Get Irs 8965 Form

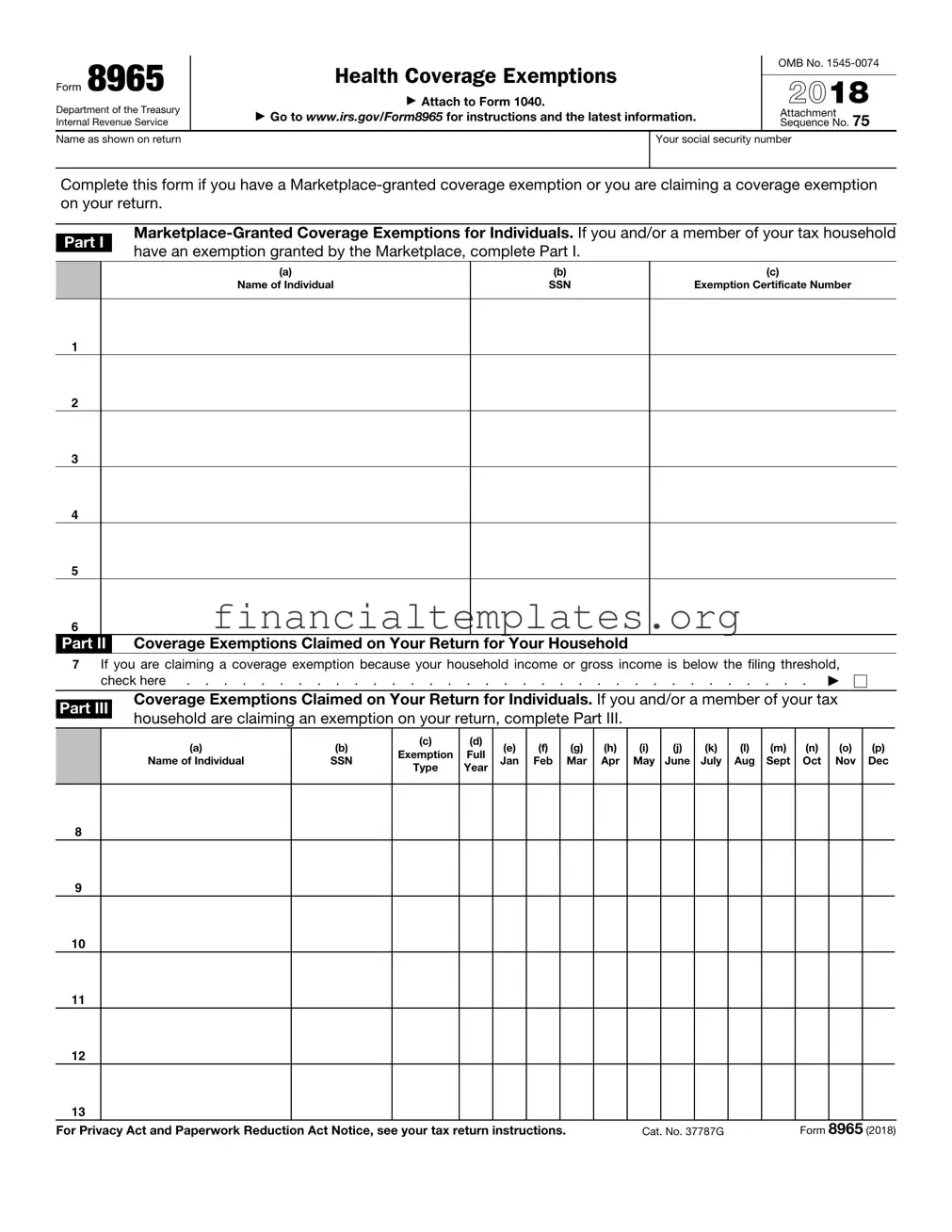

Navigating through tax forms can often feel like trying to find your way through a maze, but understanding each form's purpose helps eliminate confusion. The IRS Form 8965 is an essential document for those who need to report their health coverage status to the Internal Revenue Service (IRS). Specifically designed for individuals who qualify for health coverage exemptions, this form plays a crucial role during the tax filing process. Whether these exemptions are granted by the Marketplace or are claimed directly on the tax return, Form 8965 provides a structured way to list them. It comprises sections for marketplace-granted coverage exemptions for both individuals and members of their tax household, as well as exemptions claimed on the return by the taxpayer. Filled with various identifiers like social security numbers and exemption certificate numbers, this form aids in ensuring that individuals and households that do not have minimum essential health coverage but qualify for an exemption, do not face the penalties that others without such coverage might. For those unfamiliar, the attachment to the tax return and navigation through the exemptions can seem daunting. However, the instructions provided by the IRS, available on their official website, aim to simplify the process, making it accessible for taxpayers to comply with health coverage reporting requirements.

Irs 8965 Example

Form 8965 |

Health Coverage Exemptions |

OMB No. |

||

|

||||

2018 |

||||

Department of the Treasury |

▶ Attach to Form 1040. |

|||

▶ Go to www.irs.gov/Form8965 for instructions and the latest information. |

Attachment |

|||

Internal Revenue Service |

Sequence No. 75 |

|||

Name as shown on return |

|

Your social security number |

||

|

|

|

|

|

Complete this form if you have a

|

|

||||

Part I |

|||||

have an exemption granted by the Marketplace, complete Part I. |

|

||||

|

|

|

|||

|

|

(a) |

(b) |

(c) |

|

|

|

Name of Individual |

SSN |

Exemption Certificate Number |

|

|

|

|

|

|

|

1 |

|

|

|

|

|

2 |

|

|

|

|

|

3 |

|

|

|

|

|

4 |

|

|

|

|

|

5 |

|

|

|

|

|

6 |

|

|

|

|

|

Part II |

Coverage Exemptions Claimed on Your Return |

for Your Household |

|

||

7If you are claiming a coverage exemption because your household income or gross income is below the filing threshold,

|

check here |

. . . . . . . . . |

. . . . . |

. . . . |

. |

▶ |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coverage Exemptions Claimed on Your Return for Individuals. If you and/or a member of your tax |

|

|||||||||||||||

Part III |

|

|||||||||||||||||

household are claiming an exemption on your return, complete Part III. |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

|

(g) |

(h) |

(i) |

(j) |

(k) |

(l) |

(m) |

(n) |

(o) |

(p) |

|

|

Exemption |

Full |

|

||||||||||||||

|

|

Name of Individual |

SSN |

Jan |

Feb |

|

Mar |

Apr |

May |

June |

July |

Aug |

Sept |

Oct |

Nov |

Dec |

||

|

|

Type |

Year |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see your tax return instructions. |

|

|

Cat. No. 37787G |

|

|

Form |

8965 |

(2018) |

||||||||||

Document Specifics

| Fact Number | Detail |

|---|---|

| 1 | Form 8965 is used to report Health Coverage Exemptions. |

| 2 | The form's official title is "Health Coverage Exemptions" under OMB No. 1545-0074 for the year 2018. |

| 3 | It is an attachment to Form 1040, the standard federal income tax return. |

| 4 | Detailed instructions and updates for Form 8965 are available on the IRS website. |

| 5 | Part I of the form is dedicated to Marketplace-Granted Coverage Exemptions for individuals and their tax household members. |

| 6 | Individuals can claim coverage exemptions directly on their return for their household in Part II. |

| 7 | Part III allows individuals within a tax household to claim specific exemptions for themselves. |

| 8 | The form concludes with references to the Privacy Act and the Paperwork Reduction Act Notice, guiding users towards their tax return instructions for more details. |

Guide to Writing Irs 8965

Completing the IRS Form 8965 is a necessary step for individuals who are claiming health coverage exemptions for the tax year. This document is attached to your Form 1040 tax return. The process involves providing information on marketplace-granted coverage exemptions and exemptions claimed on your tax return. To ensure accuracy, it is important to gather all relevant information before starting the form, including exemption certificate numbers and social security numbers for anyone in your household for whom you are claiming exemptions.

- Start by writing your name and social security number exactly as they appear on your tax return at the top of Form 8965.

- Part I: If you have a Marketplace-granted coverage exemption, enter the name, social security number (SSN), and exemption certificate number for each individual in your tax household who was granted an exemption. Use lines 1 through 6 for separate individuals.

- Part II: Check the box on line 7 if you are claiming a coverage exemption for your household because your household income or gross income is below the filing threshold.

- Part III: To claim coverage exemptions on your return for specific individuals, fill out lines 8 through 13. Include the exemption type and full name of each individual, their SSN, and mark the months for which each exemption is being claimed. Use the appropriate codes for exemption types as described in the instructions for Form 8965.

- Review the form thoroughly to ensure all information is correct and complete. Missing or incorrect information can delay the processing of your tax return.

- Attach Form 8965 to your Form 1040 tax return before submitting it to the IRS. Ensure all other required documents and schedules are also attached to your tax return.

- Visit www.irs.gov/Form8965 for the latest instructions or information regarding Form 8965 if needed.

After filling out Form 8965, the next step is to finalize your tax return for submission. This form, along with any other required documents, should be securely attached to your Form 1040. Submitting a complete and accurate tax return is crucial for the timely processing of your return by the IRS. Remember to make copies of all documents for your records before mailing them to the IRS.

Understanding Irs 8965

What is the Form 8965 used for?

Form 8965, Health Coverage Exemptions, is used by individuals to report any health coverage exemptions they qualify for. This includes exemptions granted by the Health Insurance Marketplace or exemptions claimed on your tax return. It's attached to your Form 1040 tax return.

Who needs to complete Form 8965?

Anyone who has received a Marketplace-granted coverage exemption or is claiming a coverage exemption on their tax return should complete Form 8965. This is necessary if you or someone in your tax household didn't have health coverage for part or all of the year and qualifies for an exemption.

What are Marketplace-Granted Coverage Exemptions?

Marketplace-granted coverage exemptions are exemptions granted by the Health Insurance Marketplace. These exemptions are provided to individuals or members of a tax household who meet certain criteria. If you have been granted this type of exemption, you'll need to complete Part I of Form 8965, including the Exemption Certificate Number (ECN) provided by the Marketplace.

How do I claim a coverage exemption on my return?

To claim a coverage exemption on your return, you would need to complete Part III of Form 8965. This section is for individuals or members of your tax household who are claiming exemptions directly on their tax return, rather than through the Marketplace. Reasons for these exemptions vary and can include your household income or gross income being below the filing threshold.

What information do I need to provide on Form 8965?

You'll need to provide the name and Social Security number (SSN) of each individual claiming an exemption. For Marketplace-granted exemptions, the Exemption Certificate Number (ECN) is also required. For exemptions claimed on your return, you'll check the appropriate box in Part II if it's for your whole household or list each individual and the months they are exempt in Part III.

Can I claim a coverage exemption for the entire year?

Yes, if you or members of your tax household qualify for an exemption for all 12 months of the year, you can claim a full-year coverage exemption. This applies to both Marketplace-granted coverage exemptions and exemptions claimed directly on your return.

Where can I find more information or get help with Form 8965?

For instructions and the latest information regarding Form 8965, you can visit the official IRS website at www.irs.gov/Form8965. This resource provides detailed information on how to complete the form, along with guidance on eligibility for different types of exemptions.

Common mistakes

Not attaching the form to Form 1040: This form is an attachment to your tax return. Forgetting to include it with Form 1040 can lead to processing delays or even penalties.

Misunderstanding the exemption categories: There are different exemptions for different situations. Mixing them up or selecting the wrong one can cause incorrect processing of your exemption.

Incorrect Social Security Numbers (SSN): Typos or incorrect SSNs can lead to major headaches and delays. The IRS uses your SSN to verify your identity and tax obligations.

Omitting Exemption Certificate Numbers (ECN) for Marketplace-granted exemptions. If you received an exemption from the Marketplace, you must include your ECN. Failure to do so can invalidate your exemption claim.

Forgetting to complete Part III for individual exemptions: If you're claiming exemptions directly on your return for any household member, not thoroughly completing Part III is a common oversight.

Leaving out coverage months. For each exemption claimed, you need to indicate the specific months that the exemption applies to. Skipping this detail can render your exemption incomplete.

Not checking if household income is below the filing threshold: This is a crucial step. If your household income is below the threshold, you might not need to file a tax return at all, which makes this form unnecessary.

Misreading instructions. The IRS provides detailed instructions for Form 8965 on their website. Overlooking these guidelines is a common mistake that can lead to errors in filling out the form.

Incorrectly claiming exemptions for months with coverage. If you had health coverage for any part of the month, claim the exemption for that month can lead to discrepancies.

Failing to seek professional help: If you’re unsure about how to properly fill out Form 8965 or if it even applies to you, not consulting with a tax professional can be a big mistake.

Filling out IRS forms can be daunting, but understanding these common mistakes and how to avoid them can streamline the process, ensuring you accurately report your health coverage exemptions.

Documents used along the form

When preparing taxes, especially if managing the complexities around health coverage exemptions, the IRS Form 8965 is crucial. However, to accurately complete this process, one may need additional forms and documents. These assist in substantiating claims made on Form 8965, ensuring compliance, and maximizing the taxpayer's benefits. The following list details common forms and documents often used alongside Form 8965, providing a brief overview of each to aid in understanding and preparation.

- Form 1040: The U.S. Individual Income Tax Return is central to the filing process. It's where taxpayers declare their income, deductions, and credits. Form 8965 is attached to this form, integrating one's health coverage information with their overall tax status.

- Form 1095-A: The Health Insurance Marketplace Statement details the health coverage purchased through the Marketplace. It's vital for calculating the premium tax credit and reconciling it on Form 8962, necessary for those taking advantage of health coverage exemptions.

- Form 8962: The Premium Tax Credit form is used to calculate one’s premium tax credits and reconcile any advance payments. This is crucial for individuals claiming health coverage exemptions, as it affects their overall tax liability or refund.

- Form 1095-B: The Health Coverage form, issued by insurance providers outside the Marketplace, provides information about an individual's health insurance coverage, helpful for proving that one met health coverage requirements or for identifying months without coverage.

- Form 1095-C: The Employer-Provided Health Insurance Offer and Coverage form, provided by employers, details the health coverage offered to employees. It's essential for individuals to understand their health coverage situation within the context of exemptions.

- Exemption Certificate Number (ECN): This isn't a form but an important document. Received upon being granted a health coverage exemption by the Marketplace, the ECN is needed when completing Form 8965 to report the exemption accurately.

- State or Federal Marketplace Correspondence: Any official letters or notices received from the Marketplace can be crucial. They often contain information regarding changes in eligibility, coverage, or exemptions that may impact one's tax return.

Understanding the purpose and requirements of these forms ensures a smoother tax filing process, particularly when dealing with the intricacies of health coverage exemptions. Accurate and complete documentation supports the tax preparation process, from demonstrating eligibility for exemptions to achieving compliance with tax laws. This comprehensive approach allows taxpayers to effectively navigate their filing, benefiting from possible exemptions while fulfilling their obligations.

Similar forms

The IRS Form 1040, "U.S. Individual Income Tax Return," is one document that shares similarities with the IRS Form 8965. Both forms are integral to the annual tax filing process for individuals in the United States. Form 1040 serves as the foundation for personal income tax filing, where taxpayers report their income, deductions, and credits. Form 8965, on the other hand, is an attachment to Form 1040 for those who need to report health coverage exemptions. Although their purposes differ—Form 1040 for reporting income and Form 8965 for reporting healthcare coverage exemptions—the connection lies in their shared role in the individual's tax filing process.

The IRS Form 1095-A, "Health Insurance Marketplace Statement," is another document related to Form 8965. Form 1095-A provides information on health insurance obtained through the Marketplace, including the coverage months and the amounts of any advanced premium tax credit received. Individuals use this information to complete Form 8965 if they're claiming a Marketplace-granted coverage exemption or for calculating the premium tax credit on Form 8962. Both forms are pivotal for individuals involved in the health insurance Marketplace, with Form 1095-A supplying necessary details for accurately completing Form 8965 or Form 8962.

Form 8962, "Premium Tax Credit," bears resemblance to Form 8965 in its connection to health insurance coverage through the Marketplace. While Form 8965 is used to report health coverage exemptions, Form 8962 is utilized by individuals who want to reconcile or claim the premium tax credit, which helps lower health insurance costs for those eligible. Both forms interact closely with health insurance coverage details obtained from the Marketplace, reflecting the financial aspects of health care coverage on taxpayers' filings.

The IRS Form 1095-B, "Health Coverage," also relates closely to Form 8965. Form 1095-B is issued by insurance providers and employers to report an individual's health insurance coverage status throughout the year. This information is crucial for taxpayers needing to complete Form 8965, as it helps determine if the individual falls into any exemption category due to their coverage status. While Form 1095-B reports health coverage, Form 8965 deals with exemptions from the coverage requirement, making them counterpart documents in the context of reporting health insurance on tax returns.

The IRS Form 1095-C, "Employer-Provided Health Insurance Offer and Coverage," parallels Form 1095-B and impacts Form 8965. Issued by employers, Form 1095-C provides information about the health insurance they offer to their employees. Similar to Form 1095-B, the details included in Form 1095-C assist taxpayers in determining whether they qualify for a health coverage exemption that would be reported on Form 8965. Both forms are integral for individuals in understanding their health insurance coverage and any implications it may have on their tax filings.

Form W-2, "Wage and Tax Statement," indirectly relates to Form 8965 through its reporting of an employee's annual wages and taxes withheld, which includes information on health insurance premiums deducted from wages if applicable. While its primary function is reporting income and tax details for employment, the information on healthcare coverage provided in the W-2 can influence the need for completing Form 8965 by indicating employer-provided health insurance, thereby affecting exemption eligibility.

Form 1040-SR, "U.S. Tax Return for Seniors," shares its foundational purpose with Form 1040 and, by extension, relates to Form 8965. Designed for taxpayers aged 65 and older, Form 1040-SR accommodates the same tax reporting needs as Form 1040 but with a format easier for seniors. Since Form 8965 is an attachment to Form 1040, it also connects to Form 1040-SR whenever exemptions for health coverage need to be reported, making both forms part of the broader income tax filing process for senior citizens.

The IRS Form 4868, "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return," while primarily used to request more time to file Form 1040, indirectly associates with Form 8965. Filing Form 4868 extends the deadline for all associated tax documents, including any necessary completion of Form 8965 for health coverage exemptions. Thus, while serving different purposes—Form 4868 for an extension, and Form 8965 for reporting exemptions—they interact within the tax filing timeline.

Form 8822, "Change of Address," though administrative in nature, affects how individuals receive information regarding health insurance and exemptions, potentially impacting Form 8965 filings. If a taxpayer moves and files Form 8822 to notify the IRS of their new address, this ensures they receive all crucial tax documents and correspondence, including information that may affect their health coverage exemptions. The ability to correctly report exemptions on Form 8965 can depend on the timely receipt of notices and documents influenced by the accurate filing of Form 8822.

The IRS Form 8889, "Health Savings Accounts (HSAs)," complements Form 8965 by detailing contributions, distributions, and the tax treatment of HSAs, which can offer tax-advantaged ways to pay for healthcare costs. Although focused on HSAs, the utilization of these accounts and reporting on Form 8889 can indirectly influence the health coverage status and exemption needs reported on Form 8965. For individuals with HSAs, both forms work together within the realm of healthcare costs and tax implications.

Dos and Don'ts

Filling out IRS Form 8965, Health Coverage Exemptions, requires careful attention for accuracy and compliance. Here are seven do's and don'ts to guide you through the process.

- Do thoroughly read the instructions available on the IRS website before starting. The IRS provides extensive guidelines that can clarify questions you might have and prevent common errors.

- Do gather all necessary information beforehand, including Social Security numbers and exemption certificate numbers for everyone included in your tax household.

- Do double-check the names and Social Security numbers against official documents to ensure they match. This reduces the chance of processing delays due to discrepancies.

- Do use the correct year's form. Tax forms and regulations can change from year to year, so it's crucial to use the version of Form 8965 that matches the tax year you are filing for.

- Don't leave any required fields blank. Incomplete forms can lead to processing delays or even the denial of your exemption claim. If a particular section doesn't apply to you, follow the IRS instructions for how to indicate this properly.

- Don't guess on dates or figures. If you're claiming exemptions based on specific periods or financial thresholds, make sure your entries are accurate and supported by documentation, in case the IRS asks for verification.

- Don't assume you don't qualify for exemptions without checking. The IRS provides a variety of exemptions based on income, employment status, and other factors. Review the criteria carefully to see if you're eligible before deciding not to claim an exemption.

Filling out IRS forms can be daunting, but careful preparation and attention to detail can help ensure your Form 8965 is completed correctly and your exemptions are properly claimed. Remember, when in doubt, consulting with a tax professional can provide clarity and peace of mind during the filing process.

Misconceptions

Understanding the IRS Form 8965 can often be complex, and several misconceptions can lead to confusion. Here are eight common misconceptions about Form 8965 and the facts that clarify them:

- Form 8965 is required for everyone filing a tax return. This is not true. Only those who have a marketplace-granted coverage exemption or are claiming a coverage exemption on their return need to complete and attach Form 8965.

- You must pay a penalty if you don't have health coverage and don't file Form 8965. While it was once true that a penalty could be assessed for not having health coverage, this penalty has been reduced to $0 at the federal level for tax years 2019 and beyond. Filing Form 8965 is about claiming exemptions, not about automatically incurring a penalty.

- Form 8965 is too complicated to fill out on your own. Though the form may seem complex due to its detailed nature, the IRS provides comprehensive instructions to help individuals understand how to complete it. Assistance from a tax professional can be sought if needed, but many individuals can fill it out with the instructions alone.

- The form needs to be filled out for each month you didn’t have coverage. Actually, Form 8965 allows you to claim exemptions for any month of the year you or a member of your tax household had a coverage exemption. It isn't only for months without coverage.

- Only one type of exemption can be claimed. In fact, you can claim different types of exemptions for different members of your tax household. The form has provisions to list multiple exemptions.

- Marketplace-Granted Coverage Exemptions are the only exemptions available. Besides the exemptions granted by the Marketplace, individuals can also claim a variety of exemptions directly on their tax return using Form 8965.

- If you've missed the deadline for applying for a Marketplace exemption, you can't get an exemption for that year. While marketplace exemptions need to be applied for, some exemptions can be claimed directly on your tax return with Form 8965, even after the year has ended.

- If you file Form 8965, you don’t need to maintain health insurance. Filing Form 8965 is about reporting coverage exemptions, not about maintaining health insurance. While there's no longer a federal penalty for not having health insurance, it's still advisable to have it for health and financial reasons.

It's important to understand the role and requirements of Form 8965 to ensure compliance with tax obligations and to take advantage of exemptions you may be eligible for. Getting the facts straight can help avoid unnecessary stress or confusion when filing your taxes.

Key takeaways

Understanding the IRS Form 8965, which pertains to Health Coverage Exemptions, is crucial for ensuring proper compliance with tax regulations concerning health insurance coverage. Below are key takeaways regarding filling out and using the IRS 8965 form:

- Attachment Requirement: The IRS 8965 form should be attached to Form 1040. This linkage is essential as it allows taxpayers to report any coverage exemptions in conjunction with their annual tax return.

- Marketplace-Granted Coverage Exemptions: Part I of the form is designated for individuals or members of a tax household who have received exemptions directly from the Health Insurance Marketplace. It's important to accurately complete this section if applicable, providing details such as the name, social security number (SSN), and Exemption Certificate Number for each exempt individual.

- Household Income Exemption: Taxpayers with household incomes or gross incomes below the filing threshold have the option to claim a coverage exemption. This is indicated by checking a specific box in Part II of the form, simplifying the process for those who qualify under this criterion.

- Exemptions Claimed on Your Return: Part III allows individuals within a taxpayer's household who are claiming an exemption on their return to be listed comprehensively. This part captures detailed information, including full names, SSNs, the type of exemption, and the exemption's applicable months, ensuring a clear record of who in the household is exempt and for which periods.

- Privacy Act and Paperwork Reduction Act Notice: The form includes a notice regarding the Privacy Act and Paperwork Reduction Act. This notice, usually found in the tax return instructions, highlights the importance of understanding one’s rights and obligations concerning the information provided on the form.

Filling out the IRS Form 8965 accurately is vital for taxpayers seeking to report health coverage exemptions. It helps avoid penalties associated with failing to possess health insurance as mandated by law. Therefore, understanding each part of the form and ensuring correct and comprehensive completion is imperative.

Popular PDF Documents

Income Tax Exemption - Clarifies that disclosure is voluntary but necessary for processing the exemption to prevent wrongful application of withholding status.

IRS 2439 - Completion of this form by the fund is mandatory when there are undistributed capital gains.