These actions can include issuing a summons, issuing a Notice of Levy, among others.

- Enter the Revenue Officer’s name assigned to your case. This is the person you may need to contact for any questions or clarification.

- Provide the Office address of the Revenue Officer. This is where any physical documents should be sent if not submitted electronically.

- Indicate the Date when the form is being filled out. This helps both the taxpayer and the IRS keep track of the timeline of communication.

- Lastly, include the Telephone number of the Revenue Officer. This contact information is vital for direct communication if there are any issues or further requirements.

After completing these steps, the form should be reviewed for accuracy and completeness. It's critical to submit Form 9297 by the required deadline to ensure a smooth process in resolving tax matters. Following the submission, be prepared to communicate further with the IRS or the designated Revenue Officer should there be any follow-up questions or additional requests for information.

Understanding Irs 9297

What is Form 9297?

Form 9297, known as Summary of Taxpayer Contact, is a document used by the Internal Revenue Service (IRS) to communicate with taxpayers. It outlines the information or documents required from the taxpayer, the deadline for submission, and the consequences of not meeting these deadlines.

Why did I receive Form 9297?

You received Form 9297 because the IRS needs additional information or documents from you to process your tax case. This form serves as a formal request and ensures you are aware of what is needed, by when, and the potential outcomes if the requirements are not met.

What types of documents might the IRS request on Form 9297?

The IRS may request a wide range of documents via Form 9297, depending on the specifics of your tax case. Common requests include income statements, expense receipts, bank statements, employment records, and other documents that can substantiate claims made on your tax return.

What happens if I don't provide the requested information by the deadline?

If you fail to meet the deadline specified in Form 9297, the IRS may take various actions. These can include issuing a summons, imposing a levy on your assets, or taking other enforcement actions to collect the information or settle any tax liabilities. It's crucial to respond by the specified date to avoid such outcomes.

Can I request an extension to provide the requested information?

Yes, in many cases it is possible to request an extension to provide the information requested on Form 9297. It's essential to contact the revenue officer named on the form as soon as you realize you need more time, to discuss your options and request an extension if available.

Who should I contact if I have questions about Form 9297?

If you have questions about the form or the information requested, the best point of contact is the revenue officer whose name and telephone number are listed on the form. They can provide guidance specific to your case and assist with any concerns you might have.

Is there a deadline for the IRS to issue Form 9297?

There is no specific deadline for the IRS to issue Form 9297. The timing depends on the individual case and when the IRS identifies a need for additional information or documents from the taxpayer. The form is issued at the IRS's discretion as part of their process in handling and resolving tax matters.

What should I do after receiving Form 9297?

After receiving Form 9297, review the document carefully to understand what information or documents are required, and note the deadline for submission. Gather the requested materials as soon as possible, and submit them by the specified date. If you have any doubts or need more time, contact the revenue officer listed on the form promptly.

Can I submit the requested information electronically?

Whether you can submit information electronically depends on the nature of the documents and the IRS's current policies on electronic submissions. It's advisable to ask the revenue officer handling your case about the best way to submit your documents, as they can provide the most accurate and up-to-date advice.

What are the consequences of repeatedly failing to provide requested documents?

Repeatedly failing to provide requested documents can lead to escalated enforcement actions by the IRS. These can include, but are not limited to, more aggressive collection efforts, additional penalties, and legal action. It's in your best interest to comply with requests outlined in Form 9297 to avoid these serious consequences.

Common mistakes

Frequently, individuals mistakenly provide an incorrect Taxpayer’s ID #, such as mixing up digits or transposing numbers. This simple error can lead to significant delays in processing and potential misunderstandings regarding one's tax account status.

Another common oversight is the failure to provide all requested Information/Documents by the specified Date required. Often, individuals overlook one or more documents, not realizing the critical role each document plays in the evaluation of their tax situation.

Some taxpayers do not fully appreciate the severity of the Notification of consequences of failure to meet the above deadlines. Ignoring or underestimating the importance of this notification can result in unexpected actions from the IRS, such as levies or summons, that could have been avoided.

Omitting the Revenue Officer’s name and not using the correct Office address when corresponding or submitting the Form 9297 can disrupt the communication flow. This type of error often leads to misplaced documents and unnecessary delays.

Not providing a current Telephone number where the taxpayer can be reached for further clarification or questions can significantly slow down the resolution process. It is crucial for effective and timely communication between the taxpayer and the IRS.

Occasionally, taxpayers submit outdated versions of Form 9297, not realizing that the form has been revised. Using an outdated form can lead to requests for additional information, as the requirements may have changed since the last revision date.

It is essential for individuals to pay close attention to detail when completing and submitting the IRS Form 9297 to avoid these common mistakes. Prompt and accurate communication with the IRS can help prevent unnecessary complications in one's tax affairs.

Documents used along the form

When dealing with IRS Form 9297, a "Summary of Taxpayer Contact", it's important to be thorough and well-prepared. This form is used to outline the specific documents or information the IRS requires from a taxpayer by a certain date, along with the consequences of not complying with this request. But Form 9297 rarely travels alone. It's often accompanied by a range of other forms and documents, each serving its unique purpose in the intricate dance of tax compliance and communication with the Internal Revenue Service. Understanding these accompanying documents can help taxpayers navigate their obligations more effectively.

- Form 1040 (U.S. Individual Income Tax Return) - This is the standard federal income tax form for individuals, where taxpayers report their annual income, claim deductions, and calculate the amount of tax owed or refund due.

- Form 433-A (Collection Information Statement for Wage Earners and Self-Employed Individuals) - This form provides the IRS with information about the taxpayer's financial situation, often used to determine payment plans or settlement options for outstanding taxes.

- Form 656 (Offer in Compromise) - When taxpayers believe they are unable to pay the full amount of taxes they owe, this form allows them to propose a lesser amount as a settlement.

- Form 8821 (Tax Information Authorization) - This document authorizes an individual or organization to review and receive confidential tax information on behalf of the taxpayer.

- Form 2848 (Power of Attorney and Declaration of Representative) - Through this form, taxpayers can grant a qualified individual, such as an accountant or lawyer, the authority to represent them before the IRS.

- Form 4506-T (Request for Transcript of Tax Return) - Taxpayers use this form to request a transcript of their tax return, which is often needed for loan applications and to resolve issues with the IRS.

- Form 9465 (Installment Agreement Request) - If taxpayers cannot pay their tax debt in full, this form lets them request a monthly payment plan.

- Notice CP14 (Balance Due) - This notice is sent by the IRS to inform taxpayers of the amount due, including taxes, penalties, and interest, for a specific tax year.

- Notice of Federal Tax Lien - This document notifies the public that the government has a legal claim against a taxpayer's property due to an unpaid tax debt.

Together, these forms and documents play critical roles in the tax filing and payment process, helping taxpayers meet their obligations and resolve discrepancies with the IRS. Whether you're responding to an IRS request, settling a tax debt, or authorizing a representative, understanding the purpose of these documents can significantly streamline the process. This knowledge ensures not only compliance with tax laws but also a more navigable path through the complexities of tax management.

Similar forms

The Form 4868, known as the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, shares a common purpose with the IRS Form 9297 in assisting taxpayers in managing their filing obligations. While Form 9297 outlines the specific documents or information required from the taxpayer and the consequences of not providing them by the specified deadlines, Form 4868 serves to provide taxpayers additional time to file their tax returns. It similarly underscores the importance of meeting IRS deadlines to avoid penalties or further IRS action.

Form 2848, Power of Attorney and Declaration of Representative, is similar to Form 9297 in that it involves precise taxpayer information and stipulates the authorization of individuals to take specific actions on behalf of the taxpayer. Where Form 9297 provides a summary of what is required from the taxpayer including deadlines for submission, Form 2848 designates another person to handle the taxpayer’s affairs with the IRS, thereby making it crucial in circumstances where direct taxpayer action or response is not feasible.

Another related document is the Form 433-F, Collection Information Statement, which, like Form 9297, is used by the IRS to gather necessary information from taxpayers. Form 433-F is focused on collecting financial information to determine how the taxpayer can settle outstanding tax liabilities. The connection lies in the necessity for timely and accurate information submission to the IRS to prevent consequential actions, such as those highlighted in Form 9297’s notification section.

The Notice of Deficiency, also referred to as Letter 3219, bears resemblance to the IRS Form 9297 since both documents are part of the IRS's administrative processes to inform taxpayers about issues with their accounts. While the Notice of Deficiency is a formal declaration by the IRS of taxes owed due to discrepancies found during an audit, Form 9297 is a preemptive measure to avoid such discrepancies from leading to a Notice of Deficiency, by requesting specific information or documents by a certain deadline.

Form 656, Offer in Compromise, relates to Form 9297 in that it represents an option for taxpayers to resolve their tax liabilities. Form 9297 alerts taxpayers to the need for specific actions by certain deadlines to prevent IRS enforcement actions. In contrast, Form 656 allows taxpayers to negotiate their tax debt under specific circumstances. Both forms signify a critical engagement with the IRS to avoid or mitigate penalties or additional tax obligations.

Lastly, the CP2000 Notice, or Underreported Income Notice, is akin to Form 9297 as it is a part of the IRS’s process to inform taxpayers about issues with their tax returns. The CP2000 Notice identifies discrepancies between the income information the IRS has received and what the taxpayer has reported, requesting additional information or correction. Form 9297 similarly requires taxpayers to provide necessary documentation by specified deadlines to resolve issues potentially preventing such discrepancies.

Dos and Don'ts

When filling out the IRS 9297 form, it's essential to follow best practices to ensure the process is completed correctly and efficiently. Here are some dos and don'ts to consider:

- Do verify the taxpayer's name and ID number for accuracy to avoid any confusion or processing delays.

- Do provide all required information and documents by the specified date to prevent possible adverse actions from the IRS.

- Do clearly understand the consequences of failure to meet the deadlines, such as the possibility of a summons, a Notice of Levy, or other specified actions.

- Do include the contact information of the Revenue Officer handling the case for any necessary follow-ups or clarification.

- Do double-check the form for completeness and accuracy before submission to minimize any potential issues.

- Don't disregard the specified deadlines for submitting information/documents, as this can lead to complications with the IRS.

- Don't leave any required fields blank. If a section does not apply to your situation, fill in with "N/A" or the appropriate indication to signify it has been reviewed but is not applicable.

- Don't forget to document any communications with the IRS or actions taken in relation to the form. Keeping a record can be helpful if there are any disputes or misunderstandings in the future.

- Don't hesitate to reach out to a tax professional if there are any uncertainties about how to properly fill out the form. Getting guidance can prevent errors and ensure the process goes smoothly.

Misconceptions

The IRS 9297 form, often referred to as the Summary of Taxpayer Contact, is surrounded by various misconceptions. Understanding the reality behind these misconceptions is crucial for taxpayers and professionals alike to navigate their interactions with the IRS more effectively.

Misconception 1: The IRS 9297 form is an audit notice. Contrary to this belief, the form is actually a communication tool used by IRS officials to summarize the details of a conversation or meeting with a taxpayer. It includes information such as the taxpayer's name, ID number, and the documents or information required from them.

Misconception 2: Filling out Form 9297 is optional. When requested by an IRS representative, providing the requested information on Form 9297 is indeed necessary. Failure to comply can lead to further actions from the IRS, such as issuing a summons or a Notice of Levy.

Misconception 3: Form 9297 can only be issued by IRS auditors. In reality, any IRS officer handling a taxpayer's case, including revenue officers, can issue this form. It serves as a means to document specific taxpayer obligations regarding their tax case.

Misconception 4: The form is a final determination of tax owed. This is not accurate. Instead, Form 9297 merely outlines what information or documents the IRS is requesting from the taxpayer. It does not calculate or demand payment of taxes owed.

Misconception 5: Taxpayers have an unlimited amount of time to respond to Form 9297. The form specifies a date by which the requested information or documents must be provided. Ignoring this deadline can trigger enforcement actions by the IRS.

Misconception 6: The consequences for not complying with Form 9297 are minimal. The reality is that failure to comply can lead to significant consequences, such as the issuance of a summons or a Notice of Levy, among other enforcement actions.

Misconception 7: Responses to Form 9297 can only be submitted by mail. While the form does provide a mailing address, taxpayers often have multiple options for submitting their information, depending on the IRS office handling their case. It is best to confirm with the issuing officer.

Misconception 8: Form 9297 is a new requirement from the IRS. This form has been in use since at least May 2009, as indicated by its revision date, and serves as an established method for the IRS to request information from taxpayers.

Misconception 9: Any corrections to the information on Form 9297 can only be made by the IRS. If there are errors or discrepancies in the information listed on the form, taxpayers should proactively contact the IRS officer who issued the form to discuss necessary corrections.

Dispelling these misconceptions is essential for fostering a more transparent and effective dialogue between taxpayers and the IRS. By understanding the purpose and requirements of the IRS 9297 form, taxpayers can better prepare for and respond to IRS requests, ultimately aiding in the efficient resolution of their tax matters.

Key takeaways

Filling out and using the IRS Form 9297 requires careful attention to detail and understanding its significance. This form, known as the Summary of Taxpayer Contact, plays a crucial role in tax compliance and communication with the IRS. Here are key takeaways to guide taxpayers through the process:

- Form 9297 is used by the IRS to summarize the details of contact between a revenue officer and a taxpayer. It serves as a formal record of the interaction.

- The form lists the taxpayer's name and ID number, making it crucial for the taxpayer to verify these details for accuracy.

- It specifies the information or documents that the taxpayer is required to provide. Taxpayers should carefully review this section to understand what is expected of them.

- A deadline is outlined for when the requested information or documents need to be submitted. It is in the taxpayer's best interest to adhere to this deadline to avoid potential issues.

- The form includes a notification of the consequences for failing to meet the specified deadlines. This could involve enforcement actions by the IRS, such as issuing a summons or a Notice of Levy.

- Contact details for the revenue officer, including their name, office address, and telephone number, are provided. This information can be used by taxpayers seeking to clarify doubts or if they need further assistance.

- The importance of addressing any inaccuracies or misunderstandings with the revenue officer as soon as possible cannot be overstated. Prompt communication can prevent unnecessary complications.

- Finally, taxpayers should keep a copy of Form 9297 for their records. It serves as proof of the IRS's communication and requests, which might be useful for future reference.

While the process of dealing with the IRS and its forms can seem daunting, understanding the purpose and requirements of Form 9297 can simplify tax compliance. By taking proactive steps and remaining well-informed, taxpayers can navigate their obligations with greater ease and confidence.

Popular PDF Documents

Florida Sales Tax by County - Include telephone numbers for both the taxpayer and preparer for possible follow-up or verification.

Sss Form Loan - Designed to accommodate both individual borrowers and their employers, this form simplifies the submission process, enhancing efficiency.

Hawaii Department of Taxation - Instructions highlight the importance of attaching Schedule GE for claiming deductions.