Get IRS 8962 Form

Navigating tax forms can often feel like a complex journey, particularly when it comes to understanding how certain benefits affect your tax obligations and refunds. The IRS 8962 form is essential for individuals who have received a premium tax credit under the Affordable Care Act. This form plays a critical role in ensuring that taxpayers correctly reconcile the credit they are eligible for with the amount they have already received. The task is not just about ensuring compliance with tax laws but also about optimizing one’s tax situation to potentially increase their refund or reduce the amount owed. Calculating the premium tax credit involves a detailed process that takes into account household income, family size, and the cost of health plans in your area, demonstrating the intricate relationship between your personal circumstances and your tax responsibilities. Understanding the IRS 8962 form is crucial for anyone looking to navigate the complexities of healthcare-related tax credits, and getting it right can have a significant impact on your financial health.

IRS 8962 Example

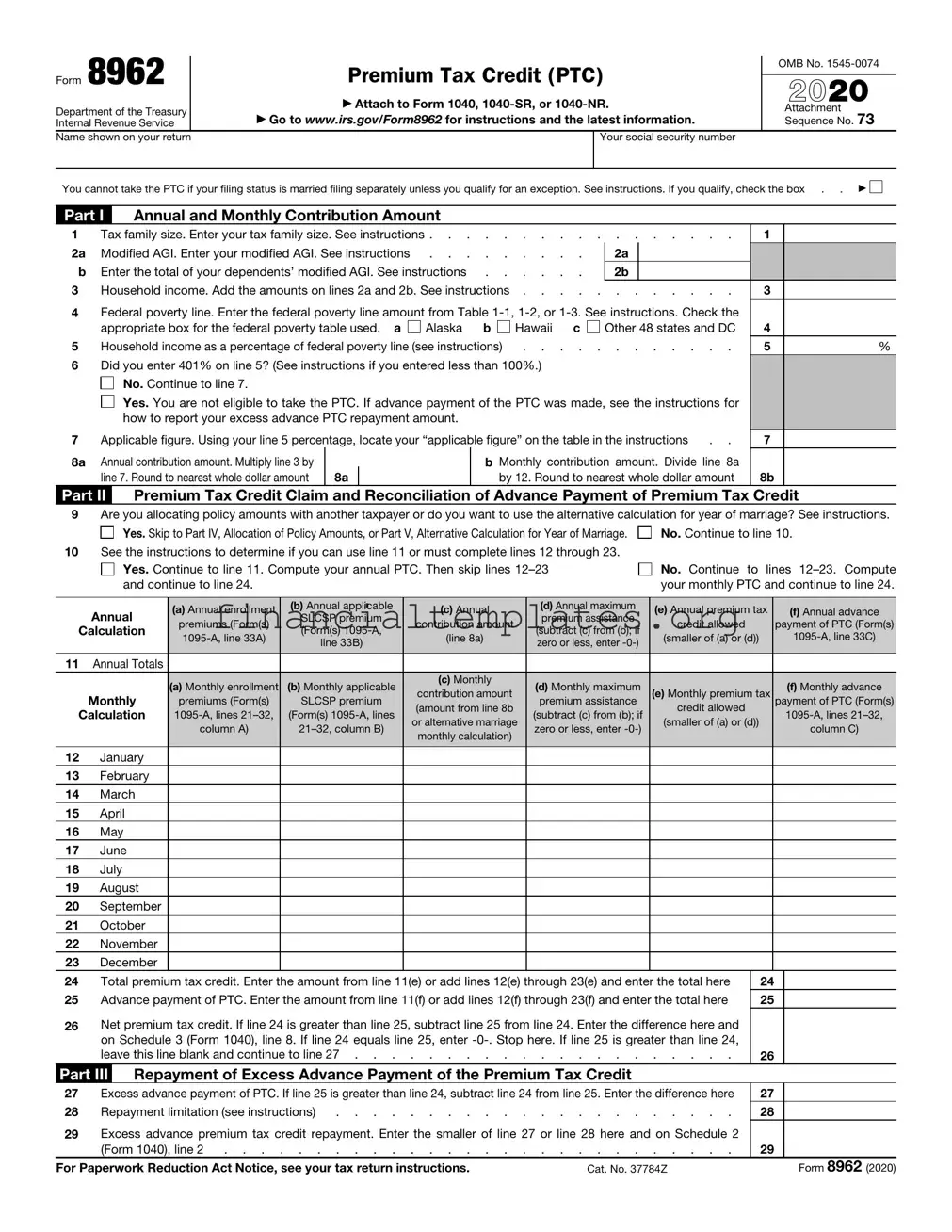

Form 8962

Department of the Treasury Internal Revenue Service

Name shown on your return

Premium Tax Credit (PTC)

▶Attach to Form 1040,

▶Go to www.irs.gov/Form8962 for instructions and the latest information.

Your social security number

OMB No.

2021

Attachment Sequence No. 73

A.If you, or your spouse (if filing a joint return), received, or were approved to receive, unemployment compensation for any week beginning during 2021,

check the box. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

B.You cannot take the PTC if your filing status is married filing separately unless you qualify for an exception. See instructions. If you qualify, check the box ▶

Part I |

Annual and Monthly Contribution Amount |

|

|

|

|

|

|

|

||||

1 |

Tax family size. Enter your tax family size. See instructions |

1 |

|

|

||||||||

2a |

Modified AGI. Enter your modified AGI. See instructions . . . |

. |

. . . . . |

2a |

|

|

|

|

||||

b |

Enter the total of your dependents’ modified AGI. See instructions |

. |

. . . . . |

2b |

|

|

|

|

||||

3 |

Household income. Add the amounts on lines 2a and 2b. See instructions |

3 |

|

|

||||||||

4 |

Federal poverty line. Enter the federal poverty line amount from Table |

|

|

|

||||||||

|

appropriate box for the federal poverty table used. a |

Alaska |

b |

Hawaii c |

Other 48 states and DC |

4 |

|

|

||||

5 |

Household income as a percentage of federal poverty line (see instructions) |

5 |

|

% |

||||||||

6 |

Reserved for future use |

|

|

|

||||||||

7 |

Applicable figure. Using your line 5 percentage, locate your “applicable figure” on the table in the instructions . . |

7 |

|

|

||||||||

8a |

Annual contribution amount. Multiply line 3 by |

8a |

|

|

b Monthly contribution amount. Divide line 8a |

8b |

|

|

||||

|

line 7. Round to nearest whole dollar amount |

|

|

|

by 12. Round to nearest whole dollar amount |

|

|

|||||

Part II |

Premium Tax Credit Claim |

and |

Reconciliation |

of Advance Payment of Premium Tax Credit |

|

|||||||

9Are you allocating policy amounts with another taxpayer or do you want to use the alternative calculation for year of marriage? See instructions.

Yes. Skip to Part IV, Allocation of Policy Amounts, or Part V, Alternative Calculation for Year of Marriage. |

No. Continue to line 10. |

10See the instructions to determine if you can use line 11 or must complete lines 12 through 23.

Yes. Continue to line 11. Compute your annual PTC. Then skip lines

Yes. Continue to line 11. Compute your annual PTC. Then skip lines

No. Continue to lines

Annual |

(a) Annual enrollment |

(b) Annual applicable |

(c) Annual |

(d) Annual maximum |

(e) Annual premium tax |

(f) Annual advance |

|

SLCSP premium |

premium assistance |

||||||

premiums (Form(s) |

contribution amount |

credit allowed |

payment of PTC (Form(s) |

||||

Calculation |

(Form(s) |

(subtract (c) from (b); if |

|||||

(line 8a) |

(smaller of (a) or (d)) |

||||||

|

line 33B) |

zero or less, enter |

|||||

|

|

|

|

|

|||

|

|

|

|

|

|

|

11Annual Totals

|

(a) Monthly enrollment |

(b) Monthly applicable |

(c) Monthly |

(d) Monthly maximum |

|

(f) Monthly advance |

|

|

contribution amount |

(e) Monthly premium tax |

|||||

Monthly |

premiums (Form(s) |

SLCSP premium |

premium assistance |

payment of PTC (Form(s) |

|||

Calculation |

(Form(s) |

(amount from line 8b |

(subtract (c) from (b); if |

credit allowed |

|||

or alternative marriage |

(smaller of (a) or (d)) |

||||||

|

column A) |

zero or less, enter |

column C) |

||||

|

monthly calculation) |

|

|||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

12January

13February

14March

15April

16May

17June

18July

19August

20September

21October

22November

23December

24 |

Total premium tax credit. Enter the amount from line 11(e) or add lines 12(e) through 23(e) and enter the total here |

24 |

25 |

Advance payment of PTC. Enter the amount from line 11(f) or add lines 12(f) through 23(f) and enter the total here |

25 |

26Net premium tax credit. If line 24 is greater than line 25, subtract line 25 from line 24. Enter the difference here and on Schedule 3 (Form 1040), line 9. If line 24 equals line 25, enter

|

leave this line blank and continue to line 27 |

26 |

|

Part III |

Repayment of Excess Advance Payment of the Premium Tax Credit |

|

|

27 |

Excess advance payment of PTC. If line 25 is greater than line 24, subtract line 24 from line 25. Enter the difference here |

27 |

|

28 |

Repayment limitation (see instructions) |

28 |

|

29Excess advance premium tax credit repayment. Enter the smaller of line 27 or line 28 here and on Schedule 2

(Form 1040), line 2 |

29 |

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 37784Z |

Form 8962 (2021) |

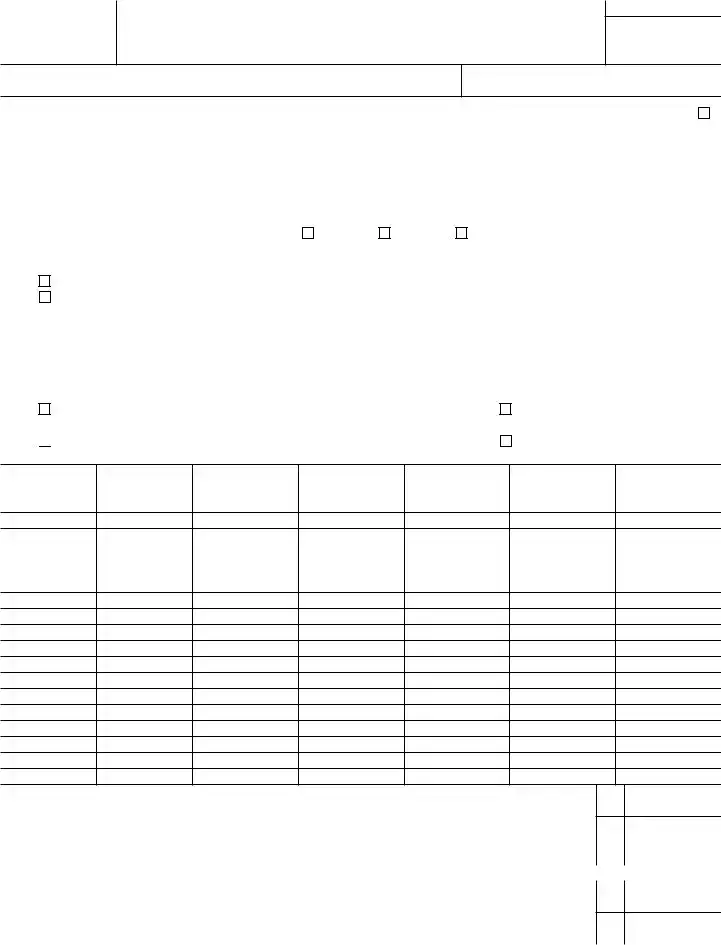

Form 8962 (2021) |

Page 2 |

|

Part IV |

Allocation of Policy Amounts |

|

Complete the following information for up to four policy amount allocations. See instructions for allocation details.

Allocation 1

30(a) Policy Number (Form

(b)SSN of other taxpayer

(c)Allocation start month

(d)Allocation stop month

Allocation percentage applied to monthly amounts

(e)Premium Percentage

(f)SLCSP Percentage

(g)Advance Payment of the PTC Percentage

Allocation 2

31(a) Policy Number (Form

(b)SSN of other taxpayer

(c)Allocation start month

(d)Allocation stop month

Allocation percentage applied to monthly amounts

(e)Premium Percentage

(f)SLCSP Percentage

(g)Advance Payment of the PTC Percentage

Allocation 3

32(a) Policy Number (Form

(b)SSN of other taxpayer

(c)Allocation start month

(d)Allocation stop month

Allocation percentage applied to monthly amounts

(e)Premium Percentage

(f)SLCSP Percentage

(g)Advance Payment of the PTC Percentage

Allocation 4

33(a) Policy Number (Form

(b)SSN of other taxpayer

(c)Allocation start month

(d)Allocation stop month

Allocation percentage applied to monthly amounts

(e)Premium Percentage

(f)SLCSP Percentage

(g)Advance Payment of the PTC Percentage

34Have you completed all policy amount allocations?

Yes. Multiply the amounts on Form

Yes. Multiply the amounts on Form

No. See the instructions to report additional policy amount allocations.

Part V Alternative Calculation for Year of Marriage

Complete line(s) 35 and/or 36 to elect the alternative calculation for year of marriage. For eligibility to make the election, see the instructions for line 9. To complete line(s) 35 and/or 36 and compute the amounts for lines

35 |

Alternative entries |

(a) |

Alternative family size |

(b) Alternative monthly |

(c) |

Alternative start month |

(d) |

Alternative stop month |

|

|

contribution amount |

|

|

|

|

||

|

for your SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

Alternative entries |

(a) |

Alternative family size |

(b) Alternative monthly |

(c) |

Alternative start month |

(d) |

Alternative stop month |

|

|

contribution amount |

|

|

|

|

||

|

for your spouse’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 8962 (2021) |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 8962 | It's used to calculate and report your Premium Tax Credit (PTC), which helps eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace. |

| Eligibility for Using Form 8962 | You must have health insurance coverage through a Health Insurance Marketplace and have lower or moderate income to be eligible for the credit and to use this form. |

| Connection to Form 1095-A | You need information from Form 1095-A, Health Insurance Marketplace Statement, to fill out Form 8962. This form provides details about your health insurance coverage. |

| Adjusting Premium Tax Credit | If you received too much or too little advance payment of Premium Tax Credit throughout the year, you use Form 8962 to calculate the correct amount, leading to either owing money to the IRS or receiving a refund. |

| Reconciliation Process | The process involves comparing the amount of Premium Tax Credit you're eligible for based on your annual income with the amount that was advanced to you during the year. This is done on Form 8962. |

| Filing Requirement | If you received advance payments of the Premium Tax Credit, you must file a tax return and include Form 8962, even if you're otherwise not required to file a return. |

| Impact on Tax Refunds or Liabilities | Completing Form 8962 accurately is crucial as it could significantly affect your tax refund or the amount you owe the IRS. Mistakes on the form can lead to delays or adjustments in your refund. |

| No State-Specific Versions | Form 8962 is a federal form used across all states, hence there are no state-specific versions of this form. It is governed by federal tax law. |

Guide to Writing IRS 8962

Filling out the IRS 8962 form is a crucial step for individuals who need to reconcile their premium tax credit or calculate their credit amount. This process may seem daunting at first glance, but with careful attention to detail and the right information at hand, it can be completed accurately. The goal here is to ensure that you’ve received the correct amount of credit to which you're entitled. Let’s walk through the steps necessary to fill out the form correctly.

- Gather all necessary documents, including your Form 1095-A, which is the Health Insurance Marketplace Statement, and your completed Form 1040.

- Begin with Part I of the form. Here, you will provide information about your annual and monthly contribution amounts. Calculate your family size and your household income to determine your applicable figure.

- Move to Part II to calculate the Premium Tax Credit (PTC). Input the requested details about your insurance premiums, the monthly premium for the second lowest cost silver plan (SLCSP), and any advance payment of premium tax credit (APTC).

- In Part III, reconcile any advance payments of the premium tax credit. Compare the amounts from Part II to determine if you're owed a credit or if you must repay any excess advance payments.

- Complete Part IV if you are allocating policy amounts with another taxpayer, such as in situations of shared custody. This section requires coordination with the other taxpayer to accurately divide the shared policy amounts.

- Finally, review your form for accuracy. Ensure all calculations are correct and that you have included all required information. Incorrect or incomplete forms may delay processing and affect your tax obligations.

Once completed, attach Form 8962 to your tax return and submit it to the IRS. This form is essential for anyone who has received a premium tax credit or needs to reconcile any advance payment credits. Ensuring accuracy and completeness not only helps avoid potential penalties but also guarantees that you receive the correct amount of credit you're eligible for. Remember, the IRS provides resources and guidelines on their official website, which can offer additional help if needed.

Understanding IRS 8962

-

What is IRS Form 8962 and who needs to fill it out?

IRS Form 8962, Premium Tax Credit (PTC), is designed for taxpayers to figure out the amount of their premium tax credit (PTC) or to reconcile the credit with any advance payments of the premium tax credit (APTC). Individuals who purchased health insurance through the Health Insurance Marketplace and those who want to claim the PTC need to complete this form. It's essential for individuals who received a Form 1095-A, Health Insurance Marketplace Statement, indicating they received APTC or are eligible for the PTC.

-

How is the Premium Tax Credit calculated on Form 8962?

The Premium Tax Credit calculation involves a few steps, starting with your household income and comparing it to the federal poverty line. This calculation takes into account your filing status, the number of dependents, and where you live. Based on this information, Form 8962 helps determine the amount of your PTC by aligning your household income with the applicable percentage of the federal poverty line, factoring in the premiums for the silver plan in your area, and any adjustments for age. The goal is to establish a subsidy amount that helps make purchasing health insurance more affordable for you.

-

What happens if I don't reconcile the Advance Payments of the Premium Tax Credit?

Reconciling the Advance Payments of the Premium Tax Credit (APTC) is a crucial step in the tax return process for anyone who received APTC during the tax year. If you fail to reconcile these payments on Form 8962, the IRS may delay your tax refund or withhold future tax refunds until the reconciliation is completed. Furthermore, failing to reconcile APTC may disqualify you from receiving advance payments in future years, making it important to accurately complete and submit Form 8962 with your tax return.

-

Where can I get assistance with filling out Form 8962?

Assistance with filling out Form 8962 is available from several sources. The IRS offers guidelines and instructions for the form on its official website, which is a comprehensive resource for understanding the form's requirements. Additionally, free tax help is available through the IRS Volunteer Income Tax Assistance (VITA) program for qualifying individuals. Professional tax advisors or certified public accountants (CPAs) can also provide guidance and help ensure that the form is filled out correctly, particularly in complex situations.

Common mistakes

Not filling out the form at all. If you received APTC or need to claim the PTC, you must complete and file IRS Form 8962 with your tax return. Failing to do so can lead to delays in processing your tax return and affect your premium tax credit eligibility.

Entering incorrect income information. The amount of premium tax credit you're eligible for is based on your household income in relation to the federal poverty line. Incorrectly reporting your income can result in receiving too much or too little credit.

Not including information from all 1095-A forms. If you or a family member purchased health insurance through the Marketplace, you should receive a Form 1095-A for each policy. Failing to use information from each 1095-A form can lead to inaccuracies in calculating your PTC.

Mixing up the columns for monthly premium amounts and the SLCSP (second lowest cost Silver plan). The form requires you to list the monthly amount of your health insurance premium and the premium for the SLCSP, which is used to calculate the PTC. Mixing these up can drastically affect your credit amount.

Forgetting to sign the form. It sounds simple, but an unsigned tax form is like an unread book; it doesn't fulfill its purpose. An unsigned Form 8962 can delay the processing of your tax return.

Documents used along the form

The Internal Revenue Service (IRS) Form 8962, Premium Tax Credit (PTC), is essential for taxpayers who want to calculate and report the amount of their premium tax credit from healthcare coverage obtained through the Health Insurance Marketplace. Filing this form accurately necessitates gathering various documents and forms that contain pertinent income, family, and health insurance information. Here are eight common documents and forms that are often used in conjunction with Form 8962.

- Form 1040 - The U.S. Individual Income Tax Return is pivotal for reporting annual income, calculating tax liability, and determining eligibility for the premium tax credit. It provides crucial data that impacts Form 8962 calculations.

- Form 1095-A - The Health Insurance Marketplace Statement details the health insurance premiums paid and advance payments of the premium tax credit. This information is directly used on Form 8962 to compute the actual credit amount.

- Form 1095-B - This form, Health Coverage, reports personal and family health coverage information but does not directly affect the 8962 form. However, it can assist in verifying the coverage reported on other forms.

- Form 1095-C - The Employer-Provided Health Insurance Offer and Coverage form outlines the health insurance coverage offered and provided by employers. It's helpful for verifying information but, similar to Form 1095-B, it doesn't directly impact Form 8962 calculations.

- Schedule 1 (Form 1040) - Additional Income and Adjustments to Income helps to adjust gross income, which can influence the calculation of the premium tax credit on Form 8962.

- Schedule 2 (Form 1040) - Tax provides additional taxes that may affect a taxpayer’s adjusted gross income and subsequent eligibility and calculation of the premium tax credit.

- Schedule 3 (Form 1040) - Additional Credits and Payments includes non-refundable credits that can impact the overall tax situation, indirectly influencing premium tax credit calculations.

- W-2 Forms - Wage and Tax Statements from employers indicate earnings and taxes withheld, essential for accurately reporting income on Form 1040 and consequently affecting the premium tax credit.

Using these documents in conjunction with IRS Form 8962 ensures a comprehensive and accurate approach to calculating the premium tax credit. It's a testament to the interconnected nature of tax documentation and the necessity of thorough record-keeping. Taxpayers should gather these forms and documents well in advance of deadlines to facilitate a smoother filing process.

Similar forms

The IRS Form 1040, known as the U.S. Individual Income Tax Return, resembles the IRS 8962 form in its role as a cornerstone document for tax filing. Both forms are integral to the annual tax filing process for individuals, with the 1040 form serving to calculate taxable income and total taxes due, while the 8962 form is used to compute the premium tax credit and reconcile any advance credit payments. This connection ensures taxpayers accurately report their financial situation and receive any credits for which they are eligible.

Similarly, the IRS Schedule C mirrors the IRS 8962 form through its function of reporting income or loss from a business operated or a profession practiced as a sole proprietor. Like the 8962, which aids in the calculation of premium tax credit eligibility based on income, Schedule C is crucial for determining the taxable income after business expenses, significantly affecting the taxpayer's overall financial assessment and eligibility for certain tax benefits or obligations.

The IRS Form 1095-A, the Health Insurance Marketplace Statement, is closely related to Form 8962 in content and purpose. Form 1095-A provides detailed information about health insurance coverage purchased through the Marketplace, which is essential for completing Form 8962. The information on Form 1095-A, such as the monthly premium and subsidy amount, directly feeds into the calculations required on Form 8962 for the premium tax credit, illustrating their interconnected roles in the tax filing process.

Form 1095-B, the Health Coverage form, and Form 8962 share a common goal of documenting health insurance information, albeit for different reasons. While Form 1095-B verifies that an individual has minimum essential coverage, thus avoiding the health care mandate penalty (applicable in tax years when the mandate was in force), Form 8962 focuses on calculating the premium tax credit. Both forms are pivotal for individuals to demonstrate compliance with health insurance requirements under the Affordable Care Act.

The W-2 form, or Wage and Tax Statement, also has a significant connection to Form 8962. It provides information about an employee's income and taxes withheld, which are key figures for accurately filling out the IRS 8962 form. Since the premium tax credit calculation on Form 8962 depends on the taxpayer's income, the data supplied by the W-2 form directly impacts the determination of the credit amount. This interrelation underscores the broader financial picture required for precise tax obligations and benefits assessments.

The IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), shares common ground with Form 8962 by offering tax advantages based on personal circumstances. Form 8863 is used to claim education credits, reducing the tax bill for those who qualify based on tuition payments and related expenses. Similarly, Form 8962 helps taxpayers lower their insurance costs through the premium tax credit. Both forms thus play crucial roles in reducing the taxpayer's financial burden through specific credits.

Last but not least, the IRS Form 8965, Health Coverage Exemptions, parallels Form 8962 by dealing with health insurance information under the Affordable Care Act. Form 8965 is used to report any exemptions from the health insurance requirement, potentially reducing or eliminating the penalty for not having health coverage in tax years when such a penalty applied. Though coming from different angles—8965 for exemptions and 8962 for credit calculation—both forms address the tax implications of health care coverage, reflecting the complex interplay between health insurance status and tax liabilities.

Dos and Don'ts

Understanding the correct way to fill out the IRS 8962 form is essential for accurately reporting health insurance premiums and calculating any potential premium tax credit. Below are key actions to take and avoid during the process:

- Do gather all necessary documents, including Form 1095-A, before starting. This ensures all information entered is accurate.

- Do read the instructions for Form 8962 provided by the IRS carefully to understand each section and what is required.

- Do use accurate figures from your Form 1095-A to fill in the Premium Tax Credit (PTC) section. Approximations can lead to discrepancies and potential audits.

- Do check your math twice. Errors in calculation can affect the amount of credit you're eligible for or cause delays in processing.

- Don't guess about your income or household information. Use exact figures to ensure the IRS can accurately calculate your premium tax credit.

- Don't leave any required fields blank. If a section does not apply to you, make sure to fill it with "0" or "N/A" as instructed.

- Don't ignore IRS notices requesting additional information about your Form 8962. Respond promptly to avoid delays or issues with your tax return.

- Don't forget to sign and date the form if you are filing a paper return. An unsigned form can delay processing and affect your tax credits.

Adhering to these dos and don'ts will help streamline the process of completing Form 8962, ensuring that it is done correctly and efficiently.

Misconceptions

The IRS Form 8962, vital for reconciling the Premium Tax Credit (PTC) with the health insurance marketplace, often sparks confusion. This form plays a critical role in ensuring that individuals who received a premium subsidy for health insurance through the marketplace can correctly report it on their tax returns. Here, we address six common misconceptions to clarify its purpose and requirements.

- Misconception 1: The Form 8962 is only for those who owe taxes. This is a prevailing misunderstanding. In reality, the form is used to reconcile the amount of premium tax credit received with the amount an individual is eligible for, based on their final income. This process can lead to a refund, an additional tax liability, or no change at all, depending on the circumstances.

- Misconception 2: You don’t need to file Form 8962 if your income changes mid-year. Changes in income, whether an increase or decrease, can significantly impact the premium tax credit amount you're eligible for. Reporting these changes by filing Form 8962 is essential to ensure you receive the correct credit or owe the correct amount.

- Misconception 3: Filling out the Form 8962 is optional. This notion is incorrect for taxpayers who received a premium subsidy through the marketplace. Filing this form is a requirement to reconcile the advance payments of the premium tax credit with the actual credit amount eligible based on the yearly income.

- Misconception 4: Only individuals can file Form 8962. While it's true that the form is designed for individual taxpayers, it's also necessary for households where family members are included in the healthcare plan. The household's income is considered collectively to determine the premium tax credit.

- Misconception 5: If you didn’t receive a Form 1095-A, you don’t need to file Form 8962. This misunderstanding can lead to issues with the IRS. The Form 1095-A is sent by the health insurance marketplace and is crucial for completing Form 8962 accurately. If you did not receive this form but were enrolled in a marketplace plan, you should contact the marketplace to obtain it.

- Misconception 6: The IRS automatically corrects errors on Form 8962. While the IRS may catch and attempt to correct some discrepancies, it's the taxpayer's responsibility to accurately complete and file Form 8962. Errors can lead to delays in processing returns, adjustments in tax liabilities, or in some cases, an IRS audit. Proper completion helps prevent these complications.

Understanding these misconceptions about the IRS Form 8962 is crucial for accurately reconciling the Premium Tax Credit and ensuring compliance with tax laws. If you are unsure about any aspect of filing this form, consider seeking professional advice to aid in navigating these requirements.

Key takeaways

The Internal Revenue Service (IRS) Form 8962 is a crucial document for individuals who receive a premium tax credit or need to reconcile these credits on their tax returns. Understanding its purpose, how to fill it out, and its implications is essential for accurately reporting your financial situation and possibly benefiting from these credits. Below are ten key takeaways about the IRS Form 8962 that can help guide you through the process smoothly:

- Form 8962 is used to reconcile advance payments of the premium tax credit. These are the amounts paid directly to your insurance company to lower your monthly premium costs.

- If you bought health insurance through the Marketplace, you must file Form 8962 with your tax return if you want to claim the premium tax credit or if advance payment of this credit was made.

- To accurately complete Form 8962, you'll need information from Form 1095-A, which is sent by the Marketplace. Form 1095-A provides details about your insurance policy, your premiums, and the advance payments of the premium tax credit.

- You calculate your premium tax credit on Form 8962, and this amount can either lower the tax you owe or increase your refund.

- If your advance payments are more than your actual premium tax credit, you might have to repay some or all of the excess with your tax return.

- Conversely, if your calculated premium tax credit is more than the advance payments made on your behalf, you may receive the difference as a refund.

- Filling out Form 8962 requires you to determine your household income and family size because they affect your premium tax credit amount.

- Using the correct filing status is vital when completing Form 8962. Your filing status can impact your eligibility for the premium tax credit and its amount.

- There are parts of Form 8962 that might not be relevant for everyone. Make sure to read the instructions carefully to only fill out the sections that apply to your situation.

- If you find filling out Form 8962 challenging, seeking help from a tax professional or utilizing IRS resources is advisable. Making errors can affect your taxes and potentially lead to paying back credits or facing penalties.

Getting familiar with IRS Form 8962 and understanding how to accurately complete it can significantly influence your tax filings. By following these key takeaways, you can navigate the complexities of the premium tax credit, ensuring that you comply with tax laws while optimizing your financial outcome.